Key Insights

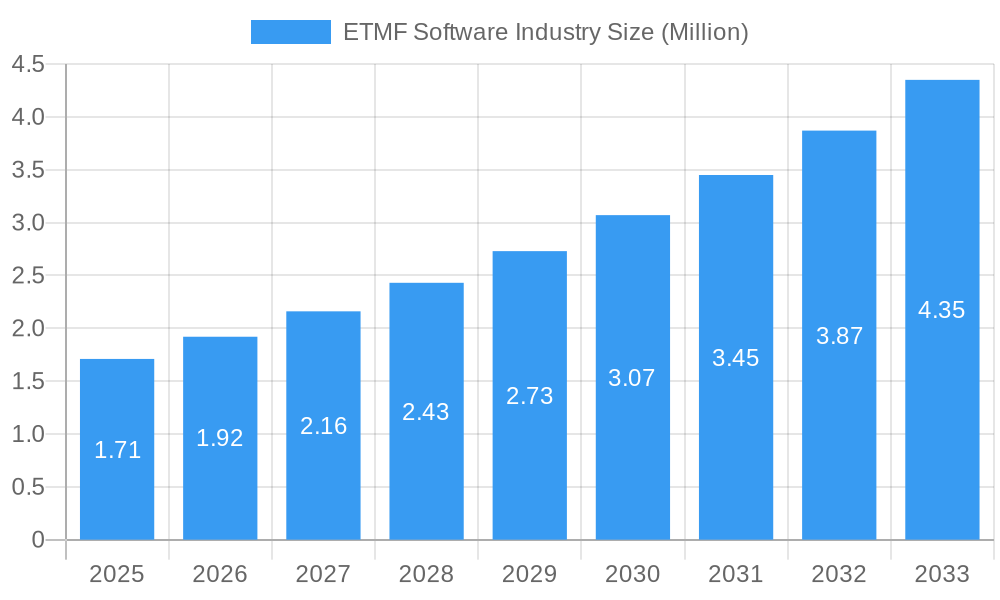

The Electronic Trial Master File (eTMF) software market is experiencing robust expansion, projected to reach approximately USD 1.71 million in 2025 with a Compound Annual Growth Rate (CAGR) of 12.55% through 2033. This significant growth is propelled by the increasing demand for efficient, compliant, and digitized clinical trial management solutions across the pharmaceutical and biotechnology sectors. Key drivers include the escalating complexity of global clinical trials, stringent regulatory requirements from bodies like the FDA and EMA, and the growing emphasis on data integrity and accessibility. The shift towards decentralized and hybrid clinical trials further amplifies the need for eTMF systems that facilitate remote collaboration and document management. Moreover, the inherent benefits of eTMF, such as reduced operational costs, improved audit readiness, and accelerated trial timelines, are compelling organizations to adopt these advanced solutions.

ETMF Software Industry Market Size (In Million)

The eTMF software landscape is characterized by continuous innovation and a focus on enhancing user experience and interoperability. The market segments into Services and Software, with the latter likely holding a larger share due to the perpetual need for robust platform development and upgrades. End-users are predominantly Pharmaceutical & Biotechnology Companies and Contract Research Organizations (CROs), who are at the forefront of clinical research and bear the primary responsibility for regulatory compliance. The market is seeing increased competition among established players like Veeva Systems, Oracle Corporation, and Aris Global LLC, alongside emerging innovators. Restraints, such as the initial investment costs and the challenge of integrating eTMF systems with existing legacy systems, are being addressed through cloud-based solutions and improved vendor support. The Asia Pacific region, particularly China and India, is anticipated to emerge as a significant growth pocket due to expanding pharmaceutical R&D activities and a burgeoning demand for advanced clinical trial technologies.

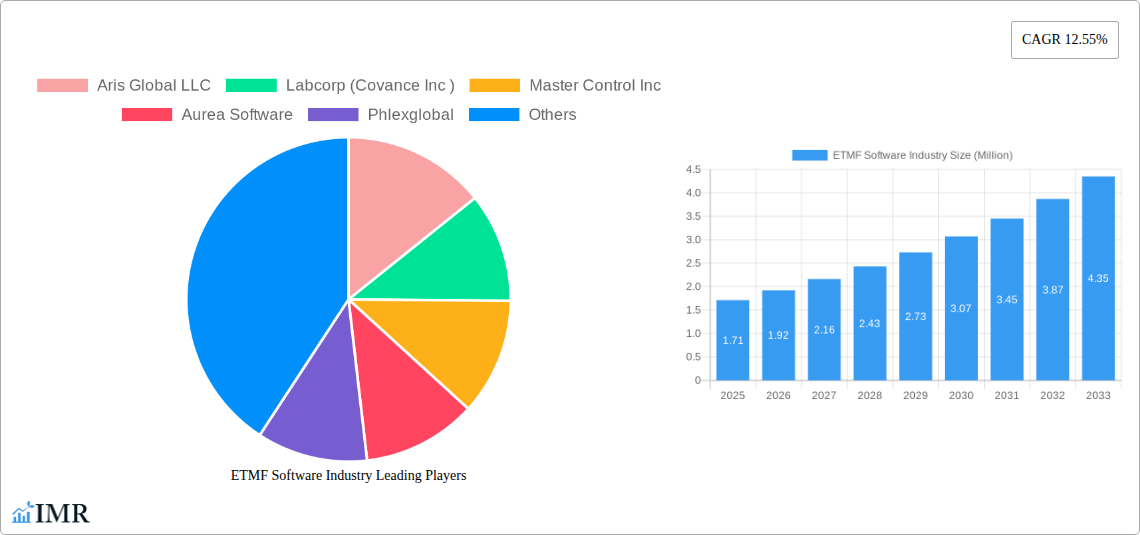

ETMF Software Industry Company Market Share

Comprehensive Report: ETMF Software Industry Market Analysis 2025-2033

This in-depth report provides a detailed analysis of the Electronic Trial Master File (ETMF) software market, covering its dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. With a study period spanning 2019-2033, this report offers crucial insights for stakeholders seeking to understand and capitalize on the evolving needs of clinical research and pharmaceutical operations. The report includes a base year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019-2024. We present all quantitative values in Million units.

ETMF Software Industry Market Dynamics & Structure

The ETMF software market is characterized by a dynamic interplay of technological advancements, stringent regulatory mandates, and evolving end-user demands. Market concentration remains moderate, with a few dominant players vying for market share against a growing number of specialized solution providers. Technological innovation is primarily driven by the need for enhanced data integrity, audit readiness, and streamlined document management in clinical trials. The global adoption of electronic ETMF solutions is a direct response to increasing regulatory scrutiny, with frameworks like ICH GCP and 21 CFR Part 11 guiding platform development and implementation. Competitive product substitutes, such as paper-based TMFs and less integrated digital solutions, are gradually being phased out. End-user demographics are heavily skewed towards Pharmaceutical & Biotechnology Companies and Contract Research Organizations (CROs), which represent the largest consumer base. Mergers and acquisitions (M&A) trends are evident as larger entities seek to consolidate their offerings and expand their market reach. For instance, in the historical period, there have been xx significant M&A deals, indicating a consolidation phase. Innovation barriers include the high cost of compliance validation and the significant investment required for system integration with existing clinical trial management systems. The market is continuously pushed towards cloud-based solutions and AI-driven automation to improve efficiency.

- Market Concentration: Moderate, with a mix of established leaders and emerging niche players.

- Technological Innovation Drivers: Data integrity, audit readiness, cloud adoption, AI for document processing.

- Regulatory Frameworks: ICH GCP, 21 CFR Part 11 are paramount.

- Competitive Product Substitutes: Paper-based TMFs, basic document management systems.

- End-User Demographics: Dominated by Pharmaceutical & Biotechnology Companies and CROs.

- M&A Trends: Strategic acquisitions to expand market share and service portfolios.

ETMF Software Industry Growth Trends & Insights

The ETMF software market is poised for significant growth, driven by the increasing complexity and globalization of clinical trials. The market size evolution indicates a steady upward trajectory, with adoption rates for electronic ETMF solutions rapidly accelerating across all segments of the life sciences industry. The base year 2025 is expected to witness a market size of $xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological disruptions, including the integration of artificial intelligence (AI) for automated metadata extraction and anomaly detection, are transforming operational efficiency. Furthermore, the growing emphasis on decentralized clinical trials (DCTs) is creating new demands for robust and accessible eTMF solutions. Consumer behavior shifts are also playing a crucial role, with sponsors and CROs increasingly prioritizing platforms that offer seamless integration, enhanced collaboration, and real-time visibility into trial documentation. The market penetration of eTMF software, currently at xx% in 2025, is projected to reach xx% by 2033. The shift from fragmented document management to comprehensive, centralized eTMF platforms underscores the industry's commitment to compliance, data quality, and accelerated drug development timelines. The historical period (2019-2024) saw an average CAGR of xx%, laying a strong foundation for future expansion.

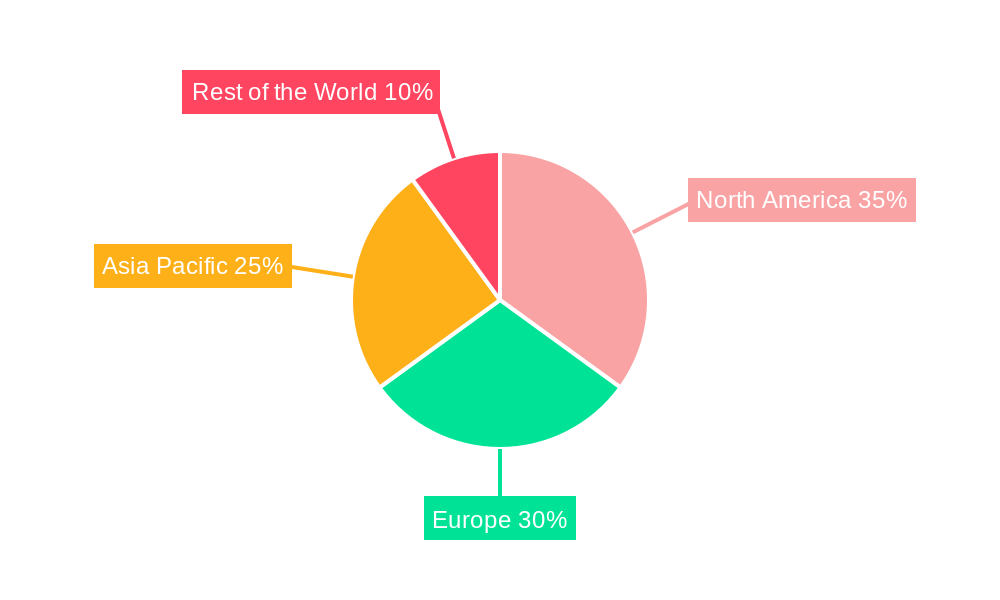

Dominant Regions, Countries, or Segments in ETMF Software Industry

North America currently stands as the dominant region in the ETMF software industry, primarily driven by the high concentration of pharmaceutical and biotechnology companies, robust regulatory oversight, and advanced clinical research infrastructure. The United States, in particular, leads the market due to its well-established drug development ecosystem and early adoption of digital health technologies. The market share in North America for 2025 is estimated at xx%, with a projected CAGR of xx% during the forecast period. The segment of Pharmaceutical & Biotechnology Companies within the End-User category is the largest contributor to market growth, accounting for approximately xx% of the total market revenue in 2025. This dominance is fueled by the sheer volume of clinical trials conducted by these organizations and their stringent requirements for compliance and data security. Key drivers in this region include favorable economic policies supporting R&D, significant investment in clinical trial technology, and a highly skilled workforce. Infrastructure plays a vital role, with widespread internet connectivity and cloud computing capabilities enabling the seamless implementation of eTMF solutions. Contract Research Organizations (CROs) in North America also represent a significant market segment, leveraging eTMF solutions to provide efficient and compliant services to their clients. The growth potential in this region remains high, although increased competition and saturation may lead to a slight deceleration in CAGR in the later years of the forecast.

- Leading Region: North America (USA, Canada).

- Dominant End-User Segment: Pharmaceutical & Biotechnology Companies.

- Key Growth Drivers (North America): Strong R&D investment, advanced regulatory framework, early technology adoption.

- Market Share (2025): North America - xx%; Pharmaceutical & Biotechnology Companies - xx%.

- Growth Potential: High, supported by ongoing innovation and demand for compliance.

ETMF Software Industry Product Landscape

The ETMF software product landscape is characterized by continuous innovation focused on enhancing user experience, improving data accuracy, and ensuring regulatory compliance. Key product innovations include AI-powered natural language processing for automated document indexing and review, advanced audit trail functionalities, and seamless integration capabilities with other clinical trial management systems (CTMS) and electronic data capture (EDC) platforms. These solutions offer robust features for document management, version control, and quality control, ensuring that all trial documentation is accurate, complete, and readily accessible. Performance metrics revolve around reduced document processing times, improved audit readiness scores, and enhanced data security. Unique selling propositions often lie in specialized functionalities such as eSource integration, advanced reporting dashboards, and specialized modules for specific therapeutic areas. Technological advancements are steadily moving towards more intuitive interfaces, predictive analytics for risk management, and enhanced collaboration tools for global trial teams. The market currently offers a variety of software solutions, with a projected market value of $xx Million for Software in 2025, and Services valued at $xx Million.

Key Drivers, Barriers & Challenges in ETMF Software Industry

The ETMF software industry is propelled by several key drivers. The escalating complexity and globalization of clinical trials necessitate efficient, compliant, and accessible documentation solutions. Strict regulatory requirements, such as 21 CFR Part 11, mandate electronic record-keeping and audit trails, driving the adoption of validated eTMF systems. Technological advancements, including cloud computing and AI, offer enhanced data management and processing capabilities, reducing operational costs and improving efficiency.

Conversely, several barriers and challenges impede market growth. The high initial investment required for implementing and validating eTMF software can be a significant hurdle, especially for smaller organizations. Integration challenges with existing legacy systems can also create complexities. Furthermore, resistance to change within organizations and the need for extensive training to ensure proper user adoption represent considerable restraints. Supply chain issues are less prevalent for software, but concerns around data privacy and security in cloud-based solutions persist. Competitive pressures from numerous vendors offering similar functionalities also contribute to market challenges.

- Key Drivers: Regulatory compliance, globalization of trials, technological advancements (cloud, AI).

- Barriers: High implementation costs, integration complexities, organizational resistance to change.

- Challenges: Data security concerns, competitive market landscape, need for robust training.

Emerging Opportunities in ETMF Software Industry

Emerging opportunities in the ETMF software industry lie in the increasing demand for integrated eTMF solutions that support decentralized clinical trials (DCTs) and hybrid trial models. The growing emphasis on real-world evidence (RWE) generation presents an opportunity for eTMF platforms to incorporate and manage data from diverse sources. Furthermore, the untapped potential in emerging markets, particularly in Asia-Pacific and Latin America, offers significant growth prospects as these regions expand their clinical research capabilities. The development of AI-powered predictive analytics within eTMF systems to identify potential compliance risks or deviations before they occur is another promising avenue. Evolving consumer preferences for user-friendly, mobile-compatible solutions will also drive innovation and market expansion.

Growth Accelerators in the ETMF Software Industry Industry

Growth in the ETMF software industry is significantly accelerated by ongoing technological breakthroughs, particularly in AI and machine learning, which are enhancing automation and efficiency in document review and metadata extraction. Strategic partnerships between eTMF software providers and other clinical trial technology vendors are creating integrated ecosystems that offer comprehensive solutions to sponsors and CROs. Market expansion strategies, including targeting emerging economies and niche therapeutic areas with specific eTMF requirements, are also contributing to sustained growth. The increasing acceptance and adoption of cloud-based eTMF solutions, driven by their scalability, accessibility, and cost-effectiveness, serve as a major catalyst for long-term market expansion.

Key Players Shaping the ETMF Software Industry Market

- Aris Global LLC

- Labcorp (Covance Inc)

- Master Control Inc

- Aurea Software

- Phlexglobal

- Oracle Corporation

- Transperfect

- Clinevo Technology

- Veeva Systems

- Sureclinical

Notable Milestones in ETMF Software Industry Sector

- February 2023: Vial, a clinical research organization (CRO), signed a partnership agreement with Egnyte for the integration of the Life Sciences eTMF (electronic trial master file) solution into Vial's platform. This integration enhances audit readiness and compliance for life sciences companies.

- September 2022: Montrium launched its expert-led trial master file (TMF) services and its new TMF maturity educational training, supporting clinical operations and TMF teams throughout the clinical development journey.

In-Depth ETMF Software Industry Market Outlook

The ETMF software industry market outlook remains exceptionally positive, driven by the relentless pursuit of efficiency, compliance, and data integrity in clinical research. Future market potential is substantial, with continued adoption of advanced technologies like AI and machine learning expected to revolutionize document management. Strategic opportunities lie in developing more integrated platforms that seamlessly connect with the entire clinical trial ecosystem, from site initiation to regulatory submission. The growing trend towards data centralization and real-time analytics will further bolster the demand for robust eTMF solutions. Emerging markets and the increasing demand for specialized eTMF functionalities in areas like real-world evidence will provide fertile ground for growth. The industry is on a trajectory of continuous innovation, ensuring its vital role in accelerating the delivery of safe and effective therapies to patients worldwide.

ETMF Software Industry Segmentation

-

1. Product Type

- 1.1. Services

- 1.2. Software

-

2. End-User

- 2.1. Pharmaceutical & Biotechnology Companies

- 2.2. Contract Research Organizations

- 2.3. Other End-Users

ETMF Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

ETMF Software Industry Regional Market Share

Geographic Coverage of ETMF Software Industry

ETMF Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of ETMF Systems; Increasing Number of Research & Development Activities

- 3.3. Market Restrains

- 3.3.1. Budget Constraints

- 3.4. Market Trends

- 3.4.1. Pharmaceutical & Biotechnology Companies Segment is Expected to Exhibit a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ETMF Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Services

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Pharmaceutical & Biotechnology Companies

- 5.2.2. Contract Research Organizations

- 5.2.3. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America ETMF Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Services

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Pharmaceutical & Biotechnology Companies

- 6.2.2. Contract Research Organizations

- 6.2.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe ETMF Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Services

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Pharmaceutical & Biotechnology Companies

- 7.2.2. Contract Research Organizations

- 7.2.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific ETMF Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Services

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Pharmaceutical & Biotechnology Companies

- 8.2.2. Contract Research Organizations

- 8.2.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World ETMF Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Services

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Pharmaceutical & Biotechnology Companies

- 9.2.2. Contract Research Organizations

- 9.2.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Aris Global LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Labcorp (Covance Inc )

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Master Control Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aurea Software

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Phlexglobal

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Oracle Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Transperfect

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Clinevo Technology

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Veeva Systems

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sureclinical

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Aris Global LLC

List of Figures

- Figure 1: Global ETMF Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America ETMF Software Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America ETMF Software Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America ETMF Software Industry Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America ETMF Software Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America ETMF Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America ETMF Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe ETMF Software Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe ETMF Software Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe ETMF Software Industry Revenue (Million), by End-User 2025 & 2033

- Figure 11: Europe ETMF Software Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe ETMF Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe ETMF Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific ETMF Software Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific ETMF Software Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific ETMF Software Industry Revenue (Million), by End-User 2025 & 2033

- Figure 17: Asia Pacific ETMF Software Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific ETMF Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific ETMF Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World ETMF Software Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Rest of the World ETMF Software Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of the World ETMF Software Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Rest of the World ETMF Software Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Rest of the World ETMF Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World ETMF Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ETMF Software Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global ETMF Software Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global ETMF Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global ETMF Software Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global ETMF Software Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global ETMF Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global ETMF Software Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global ETMF Software Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global ETMF Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global ETMF Software Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global ETMF Software Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 21: Global ETMF Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific ETMF Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global ETMF Software Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 29: Global ETMF Software Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global ETMF Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ETMF Software Industry?

The projected CAGR is approximately 12.55%.

2. Which companies are prominent players in the ETMF Software Industry?

Key companies in the market include Aris Global LLC, Labcorp (Covance Inc ), Master Control Inc, Aurea Software, Phlexglobal, Oracle Corporation, Transperfect, Clinevo Technology, Veeva Systems, Sureclinical.

3. What are the main segments of the ETMF Software Industry?

The market segments include Product Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of ETMF Systems; Increasing Number of Research & Development Activities.

6. What are the notable trends driving market growth?

Pharmaceutical & Biotechnology Companies Segment is Expected to Exhibit a Significant Growth.

7. Are there any restraints impacting market growth?

Budget Constraints.

8. Can you provide examples of recent developments in the market?

In February 2023, Vial, a clinical research organization (CRO), signed a partnership agreement with Egnyte for the integration of the Life Sciences eTMF (electronic trial master file) solution into Vial's platform. As per the company, Egnyte eTMF is a 21 CFR Part 11 compliant platform that lowers the processing time for documents and data, maintains compliance, and enhances audit readiness for life sciences companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ETMF Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ETMF Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ETMF Software Industry?

To stay informed about further developments, trends, and reports in the ETMF Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence