Key Insights

The European PVC market is projected for substantial growth, fueled by robust demand in construction, automotive, and healthcare. With a projected market size of $6.3 million in 2025 and a CAGR of 3.7%, the industry is set for expansion between 2025 and 2033. PVC's inherent versatility, durability, and cost-effectiveness are key drivers. Construction remains a primary engine, with widespread use in pipes, window profiles, flooring, and cables, boosted by infrastructure development and renovation. The automotive sector increasingly utilizes PVC for lightweight interior components and insulation, enhancing fuel efficiency. Healthcare's consistent demand for medical devices, including blood bags and sterile packaging, further supports market stability. Emerging applications in renewable energy, such as solar panel components, also promise future expansion.

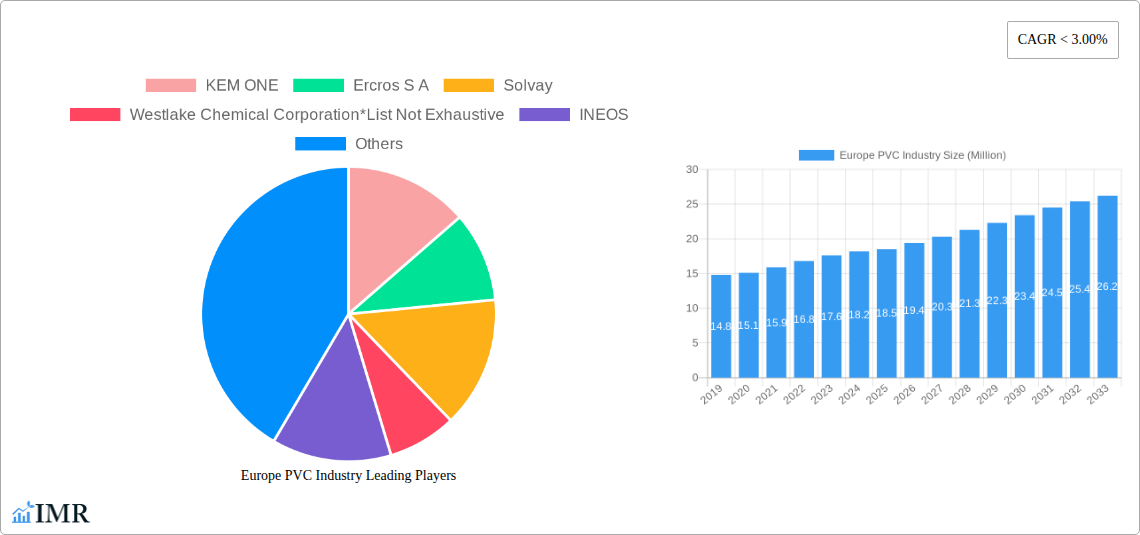

Europe PVC Industry Market Size (In Million)

While environmental regulations and sustainable alternatives present challenges, the European PVC market demonstrates resilience. Manufacturers are investing in advanced technologies and innovative formulations to improve environmental profiles and meet sustainability demands. The forecast period (2025-2033) anticipates continued positive momentum. The 2025 market size of $6.3 million is expected to reach approximately $8.5 million by 2033, highlighting a dynamic market landscape driven by technological advancements and strategic penetration.

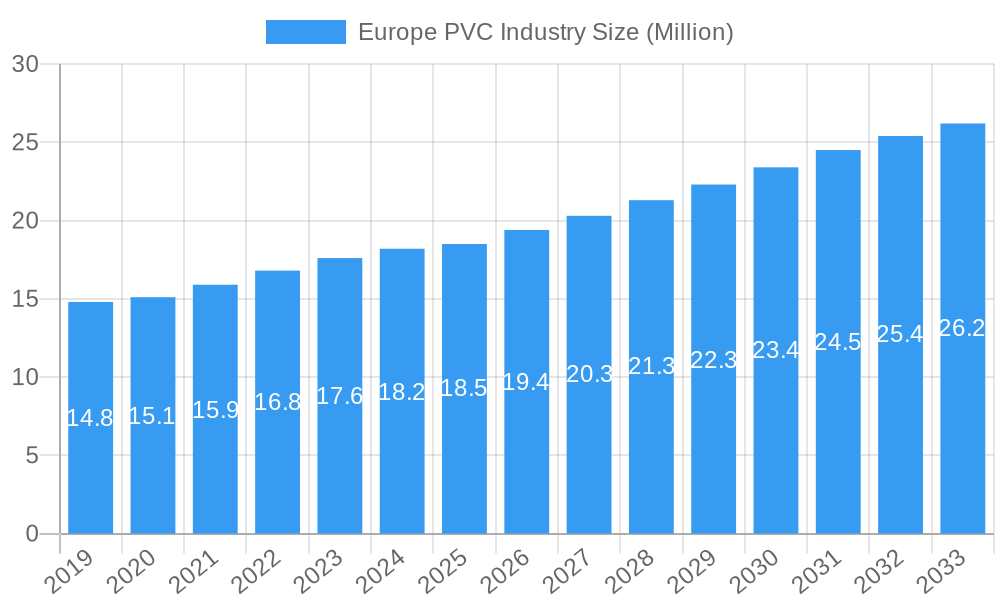

Europe PVC Industry Company Market Share

Europe PVC Industry Market Insights Report: Comprehensive Analysis & Forecast 2019-2033

This in-depth report provides a complete analysis of the dynamic Europe PVC (Polyvinyl Chloride) industry, offering critical insights into market size, growth trends, key players, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this study is an essential resource for industry stakeholders seeking to understand and capitalize on the evolving PVC market landscape. Our analysis includes a detailed examination of parent and child markets, enabling a nuanced understanding of demand drivers and segment performance. All values are presented in Million units.

Europe PVC Industry Market Dynamics & Structure

The Europe PVC industry exhibits a moderately concentrated market structure, influenced by significant technological advancements and stringent regulatory frameworks. Innovation in PVC formulations, particularly in enhancing sustainability and performance, acts as a key driver. For instance, the development of bio-based PVC alternatives and advanced stabilization technologies is reshaping product offerings. Regulatory scrutiny, especially concerning environmental impact and health standards, significantly influences product development and market entry strategies. Competitive product substitutes, such as polypropylene and polyethylene, pose a consistent challenge, particularly in packaging and some construction applications. End-user demographics, characterized by an aging infrastructure in many European countries and a growing demand for energy-efficient building materials, play a crucial role in shaping demand. Mergers and acquisitions (M&A) activity, while not as frequent as in some other chemical sectors, remains a strategic tool for market consolidation and expansion. In 2023, an estimated 5 M&A deals were recorded, with a total deal value of approximately $500 million, indicating strategic consolidation and investment in specialized PVC segments. Innovation barriers include the high cost of R&D for novel formulations and the lengthy approval processes for new materials in regulated industries like healthcare and construction.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation: Driven by sustainability, performance enhancement, and regulatory compliance.

- Regulatory Frameworks: Strict environmental and health regulations influence product development and market access.

- Competitive Substitutes: Polypropylene, polyethylene, and other polymers present competition in specific applications.

- End-User Demographics: Aging infrastructure and demand for sustainable building materials are key factors.

- M&A Trends: Strategic consolidation and investment in specialized PVC segments.

- Innovation Barriers: High R&D costs and lengthy regulatory approval processes.

Europe PVC Industry Growth Trends & Insights

The Europe PVC industry is poised for sustained growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% between 2025 and 2033. This growth is underpinned by a robust recovery in the construction sector, increasing demand for durable and versatile materials in automotive applications, and a steady rise in healthcare sector requirements. The market size is anticipated to grow from an estimated $40,500 million in 2025 to over $57,000 million by 2033. Adoption rates for innovative PVC products, such as those with enhanced fire retardancy and lower environmental impact, are steadily increasing. Technological disruptions are primarily focused on improving the sustainability profile of PVC, including advancements in recycling technologies and the development of bio-attributed PVC. Consumer behavior shifts are also contributing, with a growing preference for durable, long-lasting products and an increasing awareness of the environmental impact of materials. For instance, the demand for energy-efficient window profiles and advanced insulation materials in the building and construction segment is a significant growth driver. The "circular economy" concept is gaining traction, pushing manufacturers to invest in closed-loop recycling systems for PVC products. The increasing adoption of lead-free stabilizers, driven by regulatory pressures and consumer demand for safer products, is another notable trend shaping the market. The market penetration of rigid PVC in the pipes and fittings segment is expected to remain high, while flexible PVC continues to find strong traction in films, sheets, and wires and cables.

Dominant Regions, Countries, or Segments in Europe PVC Industry

The Building and Construction end-user industry is the undisputed leader in the Europe PVC market, accounting for an estimated 55% of the total market share in 2025. This dominance is fueled by extensive use of PVC in pipes and fittings, profiles for windows and doors, roofing membranes, flooring, and electrical insulation. Germany, as Europe's largest economy and a major hub for construction and manufacturing, is expected to be the leading country, contributing approximately 22% to the overall European PVC market in 2025.

Dominant End-User Industry: Building and Construction (Estimated 55% market share in 2025)

- Key Drivers: Infrastructure development, renovation and refurbishment projects, demand for durable and cost-effective materials, energy efficiency mandates.

- Market Size Contribution (2025): Approximately $22,275 million.

- Growth Potential: Continued investment in sustainable construction practices and urban development projects.

Leading Country: Germany (Estimated 22% market share in 2025)

- Key Drivers: Strong industrial base, high per capita consumption, significant construction activity, advanced recycling infrastructure.

- Market Size Contribution (2025): Approximately $8,910 million.

- Growth Potential: Focus on energy-efficient buildings and infrastructure modernization.

Dominant Product Type: Rigid PVC (Estimated 60% of total PVC product market in 2025)

- Key Drivers: High demand for pipes, fittings, and profiles due to durability, chemical resistance, and cost-effectiveness.

- Market Size Contribution (2025): Estimated $24,300 million (within the total PVC market).

- Growth Potential: Continued infrastructure projects and residential construction.

Dominant Application: Pipes and Fittings (Estimated 35% of total PVC application market in 2025)

- Key Drivers: Essential for water supply, sewage systems, and industrial fluid transport.

- Market Size Contribution (2025): Estimated $14,175 million (within the total PVC market).

- Growth Potential: Replacement of aging infrastructure and new construction projects.

Dominant Stabilizer Type: Calcium-based Stabilizers (Ca-Zn Stabilizers) (Estimated 45% market share in 2025)

- Key Drivers: Growing regulatory pressure to phase out lead-based stabilizers, environmental concerns, and improved performance characteristics.

- Market Size Contribution (2025): Estimated $18,225 million (within the total stabilizer market).

- Growth Potential: Continued adoption driven by environmental regulations and demand for safer alternatives.

Europe PVC Industry Product Landscape

The Europe PVC industry is characterized by a diverse product landscape encompassing both rigid and flexible formulations, each tailored for specific applications. Rigid PVC dominates, offering excellent mechanical strength and durability for pipes, fittings, and profiles. Flexible PVC, conversely, provides elasticity and is crucial for films, sheets, wires, and cables. Innovations are focusing on specialized grades like low-smoke PVC for enhanced safety in confined spaces and chlorinated PVC (CPVC) for high-temperature applications. The development of bio-based PVC and advanced recycling techniques are emerging as unique selling propositions, addressing growing environmental concerns. Performance metrics like chemical resistance, UV stability, and flame retardancy are continuously being improved through advanced additive packages and polymer science.

Key Drivers, Barriers & Challenges in Europe PVC Industry

Key Drivers: The Europe PVC industry is propelled by several key drivers. Infrastructure Development in emerging economies and the ongoing need for replacement of aging infrastructure in established markets create consistent demand for PVC in pipes, fittings, and construction materials. Technological advancements in PVC formulations, leading to improved performance, durability, and sustainability, are crucial. Government initiatives promoting energy efficiency and sustainable building practices further boost demand for PVC-based products like window profiles and insulation. The versatility and cost-effectiveness of PVC make it an attractive material across a wide range of applications.

Barriers & Challenges: Significant challenges also shape the Europe PVC market. Stringent environmental regulations, particularly concerning plastic waste and the use of certain additives, pose a continuous hurdle. Fluctuations in raw material prices, primarily linked to crude oil and natural gas, impact production costs and profitability. The competitive pressure from alternative materials like polypropylene and polyethylene in certain applications remains a concern. Furthermore, public perception and concerns regarding the environmental impact of plastics can influence demand and necessitate proactive communication and sustainable practices. Supply chain disruptions, as experienced in recent years, also present a significant challenge. The market size impact of regulatory hurdles on lead-based stabilizers is estimated to reduce their market share by 15% by 2028.

Emerging Opportunities in Europe PVC Industry

Emerging opportunities in the Europe PVC industry lie in the growing demand for sustainable and circular economy solutions. The development and wider adoption of bio-based and recycled PVC present a significant growth avenue, aligning with EU Green Deal objectives. Innovations in high-performance PVC compounds for specialized applications in the automotive (lightweighting, interior components), electrical and electronics (advanced insulation), and healthcare (medical devices) sectors offer untapped potential. The increasing focus on energy-efficient building solutions will continue to drive demand for PVC profiles, membranes, and insulation materials. Furthermore, the exploration of novel applications in areas like 3D printing and advanced composite materials using PVC resins is expected to open new markets.

Growth Accelerators in the Europe PVC Industry Industry

Several growth accelerators are poised to propel the Europe PVC industry forward. Continued investment in research and development for sustainable PVC production methods and enhanced material properties is critical. Strategic partnerships and collaborations between raw material suppliers, PVC compounders, and end-users will foster innovation and market penetration. Government incentives and supportive policies for the adoption of eco-friendly building materials and circular economy practices will further accelerate growth. The global shift towards electrification and renewable energy is expected to create new demand for PVC in infrastructure related to these sectors, such as cable insulation and specialized components. Market expansion into niche applications and regions with growing industrial bases will also contribute significantly to long-term growth.

Key Players Shaping the Europe PVC Industry Market

- KEM ONE

- Ercros S A

- Solvay

- Westlake Chemical Corporation

- INEOS

- Oltchim SA

- Orbia

- BASF SE

- Industrie Generali S P A

- Shin-Etsu Chemical Co Ltd

- Formosa Plastics Corporation

- Covestro AG

- Lukoil

- Sibur

- Benvic Group

- Vynova

Notable Milestones in Europe PVC Industry Sector

- October 2022: Westlake Vinnolit launches "GreenVin," a bio-based PVC product made out of cooking oil in order to reduce carbon footprints and promote renewable energy.

- August 2022: PVC Group, an investment subsidiary of Investindustrial Growth, has initiated a process to disinvest its share from Benvic Compounds, a PVC manufacturing company, after four years of working together.

In-Depth Europe PVC Industry Market Outlook

The Europe PVC industry is projected for robust growth, driven by an increasing emphasis on sustainability and circular economy principles. The forecast indicates a sustained demand for PVC in its traditional applications like construction and infrastructure, complemented by emerging opportunities in high-performance and eco-friendly material solutions. Strategic investments in recycling technologies, bio-based feedstocks, and innovative PVC formulations will be key to unlocking future market potential. The industry is poised to witness significant expansion in specialized segments, catering to evolving demands from sectors such as automotive, electricals, and healthcare. Collaboration and innovation will be paramount in navigating regulatory landscapes and capitalizing on the increasing consumer preference for sustainable products, solidifying PVC's position as a vital material in the European economy.

Europe PVC Industry Segmentation

-

1. Product Type

-

1.1. Rigid PVC

- 1.1.1. Clear Rigid PVC

- 1.1.2. Non-Clear Rigid PVC

-

1.2. Flexible PVC

- 1.2.1. Clear Flexible PVC

- 1.2.2. Non-clear Flexible PVC

- 1.3. Low-smoke PVC

- 1.4. Chlorinated PVC

-

1.1. Rigid PVC

-

2. Stabilizer Type

- 2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 2.2. Lead-based Stabilizers (Pb Stabilizers)

- 2.3. Tin- and

- 2.4. Barium-based and Others (Liquid Mixed Metals)

-

3. Application

- 3.1. Pipes and Fittings

- 3.2. Films and Sheets

- 3.3. Wires and Cables

- 3.4. Bottles

- 3.5. Profiles, Hoses and Tubings

- 3.6. Other Applications

-

4. End-user Industry

- 4.1. Building and Construction

- 4.2. Automotive

- 4.3. Electrical and Electronics

- 4.4. Packaging

- 4.5. Footwear

- 4.6. Healthcare

- 4.7. Other End-user Industries

Europe PVC Industry Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Spain

- 6. Turkey

- 7. Rest of Europe

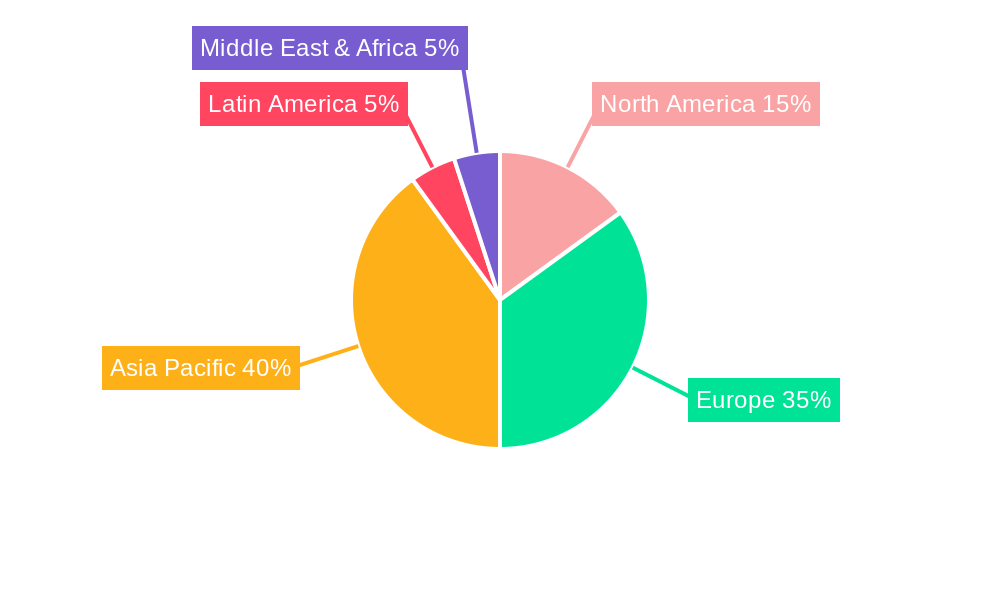

Europe PVC Industry Regional Market Share

Geographic Coverage of Europe PVC Industry

Europe PVC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Plastics to Reduce Vehicle Weight and Enhance Fuel Economy; Growing Demand from the Construction Industry; Increasing Applications in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. Hazardous Impact on Humans and the Environment

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe PVC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid PVC

- 5.1.1.1. Clear Rigid PVC

- 5.1.1.2. Non-Clear Rigid PVC

- 5.1.2. Flexible PVC

- 5.1.2.1. Clear Flexible PVC

- 5.1.2.2. Non-clear Flexible PVC

- 5.1.3. Low-smoke PVC

- 5.1.4. Chlorinated PVC

- 5.1.1. Rigid PVC

- 5.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 5.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 5.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 5.2.3. Tin- and

- 5.2.4. Barium-based and Others (Liquid Mixed Metals)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Pipes and Fittings

- 5.3.2. Films and Sheets

- 5.3.3. Wires and Cables

- 5.3.4. Bottles

- 5.3.5. Profiles, Hoses and Tubings

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Building and Construction

- 5.4.2. Automotive

- 5.4.3. Electrical and Electronics

- 5.4.4. Packaging

- 5.4.5. Footwear

- 5.4.6. Healthcare

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. France

- 5.5.3. Germany

- 5.5.4. Italy

- 5.5.5. Spain

- 5.5.6. Turkey

- 5.5.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe PVC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Rigid PVC

- 6.1.1.1. Clear Rigid PVC

- 6.1.1.2. Non-Clear Rigid PVC

- 6.1.2. Flexible PVC

- 6.1.2.1. Clear Flexible PVC

- 6.1.2.2. Non-clear Flexible PVC

- 6.1.3. Low-smoke PVC

- 6.1.4. Chlorinated PVC

- 6.1.1. Rigid PVC

- 6.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 6.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 6.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 6.2.3. Tin- and

- 6.2.4. Barium-based and Others (Liquid Mixed Metals)

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Pipes and Fittings

- 6.3.2. Films and Sheets

- 6.3.3. Wires and Cables

- 6.3.4. Bottles

- 6.3.5. Profiles, Hoses and Tubings

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Building and Construction

- 6.4.2. Automotive

- 6.4.3. Electrical and Electronics

- 6.4.4. Packaging

- 6.4.5. Footwear

- 6.4.6. Healthcare

- 6.4.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France Europe PVC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Rigid PVC

- 7.1.1.1. Clear Rigid PVC

- 7.1.1.2. Non-Clear Rigid PVC

- 7.1.2. Flexible PVC

- 7.1.2.1. Clear Flexible PVC

- 7.1.2.2. Non-clear Flexible PVC

- 7.1.3. Low-smoke PVC

- 7.1.4. Chlorinated PVC

- 7.1.1. Rigid PVC

- 7.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 7.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 7.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 7.2.3. Tin- and

- 7.2.4. Barium-based and Others (Liquid Mixed Metals)

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Pipes and Fittings

- 7.3.2. Films and Sheets

- 7.3.3. Wires and Cables

- 7.3.4. Bottles

- 7.3.5. Profiles, Hoses and Tubings

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Building and Construction

- 7.4.2. Automotive

- 7.4.3. Electrical and Electronics

- 7.4.4. Packaging

- 7.4.5. Footwear

- 7.4.6. Healthcare

- 7.4.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany Europe PVC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Rigid PVC

- 8.1.1.1. Clear Rigid PVC

- 8.1.1.2. Non-Clear Rigid PVC

- 8.1.2. Flexible PVC

- 8.1.2.1. Clear Flexible PVC

- 8.1.2.2. Non-clear Flexible PVC

- 8.1.3. Low-smoke PVC

- 8.1.4. Chlorinated PVC

- 8.1.1. Rigid PVC

- 8.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 8.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 8.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 8.2.3. Tin- and

- 8.2.4. Barium-based and Others (Liquid Mixed Metals)

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Pipes and Fittings

- 8.3.2. Films and Sheets

- 8.3.3. Wires and Cables

- 8.3.4. Bottles

- 8.3.5. Profiles, Hoses and Tubings

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Building and Construction

- 8.4.2. Automotive

- 8.4.3. Electrical and Electronics

- 8.4.4. Packaging

- 8.4.5. Footwear

- 8.4.6. Healthcare

- 8.4.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe PVC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Rigid PVC

- 9.1.1.1. Clear Rigid PVC

- 9.1.1.2. Non-Clear Rigid PVC

- 9.1.2. Flexible PVC

- 9.1.2.1. Clear Flexible PVC

- 9.1.2.2. Non-clear Flexible PVC

- 9.1.3. Low-smoke PVC

- 9.1.4. Chlorinated PVC

- 9.1.1. Rigid PVC

- 9.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 9.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 9.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 9.2.3. Tin- and

- 9.2.4. Barium-based and Others (Liquid Mixed Metals)

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Pipes and Fittings

- 9.3.2. Films and Sheets

- 9.3.3. Wires and Cables

- 9.3.4. Bottles

- 9.3.5. Profiles, Hoses and Tubings

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Building and Construction

- 9.4.2. Automotive

- 9.4.3. Electrical and Electronics

- 9.4.4. Packaging

- 9.4.5. Footwear

- 9.4.6. Healthcare

- 9.4.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe PVC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Rigid PVC

- 10.1.1.1. Clear Rigid PVC

- 10.1.1.2. Non-Clear Rigid PVC

- 10.1.2. Flexible PVC

- 10.1.2.1. Clear Flexible PVC

- 10.1.2.2. Non-clear Flexible PVC

- 10.1.3. Low-smoke PVC

- 10.1.4. Chlorinated PVC

- 10.1.1. Rigid PVC

- 10.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 10.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 10.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 10.2.3. Tin- and

- 10.2.4. Barium-based and Others (Liquid Mixed Metals)

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Pipes and Fittings

- 10.3.2. Films and Sheets

- 10.3.3. Wires and Cables

- 10.3.4. Bottles

- 10.3.5. Profiles, Hoses and Tubings

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Building and Construction

- 10.4.2. Automotive

- 10.4.3. Electrical and Electronics

- 10.4.4. Packaging

- 10.4.5. Footwear

- 10.4.6. Healthcare

- 10.4.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Turkey Europe PVC Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Rigid PVC

- 11.1.1.1. Clear Rigid PVC

- 11.1.1.2. Non-Clear Rigid PVC

- 11.1.2. Flexible PVC

- 11.1.2.1. Clear Flexible PVC

- 11.1.2.2. Non-clear Flexible PVC

- 11.1.3. Low-smoke PVC

- 11.1.4. Chlorinated PVC

- 11.1.1. Rigid PVC

- 11.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 11.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 11.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 11.2.3. Tin- and

- 11.2.4. Barium-based and Others (Liquid Mixed Metals)

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Pipes and Fittings

- 11.3.2. Films and Sheets

- 11.3.3. Wires and Cables

- 11.3.4. Bottles

- 11.3.5. Profiles, Hoses and Tubings

- 11.3.6. Other Applications

- 11.4. Market Analysis, Insights and Forecast - by End-user Industry

- 11.4.1. Building and Construction

- 11.4.2. Automotive

- 11.4.3. Electrical and Electronics

- 11.4.4. Packaging

- 11.4.5. Footwear

- 11.4.6. Healthcare

- 11.4.7. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe PVC Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Rigid PVC

- 12.1.1.1. Clear Rigid PVC

- 12.1.1.2. Non-Clear Rigid PVC

- 12.1.2. Flexible PVC

- 12.1.2.1. Clear Flexible PVC

- 12.1.2.2. Non-clear Flexible PVC

- 12.1.3. Low-smoke PVC

- 12.1.4. Chlorinated PVC

- 12.1.1. Rigid PVC

- 12.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 12.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 12.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 12.2.3. Tin- and

- 12.2.4. Barium-based and Others (Liquid Mixed Metals)

- 12.3. Market Analysis, Insights and Forecast - by Application

- 12.3.1. Pipes and Fittings

- 12.3.2. Films and Sheets

- 12.3.3. Wires and Cables

- 12.3.4. Bottles

- 12.3.5. Profiles, Hoses and Tubings

- 12.3.6. Other Applications

- 12.4. Market Analysis, Insights and Forecast - by End-user Industry

- 12.4.1. Building and Construction

- 12.4.2. Automotive

- 12.4.3. Electrical and Electronics

- 12.4.4. Packaging

- 12.4.5. Footwear

- 12.4.6. Healthcare

- 12.4.7. Other End-user Industries

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 KEM ONE

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ercros S A

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Solvay

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Westlake Chemical Corporation*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 INEOS

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Oltchim SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Orbia

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BASF SE

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Industrie Generali S P A

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Shin-Etsu Chemical Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Formosa Plastics Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Covestro AG

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Lukoil

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Sibur

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Benvic Group

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Vynova

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 KEM ONE

List of Figures

- Figure 1: Europe PVC Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe PVC Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe PVC Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Europe PVC Industry Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 3: Europe PVC Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Europe PVC Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe PVC Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe PVC Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Europe PVC Industry Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 8: Europe PVC Industry Revenue million Forecast, by Application 2020 & 2033

- Table 9: Europe PVC Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe PVC Industry Revenue million Forecast, by Country 2020 & 2033

- Table 11: Europe PVC Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: Europe PVC Industry Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 13: Europe PVC Industry Revenue million Forecast, by Application 2020 & 2033

- Table 14: Europe PVC Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 15: Europe PVC Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Europe PVC Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 17: Europe PVC Industry Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 18: Europe PVC Industry Revenue million Forecast, by Application 2020 & 2033

- Table 19: Europe PVC Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 20: Europe PVC Industry Revenue million Forecast, by Country 2020 & 2033

- Table 21: Europe PVC Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Europe PVC Industry Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 23: Europe PVC Industry Revenue million Forecast, by Application 2020 & 2033

- Table 24: Europe PVC Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 25: Europe PVC Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: Europe PVC Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 27: Europe PVC Industry Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 28: Europe PVC Industry Revenue million Forecast, by Application 2020 & 2033

- Table 29: Europe PVC Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 30: Europe PVC Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: Europe PVC Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 32: Europe PVC Industry Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 33: Europe PVC Industry Revenue million Forecast, by Application 2020 & 2033

- Table 34: Europe PVC Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 35: Europe PVC Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Europe PVC Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 37: Europe PVC Industry Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 38: Europe PVC Industry Revenue million Forecast, by Application 2020 & 2033

- Table 39: Europe PVC Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 40: Europe PVC Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe PVC Industry?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Europe PVC Industry?

Key companies in the market include KEM ONE, Ercros S A, Solvay, Westlake Chemical Corporation*List Not Exhaustive, INEOS, Oltchim SA, Orbia, BASF SE, Industrie Generali S P A, Shin-Etsu Chemical Co Ltd, Formosa Plastics Corporation, Covestro AG, Lukoil, Sibur, Benvic Group, Vynova.

3. What are the main segments of the Europe PVC Industry?

The market segments include Product Type, Stabilizer Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.3 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Plastics to Reduce Vehicle Weight and Enhance Fuel Economy; Growing Demand from the Construction Industry; Increasing Applications in the Healthcare Industry.

6. What are the notable trends driving market growth?

Growing Demand from the Construction Industry.

7. Are there any restraints impacting market growth?

Hazardous Impact on Humans and the Environment.

8. Can you provide examples of recent developments in the market?

October 2022: Westlake Vinnolit launches "GreenVin," a bio-based PVC product made out of cooking oil in order to reduce carbon footprints and promote renewable energy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe PVC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe PVC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe PVC Industry?

To stay informed about further developments, trends, and reports in the Europe PVC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence