Key Insights

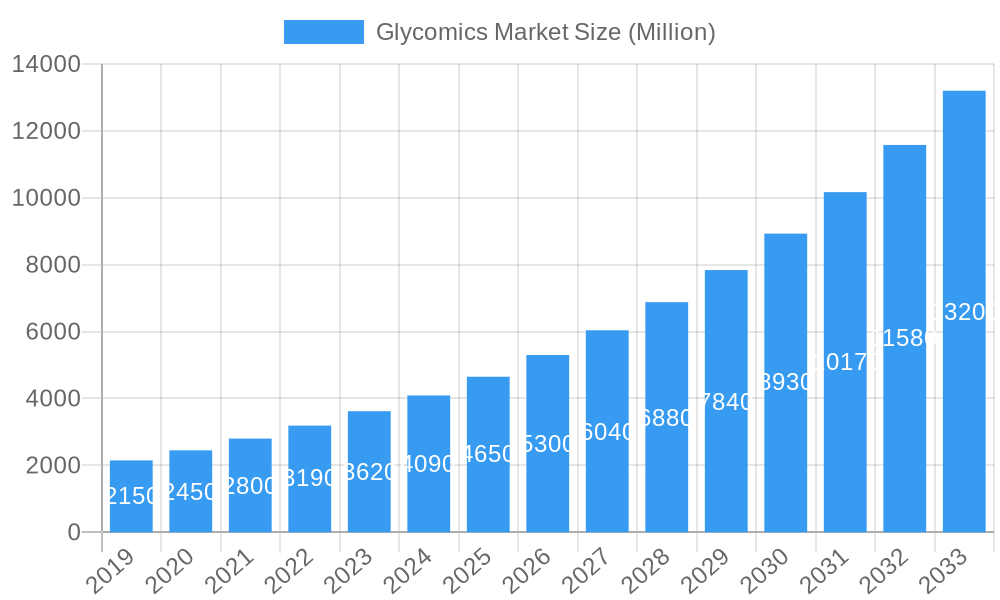

The global Glycomics market is set for significant expansion, projected to reach $2.12 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 13.85% through 2033. This growth is attributed to increasing demand for advanced diagnostics and therapeutics, a deeper understanding of glycan roles in biological processes, and continuous innovation in glycomic tools. The rising prevalence of chronic diseases like cancer, diabetes, and infectious diseases, where glycans are implicated, further drives market demand. The market is segmented by Product Type into Instruments, Reagents and Kits, and Enzymes, with Instruments expected to lead due to their sophisticated glycan profiling capabilities. Applications in Drug Development and Diagnostics are anticipated to be the primary revenue drivers, underscoring glycomics' impact on healthcare advancements.

Glycomics Market Market Size (In Billion)

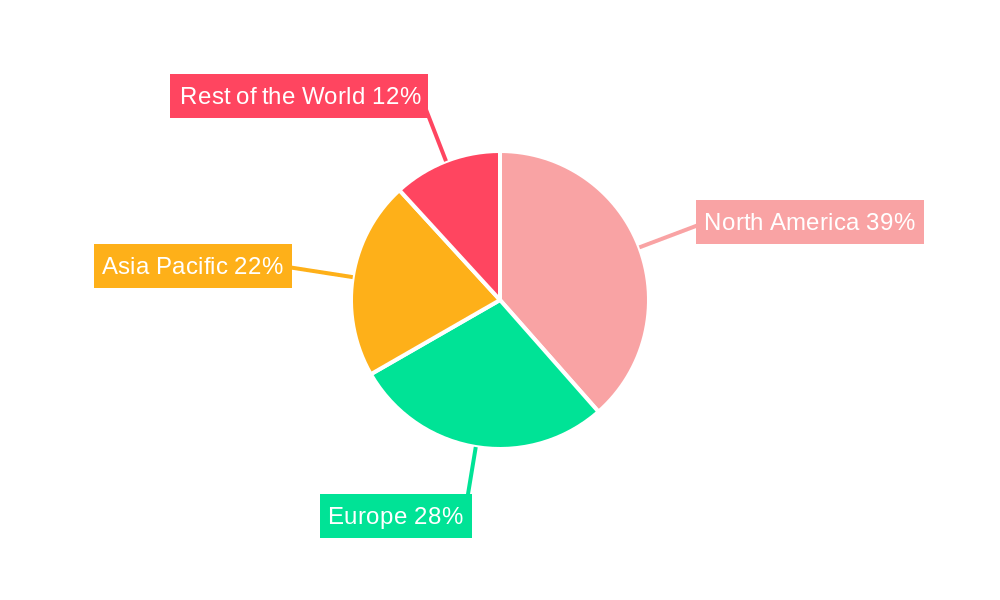

Key industry players, including Merck KGaA, Thermo Fisher Scientific Inc., and Agilent Technologies Inc., are actively investing in research and development to enhance their product offerings and meet evolving market needs. North America is expected to maintain a dominant position, supported by robust life sciences research funding and a well-established healthcare infrastructure. However, the Asia Pacific region is poised for the fastest growth, driven by increasing healthcare expenditure and a growing focus on precision medicine. While significant opportunities exist, the market may face challenges from the high cost of advanced glycomic technologies and the inherent complexity of glycan analysis. Nevertheless, the transformative potential of glycomics in disease understanding and treatment ensures sustained market growth.

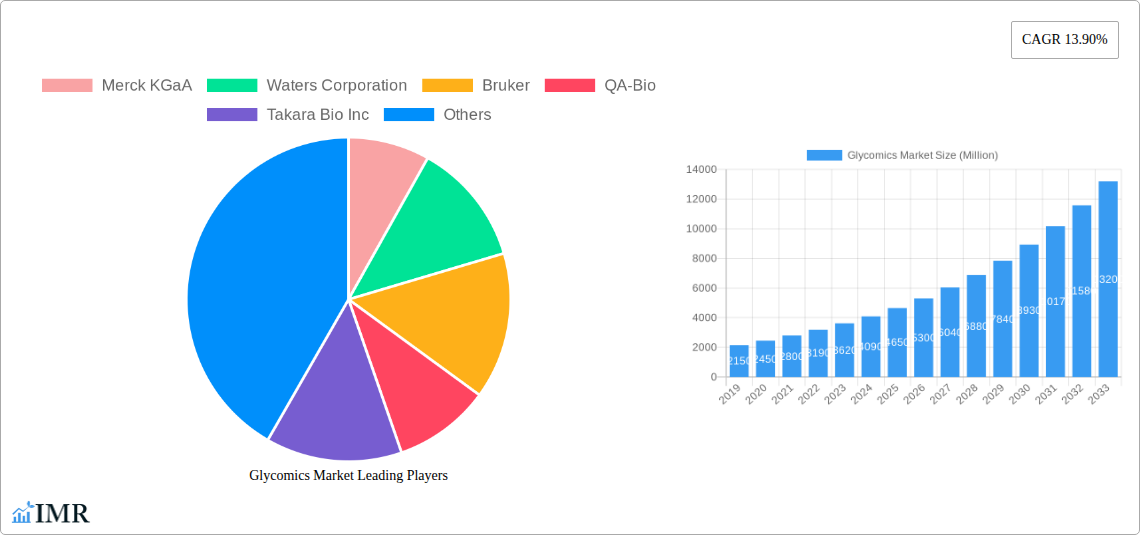

Glycomics Market Company Market Share

Glycomics Market: Innovations, Applications, and Future Outlook (2025–2033)

Explore the expanding potential of the glycomics market, a sector fueled by advancements in drug development, diagnostics, and personalized medicine. This report offers a comprehensive overview of the global glycomics market size, market share, and key industry trends from 2025 to 2033, with a focus on the base year 2025 and the forecast period 2025–2033. Analyze the dynamics of glycobiology and the crucial role of glycans in biological processes and their applications across pharmaceuticals, biotechnology, and healthcare.

This report details glycomics market segmentation by Product Type (Instruments, Reagents and Kits, Enzymes) and Application (Drug Development, Diagnostics, Other Applications). Identify how leading companies such as Merck KGaA, Thermo Fisher Scientific Inc., and Agilent Technologies Inc. are influencing the glycomics market landscape through technological innovation.

Understand the key drivers of glycomics market growth, including increased research funding, demand for advanced diagnostics, and the growing understanding of glycosylation in disease. Conversely, assess the barriers and challenges such as the complexity of glycan analysis and regulatory hurdles. Discover emerging opportunities and growth accelerators within the glycomics market, including glycoengineering, mass spectrometry advancements, and glycan-based therapeutics.

This report provides invaluable insights for stakeholders navigating the complexities and capitalizing on the growth potential of the glycomics market, featuring a detailed market outlook, dominant regions, and notable milestones.

Glycomics Market Market Dynamics & Structure

The global glycomics market is characterized by a moderate level of concentration, with a few key players holding significant market share in specialized segments. However, the increasing accessibility of advanced analytical technologies and a growing understanding of glycans' biological significance are fostering a dynamic competitive environment. Technological innovation is the primary driver, with continuous advancements in mass spectrometry, chromatography, and bioinformatics software enabling more comprehensive and accurate glycan analysis. Regulatory frameworks, particularly in pharmaceutical and diagnostic applications, are evolving to accommodate the unique challenges of glycomics research and product development. Competitive product substitutes are emerging, primarily in the form of alternative analytical techniques or simplified glycan profiling methods. End-user demographics span academic research institutions, pharmaceutical and biotechnology companies, contract research organizations (CROs), and diagnostic laboratories, all seeking to leverage glycomics for disease understanding and therapeutic development. Mergers and acquisitions (M&A) trends are indicative of market consolidation and strategic expansion, allowing companies to broaden their product portfolios and technological capabilities. For instance, recent M&A activities have focused on integrating glycomics platforms with broader proteomics and genomics initiatives.

- Market Concentration: Moderate, with established players in instrument manufacturing and specialized reagents.

- Technological Innovation Drivers: Advancements in mass spectrometry (e.g., high-resolution MS/MS), glycan labeling techniques, and computational glycomics.

- Regulatory Frameworks: Ongoing efforts to standardize glycan analysis methodologies and regulatory pathways for glycan-based therapeutics.

- Competitive Product Substitutes: Advancements in next-generation sequencing and CRISPR-based gene editing impacting target discovery.

- End-User Demographics: Growing adoption by academic research, biopharmaceutical R&D, and clinical diagnostics.

- M&A Trends: Focus on acquiring companies with unique glycan analysis technologies and bioinformatics expertise. Recent M&A deal volumes are projected to increase by approximately 15% from 2024 to 2025, reflecting strategic consolidation.

Glycomics Market Growth Trends & Insights

The glycomics market is poised for substantial growth, driven by an increasing appreciation for the intricate roles of glycans in cellular function, disease progression, and therapeutic response. The market size has witnessed a steady upward trajectory, with historical data indicating robust growth from 2019 to 2024, transitioning into a period of accelerated expansion. This growth is underpinned by escalating investments in glycomics research and development, particularly within the pharmaceutical and biotechnology sectors. The adoption rates of advanced glycomics technologies, such as sophisticated mass spectrometry platforms and automated glycan analysis systems, are steadily increasing as their utility in drug discovery, vaccine development, and diagnostics becomes more evident. Technological disruptions, including the development of novel glycan sequencing methods and the integration of artificial intelligence in glycan data interpretation, are further fueling market expansion. Consumer behavior shifts, characterized by a growing demand for personalized medicine and more accurate diagnostic tools, are compelling researchers and clinicians to explore glycan biomarkers. The CAGR for the glycomics market is projected to be a significant XX% between 2025 and 2033, reflecting a sustained and dynamic growth phase. Market penetration for routine glycomics analysis in specific therapeutic areas is expected to rise from approximately XX% in 2025 to over XX% by 2033, signifying a deepening integration into standard research and clinical workflows. The increasing prevalence of chronic diseases, coupled with the need for more effective treatments and early diagnostic capabilities, acts as a major catalyst for glycomics adoption. Furthermore, the growing understanding of the glycome's impact on immune responses and cancer biology is opening up new avenues for therapeutic interventions and diagnostic applications, further stimulating market demand. The development of high-throughput glycan profiling techniques and affordable analytical instrumentation is democratizing access to glycomics research, enabling smaller research groups and developing economies to participate more actively in this field. This expanding base of researchers and applications is creating a virtuous cycle of innovation and market growth.

Dominant Regions, Countries, or Segments in Glycomics Market

North America currently stands as the dominant region in the global glycomics market, driven by substantial investments in life sciences research, a well-established biotechnology and pharmaceutical industry, and a high adoption rate of advanced analytical technologies. The United States, in particular, is a powerhouse, fueled by significant government funding for biomedical research through agencies like the National Institutes of Health (NIH), alongside strong private sector R&D initiatives. This robust ecosystem supports the extensive use of glycomics Instruments, such as high-resolution mass spectrometers and automated sample preparation systems, which are critical for complex glycan analysis. The Reagents and Kits segment also thrives in North America due to the presence of leading global manufacturers and a high demand from research institutions for specialized tools.

Application-wise, Drug Development is a primary driver in North America, with pharmaceutical companies heavily investing in glycomics to understand drug targets, optimize biologics, and develop glycosylation inhibitors or modifiers. The stringent regulatory requirements for drug efficacy and safety also necessitate detailed glycan profiling. Diagnostics is another significant segment, with ongoing research into glycan biomarkers for early disease detection, prognosis, and patient stratification in areas like cancer and infectious diseases. The country's advanced healthcare infrastructure and proactive approach to adopting novel diagnostic technologies further bolster this segment.

- Leading Region: North America.

- Key Country: United States.

- Dominant Product Type Segment: Instruments.

- Key Drivers: High R&D expenditure, presence of leading instrument manufacturers, and demand for advanced analytical capabilities.

- Market Share: Projected to account for approximately XX% of the global Instruments segment by 2025.

- Dominant Application Segment: Drug Development.

- Key Drivers: Extensive use in biologics characterization, therapeutic antibody development, and target identification.

- Growth Potential: Significant opportunities in developing glycosylation-targeted therapies.

- Economic Policies: Favorable government incentives for R&D and biopharmaceutical innovation.

- Infrastructure: World-class research facilities and a robust network of academic and industrial collaborations.

Glycomics Market Product Landscape

The glycomics product landscape is characterized by continuous innovation, focusing on enhancing sensitivity, throughput, and ease of use. Instruments are advancing with higher resolution mass spectrometers capable of detailed glycan isomer differentiation and automated sample preparation workflows. The reagents and kits segment is witnessing the development of novel fluorescent and isotopic labels for more precise glycan detection, alongside curated glycan libraries and standards for accurate quantification and identification. Enzymes and enzyme-based kits are crucial for targeted glycan cleavage, modification, and synthesis, facilitating complex glycan structure elucidation and application-specific glycan production. Performance metrics such as limit of detection (LOD), resolution, and speed are continually improving, enabling researchers to analyze increasingly complex biological samples with greater confidence. Unique selling propositions lie in integrated workflows that combine sample preparation, separation, detection, and bioinformatics analysis, offering end-to-end solutions for glycomics research.

Key Drivers, Barriers & Challenges in Glycomics Market

Key Drivers:

- Advancements in Analytical Technologies: High-resolution mass spectrometry, advanced chromatography, and sophisticated bioinformatics tools are enhancing the depth and accuracy of glycan analysis.

- Growing Understanding of Glycosylation in Disease: The identification of glycans as critical biomarkers for various diseases, including cancer, infectious diseases, and autoimmune disorders, is driving demand for glycomics applications in diagnostics and therapeutics.

- Increased Investment in Biopharmaceutical R&D: Pharmaceutical and biotechnology companies are increasingly leveraging glycomics for drug discovery, development, and characterization of biologics.

- Demand for Personalized Medicine: Glycans play a crucial role in individual responses to treatments, fueling the need for glycomics to develop tailored therapeutic strategies.

Barriers & Challenges:

- Complexity of Glycan Structure: The immense diversity and complexity of glycan structures pose significant analytical challenges, requiring specialized expertise and sophisticated instrumentation.

- Lack of Standardization: The absence of universally standardized methodologies for glycan analysis and data interpretation can hinder comparability across studies and limit widespread clinical adoption.

- High Cost of Instrumentation and Reagents: Advanced glycomics instrumentation and specialized reagents can be expensive, limiting access for smaller research institutions and cost-sensitive applications.

- Data Interpretation and Bioinformatics: The vast amount of complex data generated by glycomics analyses requires advanced bioinformatics tools and skilled personnel for effective interpretation.

- Regulatory Hurdles: Developing and obtaining regulatory approval for glycan-based diagnostics and therapeutics can be a lengthy and complex process.

- Supply Chain Issues: Disruptions in the supply chain for specialized reagents or instrument components can impact research continuity.

Emerging Opportunities in Glycomics Market

Emerging opportunities in the glycomics market lie in the development of novel glycan-based therapeutics for unmet medical needs, particularly in oncology and infectious diseases. The growing application of glycomics in the field of microbiome research, understanding the complex interplay between host and microbial glycans, presents a significant untapped market. Furthermore, the integration of glycomics with other omics technologies, such as genomics, proteomics, and metabolomics, offers a holistic approach to understanding biological systems and identifying multi-modal biomarkers. The development of point-of-care glycan detection devices and AI-driven glycan analysis platforms also represents a promising avenue for market expansion, enabling faster and more accessible glycomics applications. The increasing focus on quality control and characterization of biologics, especially monoclonal antibodies and vaccines, will continue to drive demand for advanced glycomics solutions.

Growth Accelerators in the Glycomics Market Industry

Several key growth accelerators are propelling the glycomics market forward. Technological breakthroughs in glycan synthesis and sequencing are expanding the scope of glycomics research and application. Strategic partnerships between instrument manufacturers, reagent suppliers, and pharmaceutical companies are fostering innovation and accelerating the translation of research findings into commercial products. The expansion of glycomics applications into emerging fields like cellular agriculture and food science, where understanding glycosylation is crucial for product quality and safety, is also contributing to market growth. Furthermore, increasing global healthcare expenditure and a growing emphasis on preventive medicine are creating a fertile ground for the adoption of advanced diagnostic tools, including those based on glycan biomarkers. The development of robust glycan databases and computational tools that can predict glycan functions and their roles in disease are also acting as significant accelerators.

Key Players Shaping the Glycomics Market Market

- Merck KGaA

- Waters Corporation

- Bruker

- QA-Bio

- Takara Bio Inc

- Agilent Technologies Inc

- New England Biolabs Inc

- Shimadzu Corporation

- Danaher (SCIEX)

- ThermoFisher Scientific Inc

Notable Milestones in Glycomics Market Sector

- 2019: Launch of advanced high-resolution mass spectrometry platforms enabling deeper glycan profiling.

- 2020: Significant increase in research publications focusing on glycan biomarkers for COVID-19.

- 2021: Introduction of novel automated glycan sample preparation systems, reducing analysis time.

- 2022: Strategic acquisitions of specialized glycomics software and bioinformatics companies.

- 2023: Advancements in glycan synthesis techniques for therapeutic applications.

- 2024: Increased adoption of glycomics in vaccine development and characterization.

In-Depth Glycomics Market Market Outlook

The future outlook for the glycomics market is exceptionally promising, driven by sustained innovation and an expanding understanding of glycans' fundamental roles in biology and disease. Growth accelerators such as the relentless pursuit of personalized medicine, the development of novel glyco-therapeutics, and the integration of glycomics with other omics technologies will continue to fuel market expansion. Strategic partnerships and collaborative research initiatives are expected to further accelerate the translation of scientific discoveries into clinical applications. The increasing demand for accurate and early disease diagnostics, coupled with the growing complexity of biologics, ensures a sustained need for advanced glycomics solutions. The market is set to witness significant opportunities in untapped therapeutic areas and novel applications, making it a critical frontier in biomedical research and healthcare.

Glycomics Market Segmentation

-

1. Product Type

- 1.1. Instruments

- 1.2. Reagents and Kits

- 1.3. Enzymes

-

2. Application

- 2.1. Drug Development

- 2.2. Diagnostics

- 2.3. Other Applications

Glycomics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Glycomics Market Regional Market Share

Geographic Coverage of Glycomics Market

Glycomics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Research and Development Activities in Glycomics; Technological Advancements in Products

- 3.3. Market Restrains

- 3.3.1. ; Complexity of Glycomics Coupled With The High Cost Involved in the Process

- 3.4. Market Trends

- 3.4.1. Drug Discovery and Development Segment is Expected to Hold a Major Market Share in the Glycomics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glycomics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Instruments

- 5.1.2. Reagents and Kits

- 5.1.3. Enzymes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Drug Development

- 5.2.2. Diagnostics

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Glycomics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Instruments

- 6.1.2. Reagents and Kits

- 6.1.3. Enzymes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Drug Development

- 6.2.2. Diagnostics

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Glycomics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Instruments

- 7.1.2. Reagents and Kits

- 7.1.3. Enzymes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Drug Development

- 7.2.2. Diagnostics

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Glycomics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Instruments

- 8.1.2. Reagents and Kits

- 8.1.3. Enzymes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Drug Development

- 8.2.2. Diagnostics

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Glycomics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Instruments

- 9.1.2. Reagents and Kits

- 9.1.3. Enzymes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Drug Development

- 9.2.2. Diagnostics

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Merck KGaA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Waters Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bruker

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 QA-Bio

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Takara Bio Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Agilent Technologies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 New England Biolabs Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Shimadzu Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Danaher (SCIEX)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ThermoFisher Scientific Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Merck KGaA

List of Figures

- Figure 1: Global Glycomics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Glycomics Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Glycomics Market Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Glycomics Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Glycomics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Glycomics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Glycomics Market Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Glycomics Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Glycomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Glycomics Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Glycomics Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Glycomics Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Glycomics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Glycomics Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Glycomics Market Revenue (billion), by Product Type 2025 & 2033

- Figure 16: Europe Glycomics Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 17: Europe Glycomics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Glycomics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Glycomics Market Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Glycomics Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Glycomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Glycomics Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Glycomics Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Glycomics Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Glycomics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Glycomics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Glycomics Market Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Glycomics Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Glycomics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Glycomics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Glycomics Market Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Glycomics Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Glycomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Glycomics Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Glycomics Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Glycomics Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Glycomics Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Glycomics Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Glycomics Market Revenue (billion), by Product Type 2025 & 2033

- Figure 40: Rest of the World Glycomics Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 41: Rest of the World Glycomics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Rest of the World Glycomics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Rest of the World Glycomics Market Revenue (billion), by Application 2025 & 2033

- Figure 44: Rest of the World Glycomics Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Rest of the World Glycomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Rest of the World Glycomics Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Rest of the World Glycomics Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Rest of the World Glycomics Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Glycomics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Glycomics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Glycomics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Glycomics Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Glycomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Glycomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Glycomics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Glycomics Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Glycomics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Glycomics Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Global Glycomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Glycomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Glycomics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Glycomics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Glycomics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Glycomics Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 21: Global Glycomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Glycomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Glycomics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Glycomics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Glycomics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global Glycomics Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Glycomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Glycomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Glycomics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Glycomics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Glycomics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Glycomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Glycomics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 56: Global Glycomics Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 57: Global Glycomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 58: Global Glycomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Glycomics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Glycomics Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glycomics Market?

The projected CAGR is approximately 13.85%.

2. Which companies are prominent players in the Glycomics Market?

Key companies in the market include Merck KGaA, Waters Corporation, Bruker, QA-Bio, Takara Bio Inc, Agilent Technologies Inc, New England Biolabs Inc, Shimadzu Corporation, Danaher (SCIEX), ThermoFisher Scientific Inc.

3. What are the main segments of the Glycomics Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Research and Development Activities in Glycomics; Technological Advancements in Products.

6. What are the notable trends driving market growth?

Drug Discovery and Development Segment is Expected to Hold a Major Market Share in the Glycomics Market.

7. Are there any restraints impacting market growth?

; Complexity of Glycomics Coupled With The High Cost Involved in the Process.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glycomics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glycomics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glycomics Market?

To stay informed about further developments, trends, and reports in the Glycomics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence