Key Insights

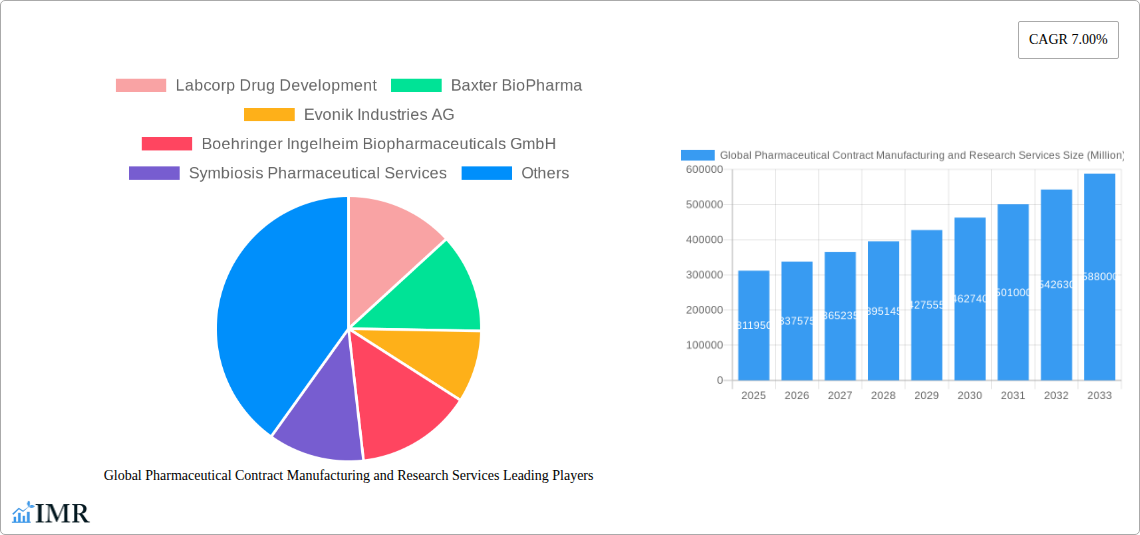

The Global Pharmaceutical Contract Manufacturing and Research Services market is poised for robust expansion, projected to reach $311.95 billion in 2025. This growth is driven by an impressive Compound Annual Growth Rate (CAGR) of 8.2%, indicating a sustained upward trajectory throughout the forecast period of 2025-2033. A significant factor fueling this market surge is the increasing demand for specialized pharmaceutical manufacturing services, particularly in areas like API/Bulk Drugs and Finished Dose Formulations, as pharmaceutical companies increasingly outsource production to optimize costs and leverage external expertise. Furthermore, the burgeoning field of advanced drug delivery systems and innovative packaging solutions is creating substantial opportunities for contract organizations to offer cutting-edge development and manufacturing capabilities. The research services segment is equally dynamic, propelled by intense R&D efforts in high-demand therapeutic areas such as Oncology, Vaccines, and Inflammation & Immunology, alongside a growing focus on Cardiology and Neuroscience. This sustained innovation necessitates collaborative partnerships with contract research organizations (CROs) to accelerate drug discovery and development pipelines, further underpinning the market's expansion.

Global Pharmaceutical Contract Manufacturing and Research Services Market Size (In Billion)

The market's healthy growth is also supported by several key trends, including the continuous outsourcing of complex manufacturing processes by big pharma to specialized contract development and manufacturing organizations (CDMOs). This trend is amplified by the need for advanced capabilities in biologics manufacturing and sterile injectables. The increasing adoption of digital technologies and automation in R&D and manufacturing is streamlining operations and enhancing efficiency, attracting more investment and driving market penetration. While the market enjoys strong growth, potential restraints such as stringent regulatory compliance, evolving intellectual property landscapes, and the need for significant capital investment in specialized facilities could pose challenges. However, the strategic advantages offered by outsourcing, including access to specialized expertise, reduced time-to-market, and cost efficiencies, are expected to outweigh these challenges, ensuring a dynamic and expanding market for pharmaceutical contract manufacturing and research services globally.

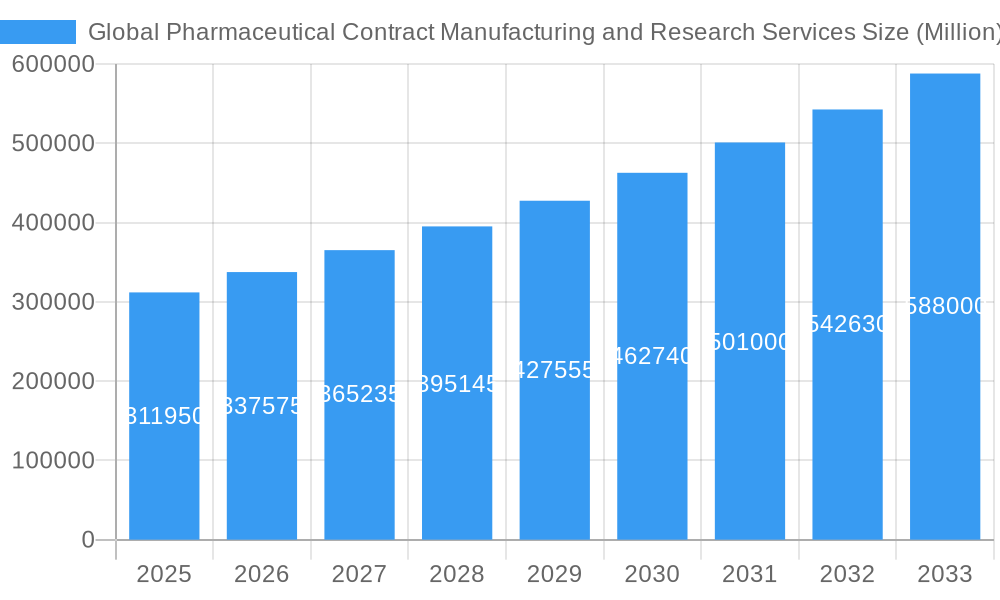

Global Pharmaceutical Contract Manufacturing and Research Services Company Market Share

Global Pharmaceutical Contract Manufacturing and Research Services Market: A Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a definitive analysis of the global pharmaceutical contract manufacturing and research services market, encompassing its intricate dynamics, growth trajectories, and future outlook. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an indispensable resource for industry stakeholders seeking to navigate this rapidly evolving landscape. We delve into critical segments, including Manufacturing Services (API/Bulk Drugs, Advanced Drug Delivery Formulations Packaging, Finished Dose Formulations) and Research Services (Oncology, Vaccines, Inflammation and Immunology, Cardiology, Neuroscience, Other Research Services), and examine the influence of key companies like Labcorp Drug Development, Baxter BioPharma, Evonik Industries AG, Boehringer Ingelheim Biopharmaceuticals GmbH, Symbiosis Pharmaceutical Services, Aurigene Pharmaceutical Services Ltd, Piramal Pharma Solutions, Thermo Fisher Scientific (PPD Inc), AbbVie, Dalton Pharma Services, Sterling Pharma Solutions, and Lonza AG.

Global Pharmaceutical Contract Manufacturing and Research Services Market Dynamics & Structure

The global pharmaceutical contract manufacturing and research services market is characterized by a moderate level of concentration, with a mix of large, established players and a growing number of specialized niche providers. Technological innovation is a primary driver, fueled by advancements in biologics, gene therapy, and personalized medicine, which necessitate specialized manufacturing and research capabilities. Regulatory frameworks, including stringent quality control standards and evolving approval processes by bodies like the FDA and EMA, significantly shape market entry and operational strategies. Competitive product substitutes, while less direct in contract manufacturing, exist in the form of in-house development and manufacturing by large pharmaceutical companies, although the trend towards outsourcing continues to gain momentum. End-user demographics are shifting, with an increasing demand for specialized treatments for chronic diseases and an aging global population driving the need for innovative drug development and manufacturing. Mergers and acquisition (M&A) trends are actively consolidating the market, as larger players seek to expand their service portfolios, geographical reach, and technological expertise.

- Market Concentration: Moderate, with key players holding significant market share but also room for specialized CDMOs.

- Technological Innovation: Driven by biologics, cell & gene therapies, and advanced drug delivery systems.

- Regulatory Frameworks: Strict adherence to GMP, GCP, and evolving global guidelines is paramount.

- Competitive Landscape: Competition from in-house capabilities and specialized service providers.

- End-User Demographics: Aging populations and rising prevalence of chronic diseases fuel demand.

- M&A Trends: Consolidation is a key strategy for market expansion and capability enhancement.

Global Pharmaceutical Contract Manufacturing and Research Services Growth Trends & Insights

The global pharmaceutical contract manufacturing and research services market is poised for substantial growth, driven by an increasing number of drug discovery pipelines, a growing demand for specialized biologics and complex formulations, and the strategic outsourcing decisions made by pharmaceutical and biotechnology companies. The market size is projected to experience a significant expansion over the forecast period. Adoption rates for outsourced services are escalating as companies seek to leverage external expertise, reduce capital expenditure, and accelerate time-to-market for their drug candidates. Technological disruptions, such as the rise of continuous manufacturing, advanced analytical techniques, and sophisticated data management systems, are reshaping both manufacturing processes and research methodologies, leading to increased efficiency and precision. Consumer behavior shifts, including a greater emphasis on personalized medicine and targeted therapies, are creating new avenues for contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) to offer specialized services. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. The penetration of outsourcing in early-stage drug development and complex manufacturing processes is expected to rise considerably.

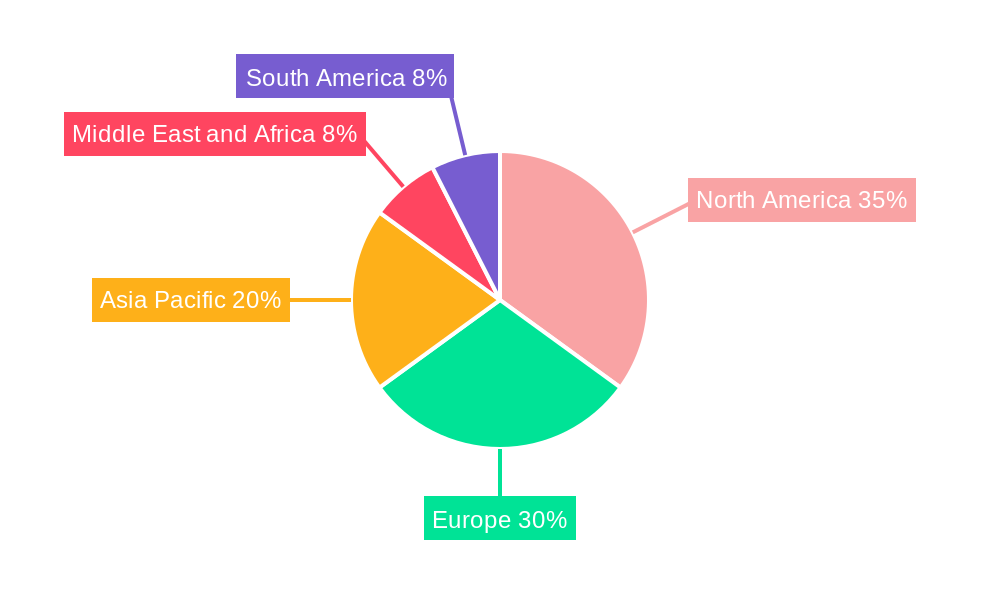

Dominant Regions, Countries, or Segments in Global Pharmaceutical Contract Manufacturing and Research Services

North America, particularly the United States, is anticipated to remain a dominant region in the global pharmaceutical contract manufacturing and research services market. This dominance is fueled by a robust ecosystem of innovative biotechnology and pharmaceutical companies, significant R&D investments, a well-established regulatory framework, and a high concentration of leading CDMOs and CROs. The segment of Research Services: Oncology is a major growth driver within this region, owing to the high unmet need and continuous innovation in cancer therapies. Additionally, Manufacturing Services: API/Bulk Drugs and Finished Dose Formulations are crucial, supporting the large volume production requirements of blockbuster drugs and a steady stream of new product launches.

Key drivers for North America's dominance include:

- Advanced R&D Infrastructure: Presence of world-class research institutions and a vibrant biotech startup scene.

- Strong Pharmaceutical Pipeline: A high volume of drug candidates entering clinical trials.

- Favorable Regulatory Environment: Established pathways for drug approval and market access.

- Significant Investment: High levels of venture capital funding and strategic investments in the sector.

- Technological Adoption: Early and widespread adoption of new manufacturing and research technologies.

In terms of specific segments, Oncology research services are experiencing exceptional demand due to breakthroughs in immunotherapy, targeted therapies, and personalized medicine, driving significant outsourcing of complex preclinical and clinical research. Similarly, the manufacturing of API/Bulk Drugs and Finished Dose Formulations for oncology drugs, often involving complex chemical synthesis and sterile fill-finish operations, sees substantial outsourcing. The growth potential for these segments remains exceptionally high, supported by an aging global population and the persistent challenge of developing effective cancer treatments.

Global Pharmaceutical Contract Manufacturing and Research Services Product Landscape

The product landscape within the pharmaceutical contract manufacturing and research services market is characterized by an increasing sophistication and specialization. Innovations in Advanced Drug Delivery Formulations Packaging are crucial, enabling better patient compliance, improved drug efficacy, and extended patent life for pharmaceutical companies. This includes the development of novel delivery systems like sustained-release formulations, transdermal patches, and injectable depots. In research services, the focus is on developing novel Oncology therapeutics and Vaccines, requiring cutting-edge biological assays, complex molecular biology techniques, and specialized manufacturing capabilities for biologics. Companies are increasingly offering integrated services that encompass the entire drug development lifecycle, from early-stage discovery and preclinical research to clinical trial manufacturing and commercial-scale production, providing unique selling propositions centered on speed, quality, and comprehensive support.

Key Drivers, Barriers & Challenges in Global Pharmaceutical Contract Manufacturing and Research Services

Key drivers propelling the global pharmaceutical contract manufacturing and research services market include the escalating R&D costs for pharmaceutical companies, the growing pipeline of complex biologics and specialized therapies, and the need for specialized expertise and technology that many drug developers may not possess in-house. The increasing trend of pharmaceutical companies focusing on core competencies like drug discovery and marketing, while outsourcing manufacturing and research, acts as a significant catalyst. Furthermore, the demand for faster drug development timelines and the desire to mitigate investment risks are strong motivators for outsourcing.

- Technological Advancements: Biologics, gene therapies, and advanced drug delivery systems.

- Cost Optimization: Reducing capital expenditure and operational costs for pharma companies.

- Specialized Expertise: Access to highly skilled personnel and niche technologies.

- Accelerated Timelines: Streamlining drug development and manufacturing processes.

- Focus on Core Competencies: Allowing pharma companies to concentrate on R&D and commercialization.

However, the market faces several significant barriers and challenges. Supply chain disruptions, as evidenced by recent global events, pose a considerable risk, impacting the timely delivery of raw materials and finished products. Stringent and evolving regulatory hurdles across different geographies require meticulous compliance and can lead to delays and increased costs. Intense competitive pressures among CDMOs and CROs can impact pricing and profit margins. Intellectual property protection remains a critical concern for clients outsourcing sensitive research and manufacturing processes.

- Supply Chain Vulnerabilities: Raw material shortages and logistical challenges.

- Regulatory Complexities: Navigating diverse and changing global compliance requirements.

- Intense Competition: Price pressure and the need for differentiation.

- Intellectual Property Protection: Ensuring the security of sensitive client data and innovations.

- Talent Acquisition and Retention: Securing skilled scientists and manufacturing personnel.

Emerging Opportunities in Global Pharmaceutical Contract Manufacturing and Research Services

Emerging opportunities in the global pharmaceutical contract manufacturing and research services market are abundant, driven by advancements in personalized medicine and the burgeoning field of cell and gene therapies. The increasing complexity of these novel modalities necessitates specialized manufacturing capabilities and extensive research support, creating significant demand for CDMOs and CROs equipped to handle them. Furthermore, the growing focus on rare diseases and orphan drugs presents a niche but high-value opportunity for specialized service providers. The expanding emerging markets, particularly in Asia, offer untapped potential for outsourcing services as these regions continue to invest heavily in their domestic pharmaceutical industries.

Growth Accelerators in the Global Pharmaceutical Contract Manufacturing and Research Services Industry

Several key growth accelerators are propelling the global pharmaceutical contract manufacturing and research services industry forward. The ongoing investment in novel drug modalities, such as mRNA-based therapies and antibody-drug conjugates (ADCs), is a significant driver, demanding specialized manufacturing and research expertise. Strategic partnerships and collaborations between pharmaceutical companies and CDMOs/CROs are becoming increasingly common, fostering innovation and streamlining the drug development process. Market expansion strategies, including the establishment of new manufacturing facilities in cost-effective regions and the acquisition of companies with complementary capabilities, are also contributing to sustained growth.

Key Players Shaping the Global Pharmaceutical Contract Manufacturing and Research Services Market

- Labcorp Drug Development

- Baxter BioPharma

- Evonik Industries AG

- Boehringer Ingelheim Biopharmaceuticals GmbH

- Symbiosis Pharmaceutical Services

- Aurigene Pharmaceutical Services Ltd

- Piramal Pharma Solutions

- Thermo Fisher Scientific (PPD Inc)

- AbbVie

- Dalton Pharma Services

- Sterling Pharma Solutions

- Lonza AG

Notable Milestones in Global Pharmaceutical Contract Manufacturing and Research Services Sector

- 2019: Lonza AG's significant investment in expanding its biologics manufacturing capacity to meet growing demand.

- 2020: Thermo Fisher Scientific's acquisition of PPD Inc., enhancing its clinical research services portfolio.

- 2021: Boehringer Ingelheim Biopharmaceuticals GmbH's announcement of new facilities for advanced biopharmaceutical manufacturing.

- 2022: Piramal Pharma Solutions' strategic expansion of its sterile manufacturing capabilities.

- 2023: The increasing number of CDMOs specializing in cell and gene therapy manufacturing and research.

- Ongoing: Continuous advancements in AI and machine learning integration within pharmaceutical R&D and manufacturing processes by various service providers.

In-Depth Global Pharmaceutical Contract Manufacturing and Research Services Market Outlook

The future outlook for the global pharmaceutical contract manufacturing and research services market is exceptionally bright, characterized by sustained growth and significant strategic opportunities. The increasing complexity of drug pipelines, particularly in areas like biologics, oncology, and rare diseases, will continue to drive demand for specialized outsourcing. Technological advancements, including the integration of artificial intelligence in drug discovery and the adoption of advanced manufacturing techniques, will further enhance the efficiency and capabilities of service providers. Strategic collaborations and a focus on specialized therapeutic areas will be crucial for companies to differentiate themselves and capture market share. The market's trajectory indicates a strong upward trend, promising substantial returns for stakeholders adept at navigating its evolving dynamics.

Global Pharmaceutical Contract Manufacturing and Research Services Segmentation

-

1. Manufacturing Services

- 1.1. API/Bulk Drugs

- 1.2. Advanced Drug Delivery Formulations Packaging

- 1.3. Finished Dose Formulations

-

2. Research Services

- 2.1. Oncology

- 2.2. Vaccines

- 2.3. Inflammation and Immunology

- 2.4. Cardiology

- 2.5. Neuroscience

- 2.6. Other Research Services

Global Pharmaceutical Contract Manufacturing and Research Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Pharmaceutical Contract Manufacturing and Research Services Regional Market Share

Geographic Coverage of Global Pharmaceutical Contract Manufacturing and Research Services

Global Pharmaceutical Contract Manufacturing and Research Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand To Develop Pharmaceutical Drugs; Low Manufacturing Cost And Improving Economic Condition of Developing Countries; Rising Use of Biologics

- 3.3. Market Restrains

- 3.3.1. Regulatory Issues Pertaining to the Drug Approval; Limited Outsourcing Opted by Pharmaceutical Companies

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Hold a Major Market Share in the Pharmaceutical Contract Manufacturing and Research Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Contract Manufacturing and Research Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 5.1.1. API/Bulk Drugs

- 5.1.2. Advanced Drug Delivery Formulations Packaging

- 5.1.3. Finished Dose Formulations

- 5.2. Market Analysis, Insights and Forecast - by Research Services

- 5.2.1. Oncology

- 5.2.2. Vaccines

- 5.2.3. Inflammation and Immunology

- 5.2.4. Cardiology

- 5.2.5. Neuroscience

- 5.2.6. Other Research Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 6. North America Global Pharmaceutical Contract Manufacturing and Research Services Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 6.1.1. API/Bulk Drugs

- 6.1.2. Advanced Drug Delivery Formulations Packaging

- 6.1.3. Finished Dose Formulations

- 6.2. Market Analysis, Insights and Forecast - by Research Services

- 6.2.1. Oncology

- 6.2.2. Vaccines

- 6.2.3. Inflammation and Immunology

- 6.2.4. Cardiology

- 6.2.5. Neuroscience

- 6.2.6. Other Research Services

- 6.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 7. Europe Global Pharmaceutical Contract Manufacturing and Research Services Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 7.1.1. API/Bulk Drugs

- 7.1.2. Advanced Drug Delivery Formulations Packaging

- 7.1.3. Finished Dose Formulations

- 7.2. Market Analysis, Insights and Forecast - by Research Services

- 7.2.1. Oncology

- 7.2.2. Vaccines

- 7.2.3. Inflammation and Immunology

- 7.2.4. Cardiology

- 7.2.5. Neuroscience

- 7.2.6. Other Research Services

- 7.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 8. Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 8.1.1. API/Bulk Drugs

- 8.1.2. Advanced Drug Delivery Formulations Packaging

- 8.1.3. Finished Dose Formulations

- 8.2. Market Analysis, Insights and Forecast - by Research Services

- 8.2.1. Oncology

- 8.2.2. Vaccines

- 8.2.3. Inflammation and Immunology

- 8.2.4. Cardiology

- 8.2.5. Neuroscience

- 8.2.6. Other Research Services

- 8.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 9. Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 9.1.1. API/Bulk Drugs

- 9.1.2. Advanced Drug Delivery Formulations Packaging

- 9.1.3. Finished Dose Formulations

- 9.2. Market Analysis, Insights and Forecast - by Research Services

- 9.2.1. Oncology

- 9.2.2. Vaccines

- 9.2.3. Inflammation and Immunology

- 9.2.4. Cardiology

- 9.2.5. Neuroscience

- 9.2.6. Other Research Services

- 9.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 10. South America Global Pharmaceutical Contract Manufacturing and Research Services Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 10.1.1. API/Bulk Drugs

- 10.1.2. Advanced Drug Delivery Formulations Packaging

- 10.1.3. Finished Dose Formulations

- 10.2. Market Analysis, Insights and Forecast - by Research Services

- 10.2.1. Oncology

- 10.2.2. Vaccines

- 10.2.3. Inflammation and Immunology

- 10.2.4. Cardiology

- 10.2.5. Neuroscience

- 10.2.6. Other Research Services

- 10.1. Market Analysis, Insights and Forecast - by Manufacturing Services

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Labcorp Drug Development

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Baxter BioPharma

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Evonik Industries AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Boehringer Ingelheim Biopharmaceuticals GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Symbiosis Pharmaceutical Services

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aurigene Pharmaceutical Services Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Piramal Pharma Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thermo Fisher Scientific (PPD Inc )

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AbbVie

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dalton Pharma Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sterling Pharma Solutions

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Lonza AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Labcorp Drug Development

List of Figures

- Figure 1: Global Global Pharmaceutical Contract Manufacturing and Research Services Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Global Pharmaceutical Contract Manufacturing and Research Services Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Manufacturing Services 2025 & 2033

- Figure 4: North America Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Manufacturing Services 2025 & 2033

- Figure 5: North America Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Manufacturing Services 2025 & 2033

- Figure 6: North America Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Manufacturing Services 2025 & 2033

- Figure 7: North America Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Research Services 2025 & 2033

- Figure 8: North America Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Research Services 2025 & 2033

- Figure 9: North America Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Research Services 2025 & 2033

- Figure 10: North America Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Research Services 2025 & 2033

- Figure 11: North America Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Manufacturing Services 2025 & 2033

- Figure 16: Europe Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Manufacturing Services 2025 & 2033

- Figure 17: Europe Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Manufacturing Services 2025 & 2033

- Figure 18: Europe Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Manufacturing Services 2025 & 2033

- Figure 19: Europe Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Research Services 2025 & 2033

- Figure 20: Europe Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Research Services 2025 & 2033

- Figure 21: Europe Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Research Services 2025 & 2033

- Figure 22: Europe Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Research Services 2025 & 2033

- Figure 23: Europe Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Manufacturing Services 2025 & 2033

- Figure 28: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Manufacturing Services 2025 & 2033

- Figure 29: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Manufacturing Services 2025 & 2033

- Figure 30: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Manufacturing Services 2025 & 2033

- Figure 31: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Research Services 2025 & 2033

- Figure 32: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Research Services 2025 & 2033

- Figure 33: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Research Services 2025 & 2033

- Figure 34: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Research Services 2025 & 2033

- Figure 35: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Manufacturing Services 2025 & 2033

- Figure 40: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Manufacturing Services 2025 & 2033

- Figure 41: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Manufacturing Services 2025 & 2033

- Figure 42: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Manufacturing Services 2025 & 2033

- Figure 43: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Research Services 2025 & 2033

- Figure 44: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Research Services 2025 & 2033

- Figure 45: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Research Services 2025 & 2033

- Figure 46: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Research Services 2025 & 2033

- Figure 47: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Manufacturing Services 2025 & 2033

- Figure 52: South America Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Manufacturing Services 2025 & 2033

- Figure 53: South America Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Manufacturing Services 2025 & 2033

- Figure 54: South America Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Manufacturing Services 2025 & 2033

- Figure 55: South America Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Research Services 2025 & 2033

- Figure 56: South America Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Research Services 2025 & 2033

- Figure 57: South America Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Research Services 2025 & 2033

- Figure 58: South America Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Research Services 2025 & 2033

- Figure 59: South America Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Global Pharmaceutical Contract Manufacturing and Research Services Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Global Pharmaceutical Contract Manufacturing and Research Services Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Manufacturing Services 2020 & 2033

- Table 2: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Manufacturing Services 2020 & 2033

- Table 3: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Research Services 2020 & 2033

- Table 4: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Research Services 2020 & 2033

- Table 5: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Manufacturing Services 2020 & 2033

- Table 8: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Manufacturing Services 2020 & 2033

- Table 9: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Research Services 2020 & 2033

- Table 10: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Research Services 2020 & 2033

- Table 11: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Manufacturing Services 2020 & 2033

- Table 20: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Manufacturing Services 2020 & 2033

- Table 21: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Research Services 2020 & 2033

- Table 22: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Research Services 2020 & 2033

- Table 23: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Manufacturing Services 2020 & 2033

- Table 38: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Manufacturing Services 2020 & 2033

- Table 39: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Research Services 2020 & 2033

- Table 40: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Research Services 2020 & 2033

- Table 41: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Manufacturing Services 2020 & 2033

- Table 56: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Manufacturing Services 2020 & 2033

- Table 57: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Research Services 2020 & 2033

- Table 58: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Research Services 2020 & 2033

- Table 59: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Manufacturing Services 2020 & 2033

- Table 68: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Manufacturing Services 2020 & 2033

- Table 69: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Research Services 2020 & 2033

- Table 70: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Research Services 2020 & 2033

- Table 71: Global Pharmaceutical Contract Manufacturing and Research Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Pharmaceutical Contract Manufacturing and Research Services Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Global Pharmaceutical Contract Manufacturing and Research Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Global Pharmaceutical Contract Manufacturing and Research Services Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Pharmaceutical Contract Manufacturing and Research Services?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the Global Pharmaceutical Contract Manufacturing and Research Services?

Key companies in the market include Labcorp Drug Development, Baxter BioPharma, Evonik Industries AG, Boehringer Ingelheim Biopharmaceuticals GmbH, Symbiosis Pharmaceutical Services, Aurigene Pharmaceutical Services Ltd, Piramal Pharma Solutions, Thermo Fisher Scientific (PPD Inc ), AbbVie, Dalton Pharma Services, Sterling Pharma Solutions, Lonza AG.

3. What are the main segments of the Global Pharmaceutical Contract Manufacturing and Research Services?

The market segments include Manufacturing Services, Research Services.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand To Develop Pharmaceutical Drugs; Low Manufacturing Cost And Improving Economic Condition of Developing Countries; Rising Use of Biologics.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Hold a Major Market Share in the Pharmaceutical Contract Manufacturing and Research Services Market.

7. Are there any restraints impacting market growth?

Regulatory Issues Pertaining to the Drug Approval; Limited Outsourcing Opted by Pharmaceutical Companies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Pharmaceutical Contract Manufacturing and Research Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Pharmaceutical Contract Manufacturing and Research Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Pharmaceutical Contract Manufacturing and Research Services?

To stay informed about further developments, trends, and reports in the Global Pharmaceutical Contract Manufacturing and Research Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence