Key Insights

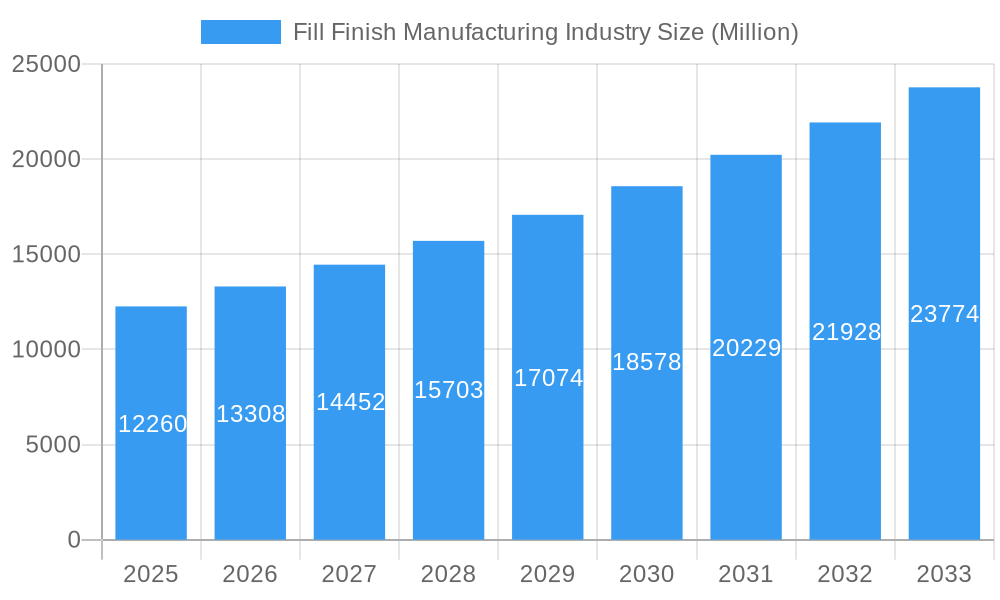

The Fill Finish Manufacturing Industry is poised for significant expansion, projected to reach USD 12.26 billion in 2025 and grow at a robust CAGR of 8.7% throughout the forecast period. This dynamic growth is primarily fueled by the increasing demand for sterile drug packaging solutions, driven by the expanding biopharmaceutical sector and the rising prevalence of chronic diseases necessitating advanced therapeutic formulations. The industry's growth is further propelled by continuous technological advancements in automated filling and sealing systems, enhancing efficiency, precision, and safety in drug production. Moreover, the surge in biologics and complex injectables, which often require specialized fill-finish processes, contributes substantially to market expansion. The growing outsourcing trend among pharmaceutical and biotechnology companies to specialized Contract Manufacturing Organizations (CMOs) also plays a pivotal role, as CMOs invest heavily in state-of-the-art fill-finish capabilities to meet stringent regulatory requirements and the evolving needs of drug manufacturers. The market's resilience is also bolstered by the critical role of fill-finish in ensuring drug product integrity and patient safety, making it an indispensable segment of the pharmaceutical supply chain.

Fill Finish Manufacturing Industry Market Size (In Billion)

Key market drivers include the escalating production of vaccines and biosimilars, the increasing focus on aseptic processing to minimize contamination risks, and the growing adoption of single-use technologies for flexibility and reduced cleaning validation burdens. Emerging economies, with their expanding healthcare infrastructure and increasing access to advanced pharmaceuticals, present significant untapped opportunities. However, the industry faces certain restraints, including the high capital investment required for advanced fill-finish equipment and the stringent regulatory landscape that necessitates continuous compliance and validation. Nevertheless, the overarching trend towards enhanced drug delivery systems, personalized medicine, and the ongoing global health initiatives are expected to outweigh these challenges, ensuring a positive trajectory for the Fill Finish Manufacturing Industry over the coming years. The market is segmented into Consumables, including Prefillable Syringes, Cartridges, Vials, and Other Consumables, serving a diverse range of End Users such as Contract Manufacturing Organizations, Pharmaceutical and Biotechnology Industries, and Others.

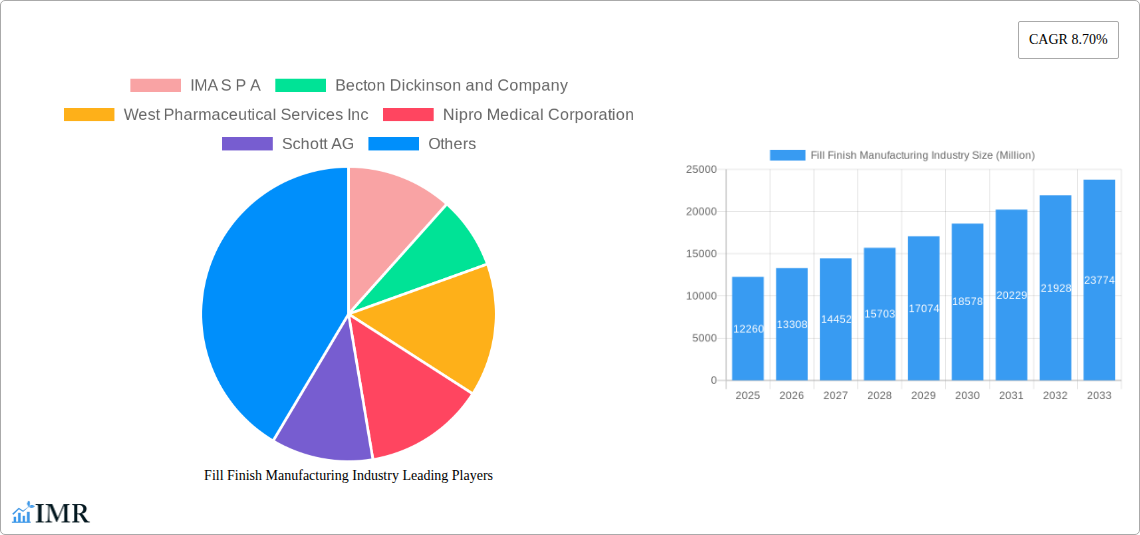

Fill Finish Manufacturing Industry Company Market Share

Fill Finish Manufacturing Industry Market Dynamics & Structure

The fill finish manufacturing industry is characterized by a moderately concentrated market structure, with a few dominant players holding significant market share, alongside a growing number of specialized Contract Manufacturing Organizations (CMOs). Technological innovation is a primary driver, fueled by the increasing demand for advanced drug delivery systems and sterile injectable manufacturing. Key innovations include advancements in automation, isolator technology, and advanced aseptic processing techniques, all aimed at enhancing product quality, safety, and production efficiency. The regulatory framework, spearheaded by agencies like the FDA and EMA, plays a pivotal role, mandating stringent Good Manufacturing Practices (GMP) and sterile processing standards, thereby acting as both a barrier to entry and a driver for quality improvements. Competitive product substitutes are minimal in core sterile fill finish operations, but advancements in alternative drug delivery methods or novel packaging solutions can indirectly influence demand.

- Market Concentration: A mix of large, vertically integrated companies and specialized CMOs.

- Technological Innovation: Driven by automation, isolator technology, and aseptic processing.

- Regulatory Framework: Stringent GMP and sterile processing standards are paramount.

- Competitive Product Substitutes: Limited in core fill finish, but indirect influence from alternative delivery systems.

- End-User Demographics: Dominated by pharmaceutical and biotechnology companies, with growing reliance on CMOs.

- M&A Trends: Ongoing consolidation and strategic partnerships to expand capabilities and market reach, with an estimated xx M&A deals in the historical period (2019-2024).

Fill Finish Manufacturing Industry Growth Trends & Insights

The global fill finish manufacturing industry is experiencing robust growth, projected to reach USD xxx billion units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is propelled by a confluence of factors, including the escalating global demand for biologics and sterile injectables, the increasing prevalence of chronic diseases, and the growing pipeline of novel therapeutics requiring aseptic filling. The base year 2025 marks a critical inflection point, with an estimated market size of USD xxx billion units. The historical period (2019-2024) saw steady growth, with the market size reaching USD xxx billion units in 2024.

Technological advancements are fundamentally reshaping the industry. The adoption of advanced aseptic processing technologies, such as Restricted Access Barrier Systems (RABS) and isolators, is accelerating, enhancing sterility assurance and minimizing human intervention. Automation and digitalization are further optimizing production lines, improving efficiency, and reducing the risk of errors. The rising trend of outsourcing drug manufacturing, particularly sterile fill finish operations, to specialized CMOs is a significant market mover. This allows pharmaceutical and biotechnology companies to focus on R&D and marketing while leveraging the expertise and infrastructure of CMOs.

Consumer behavior shifts, primarily driven by an aging global population and a heightened awareness of health and wellness, are contributing to increased demand for pharmaceutical products, including vaccines, biologics, and specialty injectables. The development of prefilled syringes and advanced drug delivery devices is also influencing market dynamics, offering convenience and improved patient compliance. Furthermore, the ongoing advancements in cell and gene therapies, which often require complex sterile manufacturing processes, present a substantial growth opportunity. The market penetration of advanced fill finish solutions is expected to rise as manufacturers prioritize safety, efficiency, and regulatory compliance.

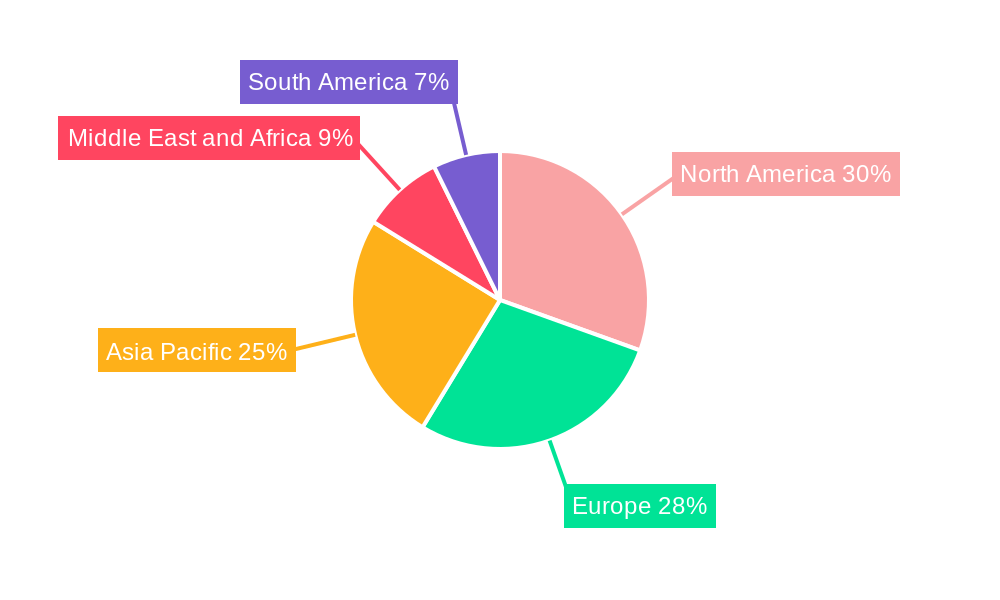

Dominant Regions, Countries, or Segments in Fill Finish Manufacturing Industry

North America currently leads the fill finish manufacturing industry, driven by its well-established pharmaceutical and biotechnology sectors, robust R&D investments, and a favorable regulatory environment. The United States, in particular, is a powerhouse, accounting for a significant portion of global pharmaceutical production and innovation. The presence of leading pharmaceutical companies, a high concentration of contract manufacturing organizations, and a strong demand for advanced therapeutics underpin this dominance. The region's focus on technological innovation, including the early adoption of advanced aseptic processing technologies and automation, further solidifies its leading position.

Within the Product Type: Consumables segment, Prefillable Syringes are a dominant sub-segment, experiencing rapid growth due to their convenience, improved dose accuracy, and reduced risk of contamination compared to traditional vial-and-syringe methods. The increasing use of prefillable syringes for biologics, vaccines, and chronic disease management drugs is a key growth driver. Cartridges also represent a significant and growing market, particularly for insulin pens and other self-injection devices. Vials, while a mature segment, continue to hold a substantial share, especially for large-volume parenteral preparations and certain biopharmaceuticals. Other Consumables, including stoppers, plungers, and specialized closure systems, are critical components of the fill finish process and see consistent demand.

From an End User perspective, the Pharmaceutical and Biotechnology Industries are the largest and most influential segment. These companies are the primary drivers of demand, investing heavily in the development and manufacturing of sterile injectable drugs, vaccines, and advanced therapies. The burgeoning biologics market, with its complex manufacturing requirements, is a significant contributor to this segment's growth. Contract Manufacturing Organizations (CMOs) are another pivotal segment, experiencing substantial growth as more pharmaceutical and biotech companies opt to outsource their fill finish operations. CMOs offer specialized expertise, scalable capacity, and cost-effectiveness, making them indispensable partners. The Others segment, encompassing research institutions and smaller biotechs, also contributes to demand, albeit to a lesser extent.

Key drivers for regional dominance include economic policies that support pharmaceutical R&D and manufacturing, robust healthcare infrastructure, and a skilled workforce. For instance, government initiatives aimed at boosting domestic pharmaceutical production and incentivizing innovation in countries like the United States and Germany have been instrumental. The availability of advanced manufacturing technologies and a strong supply chain network for raw materials and equipment further contribute to the dominance of key regions.

Fill Finish Manufacturing Industry Product Landscape

The fill finish manufacturing industry is defined by a landscape of innovative products and technologies aimed at ensuring the sterility, safety, and efficacy of injectable pharmaceuticals and biologics. Innovations in drug delivery devices, such as prefillable syringes and autoinjectors, are paramount, offering enhanced patient convenience and compliance. Advanced aseptic processing equipment, including isolators and Restricted Access Barrier Systems (RABS), represents a significant technological leap, minimizing contamination risks and enabling highly controlled manufacturing environments. The development of specialized vials and stoppers designed for specific drug formulations and sensitive biologics, ensuring product integrity and shelf-life, is also a key focus.

Key Drivers, Barriers & Challenges in Fill Finish Manufacturing Industry

Key Drivers:

- Growing Demand for Biologics and Vaccines: The surging global demand for complex biologics, biosimilars, and vaccines, particularly in light of pandemics and an aging population, directly fuels the need for sterile fill finish manufacturing.

- Technological Advancements: Innovations in automation, isolator technology, and advanced aseptic processing are increasing efficiency, safety, and product quality, driving investment in new equipment and capabilities.

- Outsourcing Trends: The increasing reliance of pharmaceutical and biotechnology companies on Contract Manufacturing Organizations (CMOs) for specialized fill finish services is expanding the market.

- Rise of Personalized Medicine: The development of individualized therapies and targeted treatments often requires smaller batch sizes and highly specialized sterile filling capabilities.

Key Barriers & Challenges:

- Stringent Regulatory Compliance: Adhering to evolving and rigorous GMP, FDA, and EMA regulations requires significant investment in infrastructure, validation, and quality control, acting as a substantial barrier to entry.

- High Capital Investment: Establishing and maintaining state-of-the-art sterile fill finish facilities, including specialized equipment like isolators, demands substantial capital expenditure.

- Supply Chain Vulnerabilities: Disruptions in the supply chain for critical raw materials, components (e.g., specialized stoppers, vials), and manufacturing equipment can significantly impact production timelines and costs.

- Skilled Workforce Shortage: A lack of qualified personnel with expertise in aseptic processing and sterile manufacturing can pose a significant challenge for capacity expansion and operational excellence.

- Competition and Pricing Pressures: While capital-intensive, the market can experience pricing pressures, especially from established CMOs with economies of scale, creating a challenging competitive landscape.

Emerging Opportunities in Fill Finish Manufacturing Industry

Emerging opportunities in the fill finish manufacturing industry are centered around the increasing demand for complex biopharmaceuticals, including cell and gene therapies, which necessitate highly specialized aseptic processing. The growing adoption of prefilled syringes and advanced drug delivery devices, driven by patient convenience and compliance, presents a significant avenue for growth. Furthermore, the expansion of fill finish capabilities in emerging markets, catering to the rising healthcare needs and growing pharmaceutical industries in these regions, offers untapped potential. The development of innovative containment and sterilization technologies for highly potent active pharmaceutical ingredients (HPAPIs) also represents a niche but rapidly growing opportunity.

Growth Accelerators in the Fill Finish Manufacturing Industry Industry

Long-term growth in the fill finish manufacturing industry is being significantly accelerated by breakthroughs in biopharmaceutical development, leading to a constant influx of new injectable drugs requiring sterile manufacturing. Strategic partnerships between pharmaceutical giants and specialized CMOs are facilitating the scaling of production for novel therapies. Market expansion strategies, including the establishment of new manufacturing facilities in key geographic regions and the acquisition of companies with complementary capabilities, are further driving growth. The continuous innovation in automation and digitalization of fill finish processes, enhancing efficiency and reducing operational costs, also acts as a powerful growth accelerator.

Key Players Shaping the Fill Finish Manufacturing Industry Market

- IMA S.P.A

- Becton Dickinson and Company

- West Pharmaceutical Services Inc

- Nipro Medical Corporation

- Schott AG

- Syntegon Technology GmbH (Robert Bosch GmbH)

- Piramal Pharma Solutions

- Optima

- Groninger & Co GmbH

- Gerresheimer AG

Notable Milestones in Fill Finish Manufacturing Industry Sector

- 2020: Increased global demand for vaccine fill finish capabilities due to the COVID-19 pandemic, leading to significant capacity expansions by key players.

- 2021: Advancements in isolator technology leading to enhanced sterility assurance and reduced contamination risk in aseptic processing.

- 2022: Growing focus on sustainable manufacturing practices within the fill finish sector, with companies investing in energy-efficient equipment and waste reduction initiatives.

- 2023: Rise in strategic acquisitions and partnerships aimed at consolidating market share and expanding service offerings in specialized areas like prefillable syringe manufacturing.

- 2024: Increased investment in robotic automation and AI-driven quality control systems to optimize fill finish processes and enhance overall efficiency.

In-Depth Fill Finish Manufacturing Industry Market Outlook

The future outlook for the fill finish manufacturing industry is exceptionally bright, driven by sustained growth in biologics, vaccines, and advanced therapies. Growth accelerators such as ongoing technological innovation in aseptic processing, automation, and digitalization will continue to enhance efficiency and safety. Strategic collaborations between innovator drug companies and specialized CMOs will be crucial for scaling production of complex molecules. The expanding market for prefilled syringes and advanced drug delivery systems, coupled with the increasing healthcare expenditure in emerging economies, will further propel market expansion. Companies that can navigate stringent regulatory landscapes, invest in cutting-edge technology, and secure reliable supply chains will be well-positioned to capitalize on the substantial growth opportunities ahead.

Fill Finish Manufacturing Industry Segmentation

-

1. Product Type

-

1.1. Consumables

- 1.1.1. Prefillable Syringes

- 1.1.2. Cartridges

- 1.1.3. Vials

- 1.1.4. Other Consumables

-

1.1. Consumables

-

2. End User

- 2.1. Contract Manufacturing Organizations

- 2.2. Pharmaceutical and Biotechnology Industries

- 2.3. Others

Fill Finish Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Fill Finish Manufacturing Industry Regional Market Share

Geographic Coverage of Fill Finish Manufacturing Industry

Fill Finish Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Technological Advancement in Fill Finish Products; Rise in Fill Finish Outsourcing

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Issues; High Production Costs

- 3.4. Market Trends

- 3.4.1. Consumables segment is Expected to Hold a Major Market Share in the Fill Finish Manufacturing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fill Finish Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Consumables

- 5.1.1.1. Prefillable Syringes

- 5.1.1.2. Cartridges

- 5.1.1.3. Vials

- 5.1.1.4. Other Consumables

- 5.1.1. Consumables

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Contract Manufacturing Organizations

- 5.2.2. Pharmaceutical and Biotechnology Industries

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Fill Finish Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Consumables

- 6.1.1.1. Prefillable Syringes

- 6.1.1.2. Cartridges

- 6.1.1.3. Vials

- 6.1.1.4. Other Consumables

- 6.1.1. Consumables

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Contract Manufacturing Organizations

- 6.2.2. Pharmaceutical and Biotechnology Industries

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Fill Finish Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Consumables

- 7.1.1.1. Prefillable Syringes

- 7.1.1.2. Cartridges

- 7.1.1.3. Vials

- 7.1.1.4. Other Consumables

- 7.1.1. Consumables

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Contract Manufacturing Organizations

- 7.2.2. Pharmaceutical and Biotechnology Industries

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Fill Finish Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Consumables

- 8.1.1.1. Prefillable Syringes

- 8.1.1.2. Cartridges

- 8.1.1.3. Vials

- 8.1.1.4. Other Consumables

- 8.1.1. Consumables

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Contract Manufacturing Organizations

- 8.2.2. Pharmaceutical and Biotechnology Industries

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Fill Finish Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Consumables

- 9.1.1.1. Prefillable Syringes

- 9.1.1.2. Cartridges

- 9.1.1.3. Vials

- 9.1.1.4. Other Consumables

- 9.1.1. Consumables

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Contract Manufacturing Organizations

- 9.2.2. Pharmaceutical and Biotechnology Industries

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Fill Finish Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Consumables

- 10.1.1.1. Prefillable Syringes

- 10.1.1.2. Cartridges

- 10.1.1.3. Vials

- 10.1.1.4. Other Consumables

- 10.1.1. Consumables

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Contract Manufacturing Organizations

- 10.2.2. Pharmaceutical and Biotechnology Industries

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IMA S P A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Becton Dickinson and Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 West Pharmaceutical Services Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nipro Medical Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schott AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Syntegon Technology GmbH (Robert Bosch GmbH)*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Piramal Pharma Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Optima

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Groninger & Co GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gerresheimer AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IMA S P A

List of Figures

- Figure 1: Global Fill Finish Manufacturing Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Fill Finish Manufacturing Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Fill Finish Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Fill Finish Manufacturing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Fill Finish Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Fill Finish Manufacturing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Fill Finish Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fill Finish Manufacturing Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Fill Finish Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Fill Finish Manufacturing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Fill Finish Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Fill Finish Manufacturing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Fill Finish Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fill Finish Manufacturing Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Fill Finish Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Fill Finish Manufacturing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Fill Finish Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Fill Finish Manufacturing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Fill Finish Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Fill Finish Manufacturing Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East and Africa Fill Finish Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East and Africa Fill Finish Manufacturing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Middle East and Africa Fill Finish Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Fill Finish Manufacturing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Fill Finish Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Fill Finish Manufacturing Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Fill Finish Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Fill Finish Manufacturing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: South America Fill Finish Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Fill Finish Manufacturing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Fill Finish Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 21: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 35: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Global Fill Finish Manufacturing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Fill Finish Manufacturing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fill Finish Manufacturing Industry?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Fill Finish Manufacturing Industry?

Key companies in the market include IMA S P A, Becton Dickinson and Company, West Pharmaceutical Services Inc, Nipro Medical Corporation, Schott AG, Syntegon Technology GmbH (Robert Bosch GmbH)*List Not Exhaustive, Piramal Pharma Solutions, Optima, Groninger & Co GmbH, Gerresheimer AG.

3. What are the main segments of the Fill Finish Manufacturing Industry?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Technological Advancement in Fill Finish Products; Rise in Fill Finish Outsourcing.

6. What are the notable trends driving market growth?

Consumables segment is Expected to Hold a Major Market Share in the Fill Finish Manufacturing Market.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Issues; High Production Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fill Finish Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fill Finish Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fill Finish Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Fill Finish Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence