Key Insights

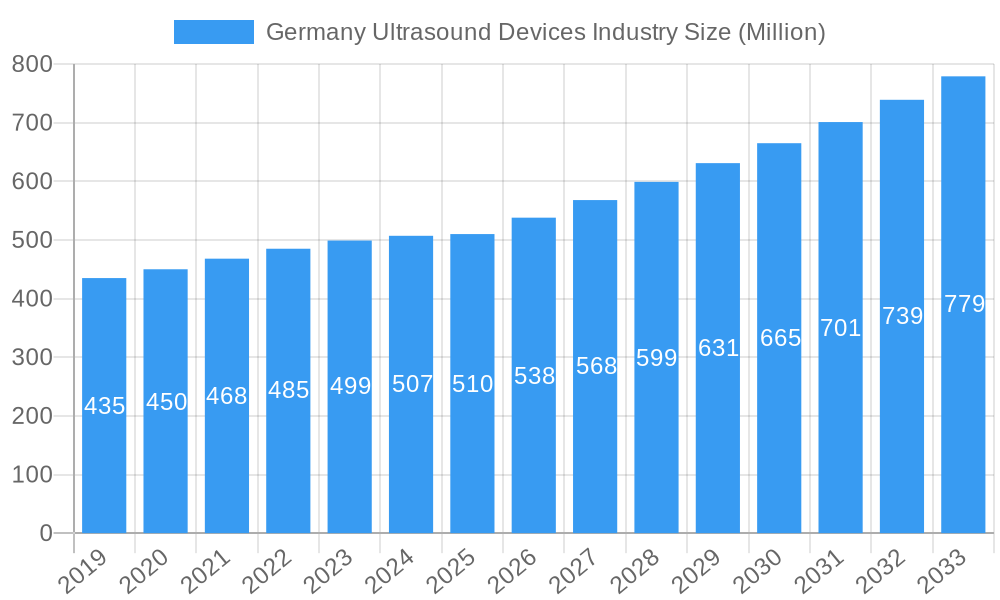

The German ultrasound devices market is poised for robust expansion, with an estimated market size of USD 510 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.70% through 2033. This signifies a healthy and expanding sector within the broader European healthcare landscape. Key growth drivers for this market include the increasing prevalence of chronic diseases requiring advanced diagnostic imaging, the continuous technological advancements in ultrasound technology leading to enhanced imaging capabilities and portability, and a growing demand for minimally invasive diagnostic procedures. The rising adoption of 3D and 4D ultrasound imaging, along with Doppler imaging, is transforming diagnostic accuracy across various specialties.

Germany Ultrasound Devices Industry Market Size (In Million)

The market is segmented across critical applications such as Anesthesiology, Cardiology, Gynecology/Obstetrics, Musculoskeletal, Radiology, and Critical Care, each contributing to the overall demand. Innovations in portable ultrasound devices are democratizing access to advanced diagnostics, particularly in remote areas and point-of-care settings. While the market exhibits strong growth potential, potential restraints could include the high initial cost of advanced ultrasound systems and stringent regulatory frameworks governing medical devices in Germany. However, the commitment of leading global players like GE Healthcare, Siemens Healthineers, and Koninklijke Philips NV to innovation and market presence suggests a dynamic competitive environment focused on addressing these challenges and capitalizing on emerging opportunities within the German healthcare ecosystem.

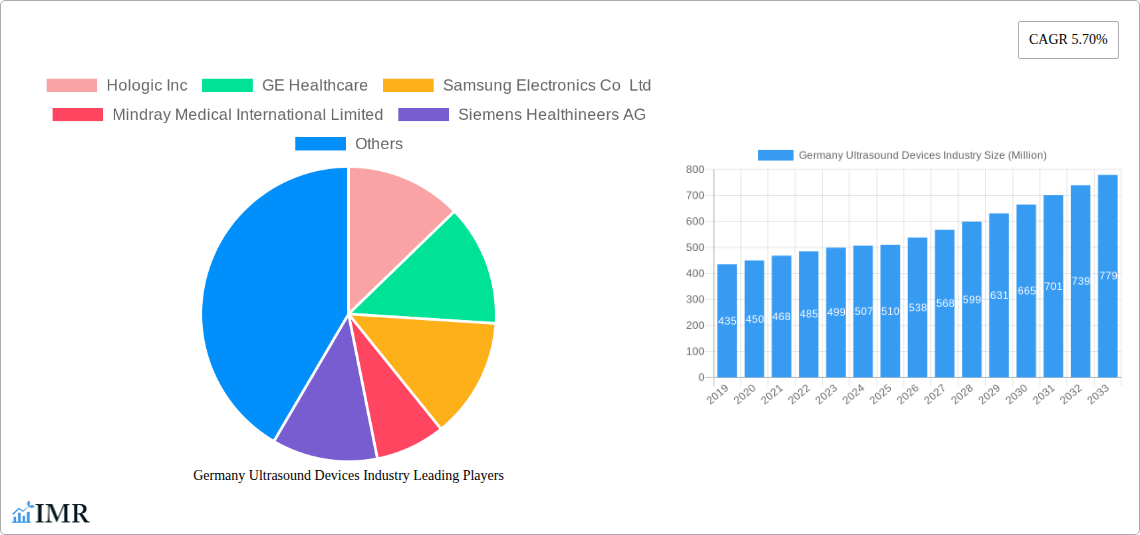

Germany Ultrasound Devices Industry Company Market Share

Germany Ultrasound Devices Industry: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Germany Ultrasound Devices Industry, offering critical insights into market dynamics, growth trends, competitive landscape, and future potential. Delve into parent and child market segmentation, backed by robust data and expert analysis, to understand the intricate workings of this vital healthcare sector. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to navigate and capitalize on opportunities within the German medical imaging market. High-traffic keywords including ultrasound devices Germany, medical imaging market, diagnostic ultrasound, portable ultrasound machines, cardiology ultrasound, obstetrics ultrasound, and radiology ultrasound are seamlessly integrated to maximize search engine visibility. All values are presented in Million units, with historical data from 2019-2024 and forecast data for 2025-2033.

Germany Ultrasound Devices Industry Market Dynamics & Structure

The Germany Ultrasound Devices Industry exhibits a moderately concentrated market structure, driven by a blend of established multinational corporations and agile domestic players. Technological innovation remains a primary driver, with continuous advancements in imaging resolution, portability, and artificial intelligence integration enhancing diagnostic capabilities and patient care. The regulatory framework, overseen by stringent EU and national health authorities, ensures product safety and efficacy, while also posing a barrier to entry for new entrants. Competitive product substitutes, such as MRI and CT scanners, offer alternative diagnostic modalities, though ultrasound's cost-effectiveness, real-time imaging, and non-invasiveness secure its prominent position. End-user demographics are shifting, with an aging population and increasing prevalence of chronic diseases fueling demand for advanced diagnostic tools. Mergers and acquisitions (M&A) trends are moderately active, with companies seeking to expand their product portfolios, market reach, and technological expertise.

- Market Concentration: Dominated by a few key global players, with a growing presence of specialized manufacturers.

- Technological Innovation Drivers: Miniaturization, AI integration, advanced visualization techniques (e.g., 3D/4D), and improved Doppler capabilities.

- Regulatory Frameworks: Strict adherence to EU medical device regulations (MDR) and national healthcare standards.

- Competitive Product Substitutes: MRI, CT scans, X-ray, though ultrasound offers unique advantages.

- End-User Demographics: Growing demand from an aging population, increasing chronic disease burden, and focus on preventative healthcare.

- M&A Trends: Strategic acquisitions to enhance product offerings and market access, with an estimated xx M&A deals observed during the historical period.

Germany Ultrasound Devices Industry Growth Trends & Insights

The Germany Ultrasound Devices Industry is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025-2033). This expansion is underpinned by several critical factors including increasing healthcare expenditure, rising adoption of advanced diagnostic technologies in both hospital and outpatient settings, and a growing awareness of ultrasound's diagnostic versatility across various medical specialties. The market size evolution shows a steady upward trajectory, with the market value estimated to reach USD xx billion by 2033, from approximately USD xx billion in 2025. Adoption rates of portable ultrasound machines are particularly surging, driven by their convenience and ability to facilitate point-of-care diagnostics, thereby improving patient outcomes and reducing healthcare costs. Technological disruptions, such as the integration of artificial intelligence for automated image analysis and the development of miniaturized, semiconductor chip-based ultrasound devices like the Butterfly iQ+, are revolutionizing diagnostic workflows and enabling earlier, more informed clinical decisions. Consumer behavior shifts are evident, with a greater emphasis on personalized medicine and preventative care, prompting a higher demand for non-invasive diagnostic tools like ultrasound. The market penetration of advanced ultrasound systems, particularly in cardiology and obstetrics, is expected to deepen as healthcare providers increasingly invest in state-of-the-art equipment.

Dominant Regions, Countries, or Segments in Germany Ultrasound Devices Industry

Within the Germany Ultrasound Devices Industry, the Radiology application segment consistently emerges as a dominant force, driven by its extensive use in diagnosing a wide spectrum of conditions, from routine screenings to complex pathological assessments. The 2D Ultrasound Imaging technology also holds a substantial market share due to its foundational role and widespread availability, although advanced 3D and 4D Ultrasound Imaging are rapidly gaining traction, particularly in gynecology/obstetrics and cardiology, for their superior visualization capabilities. The Stationary Ultrasound type remains prevalent in hospital settings, offering enhanced features and patient throughput, while the Portable Ultrasound segment is witnessing exceptional growth due to its adaptability in emergency medicine, critical care, and remote patient monitoring.

- Dominant Application: Radiology:

- High demand for diagnostic imaging across various sub-specialties including abdominal, breast, and musculoskeletal imaging.

- Increasing utilization for interventional procedures and image-guided biopsies.

- Expected market share of approximately xx% in 2025.

- Dominant Technology: 2D Ultrasound Imaging:

- Established technology with a wide range of applications and a lower cost of entry.

- Foundation for most ultrasound examinations.

- Still accounts for the largest share of units sold annually.

- Rapidly Growing Segment: Portable Ultrasound:

- Driven by the need for point-of-care diagnostics, emergency medicine, and remote patient management.

- Facilitates faster decision-making and improved patient accessibility to diagnostic services.

- Strong growth potential, with an estimated CAGR of xx% during the forecast period.

- Key Growth Drivers:

- Economic Policies: Government incentives for healthcare infrastructure development and technology adoption.

- Infrastructure: Well-established healthcare network with a high density of hospitals and clinics.

- Technological Advancements: Continuous innovation in imaging quality, portability, and AI integration.

- End-User Preferences: Growing demand for non-invasive, cost-effective diagnostic solutions.

Germany Ultrasound Devices Industry Product Landscape

The Germany Ultrasound Devices Industry product landscape is characterized by continuous innovation, focusing on enhanced diagnostic accuracy, user-friendliness, and portability. Manufacturers are actively developing systems with superior image resolution, advanced Doppler capabilities for blood flow analysis, and sophisticated 3D and 4D imaging for detailed anatomical visualization. High-intensity focused ultrasound (HIFU) technology is emerging for therapeutic applications. The integration of artificial intelligence (AI) is a significant trend, enabling automated image interpretation, workflow optimization, and improved diagnostic confidence. Hologic Inc., GE Healthcare, Samsung Electronics Co Ltd, Mindray Medical International Limited, Siemens Healthineers AG, Koninklijke Philips NV, Canon Medical Systems Corporation, SonoScape Medical Corp, Esaote SA, and Fujifilm Holdings Corporation are at the forefront of these advancements, offering a diverse range of stationary and portable ultrasound devices tailored for applications in Anesthesiology, Cardiology, Gynecology/Obstetrics, Musculoskeletal, Radiology, and Critical Care.

Key Drivers, Barriers & Challenges in Germany Ultrasound Devices Industry

The Germany Ultrasound Devices Industry is propelled by several key drivers, including the increasing demand for advanced diagnostic imaging, a growing emphasis on preventative healthcare, and continuous technological innovation leading to more sophisticated and accessible ultrasound systems. Government initiatives promoting healthcare modernization and the rising prevalence of chronic diseases also contribute significantly to market growth.

- Key Drivers:

- Aging population and increasing incidence of chronic diseases.

- Technological advancements in imaging capabilities and AI integration.

- Growing adoption of portable ultrasound for point-of-care diagnostics.

- Government support for healthcare infrastructure development.

- Cost-effectiveness and non-invasive nature of ultrasound compared to other imaging modalities.

However, the industry faces certain barriers and challenges. High initial investment costs for advanced ultrasound systems can be a restraint, especially for smaller healthcare facilities. Stringent regulatory approval processes and the need for specialized training for medical professionals can also pose hurdles. Competition from alternative imaging technologies and the ongoing need for data security and privacy compliance are also significant considerations.

- Key Barriers & Challenges:

- High capital expenditure for advanced systems.

- Complex regulatory landscape and long approval cycles.

- Requirement for skilled personnel and continuous training.

- Intense competition from alternative imaging modalities.

- Data security and patient privacy concerns.

- Supply chain disruptions affecting component availability (estimated impact of xx% on production timelines).

Emerging Opportunities in Germany Ultrasound Devices Industry

Emerging opportunities in the Germany Ultrasound Devices Industry lie in the expanding use of ultrasound in niche applications, such as point-of-care ultrasound (POCUS) in primary care settings and at home. The development of AI-powered diagnostic tools that can assist less experienced practitioners and improve diagnostic accuracy presents a significant avenue for growth. Furthermore, the integration of ultrasound with telemedicine platforms for remote consultations and diagnostics offers a new frontier. The increasing focus on minimally invasive procedures also drives demand for advanced ultrasound guidance.

- POCUS Expansion: Increased adoption in emergency rooms, intensive care units, and even by general practitioners.

- AI-Driven Diagnostics: Development of AI algorithms for automated image analysis, disease detection, and workflow optimization.

- Telemedicine Integration: Utilization of ultrasound in remote patient monitoring and virtual consultations.

- Therapeutic Ultrasound: Growing interest and research in high-intensity focused ultrasound (HIFU) for therapeutic applications.

- Wearable Ultrasound Devices: Future potential for continuous monitoring and non-invasive diagnostics.

Growth Accelerators in the Germany Ultrasound Devices Industry Industry

Growth in the Germany Ultrasound Devices Industry is being significantly accelerated by strategic partnerships and collaborations between technology providers and healthcare institutions. The continuous drive for miniaturization and affordability in portable ultrasound devices is making advanced diagnostics more accessible across various clinical settings. Furthermore, the increasing investment in research and development focused on AI integration for enhanced image interpretation and predictive diagnostics is a major catalyst. The growing awareness and training initiatives for point-of-care ultrasound (POCUS) among medical professionals are also expanding the application scope and adoption rates, further solidifying the market's growth trajectory.

Key Players Shaping the Germany Ultrasound Devices Industry Market

- Hologic Inc

- GE Healthcare

- Samsung Electronics Co Ltd

- Mindray Medical International Limited

- Siemens Healthineers AG

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- SonoScape Medical Corp

- Esaote SA

- Fujifilm Holdings Corporation

Notable Milestones in Germany Ultrasound Devices Industry Sector

- June 2023: Exo partnered with Sana Kliniken AG to bring its high-performance handheld ultrasound platform and artificial intelligence to more medical staff, enabling real-time decisions that improve patient outcomes, streamline workflow inefficiencies, and lower costs.

- February 2023: University Hospital Bonn (UKB) and the Medical Faculty Bonn installed the advanced ultrasound system Butterfly Blueprint from Butterfly Network, Inc., to teach medical and midwifery students at the UKB. The innovative, semiconductor chip-based Butterfly iQ+ enables more informed diagnosis and treatment directly at the patient's bedside and supports complex ultrasound training integrated into studies throughout the UKB campus.

In-Depth Germany Ultrasound Devices Industry Market Outlook

The Germany Ultrasound Devices Industry is set for sustained growth, driven by technological advancements, increasing healthcare investments, and a growing demand for non-invasive diagnostic solutions. The integration of artificial intelligence and the expansion of point-of-care ultrasound (POCUS) will be pivotal in shaping the future market landscape. Strategic collaborations and the ongoing development of more affordable and versatile ultrasound devices are expected to further accelerate adoption rates across diverse healthcare settings. The industry presents significant opportunities for innovation and expansion, particularly in areas like AI-driven diagnostics, telemedicine integration, and therapeutic ultrasound applications, promising a dynamic and evolving market in the coming years.

Germany Ultrasound Devices Industry Segmentation

-

1. Application

- 1.1. Anesthesiology

- 1.2. Cardiology

- 1.3. Gynecology/Obstetrics

- 1.4. Musculoskeletal

- 1.5. Radiology

- 1.6. Critical Care

- 1.7. Other Applications

-

2. Technology

- 2.1. 2D Ultrasound Imaging

- 2.2. 3D and 4D Ultrasound Imaging

- 2.3. Doppler Imaging

- 2.4. High-intensity Focused Ultrasound

-

3. Type

- 3.1. Stationary Ultrasound

- 3.2. Portable Ultrasound

Germany Ultrasound Devices Industry Segmentation By Geography

- 1. Germany

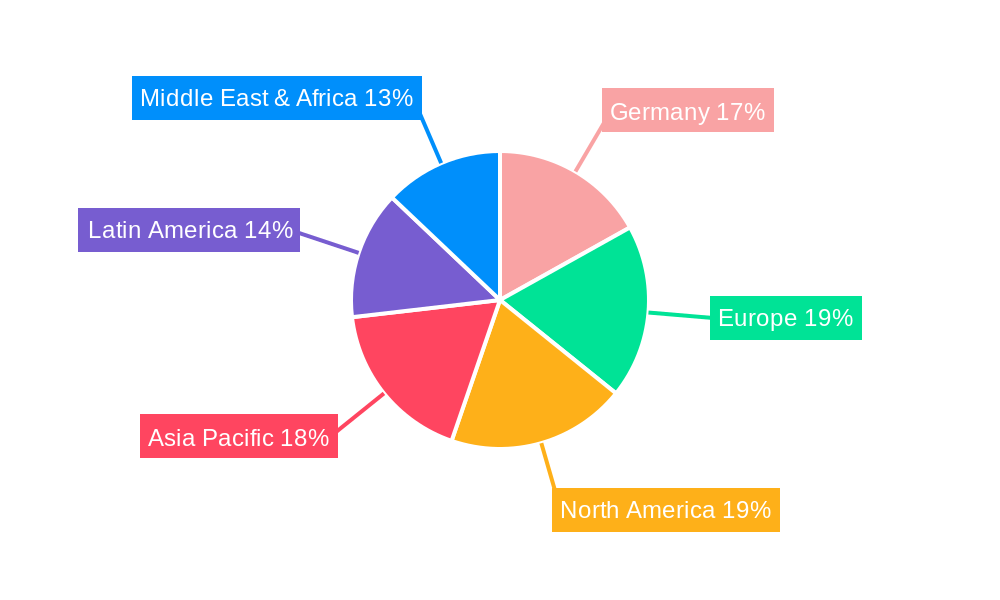

Germany Ultrasound Devices Industry Regional Market Share

Geographic Coverage of Germany Ultrasound Devices Industry

Germany Ultrasound Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Chronic Diseases; Technological Advancements of Ultrasound Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1 By Technology

- 3.4.2 High-intensity Focused Ultrasound Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Ultrasound Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Anesthesiology

- 5.1.2. Cardiology

- 5.1.3. Gynecology/Obstetrics

- 5.1.4. Musculoskeletal

- 5.1.5. Radiology

- 5.1.6. Critical Care

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. 2D Ultrasound Imaging

- 5.2.2. 3D and 4D Ultrasound Imaging

- 5.2.3. Doppler Imaging

- 5.2.4. High-intensity Focused Ultrasound

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Stationary Ultrasound

- 5.3.2. Portable Ultrasound

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hologic Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GE Healthcare

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mindray Medical International Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Healthineers AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koninklijke Philips NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canon Medical Systems Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SonoScape Medical Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Esaote SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fujifilm Holdings Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hologic Inc

List of Figures

- Figure 1: Germany Ultrasound Devices Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Ultrasound Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Ultrasound Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Germany Ultrasound Devices Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Germany Ultrasound Devices Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Germany Ultrasound Devices Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 5: Germany Ultrasound Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Germany Ultrasound Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Germany Ultrasound Devices Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Germany Ultrasound Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Germany Ultrasound Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Germany Ultrasound Devices Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Germany Ultrasound Devices Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Germany Ultrasound Devices Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 13: Germany Ultrasound Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Germany Ultrasound Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Germany Ultrasound Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Ultrasound Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Ultrasound Devices Industry?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Germany Ultrasound Devices Industry?

Key companies in the market include Hologic Inc, GE Healthcare, Samsung Electronics Co Ltd, Mindray Medical International Limited, Siemens Healthineers AG, Koninklijke Philips NV, Canon Medical Systems Corporation, SonoScape Medical Corp, Esaote SA, Fujifilm Holdings Corporation.

3. What are the main segments of the Germany Ultrasound Devices Industry?

The market segments include Application, Technology, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 510 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Chronic Diseases; Technological Advancements of Ultrasound Devices.

6. What are the notable trends driving market growth?

By Technology. High-intensity Focused Ultrasound Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In June 2023, Exo partnered with Sana Kliniken AG to bring its high-performance handheld ultrasound platform and artificial intelligence to more medical staff to enable real-time decisions that improve patient outcomes, streamline workflow inefficiencies, and lower costs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Ultrasound Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Ultrasound Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Ultrasound Devices Industry?

To stay informed about further developments, trends, and reports in the Germany Ultrasound Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence