Key Insights

The European Hair and Skincare Market is projected to reach $24 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 5.9% from a base year of 2023. Key growth factors include heightened consumer emphasis on personal wellness and grooming, a significant surge in demand for natural and organic formulations, and ongoing product innovation. Consumers increasingly seek specialized and premium solutions for their unique hair and skin concerns. Evolving distribution channels, particularly the expansion of online retail, are enhancing accessibility and convenience. Growing awareness of the holistic connection between skincare and overall health further stimulates demand for a broad spectrum of advanced products.

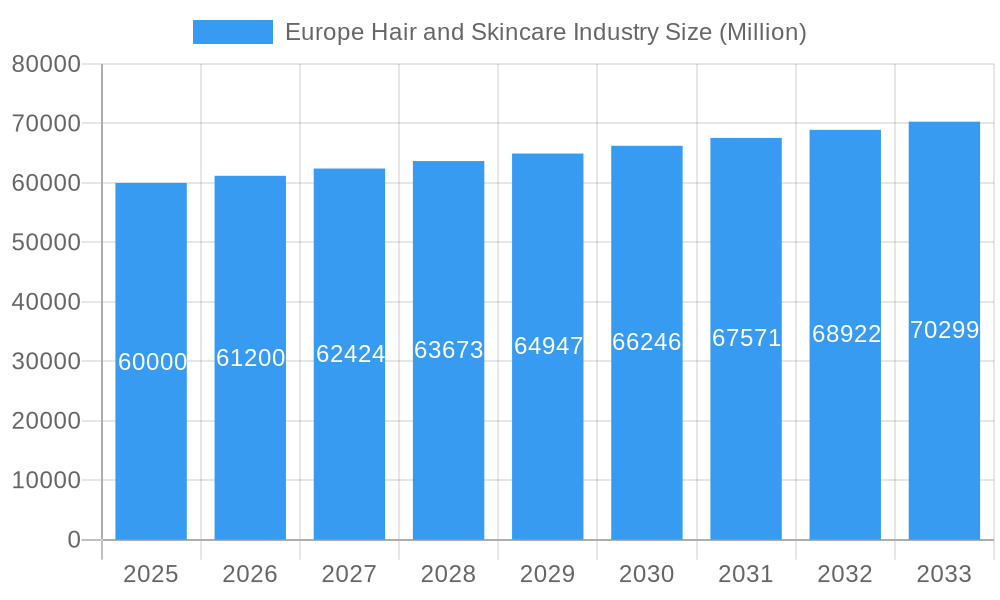

Europe Hair and Skincare Industry Market Size (In Billion)

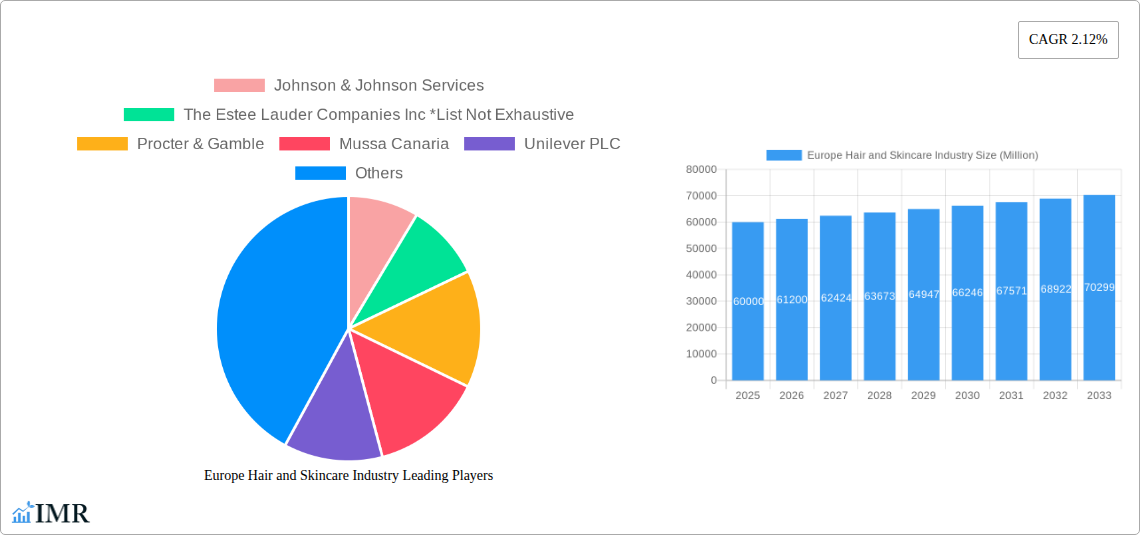

Market segmentation addresses diverse consumer needs across skincare and haircare categories. Skincare offerings include comprehensive Face Care (cleansers, masks, exfoliators, serums, moisturizers, creams, lotions), Body Care (creams, lotions, washes), and Lip Care. Hair Care comprises shampoos, conditioners, oils, and specialized treatments. The market serves both Mass and Premium segments, utilizing a variety of distribution channels, including Hypermarkets/Supermarkets, Specialist Retailers, and the rapidly growing Online Retail sector. Leading global competitors such as Johnson & Johnson Services, Procter & Gamble, Unilever PLC, and L'Oréal SA are actively shaping the market through R&D investments and strategic acquisitions. Success in this dynamic, consumer-centric European market hinges on adapting to emerging trends and understanding regional consumer behavior in key markets like Germany, France, and the United Kingdom.

Europe Hair and Skincare Industry Company Market Share

Europe Hair and Skincare Industry Market Dynamics & Structure

The Europe Hair and Skincare Industry is characterized by a moderately concentrated market, with major global players like L'Oréal SA, Procter & Gamble, and Unilever PLC holding significant market share. However, a growing number of niche and premium brands are emerging, particularly in the premium skincare segment, driven by increasing consumer demand for specialized and ethically sourced products. Technological innovation is a key driver, with advancements in formulation, ingredients (e.g., biotechnology, natural actives), and delivery systems constantly reshaping product offerings. Regulatory frameworks, particularly concerning ingredient safety and marketing claims (e.g., REACH compliance in cosmetics), influence product development and market entry. Competitive product substitutes are abundant across both mass and premium categories, ranging from established multi-brand retailers to direct-to-consumer (DTC) brands. End-user demographics are shifting, with an aging population driving demand for anti-aging solutions and a growing Gen Z cohort influencing trends towards clean beauty and sustainability. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and expansion, with significant deal volumes observed in recent years, especially in acquiring innovative start-ups.

- Market Concentration: Moderately concentrated with global giants and a rising number of niche players.

- Technological Innovation: Driven by advanced formulations, biotechnology, and sustainable ingredients.

- Regulatory Frameworks: Strict adherence to safety and marketing regulations like REACH.

- Competitive Landscape: High competition from mass-market brands, premium specialists, and DTC offerings.

- End-User Demographics: Shifting preferences driven by aging populations and conscious consumerism (Gen Z).

- M&A Activity: Active M&A landscape for market consolidation and innovation acquisition.

Europe Hair and Skincare Industry Growth Trends & Insights

The Europe Hair and Skincare Industry is poised for robust growth, projected to expand significantly from its current valuation of approximately $65,800 million in 2025. This expansion is underpinned by a confluence of evolving consumer behaviors, technological advancements, and a heightened awareness of personal well-being. The skincare segment, particularly face care, is expected to remain the dominant revenue generator, driven by continuous innovation in product types such as oils/serums and moisturizers, catering to specific concerns like anti-aging and hydration. The hair care sector is also witnessing substantial growth, with conditioners and shampoos seeing consistent demand, augmented by innovative treatments for hair loss and scalp health.

Consumer adoption rates for specialized and scientifically backed products are on an upward trajectory. The premium skincare category, in particular, is experiencing faster growth than the mass market, as consumers are willing to invest more in products offering demonstrable results and ethical sourcing. This shift is fueled by increased disposable incomes in certain European nations and a broader cultural emphasis on self-care. Technological disruptions are playing a pivotal role. The integration of AI in product development, personalized skincare routines, and the rise of smart beauty devices are transforming consumer engagement. Furthermore, the focus on sustainability and clean beauty ingredients is not just a trend but a fundamental driver of purchasing decisions, pushing brands to reformulate and rethink their entire product lifecycle.

The online retail distribution channel continues its meteoric rise, offering unparalleled convenience and access to a wider array of brands and products. This channel's share is expected to grow substantially, influencing traditional retail strategies. Market penetration of advanced skincare solutions is deepening, particularly in Western European countries, while emerging markets in Eastern Europe are showing promising growth potential as disposable incomes rise. The CAGR for the Europe Hair and Skincare Industry is anticipated to be around 4.5% during the forecast period of 2025-2033. Consumer behavior is increasingly informed by social media influencers, online reviews, and a demand for transparency regarding ingredients and brand values. This creates a dynamic environment where brands must continually innovate and adapt to maintain relevance and capture market share. The interplay of these factors — from product innovation and distribution channel evolution to fundamental shifts in consumer consciousness — will define the growth trajectory of this vibrant industry.

Dominant Regions, Countries, or Segments in Europe Hair and Skincare Industry

The Europe Hair and Skincare Industry is a dynamic landscape, with Skin Care consistently emerging as the dominant segment, driven by escalating consumer focus on health, wellness, and aesthetic appeal. Within the Skin Care segment, Face Care commands the largest market share. This dominance is further amplified by the sub-segments of Moisturizers and Oils/Serums, which are experiencing robust growth due to the persistent demand for anti-aging solutions, hydration, and targeted treatments for various skin concerns like acne, hyperpigmentation, and sensitivity. The increasing adoption of advanced formulations incorporating potent active ingredients, alongside a growing preference for clean and natural products, further bolsters the performance of Face Care.

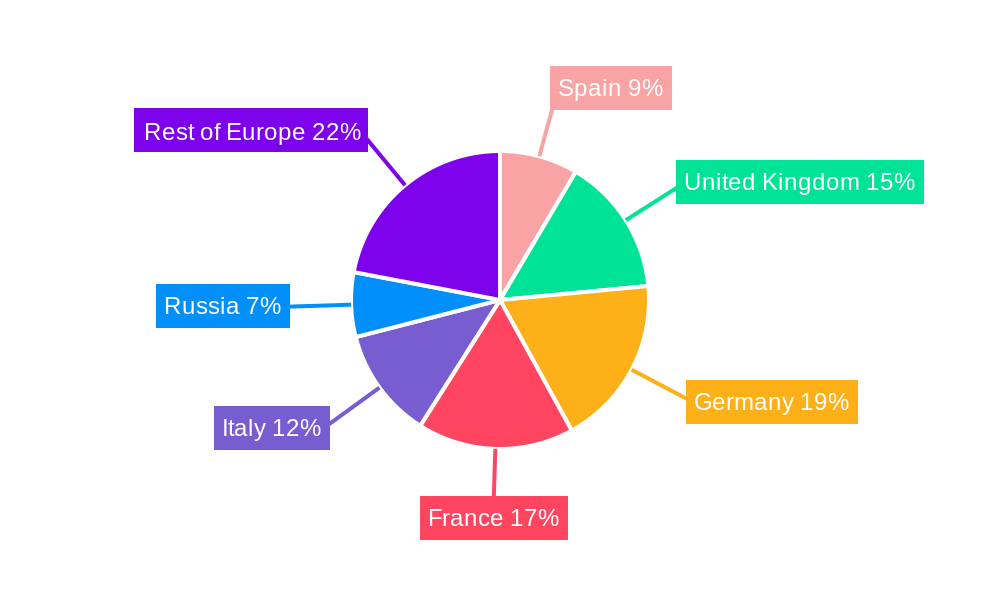

Geographically, Western Europe, particularly countries like Germany, France, the United Kingdom, and Italy, continues to be the powerhouse of the Europe Hair and Skincare Industry. These nations benefit from high disposable incomes, established retail infrastructure, a mature consumer base with a high propensity to spend on personal care, and a strong presence of both global and local premium beauty brands. The sophisticated distribution networks, encompassing hypermarkets/supermarkets, specialist retail stores, and increasingly, online retail, facilitate widespread product availability and market penetration. The economic policies in these regions have historically supported consumer spending on discretionary goods, including high-value beauty products.

The premium category within both Hair Care and Skin Care is a significant growth driver, outperforming the mass market. Consumers in these dominant regions are increasingly seeking personalized solutions, scientifically proven efficacy, and ethically produced goods, making them willing to pay a premium. The growth of specialist retail stores, including beauty boutiques and concept stores, caters directly to this demand for curated and exclusive product experiences. Furthermore, the rapid expansion of online retail in these mature markets allows for wider accessibility to a broader spectrum of brands, from established luxury houses to emerging independent labels, further fueling the growth of the premium segment. The sophisticated understanding of ingredient benefits and the proactive approach to preventive skincare among consumers in Western Europe contribute significantly to the overall dominance of the skincare segment.

- Dominant Segment: Skin Care

- Key Sub-Segments: Face Care (Moisturizers, Oils/Serums)

- Growth Drivers: Anti-aging demand, clean beauty trend, advanced formulations.

- Dominant Region: Western Europe

- Leading Countries: Germany, France, United Kingdom, Italy

- Factors: High disposable income, mature consumer base, advanced retail infrastructure.

- Dominant Category: Premium

- Impact: Outperforming mass market due to demand for personalization and efficacy.

- Key Distribution Channels: Hypermarket/Supermarkets, Specialist Retail Stores, Online Retail.

Europe Hair and Skincare Industry Product Landscape

The Europe Hair and Skincare Industry is a hotbed of innovation, with product development focusing on efficacy, sustainability, and personalization. In skincare, advanced formulations featuring potent actives like hyaluronic acid, peptides, and ceramides are prevalent in moisturizers and serums, addressing concerns from hydration to anti-aging. The rise of clean beauty has spurred the use of natural and organic ingredients in cleansers and masks, emphasizing gentle yet effective formulations. Hair care innovation is centered on scalp health, with shampoos and conditioners designed to balance the microbiome and promote hair growth. Unique selling propositions often lie in scientifically backed claims, ethically sourced ingredients, and eco-friendly packaging. Technological advancements are enabling targeted delivery systems and enhanced product performance.

Key Drivers, Barriers & Challenges in Europe Hair and Skincare Industry

The Europe Hair and Skincare Industry is propelled by several key drivers. Increasing consumer consciousness regarding personal appearance, health, and wellness is a primary motivator. Technological advancements, including innovations in ingredient science, biotechnology, and sustainable packaging, are continuously shaping product offerings. The growing popularity of online retail and e-commerce platforms provides wider accessibility and convenience for consumers, fostering market growth. Furthermore, the expanding premium category reflects a willingness among consumers to invest in high-quality, specialized beauty products.

However, the industry faces significant barriers and challenges. Stringent regulatory frameworks, such as the EU Cosmetics Regulation, necessitate extensive testing and compliance, increasing development costs and time-to-market. Intense competition from both global conglomerates and agile indie brands creates pressure on pricing and market share. Supply chain disruptions, particularly those related to raw material sourcing and logistics, can impact production and availability. Evolving consumer preferences, such as a demand for radical transparency in ingredients and ethical manufacturing, require continuous adaptation from brands. Economic uncertainties and fluctuating disposable incomes can also affect consumer spending on non-essential beauty products.

Emerging Opportunities in Europe Hair and Skincare Industry

Emerging opportunities in the Europe Hair and Skincare Industry lie in the burgeoning demand for personalized beauty solutions, driven by advancements in AI and genetic profiling, enabling bespoke product formulations. The continued expansion of the online retail channel, particularly through social commerce and influencer marketing, presents a significant avenue for reaching new customer segments. There is also a substantial untapped market for sustainable and circular economy-driven beauty products, from biodegradable packaging to refillable systems. The growing interest in inclusive beauty, catering to diverse skin tones and hair types, offers further potential. Additionally, the integration of technology, such as smart beauty devices and augmented reality (AR) for virtual try-ons, is creating novel consumer experiences and engagement opportunities.

Growth Accelerators in the Europe Hair and Skincare Industry Industry

Growth accelerators in the Europe Hair and Skincare Industry are primarily fueled by continuous product innovation, particularly in the premium skincare and advanced hair care segments. Strategic partnerships between established brands and innovative start-ups are unlocking new technologies and consumer insights. The increasing adoption of digital marketing strategies and direct-to-consumer (DTC) models is enhancing brand reach and customer engagement. Furthermore, expansion into emerging European markets with growing disposable incomes and a rising interest in beauty and personal care products presents significant growth potential. The industry's ability to adapt to and capitalize on evolving consumer trends, such as clean beauty and sustainability, will be crucial for sustained growth.

Key Players Shaping the Europe Hair and Skincare Industry Market

- Johnson & Johnson Services

- The Estee Lauder Companies Inc

- Procter & Gamble

- Mussa Canaria

- Unilever PLC

- Amway

- Loreal SA

- Beiersdorf AG

- Natura & Co

- Carol Joy London

Notable Milestones in Europe Hair and Skincare Industry Sector

- 2020/January: L'Oréal launches its first entirely vegan skincare range, demonstrating a commitment to clean beauty and sustainability.

- 2021/March: Unilever PLC acquires a majority stake in Paula's Choice, a popular US-based skincare brand, signaling strategic expansion in the premium segment.

- 2022/June: Procter & Gamble invests heavily in R&D for advanced hair loss treatments, highlighting innovation in the hair care sector.

- 2023/October: Beiersdorf AG partners with a biotechnology firm to develop novel anti-aging ingredients for its NIVEA brand, showcasing technological advancements.

- 2024/February: Natura & Co announces a strategic review of its portfolio, indicating potential M&A activity and market recalibration.

- 2024/July: The European Union implements stricter regulations on microplastic content in cosmetic products, influencing reformulation strategies.

In-Depth Europe Hair and Skincare Industry Market Outlook

The Europe Hair and Skincare Industry is projected for sustained and significant growth, driven by an unyielding consumer pursuit of efficacy, personalized experiences, and ethical product sourcing. Key growth accelerators include the relentless pace of technological innovation in ingredient science and formulation, particularly within the premium skincare and advanced hair care segments. Strategic collaborations and acquisitions will continue to reshape the competitive landscape, while the expansion of the online retail channel, empowered by digital marketing and direct-to-consumer models, will broaden market reach and enhance consumer engagement. Emerging markets within Europe offer substantial untapped potential, fueled by rising disposable incomes and an increasing appetite for sophisticated beauty solutions. The industry’s agility in embracing sustainability and clean beauty trends will be paramount to capturing future market share and fostering long-term success.

Europe Hair and Skincare Industry Segmentation

-

1. Type

-

1.1. Skin Care

-

1.1.1. Face Care

- 1.1.1.1. Cleansers

- 1.1.1.2. Masks

- 1.1.1.3. Exfoliators/Scrubs

- 1.1.1.4. Oils/Serums

- 1.1.1.5. Moisturizers, Cream, Lotion

- 1.1.1.6. Other Face Care Products

-

1.1.2. Body Care

- 1.1.2.1. Body Cream, Lotion

- 1.1.2.2. Body Wash

- 1.1.3. Lip Care

-

1.1.1. Face Care

-

1.2. Hair Care

- 1.2.1. Shampoo

- 1.2.2. Conditioners

- 1.2.3. Hair Oil

- 1.2.4. Other Hair Care Products

-

1.1. Skin Care

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Hypermarket/Supermarkets

- 3.2. Specialist Retail Stores

- 3.3. Convenience Stores

- 3.4. Online Retail

- 3.5. Other Distribution Channels

Europe Hair and Skincare Industry Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Hair and Skincare Industry Regional Market Share

Geographic Coverage of Europe Hair and Skincare Industry

Europe Hair and Skincare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal For Natural and Organic Hair Care Products; Increased Consumer Spending on Hair Care Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Appeal for Organic and Natural Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Hair and Skincare Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Skin Care

- 5.1.1.1. Face Care

- 5.1.1.1.1. Cleansers

- 5.1.1.1.2. Masks

- 5.1.1.1.3. Exfoliators/Scrubs

- 5.1.1.1.4. Oils/Serums

- 5.1.1.1.5. Moisturizers, Cream, Lotion

- 5.1.1.1.6. Other Face Care Products

- 5.1.1.2. Body Care

- 5.1.1.2.1. Body Cream, Lotion

- 5.1.1.2.2. Body Wash

- 5.1.1.3. Lip Care

- 5.1.1.1. Face Care

- 5.1.2. Hair Care

- 5.1.2.1. Shampoo

- 5.1.2.2. Conditioners

- 5.1.2.3. Hair Oil

- 5.1.2.4. Other Hair Care Products

- 5.1.1. Skin Care

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarket/Supermarkets

- 5.3.2. Specialist Retail Stores

- 5.3.3. Convenience Stores

- 5.3.4. Online Retail

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.4.2. United Kingdom

- 5.4.3. Germany

- 5.4.4. France

- 5.4.5. Italy

- 5.4.6. Russia

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Spain Europe Hair and Skincare Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Skin Care

- 6.1.1.1. Face Care

- 6.1.1.1.1. Cleansers

- 6.1.1.1.2. Masks

- 6.1.1.1.3. Exfoliators/Scrubs

- 6.1.1.1.4. Oils/Serums

- 6.1.1.1.5. Moisturizers, Cream, Lotion

- 6.1.1.1.6. Other Face Care Products

- 6.1.1.2. Body Care

- 6.1.1.2.1. Body Cream, Lotion

- 6.1.1.2.2. Body Wash

- 6.1.1.3. Lip Care

- 6.1.1.1. Face Care

- 6.1.2. Hair Care

- 6.1.2.1. Shampoo

- 6.1.2.2. Conditioners

- 6.1.2.3. Hair Oil

- 6.1.2.4. Other Hair Care Products

- 6.1.1. Skin Care

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass

- 6.2.2. Premium

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarket/Supermarkets

- 6.3.2. Specialist Retail Stores

- 6.3.3. Convenience Stores

- 6.3.4. Online Retail

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Hair and Skincare Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Skin Care

- 7.1.1.1. Face Care

- 7.1.1.1.1. Cleansers

- 7.1.1.1.2. Masks

- 7.1.1.1.3. Exfoliators/Scrubs

- 7.1.1.1.4. Oils/Serums

- 7.1.1.1.5. Moisturizers, Cream, Lotion

- 7.1.1.1.6. Other Face Care Products

- 7.1.1.2. Body Care

- 7.1.1.2.1. Body Cream, Lotion

- 7.1.1.2.2. Body Wash

- 7.1.1.3. Lip Care

- 7.1.1.1. Face Care

- 7.1.2. Hair Care

- 7.1.2.1. Shampoo

- 7.1.2.2. Conditioners

- 7.1.2.3. Hair Oil

- 7.1.2.4. Other Hair Care Products

- 7.1.1. Skin Care

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass

- 7.2.2. Premium

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarket/Supermarkets

- 7.3.2. Specialist Retail Stores

- 7.3.3. Convenience Stores

- 7.3.4. Online Retail

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Germany Europe Hair and Skincare Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Skin Care

- 8.1.1.1. Face Care

- 8.1.1.1.1. Cleansers

- 8.1.1.1.2. Masks

- 8.1.1.1.3. Exfoliators/Scrubs

- 8.1.1.1.4. Oils/Serums

- 8.1.1.1.5. Moisturizers, Cream, Lotion

- 8.1.1.1.6. Other Face Care Products

- 8.1.1.2. Body Care

- 8.1.1.2.1. Body Cream, Lotion

- 8.1.1.2.2. Body Wash

- 8.1.1.3. Lip Care

- 8.1.1.1. Face Care

- 8.1.2. Hair Care

- 8.1.2.1. Shampoo

- 8.1.2.2. Conditioners

- 8.1.2.3. Hair Oil

- 8.1.2.4. Other Hair Care Products

- 8.1.1. Skin Care

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass

- 8.2.2. Premium

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarket/Supermarkets

- 8.3.2. Specialist Retail Stores

- 8.3.3. Convenience Stores

- 8.3.4. Online Retail

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Hair and Skincare Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Skin Care

- 9.1.1.1. Face Care

- 9.1.1.1.1. Cleansers

- 9.1.1.1.2. Masks

- 9.1.1.1.3. Exfoliators/Scrubs

- 9.1.1.1.4. Oils/Serums

- 9.1.1.1.5. Moisturizers, Cream, Lotion

- 9.1.1.1.6. Other Face Care Products

- 9.1.1.2. Body Care

- 9.1.1.2.1. Body Cream, Lotion

- 9.1.1.2.2. Body Wash

- 9.1.1.3. Lip Care

- 9.1.1.1. Face Care

- 9.1.2. Hair Care

- 9.1.2.1. Shampoo

- 9.1.2.2. Conditioners

- 9.1.2.3. Hair Oil

- 9.1.2.4. Other Hair Care Products

- 9.1.1. Skin Care

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass

- 9.2.2. Premium

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarket/Supermarkets

- 9.3.2. Specialist Retail Stores

- 9.3.3. Convenience Stores

- 9.3.4. Online Retail

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Hair and Skincare Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Skin Care

- 10.1.1.1. Face Care

- 10.1.1.1.1. Cleansers

- 10.1.1.1.2. Masks

- 10.1.1.1.3. Exfoliators/Scrubs

- 10.1.1.1.4. Oils/Serums

- 10.1.1.1.5. Moisturizers, Cream, Lotion

- 10.1.1.1.6. Other Face Care Products

- 10.1.1.2. Body Care

- 10.1.1.2.1. Body Cream, Lotion

- 10.1.1.2.2. Body Wash

- 10.1.1.3. Lip Care

- 10.1.1.1. Face Care

- 10.1.2. Hair Care

- 10.1.2.1. Shampoo

- 10.1.2.2. Conditioners

- 10.1.2.3. Hair Oil

- 10.1.2.4. Other Hair Care Products

- 10.1.1. Skin Care

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Mass

- 10.2.2. Premium

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hypermarket/Supermarkets

- 10.3.2. Specialist Retail Stores

- 10.3.3. Convenience Stores

- 10.3.4. Online Retail

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Europe Hair and Skincare Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Skin Care

- 11.1.1.1. Face Care

- 11.1.1.1.1. Cleansers

- 11.1.1.1.2. Masks

- 11.1.1.1.3. Exfoliators/Scrubs

- 11.1.1.1.4. Oils/Serums

- 11.1.1.1.5. Moisturizers, Cream, Lotion

- 11.1.1.1.6. Other Face Care Products

- 11.1.1.2. Body Care

- 11.1.1.2.1. Body Cream, Lotion

- 11.1.1.2.2. Body Wash

- 11.1.1.3. Lip Care

- 11.1.1.1. Face Care

- 11.1.2. Hair Care

- 11.1.2.1. Shampoo

- 11.1.2.2. Conditioners

- 11.1.2.3. Hair Oil

- 11.1.2.4. Other Hair Care Products

- 11.1.1. Skin Care

- 11.2. Market Analysis, Insights and Forecast - by Category

- 11.2.1. Mass

- 11.2.2. Premium

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Hypermarket/Supermarkets

- 11.3.2. Specialist Retail Stores

- 11.3.3. Convenience Stores

- 11.3.4. Online Retail

- 11.3.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Hair and Skincare Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Skin Care

- 12.1.1.1. Face Care

- 12.1.1.1.1. Cleansers

- 12.1.1.1.2. Masks

- 12.1.1.1.3. Exfoliators/Scrubs

- 12.1.1.1.4. Oils/Serums

- 12.1.1.1.5. Moisturizers, Cream, Lotion

- 12.1.1.1.6. Other Face Care Products

- 12.1.1.2. Body Care

- 12.1.1.2.1. Body Cream, Lotion

- 12.1.1.2.2. Body Wash

- 12.1.1.3. Lip Care

- 12.1.1.1. Face Care

- 12.1.2. Hair Care

- 12.1.2.1. Shampoo

- 12.1.2.2. Conditioners

- 12.1.2.3. Hair Oil

- 12.1.2.4. Other Hair Care Products

- 12.1.1. Skin Care

- 12.2. Market Analysis, Insights and Forecast - by Category

- 12.2.1. Mass

- 12.2.2. Premium

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Hypermarket/Supermarkets

- 12.3.2. Specialist Retail Stores

- 12.3.3. Convenience Stores

- 12.3.4. Online Retail

- 12.3.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Johnson & Johnson Services

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 The Estee Lauder Companies Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Procter & Gamble

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Mussa Canaria

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Unilever PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Amway

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Loreal SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Beiersodrf AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Natura & Co

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Carol Joy London

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Johnson & Johnson Services

List of Figures

- Figure 1: Europe Hair and Skincare Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Hair and Skincare Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Hair and Skincare Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Hair and Skincare Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 3: Europe Hair and Skincare Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Hair and Skincare Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Hair and Skincare Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Hair and Skincare Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Europe Hair and Skincare Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe Hair and Skincare Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Hair and Skincare Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Hair and Skincare Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 11: Europe Hair and Skincare Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Hair and Skincare Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Hair and Skincare Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Hair and Skincare Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 15: Europe Hair and Skincare Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Hair and Skincare Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Hair and Skincare Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Hair and Skincare Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 19: Europe Hair and Skincare Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: Europe Hair and Skincare Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Hair and Skincare Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Europe Hair and Skincare Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 23: Europe Hair and Skincare Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Hair and Skincare Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Europe Hair and Skincare Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Hair and Skincare Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 27: Europe Hair and Skincare Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Hair and Skincare Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Europe Hair and Skincare Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Europe Hair and Skincare Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 31: Europe Hair and Skincare Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 32: Europe Hair and Skincare Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Hair and Skincare Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Europe Hair and Skincare Industry?

Key companies in the market include Johnson & Johnson Services, The Estee Lauder Companies Inc *List Not Exhaustive, Procter & Gamble, Mussa Canaria, Unilever PLC, Amway, Loreal SA, Beiersodrf AG, Natura & Co, Carol Joy London.

3. What are the main segments of the Europe Hair and Skincare Industry?

The market segments include Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 24 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal For Natural and Organic Hair Care Products; Increased Consumer Spending on Hair Care Products.

6. What are the notable trends driving market growth?

Growing Appeal for Organic and Natural Products.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Hair and Skincare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Hair and Skincare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Hair and Skincare Industry?

To stay informed about further developments, trends, and reports in the Europe Hair and Skincare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence