Key Insights

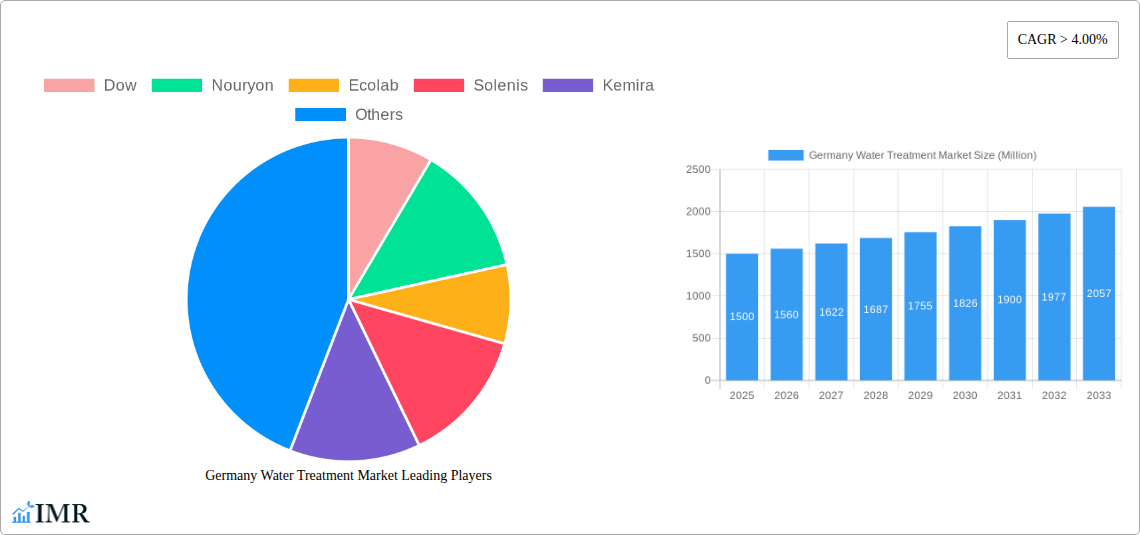

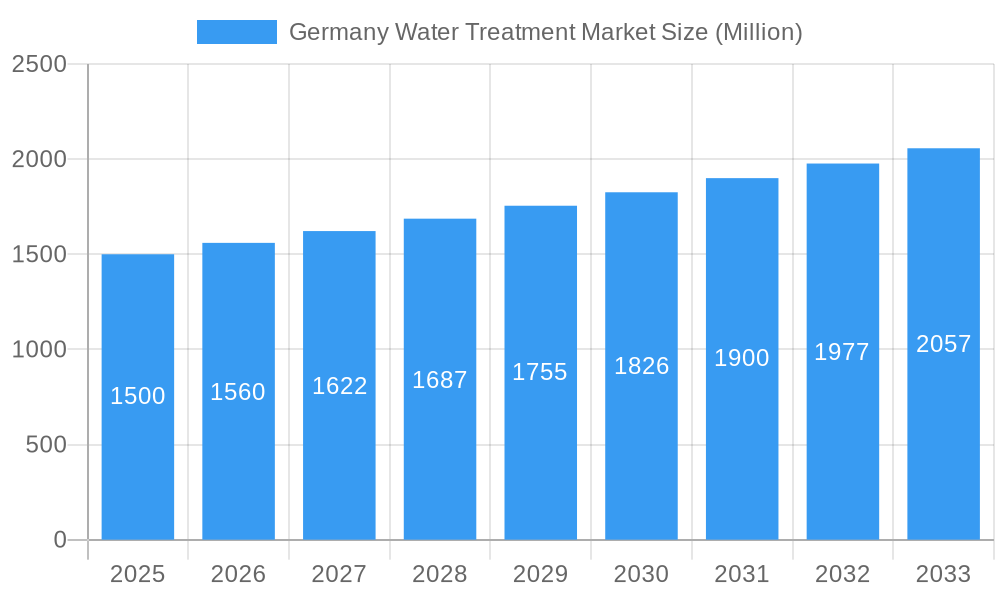

The German water treatment market is poised for substantial growth, driven by industrial expansion, stringent environmental regulations, and increasing water scarcity awareness. Anticipated to achieve a Compound Annual Growth Rate (CAGR) of 5.3%, the market size is projected to reach $48 billion by 2033, with 2025 as the base year. Key growth factors include escalating demand for efficient purification across municipal, industrial, and commercial sectors, alongside the adoption of advanced technologies like membrane filtration and reverse osmosis. Challenges include high initial investment costs and potential regulatory shifts. The market is segmented by technology, application, and region. Leading players include Dow, Nouryon, Ecolab, Solenis, Kemira, Solvay, Lonza, Kurita Water Industries Ltd, and Suez, all actively pursuing innovation and strategic alliances.

Germany Water Treatment Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth supported by government investments in water infrastructure and a strong emphasis on sustainable water management. Increased water reuse and recycling, coupled with stricter effluent discharge standards, will further propel the demand for advanced treatment solutions. Industrial applications, particularly from manufacturing and energy sectors, represent a significant market share, while the municipal segment offers considerable potential due to urbanization and aging infrastructure.

Germany Water Treatment Market Company Market Share

This report offers a comprehensive analysis of the German water treatment market, providing critical insights for industry professionals, investors, and decision-makers. It examines market dynamics, growth trends, key players, and future opportunities from 2019 to 2033. The market size in 2025 is estimated at $48 billion.

Germany Water Treatment Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the German water treatment sector. The market is characterized by a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized firms fosters innovation and competition.

- Market Concentration: The top five players hold an estimated XX% market share in 2025. This concentration is expected to remain relatively stable throughout the forecast period.

- Technological Innovation: The adoption of advanced technologies like membrane filtration, UV disinfection, and AI-driven process optimization is driving market growth. However, high initial investment costs present a barrier to entry for some smaller companies.

- Regulatory Framework: Strict environmental regulations in Germany, including those related to wastewater discharge and water quality, are pivotal in shaping market demand and influencing technological choices.

- Competitive Product Substitutes: The market faces competition from alternative water management strategies, such as water reuse and rainwater harvesting, although these remain niche applications.

- End-User Demographics: The key end-users include industrial facilities, municipal water utilities, and commercial establishments across various sectors like food & beverage, pharmaceuticals, and manufacturing.

- M&A Trends: The past five years have witnessed XX M&A deals in the German water treatment market, indicating a trend of consolidation and expansion among key players. This is expected to continue, albeit at a moderate pace, in the coming years.

Germany Water Treatment Market Growth Trends & Insights

The German water treatment market exhibits robust growth, driven by increasing industrialization, stringent environmental regulations, and a growing focus on water conservation. The market is experiencing a shift towards sustainable and efficient water treatment solutions.

The market size grew from €XX Million in 2019 to an estimated €XX Million in 2025, reflecting a CAGR of XX% during the historical period. This positive growth trajectory is expected to continue, with a projected CAGR of XX% from 2025 to 2033. Market penetration is increasing across various sectors, particularly in industrial applications, with municipal segments showing consistent, albeit slower, growth. Technological advancements, coupled with rising environmental awareness, are contributing to this accelerated adoption.

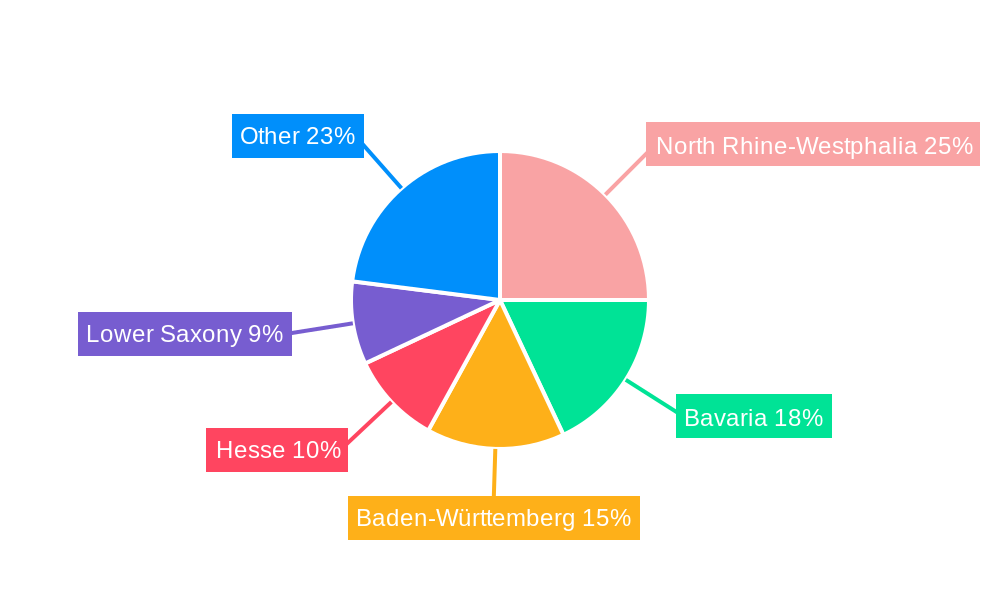

Dominant Regions, Countries, or Segments in Germany Water Treatment Market

The industrial heartland of Germany (e.g., North Rhine-Westphalia, Bavaria) represents the largest segment within the market, driven by high industrial activity and demand for water treatment solutions.

- Key Drivers:

- Strong industrial base and associated water treatment needs

- Stringent environmental regulations in the region

- Government incentives and funding for water infrastructure projects

- Growing awareness of water scarcity and sustainability

- Dominance Factors: High concentration of industrial facilities, robust infrastructure, and proactive regulatory environment contribute to this region's dominance. The market share of this region is estimated at XX% in 2025. This dominance is expected to persist, albeit with some growth in other regions due to targeted investments.

Germany Water Treatment Market Product Landscape

The market offers a wide array of water treatment technologies, including membrane filtration (reverse osmosis, ultrafiltration, microfiltration), chemical treatment (coagulation, flocculation, disinfection), and advanced oxidation processes (AOPs). Recent innovations include the integration of IoT sensors for real-time monitoring and AI-powered process optimization. These technologies cater to diverse applications, from potable water treatment to industrial wastewater management. The focus is increasingly on energy efficiency, cost-effectiveness, and environmental sustainability.

Key Drivers, Barriers & Challenges in Germany Water Treatment Market

Key Drivers:

- Stringent environmental regulations mandate advanced treatment technologies.

- Growing industrialization increases demand for industrial wastewater treatment solutions.

- Rising water scarcity and growing awareness of water conservation drive adoption rates.

Challenges:

- High upfront capital costs for advanced water treatment systems can be a barrier for smaller businesses. This leads to a slower adoption rate in certain market segments.

- Fluctuations in raw material prices and supply chain disruptions pose challenges to cost management and timely project delivery. The impact is estimated at a XX% increase in project costs in the past two years.

- Intense competition among established players and the emergence of new entrants create pressure on profit margins.

Emerging Opportunities in Germany Water Treatment Market

- Growing demand for decentralized water treatment solutions in rural areas.

- Increased focus on water reuse and recycling to minimize water stress.

- Development of innovative solutions for treating emerging contaminants.

Growth Accelerators in the Germany Water Treatment Market Industry

Technological breakthroughs in membrane filtration, automation, and AI are accelerating market growth. Strategic partnerships between technology providers and water treatment companies are facilitating the adoption of cutting-edge solutions. Furthermore, government initiatives promoting sustainable water management are creating favorable market conditions.

Notable Milestones in Germany Water Treatment Market Sector

- 2022-Q4: Dow launched a new line of sustainable water treatment chemicals.

- 2023-Q1: A major merger occurred between two smaller water treatment companies.

- 2023-Q2: New regulations on industrial wastewater discharge came into effect. (Specific details and impact would be included here in a full report).

In-Depth Germany Water Treatment Market Market Outlook

The German water treatment market is poised for sustained growth, driven by a confluence of factors: robust economic activity, strengthening environmental regulations, and technological innovation. Opportunities exist in both the municipal and industrial sectors, with a particular focus on sustainable and efficient solutions. Strategic partnerships and investments in R&D are crucial for companies seeking to capture market share in this dynamic and expanding market. The market is projected to reach €XX Million by 2033, presenting significant opportunities for growth and innovation.

Germany Water Treatment Market Segmentation

-

1. Product Type

- 1.1. Coagulants & Flocculants

- 1.2. Biocide & Disinfectant

- 1.3. Defoamer & Defoaming Agent

- 1.4. pH & Adjuster & Softener

- 1.5. Scale & Corrosion Inhibitor

- 1.6. Others

-

2. End-user Industry

- 2.1. Power

- 2.2. Oil & Gas

- 2.3. Chemical Manufcaturing

- 2.4. Municipal

- 2.5. Mining and Mineral Processing

- 2.6. Food & Beverage

- 2.7. Pulp & Paper

- 2.8. Others

Germany Water Treatment Market Segmentation By Geography

- 1. Germany

Germany Water Treatment Market Regional Market Share

Geographic Coverage of Germany Water Treatment Market

Germany Water Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing demand from the power and industrial sectors; Rising ground and surface water pollution; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing demand from the power and industrial sectors; Rising ground and surface water pollution; Other Drivers

- 3.4. Market Trends

- 3.4.1. Coagulants & Flocculants to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Water Treatment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Coagulants & Flocculants

- 5.1.2. Biocide & Disinfectant

- 5.1.3. Defoamer & Defoaming Agent

- 5.1.4. pH & Adjuster & Softener

- 5.1.5. Scale & Corrosion Inhibitor

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power

- 5.2.2. Oil & Gas

- 5.2.3. Chemical Manufcaturing

- 5.2.4. Municipal

- 5.2.5. Mining and Mineral Processing

- 5.2.6. Food & Beverage

- 5.2.7. Pulp & Paper

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dow

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nouryon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ecolab

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solenis

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kemira

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Solvay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lonza

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kurita Water Industries Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Suez*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Dow

List of Figures

- Figure 1: Germany Water Treatment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Water Treatment Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Water Treatment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Germany Water Treatment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Germany Water Treatment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Water Treatment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Germany Water Treatment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Germany Water Treatment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Water Treatment Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Germany Water Treatment Market?

Key companies in the market include Dow, Nouryon, Ecolab, Solenis, Kemira, Solvay, Lonza, Kurita Water Industries Ltd, Suez*List Not Exhaustive.

3. What are the main segments of the Germany Water Treatment Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 48 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing demand from the power and industrial sectors; Rising ground and surface water pollution; Other Drivers.

6. What are the notable trends driving market growth?

Coagulants & Flocculants to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

; Increasing demand from the power and industrial sectors; Rising ground and surface water pollution; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Water Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Water Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Water Treatment Market?

To stay informed about further developments, trends, and reports in the Germany Water Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence