Key Insights

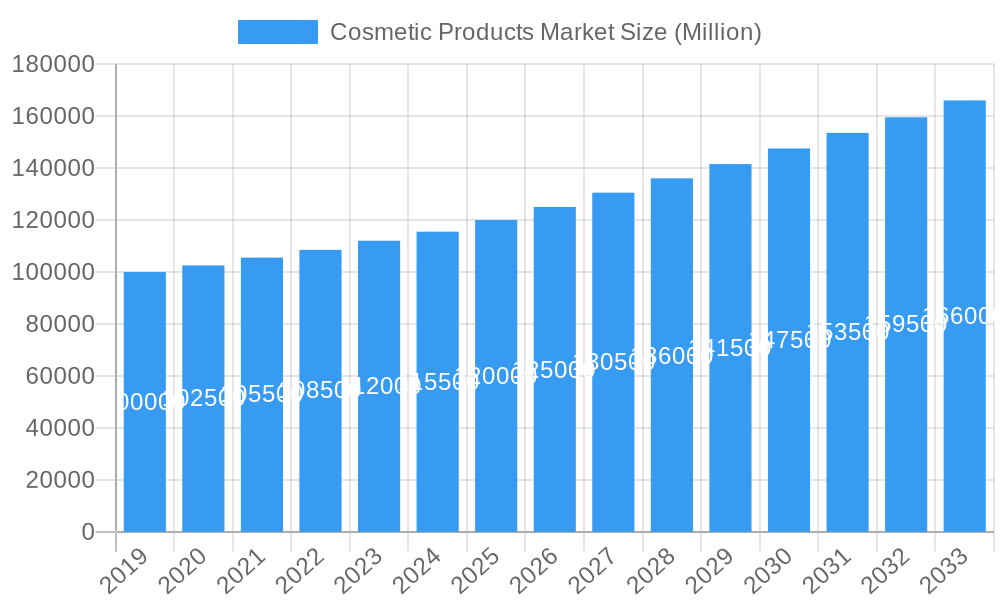

The global Cosmetic Products Market is projected to experience significant expansion, reaching an estimated size of 67.54 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.01% through 2033. This growth is propelled by evolving consumer preferences, innovation in product development, increased focus on personal grooming, rising disposable incomes in emerging economies, and the influential role of digital marketing in shaping beauty trends. Consumers are increasingly prioritizing products that offer skincare benefits, natural or organic ingredients, and align with health and wellness awareness. The market is segmented by product type, including Facial Make-up, Eye Make-up, Lip Make-up, and Nail Make-up, each contributing to the overall market dynamism. Demand spans both premium and mass-market cosmetics across diverse distribution channels, notably the expanding online retail sector alongside hypermarkets and specialty stores. Key industry leaders such as L'Oréal S.A., The Estée Lauder Companies Inc., and Shiseido Company Limited are driving innovation and serving a global consumer base.

Cosmetic Products Market Market Size (In Billion)

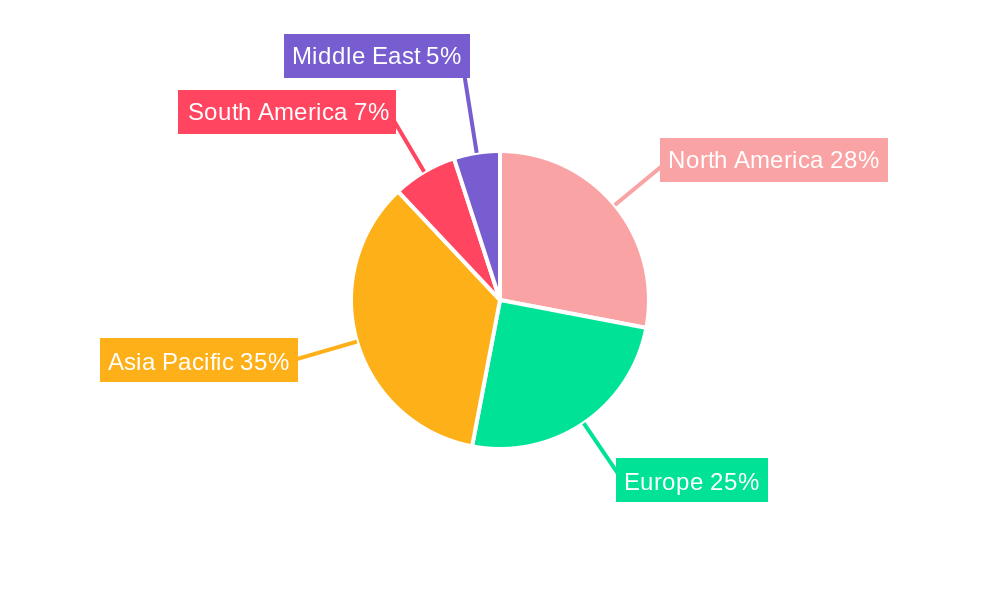

Emerging trends like clean beauty, personalized cosmetics, and sustainable supply chain practices are shaping the market's trajectory. Consumers demand transparency in ingredient sourcing and manufacturing, encouraging environmentally conscious approaches. However, market growth may be tempered by intense competition, potential economic downturns, and shifts in consumer spending. Regulatory complexities regarding product safety and labeling also present challenges. Despite these factors, the persistent demand for cosmetic products, driven by self-expression and enhancement, ensures a positive outlook. The Asia Pacific region, especially China and India, is anticipated to be a major growth contributor due to its growing middle class and adoption of beauty routines. Mature markets in North America and Europe continue to show steady growth, fueled by innovation and premiumization.

Cosmetic Products Market Company Market Share

This comprehensive report offers a detailed analysis of the global Cosmetic Products Market, providing critical insights into market dynamics, growth trends, regional performance, product landscape, and key players. With a study period from 2019 to 2033 and detailed forecasts for 2025–2033, this report utilizes high-traffic keywords and a structured methodology to deliver essential market intelligence for industry professionals. Analysis includes parent and child market segments such as facial, eye, lip, and nail makeup, across mass and premium categories, and various distribution channels including hypermarkets, specialty stores, online retail, and pharmacies. All quantitative values are presented in billions.

Cosmetic Products Market Market Dynamics & Structure

The Cosmetic Products Market is characterized by a dynamic interplay of factors shaping its present and future trajectory. Market concentration varies across sub-segments, with established global players like L'Oréal S.A., The Estée Lauder Companies Inc., and Shiseido Company Limited holding significant shares in certain categories, particularly premium facial and eye make-up. However, the rise of direct-to-consumer (DTC) brands and specialized niche players contributes to a more fragmented landscape in others. Technological innovation remains a paramount driver, fueled by advancements in ingredient science, sustainable formulations, and digital integration in product development and customer engagement. Regulatory frameworks, including stringent ingredient safety standards and labeling requirements in regions like the EU and North America, significantly influence product development and market entry strategies. Competitive product substitutes are abundant, ranging from traditional cosmetic products to emerging beauty tech devices and personalized beauty solutions. End-user demographics are evolving, with a growing demand for inclusivity, ethical sourcing, and products catering to diverse skin tones and concerns. Mergers & Acquisitions (M&A) trends continue to shape the market, with larger corporations strategically acquiring innovative startups and emerging brands to expand their product portfolios and market reach. For instance, LVMH Moët Hennessy Louis Vuitton has consistently invested in acquiring premium and niche beauty brands.

- Market Concentration: Moderate to high in premium segments, with increasing fragmentation driven by independent brands.

- Technological Innovation: Driven by sustainable ingredients, personalized beauty solutions, and advanced formulations.

- Regulatory Frameworks: Impacting product safety, ingredient transparency, and market access.

- Competitive Substitutes: Growing from beauty tech to DIY beauty solutions.

- End-User Demographics: Shifting towards inclusivity, sustainability, and customization.

- M&A Trends: Strategic acquisitions to enhance brand portfolios and market penetration.

Cosmetic Products Market Growth Trends & Insights

The global Cosmetic Products Market is poised for robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and expanding market reach. The market size is projected to witness a significant expansion from approximately $280,000 million units in the historical period (2019-2024) to reach an estimated $350,000 million units by the base year 2025, and is forecasted to ascend to over $450,000 million units by 2033. This growth is underpinned by a compound annual growth rate (CAGR) of approximately 5.2% during the forecast period (2025–2033). Adoption rates for innovative product categories, such as clean beauty, vegan cosmetics, and advanced skincare-infused make-up, are steadily increasing. Technological disruptions, including the integration of AI for personalized recommendations and virtual try-on experiences, are enhancing consumer engagement and driving sales, particularly through online retail channels. Consumer behavior shifts are profoundly impacting the market, with a heightened emphasis on product efficacy, ingredient transparency, sustainability, and ethical sourcing. The demand for multi-functional products that offer both cosmetic benefits and skincare advantages is also on the rise. Furthermore, the increasing disposable income in emerging economies, coupled with a growing awareness of beauty trends through social media platforms, is fueling demand across a wider demographic spectrum. The influence of social media influencers and celebrity endorsements continues to play a crucial role in product discovery and purchase decisions, accelerating the adoption of new cosmetic products.

Dominant Regions, Countries, or Segments in Cosmetic Products Market

The Facial Make-up Products segment consistently emerges as the dominant force within the broader Cosmetic Products Market, driven by its pervasive application and continuous innovation across both mass and premium categories. This segment is projected to account for approximately 45% of the total market value by 2025, valued at an estimated $157,500 million units. North America and Europe currently represent the largest regional markets for cosmetic products, driven by high disposable incomes, a mature beauty consumer base, and well-established distribution networks. However, the Asia-Pacific region, particularly China and India, is exhibiting the fastest growth rates, fueled by a burgeoning middle class, increasing urbanization, and a rapid adoption of global beauty trends. Within the product type segmentation, facial make-up, encompassing foundations, concealers, blush, bronzers, and highlighters, consistently commands the largest market share due to its fundamental role in daily beauty routines and the constant influx of new formulations and finishes. The premium category within facial make-up products often leads in terms of revenue due to higher price points associated with advanced formulations, exclusive ingredients, and strong brand equity.

- Dominant Product Segment: Facial Make-up Products, with an estimated market value of $157,500 million units in 2025.

- Key Drivers for Facial Make-up:

- Constant product innovation in formulations, shades, and finishes.

- High demand for complexion-enhancing products across all age groups.

- Strong influence of beauty trends and social media.

- Growth of the premium segment with advanced skincare benefits.

- Leading Regions: North America and Europe currently dominate, with Asia-Pacific showing the fastest growth.

- Category Dominance: Premium facial make-up products contribute significantly to overall market value due to higher pricing and perceived quality.

- Distribution Channel Influence: Online retail stores are increasingly important for both mass and premium facial make-up, offering wider selection and convenience.

Cosmetic Products Market Product Landscape

The Cosmetic Products Market is a vibrant landscape of continuous innovation, marked by advancements in product formulations, application techniques, and ingredient functionalities. Facial make-up products, in particular, are witnessing a surge in demand for long-wearing, transfer-proof formulas with added skincare benefits, such as SPF protection and hydration. Eye make-up products are evolving with specialized applicators and multi-dimensional finishes. Lip make-up products are seeing a trend towards comfortable, hydrating formulas that offer vibrant color payoff and a glossy or matte finish, with a notable increase in demand for lip liners and balms. Nail make-up products are experiencing innovation in terms of quick-drying formulas, chip resistance, and a wider array of finishes, including holographic and gel-like effects. The market is also characterized by a strong emphasis on "clean beauty" and sustainable sourcing, leading to the development of products formulated with natural, organic, and ethically sourced ingredients, minimizing the use of harsh chemicals.

Key Drivers, Barriers & Challenges in Cosmetic Products Market

Key Drivers:

- Growing Consumer Demand: An increasing global population and rising disposable incomes, particularly in emerging economies, fuel the demand for cosmetic products.

- Technological Advancements: Innovations in formulations, ingredients, and application technologies enhance product performance and consumer experience.

- Influence of Social Media and Influencers: Digital platforms play a crucial role in product discovery, trend dissemination, and driving purchasing decisions.

- Focus on Personalization and Inclusivity: Brands are increasingly developing products that cater to diverse skin tones, types, and individual preferences.

- E-commerce Growth: Online retail channels provide wider accessibility and convenience, significantly boosting sales.

Barriers & Challenges:

- Intense Competition: The market is highly competitive, with numerous established brands and emerging players vying for market share.

- Stringent Regulations: Evolving regulatory landscapes concerning ingredient safety, labeling, and product claims can pose compliance challenges.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and raw material availability can impact production and distribution.

- Economic Downturns: Reduced consumer spending during economic slowdowns can negatively affect the sales of discretionary items like cosmetics.

- Counterfeit Products: The proliferation of counterfeit cosmetic products erodes brand trust and consumer safety.

Emerging Opportunities in Cosmetic Products Market

The Cosmetic Products Market is brimming with emerging opportunities, particularly in the realm of sustainable and ethical beauty. The growing consumer consciousness around environmental impact and animal welfare is creating a strong demand for vegan, cruelty-free, and eco-friendly packaging solutions. Personalized beauty, driven by advancements in AI and data analytics, offers significant potential for brands to develop customized product formulations and recommendations. The integration of "skinification" into make-up products, where cosmetics offer tangible skincare benefits like anti-aging and hydration, is another rapidly expanding opportunity. Furthermore, untapped markets in developing regions, with their rapidly growing middle class and increasing adoption of beauty trends, present substantial growth potential for both mass and premium cosmetic brands. The metaverse and virtual beauty experiences also offer novel avenues for brand engagement and product showcasing.

Growth Accelerators in the Cosmetic Products Market Industry

Several factors are acting as significant growth accelerators for the Cosmetic Products Market. The continuous innovation in product development, driven by R&D in ingredient science and biotechnology, leads to more effective and desirable products. Strategic partnerships and collaborations between brands, retailers, and technology providers are fostering new distribution channels and enhancing consumer experiences. For instance, collaborations between cosmetic brands and e-commerce giants streamline online sales and reach. Market expansion strategies, including aggressive penetration into emerging economies and the launch of localized product lines, are tapping into new customer bases. The increasing focus on inclusivity and diversity in product offerings and marketing campaigns resonates with a broader consumer segment, driving sales and brand loyalty. The development of innovative packaging solutions that are sustainable and user-friendly further enhances product appeal and market competitiveness.

Key Players Shaping the Cosmetic Products Market Market

- The Estée Lauder Companies Inc.

- Oriflame Holding AG

- Shiseido Company Limited

- Huda Beauty

- Puig

- L'Oréal S A

- Revlon Inc

- Natura & Co

- LVMH Moët Hennessy Louis Vuitton

- JAB Cosmetics B V (Coty Inc.)

Notable Milestones in Cosmetic Products Market Sector

- May 2022: Estée Lauder, in partnership with Shoppers Stop, inaugurated an exclusive SS Beauty store in Mumbai, India, reinforcing their strategic alliance and expanding the retail presence for Estée Lauder brands like MAC Cosmetics, Clinique, Bobbi Brown, Jo Malone, Estee Lauder, Smashbox, and Tom Ford.

- May 2022: M.A.C Cosmetics, a brand under The Estée Lauder Companies Inc., collaborated with Netflix to launch a unique Stranger Things makeup collection, featuring themed shade names and limited-edition packaging inspired by the iconic series.

- May 2022: L'Oréal's Maybelline New York introduced its Super Stay Vinyl Ink Liquid Lip Color, a long-lasting, no-budge vinyl lip product available in ten vibrant shades, catering to the demand for enduring lip color.

In-Depth Cosmetic Products Market Market Outlook

The Cosmetic Products Market is set for a period of sustained and dynamic growth, propelled by an ongoing commitment to innovation, sustainability, and consumer-centric strategies. The increasing demand for personalized beauty solutions, driven by advanced data analytics and AI, presents a significant avenue for market expansion. Furthermore, the "skinification" trend, where makeup products offer inherent skincare benefits, is expected to continue its upward trajectory. As emerging economies continue to develop and their consumer bases become more sophisticated in their beauty preferences, these regions will represent substantial growth opportunities for both mass-market and premium cosmetic brands. Strategic market expansion, coupled with a keen understanding of evolving consumer values concerning ethical sourcing and environmental responsibility, will be paramount for long-term success and value creation within this vibrant industry.

Cosmetic Products Market Segmentation

-

1. Product Type

- 1.1. Facial Make-up Products

- 1.2. Eye Make-up Products

- 1.3. Lip Make-up Products

- 1.4. Nail Make-up Products

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Hypermarkets/Supermarkets

- 3.2. Specialty Stores

- 3.3. Online Retail Stores

- 3.4. Pharmacies and Drug Stores

- 3.5. Other Distribution Channels

Cosmetic Products Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. South Africa

- 6.2. Rest of Middle East

Cosmetic Products Market Regional Market Share

Geographic Coverage of Cosmetic Products Market

Cosmetic Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription

- 3.3. Market Restrains

- 3.3.1. High Cost of Rented Apparel Maintenance

- 3.4. Market Trends

- 3.4.1 Inclination Toward Organic

- 3.4.2 Vegan and Cruelty-Free Cosmetic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetic Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Facial Make-up Products

- 5.1.2. Eye Make-up Products

- 5.1.3. Lip Make-up Products

- 5.1.4. Nail Make-up Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets/Supermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Pharmacies and Drug Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cosmetic Products Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Facial Make-up Products

- 6.1.2. Eye Make-up Products

- 6.1.3. Lip Make-up Products

- 6.1.4. Nail Make-up Products

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass

- 6.2.2. Premium

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarkets/Supermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Pharmacies and Drug Stores

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Cosmetic Products Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Facial Make-up Products

- 7.1.2. Eye Make-up Products

- 7.1.3. Lip Make-up Products

- 7.1.4. Nail Make-up Products

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass

- 7.2.2. Premium

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarkets/Supermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Pharmacies and Drug Stores

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Cosmetic Products Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Facial Make-up Products

- 8.1.2. Eye Make-up Products

- 8.1.3. Lip Make-up Products

- 8.1.4. Nail Make-up Products

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass

- 8.2.2. Premium

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarkets/Supermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Pharmacies and Drug Stores

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Cosmetic Products Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Facial Make-up Products

- 9.1.2. Eye Make-up Products

- 9.1.3. Lip Make-up Products

- 9.1.4. Nail Make-up Products

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass

- 9.2.2. Premium

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarkets/Supermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Pharmacies and Drug Stores

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Cosmetic Products Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Facial Make-up Products

- 10.1.2. Eye Make-up Products

- 10.1.3. Lip Make-up Products

- 10.1.4. Nail Make-up Products

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Mass

- 10.2.2. Premium

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hypermarkets/Supermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Pharmacies and Drug Stores

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. United Arab Emirates Cosmetic Products Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Facial Make-up Products

- 11.1.2. Eye Make-up Products

- 11.1.3. Lip Make-up Products

- 11.1.4. Nail Make-up Products

- 11.2. Market Analysis, Insights and Forecast - by Category

- 11.2.1. Mass

- 11.2.2. Premium

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Hypermarkets/Supermarkets

- 11.3.2. Specialty Stores

- 11.3.3. Online Retail Stores

- 11.3.4. Pharmacies and Drug Stores

- 11.3.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 The Estée Lauder Companies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Oriflame Holding AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Shiseido Company Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Huda Beauty

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Puig *List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 L'Oréal S A

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Revlon Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Natura & Co

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 LVMH Moët Hennessy Louis Vuitton

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 JAB Cosmetics B V (Coty Inc )

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 The Estée Lauder Companies Inc

List of Figures

- Figure 1: Global Cosmetic Products Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cosmetic Products Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Cosmetic Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cosmetic Products Market Revenue (billion), by Category 2025 & 2033

- Figure 5: North America Cosmetic Products Market Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Cosmetic Products Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America Cosmetic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Cosmetic Products Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Cosmetic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cosmetic Products Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Cosmetic Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Cosmetic Products Market Revenue (billion), by Category 2025 & 2033

- Figure 13: Europe Cosmetic Products Market Revenue Share (%), by Category 2025 & 2033

- Figure 14: Europe Cosmetic Products Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Europe Cosmetic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Cosmetic Products Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Cosmetic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cosmetic Products Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Cosmetic Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Cosmetic Products Market Revenue (billion), by Category 2025 & 2033

- Figure 21: Asia Pacific Cosmetic Products Market Revenue Share (%), by Category 2025 & 2033

- Figure 22: Asia Pacific Cosmetic Products Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Cosmetic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Cosmetic Products Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Cosmetic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Cosmetic Products Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: South America Cosmetic Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Cosmetic Products Market Revenue (billion), by Category 2025 & 2033

- Figure 29: South America Cosmetic Products Market Revenue Share (%), by Category 2025 & 2033

- Figure 30: South America Cosmetic Products Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: South America Cosmetic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Cosmetic Products Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Cosmetic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Cosmetic Products Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Middle East Cosmetic Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East Cosmetic Products Market Revenue (billion), by Category 2025 & 2033

- Figure 37: Middle East Cosmetic Products Market Revenue Share (%), by Category 2025 & 2033

- Figure 38: Middle East Cosmetic Products Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: Middle East Cosmetic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East Cosmetic Products Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Cosmetic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: United Arab Emirates Cosmetic Products Market Revenue (billion), by Product Type 2025 & 2033

- Figure 43: United Arab Emirates Cosmetic Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: United Arab Emirates Cosmetic Products Market Revenue (billion), by Category 2025 & 2033

- Figure 45: United Arab Emirates Cosmetic Products Market Revenue Share (%), by Category 2025 & 2033

- Figure 46: United Arab Emirates Cosmetic Products Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 47: United Arab Emirates Cosmetic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: United Arab Emirates Cosmetic Products Market Revenue (billion), by Country 2025 & 2033

- Figure 49: United Arab Emirates Cosmetic Products Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetic Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Cosmetic Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 3: Global Cosmetic Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Cosmetic Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cosmetic Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Cosmetic Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Global Cosmetic Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Cosmetic Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Cosmetic Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Cosmetic Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 15: Global Cosmetic Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Cosmetic Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Germany Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Italy Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Russia Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Cosmetic Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 25: Global Cosmetic Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 26: Global Cosmetic Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Cosmetic Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: China Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Australia Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Cosmetic Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: Global Cosmetic Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 35: Global Cosmetic Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Cosmetic Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Cosmetic Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 41: Global Cosmetic Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 42: Global Cosmetic Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Cosmetic Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Cosmetic Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 45: Global Cosmetic Products Market Revenue billion Forecast, by Category 2020 & 2033

- Table 46: Global Cosmetic Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Cosmetic Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: South Africa Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East Cosmetic Products Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Products Market?

The projected CAGR is approximately 6.01%.

2. Which companies are prominent players in the Cosmetic Products Market?

Key companies in the market include The Estée Lauder Companies Inc, Oriflame Holding AG, Shiseido Company Limited, Huda Beauty, Puig *List Not Exhaustive, L'Oréal S A, Revlon Inc, Natura & Co, LVMH Moët Hennessy Louis Vuitton, JAB Cosmetics B V (Coty Inc ).

3. What are the main segments of the Cosmetic Products Market?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription.

6. What are the notable trends driving market growth?

Inclination Toward Organic. Vegan and Cruelty-Free Cosmetic Products.

7. Are there any restraints impacting market growth?

High Cost of Rented Apparel Maintenance.

8. Can you provide examples of recent developments in the market?

May 2022: Estée Lauder with Shoppers Stop opened an exclusive SS Beauty store in Mumbai. With this establishment, the two companies have strengthened their partnership in India. The SS beauty store will offer only Estée Lauder brands like MAC Cosmetics, Clinique, Bobbi Brown, Jo Malone, Estee Lauder, Smashbox, and Tom Ford.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetic Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetic Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetic Products Market?

To stay informed about further developments, trends, and reports in the Cosmetic Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence