Key Insights

South Korea's luxury goods market is set for substantial growth, projected to reach $2.02 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 1.31% from 2025 to 2033. This expansion is driven by an increasing affluent population with a strong demand for premium products, a consumer culture valuing status, and the influence of inherited wealth among younger generations. The global impact of K-culture and celebrity endorsements is also boosting local interest in luxury items. Key trends include experiential luxury, sustainable and ethically sourced products, and the digitalization of the shopping experience. Potential market challenges include geopolitical uncertainties impacting supply chains and shifts in consumer spending during economic downturns.

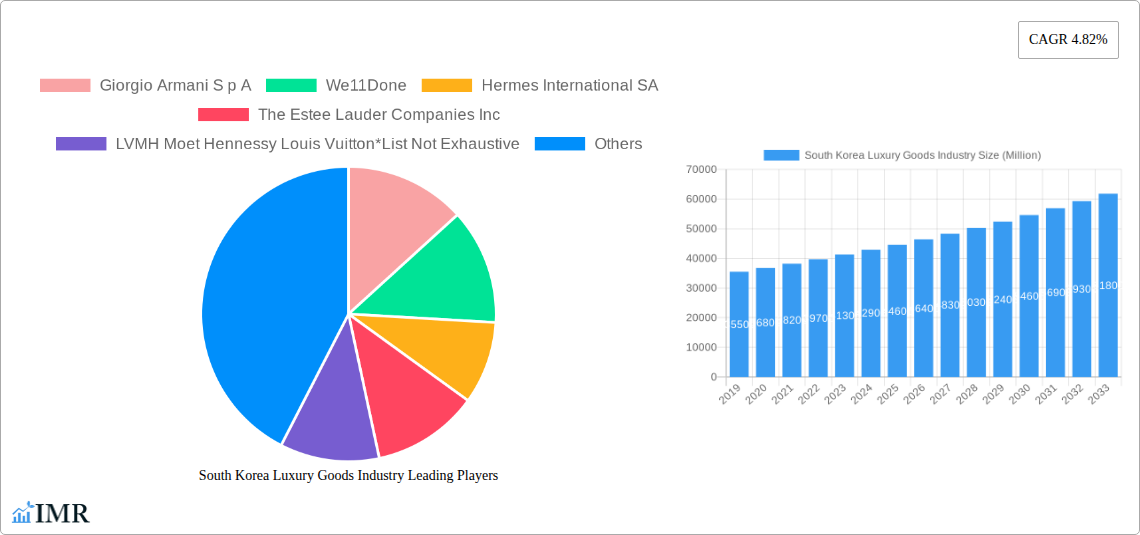

South Korea Luxury Goods Industry Market Size (In Billion)

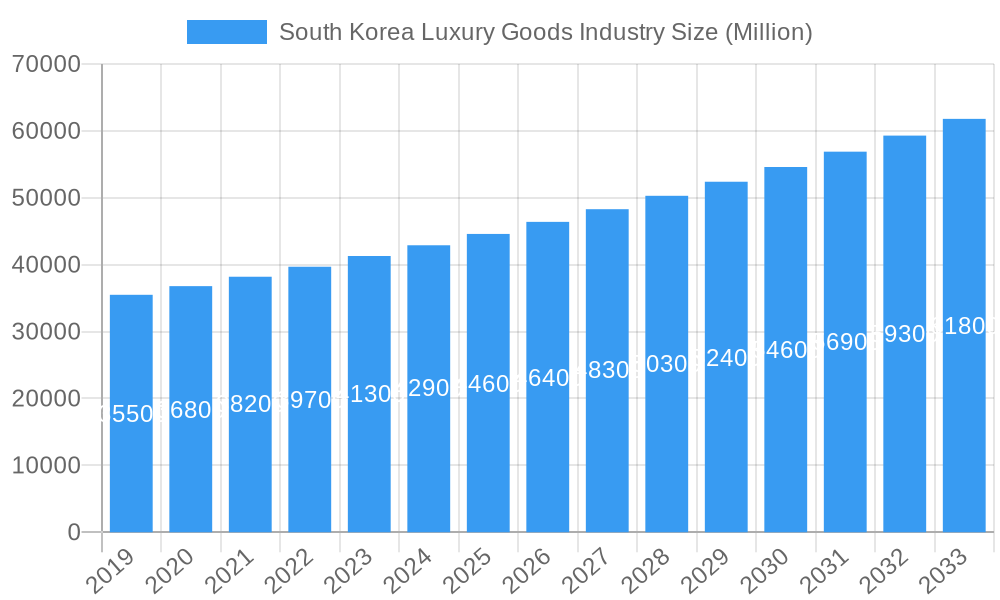

The South Korean luxury goods market is segmented by product categories, with Clothing, Apparel, Footwear, and Bags leading demand, influenced by fashion trends. Jewelry and Watches are also significant, appealing to consumers seeking status symbols and lasting value. Distribution channels are evolving, with online retail experiencing rapid growth alongside established single-brand and multi-brand stores. Prominent global and domestic brands, including Giorgio Armani, Chanel, LVMH, and Kering (Gucci), are actively competing through innovative collections and personalized customer engagement. South Korea's robust luxury market performance highlights its importance in the Asia-Pacific region.

South Korea Luxury Goods Industry Company Market Share

South Korea Luxury Goods Industry: Market Analysis & Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the South Korean luxury goods industry, forecasting its trajectory from 2019 to 2033. Delve into market dynamics, growth drivers, regional dominance, product landscape, and emerging opportunities within this vibrant sector. Discover key strategies for navigating competitive pressures and capitalizing on burgeoning consumer demand for high-end fashion, accessories, and exclusive experiences.

South Korea Luxury Goods Industry Market Dynamics & Structure

The South Korean luxury goods market exhibits a dynamic yet concentrated structure, driven by a discerning and affluent consumer base. Technological innovation plays a pivotal role, from advanced e-commerce platforms enhancing accessibility to sophisticated personalization technologies. Regulatory frameworks are generally favorable, supporting brand investment and consumer protection, although evolving digital trade policies require continuous monitoring. Competitive product substitutes are present, particularly from fast-fashion brands mimicking high-end aesthetics, but the intrinsic value and brand heritage of true luxury goods remain a strong differentiator. End-user demographics are increasingly younger and digitally native, with a significant portion of wealth concentrated among millennials and Gen Z, who prioritize experiential luxury and ethical sourcing. Mergers and acquisitions (M&A) trends reflect a consolidation of power among established conglomerates and strategic investments in promising niche brands, indicating a maturing market.

- Market Concentration: Dominated by a few global luxury powerhouses alongside a growing number of successful domestic brands.

- Technological Innovation Drivers: E-commerce integration, AI-powered personalization, virtual try-on technologies, and blockchain for authenticity verification.

- Regulatory Frameworks: Relatively stable, with a focus on consumer rights, import duties, and intellectual property protection.

- Competitive Product Substitutes: High-quality affordable fashion and counterfeit goods pose challenges, yet are mitigated by brand exclusivity and provenance.

- End-User Demographics: Younger affluent consumers (Millennials, Gen Z) with a strong online presence and demand for sustainable and ethically produced luxury.

- M&A Trends: Strategic acquisitions of burgeoning Korean luxury brands by global players and consolidation within domestic conglomerates to leverage scale and market reach.

South Korea Luxury Goods Industry Growth Trends & Insights

The South Korean luxury goods market is poised for substantial growth, driven by robust economic fundamentals and evolving consumer aspirations. The market size has witnessed consistent expansion, fueled by rising disposable incomes and a strong cultural appreciation for premium products. Adoption rates for both established and emerging luxury brands remain high, indicating a resilient demand. Technological disruptions are not only transforming distribution but also the very nature of luxury consumption, with digital experiences becoming as crucial as physical ones. Consumer behavior shifts are profound, marked by a greater emphasis on personalization, sustainability, and the narrative behind brands. The market is transitioning from purely status-driven purchases to value-driven choices, where provenance, craftsmanship, and ethical considerations heavily influence purchasing decisions. The increasing prevalence of "flex culture" and the aspiration for aspirational lifestyles further accelerate this trend.

- Market Size Evolution: Experiencing steady year-on-year growth, projected to reach xx Million units by 2025 and further expand by xx% by 2033.

- Adoption Rates: High for established international luxury brands and rapidly increasing for innovative domestic labels.

- Technological Disruptions: Online luxury sales are booming, virtual showrooms are gaining traction, and NFTs are emerging as a novel form of luxury ownership and authentication.

- Consumer Behavior Shifts: Increased demand for sustainable and ethically sourced products, a preference for experiential luxury, and a growing influence of social media on purchasing decisions.

- Market Penetration: Expected to reach xx% by 2025, with significant room for growth in emerging luxury categories and for brands catering to younger demographics.

- CAGR: The industry is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Dominant Regions, Countries, or Segments in South Korea Luxury Goods Industry

Within the South Korean luxury goods industry, the Clothing and Apparel segment, along with Bags, consistently emerges as the dominant force, driving market growth. Seoul, as the nation's capital and economic heart, remains the undisputed epicentre for luxury retail, boasting the highest concentration of flagship stores, department stores, and high-end boutiques. This dominance is underpinned by a confluence of factors including significant disposable income, a highly fashion-conscious population, and a strong presence of global luxury brands establishing their primary South Korean presence here. The influence of K-fashion and K-beauty has also amplified the appeal of domestically designed luxury apparel, further solidifying this segment's leadership.

The Online Stores distribution channel is rapidly ascending in importance, challenging traditional brick-and-mortar establishments. This surge is propelled by technological advancements, the convenience offered to a digitally savvy population, and the ability of online platforms to reach consumers beyond the major metropolitan areas. Strategic investments by luxury brands in sophisticated e-commerce infrastructure and partnerships with leading online retailers have been instrumental in this shift. The Single-Brand Stores segment continues to be a cornerstone for brand experience and customer loyalty, allowing for complete control over brand narrative and product presentation. However, the increasing demand for curated selections and unique brand discovery is fueling the growth of Multi-Brand Stores and concept stores.

- Dominant Segment (Type): Clothing and Apparel, accounting for an estimated xx% of the total market value.

- Dominant Segment (Type): Bags, following closely with xx% market share, driven by iconic designer pieces.

- Dominant Distribution Channel: Online Stores, projected to capture xx% of sales by 2025, with a CAGR of xx%.

- Dominant Distribution Channel: Single-Brand Stores, crucial for brand experience and customer loyalty, holding xx% of the market.

- Key Drivers for Dominance: High disposable income in Seoul, strong K-fashion influence, sophisticated digital infrastructure, and a growing demand for personalized luxury experiences.

- Growth Potential in Other Segments: Footwear and Watches also show significant growth potential, driven by brand collaborations and limited editions.

South Korea Luxury Goods Industry Product Landscape

The product landscape within the South Korean luxury goods industry is characterized by a blend of timeless craftsmanship and cutting-edge innovation. Iconic Clothing and Apparel lines from global fashion houses remain a staple, complemented by the rising prominence of avant-garde domestic designers. The Footwear segment sees continuous evolution with the introduction of sustainable materials and technologically integrated designs. Bags, from classic leather totes to statement clutches, continue to be a significant revenue driver, with limited editions and personalized options highly sought after. In Watches, precision engineering meets artistic expression, with a growing demand for both heritage Swiss brands and innovative independent watchmakers. Jewelry ranges from exquisite fine jewelry to contemporary designer pieces, often incorporating precious gemstones and intricate metalwork. Other Accessories, including luxury eyewear, scarves, and small leather goods, contribute significantly to the overall market value, offering accessible entry points into the luxury ecosystem.

Key Drivers, Barriers & Challenges in South Korea Luxury Goods Industry

Key Drivers: The South Korean luxury goods industry is propelled by a burgeoning affluent population with high disposable incomes and a strong cultural affinity for premium brands. Technological adoption, particularly in e-commerce and digital marketing, allows for wider reach and personalized consumer engagement. The influence of K-culture and celebrity endorsements significantly boosts brand desirability. Government initiatives promoting creative industries and international trade also contribute to market growth.

Barriers & Challenges: High import duties and taxes can increase product prices, impacting affordability. Intense competition, both from established global players and agile domestic brands, necessitates constant innovation and strategic differentiation. Counterfeit goods pose a persistent threat to brand integrity and revenue. Supply chain disruptions, particularly in sourcing raw materials and ensuring timely delivery, can impact operational efficiency. Evolving consumer preferences towards sustainability and ethical practices require brands to adapt their production and marketing strategies.

Emerging Opportunities in South Korea Luxury Goods Industry

Emerging opportunities within the South Korean luxury goods market lie in the growing demand for sustainable and ethically produced luxury items. The rise of the "conscious consumer" presents a significant avenue for brands committed to environmental and social responsibility. Furthermore, the untapped potential in experiential luxury, such as exclusive travel packages, curated events, and personalized styling services, offers a new dimension for engagement. The increasing acceptance of pre-owned luxury goods also presents a burgeoning market for certified resale platforms. Finally, the continued growth of niche luxury categories, like high-end pet accessories and bespoke home décor, caters to the diverse needs of the affluent consumer.

Growth Accelerators in the South Korea Luxury Goods Industry Industry

Several catalysts are accelerating the long-term growth of the South Korean luxury goods industry. Technological breakthroughs in artificial intelligence and virtual reality are enabling hyper-personalized shopping experiences and immersive brand storytelling. Strategic partnerships between established luxury houses and innovative tech startups are creating novel product offerings and distribution models. Market expansion strategies, including the exploration of secondary cities and the development of omni-channel retail networks, are crucial for tapping into new consumer segments. The continued rise of South Korea as a global cultural powerhouse also provides a strong platform for domestic and international luxury brands to gain traction.

Key Players Shaping the South Korea Luxury Goods Industry Market

- Giorgio Armani S p A

- We11Done

- Hermes International SA

- The Estee Lauder Companies Inc

- LVMH Moet Hennessy Louis Vuitton

- Gentle Monster

- Chanel

- Kering Group (Gucci)

- Rolex SA

- H & M Hennes & Mauritz AB (H&M)

- Prada Holding S p A

Notable Milestones in South Korea Luxury Goods Industry Sector

- May 2022: Dior, the French fashion brand, opened a large pop-up store in Seoul, South Korea, featuring multiple rooms dedicated to its women's ready-to-wear line, significantly boosting brand visibility and engagement.

- January 2022: Sequoia Capital China agreed to acquire a prominent stake in the South Korean luxury brand We11done, the in-house brand of the Korean concept store, Rare Market, signaling strong investor confidence in emerging domestic luxury labels.

- February 2021: Kampos, an Italian luxury brand, entered the South Korean market through a strategic partnership with Sanghyun Yu, a Seoul-based distributor with deep market knowledge, marking a key step in its global expansion strategy.

In-Depth South Korea Luxury Goods Industry Market Outlook

The South Korean luxury goods industry is set for continued robust growth, propelled by a confluence of accelerating factors. The increasing adoption of digital technologies will further enhance accessibility and personalize consumer experiences, making luxury more inclusive yet exclusive. Strategic market expansion and a focus on sustainable and ethically sourced products will resonate deeply with the evolving values of the South Korean consumer. The industry's ability to continually innovate in product design, retail experiences, and brand storytelling will be paramount. Investment in niche segments and experiential offerings presents significant future market potential, promising sustained revenue streams and brand loyalty. Navigating regulatory shifts and maintaining a strong brand narrative amidst intense competition will be critical for long-term success.

South Korea Luxury Goods Industry Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Watches

- 1.5. Jewelry

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

South Korea Luxury Goods Industry Segmentation By Geography

- 1. South Korea

South Korea Luxury Goods Industry Regional Market Share

Geographic Coverage of South Korea Luxury Goods Industry

South Korea Luxury Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sunglasses As A Fashion Statement; Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Celebrities Endorsements Driving the Demand for Luxury Goods in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Watches

- 5.1.5. Jewelry

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 We11Done

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermes International SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Estee Lauder Companies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gentle Monster

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chanel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering Group (Gucci)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolex SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & M Hennes & Mauritz AB (H&M)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Prada Holding S p A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: South Korea Luxury Goods Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Luxury Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Luxury Goods Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Korea Luxury Goods Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: South Korea Luxury Goods Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Korea Luxury Goods Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: South Korea Luxury Goods Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: South Korea Luxury Goods Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Luxury Goods Industry?

The projected CAGR is approximately 1.31%.

2. Which companies are prominent players in the South Korea Luxury Goods Industry?

Key companies in the market include Giorgio Armani S p A, We11Done, Hermes International SA, The Estee Lauder Companies Inc, LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive, Gentle Monster, Chanel, Kering Group (Gucci), Rolex SA, H & M Hennes & Mauritz AB (H&M), Prada Holding S p A.

3. What are the main segments of the South Korea Luxury Goods Industry?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Sunglasses As A Fashion Statement; Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Celebrities Endorsements Driving the Demand for Luxury Goods in South Korea.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In May 2022, Dior, the French fashion brand opened a large pop-up store in Seoul, South Korea. The store features several rooms inside, each dedicated to a definite segment of the women's ready-to-wear line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Luxury Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Luxury Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Luxury Goods Industry?

To stay informed about further developments, trends, and reports in the South Korea Luxury Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence