Key Insights

The global hockey market is projected for robust expansion, estimated to reach 9.5 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This growth is driven by increasing global participation in organized leagues, rising recreational play, and the sport's growing spectator appeal, especially in emerging economies. Demand for high-performance equipment like sticks and balls, essential for professional and amateur players, remains a key market driver. Innovations in materials and technology are producing lighter, more durable, and responsive gear, encouraging investment in premium products. The protective gear segment is also thriving due to heightened safety awareness and stricter regulations. Online retail is emerging as a significant sales channel, offering wider selections and competitive pricing, complementing traditional brick-and-mortar stores. Major players such as Adidas AG, Grays of Cambridge, and Ritual Hockey are innovating and expanding their product lines to meet diverse consumer demands.

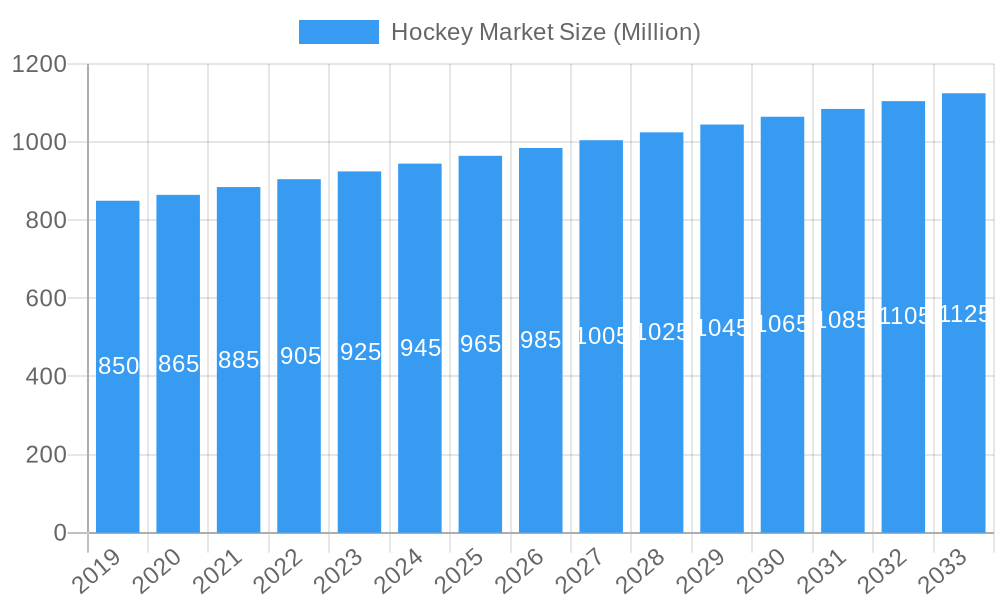

Hockey Market Market Size (In Billion)

Evolving consumer preferences and technological advancements are shaping market trends. Advanced composite materials in hockey sticks enhance power and control, attracting performance-focused players. Innovations in footwear technology, emphasizing grip, ankle support, and lightweight design, are vital for the shoe segment. While the market outlook is positive, factors like the high cost of professional equipment and perceived entry barriers due to gear and training expenses may pose challenges. However, manufacturers' efforts to introduce more affordable product lines, coupled with the proliferation of community programs and the expanding reach of professional leagues, are expected to offset these restraints. North America and Europe, established hockey regions, show strong potential, while the Asia Pacific region offers significant untapped growth opportunities due to its developing youth sports culture and increasing disposable incomes. Strategic marketing, athlete endorsements, and e-commerce expansion will be critical for sustained market penetration and revenue growth.

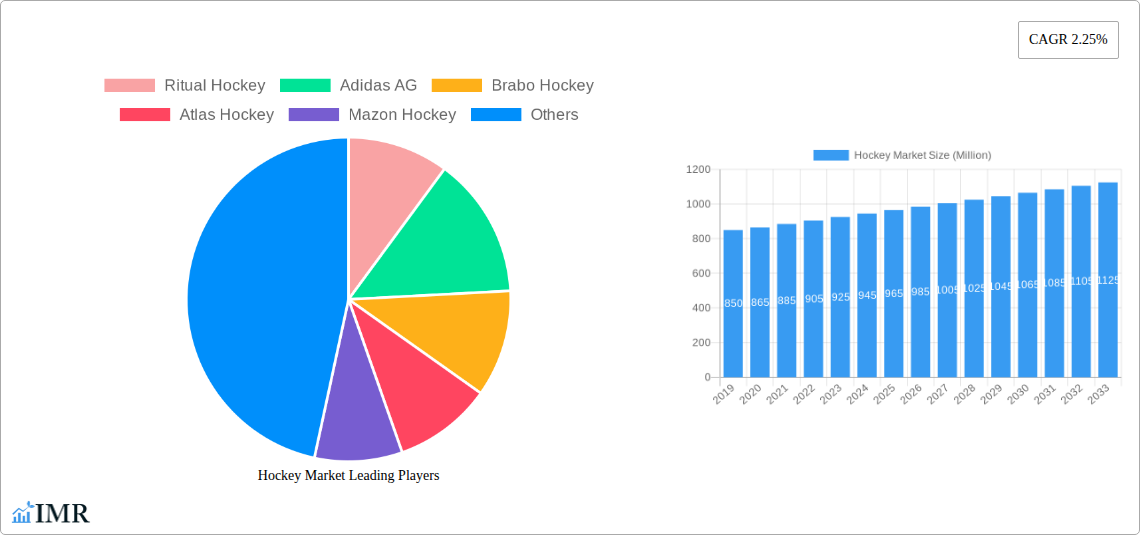

Hockey Market Company Market Share

Comprehensive Hockey Market Report: Size, Trends, and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Hockey Market, meticulously examining its dynamics, growth trajectories, and future potential. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033, this research offers unparalleled insights for industry stakeholders. We delve into parent and child market segmentation, product types, distribution channels, and key players to deliver a holistic market overview. Values are presented in Million units for clarity and strategic decision-making.

Hockey Market Market Dynamics & Structure

The global Hockey Market exhibits a moderately concentrated structure, with a few key players dominating specific product categories and regions, while a larger number of smaller and niche manufacturers contribute to overall market diversity. Technological innovation acts as a primary driver, fueled by the continuous pursuit of enhanced performance, player safety, and product durability. Material science advancements, such as the development of lighter yet stronger composite materials for hockey sticks, significantly influence product development. Regulatory frameworks, primarily concerning safety standards for protective gear and equipment, play a crucial role in shaping manufacturing processes and product certifications. Competitive product substitutes, though less prevalent in core hockey equipment, can emerge from adjacent sports or alternative training methods. End-user demographics are diverse, encompassing professional athletes, amateur players, and recreational enthusiasts, each with distinct purchasing behaviors and product preferences. Mergers and acquisitions (M&A) are a recurring trend, aimed at expanding product portfolios, gaining market access, and consolidating competitive positions. For instance, M&A activity in the hockey equipment sector has seen an estimated XX deal volumes in the historical period, driven by the desire for market share growth and synergy realization. Barriers to innovation often stem from high research and development costs, lengthy product testing cycles, and the challenge of convincing established consumer preferences for radical design changes.

- Market Concentration: Moderate to high in specific product segments like high-performance hockey sticks.

- Technological Innovation: Driven by material science, aerodynamics, and player safety technologies.

- Regulatory Influence: Focus on safety standards for protective gear, impacting product design and compliance.

- Competitive Landscape: Characterized by a mix of global brands and specialized regional players.

- End-User Demographics: Spans professional, amateur, and recreational segments with varied demands.

- M&A Trends: Strategic acquisitions to broaden product offerings and market reach, with an estimated XX M&A deals in the historical period.

- Innovation Barriers: High R&D investment, long product validation cycles, and consumer inertia.

Hockey Market Growth Trends & Insights

The Hockey Market is projected to experience robust growth, driven by increasing global participation in field hockey and ice hockey, coupled with significant advancements in equipment technology and accessibility initiatives. The market size, estimated at XX Million units in 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by several key trends. Firstly, the growing popularity of hockey as a sport at both professional and amateur levels, particularly in emerging economies, is leading to higher demand for equipment. Adoption rates are steadily increasing, with more individuals, especially youth, being introduced to the sport through school programs and community leagues. Technological disruptions are continuously reshaping the product landscape. Innovations in composite materials for hockey sticks have resulted in lighter, more powerful, and durable options, attracting both seasoned players and new entrants. Similarly, advancements in field hockey shoes prioritize enhanced grip, ankle support, and shock absorption, contributing to improved player performance and injury prevention. Consumer behavior is also evolving, with a discernible shift towards online purchasing for convenience and wider product selection. The accessibility of entry-level equipment packages, exemplified by initiatives like the USA Field Hockey Equipment store launched in June 2021, is crucial in attracting new players and expanding the market base. This trend is further supported by strategic partnerships, such as Ritual Hockey's collaboration with Clubhouse Hockey announced in May 2021, aimed at addressing market gaps and enhancing product availability. The overall market penetration is expected to deepen as more regions embrace organized hockey leagues and as manufacturers focus on developing affordable yet high-quality equipment for grassroots development. The market is not just about elite performance but also about fostering a wider community of players through accessible and engaging product offerings.

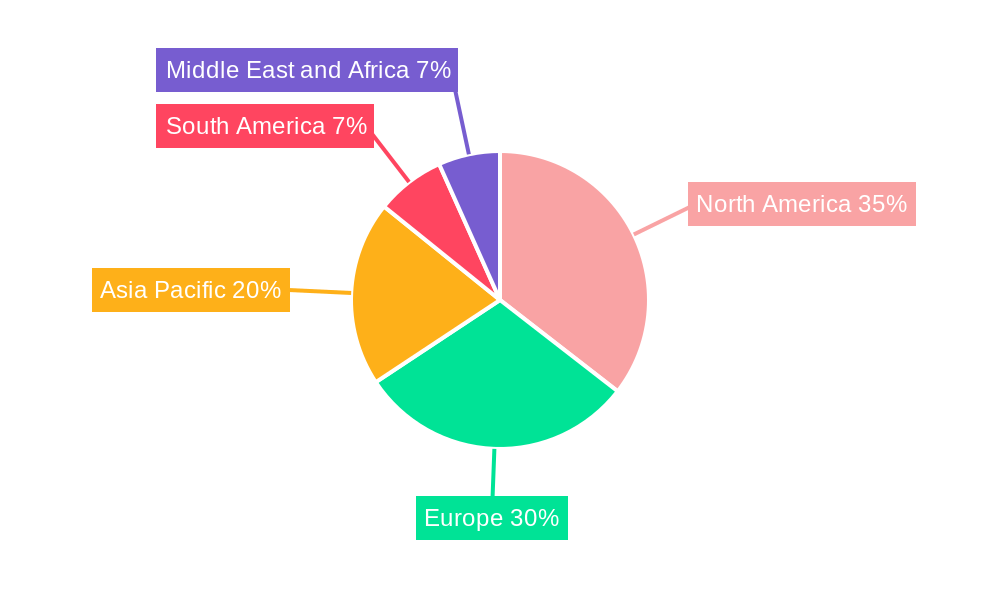

Dominant Regions, Countries, or Segments in Hockey Market

The global Hockey Market is witnessing dynamic growth across various regions and product segments, with Europe currently identified as the dominant region, driven by its established ice hockey culture and strong field hockey participation. Within Europe, countries like Canada for ice hockey and The Netherlands and Australia for field hockey stand out as significant growth engines, supported by robust sports infrastructure and government initiatives promoting athletic development. The Product Type segment of Hockey Sticks and Balls is the largest contributor to the overall market value and volume, accounting for an estimated XX% of the market share in the base year 2025. This dominance is attributed to the fundamental nature of these products for both ice and field hockey. The innovation in composite materials for sticks and the development of specialized balls for different playing surfaces continuously drive demand within this segment.

- Dominant Region: Europe, with strong representation from North America and Oceania.

- Key Countries: Canada (Ice Hockey), USA (Ice Hockey & growing Field Hockey), The Netherlands, Australia, Germany (Field Hockey).

- Dominance Factors: Established professional leagues, strong grassroots participation, government support for sports, and a rich history of hockey.

- Leading Product Segment: Hockey Sticks and Balls (estimated XX% market share in 2025).

- Key Drivers: Essential equipment for all levels of play, continuous technological advancements in materials and design, and consistent demand from both professional and amateur players.

- Market Potential: High demand for both high-performance and entry-level options.

- Growing Segment: Protective Gear and Accessories, including Pads and Helmets.

- Drivers: Increasing emphasis on player safety, evolving regulations mandating protective equipment, and innovations in lightweight yet highly protective materials.

- Market Trajectory: Significant growth potential due to heightened awareness and stricter safety standards.

- Distribution Channel Dominance: While Offline Retail Stores historically held a stronger position, Online Retail Stores are rapidly gaining prominence.

- Online Retail Drivers: Convenience, wider product selection, competitive pricing, and direct-to-consumer engagement strategies by manufacturers.

- Offline Retail Strengths: In-store fitting, expert advice, and immediate availability for local players.

The Distribution Channel of Online Retail Stores is experiencing a surge in growth, projected to surpass Offline Retail Stores in market share by the end of the forecast period. This shift is propelled by the increasing comfort of consumers with e-commerce and the strategic expansion of online platforms offering specialized hockey equipment. The June 2021 launch of the USA Field Hockey Equipment store, providing accessible and affordable entry-level packages, exemplifies this trend towards increased online accessibility.

Hockey Market Product Landscape

The Hockey Market product landscape is characterized by relentless innovation focused on enhancing performance, player comfort, and safety. In hockey sticks, the introduction of advanced composite materials, such as carbon fiber and Kevlar blends, has led to lighter, stronger, and more responsive designs. The development of innovative head shapes, like Ritual Hockey's NEW Plus+ head shape (June 2020) with squared corners for increased surface area, exemplifies the pursuit of improved ball control and hitting power. For field hockey shoes, manufacturers are focusing on specialized sole designs for optimal grip on various surfaces, enhanced ankle support to prevent injuries, and lightweight construction for agility. Protective gear, including pads and helmets, benefits from advancements in impact-absorbing materials and ergonomic designs, ensuring maximum protection without compromising mobility. These product innovations are crucial in meeting the evolving demands of both professional athletes seeking a competitive edge and amateur players looking for superior playing experiences.

Key Drivers, Barriers & Challenges in Hockey Market

The Hockey Market is propelled by several key drivers, including the growing global popularity of both ice hockey and field hockey, increasing disposable incomes that facilitate sports participation, and continuous technological innovations in equipment design and materials. Government initiatives supporting sports development and school-based programs further contribute to player recruitment.

- Key Drivers:

- Increasing global participation in ice and field hockey.

- Technological advancements in equipment materials and design.

- Growing disposable incomes and investment in sports.

- Government and institutional support for sports development.

Conversely, the market faces significant barriers and challenges. High manufacturing costs for advanced composite materials can lead to premium pricing, limiting accessibility for some segments. Supply chain disruptions, as seen in recent global events, can impact the availability and cost of raw materials and finished goods. Intense competition among established brands and the emergence of new entrants also pose challenges in market penetration and brand loyalty. Regulatory hurdles related to safety standards, while crucial for player well-being, can also increase product development and compliance costs.

- Key Barriers & Challenges:

- High manufacturing costs for advanced equipment.

- Supply chain volatility and raw material sourcing issues.

- Intense market competition and price sensitivity.

- Stringent safety regulations and compliance costs.

Emerging Opportunities in Hockey Market

Emerging opportunities in the Hockey Market lie in the untapped potential of developing economies with growing interest in organized sports. The development of more affordable, durable, and technologically sound entry-level equipment can significantly expand the player base in these regions. Furthermore, the increasing demand for sustainable and eco-friendly sports equipment presents a niche but growing opportunity for manufacturers focusing on recycled materials and environmentally conscious production processes. The expansion of e-sports and virtual reality simulations related to hockey could also create new avenues for engagement and potentially drive demand for related physical equipment.

Growth Accelerators in the Hockey Market Industry

The Hockey Market is poised for accelerated growth through several catalysts. Technological breakthroughs in material science, leading to lighter, stronger, and more responsive equipment, will continue to be a major growth driver. Strategic partnerships and collaborations, such as Ritual Hockey's alliance with Clubhouse Hockey, are crucial for expanding market reach, optimizing distribution, and filling specific market voids. Furthermore, proactive market expansion strategies targeting emerging economies through localized product offerings and marketing campaigns can unlock significant growth potential. The increasing focus on player development at the grassroots level, supported by specialized equipment and training programs, will ensure a sustained pipeline of future players and consumers.

Key Players Shaping the Hockey Market Market

- Ritual Hockey

- Adidas AG

- Brabo Hockey

- Atlas Hockey

- Mazon Hockey

- Dita Hockey

- Grays of Cambridge (International) Ltd

- Osaka World

- Gryphon Hockey Ltd

- STX

- OBO

- Princess Sportsgear

Notable Milestones in Hockey Market Sector

- June 2021: USA Field Hockey officially launched the USA Field Hockey Equipment store, an online store that provides entry-level and modified equipment packages to make field hockey more accessible and affordable.

- May 2021: Ritual Hockey announced its partnership with Clubhouse Hockey. The purpose of this partnership was to fill the gaps in the market with the help of Clubhouse Hockey's resources.

- June 2020: Ritual Hockey introduced a NEW Plus + head shape hockey stick across all origins of both the Velocity and Ultra molds. The Plus + head shape is the same length as the Standard head shape but the company has squared the corners to increase the surface area, resulting in a 20% bigger toe end.

In-Depth Hockey Market Market Outlook

The Hockey Market is projected for sustained and accelerated growth, driven by a confluence of factors including increasing global participation, continuous product innovation, and expanding market access. Strategic partnerships and the development of more accessible and affordable equipment will be pivotal in unlocking the full potential of emerging markets. The industry's focus on enhancing player performance and safety through advanced materials and ergonomic designs will continue to be a key differentiator. The market outlook suggests a dynamic environment where companies that adapt to evolving consumer preferences, embrace digital distribution channels, and invest in grassroots development will be best positioned for long-term success. The integration of sustainable practices and the exploration of new engagement platforms will further shape the future of the hockey market.

Hockey Market Segmentation

-

1. Product Type

- 1.1. Hockey Sticks and Balls

- 1.2. Field Hockey Shoes

-

1.3. Protective Gear and Accessories

- 1.3.1. Pads

- 1.3.2. Helmets

- 1.3.3. Other Protective Gears and Accessories

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Hockey Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Hockey Market Regional Market Share

Geographic Coverage of Hockey Market

Hockey Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Sports Participation; Trend of Athleisure

- 3.3. Market Restrains

- 3.3.1. Availability of Fake and Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Interest and Participation Rate in Field Hockey

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hockey Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hockey Sticks and Balls

- 5.1.2. Field Hockey Shoes

- 5.1.3. Protective Gear and Accessories

- 5.1.3.1. Pads

- 5.1.3.2. Helmets

- 5.1.3.3. Other Protective Gears and Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Hockey Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hockey Sticks and Balls

- 6.1.2. Field Hockey Shoes

- 6.1.3. Protective Gear and Accessories

- 6.1.3.1. Pads

- 6.1.3.2. Helmets

- 6.1.3.3. Other Protective Gears and Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Hockey Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hockey Sticks and Balls

- 7.1.2. Field Hockey Shoes

- 7.1.3. Protective Gear and Accessories

- 7.1.3.1. Pads

- 7.1.3.2. Helmets

- 7.1.3.3. Other Protective Gears and Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Hockey Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hockey Sticks and Balls

- 8.1.2. Field Hockey Shoes

- 8.1.3. Protective Gear and Accessories

- 8.1.3.1. Pads

- 8.1.3.2. Helmets

- 8.1.3.3. Other Protective Gears and Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Hockey Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Hockey Sticks and Balls

- 9.1.2. Field Hockey Shoes

- 9.1.3. Protective Gear and Accessories

- 9.1.3.1. Pads

- 9.1.3.2. Helmets

- 9.1.3.3. Other Protective Gears and Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Hockey Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Hockey Sticks and Balls

- 10.1.2. Field Hockey Shoes

- 10.1.3. Protective Gear and Accessories

- 10.1.3.1. Pads

- 10.1.3.2. Helmets

- 10.1.3.3. Other Protective Gears and Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ritual Hockey

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Adidas AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Brabo Hockey

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Atlas Hockey

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mazon Hockey

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dita Hockey

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grays of Cambridge (International) Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Osaka World

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gryphon Hockey Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 STX*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OBO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Princess Sportsgear

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Ritual Hockey

List of Figures

- Figure 1: Global Hockey Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hockey Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Hockey Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Hockey Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Hockey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Hockey Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Hockey Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Hockey Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Hockey Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Hockey Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Hockey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Hockey Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Hockey Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Hockey Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Hockey Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Hockey Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Hockey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Hockey Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Hockey Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Hockey Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Hockey Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Hockey Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Hockey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Hockey Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Hockey Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Hockey Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Hockey Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Hockey Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Hockey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Hockey Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Hockey Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hockey Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Hockey Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Hockey Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Hockey Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Hockey Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Hockey Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Hockey Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Hockey Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Hockey Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Hockey Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Hockey Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Hockey Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Hockey Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Hockey Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Hockey Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Hockey Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Hockey Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Hockey Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Hockey Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hockey Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Hockey Market?

Key companies in the market include Ritual Hockey, Adidas AG, Brabo Hockey, Atlas Hockey, Mazon Hockey, Dita Hockey, Grays of Cambridge (International) Ltd, Osaka World, Gryphon Hockey Ltd, STX*List Not Exhaustive, OBO, Princess Sportsgear.

3. What are the main segments of the Hockey Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Sports Participation; Trend of Athleisure.

6. What are the notable trends driving market growth?

Rising Interest and Participation Rate in Field Hockey.

7. Are there any restraints impacting market growth?

Availability of Fake and Counterfeit Products.

8. Can you provide examples of recent developments in the market?

June 2021: USA Field Hockey officially launched the USA Field Hockey Equipment store, an online store that provides entry-level and modified equipment packages to make field hockey more accessible and affordable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hockey Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hockey Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hockey Market?

To stay informed about further developments, trends, and reports in the Hockey Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence