Key Insights

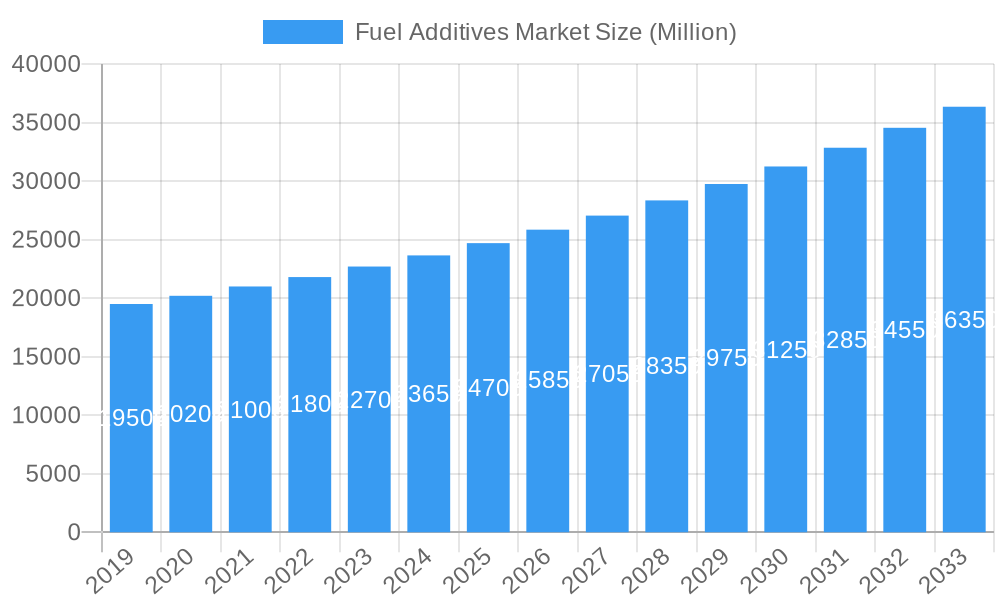

The global Fuel Additives Market is poised for robust expansion, projected to reach approximately USD 25,000 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 5.09% through 2033. This significant market growth is propelled by a confluence of factors, primarily the escalating demand for enhanced fuel efficiency and performance across various transportation and industrial sectors. Stringent emission regulations worldwide are compelling manufacturers to develop cleaner-burning fuels, thus driving the adoption of advanced fuel additives that reduce harmful pollutants and improve combustion processes. Furthermore, the increasing exploration and production of crude oil, coupled with the growing refining capacity, particularly in emerging economies, directly translates to a higher volume of fuel produced and, consequently, a greater need for fuel additives to maintain fuel quality and meet performance standards. The market is also benefiting from technological advancements in additive formulations, leading to more effective and specialized solutions for diverse fuel types and applications.

Fuel Additives Market Market Size (In Billion)

The market's trajectory is further shaped by evolving consumption patterns and critical industry trends. The diesel segment, driven by its widespread use in heavy-duty vehicles and industrial machinery, is expected to remain a dominant application area. Simultaneously, the gasoline segment is witnessing increased demand for additives that improve engine cleanliness and fuel economy. Geographically, the Asia Pacific region is emerging as a key growth engine, fueled by rapid industrialization, expanding automotive fleets, and increasing disposable incomes in countries like China and India. Key players are strategically investing in research and development to introduce innovative additive solutions, including advanced deposit control agents, high-performance cetane improvers, and eco-friendly formulations. However, the market faces certain restraints, such as fluctuating raw material prices, particularly for petrochemical derivatives, and growing environmental concerns regarding the long-term impact of certain additive components. Despite these challenges, the continuous innovation and the indispensable role of fuel additives in optimizing fuel performance and meeting regulatory demands underscore a promising outlook for the global Fuel Additives Market.

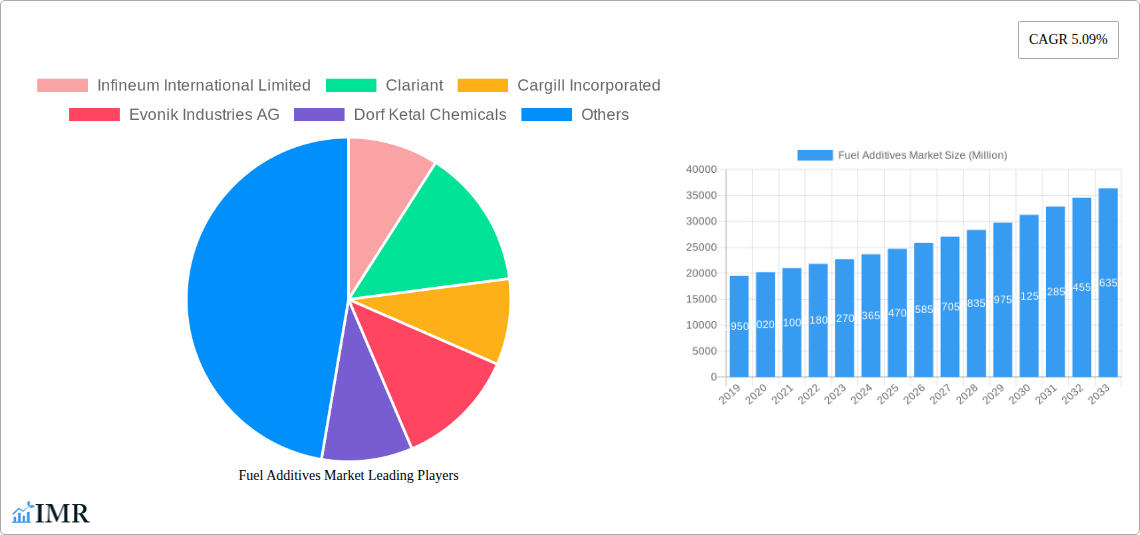

Fuel Additives Market Company Market Share

This comprehensive report, Fuel Additives Market: Global Outlook & Forecast 2025-2033, delves deep into the dynamic world of fuel additives, providing an unparalleled analysis for industry stakeholders. From enhancing engine efficiency to meeting stringent environmental regulations, fuel additives are critical components of the global energy landscape. Our report offers granular insights into market size, growth trajectories, competitive strategies, and emerging trends across key segments and regions. We meticulously analyze parent and child markets, including Deposit Control Additives, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion Additives, Cold Flow Improvers, and Antiknock Agents, applied across Diesel, Gasoline, and Jet Fuel applications.

Fuel Additives Market Market Dynamics & Structure

The global fuel additives market is characterized by a moderate to high level of concentration, with major players investing heavily in research and development to meet evolving engine technologies and stricter environmental mandates. Technological innovation is a primary driver, with a constant push for more efficient, cleaner-burning fuel formulations. Regulatory frameworks, particularly concerning emissions standards and fuel quality, significantly shape market dynamics, pushing for the adoption of advanced additive packages. Competitive product substitutes, such as alternative fuels and engine modifications, exist but are often complementary to additive solutions. End-user demographics, including commercial fleets, individual vehicle owners, and aviation industries, exhibit varying demands for performance enhancement and cost-effectiveness. Mergers and acquisitions (M&A) trends are evident as larger companies seek to consolidate market share and expand their product portfolios.

- Market Concentration: Dominated by a few key global players, but with significant opportunities for specialized niche providers.

- Technological Innovation: Driven by the demand for improved fuel economy, reduced emissions (e.g., NOx, particulate matter), and enhanced engine longevity.

- Regulatory Frameworks: Stringent emission standards globally, such as Euro 7 and EPA regulations, are accelerating the adoption of advanced fuel additive technologies.

- Competitive Product Substitutes: While alternative fuels and electric vehicles are emerging, the vast existing internal combustion engine fleet ensures continued demand for fuel additives.

- End-User Demographics: Diverse needs from heavy-duty diesel trucks requiring superior lubricity and detergency to gasoline vehicles seeking improved octane and deposit control.

- M&A Trends: Strategic acquisitions to gain access to new technologies, markets, and customer bases.

Fuel Additives Market Growth Trends & Insights

The fuel additives market is projected for robust growth, fueled by increasing global energy demand and the continuous evolution of internal combustion engine technology. Our analysis leverages extensive market data to provide a detailed understanding of market size evolution, adoption rates of specialized additives, and the impact of technological disruptions on consumer behavior. The base year of 2025 estimates the market at approximately $35,000 million units, with a projected Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period of 2025–2033. This growth is underpinned by the necessity to optimize fuel performance and reduce the environmental footprint of existing transportation and industrial sectors. Factors such as rising vehicle parc in emerging economies, the demand for premium fuels, and the continuous development of sophisticated engine designs are key contributors to market penetration of advanced additive solutions.

- Market Size Evolution: From an estimated $35,000 million units in 2025, the market is set for significant expansion.

- Adoption Rates: Increasing adoption of high-performance additive packages to meet stricter emission norms and improve fuel efficiency.

- Technological Disruptions: Innovations in additive chemistry are enabling better performance across a wider range of fuel types and engine configurations.

- Consumer Behavior Shifts: Growing awareness among fleet managers and consumers about the long-term benefits of using additive-treated fuels, including reduced maintenance costs and improved engine life.

- Market Penetration: Expected to increase as new additive formulations become more cost-effective and widely available across different fuel grades.

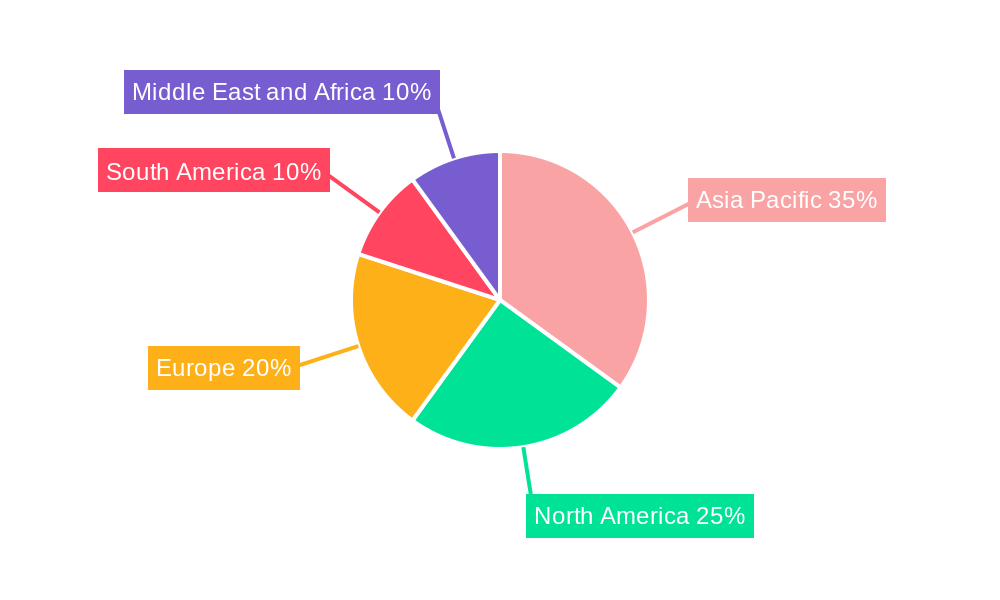

Dominant Regions, Countries, or Segments in Fuel Additives Market

The Diesel application segment is poised to dominate the global fuel additives market, driven by its widespread use in heavy-duty transportation, industrial machinery, and agricultural equipment. Asia Pacific is emerging as the leading region, propelled by rapid industrialization, a burgeoning vehicle parc, and increasing government initiatives to improve fuel quality and reduce emissions. Within this region, countries like China and India, with their substantial manufacturing bases and expanding transportation networks, represent significant growth opportunities. The demand for Deposit Control Additives and Lubricity Additives in the diesel segment is particularly strong, as these additives are crucial for maintaining engine cleanliness, preventing wear, and improving overall fuel efficiency in these demanding applications.

- Dominant Segment (Application): Diesel application segment, crucial for heavy-duty vehicles and industrial engines.

- Key Drivers: Growing demand for efficient and durable diesel engines in transportation and industrial sectors.

- Market Share: Expected to hold a substantial share of the overall fuel additives market.

- Dominant Region: Asia Pacific, owing to robust economic growth and increasing transportation infrastructure.

- Key Drivers: Rapid urbanization, expanding manufacturing output, and stricter environmental regulations are driving demand for advanced fuel additives.

- Growth Potential: Significant untapped market potential with increasing adoption of cleaner fuel technologies.

- Dominant Product Type: Deposit Control Additives and Lubricity Additives.

- Key Drivers: Essential for maintaining engine performance, preventing wear, and meeting emission standards in diesel engines.

- Market Share: High demand driven by the extensive use of diesel in commercial and industrial applications.

Fuel Additives Market Product Landscape

The fuel additives market showcases a vibrant product landscape characterized by continuous innovation aimed at enhancing fuel performance and environmental compatibility. Key product categories like Deposit Control Additives ensure engine cleanliness by preventing the formation of harmful deposits in fuel injectors and combustion chambers. Cetane Improvers boost the ignition quality of diesel fuel, leading to smoother combustion and reduced emissions. Lubricity Additives are vital for protecting fuel pumps and injectors from wear, especially in low-sulfur diesel fuels. Antioxidants prevent fuel degradation during storage, while Anticorrosion additives protect fuel systems from rust. Cold Flow Improvers enhance fuel fluidity in low temperatures, crucial for cold climates, and Antiknock Agents are essential for gasoline to prevent knocking and improve octane ratings. These advancements are crucial for meeting evolving engine technologies and regulatory demands.

Key Drivers, Barriers & Challenges in Fuel Additives Market

Key Drivers:

- Stringent Emission Regulations: Global mandates for reduced tailpipe emissions and improved fuel efficiency are compelling the use of advanced fuel additives.

- Growing Vehicle Parc: Increasing global vehicle ownership, particularly in emerging economies, directly translates to higher fuel consumption and additive demand.

- Technological Advancements in Engines: Modern engines, designed for higher efficiency and lower emissions, require sophisticated additive packages to perform optimally.

- Demand for Premium Fuels: Consumers and fleet operators are increasingly opting for premium fuel grades that often contain enhanced additive formulations for better performance and protection.

Barriers & Challenges:

- Fluctuating Crude Oil Prices: Volatility in crude oil prices can impact the cost of base fuels, consequently affecting the demand and pricing strategies for fuel additives.

- Shift Towards Electric Vehicles: The long-term trend towards electrification of transportation could eventually reduce the overall demand for fuel additives in the automotive sector.

- Complexity of Formulations: Developing and testing new additive formulations to meet diverse and evolving performance requirements can be complex and costly.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials required for additive production.

Emerging Opportunities in Fuel Additives Market

Emerging opportunities in the fuel additives market lie in the development of eco-friendly and bio-based additive solutions to support the growing demand for sustainable fuels. The increasing use of biofuels, such as biodiesel and ethanol, presents a significant opportunity for specialized additives that can improve their stability, compatibility, and performance characteristics. Furthermore, the demand for additives that enhance the efficiency and reduce emissions in the burgeoning maritime and aviation sectors, particularly for sustainable aviation fuels (SAFs) and low-sulfur marine fuels, offers considerable growth potential. Innovations in smart additives that can provide real-time monitoring and performance feedback within fuel systems also represent a forward-looking development.

Growth Accelerators in the Fuel Additives Market Industry

Growth accelerators in the fuel additives industry are being driven by a convergence of technological breakthroughs, strategic partnerships, and market expansion strategies. The development of novel additive chemistries that offer multi-functional benefits, such as enhanced detergency combined with improved lubricity, is a key catalyst. Strategic collaborations between additive manufacturers, oil companies, and original equipment manufacturers (OEMs) are crucial for co-developing and validating additive solutions for the next generation of engines. Furthermore, market expansion into emerging economies with rapidly growing transportation sectors and increasingly stringent environmental regulations is a significant growth accelerator, creating new demand centers for these essential products.

Key Players Shaping the Fuel Additives Market Market

- Infineum International Limited

- Clariant

- Cargill Incorporated

- Evonik Industries AG

- Dorf Ketal Chemicals

- BASF SE

- Chevron Corporation

- The Lubrizol Corporation

- Baker Hughes Company

- TotalEnergies SE

- Lanxess

- Innospec

- Afton Chemical

- Exxon Mobil corporation

Notable Milestones in Fuel Additives Market Sector

- April 2022: Afton Chemical's Greenclean 3 launched in North America, a significant advancement in diesel fuel detergent technology designed to enhance the performance of heavy-duty fleets and off-road vehicles.

- March 2022: Afton Chemical Corporation completed the expansion of its phase 3 Singapore Chemical Additive Manufacturing Facility, enhancing its fuel Performance Additives (GPA) blending capabilities to serve Asian customers more effectively through localized supply chain solutions.

In-Depth Fuel Additives Market Market Outlook

The future of the fuel additives market is bright, with strong growth projected driven by continued innovation and global demand for efficient and cleaner energy solutions. The ongoing development of advanced additive technologies that address evolving environmental regulations and engine performance requirements will be a primary growth accelerato r. Strategic partnerships and a focus on sustainable and bio-based additive solutions will pave the way for new market opportunities. The increasing demand from the aviation and maritime sectors, coupled with the persistent need for optimized performance in traditional internal combustion engines, ensures a dynamic and expanding market for fuel additives. This outlook underscores significant potential for market players to innovate and capture value.

Fuel Additives Market Segmentation

-

1. Product Type

- 1.1. Deposit Control

- 1.2. Cetane Improvers

- 1.3. Lubricity Additives

- 1.4. Antioxidants

- 1.5. Anticorrosion

- 1.6. Cold Flow Improvers

- 1.7. Antiknock Agents

- 1.8. Other Product Types

-

2. Application

- 2.1. Diesel

- 2.2. Gasoline

- 2.3. Jet Fuel

- 2.4. Other Applications

Fuel Additives Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Fuel Additives Market Regional Market Share

Geographic Coverage of Fuel Additives Market

Fuel Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enactment of Stringent Environmental Regulations; Degrading Quality of Crude Oil

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Battery Electric Vehicles (BEVs); High Costs of R&D Activities

- 3.4. Market Trends

- 3.4.1. Gasoline to Dominate the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Deposit Control

- 5.1.2. Cetane Improvers

- 5.1.3. Lubricity Additives

- 5.1.4. Antioxidants

- 5.1.5. Anticorrosion

- 5.1.6. Cold Flow Improvers

- 5.1.7. Antiknock Agents

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diesel

- 5.2.2. Gasoline

- 5.2.3. Jet Fuel

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Deposit Control

- 6.1.2. Cetane Improvers

- 6.1.3. Lubricity Additives

- 6.1.4. Antioxidants

- 6.1.5. Anticorrosion

- 6.1.6. Cold Flow Improvers

- 6.1.7. Antiknock Agents

- 6.1.8. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diesel

- 6.2.2. Gasoline

- 6.2.3. Jet Fuel

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Deposit Control

- 7.1.2. Cetane Improvers

- 7.1.3. Lubricity Additives

- 7.1.4. Antioxidants

- 7.1.5. Anticorrosion

- 7.1.6. Cold Flow Improvers

- 7.1.7. Antiknock Agents

- 7.1.8. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diesel

- 7.2.2. Gasoline

- 7.2.3. Jet Fuel

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Deposit Control

- 8.1.2. Cetane Improvers

- 8.1.3. Lubricity Additives

- 8.1.4. Antioxidants

- 8.1.5. Anticorrosion

- 8.1.6. Cold Flow Improvers

- 8.1.7. Antiknock Agents

- 8.1.8. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diesel

- 8.2.2. Gasoline

- 8.2.3. Jet Fuel

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Deposit Control

- 9.1.2. Cetane Improvers

- 9.1.3. Lubricity Additives

- 9.1.4. Antioxidants

- 9.1.5. Anticorrosion

- 9.1.6. Cold Flow Improvers

- 9.1.7. Antiknock Agents

- 9.1.8. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Diesel

- 9.2.2. Gasoline

- 9.2.3. Jet Fuel

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Fuel Additives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Deposit Control

- 10.1.2. Cetane Improvers

- 10.1.3. Lubricity Additives

- 10.1.4. Antioxidants

- 10.1.5. Anticorrosion

- 10.1.6. Cold Flow Improvers

- 10.1.7. Antiknock Agents

- 10.1.8. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Diesel

- 10.2.2. Gasoline

- 10.2.3. Jet Fuel

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineum International Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cargill Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Evonik Industries AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dorf Ketal Chemicals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chevron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Lubrizol Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baker Hughes Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TotalEnergies SE *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lanxess

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Innospec

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Afton Chemical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Exxon Mobil corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Infineum International Limited

List of Figures

- Figure 1: Global Fuel Additives Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Fuel Additives Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 5: Asia Pacific Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: Asia Pacific Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: Asia Pacific Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 8: Asia Pacific Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 9: Asia Pacific Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: Asia Pacific Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fuel Additives Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 16: North America Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 17: North America Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: North America Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: North America Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 20: North America Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 21: North America Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: North America Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 25: North America Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Fuel Additives Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 28: Europe Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 29: Europe Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 32: Europe Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 33: Europe Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 37: Europe Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Fuel Additives Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 40: South America Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 41: South America Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 44: South America Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 45: South America Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 49: South America Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Fuel Additives Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Fuel Additives Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Fuel Additives Market Volume (Million), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Fuel Additives Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Fuel Additives Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Fuel Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 56: Middle East and Africa Fuel Additives Market Volume (Million), by Application 2025 & 2033

- Figure 57: Middle East and Africa Fuel Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Fuel Additives Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Fuel Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Middle East and Africa Fuel Additives Market Volume (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Fuel Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Fuel Additives Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Global Fuel Additives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Fuel Additives Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 11: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: China Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: China Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: India Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Japan Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: South Korea Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 24: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 26: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 27: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 29: United States Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United States Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Canada Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Canada Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 35: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 37: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 39: Germany Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 41: France Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: Italy Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Italy Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 50: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 51: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 52: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 53: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 54: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 55: Brazil Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Brazil Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 57: Mexico Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Mexico Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: Argentina Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Argentina Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Global Fuel Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 64: Global Fuel Additives Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 65: Global Fuel Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 66: Global Fuel Additives Market Volume Million Forecast, by Application 2020 & 2033

- Table 67: Global Fuel Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 68: Global Fuel Additives Market Volume Million Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 71: South Africa Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: South Africa Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Fuel Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Fuel Additives Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fuel Additives Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Fuel Additives Market?

Key companies in the market include Infineum International Limited, Clariant, Cargill Incorporated, Evonik Industries AG, Dorf Ketal Chemicals, BASF SE, Chevron Corporation, The Lubrizol Corporation, Baker Hughes Company, TotalEnergies SE *List Not Exhaustive, Lanxess, Innospec, Afton Chemical, Exxon Mobil corporation.

3. What are the main segments of the Fuel Additives Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Enactment of Stringent Environmental Regulations; Degrading Quality of Crude Oil.

6. What are the notable trends driving market growth?

Gasoline to Dominate the Market Studied.

7. Are there any restraints impacting market growth?

Increasing Demand for Battery Electric Vehicles (BEVs); High Costs of R&D Activities.

8. Can you provide examples of recent developments in the market?

April 2022: Afton Chemical's Greenclean 3 is an advancement in diesel fuel detergent technology launched in North America. This powerful, creative technology will continue to improve the performance of heavy-duty fleets and off-road vehicles equipped with cutting-edge engine technology and pollution control systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fuel Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fuel Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fuel Additives Market?

To stay informed about further developments, trends, and reports in the Fuel Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence