Key Insights

The North America E-commerce Watch Market is projected to achieve a market size of $75.8 billion by 2029, expanding at a Compound Annual Growth Rate (CAGR) of 4.5% from the base year 2024. This growth is propelled by increasing consumer preference for online shopping convenience, the widespread adoption of smartwatches with advanced functionalities, and the expanding reach of e-commerce platforms across the United States, Canada, and Mexico. The market's dynamism is further underscored by strong smart device integration, effectively merging traditional timekeeping with wearable technology. Leading companies such as Apple Inc., Samsung Electronics Co. Ltd., and Garmin Ltd. are driving innovation with features for health monitoring, fitness tracking, and seamless connectivity, significantly boosting consumer demand. The ease of purchasing a diverse range of watches, from classic to sophisticated smartwatches, through direct company channels and third-party retailers, reinforces the dominance of e-commerce. The market is expected to exhibit sustained growth throughout the forecast period.

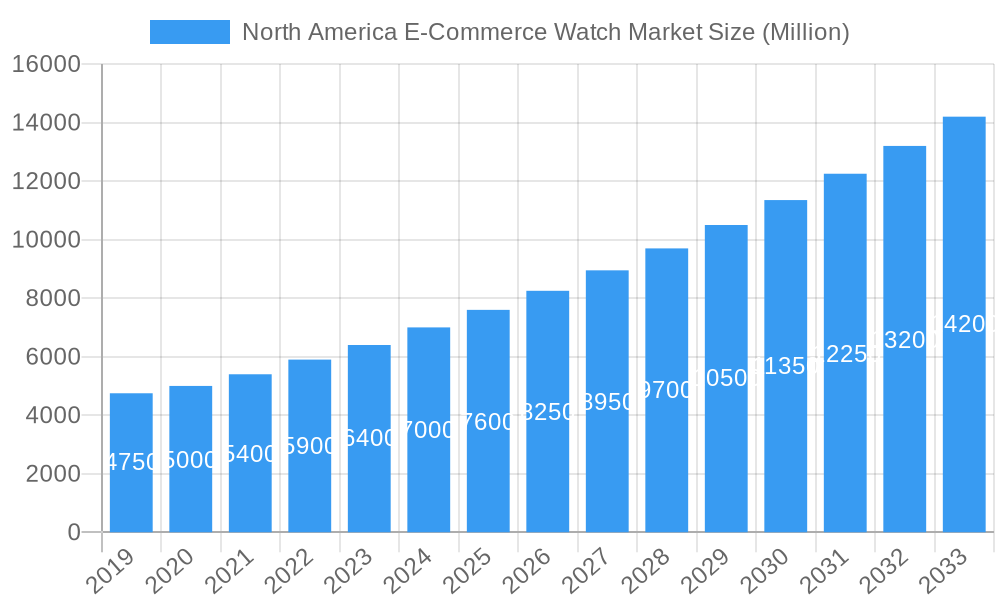

North America E-Commerce Watch Market Market Size (In Billion)

The competitive environment features both established watchmakers and technology leaders competing for digital market share. Companies are prioritizing user-friendly online platforms, secure payment systems, and efficient logistics to optimize the customer experience. While online sales of luxury watches are increasing, smartwatches and mid-range traditional watches, offering accessible pricing and diverse features, are anticipated to be the primary volume drivers. Emerging trends like personalized shopping, augmented reality try-on features, and subscription services for watch accessories are set to influence market evolution. However, challenges such as intense price competition, the necessity for robust cybersecurity to safeguard consumer data, and logistical complexities for returns and repairs in an online setting exist. Despite these factors, the North America E-commerce Watch Market is on a trajectory of substantial growth and transformation, reflecting broader shifts in consumer behavior and technological integration.

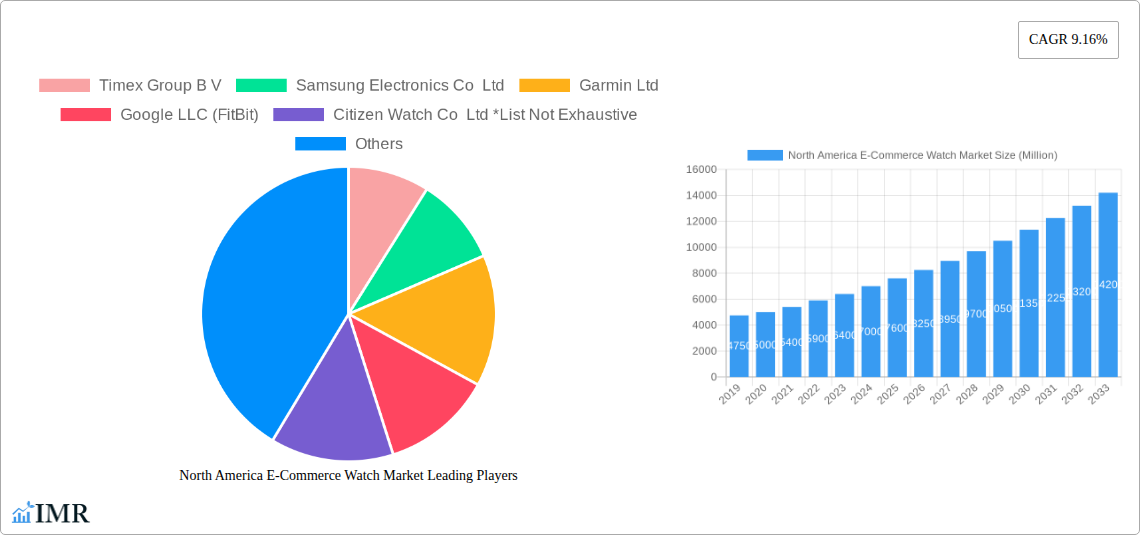

North America E-Commerce Watch Market Company Market Share

North America E-Commerce Watch Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report delivers a crucial analysis of the North America E-Commerce Watch Market, offering granular insights into market dynamics, growth trajectories, and key player strategies. With a comprehensive study period spanning from 2019 to 2033, including a detailed forecast from 2025 to 2033, this report provides an invaluable resource for industry stakeholders seeking to navigate the evolving landscape of online watch sales across the United States, Canada, and Mexico.

Leveraging high-traffic keywords such as "North America smartwatch e-commerce," "online watch sales USA," "Canada digital watch market," "Mexico smart wearable trends," and "e-commerce watch market analysis," this report is meticulously optimized for search engine visibility. We delve into parent and child market segments, including Product Types (Smartwatches, Quartz/Mechanical Watches) and Platform Types (Company's Own Website, Third-Party Retailers), to offer a holistic understanding of market penetration and consumer preferences.

Key Companies Covered: Timex Group B.V., Samsung Electronics Co. Ltd., Garmin Ltd., Google LLC (Fitbit), Citizen Watch Co. Ltd. (List Not Exhaustive), Rolex SA, Casio Computer Co. Ltd., Fossil Group Inc., Apple Inc., Sony Corporation.

Report Value Presentation: All market size values are presented in Million Units.

North America E-Commerce Watch Market Dynamics & Structure

The North America E-Commerce Watch Market is characterized by a dynamic interplay of technological innovation, evolving consumer preferences, and an increasingly competitive retail environment. Market concentration is moderate, with significant influence from major tech giants like Apple and Samsung, alongside established watch manufacturers adapting their strategies for online sales. Technological innovation remains a primary driver, with a continuous influx of smartwatches boasting advanced health monitoring, connectivity features, and personalized user experiences. Regulatory frameworks, while generally supportive of e-commerce, primarily focus on data privacy and consumer protection, influencing how companies collect and utilize user data. Competitive product substitutes are abundant, ranging from dedicated fitness trackers to other smart devices that offer overlapping functionalities. End-user demographics are increasingly diverse, encompassing tech-savvy millennials and Gen Z consumers seeking feature-rich smartwatches, as well as older demographics looking for convenience and specific health-tracking capabilities. Mergers and Acquisitions (M&A) trends, though not as prevalent in this specific segment, are present as companies aim to expand their product portfolios or acquire innovative technologies.

- Market Concentration: Moderate, with key players holding substantial market share.

- Technological Innovation Drivers: Enhanced health tracking, AI integration, longer battery life, improved connectivity.

- Regulatory Frameworks: Focus on data privacy (e.g., CCPA, PIPEDA), consumer protection, and cybersecurity.

- Competitive Product Substitutes: Fitness bands, smart rings, health monitoring apps, traditional watches.

- End-User Demographics: Younger consumers (18-35) driving smartwatch adoption, older adults (45+) showing interest in health features, and general consumers seeking convenience.

- M&A Trends: Strategic acquisitions to enhance technological capabilities or expand market reach.

North America E-Commerce Watch Market Growth Trends & Insights

The North America E-Commerce Watch Market is poised for substantial growth, fueled by increasing consumer adoption of smart wearable technology and the convenience offered by online purchasing channels. Market size is projected to witness a significant CAGR of approximately 15.8% from 2025 to 2033, reaching an estimated value of $28,500 Million Units by 2033. This expansion is driven by a confluence of factors, including rising disposable incomes, a growing health and wellness consciousness among consumers, and continuous advancements in wearable technology. The penetration of smartwatches, a key segment within the e-commerce watch market, is expected to surge as consumers increasingly prioritize integrated health tracking, communication capabilities, and personalized digital experiences. Technological disruptions, such as the integration of advanced sensors for health monitoring (e.g., blood glucose, ECG), miniaturization of components, and AI-powered analytics, are continuously reshaping the product landscape and consumer expectations.

Consumer behavior shifts are profoundly influencing the market. A significant trend is the move towards purchasing smartwatches directly from manufacturers' e-commerce websites, allowing for greater control over customer experience, data, and exclusive product offerings. Simultaneously, third-party online retailers continue to play a crucial role by offering competitive pricing, wider product selections, and leveraging their established logistics networks. The historical period (2019-2024) has witnessed a steady increase in online watch sales, laying a strong foundation for future growth. The estimated year 2025 is projected to see a market size of $12,000 Million Units, setting a robust baseline for the subsequent forecast period. The perceived value proposition of smartwatches – encompassing not just timekeeping but also fitness tracking, mobile notifications, contactless payments, and even emergency assistance – is resonating deeply with a broad consumer base, propelling adoption rates and market penetration across diverse demographics.

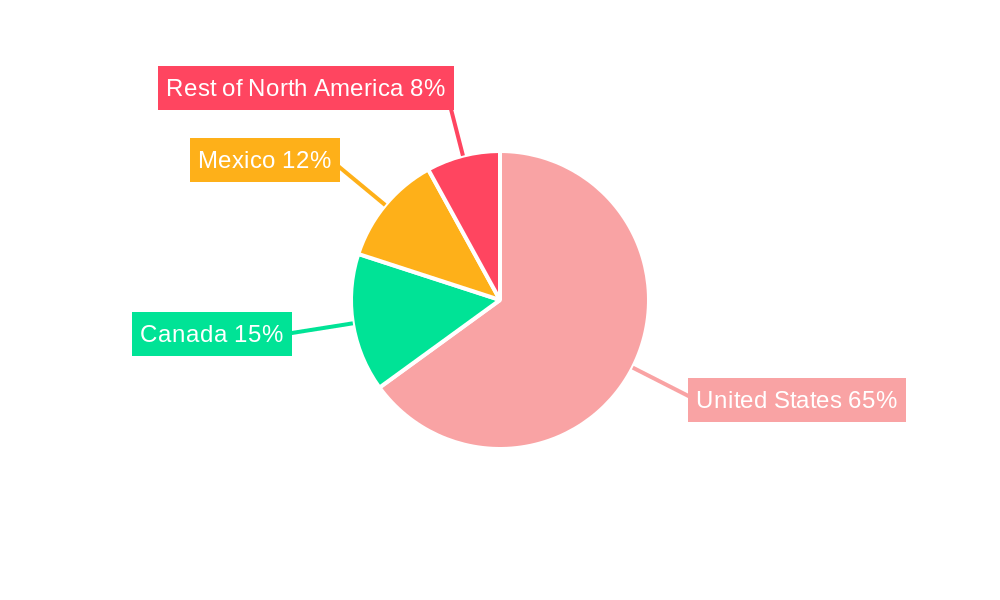

Dominant Regions, Countries, or Segments in North America E-Commerce Watch Market

The United States stands as the dominant force within the North America E-Commerce Watch Market, consistently leading in terms of market size, consumer adoption rates, and technological innovation. Its dominance is underpinned by a combination of factors, including a robust economy, high disposable incomes, a digitally connected population, and a receptive attitude towards early adoption of new technologies. The e-commerce infrastructure in the US is highly developed, with efficient logistics networks and widespread consumer trust in online purchasing.

- United States:

- Market Share: Expected to hold over 75% of the North American e-commerce watch market by 2025.

- Key Drivers: High consumer spending power, strong demand for smartwatches, advanced retail infrastructure, and significant marketing investments by major tech and watch brands.

- Growth Potential: Continued strong growth driven by innovation in health tech and a large addressable market.

Within product types, Smartwatches are unequivocally the leading segment, outpacing traditional Quartz/Mechanical watches significantly in online sales. This is attributed to their multifacet functionalities that extend beyond timekeeping.

- Product Type - Smartwatches:

- Market Dominance: Responsible for over 70% of the e-commerce watch market value in North America.

- Key Drivers: Integration of health and fitness tracking, smartphone connectivity, app ecosystems, personalized user experiences, and appeal to younger, tech-conscious demographics.

- Growth Potential: Sustained high growth due to ongoing technological advancements and increasing consumer awareness of health benefits.

On the platform type front, Company's Own Websites are experiencing rapid growth and are increasingly becoming a primary channel for direct-to-consumer (DTC) sales. While third-party retailers remain significant, brands are investing heavily in their online storefronts to enhance customer relationships, offer exclusive products, and gather valuable customer data.

- Platform Type - Company's Own Website:

- Market Growth: Exhibiting higher growth rates than third-party platforms.

- Key Drivers: Brand loyalty, direct customer engagement, control over brand messaging and pricing, exclusive product launches, and personalized customer service.

- Growth Potential: Expected to capture an increasing share of the market as brands mature their e-commerce strategies.

Canada and Mexico represent significant growth markets, with Canada mirroring many of the US trends, albeit on a smaller scale, while Mexico shows immense potential driven by a growing middle class and increasing internet penetration.

Canada:

- Market Contribution: Approximately 18% of the North American market.

- Drivers: Similar technology adoption trends to the US, strong interest in health and fitness wearables, and established e-commerce infrastructure.

Mexico:

- Market Contribution: Approximately 7% and growing rapidly.

- Drivers: Increasing internet and smartphone penetration, expanding middle class, growing awareness of health and wellness, and a young, tech-savvy population.

North America E-Commerce Watch Market Product Landscape

The North America E-Commerce Watch Market is defined by a diverse and rapidly evolving product landscape. Smartwatches lead the charge, integrating advanced features such as sophisticated health monitoring (ECG, blood oxygen, sleep tracking), GPS, contactless payments, and seamless smartphone integration. Innovations focus on enhanced battery life, more durable materials, and a wider array of sophisticated designs to appeal to both tech enthusiasts and fashion-conscious consumers. For instance, Apple's Series 8 introduced advanced women's health features and Crash Detection, while Garmin's Bounce LTE-connected kids smartwatch offers parental controls and location tracking. Citizen's CZ Smart, powered by IBM Watson, highlights a focus on personalized wellness through advanced app integration. These advancements are driven by a competitive environment that prioritizes user experience, data accuracy, and the seamless integration of wearables into daily life.

Key Drivers, Barriers & Challenges in North America E-Commerce Watch Market

Key Drivers:

- Technological Advancements: Continuous innovation in sensors, battery technology, and AI integration fuels demand for smarter, more functional timepieces.

- Growing Health and Wellness Consciousness: Consumers increasingly rely on smartwatches for health monitoring, fitness tracking, and proactive wellness management.

- E-commerce Convenience and Accessibility: The ease of online purchasing, wider selection, and competitive pricing accelerate market growth.

- Increasing Disposable Income: Higher consumer spending power allows for the adoption of premium and feature-rich smartwatches.

- Expansion of Connectivity: The proliferation of 5G networks and Bluetooth technology enhances smartwatch functionality and user experience.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical events and component shortages can impact production and availability, leading to price volatility and delayed product launches. The estimated impact on lead times can be 15-25%.

- Data Privacy and Security Concerns: Consumer apprehension regarding the collection and use of personal health data can act as a deterrent for some.

- Intense Competition: A crowded market with numerous players, including established tech giants and traditional watch brands, creates pricing pressures and marketing challenges.

- Rapid Technological Obsolescence: The fast pace of innovation requires significant R&D investment and can lead to older models becoming outdated quickly.

- Consumer Education and Awareness: For certain advanced features or niche products, educating consumers about their benefits and usage is crucial for adoption.

Emerging Opportunities in North America E-Commerce Watch Market

Emerging opportunities in the North America E-Commerce Watch Market are centered around niche applications, enhanced personalization, and expanding into underserved demographics. The integration of advanced health monitoring, such as non-invasive blood glucose monitoring or more sophisticated mental wellness tracking, presents a significant opportunity. Furthermore, the development of specialized smartwatches for specific professional fields (e.g., industrial safety, healthcare professionals) or for enhanced accessibility for elderly users and individuals with disabilities offers untapped market potential. The increasing demand for sustainable and ethically sourced materials in watch manufacturing also presents a niche where brands can differentiate themselves. The continued growth of the "connected health" ecosystem, where smartwatches act as central hubs for managing health data, creates opportunities for service-based revenue streams and partnerships with healthcare providers.

Growth Accelerators in the North America E-Commerce Watch Market Industry

Long-term growth in the North America E-Commerce Watch Market will be accelerated by several key factors. Continued breakthroughs in miniaturization and power efficiency will enable the creation of even more compact and longer-lasting smartwatches. Strategic partnerships between wearable technology companies, healthcare providers, and insurance companies are poised to unlock new use cases and revenue models, particularly in preventative care and remote patient monitoring. Market expansion strategies, including deeper penetration into rural areas with improved e-commerce logistics and increased availability of affordable yet functional smartwatches, will broaden the consumer base. The development of open-source platforms and app development ecosystems will foster innovation, leading to a wider array of specialized functionalities and personalized user experiences.

Key Players Shaping the North America E-Commerce Watch Market Market

- Apple Inc

- Samsung Electronics Co Ltd

- Garmin Ltd

- Google LLC (Fitbit)

- Timex Group B.V.

- Citizen Watch Co Ltd

- Casio Computer Co Ltd

- Fossil Group Inc

- Sony Corporation

- Rolex SA

Notable Milestones in North America E-Commerce Watch Market Sector

- January 2023: Citizen Watch Canada launched its next-generation smartwatch at CES 2023. The all-new CZ Smart features an advanced, IBM Watson-powered wellness app for easy mobile connection and personalized tracking of user habits and rhythms, available on the company's official e-commerce website.

- November 2022: Garmin launched the Bounce LTE-connected kids smartwatch in the United States via its online store, offering communication, location tracking, and health metrics for children.

- September 2022: Apple announced the launch of its Series 8 watches, featuring an innovative temperature sensor for women's health and Crash Detection, available through its online retailing store and third-party online retailers.

In-Depth North America E-Commerce Watch Market Market Outlook

The outlook for the North America E-Commerce Watch Market remains exceptionally positive, driven by a synergistic blend of technological innovation and evolving consumer demands. Smartwatches are increasingly becoming indispensable multi-functional devices, transcending their traditional role as mere timekeepers to become integral components of personal health management, communication, and digital lifestyle. The projected growth accelerators, including advancements in health tech and strategic collaborations within the connected health ecosystem, will further solidify the market's expansion. The strategic focus on enhancing user experience through personalized features, intuitive interfaces, and seamless integration across various digital platforms will be paramount. As e-commerce channels mature and brands refine their direct-to-consumer strategies, consumers can anticipate a wider array of specialized products and a more personalized purchasing journey, ensuring continued market dynamism and robust growth in the forecast period.

North America E-Commerce Watch Market Segmentation

-

1. Product Type

- 1.1. Quartz/Mechanical

- 1.2. Smart

-

2. Platform Type

- 2.1. Third Party Retailer

- 2.2. Company's Own Website

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America E-Commerce Watch Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America E-Commerce Watch Market Regional Market Share

Geographic Coverage of North America E-Commerce Watch Market

North America E-Commerce Watch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Premium Watches; Product Innovation to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Product Innovation to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Quartz/Mechanical

- 5.1.2. Smart

- 5.2. Market Analysis, Insights and Forecast - by Platform Type

- 5.2.1. Third Party Retailer

- 5.2.2. Company's Own Website

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Quartz/Mechanical

- 6.1.2. Smart

- 6.2. Market Analysis, Insights and Forecast - by Platform Type

- 6.2.1. Third Party Retailer

- 6.2.2. Company's Own Website

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Quartz/Mechanical

- 7.1.2. Smart

- 7.2. Market Analysis, Insights and Forecast - by Platform Type

- 7.2.1. Third Party Retailer

- 7.2.2. Company's Own Website

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Quartz/Mechanical

- 8.1.2. Smart

- 8.2. Market Analysis, Insights and Forecast - by Platform Type

- 8.2.1. Third Party Retailer

- 8.2.2. Company's Own Website

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America E-Commerce Watch Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Quartz/Mechanical

- 9.1.2. Smart

- 9.2. Market Analysis, Insights and Forecast - by Platform Type

- 9.2.1. Third Party Retailer

- 9.2.2. Company's Own Website

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Timex Group B V

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Samsung Electronics Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Garmin Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Google LLC (FitBit)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Citizen Watch Co Ltd *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Rolex SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Casio Computer Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Fossil Group Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Apple Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sony Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Timex Group B V

List of Figures

- Figure 1: North America E-Commerce Watch Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America E-Commerce Watch Market Share (%) by Company 2025

List of Tables

- Table 1: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 4: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 5: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: North America E-Commerce Watch Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America E-Commerce Watch Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 12: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 13: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: North America E-Commerce Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America E-Commerce Watch Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 19: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 20: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 21: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America E-Commerce Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America E-Commerce Watch Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 28: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 29: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: North America E-Commerce Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America E-Commerce Watch Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: North America E-Commerce Watch Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: North America E-Commerce Watch Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 35: North America E-Commerce Watch Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 36: North America E-Commerce Watch Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 37: North America E-Commerce Watch Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America E-Commerce Watch Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America E-Commerce Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America E-Commerce Watch Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America E-Commerce Watch Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America E-Commerce Watch Market?

Key companies in the market include Timex Group B V, Samsung Electronics Co Ltd, Garmin Ltd, Google LLC (FitBit), Citizen Watch Co Ltd *List Not Exhaustive, Rolex SA, Casio Computer Co Ltd, Fossil Group Inc, Apple Inc, Sony Corporation.

3. What are the main segments of the North America E-Commerce Watch Market?

The market segments include Product Type, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Premium Watches; Product Innovation to Drive the Market.

6. What are the notable trends driving market growth?

Product Innovation to Drive the Market.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2023: Citizen Watch Canada launched its next-generation smartwatch at CES 2023. The all-new CZ Smart was claimed to feature an advanced, IBM Watson-powered wellness app through which the device can be connected to a mobile for easy access. The app uses personal data points accumulated by the watch to boost personalization by tracking the wearer's unique characterization, rhythms, and habits. The company made this product available on its official e-commerce website.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America E-Commerce Watch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America E-Commerce Watch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America E-Commerce Watch Market?

To stay informed about further developments, trends, and reports in the North America E-Commerce Watch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence