Key Insights

The Italian beauty and personal care market is projected for steady expansion, with an estimated market size of 11.8 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 1.3. Growth is driven by rising consumer demand for premium, innovative, and ethically sourced beauty solutions, fueled by heightened awareness of personal well-being and sophisticated beauty routines. Increasing disposable income and an aging demographic prioritizing skincare and anti-aging products contribute to consistent demand. The market also benefits from a strong emphasis on natural and organic ingredients, aligning with conscious consumption trends.

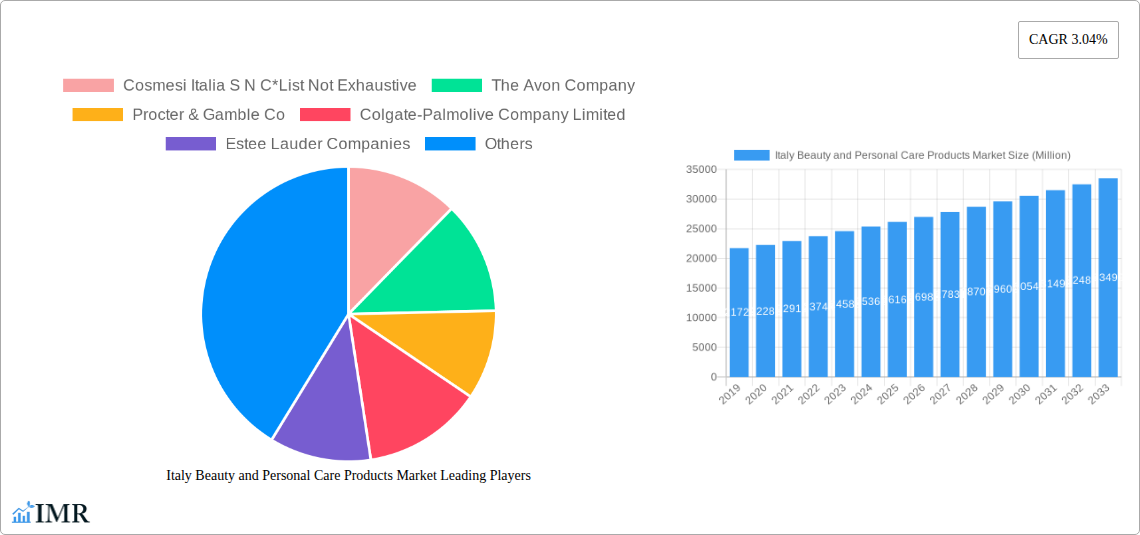

Italy Beauty and Personal Care Products Market Market Size (In Billion)

Evolving consumer trends, including the growth of men's grooming and a significant surge in online retail sales, further bolster market performance. Digital channels enhance product accessibility and consumer engagement. Challenges include intense competition and potential economic uncertainties affecting discretionary spending. However, the beauty sector's resilience, continuous innovation, and diverse segmentation (personal care, beauty & makeup, oral care) supported by multi-channel distribution will ensure sustained market dynamism.

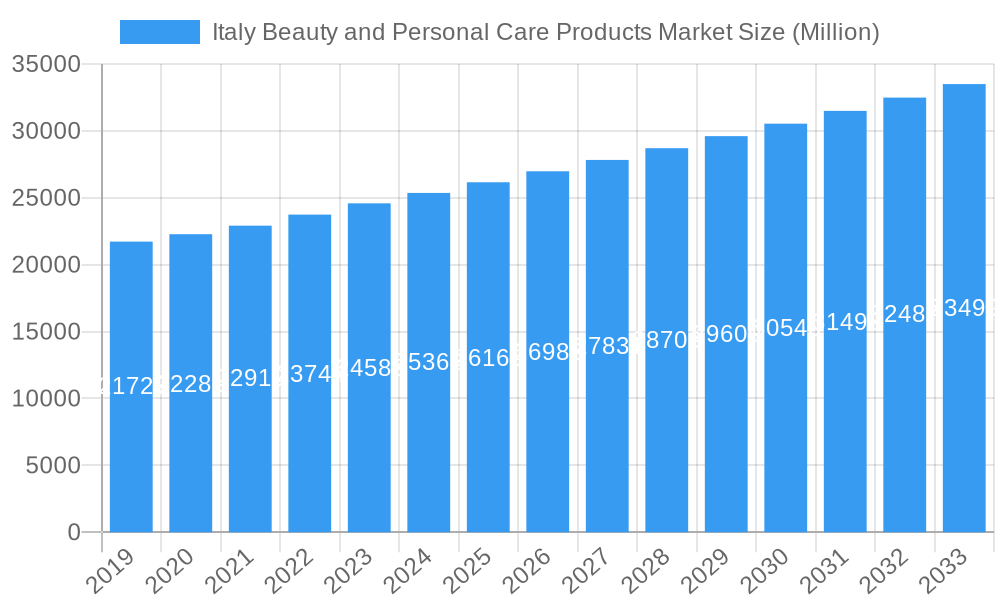

Italy Beauty and Personal Care Products Market Company Market Share

Italy Beauty and Personal Care Products Market: Comprehensive Analysis 2019–2033

This in-depth report provides a definitive analysis of the Italy Beauty and Personal Care Products Market, encompassing a robust historical review (2019-2024), a detailed base year assessment (2025), and a forward-looking forecast period (2025-2033). With a focus on high-traffic keywords such as "Italian beauty market," "personal care Italy," "cosmetics Italy," "skincare Italy," "haircare Italy," "oral care Italy," "luxury beauty Italy," and "mass market beauty Italy," this report is optimized for maximum search engine visibility and engagement with industry professionals. We dissect the market by Parent Markets: Beauty & Personal Care, and Child Markets: Cosmetics, Skincare, Haircare, Bath & Shower, Oral Care, Men's Grooming, and Deodorants & Antiperspirants. All quantitative data is presented in Million Units.

Italy Beauty and Personal Care Products Market Market Dynamics & Structure

The Italian Beauty and Personal Care Products Market exhibits a dynamic competitive landscape, characterized by a blend of established global players and agile local manufacturers. Market concentration is moderate, with leading companies like L'Oreal S.A., Procter & Gamble Co., and Unilever PLC holding significant shares, particularly in the mass market segment. However, the premium product category sees a higher degree of fragmentation with niche brands and specialized retailers gaining traction. Technological innovation is a key driver, with a growing emphasis on sustainable ingredients, advanced formulations, and personalized beauty solutions. Regulatory frameworks, primarily governed by the European Union and national Italian bodies, focus on product safety, ingredient transparency, and ethical sourcing, acting as both enablers and potential barriers for new entrants. Competitive product substitutes are abundant across all sub-segments, from natural and organic alternatives to technologically advanced formulations. End-user demographics reveal an aging population alongside a growing segment of digitally-savvy millennials and Gen Z consumers with evolving preferences for efficacy, ethical production, and experiential purchases. Mergers and acquisitions (M&A) trends, while not as prolific as in some other European markets, are driven by companies seeking to acquire innovative technologies, expand their distribution networks, or consolidate market share in niche areas. For instance, recent years have seen smaller acquisitions aimed at bolstering portfolios in the sustainable beauty and e-commerce segments.

- Market Concentration: Moderate, with key global players dominating mass segments and niche players emerging in premium.

- Technological Innovation Drivers: Sustainability, advanced formulations, personalization, digital integration.

- Regulatory Frameworks: EU and national regulations ensuring safety, transparency, and ethical standards.

- Competitive Product Substitutes: Wide array from natural/organic to high-tech formulations.

- End-User Demographics: Aging population, digitally-savvy younger consumers, evolving preferences.

- M&A Trends: Strategic acquisitions for technology, distribution, and niche market entry.

Italy Beauty and Personal Care Products Market Growth Trends & Insights

The Italy Beauty and Personal Care Products Market is projected for sustained growth, driven by evolving consumer preferences and robust market penetration strategies. Over the study period (2019-2033), the market size has demonstrated a consistent upward trajectory, reflecting increasing disposable incomes and a heightened consumer focus on self-care and wellness. The base year (2025) represents a pivotal point where established trends are amplified by new product innovations and expanding distribution channels. For instance, the Personal Care segment, encompassing Skin Care, Hair Care, and Bath and Shower products, continues to be a primary growth engine, with consumers increasingly investing in specialized treatments and premium formulations. Adoption rates for Premium Products are steadily increasing, fueled by brand prestige, ingredient efficacy, and aspirational purchasing behavior. Conversely, Mass Products maintain a strong hold due to their accessibility and widespread availability, catering to a broad consumer base.

Technological disruptions are reshaping the market, with a significant surge in Online Retail Stores as a primary distribution channel. This shift is powered by e-commerce platforms offering convenience, wider product selection, and personalized recommendations. Furthermore, the integration of AI and data analytics is enabling brands to understand consumer behavior more deeply, leading to tailored product development and targeted marketing campaigns. Consumer behavior has shifted considerably, with a greater emphasis on transparency regarding ingredients, ethical sourcing, and environmental impact. This has given rise to a growing demand for natural, organic, and cruelty-free products. The Beauty & Make-up / Cosmetics segment, while experiencing some shifts towards subtler, everyday wear, remains a significant contributor, with innovation in long-wear formulations and multi-functional products driving sales. The Oral Care segment is also witnessing innovation, with a focus on advanced whitening, sensitivity relief, and eco-friendly packaging. The Men's Grooming Products sub-segment continues its expansion, as men increasingly prioritize personal appearance and invest in specialized grooming routines. The CAGR for the overall market is expected to remain healthy, indicating consistent expansion driven by both volume and value growth. Market penetration for specialized and premium segments is expected to deepen as consumer awareness and disposable incomes rise.

Dominant Regions, Countries, or Segments in Italy Beauty and Personal Care Products Market

Within the Italian Beauty and Personal Care Products Market, the Personal Care segment, particularly Skin Care and Hair Care, emerges as the dominant force driving market growth. This dominance is underscored by a confluence of factors including deeply ingrained consumer habits, a high propensity for self-care, and continuous product innovation tailored to diverse Italian skin and hair types. The Skin Care sub-segment, further broken down into Facial Care Products, Body Care Products, and Lip Care Products, accounts for a significant market share due to the perennial demand for anti-aging solutions, hydration, and protection against environmental aggressors. Italian consumers are known for their sophisticated understanding of skincare, demanding efficacy and often willing to invest in premium brands and scientifically-backed formulations.

The Hair Care sub-segment, encompassing Shampoo, Conditioners, Hair styling and colouring products, and Other Hair Care Products, also exhibits robust growth. Factors contributing to its prominence include the cultural importance of well-maintained hair and the constant evolution of styling trends. The demand for specialized treatments, organic hair care, and color-safe products fuels this segment's expansion. While Beauty & Make-up / Cosmetics remains a vital category, its growth is somewhat influenced by evolving fashion trends and the increasing preference for natural looks, with Facial Cosmetics, Eye Cosmetics, and Lip and Nail Make-up Products adapting to these shifts.

The distribution channel landscape is led by Hypermarkets/Supermarkets for mass-market accessibility and Specialist Retail Stores and Online Retail Stores for premium and niche offerings. Pharmacies/Drug Stores play a crucial role in the distribution of dermatologically tested and clinically proven skincare products. Economic policies that support consumer spending and a robust retail infrastructure contribute significantly to the dominance of these segments. The growth potential within Personal Care remains exceptionally high, driven by an aging population seeking anti-aging solutions and a younger demographic increasingly focused on preventive skincare and advanced hair treatments. The market share within these dominant segments is substantial, reflecting the high consumer engagement and consistent demand.

Italy Beauty and Personal Care Products Market Product Landscape

The Italian Beauty and Personal Care Products Market is characterized by continuous product innovation, with a strong emphasis on efficacy, natural ingredients, and sophisticated formulations. Skin Care products are leading this charge with advancements in anti-aging serums, hydrating moisturizers featuring hyaluronic acid and peptides, and sun protection with enhanced UV filters. Hair Care sees innovation in sulfate-free shampoos, bond-repairing conditioners, and heat-styling products with protective properties. In Beauty & Make-up / Cosmetics, there's a trend towards multi-functional products like tinted moisturizers with SPF and long-lasting, transfer-proof lipsticks. The Oral Care segment is witnessing the introduction of electric toothbrushes with AI connectivity and toothpastes formulated with natural whitening agents. Performance metrics often revolve around clinical trial data, ingredient traceability, and consumer satisfaction surveys. Unique selling propositions include scientifically proven results, ethically sourced ingredients, and eco-friendly packaging. Technological advancements are seen in encapsulation technologies for sustained ingredient release and bio-fermented active ingredients.

Key Drivers, Barriers & Challenges in Italy Beauty and Personal Care Products Market

Key Drivers: The Italian Beauty and Personal Care Products Market is propelled by several key drivers. Technologically, there's a strong push towards sustainable formulations, personalized beauty solutions enabled by AI, and advanced ingredient research focusing on efficacy and safety. Economically, rising disposable incomes and a growing consumer emphasis on wellness and self-care contribute significantly to market expansion. Policy-driven factors, such as EU regulations promoting ingredient transparency and ethical sourcing, indirectly encourage innovation and consumer trust. The growing popularity of natural and organic ingredients, driven by consumer demand for healthier and more environmentally friendly products, is a major catalyst.

Barriers & Challenges: Supply chain issues, particularly those related to sourcing specialized ingredients and ensuring timely delivery of finished products, can pose significant challenges. Regulatory hurdles, while ensuring safety, can also lead to lengthy approval processes for new products and ingredients. Competitive pressures are intense, with both global conglomerates and agile local brands vying for market share. The cost of research and development for innovative products, coupled with the investment required for marketing and distribution, can be a barrier to entry for smaller players. Economic downturns and changing consumer spending habits can also impact demand, especially for premium products. Furthermore, evolving consumer awareness regarding sustainability and ethical practices necessitates constant adaptation and investment in eco-friendly solutions.

Emerging Opportunities in Italy Beauty and Personal Care Products Market

Emerging opportunities in the Italy Beauty and Personal Care Products Market are diverse and promising. The increasing demand for clean beauty and sustainable packaging presents a significant avenue for brands prioritizing eco-friendly practices. The men's grooming segment continues to expand, offering opportunities for innovative and specialized product development. The rise of personalization in beauty, driven by AI-powered diagnostics and custom formulations, is another key trend. Furthermore, untapped potential exists in catering to specific demographic needs, such as products for sensitive skin, mature skin, and vegan beauty. The continued growth of online retail and direct-to-consumer (DTC) models offers opportunities for brands to build stronger relationships with their customer base and gather valuable data for product development. The integration of wellness and beauty, through products that offer both aesthetic and health benefits, is also a growing area of interest.

Growth Accelerators in the Italy Beauty and Personal Care Products Market Industry

Several catalysts are accelerating long-term growth within the Italy Beauty and Personal Care Products Market. Technological breakthroughs in ingredient science, such as the development of novel bio-actives and advanced delivery systems, are enabling the creation of highly effective and targeted products. Strategic partnerships between ingredient suppliers, manufacturers, and retailers are fostering collaboration and driving innovation across the value chain. Market expansion strategies, including the penetration into underserved regions and the development of product lines catering to specific consumer segments, are also key growth accelerators. The increasing adoption of digital transformation across all aspects of the business, from R&D and manufacturing to marketing and customer engagement, is enhancing efficiency and driving consumer loyalty. Furthermore, the focus on experiential retail and omnichannel strategies is creating new avenues for consumer engagement and sales.

Key Players Shaping the Italy Beauty and Personal Care Products Market Market

- Cosmesi Italia S N C

- The Avon Company

- Procter & Gamble Co

- Colgate-Palmolive Company Limited

- Estee Lauder Companies

- Amway Corp

- Unilever PLC

- L'Oreal S A

- Johnson & Johnson Inc

- Beiersdorf AG

Notable Milestones in Italy Beauty and Personal Care Products Market Sector

- April 2022: Beiersdorf's Nivea Men launched its first skincare moisturizer utilizing an ingredient derived from recycled CO2, emphasizing sustainability and innovation.

- April 2022: The Avon Company introduced its New Ultra Color Lip Gloss line, featuring 3D-Light reflective pigments to enhance lip contours and pomegranate and grapefruit extracts for added benefits.

- August 2022: The Avon Company launched "New Anew Sensitive+," a product specifically designed for sensitive skin, claiming to reduce fine lines and wrinkles while replenishing the skin's moisture barrier.

In-Depth Italy Beauty and Personal Care Products Market Market Outlook

The future outlook for the Italy Beauty and Personal Care Products Market is exceptionally robust, driven by sustained consumer interest in premiumization, personalization, and conscious consumption. Growth accelerators such as the ongoing innovation in sustainable ingredients and packaging will continue to shape product development and consumer preferences. The integration of digital technologies, from AI-driven diagnostics to augmented reality try-ons, will further enhance the consumer experience and drive online sales. Strategic partnerships and market expansion into niche segments, including advanced men's grooming and specialized skincare for diverse needs, will fuel further growth. The market is poised for continued evolution, with brands that prioritize efficacy, ethical practices, and a seamless omnichannel experience likely to capture significant market share in the coming years.

Italy Beauty and Personal Care Products Market Segmentation

-

1. Category

- 1.1. Premium Products

- 1.2. Mass Products

-

2. Type

-

2.1. Personal Care

-

2.1.1. Hair Care

- 2.1.1.1. Shampoo

- 2.1.1.2. Conditioners

- 2.1.1.3. Hair styling and colouring products

- 2.1.1.4. Other Hair Care Products

-

2.1.2. Skin Care

- 2.1.2.1. Facial Care Products

- 2.1.2.2. Body Care Products

- 2.1.2.3. Lip Care Products

-

2.1.3. Bath and Shower

- 2.1.3.1. Shower Gel

- 2.1.3.2. Soaps

- 2.1.3.3. Other Bath and Shower Products

-

2.1.4. Oral Care

- 2.1.4.1. Toothbrushes

- 2.1.4.2. Toothpaste

- 2.1.4.3. Mouthwashes and Rinses

- 2.1.4.4. Other Oral Care Products

- 2.1.5. Men's Grooming Products

- 2.1.6. Deodrants and Antiperspirants

-

2.1.1. Hair Care

-

2.2. Beauty & Make-up / Cosmetics

- 2.2.1. Facial Cosmetics

- 2.2.2. Eye Cosmetics

- 2.2.3. Lip and Nail Make-up Products

-

2.1. Personal Care

-

3. Distribution Channel

- 3.1. Hypermarkets/Supermarkets

- 3.2. Convenience Stores

- 3.3. Specialist Retail Stores

- 3.4. Online Retail Stores

- 3.5. Pharmacies/Drug Stores

- 3.6. Other Distribution Channels

Italy Beauty and Personal Care Products Market Segmentation By Geography

- 1. Italy

Italy Beauty and Personal Care Products Market Regional Market Share

Geographic Coverage of Italy Beauty and Personal Care Products Market

Italy Beauty and Personal Care Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Rising Demand for Natural/Organic Personal Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Beauty and Personal Care Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Premium Products

- 5.1.2. Mass Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Personal Care

- 5.2.1.1. Hair Care

- 5.2.1.1.1. Shampoo

- 5.2.1.1.2. Conditioners

- 5.2.1.1.3. Hair styling and colouring products

- 5.2.1.1.4. Other Hair Care Products

- 5.2.1.2. Skin Care

- 5.2.1.2.1. Facial Care Products

- 5.2.1.2.2. Body Care Products

- 5.2.1.2.3. Lip Care Products

- 5.2.1.3. Bath and Shower

- 5.2.1.3.1. Shower Gel

- 5.2.1.3.2. Soaps

- 5.2.1.3.3. Other Bath and Shower Products

- 5.2.1.4. Oral Care

- 5.2.1.4.1. Toothbrushes

- 5.2.1.4.2. Toothpaste

- 5.2.1.4.3. Mouthwashes and Rinses

- 5.2.1.4.4. Other Oral Care Products

- 5.2.1.5. Men's Grooming Products

- 5.2.1.6. Deodrants and Antiperspirants

- 5.2.1.1. Hair Care

- 5.2.2. Beauty & Make-up / Cosmetics

- 5.2.2.1. Facial Cosmetics

- 5.2.2.2. Eye Cosmetics

- 5.2.2.3. Lip and Nail Make-up Products

- 5.2.1. Personal Care

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets/Supermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialist Retail Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Pharmacies/Drug Stores

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cosmesi Italia S N C*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Avon Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Procter & Gamble Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colgate-Palmolive Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Estee Lauder Companies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amway Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unilever PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 L'Oreal S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Johnson & Johnson Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Beiersdorf AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cosmesi Italia S N C*List Not Exhaustive

List of Figures

- Figure 1: Italy Beauty and Personal Care Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Beauty and Personal Care Products Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Beauty and Personal Care Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Italy Beauty and Personal Care Products Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Italy Beauty and Personal Care Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Italy Beauty and Personal Care Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Beauty and Personal Care Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 6: Italy Beauty and Personal Care Products Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Italy Beauty and Personal Care Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Italy Beauty and Personal Care Products Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Beauty and Personal Care Products Market?

The projected CAGR is approximately 1.3%.

2. Which companies are prominent players in the Italy Beauty and Personal Care Products Market?

Key companies in the market include Cosmesi Italia S N C*List Not Exhaustive, The Avon Company, Procter & Gamble Co, Colgate-Palmolive Company Limited, Estee Lauder Companies, Amway Corp, Unilever PLC, L'Oreal S A, Johnson & Johnson Inc, Beiersdorf AG.

3. What are the main segments of the Italy Beauty and Personal Care Products Market?

The market segments include Category, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Rising Demand for Natural/Organic Personal Care Products.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

April 2022: Beiersdorf's Nivea Men Launched its first skincare moisturizer with the use of an ingredient obtained from recycled CO2.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Beauty and Personal Care Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Beauty and Personal Care Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Beauty and Personal Care Products Market?

To stay informed about further developments, trends, and reports in the Italy Beauty and Personal Care Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence