Key Insights

The European coil coatings market is poised for significant expansion, with a projected market size of $10.55 billion in 2025. The industry anticipates a robust Compound Annual Growth Rate (CAGR) of 12.06% from 2025 to 2033. This growth is propelled by escalating demand for advanced coatings offering superior durability, corrosion resistance, and aesthetic appeal. Key drivers include the thriving construction sector, where pre-painted metal sheets are vital for roofing, cladding, and architectural elements, supported by sustainable building initiatives and renovation projects. The automotive industry's focus on lightweight materials and enhanced finishes, alongside the consistent need for durable coatings in industrial and domestic appliances, also fuels market expansion. The HVAC sector further contributes through its requirement for coatings resistant to diverse environmental conditions.

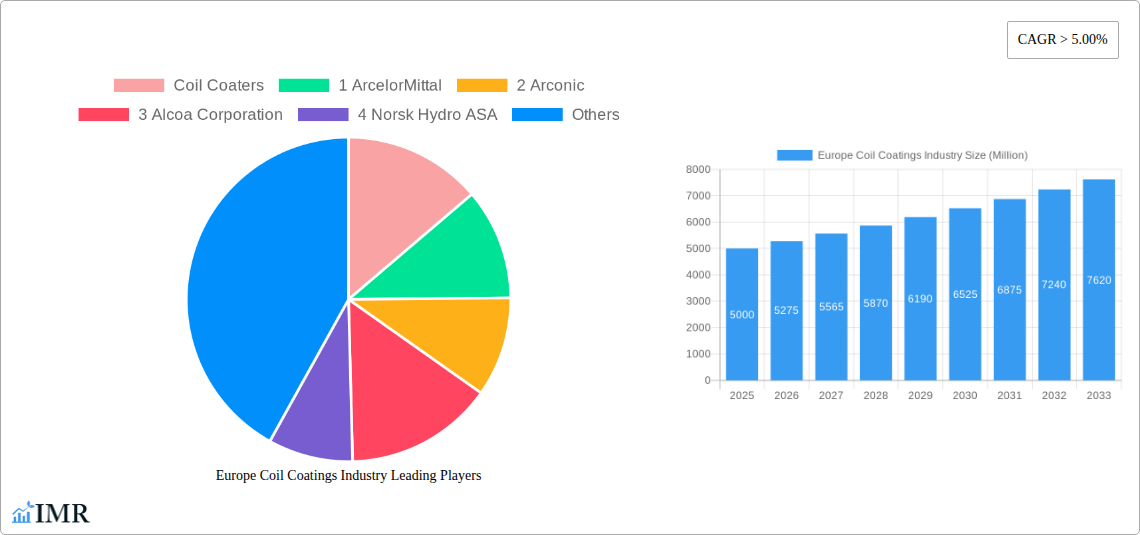

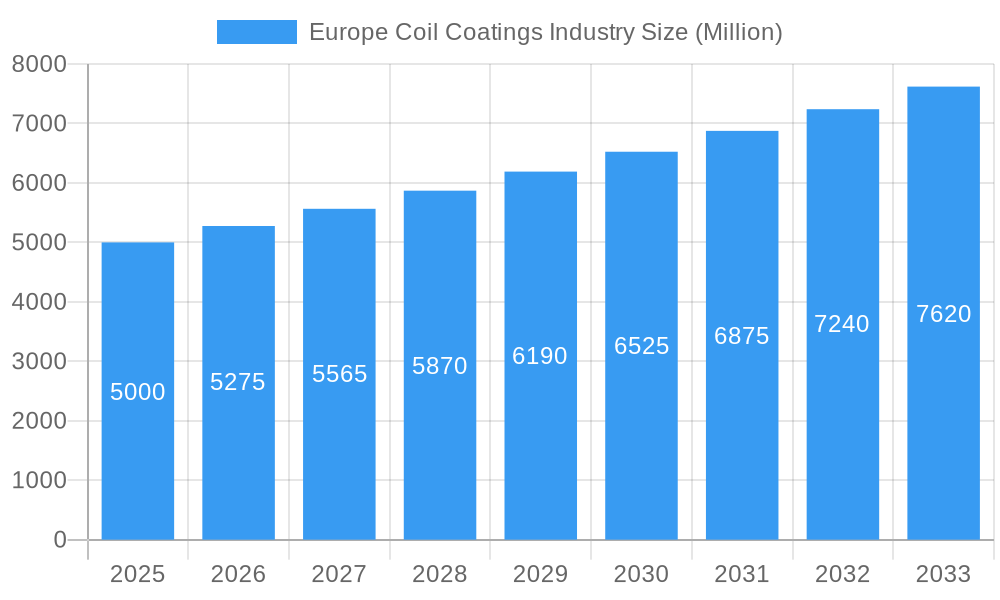

Europe Coil Coatings Industry Market Size (In Billion)

Market dynamics are influenced by the rise of sustainable solutions, including eco-friendly, low-VOC formulations driven by environmental regulations and consumer preferences. Innovations in resin technology, such as advanced Polyester and Polyvinylidene Fluorides (PVDF) coatings, are improving UV resistance and flexibility for demanding applications. Leading players in the competitive landscape include coil coaters like ArcelorMittal and Arconic, paint suppliers such as AkzoNobel and PPG Industries, and raw material providers including Wacker Chemie AG and Arkema Group. While challenges such as fluctuating raw material costs and economic uncertainties exist, continuous product innovation and expanding application areas are expected to ensure sustained growth in the European coil coatings market.

Europe Coil Coatings Industry Company Market Share

Europe Coil Coatings Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Europe Coil Coatings Industry, a critical sector underpinning advancements in construction, manufacturing, and consumer goods. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this report provides actionable insights for stakeholders seeking to navigate this dynamic market. We meticulously examine parent and child markets, offering a granular understanding of influencing factors and future trajectories. All values are presented in Million units.

Europe Coil Coatings Industry Market Dynamics & Structure

The Europe Coil Coatings Industry is characterized by a moderately concentrated market, with key players dominating significant shares. Technological innovation remains a primary driver, fueled by an increasing demand for sustainable, durable, and aesthetically pleasing coatings. Regulatory frameworks, particularly those concerning VOC emissions and environmental impact, are continuously evolving, pushing manufacturers towards greener formulations and application processes. Competitive product substitutes, such as powder coatings and pre-finished materials, pose a constant challenge, necessitating continuous product differentiation and performance enhancement. End-user demographics are shifting, with a growing preference for customized solutions and eco-friendly alternatives across various sectors. Mergers and acquisitions (M&A) activity, while present, is strategic, focusing on expanding geographical reach, acquiring advanced technologies, or consolidating market positions. The market is projected to witness a CAGR of approximately 4.5% from 2025-2033.

- Market Concentration: Dominated by a few large, integrated players and a growing number of specialized manufacturers.

- Technological Innovation Drivers: Sustainability, durability, enhanced aesthetics, energy efficiency, and smart coating functionalities.

- Regulatory Frameworks: Stringent VOC regulations (e.g., REACH), fire safety standards, and evolving eco-labeling requirements.

- Competitive Product Substitutes: Powder coatings, liquid paints applied post-fabrication, and alternative material finishes.

- End-User Demographics: Increasing demand for vibrant colors, textured finishes, and coatings with anti-microbial or self-cleaning properties.

- M&A Trends: Focus on acquisition of niche technologies, expansion into emerging European markets, and integration of supply chains.

Europe Coil Coatings Industry Growth Trends & Insights

The Europe Coil Coatings Industry is poised for robust growth, driven by sustained demand from its core end-user segments and a rising emphasis on performance and sustainability. The market size is expected to reach approximately 8,500 Million units by 2033, up from an estimated 6,200 Million units in 2025. Adoption rates for advanced coil coatings, offering superior protection against corrosion and weathering, are on an upward trajectory, particularly in the building and construction sector. Technological disruptions, such as the development of bio-based resins and UV-curable coatings, are reshaping product offerings and manufacturing processes. Consumer behavior shifts are also playing a pivotal role, with a heightened awareness of environmental impact leading to a preference for low-VOC and recyclable coating solutions. The industry is witnessing a significant trend towards digitalization in application processes, enhancing efficiency and precision.

The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of around 4.5%, a testament to the industry's resilience and innovative capacity. Key growth drivers include the ongoing urbanization in Eastern Europe, demanding extensive infrastructure development, and the automotive industry's persistent need for lightweight yet durable materials, often enhanced by advanced coil coatings. The domestic appliance sector, driven by consumer demand for premium finishes and longer product lifespans, also contributes significantly to market expansion. Furthermore, the furniture industry's increasing reliance on pre-coated metal components for aesthetic appeal and durability is a notable trend.

Technological advancements in resin formulations, such as the increased use of Polyvinylidene Fluorides (PVDF) for their exceptional weather resistance and Polyester for their cost-effectiveness and versatility, are expanding application possibilities. The development of specialized coatings for HVAC systems, offering improved thermal insulation and corrosion resistance, is another area showing promising growth. The historical period (2019-2024) laid the groundwork for this expansion, characterized by steady demand and the initial adoption of eco-friendlier coating technologies.

Dominant Regions, Countries, or Segments in Europe Coil Coatings Industry

Within the European Coil Coatings Industry, the Building and Construction end-user industry segment stands out as the dominant growth engine. Its significant market share, estimated at over 40% of the total industry value in 2025, is propelled by extensive infrastructure development, a persistent demand for durable and aesthetically appealing architectural elements, and increasing renovation projects across the continent.

- Building and Construction Dominance Factors:

- Infrastructure Investment: Government initiatives and private sector investments in new residential, commercial, and industrial buildings across Europe, particularly in Western and Southern Europe.

- Durability and Weather Resistance: The inherent need for long-lasting coatings that can withstand harsh environmental conditions, from UV radiation to extreme temperatures, makes coil-coated metals an ideal choice for roofing, cladding, and facade applications.

- Aesthetic Appeal: The growing trend of modern architecture emphasizing clean lines and vibrant colors is met by the diverse range of finishes and hues achievable with coil coatings.

- Sustainability Initiatives: The increasing focus on green building certifications and energy-efficient construction practices favors coil coatings that contribute to a building's longevity and reduce the need for frequent maintenance and replacement.

- Market Share & Growth Potential: This segment is projected to grow at a CAGR of approximately 4.8% during the forecast period (2025-2033), indicating sustained demand and significant future potential.

Among the resin types, Polyester resin coatings continue to hold a substantial market share, accounting for an estimated 35% of the total resin market in 2025. Their widespread adoption is attributed to a favorable balance of cost-effectiveness, excellent adhesion properties, and a good range of flexibility and durability, making them suitable for a broad spectrum of applications in both construction and appliances.

- Polyester Resin Dominance Factors:

- Cost-Effectiveness: Polyester coatings offer a more economical solution compared to higher-performance resins, making them a preferred choice for mass-produced items and large-scale construction projects where budget is a key consideration.

- Versatility: They provide a good balance of properties, including good flexibility, hardness, gloss retention, and color stability, catering to diverse application requirements.

- Wide Availability: The extensive manufacturing infrastructure and established supply chains for polyester resins contribute to their consistent availability and competitive pricing.

- Compatibility: They exhibit good compatibility with various substrates and pretreatment methods, simplifying the application process for coil coaters.

- Market Share & Growth Potential: While facing competition from advanced resins, Polyester is expected to maintain a strong market presence, growing at an estimated CAGR of 4.0% during the forecast period.

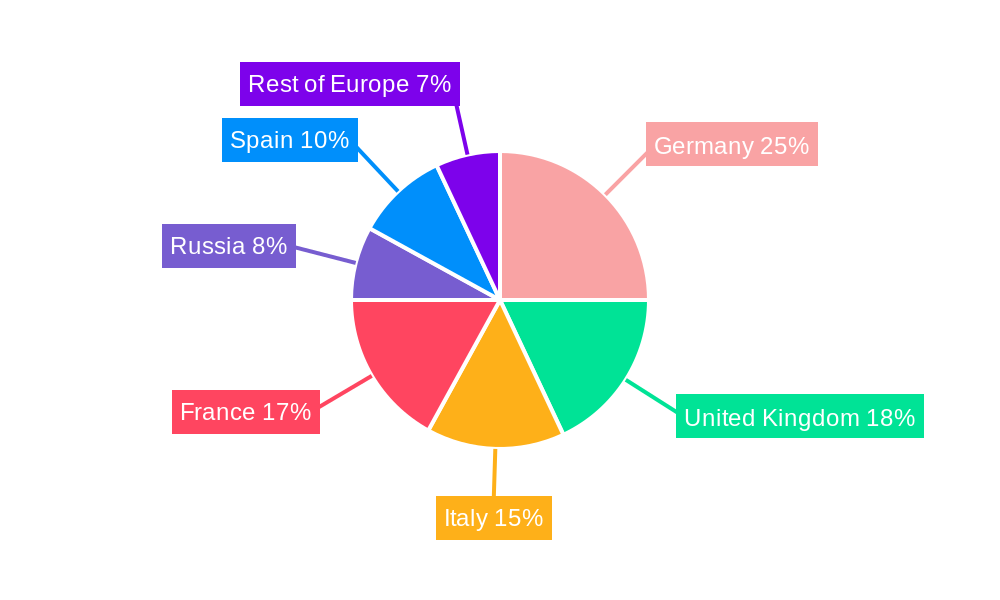

Geographically, Germany is identified as a dominant country within the European Coil Coatings Industry, holding an estimated 20% market share in 2025. Its strong industrial base, significant automotive manufacturing sector, and robust construction industry create substantial demand for high-quality coil coatings.

- Germany Dominance Factors:

- Industrial Powerhouse: Germany's leading role in manufacturing, particularly in the automotive and industrial machinery sectors, directly translates into high demand for coil-coated steel and aluminum.

- Automotive Hub: The presence of major automotive manufacturers necessitates advanced coil coatings for vehicle exteriors and components, meeting stringent quality and performance standards.

- Construction Activity: Ongoing investments in residential, commercial, and infrastructure projects, coupled with a focus on energy-efficient and modern building designs, fuel demand for architectural coil coatings.

- Technological Adoption: German industries are early adopters of new technologies and sustainable practices, driving demand for innovative and eco-friendly coil coating solutions.

- Market Share & Growth Potential: Germany is projected to grow at a CAGR of approximately 4.2% during the forecast period, reflecting its continued economic strength and industrial relevance.

Europe Coil Coatings Industry Product Landscape

The Europe Coil Coatings Industry is witnessing an evolution towards high-performance, sustainable, and aesthetically sophisticated product offerings. Innovations are focused on enhancing durability, corrosion resistance, and UV stability, extending the lifespan of coated products. The development of novel resin formulations, including advanced polyesters, weather-resistant PVDF, and flexible polyurethanes, caters to increasingly demanding applications. Performance metrics like adhesion strength, impact resistance, and flexibility are continuously being improved. Unique selling propositions revolve around eco-friendly solutions, such as low-VOC or waterborne coatings, and specialized functionalities like anti-microbial properties for appliances and self-cleaning capabilities for architectural surfaces. Technological advancements are also enabling more precise color matching and a wider spectrum of textures and finishes, meeting diverse design requirements.

Key Drivers, Barriers & Challenges in Europe Coil Coatings Industry

The Europe Coil Coatings Industry is propelled by several key drivers. Technological advancements in resin chemistry and application techniques are enhancing product performance and sustainability. The increasing demand for durable and aesthetically pleasing materials in the building and construction, automotive, and appliance sectors provides a consistent market pull. Furthermore, evolving environmental regulations are pushing for the adoption of eco-friendly coating solutions, creating opportunities for innovation.

However, the industry faces significant barriers and challenges. Fluctuations in raw material prices, particularly for key resins and pigments, can impact profitability and pricing strategies. Stringent regulatory frameworks regarding VOC emissions and hazardous substances necessitate ongoing investment in research and development for compliance. Intense competition from alternative coating technologies and substitute materials exerts downward pressure on prices. Supply chain disruptions, as experienced recently, can affect production timelines and lead times for finished products.

Emerging Opportunities in Europe Coil Coatings Industry

Emerging opportunities within the Europe Coil Coatings Industry lie in the growing demand for sustainable and bio-based coating solutions. The increasing focus on circular economy principles presents opportunities for developing recyclable and biodegradable coating formulations. Untapped markets in Eastern and Southern Europe, with their burgeoning construction and manufacturing sectors, offer significant growth potential. Innovative applications, such as smart coatings with integrated functionalities like energy harvesting or self-healing properties, are gaining traction. Evolving consumer preferences for personalized and aesthetically unique products are driving demand for specialized finishes and textures.

Growth Accelerators in the Europe Coil Coatings Industry Industry

Several catalysts are accelerating the long-term growth of the Europe Coil Coatings Industry. Continued investment in research and development is leading to breakthroughs in material science, yielding coatings with enhanced performance characteristics and reduced environmental impact. Strategic partnerships between paint manufacturers, metal producers, and end-users are fostering collaborative innovation and market penetration. Market expansion strategies, including the penetration of underdeveloped regional markets within Europe and the development of customized solutions for niche applications, are proving highly effective. The increasing adoption of digitalization and automation in the manufacturing process is also improving efficiency and reducing costs, further stimulating growth.

Key Players Shaping the Europe Coil Coatings Industry Market

- ArcelorMittal

- Arcanom

- Alcoa Corporation

- Norsk Hydro ASA

- Novelis

- Rautaruukki Corporation

- Salzgitter Flachstahl GmbH

- Tata Steel

- Thyssenkrupp

- AkzoNobel N V

- Axalta Coatings Systems

- Beckers Group

- Kansai Paint Co Ltd

- PPG Industries Inc

- The Sherwin-Williams Company

- NIPPONPAINT Co Ltd

- Brillux GmbH & Co KG

- Hempel A/S

- Wacker Chemie AG

- Arkema Group

- Bayer AG

- BASF SE

- Evonik Industries AG

- Henkel AG & Co KGaA

- Solvay

Notable Milestones in Europe Coil Coatings Industry Sector

- 2020: Introduction of new low-VOC Polyester resin formulations by leading paint suppliers, responding to stricter environmental regulations.

- 2021: Significant investment in R&D for bio-based resins by major chemical companies, aiming to offer sustainable alternatives.

- 2022: Launch of a new generation of PVDF coatings with enhanced UV resistance for architectural applications, extending product warranties.

- 2023: Consolidation of market players through several strategic M&A activities, aiming to strengthen market positions and expand product portfolios.

- 2024: Increased adoption of digital color matching and simulation technologies by coil coaters to meet precise customer demands.

In-Depth Europe Coil Coatings Industry Market Outlook

The Europe Coil Coatings Industry is projected to experience sustained growth, driven by innovation and a strong demand from core end-user industries. The ongoing shift towards sustainable and high-performance materials will continue to shape product development, with bio-based and low-VOC coatings gaining significant traction. Emerging applications in renewable energy infrastructure and advanced manufacturing will further diversify the market. Strategic collaborations and technological advancements, particularly in smart coatings and digital application processes, are expected to be key growth accelerators. Stakeholders who can adapt to evolving regulatory landscapes and capitalize on the demand for eco-friendly solutions will be well-positioned for success in this dynamic market. The outlook remains highly positive, with ample opportunities for expansion and innovation.

Europe Coil Coatings Industry Segmentation

-

1. Resin Type

- 1.1. Polyester

- 1.2. Polyvinylidene Fluorides (PVDF)

- 1.3. Polyurethane(PU)

- 1.4. Plastisols

- 1.5. Other Resin Types

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Industrial and Domestic Appliances

- 2.3. Automotive

- 2.4. Furniture

- 2.5. HVAC

- 2.6. Other End-user Industries

Europe Coil Coatings Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Russia

- 6. Spain

- 7. Rest of Europe

Europe Coil Coatings Industry Regional Market Share

Geographic Coverage of Europe Coil Coatings Industry

Europe Coil Coatings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from the Building and Construction Industry; Stringent Environmental Regulations for Conventional Products

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand from the Building and Construction Industry; Stringent Environmental Regulations for Conventional Products

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Building and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Coil Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyester

- 5.1.2. Polyvinylidene Fluorides (PVDF)

- 5.1.3. Polyurethane(PU)

- 5.1.4. Plastisols

- 5.1.5. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Industrial and Domestic Appliances

- 5.2.3. Automotive

- 5.2.4. Furniture

- 5.2.5. HVAC

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Germany Europe Coil Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Polyester

- 6.1.2. Polyvinylidene Fluorides (PVDF)

- 6.1.3. Polyurethane(PU)

- 6.1.4. Plastisols

- 6.1.5. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Building and Construction

- 6.2.2. Industrial and Domestic Appliances

- 6.2.3. Automotive

- 6.2.4. Furniture

- 6.2.5. HVAC

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. United Kingdom Europe Coil Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Polyester

- 7.1.2. Polyvinylidene Fluorides (PVDF)

- 7.1.3. Polyurethane(PU)

- 7.1.4. Plastisols

- 7.1.5. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Building and Construction

- 7.2.2. Industrial and Domestic Appliances

- 7.2.3. Automotive

- 7.2.4. Furniture

- 7.2.5. HVAC

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Italy Europe Coil Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Polyester

- 8.1.2. Polyvinylidene Fluorides (PVDF)

- 8.1.3. Polyurethane(PU)

- 8.1.4. Plastisols

- 8.1.5. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Building and Construction

- 8.2.2. Industrial and Domestic Appliances

- 8.2.3. Automotive

- 8.2.4. Furniture

- 8.2.5. HVAC

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. France Europe Coil Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Polyester

- 9.1.2. Polyvinylidene Fluorides (PVDF)

- 9.1.3. Polyurethane(PU)

- 9.1.4. Plastisols

- 9.1.5. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Building and Construction

- 9.2.2. Industrial and Domestic Appliances

- 9.2.3. Automotive

- 9.2.4. Furniture

- 9.2.5. HVAC

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Russia Europe Coil Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Polyester

- 10.1.2. Polyvinylidene Fluorides (PVDF)

- 10.1.3. Polyurethane(PU)

- 10.1.4. Plastisols

- 10.1.5. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Building and Construction

- 10.2.2. Industrial and Domestic Appliances

- 10.2.3. Automotive

- 10.2.4. Furniture

- 10.2.5. HVAC

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Spain Europe Coil Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Resin Type

- 11.1.1. Polyester

- 11.1.2. Polyvinylidene Fluorides (PVDF)

- 11.1.3. Polyurethane(PU)

- 11.1.4. Plastisols

- 11.1.5. Other Resin Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Building and Construction

- 11.2.2. Industrial and Domestic Appliances

- 11.2.3. Automotive

- 11.2.4. Furniture

- 11.2.5. HVAC

- 11.2.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Resin Type

- 12. Rest of Europe Europe Coil Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Resin Type

- 12.1.1. Polyester

- 12.1.2. Polyvinylidene Fluorides (PVDF)

- 12.1.3. Polyurethane(PU)

- 12.1.4. Plastisols

- 12.1.5. Other Resin Types

- 12.2. Market Analysis, Insights and Forecast - by End-user Industry

- 12.2.1. Building and Construction

- 12.2.2. Industrial and Domestic Appliances

- 12.2.3. Automotive

- 12.2.4. Furniture

- 12.2.5. HVAC

- 12.2.6. Other End-user Industries

- 12.1. Market Analysis, Insights and Forecast - by Resin Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Coil Coaters

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 1 ArcelorMittal

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 2 Arconic

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 3 Alcoa Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 4 Norsk Hydro ASA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 5 Novelis

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 6 Rautaruukki Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 7 Salzgitter Flachstahl GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 8 Tata Steel

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 9 Thyssenkrupp

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Paint Suppliers

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 1 AkzoNobel N V

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 2 Axalta Coatings Systems

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 3 Beckers Group

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 4 Kansai Paint Co Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 5 PPG Industries Inc

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 6 The Sherwin-Williams Company

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 7 NIPPONPAINT Co Ltd

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 8 Brillux GmbH & Co KG

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 9 Hempel A/S

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.21 Pretreatment Resins Pigments and Equipment

- 13.2.21.1. Overview

- 13.2.21.2. Products

- 13.2.21.3. SWOT Analysis

- 13.2.21.4. Recent Developments

- 13.2.21.5. Financials (Based on Availability)

- 13.2.22 1 Wacker Chemie AG

- 13.2.22.1. Overview

- 13.2.22.2. Products

- 13.2.22.3. SWOT Analysis

- 13.2.22.4. Recent Developments

- 13.2.22.5. Financials (Based on Availability)

- 13.2.23 2 Arkema Group

- 13.2.23.1. Overview

- 13.2.23.2. Products

- 13.2.23.3. SWOT Analysis

- 13.2.23.4. Recent Developments

- 13.2.23.5. Financials (Based on Availability)

- 13.2.24 3 Bayer AG

- 13.2.24.1. Overview

- 13.2.24.2. Products

- 13.2.24.3. SWOT Analysis

- 13.2.24.4. Recent Developments

- 13.2.24.5. Financials (Based on Availability)

- 13.2.25 4 BASF SE

- 13.2.25.1. Overview

- 13.2.25.2. Products

- 13.2.25.3. SWOT Analysis

- 13.2.25.4. Recent Developments

- 13.2.25.5. Financials (Based on Availability)

- 13.2.26 5 Evonik Industries AG

- 13.2.26.1. Overview

- 13.2.26.2. Products

- 13.2.26.3. SWOT Analysis

- 13.2.26.4. Recent Developments

- 13.2.26.5. Financials (Based on Availability)

- 13.2.27 6 Henkel AG & Co KGaA

- 13.2.27.1. Overview

- 13.2.27.2. Products

- 13.2.27.3. SWOT Analysis

- 13.2.27.4. Recent Developments

- 13.2.27.5. Financials (Based on Availability)

- 13.2.28 7 Solvay*List Not Exhaustive

- 13.2.28.1. Overview

- 13.2.28.2. Products

- 13.2.28.3. SWOT Analysis

- 13.2.28.4. Recent Developments

- 13.2.28.5. Financials (Based on Availability)

- 13.2.1 Coil Coaters

List of Figures

- Figure 1: Global Europe Coil Coatings Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Coil Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 3: Germany Europe Coil Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 4: Germany Europe Coil Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Germany Europe Coil Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Germany Europe Coil Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Coil Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: United Kingdom Europe Coil Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 9: United Kingdom Europe Coil Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 10: United Kingdom Europe Coil Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: United Kingdom Europe Coil Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: United Kingdom Europe Coil Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Coil Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Italy Europe Coil Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 15: Italy Europe Coil Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 16: Italy Europe Coil Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Italy Europe Coil Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Italy Europe Coil Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Italy Europe Coil Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: France Europe Coil Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 21: France Europe Coil Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 22: France Europe Coil Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: France Europe Coil Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: France Europe Coil Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: France Europe Coil Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Russia Europe Coil Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 27: Russia Europe Coil Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 28: Russia Europe Coil Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Russia Europe Coil Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Russia Europe Coil Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Russia Europe Coil Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Spain Europe Coil Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 33: Spain Europe Coil Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 34: Spain Europe Coil Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 35: Spain Europe Coil Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Spain Europe Coil Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Spain Europe Coil Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of Europe Europe Coil Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 39: Rest of Europe Europe Coil Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 40: Rest of Europe Europe Coil Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 41: Rest of Europe Europe Coil Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 42: Rest of Europe Europe Coil Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 43: Rest of Europe Europe Coil Coatings Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Coil Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: Global Europe Coil Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Europe Coil Coatings Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Coil Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 5: Global Europe Coil Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Europe Coil Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Coil Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 8: Global Europe Coil Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Europe Coil Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Coil Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 11: Global Europe Coil Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Europe Coil Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Coil Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 14: Global Europe Coil Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Europe Coil Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Europe Coil Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 17: Global Europe Coil Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Europe Coil Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Coil Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 20: Global Europe Coil Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Europe Coil Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Europe Coil Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 23: Global Europe Coil Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Europe Coil Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Coil Coatings Industry?

The projected CAGR is approximately 12.06%.

2. Which companies are prominent players in the Europe Coil Coatings Industry?

Key companies in the market include Coil Coaters, 1 ArcelorMittal, 2 Arconic, 3 Alcoa Corporation, 4 Norsk Hydro ASA, 5 Novelis, 6 Rautaruukki Corporation, 7 Salzgitter Flachstahl GmbH, 8 Tata Steel, 9 Thyssenkrupp, Paint Suppliers, 1 AkzoNobel N V, 2 Axalta Coatings Systems, 3 Beckers Group, 4 Kansai Paint Co Ltd, 5 PPG Industries Inc, 6 The Sherwin-Williams Company, 7 NIPPONPAINT Co Ltd, 8 Brillux GmbH & Co KG, 9 Hempel A/S, Pretreatment Resins Pigments and Equipment, 1 Wacker Chemie AG, 2 Arkema Group, 3 Bayer AG, 4 BASF SE, 5 Evonik Industries AG, 6 Henkel AG & Co KGaA, 7 Solvay*List Not Exhaustive.

3. What are the main segments of the Europe Coil Coatings Industry?

The market segments include Resin Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.55 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from the Building and Construction Industry; Stringent Environmental Regulations for Conventional Products.

6. What are the notable trends driving market growth?

Rising Demand from the Building and Construction Industry.

7. Are there any restraints impacting market growth?

; Increasing Demand from the Building and Construction Industry; Stringent Environmental Regulations for Conventional Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Coil Coatings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Coil Coatings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Coil Coatings Industry?

To stay informed about further developments, trends, and reports in the Europe Coil Coatings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence