Key Insights

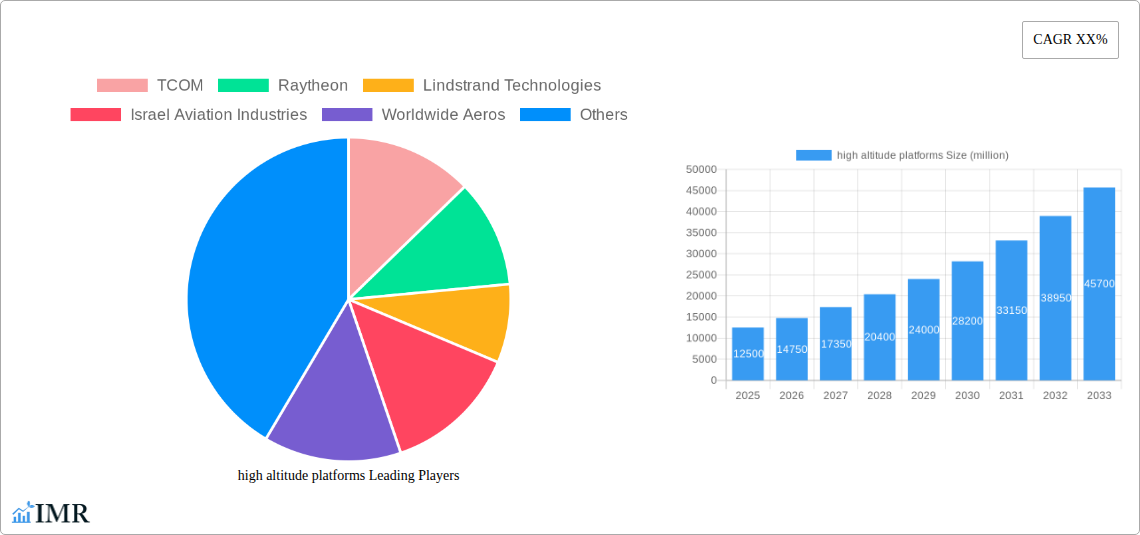

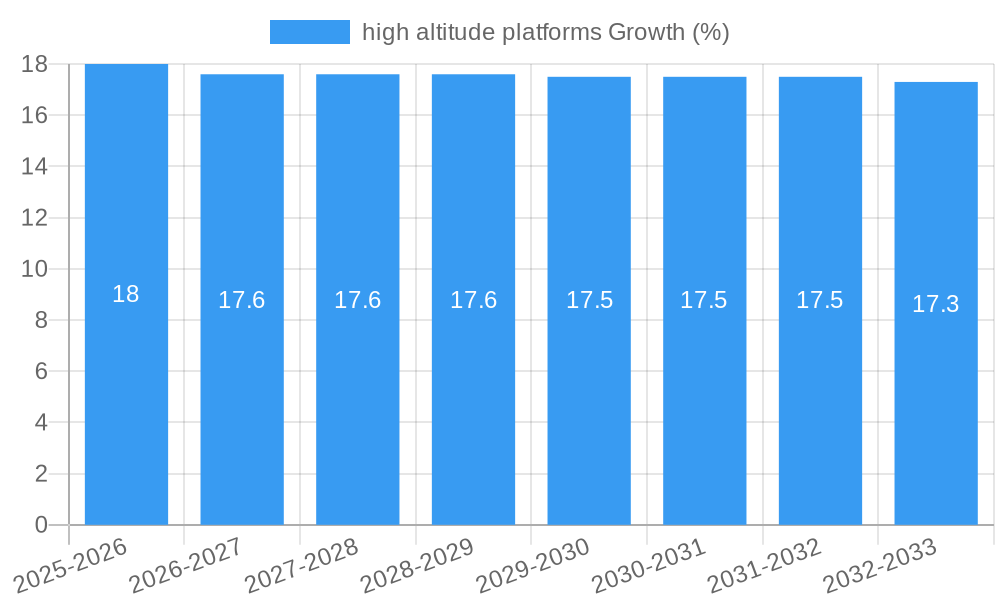

The high altitude platforms market is poised for substantial expansion, projected to reach an estimated $12,500 million by the end of 2025, with a robust compound annual growth rate (CAGR) of 18% anticipated through 2033. This significant growth is propelled by escalating demand across commercial and government sectors, particularly for advanced surveillance, communication, and data relay capabilities. Unmanned Aerial Vehicles (UAVs) are expected to dominate the market share due to their versatility and continuous technological advancements. The increasing adoption of these platforms for persistent surveillance, border security, disaster management, and facilitating high-speed internet connectivity in remote areas are key drivers. Furthermore, the ongoing evolution of airship technology, offering extended endurance and payload capacity, is also contributing to market momentum.

While the market demonstrates strong upward trajectory, certain restraints may influence its pace. High development and operational costs associated with sophisticated high-altitude platform systems, coupled with the need for specialized infrastructure and trained personnel, could pose challenges. Regulatory hurdles and evolving airspace management protocols also represent potential areas of concern. However, ongoing technological innovation, driven by key players like TCOM, Raytheon, and Lockheed Martin, is focused on cost reduction and enhanced operational efficiency. The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions aimed at developing more capable and cost-effective solutions, further fueling market growth and innovation in advanced aerial solutions.

High Altitude Platforms Market Dynamics & Structure

The high altitude platforms (HAP) market is characterized by moderate concentration, with key players like TCOM, Raytheon, and Lockheed Martin leading technological advancements. The market is driven by continuous innovation in unmanned aerial vehicles (UAV) and airships for diverse applications. Regulatory frameworks, particularly concerning airspace management and spectrum allocation for communication payloads, are evolving and present both opportunities and barriers. Competitive product substitutes, such as traditional satellite constellations and advanced terrestrial networks, are present but HAPs offer unique advantages in persistent surveillance and communication relays. End-user demographics are increasingly shifting towards government and defense sectors, with growing interest from commercial entities in telecommunications and earth observation. Mergers and acquisitions (M&A) activity, while not consistently high, indicates strategic consolidation to leverage technological synergies. For instance, the acquisition of a smaller UAV developer by a major defense contractor could significantly alter market share dynamics. The estimated market share for Government & Defense segment is expected to be around 65% by 2025, showcasing its dominance. M&A deal volumes are predicted to be in the range of 2-3 significant transactions annually during the forecast period, with an average deal value in the tens of millions of USD. Barriers to innovation include the substantial R&D investment required for developing robust and reliable HAP systems, alongside the challenges of operating in extreme atmospheric conditions.

High Altitude Platforms Growth Trends & Insights

The global high altitude platforms market is poised for significant expansion, projected to grow from approximately \$5,500 million in 2024 to an estimated \$12,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 8.5% during the forecast period of 2025-2033. This growth is fueled by an increasing demand for persistent aerial surveillance, enhanced communication capabilities, and advanced environmental monitoring solutions across both commercial and government sectors. The adoption rates for HAPs, particularly in the Government & Defense segment, have been steadily increasing, driven by their cost-effectiveness and operational flexibility compared to traditional satellite systems and manned aircraft for prolonged missions. Technological disruptions, such as advancements in lighter-than-air technologies, more efficient power sources, and sophisticated AI-driven navigation systems, are playing a pivotal role in making HAPs more viable and accessible.

The market size evolution for HAPs has been a gradual yet consistent upward trajectory, starting from an estimated \$3,800 million in 2019 to the current base year of 2025. This growth trajectory indicates a strong market penetration and increasing reliance on these platforms for critical applications. Consumer behavior shifts are becoming more apparent as industries recognize the strategic advantage of persistent, wide-area coverage offered by HAPs. For instance, the telecommunications sector is exploring HAPs to provide broadband internet access to underserved regions, directly impacting adoption rates and market penetration in the Commercial segment.

The Unmanned Aerial Vehicles (UAV) segment, particularly High Altitude Pseudo-Satellites (HAPS), is expected to dominate the market share, accounting for an estimated 45% of the total market value by 2025, projected to reach over \$2,500 million. This dominance is attributed to their versatility, enabling applications ranging from border surveillance and disaster management to telecommunications and scientific research. The CAGR for HAPS UAVs is anticipated to be around 9.2% over the forecast period.

The Airships segment, while having a smaller market share, is also experiencing a resurgence, driven by advancements in materials and propulsion, offering long endurance and significant payload capacities. This segment is predicted to grow at a CAGR of approximately 7.8%, reaching an estimated value of \$1,200 million by 2033. The Tethered Aerostat Systems segment, crucial for localized surveillance and communication, is expected to grow at a CAGR of around 7.0%, contributing an estimated \$1,500 million to the market by 2033. The increasing investment in national security and border protection, coupled with the growing need for reliable communication infrastructure in remote areas, are key factors driving this sustained growth across all HAP types.

Dominant Regions, Countries, or Segments in High Altitude Platforms

The Government & Defense segment stands as the undisputed leader in the high altitude platforms (HAP) market, projected to command an estimated 65% of the global market share in 2025, with a value anticipated to exceed \$3,575 million. This dominance is propelled by substantial investments from national defense agencies worldwide, seeking to enhance intelligence, surveillance, and reconnaissance (ISR) capabilities, border security, and tactical communication networks. The persistent nature and wide-area coverage offered by HAPs are invaluable for military operations, providing a cost-effective alternative to traditional satellite systems and manned aircraft for prolonged missions.

Within the HAPs types, Unmanned Aerial Vehicles (UAV), particularly High Altitude Pseudo-Satellites (HAPS), are the primary growth engine, expected to account for approximately 45% of the total market value by 2025, reaching over \$2,500 million. Their versatility in applications, ranging from military surveillance and drug interdiction to telecommunications and natural disaster monitoring, solidifies their leading position. The ongoing technological advancements in UAV endurance, payload capacity, and autonomy further bolster their market appeal. Key drivers in this segment include the increasing demand for real-time data acquisition and dissemination, and the development of advanced sensor technologies that can be effectively deployed on HAPS UAVs.

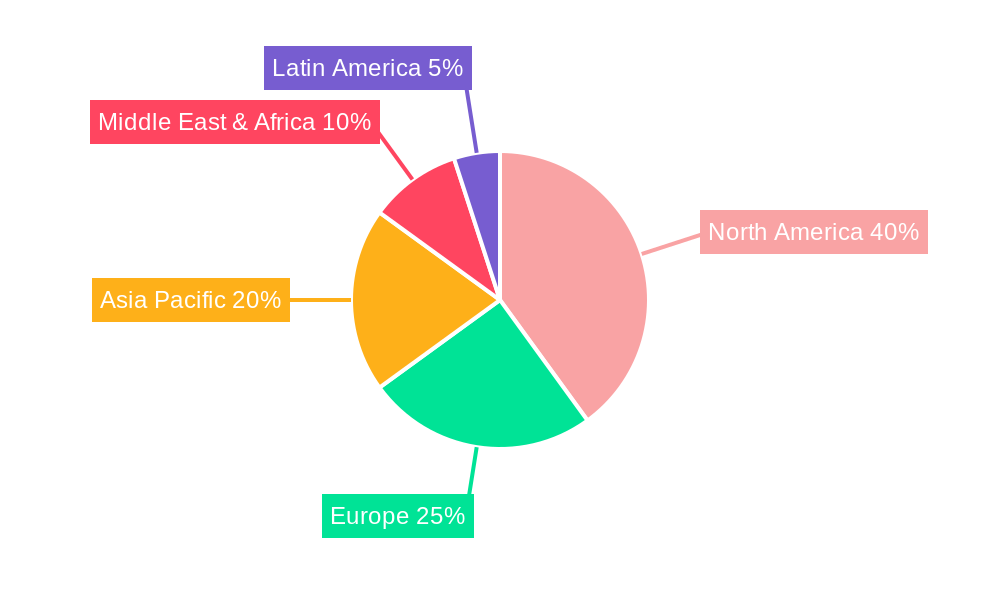

Geographically, North America is anticipated to be the dominant region, contributing an estimated 35% to the global HAP market in 2025, valued at over \$1,925 million. This leadership is attributed to the substantial defense budgets of the United States and Canada, coupled with a strong focus on technological innovation and a robust aerospace industry. The U.S. Department of Defense’s ongoing programs for persistent ISR and advanced communication solutions significantly drive the adoption of HAPs. Furthermore, the increasing deployment of HAPs for border surveillance and wildfire monitoring within North America underscores the segment's importance.

The Asia-Pacific region is emerging as a rapidly growing market, driven by increasing defense spending and a growing need for robust communication infrastructure in developing economies. Countries like China and India are investing heavily in HAP technologies for both defense and civilian applications, including disaster management and remote connectivity. This region is expected to exhibit a CAGR of approximately 9.5% during the forecast period.

Europe also represents a significant market, with countries like the United Kingdom, France, and Germany actively pursuing HAP programs for defense and scientific research. The regulatory push towards integrated airspace management and the increasing interest in stratospheric platforms for commercial applications like internet connectivity are contributing to Europe's growth.

The Commercial segment, while currently smaller than Government & Defense, is experiencing robust growth, driven by the demand for broadband internet in underserved areas, precision agriculture, and advanced environmental monitoring. This segment is projected to grow at a CAGR of around 9.0% over the forecast period. The increasing deployment of HAPS for telecommunications, especially for 5G network extensions, is a major catalyst for this segment's expansion.

High Altitude Platforms Product Landscape

The high altitude platforms (HAP) product landscape is characterized by increasing sophistication and diversification. Airships are being re-engineered with advanced materials and propulsion systems for longer endurance and greater payload capacity, suitable for surveillance and communication relay. Unmanned Aerial Vehicles (UAVs), particularly HAPS, are leading product innovation with advancements in aerodynamic efficiency, power systems (including solar and fuel cells), and autonomous navigation capabilities. These UAVs are being equipped with high-resolution sensors, advanced communication payloads, and sophisticated data processing units. Tethered Aerostat Systems are evolving to offer greater mobility, enhanced stability in adverse weather conditions, and integrated sensor suites for real-time situational awareness. Unique selling propositions include persistent on-station availability, wider coverage areas compared to ground-based systems, and lower operational costs than traditional satellites for certain applications. Technological advancements are focused on miniaturization of payloads, improved energy efficiency, and enhanced operational autonomy.

Key Drivers, Barriers & Challenges in High Altitude Platforms

Key Drivers:

- Enhanced ISR Capabilities: The persistent, wide-area surveillance and reconnaissance (ISR) capabilities of HAPs are a primary driver, crucial for national security and border protection.

- Cost-Effectiveness: HAPs offer a more cost-effective solution for sustained aerial operations compared to traditional manned aircraft and satellites, especially for communication and monitoring missions.

- Expanding Connectivity: The growing demand for broadband internet access in remote and underserved regions is driving the adoption of HAPs for telecommunications.

- Technological Advancements: Continuous improvements in materials science, propulsion systems, power generation, and AI-driven navigation are making HAPs more viable and versatile.

- Disaster Management & Environmental Monitoring: The ability of HAPs to provide real-time data for disaster response and environmental monitoring is a significant growth catalyst.

Barriers & Challenges:

- Regulatory Hurdles: Evolving air traffic management regulations and spectrum allocation policies for HAPs present significant challenges for widespread deployment.

- High R&D Investment: Developing and deploying advanced HAP systems requires substantial research and development investment, creating a barrier for smaller companies.

- Operational Complexity: Operating and maintaining HAPs in the stratosphere, with its extreme weather conditions and atmospheric dynamics, poses significant operational challenges.

- Payload Integration: Integrating complex and sensitive payloads, such as high-bandwidth communication equipment and advanced sensors, requires specialized expertise.

- Public Perception & Acceptance: For commercial applications like internet provision, gaining public acceptance and addressing concerns regarding privacy and airspace congestion are crucial.

- Supply Chain Vulnerabilities: The reliance on specialized components and manufacturing processes can lead to supply chain vulnerabilities and lead times, impacting production schedules. The estimated impact of supply chain disruptions on project timelines can range from 10% to 20%.

Emerging Opportunities in High Altitude Platforms

Emerging opportunities in the high altitude platforms (HAP) market are primarily centered around the expansion of commercial applications, particularly in telecommunications and broadcasting, by bridging the digital divide. The development of eco-friendly HAPs utilizing advanced solar and hydrogen fuel cell technologies presents a significant opportunity for sustainable operations. The increasing use of HAPs in precision agriculture for crop monitoring and yield optimization, as well as for advanced weather forecasting and climate monitoring, are also significant growth avenues. Furthermore, the development of modular and adaptable HAP platforms that can be rapidly reconfigured for various missions offers a flexible approach to market needs. The integration of advanced AI for autonomous flight operations and on-board data processing creates opportunities for enhanced efficiency and reduced human intervention.

Growth Accelerators in the High Altitude Platforms Industry

Several growth accelerators are propelling the high altitude platforms (HAP) industry forward. Strategic partnerships between HAP manufacturers and telecommunications companies are crucial for expanding broadband connectivity solutions. Continued government investment in defense modernization programs, particularly for ISR and persistent surveillance, remains a primary accelerator. Technological breakthroughs in areas such as lighter-than-air materials, advanced battery and fuel cell technology, and miniaturized sensor integration are vital for improving platform performance and reducing costs. Market expansion strategies targeting underserved regions for connectivity and the increasing demand for specialized aerial data services are also significant accelerators.

Key Players Shaping the High Altitude Platforms Market

- TCOM

- Raytheon

- Lindstrand Technologies

- Israel Aviation Industries

- Worldwide Aeros

- Lockheed Martin

- Aerostar International

- ILC Dover

- AeroVironment

- Rafael Advanced Defense Systems

Notable Milestones in High Altitude Platforms Sector

- 2019: Aerostar International successfully demonstrated extended flight endurance for its tethered aerostat systems, enhancing ISR capabilities for clients.

- 2020: Airbus' Zephyr HAPS achieved record-breaking stratospheric flight duration, highlighting advancements in solar-powered UAVs.

- 2021: TCOM launched its new generation of aerostats with enhanced payload integration and operational flexibility, securing significant government contracts.

- 2022: Lockheed Martin invested in further development of its stratospheric airship technology, focusing on a modular design for diverse applications.

- 2023: Worldwide Aeros conducted successful test flights of its stratospheric airship, showcasing its potential for telecommunications and surveillance.

- 2024 (Estimated): Raytheon announced a collaboration with a leading telecommunications firm to explore HAPS for 5G deployment in remote areas.

- 2024 (Estimated): Israel Aviation Industries showcased advanced sensor integration for its HAP platforms, enhancing surveillance accuracy.

- 2025 (Projected): Lindstrand Technologies is expected to unveil a new lightweight material for airships, promising improved performance and cost-efficiency.

- 2025 (Projected): AeroVironment is anticipated to release a new generation of HAPS UAVs with enhanced autonomous capabilities and extended operational ranges.

- 2026 (Projected): Rafael Advanced Defense Systems is expected to integrate advanced electronic warfare capabilities onto its HAP platforms for enhanced defense operations.

In-Depth High Altitude Platforms Market Outlook

The high altitude platforms (HAP) market is set for robust and sustained growth, driven by the confluence of technological innovation and increasing demand across critical sectors. Growth accelerators such as strategic partnerships for expanded connectivity, significant government investment in defense modernization, and breakthroughs in platform performance and efficiency will continue to propel the industry. The outlook suggests a future where HAPs play an indispensable role in global communication networks, persistent surveillance, and advanced environmental monitoring. The increasing adoption of HAPS UAVs, coupled with advancements in airship technology, will unlock new market potential, particularly in bridging the digital divide and enhancing national security. The market's future is characterized by a trajectory of increasing sophistication, broader application scope, and a growing recognition of HAPs as a vital component of modern infrastructure and defense capabilities.

high altitude platforms Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Government & Defense

- 1.3. Others

-

2. Types

- 2.1. Airships

- 2.2. Unmanned Aerial Vehicles (UAV)

- 2.3. Tethered Aerostat Systems

high altitude platforms Segmentation By Geography

- 1. CA

high altitude platforms REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. high altitude platforms Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Government & Defense

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Airships

- 5.2.2. Unmanned Aerial Vehicles (UAV)

- 5.2.3. Tethered Aerostat Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TCOM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Raytheon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lindstrand Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Israel Aviation Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Worldwide Aeros

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lockheed Martin

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aerostar International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ILC Dover

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AeroVironment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rafael Advanced Defense Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TCOM

List of Figures

- Figure 1: high altitude platforms Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: high altitude platforms Share (%) by Company 2024

List of Tables

- Table 1: high altitude platforms Revenue million Forecast, by Region 2019 & 2032

- Table 2: high altitude platforms Revenue million Forecast, by Application 2019 & 2032

- Table 3: high altitude platforms Revenue million Forecast, by Types 2019 & 2032

- Table 4: high altitude platforms Revenue million Forecast, by Region 2019 & 2032

- Table 5: high altitude platforms Revenue million Forecast, by Application 2019 & 2032

- Table 6: high altitude platforms Revenue million Forecast, by Types 2019 & 2032

- Table 7: high altitude platforms Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the high altitude platforms?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the high altitude platforms?

Key companies in the market include TCOM, Raytheon, Lindstrand Technologies, Israel Aviation Industries, Worldwide Aeros, Lockheed Martin, Aerostar International, ILC Dover, AeroVironment, Rafael Advanced Defense Systems.

3. What are the main segments of the high altitude platforms?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "high altitude platforms," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the high altitude platforms report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the high altitude platforms?

To stay informed about further developments, trends, and reports in the high altitude platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence