Key Insights

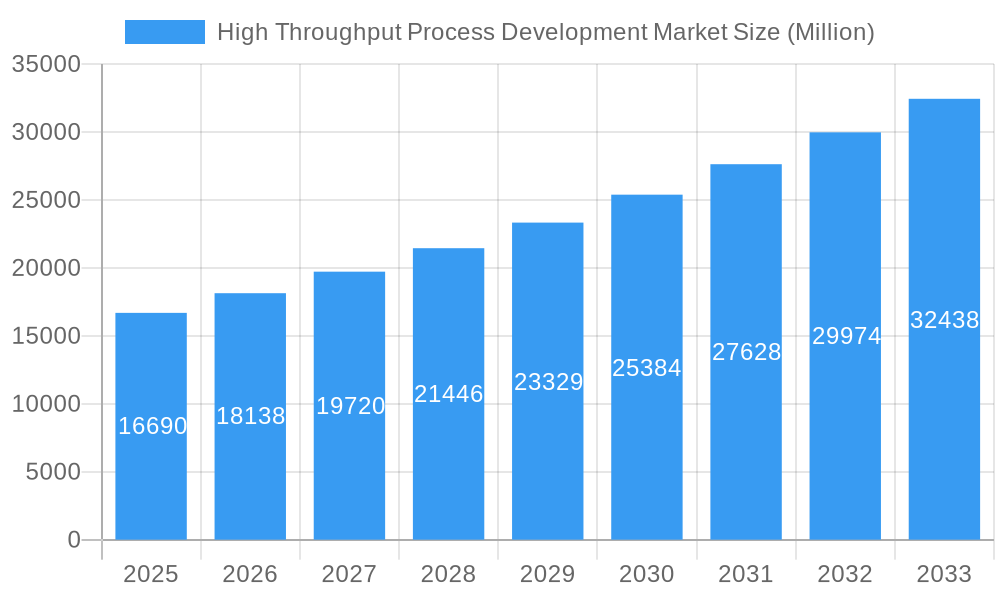

The High Throughput Process Development (HTPD) market is poised for significant expansion, driven by the escalating demand for biopharmaceuticals and the increasing complexity of drug discovery and development pipelines. With a current market size of USD 16.69 billion in 2025, the sector is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.87% through 2033. This expansion is fueled by advancements in automation, miniaturization, and data analytics, enabling researchers to screen more compounds and optimize processes at an unprecedented pace. Key drivers include the burgeoning biopharmaceutical and biotechnology sectors, necessitating faster and more efficient development cycles to bring novel therapies to market. Contract Research Organizations (CROs) are also significant contributors, leveraging HTPD solutions to enhance their service offerings and cater to the growing outsourcing needs of larger pharmaceutical companies. The increasing prevalence of chronic diseases and the ongoing pursuit of personalized medicine further underscore the critical role of HTPD in accelerating research and development.

High Throughput Process Development Market Market Size (In Billion)

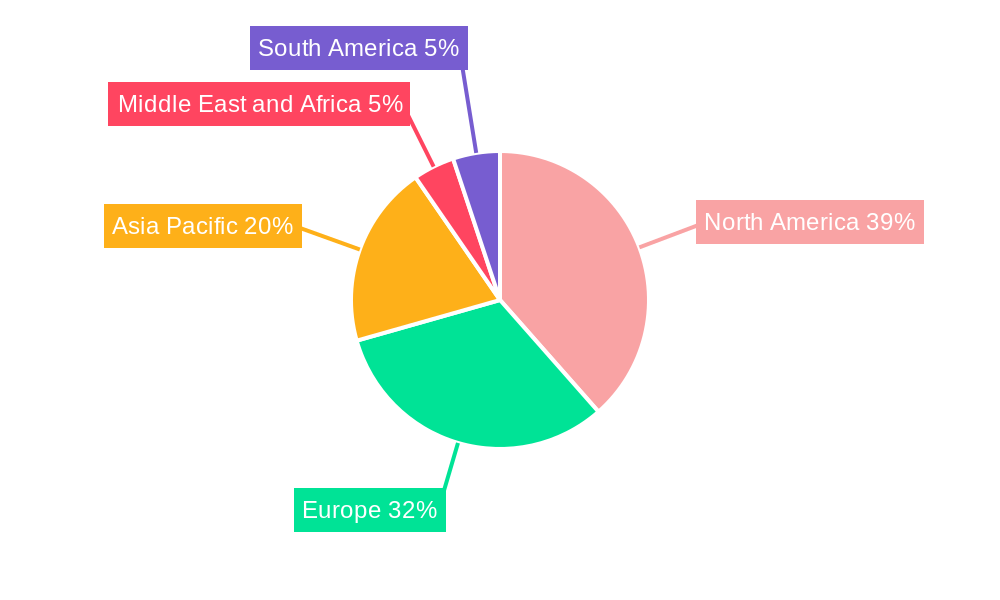

The market's growth is further supported by the ongoing innovation in HTPD technologies and product offerings. While consumables and instruments remain foundational segments, the integration of advanced software and sophisticated analytical technologies is becoming increasingly crucial. Chromatography and Ultraviolet-visible Spectroscopy are established techniques, but the market is witnessing a surge in the adoption of other cutting-edge technologies that enhance assay sensitivity, reduce turnaround times, and improve data accuracy. Despite the strong growth trajectory, certain restraints, such as the high initial investment cost for advanced HTPD systems and the need for skilled personnel to operate and interpret results, may pose challenges. However, these are being mitigated by the development of more user-friendly solutions and the increasing availability of specialized training programs. Geographically, North America and Europe currently dominate the market due to established biopharmaceutical hubs and significant R&D expenditure. However, the Asia Pacific region, particularly China and India, is emerging as a rapidly growing market, driven by increasing investments in life sciences and a growing number of biotechnology companies.

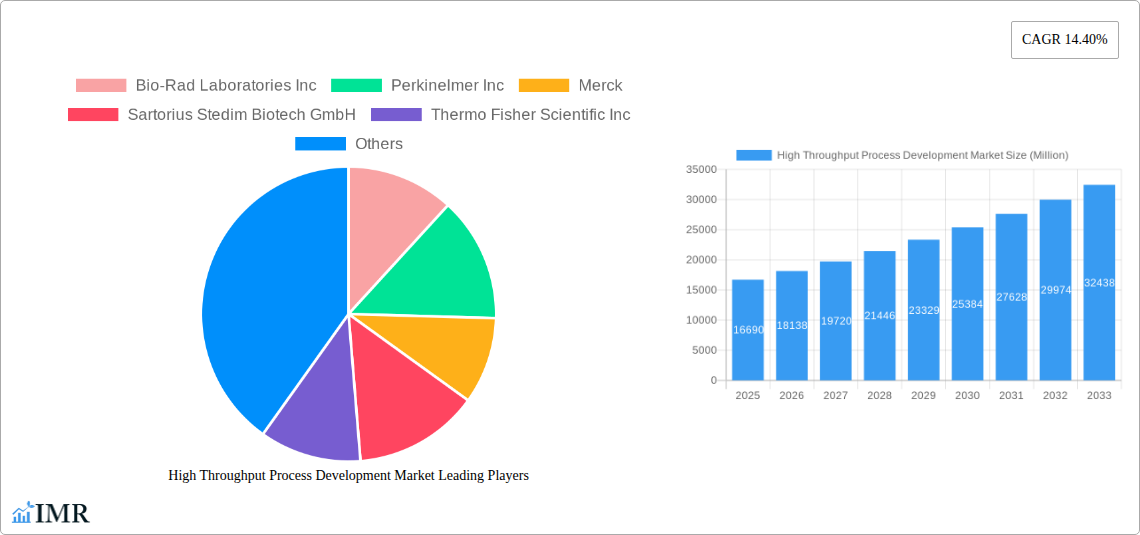

High Throughput Process Development Market Company Market Share

Unlock critical insights into the rapidly evolving High Throughput Process Development Market, a pivotal sector for innovation in biopharmaceuticals, biotechnology, and beyond. This comprehensive report delves into market dynamics, growth trajectories, regional dominance, product landscapes, and the strategic initiatives of key players. Explore the burgeoning opportunities and robust growth accelerators shaping the future of process optimization and drug discovery. Our analysis covers the study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, offering a definitive view of the market's trajectory.

High Throughput Process Development Market Dynamics & Structure

The High Throughput Process Development Market is characterized by a moderately concentrated structure, driven by significant technological innovation and increasing R&D investments. Leading players invest heavily in automating complex biological and chemical processes, aiming to accelerate drug discovery and development timelines. The market's growth is propelled by the rising demand for novel therapeutics and personalized medicine, necessitating faster and more efficient development cycles. Regulatory frameworks, while stringent, are also adapting to encourage innovation in bioprocessing. Competitive product substitutes are emerging, particularly in the realm of AI-driven predictive modeling for process optimization, but the core strengths of high throughput screening remain indispensable. End-user demographics are increasingly dominated by biopharmaceutical and biotechnology companies, along with a significant presence of Contract Research Organizations (CROs). Mergers and acquisitions (M&A) are becoming a key strategy for market consolidation and expansion, with an estimated X deal volumes in the historical period. Barriers to entry include high capital investment for advanced instrumentation and the need for specialized expertise.

- Market Concentration: Moderately concentrated with a few key global players.

- Technological Innovation Drivers: Automation, miniaturization, advanced analytics, AI/ML integration.

- Regulatory Frameworks: FDA, EMA guidelines for process validation and quality control.

- Competitive Product Substitutes: AI-driven simulation tools, advanced analytical techniques.

- End-user Demographics: Predominantly biopharma, biotech, and CROs.

- M&A Trends: Strategic acquisitions for technology integration and market expansion.

High Throughput Process Development Market Growth Trends & Insights

The High Throughput Process Development Market is poised for substantial growth, driven by escalating demand for efficient drug discovery and development pipelines. Our analysis leverages extensive market data to project a robust CAGR of approximately XX% from 2025 to 2033, with the market size expected to reach $XX billion by 2033. The adoption rate of high throughput screening technologies is accelerating across both established and emerging biopharmaceutical companies, fueled by the need to reduce R&D costs and speed up time-to-market for new therapies. Technological disruptions, such as the integration of artificial intelligence and machine learning into experimental design and data analysis, are fundamentally reshaping process development. Consumer behavior shifts, influenced by an increasing global health awareness and the demand for more effective and personalized treatments, are further stimulating market expansion. The market penetration of advanced high throughput solutions is projected to witness significant increases as more organizations recognize their strategic advantages in navigating the complexities of modern drug development. The increasing complexity of biologics, including antibodies, vaccines, and cell and gene therapies, directly contributes to the growing need for sophisticated high throughput process development capabilities. Furthermore, the ongoing pipeline of novel drug candidates across various therapeutic areas, from oncology to rare diseases, necessitates the efficient screening and optimization of manufacturing processes to ensure scalability and cost-effectiveness. This dynamic environment presents a fertile ground for continued market expansion and innovation.

Dominant Regions, Countries, or Segments in High Throughput Process Development Market

North America currently dominates the High Throughput Process Development Market, driven by a robust biopharmaceutical industry, substantial R&D investments, and a favorable regulatory environment that encourages innovation. The United States, in particular, is a powerhouse, housing numerous leading biopharmaceutical companies and contract research organizations that are early adopters of advanced process development technologies. This region benefits from significant government funding for life sciences research and a strong ecosystem of academic institutions and biotech startups, fostering continuous technological advancements.

In terms of Product and Services Type, Instruments are currently the largest segment, accounting for an estimated XX% of the market share. This dominance is attributed to the high cost and complexity of advanced automated systems required for high throughput screening and optimization. However, the Services segment, including contract research and development services, is experiencing rapid growth, driven by the outsourcing trends in the biopharmaceutical industry.

Geographically, Europe holds a significant share, with countries like Germany, the UK, and Switzerland at the forefront, owing to their established pharmaceutical sectors and increasing investments in biotechnology. The Asia-Pacific region is emerging as a high-growth market, propelled by expanding biopharmaceutical manufacturing capabilities, increasing R&D spending, and growing government support for the life sciences sector in countries like China and India.

Analyzing Technology, Chromatography remains a cornerstone in high throughput process development, playing a critical role in purification and analysis, and thus commanding a substantial market share. However, advancements in other technologies, such as Ultraviolet-visible Spectroscopy for rapid compound screening and a broad category of Other Technologies encompassing mass spectrometry, microfluidics, and automated liquid handling systems, are rapidly gaining traction and contributing to the overall market growth.

The End-user landscape is overwhelmingly dominated by Biopharmaceutical and Biotechnology Companies, who represent the primary consumers of high throughput process development solutions, accounting for an estimated XX% of the market. Their relentless pursuit of novel drug candidates and improved manufacturing efficiencies fuels the demand for these advanced technologies. Contract Research Organizations (CROs) constitute the second-largest end-user segment, increasingly leveraging high throughput capabilities to offer specialized services to their clients.

- Dominant Region: North America (USA leading)

- Key Drivers: Strong biopharmaceutical presence, high R&D expenditure, favorable regulatory landscape.

- Leading Product/Service Type: Instruments

- Growth Driver: Demand for advanced automated platforms.

- Emerging Region: Asia-Pacific

- Growth Drivers: Expanding biomanufacturing, government support, cost advantages.

- Key Technology: Chromatography

- Application: Purification and analysis in drug development.

- Primary End-user: Biopharmaceutical and Biotechnology Companies

- Driving Force: Need for accelerated drug discovery and optimization.

High Throughput Process Development Market Product Landscape

The High Throughput Process Development Market product landscape is defined by continuous innovation in automation, miniaturization, and data integration. Key product categories include advanced automated liquid handling systems, high-throughput screening platforms, sophisticated analytical instruments like mass spectrometers and plate readers, and specialized software for experimental design and data analysis. These products are engineered to handle vast numbers of samples concurrently, enabling rapid screening of chemical libraries, cell lines, and bioprocess parameters. Performance metrics are driven by speed, sensitivity, accuracy, and the ability to integrate seamlessly into complex workflows. Unique selling propositions often lie in the modularity of systems, the development of novel assays, and enhanced data management capabilities that facilitate faster decision-making.

Key Drivers, Barriers & Challenges in High Throughput Process Development Market

Key Drivers: The primary forces propelling the High Throughput Process Development Market are the escalating demand for novel therapeutics, the imperative to reduce drug development costs and timelines, and the continuous advancements in automation and analytical technologies. Government initiatives supporting biopharmaceutical R&D and the increasing complexity of biologics also act as significant catalysts.

Key Barriers & Challenges: Significant challenges include the high capital investment required for advanced instrumentation, the need for specialized technical expertise to operate and maintain these systems, and the stringent regulatory hurdles associated with process validation. Supply chain disruptions for critical components and the competitive pressure from emerging technologies also pose substantial restraints. The cost of consumables and the complexity of data management and analysis can also be limiting factors for smaller organizations.

Emerging Opportunities in High Throughput Process Development Market

Emerging opportunities in the High Throughput Process Development Market lie in the growing demand for cell and gene therapies, which require highly specialized and rapid process development. The integration of artificial intelligence (AI) and machine learning (ML) for predictive modeling and experimental optimization presents a significant untapped market. Furthermore, the expansion of biomanufacturing in emerging economies and the increasing application of high throughput techniques in areas like agricultural biotechnology and industrial enzymes offer new avenues for growth. The development of point-of-care diagnostics and personalized medicine also presents lucrative opportunities for leveraging high throughput screening capabilities.

Growth Accelerators in the High Throughput Process Development Market Industry

Catalysts driving long-term growth in the High Throughput Process Development Market industry are multifaceted. Technological breakthroughs in areas like microfluidics and lab-on-a-chip devices are enabling higher throughput and lower sample volumes. Strategic partnerships between technology providers and pharmaceutical companies are crucial for co-development and faster market penetration of innovative solutions. Market expansion strategies targeting underserved regions and the increasing adoption of contract research and development services are also significant growth accelerators, ensuring broader access to these critical technologies and expertise.

Key Players Shaping the High Throughput Process Development Market Market

- Bio-Rad Laboratories Inc

- Perkinelmer Inc

- Merck

- Sartorius Stedim Biotech GmbH

- Thermo Fisher Scientific Inc

- Tecan Group AG

- Eppendorf SE

- Danaher Corporation

- Agilent Technologies Inc

- General Electric Company (GE Healthcare)

Notable Milestones in High Throughput Process Development Market Sector

- October 2022: Ginkgo Bioworks collaborated with Merck, leveraging Ginkgo's cell engineering and enzyme design expertise, alongside its capabilities in automated high-throughput screening, manufacturing process development/optimization, bioinformatics, and analytics to develop optimal strains for targeted biocatalyst expression.

- September 2022: Fujifilm Diosynth Biotechnologies expanded its large-scale microbial manufacturing, inaugurating a high throughput process development facility at its Billingham, United Kingdom location.

In-Depth High Throughput Process Development Market Market Outlook

The future outlook for the High Throughput Process Development Market is exceptionally bright, fueled by the sustained demand for rapid and efficient drug discovery and manufacturing. Growth accelerators include the increasing adoption of AI and ML for predictive analytics, the expansion of cell and gene therapy development, and the growing outsourcing trend among biopharmaceutical companies. Strategic partnerships, technological advancements in automation and miniaturization, and the increasing penetration in emerging markets will further bolster market potential. The market is poised to witness continued innovation and expansion, playing a critical role in addressing global health challenges.

High Throughput Process Development Market Segmentation

-

1. Product and Services Type

- 1.1. Consumables

- 1.2. Instruments

- 1.3. Software

-

2. Technology

- 2.1. Chromatography

- 2.2. Ultraviolet-visible Spectroscopy

- 2.3. Other Technologies

-

3. End-user

- 3.1. Biopharmaceutical and Biotechnology Companies

- 3.2. Contract Research Organizations

- 3.3. Other End-users

High Throughput Process Development Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

High Throughput Process Development Market Regional Market Share

Geographic Coverage of High Throughput Process Development Market

High Throughput Process Development Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Research and Development Activities for Newer Drug Targets; Growth in Pressure to Lower the Manufacturing Costs in Biopharmaceutical and Biotechnology Companies

- 3.3. Market Restrains

- 3.3.1. High Cost of Advanced Technologies and Lack of Adequate Infrastructure

- 3.4. Market Trends

- 3.4.1. Biopharmaceutical & Biotechnology Companies Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Throughput Process Development Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 5.1.1. Consumables

- 5.1.2. Instruments

- 5.1.3. Software

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Chromatography

- 5.2.2. Ultraviolet-visible Spectroscopy

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Biopharmaceutical and Biotechnology Companies

- 5.3.2. Contract Research Organizations

- 5.3.3. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 6. North America High Throughput Process Development Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 6.1.1. Consumables

- 6.1.2. Instruments

- 6.1.3. Software

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Chromatography

- 6.2.2. Ultraviolet-visible Spectroscopy

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Biopharmaceutical and Biotechnology Companies

- 6.3.2. Contract Research Organizations

- 6.3.3. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 7. Europe High Throughput Process Development Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 7.1.1. Consumables

- 7.1.2. Instruments

- 7.1.3. Software

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Chromatography

- 7.2.2. Ultraviolet-visible Spectroscopy

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Biopharmaceutical and Biotechnology Companies

- 7.3.2. Contract Research Organizations

- 7.3.3. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 8. Asia Pacific High Throughput Process Development Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 8.1.1. Consumables

- 8.1.2. Instruments

- 8.1.3. Software

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Chromatography

- 8.2.2. Ultraviolet-visible Spectroscopy

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Biopharmaceutical and Biotechnology Companies

- 8.3.2. Contract Research Organizations

- 8.3.3. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 9. Middle East and Africa High Throughput Process Development Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 9.1.1. Consumables

- 9.1.2. Instruments

- 9.1.3. Software

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Chromatography

- 9.2.2. Ultraviolet-visible Spectroscopy

- 9.2.3. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Biopharmaceutical and Biotechnology Companies

- 9.3.2. Contract Research Organizations

- 9.3.3. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 10. South America High Throughput Process Development Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 10.1.1. Consumables

- 10.1.2. Instruments

- 10.1.3. Software

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Chromatography

- 10.2.2. Ultraviolet-visible Spectroscopy

- 10.2.3. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-user

- 10.3.1. Biopharmaceutical and Biotechnology Companies

- 10.3.2. Contract Research Organizations

- 10.3.3. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Product and Services Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bio-Rad Laboratories Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Perkinelmer Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sartorius Stedim Biotech GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tecan Group AG*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eppendorf SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Danaher Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Company (GE Healthcare)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bio-Rad Laboratories Inc

List of Figures

- Figure 1: Global High Throughput Process Development Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America High Throughput Process Development Market Revenue (undefined), by Product and Services Type 2025 & 2033

- Figure 3: North America High Throughput Process Development Market Revenue Share (%), by Product and Services Type 2025 & 2033

- Figure 4: North America High Throughput Process Development Market Revenue (undefined), by Technology 2025 & 2033

- Figure 5: North America High Throughput Process Development Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America High Throughput Process Development Market Revenue (undefined), by End-user 2025 & 2033

- Figure 7: North America High Throughput Process Development Market Revenue Share (%), by End-user 2025 & 2033

- Figure 8: North America High Throughput Process Development Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America High Throughput Process Development Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe High Throughput Process Development Market Revenue (undefined), by Product and Services Type 2025 & 2033

- Figure 11: Europe High Throughput Process Development Market Revenue Share (%), by Product and Services Type 2025 & 2033

- Figure 12: Europe High Throughput Process Development Market Revenue (undefined), by Technology 2025 & 2033

- Figure 13: Europe High Throughput Process Development Market Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe High Throughput Process Development Market Revenue (undefined), by End-user 2025 & 2033

- Figure 15: Europe High Throughput Process Development Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Europe High Throughput Process Development Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe High Throughput Process Development Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific High Throughput Process Development Market Revenue (undefined), by Product and Services Type 2025 & 2033

- Figure 19: Asia Pacific High Throughput Process Development Market Revenue Share (%), by Product and Services Type 2025 & 2033

- Figure 20: Asia Pacific High Throughput Process Development Market Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Asia Pacific High Throughput Process Development Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific High Throughput Process Development Market Revenue (undefined), by End-user 2025 & 2033

- Figure 23: Asia Pacific High Throughput Process Development Market Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Asia Pacific High Throughput Process Development Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific High Throughput Process Development Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa High Throughput Process Development Market Revenue (undefined), by Product and Services Type 2025 & 2033

- Figure 27: Middle East and Africa High Throughput Process Development Market Revenue Share (%), by Product and Services Type 2025 & 2033

- Figure 28: Middle East and Africa High Throughput Process Development Market Revenue (undefined), by Technology 2025 & 2033

- Figure 29: Middle East and Africa High Throughput Process Development Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa High Throughput Process Development Market Revenue (undefined), by End-user 2025 & 2033

- Figure 31: Middle East and Africa High Throughput Process Development Market Revenue Share (%), by End-user 2025 & 2033

- Figure 32: Middle East and Africa High Throughput Process Development Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa High Throughput Process Development Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America High Throughput Process Development Market Revenue (undefined), by Product and Services Type 2025 & 2033

- Figure 35: South America High Throughput Process Development Market Revenue Share (%), by Product and Services Type 2025 & 2033

- Figure 36: South America High Throughput Process Development Market Revenue (undefined), by Technology 2025 & 2033

- Figure 37: South America High Throughput Process Development Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: South America High Throughput Process Development Market Revenue (undefined), by End-user 2025 & 2033

- Figure 39: South America High Throughput Process Development Market Revenue Share (%), by End-user 2025 & 2033

- Figure 40: South America High Throughput Process Development Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America High Throughput Process Development Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Throughput Process Development Market Revenue undefined Forecast, by Product and Services Type 2020 & 2033

- Table 2: Global High Throughput Process Development Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: Global High Throughput Process Development Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 4: Global High Throughput Process Development Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global High Throughput Process Development Market Revenue undefined Forecast, by Product and Services Type 2020 & 2033

- Table 6: Global High Throughput Process Development Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 7: Global High Throughput Process Development Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 8: Global High Throughput Process Development Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global High Throughput Process Development Market Revenue undefined Forecast, by Product and Services Type 2020 & 2033

- Table 13: Global High Throughput Process Development Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Global High Throughput Process Development Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 15: Global High Throughput Process Development Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global High Throughput Process Development Market Revenue undefined Forecast, by Product and Services Type 2020 & 2033

- Table 23: Global High Throughput Process Development Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 24: Global High Throughput Process Development Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 25: Global High Throughput Process Development Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global High Throughput Process Development Market Revenue undefined Forecast, by Product and Services Type 2020 & 2033

- Table 33: Global High Throughput Process Development Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Global High Throughput Process Development Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 35: Global High Throughput Process Development Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global High Throughput Process Development Market Revenue undefined Forecast, by Product and Services Type 2020 & 2033

- Table 40: Global High Throughput Process Development Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 41: Global High Throughput Process Development Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 42: Global High Throughput Process Development Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America High Throughput Process Development Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Throughput Process Development Market?

The projected CAGR is approximately 8.87%.

2. Which companies are prominent players in the High Throughput Process Development Market?

Key companies in the market include Bio-Rad Laboratories Inc, Perkinelmer Inc, Merck, Sartorius Stedim Biotech GmbH, Thermo Fisher Scientific Inc, Tecan Group AG*List Not Exhaustive, Eppendorf SE, Danaher Corporation, Agilent Technologies Inc, General Electric Company (GE Healthcare).

3. What are the main segments of the High Throughput Process Development Market?

The market segments include Product and Services Type, Technology, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Surge in Research and Development Activities for Newer Drug Targets; Growth in Pressure to Lower the Manufacturing Costs in Biopharmaceutical and Biotechnology Companies.

6. What are the notable trends driving market growth?

Biopharmaceutical & Biotechnology Companies Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Advanced Technologies and Lack of Adequate Infrastructure.

8. Can you provide examples of recent developments in the market?

October 2022: Ginkgo Bioworks collaborated with Merck. This collaboration leveraged Ginkgo's extensive experience in cell engineering and enzyme design and its capabilities in automated high-throughput screening, manufacturing process development/optimization, bioinformatics, and analytics to deliver optimal strains for the expression of targeted biocatalysts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Throughput Process Development Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Throughput Process Development Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Throughput Process Development Market?

To stay informed about further developments, trends, and reports in the High Throughput Process Development Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence