Key Insights

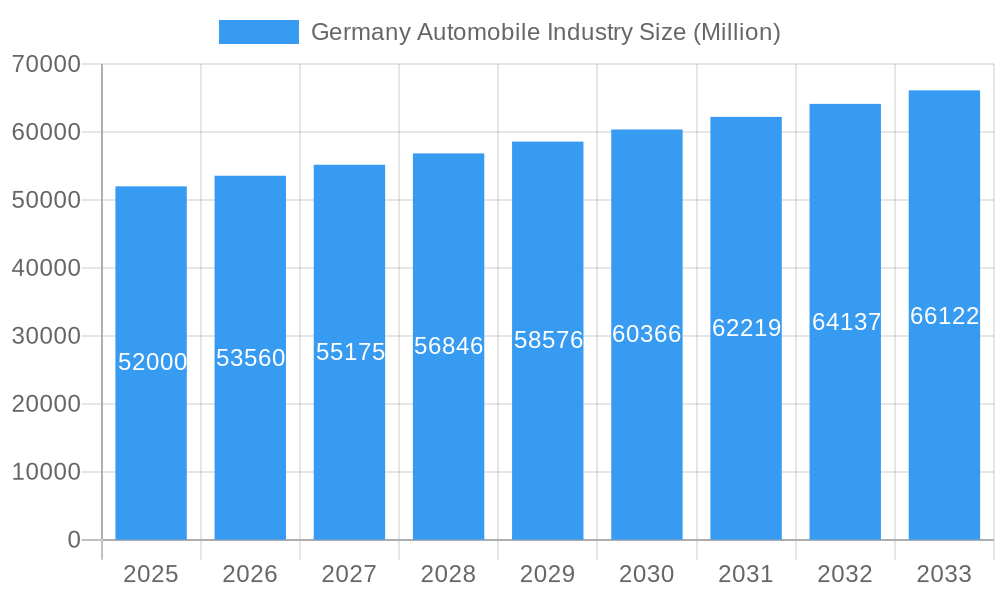

The German automobile logistics market, encompassing finished vehicle transportation, auto component logistics, and related services like warehousing and inventory management, is a robust and expanding sector. With a current market size exceeding €50 billion (a logical estimate based on comparable markets and a 3%+ CAGR), the market exhibits strong growth potential driven by several factors. The ongoing shift towards electric vehicles (EVs) necessitates specialized logistics solutions for battery transport and charging infrastructure deployment, fueling market expansion. Furthermore, increasing automation in manufacturing and supply chains leads to a higher demand for sophisticated logistics providers capable of integrating advanced technologies like IoT and AI for real-time tracking and optimized delivery. The established presence of major automotive manufacturers in Germany, coupled with a highly developed infrastructure, creates a favorable environment for growth. However, challenges remain, including fluctuating fuel prices, driver shortages, and increasing regulatory compliance costs. Nevertheless, the long-term outlook for the German automobile logistics market remains positive, projected to maintain a Compound Annual Growth Rate (CAGR) above 3% through 2033.

Germany Automobile Industry Market Size (In Billion)

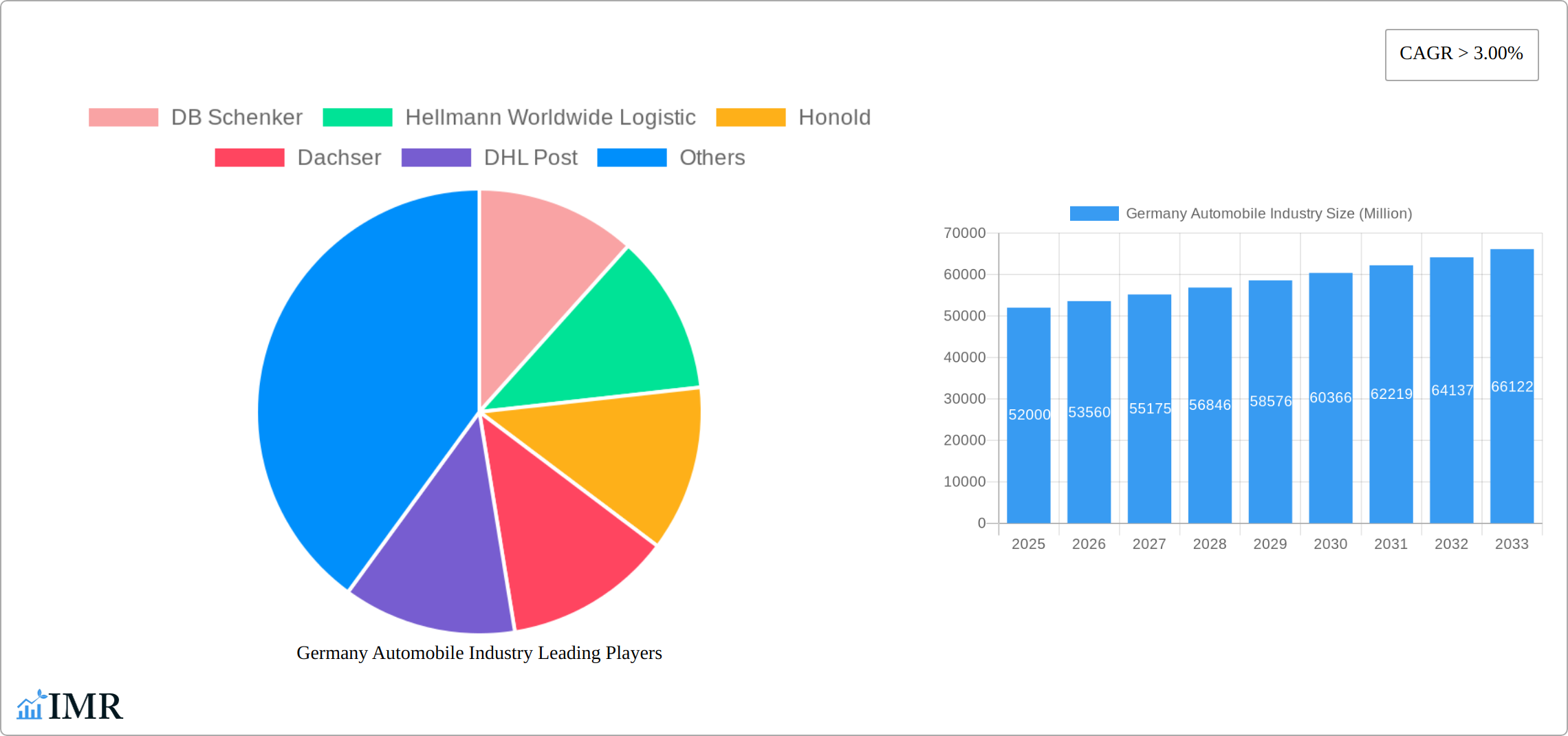

The market segmentation reveals a diverse landscape. Finished vehicle logistics holds a significant share, driven by both domestic and export movements. Auto component logistics, crucial for just-in-time manufacturing, is another significant segment. Within services, transportation accounts for a major portion, while warehousing and inventory management are gaining traction as companies optimize their supply chain efficiency. Key players like DB Schenker, DHL, Kuehne + Nagel, and others are fiercely competitive, continually investing in technology and infrastructure to maintain their market share and meet evolving customer needs. The regional distribution reflects the established automotive manufacturing hubs: North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse all represent key growth areas. The projected growth trajectory is further supported by government initiatives promoting sustainable transportation and logistics within the automotive sector.

Germany Automobile Industry Company Market Share

Germany Automobile Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the German automobile industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (Automobile Industry) and its child markets (Finished Vehicle Logistics, Auto Component Logistics, etc.) providing granular insights into market size (in million units), growth drivers, and challenges.

Germany Automobile Industry Market Dynamics & Structure

The German automobile industry, a global powerhouse, exhibits a complex interplay of market concentration, technological innovation, regulatory frameworks, and competitive forces. The market is characterized by a few dominant players alongside numerous specialized component suppliers and logistics providers. Market concentration is high in certain segments (e.g., finished vehicle manufacturing), while others (e.g., specialized logistics services) show greater fragmentation. Technological innovation, driven by electrification, autonomous driving, and digitalization, is reshaping the industry landscape, leading to significant M&A activity. Regulatory pressures related to emissions and safety standards are influencing product development and operational strategies. The emergence of substitute technologies (e.g., electric vehicles) adds to the competitive intensity. Finally, demographic shifts, particularly in urban areas, impacting consumer demand for vehicle types and logistics services, are also noteworthy.

- Market Concentration: High in finished vehicle manufacturing, moderate to low in auto component and logistics sectors. xx% market share held by top 5 manufacturers in 2024.

- Technological Innovation: Focus on electrification, autonomous driving, and connected car technologies driving significant R&D investments.

- Regulatory Framework: Stringent emission standards (Euro 7) and safety regulations shaping product design and manufacturing processes.

- Competitive Product Substitutes: Growing popularity of electric vehicles and ride-sharing services posing challenges to traditional automakers.

- End-User Demographics: Shifting preferences towards SUVs and electric vehicles influencing production and logistics strategies.

- M&A Trends: Significant consolidation within the auto component and logistics sectors, driven by economies of scale and technological advancements. xx M&A deals were recorded in the automotive logistics sector in 2023.

Germany Automobile Industry Growth Trends & Insights

The German automobile industry is experiencing a dynamic period of evolution, shaped by a confluence of macroeconomic forces, rapid technological advancements, and a significant shift in consumer preferences. While historical data from 2019 to 2024 illustrate a market that has navigated economic downturns and supply chain volatilities, the overarching trend points towards robust and sustained growth. The adoption of innovative technologies, particularly electric vehicles (EVs), is accelerating, although the pace of this transition varies across different vehicle segments. Technological disruptions are fundamentally reshaping the automotive landscape. Furthermore, evolving consumer priorities, emphasizing sustainability, advanced technology, and comprehensive digitalization, are profoundly impacting the sector's trajectory. The industry is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8-10% from 2025 to 2033, fueled by escalating demand for electric mobility solutions and sophisticated advanced driver-assistance systems (ADAS).

- Market size evolution from 2019 to 2024 exhibited fluctuations, ranging from approximately 3.5 million to 4.2 million units, influenced by global economic factors and supply chain constraints.

- The forecast period (2025-2033) anticipates steady expansion, with a projected CAGR of 8-10%, aiming to reach an estimated 6.5 million to 7.5 million units by 2033.

- The adoption rate of electric vehicles is on a consistent upward trend, forecasted to constitute 45-55% of the total vehicle market by 2033.

- Pioneering technological disruptions in areas such as autonomous driving capabilities and the integration of connected car features are serving as powerful catalysts for accelerated innovation and market expansion.

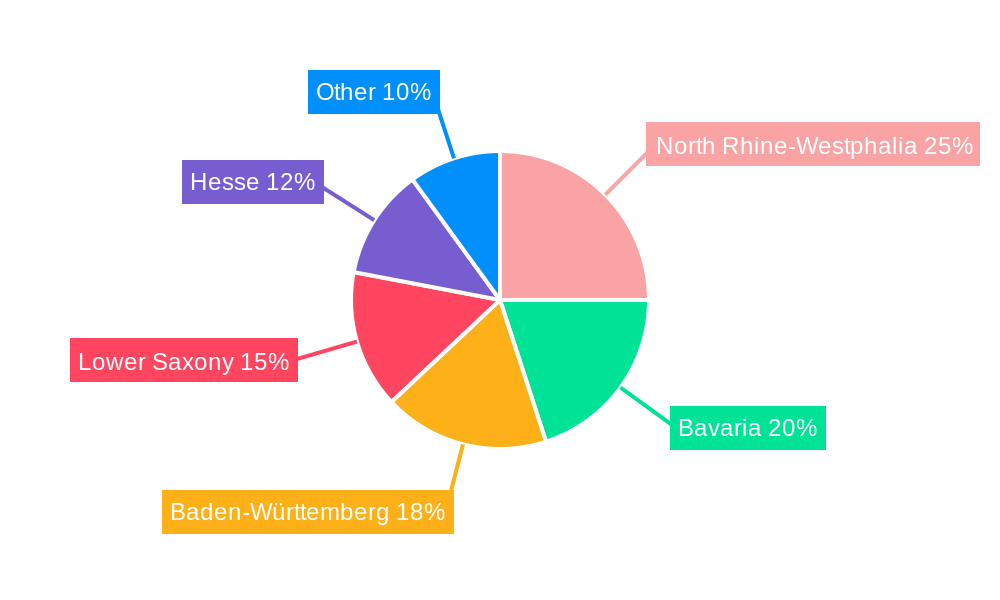

Dominant Regions, Countries, or Segments in Germany Automobile Industry

Within the robust German automotive ecosystem, specific regions stand out as epicenters of manufacturing and innovation, with Bavaria and Baden-Württemberg leading the charge due to the high concentration of major automotive manufacturers and their extensive supplier networks. In terms of market segments, the finished vehicle segment continues to command the largest market share, while the auto components sector plays a crucial role in the overall value chain. Within the supporting logistics sector, transportation and warehousing remain foundational, with a burgeoning demand for specialized services like advanced inventory management and tailored distribution solutions experiencing rapid growth. Key accelerators for this expansion include Germany's formidable automotive manufacturing base, its highly developed logistical infrastructure, and a supportive economic policy framework designed to foster industrial development and technological advancement.

- Dominant Region: Bavaria and Baden-Württemberg are the preeminent hubs for automotive manufacturing and associated industrial activities.

- Dominant Segment (by type): Finished vehicles continue their dominance, representing approximately 60-70% of the market.

- Dominant Segment (by service): Transportation services form the largest market share, closely followed by warehousing operations.

- Growth Drivers: The presence of highly integrated automotive industry clusters, a highly skilled and experienced workforce, unparalleled access to cutting-edge technologies, and proactive government policies designed to support industrial growth are significant drivers.

- Market Share: Finished vehicles capture roughly 65% of the market, while transportation and warehousing services collectively account for around 25%. The auto components sector contributes approximately 10% to the overall market share.

- Growth Potential: Significant opportunities for growth are emerging within specialized logistics services, particularly those catering to the unique demands of electric vehicle production, battery logistics, and the handling of advanced automotive components.

Germany Automobile Industry Product Landscape

The German automobile industry showcases a diverse product landscape, encompassing various vehicle types (passenger cars, commercial vehicles), advanced driver-assistance systems (ADAS), and electric vehicle (EV) technologies. Innovations are focused on improving fuel efficiency, enhancing safety features, integrating advanced connectivity, and boosting autonomous driving capabilities. These advancements enhance performance metrics such as fuel economy, safety ratings, and overall driving experience. Unique selling propositions often center on technological superiority, brand prestige, and performance attributes.

Key Drivers, Barriers & Challenges in Germany Automobile Industry

Key Drivers:

- Technological Advancements: The transformative impact of electrification, the development of autonomous driving systems, and the continuous evolution of connected car technologies are primary growth engines.

- Government Support: Favorable government policies, including substantial incentives for electric vehicle adoption and significant investments in charging infrastructure, are crucial accelerators.

- Strong Manufacturing Base: Germany's legacy of excellence in automotive manufacturing, characterized by an experienced workforce and highly efficient, established supply chains, provides a competitive advantage.

Key Challenges and Restraints:

- Supply Chain Disruptions: Persistent global challenges such as semiconductor shortages and logistical bottlenecks continue to impact production schedules and output. (Estimated Impact: A potential 5-10% decrease in production in affected periods).

- Regulatory Hurdles: Increasingly stringent emission standards and evolving safety regulations necessitate continuous investment and adaptation, potentially increasing production costs.

- Intense Competition: The German automotive industry faces formidable global competition from established and emerging automotive hubs worldwide. (Indicative Impact: Some major players experienced a noticeable shift in market share, approximately 2-4%, in recent competitive cycles).

Emerging Opportunities in Germany Automobile Industry

- Growth in electric vehicle market: Expanding charging infrastructure and government incentives.

- Development of autonomous driving technology: Opportunities in software development and sensor technologies.

- Increasing demand for connected car services: Growing adoption of telematics and infotainment systems.

Growth Accelerators in the Germany Automobile Industry Industry

Technological breakthroughs in battery technology, autonomous driving, and connected car features are poised to significantly accelerate growth. Strategic partnerships between automotive manufacturers and technology companies are also fueling innovation. Expansion into new markets, particularly in emerging economies, alongside investments in sustainable manufacturing practices, further contribute to long-term growth prospects.

Key Players Shaping the Germany Automobile Industry Market

- DB Schenker

- Hellmann Worldwide Logistics

- Honold

- Dachser

- DHL Group

- Kuehne + Nagel International AG

- Rhenus Logistics

- Geodis

- DSV Panalpina

- Rudolph Logistics Group

Notable Milestones in Germany Automobile Industry Sector

- October 2023: AD Ports Group acquires Sesé Auto Logistics, expanding its presence in finished vehicle logistics.

- February 2023: Samvardhana Motherson acquires SAS Autosystemtechnik GmbH, strengthening its position in automotive assembly and logistics services.

In-Depth Germany Automobile Industry Market Outlook

The German automobile industry is strategically positioned for sustained and significant growth, driven by relentless technological innovation and a deep understanding of evolving consumer preferences. Strategic investments in the advancement of electrification, the development of autonomous driving capabilities, and the expansion of connected car technologies are set to define the future market landscape. Promising opportunities lie in the exploration and expansion into niche market segments, a strong emphasis on developing and offering sustainable automotive solutions, and the cultivation of strategic alliances to accelerate the industry's transition towards a more environmentally conscious and technologically advanced future. The market is projected to achieve a volume of approximately 7.0 million units by 2033, signaling substantial growth potential for both established industry leaders and innovative new entrants.

Germany Automobile Industry Segmentation

-

1. Type

- 1.1. Finished Vehicle

- 1.2. Auto Component

-

2. Service

- 2.1. Transportation

- 2.2. Warehous

- 2.3. Other Services

Germany Automobile Industry Segmentation By Geography

- 1. Germany

Germany Automobile Industry Regional Market Share

Geographic Coverage of Germany Automobile Industry

Germany Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Automotive Exports driving logistics market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Finished Vehicle

- 5.1.2. Auto Component

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Transportation

- 5.2.2. Warehous

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honold

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dachser

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rhenus Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Geodis**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV Panalpina

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rudolph Logistics Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Automobile Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Automobile Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automobile Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Germany Automobile Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 3: Germany Automobile Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Germany Automobile Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Germany Automobile Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Germany Automobile Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automobile Industry?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Germany Automobile Industry?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistic, Honold, Dachser, DHL Post, Kuehne + Nagel International AG, Rhenus Logistics, Geodis**List Not Exhaustive, DSV Panalpina, Rudolph Logistics Group.

3. What are the main segments of the Germany Automobile Industry?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Automotive Exports driving logistics market.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

October 2023: AD Ports Group (ADX: ADPORTS), one of the world's premier facilitator of logistics, industry, and trade, announces that Noatum, which now leads its Logistics Cluster operations, has signed the agreement for the acquisition of the 100% equity ownership of Sesé Auto Logistics, the Finished Vehicles Logistics (FVL) business of Grupo Logístico Sesé, for a total purchase consideration (Enterprise Value - EV) of EUR 81 million. The transaction is expected to be completed by Q1 2024, subject to regulatory approvals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automobile Industry?

To stay informed about further developments, trends, and reports in the Germany Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence