Key Insights

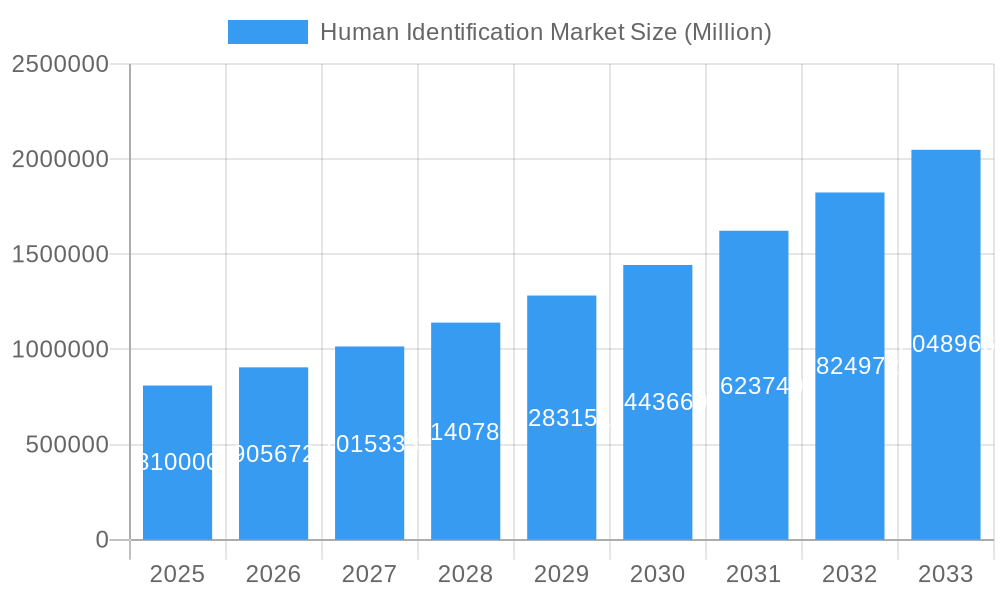

The global Human Identification Market is poised for substantial expansion, projected to reach $0.81 million by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 11.64% through 2033. This significant growth is fueled by the increasing adoption of advanced technologies such as Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS) in forensic investigations, paternity testing, and disaster victim identification. The rising demand for accurate and rapid DNA analysis, coupled with the continuous development of innovative nucleic acid purification and extraction methods, further propels market momentum. Furthermore, the expanding applications in clinical diagnostics, personalized medicine, and genetic research are contributing to a broadening market scope. Key market players are actively investing in research and development, strategic collaborations, and product launches to capitalize on these emerging opportunities and meet the evolving needs of law enforcement agencies, research institutions, and healthcare providers.

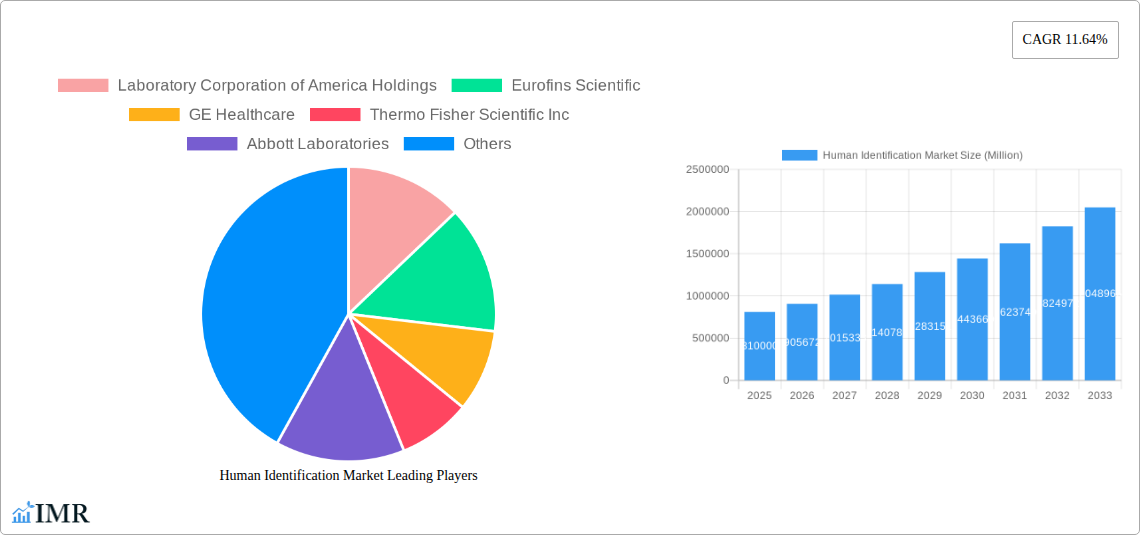

Human Identification Market Market Size (In Billion)

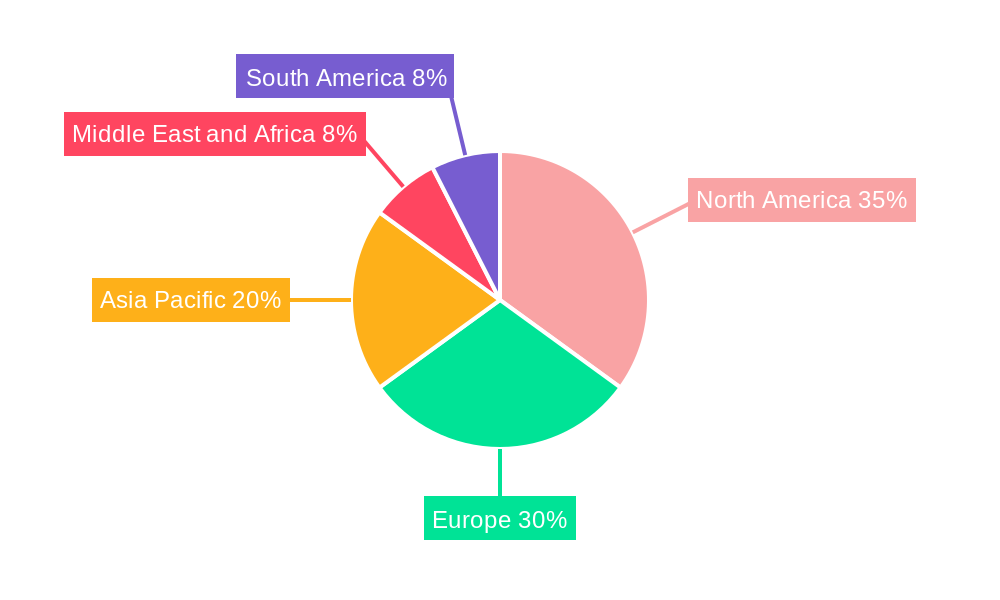

The market's expansion is also supported by a growing emphasis on homeland security and the increasing number of criminal investigations globally. The development of sophisticated software and services designed to manage and analyze large genetic datasets plays a crucial role in enhancing the efficiency of human identification processes. Despite strong growth prospects, the market may encounter challenges related to the high cost of advanced technologies and the need for specialized expertise. However, the ongoing innovation in capillary electrophoresis and rapid DNA analysis, alongside the expanding reach of these technologies into diverse applications, is expected to outweigh these restraints. Geographically, North America and Europe currently lead the market, driven by established forensic infrastructure and significant investments in R&D, while the Asia Pacific region is anticipated to witness the fastest growth due to increasing government initiatives and a growing awareness of the benefits of DNA analysis.

Human Identification Market Company Market Share

This in-depth report offers a definitive analysis of the global Human Identification Market, providing critical insights for stakeholders navigating this rapidly evolving landscape. Covering the period from 2019 to 2033, with a base year of 2025, the study meticulously examines market dynamics, growth trajectories, regional dominance, product innovation, and key industry players. Leveraging high-traffic keywords such as "DNA profiling," "forensic genetics," "paternity testing," "NGS in human identification," and "rapid DNA analysis," this report is optimized for maximum search engine visibility and industry relevance. We explore parent and child market segments, delivering a granular understanding of market segmentation and future opportunities.

Human Identification Market Market Dynamics & Structure

The Human Identification Market exhibits a moderately consolidated structure, characterized by a mix of large multinational corporations and specialized niche players. Technological innovation serves as a primary driver, with advancements in Polymerase Chain Reaction (PCR) and Next Generation Sequencing (NGS) continuously expanding the capabilities and applications of human identification. Stringent regulatory frameworks, particularly in forensic science and healthcare, dictate market entry and product development, emphasizing accuracy, reliability, and data privacy. Competitive product substitutes exist, especially in non-forensic applications, though specialized DNA analysis offers unparalleled specificity.

- Market Concentration: Dominated by key players like Thermo Fisher Scientific Inc., Qiagen N.V., and Abbott Laboratories, with a growing presence of innovative startups.

- Technological Innovation Drivers: Miniaturization of instruments, enhanced throughput of sequencing technologies, and AI-driven data analysis are key innovation areas.

- Regulatory Frameworks: Strict adherence to standards like ISO 17025 and CLIA is crucial for market access, particularly for diagnostic and forensic applications.

- End-User Demographics: A diverse user base spans law enforcement agencies, clinical diagnostic laboratories, academic research institutions, and direct-to-consumer testing providers.

- M&A Trends: Strategic acquisitions are common, aimed at consolidating market share, acquiring proprietary technologies, and expanding product portfolios. For example, reported M&A activities in the past year reached approximately 8-12 significant transactions.

Human Identification Market Growth Trends & Insights

The global Human Identification Market is poised for robust expansion, driven by increasing adoption of advanced DNA analysis techniques across diverse applications. The market size is projected to grow from an estimated USD 3,200 million in the base year 2025 to over USD 7,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 11.5% during the forecast period (2025-2033). This growth trajectory is fueled by rising crime rates, increasing demand for accurate paternity testing, advancements in personalized medicine, and government initiatives supporting forensic infrastructure development. The historical period (2019-2024) witnessed steady growth, laying the foundation for accelerated expansion.

The adoption rates of technologies like NGS and Rapid DNA Analysis are significantly increasing. NGS, for instance, is becoming more accessible and cost-effective, enabling deeper genetic insights for complex identification challenges. Rapid DNA Analysis, as evidenced by the Denver Office of the Medical Examiner's federal grant in May 2022, is revolutionizing forensic turnaround times. Consumer demand for genetic ancestry testing and health predisposition information also contributes to market penetration. Technological disruptions, such as the development of faster DNA sequencing techniques, as demonstrated by the Stanford-led research team's Guinness World Record in January 2022, are continuously pushing the boundaries of what is possible in human identification. Consumer behavior shifts towards proactive health management and a desire for definitive personal identity information are further accelerating market uptake. The integration of cloud-based data management and AI for faster interpretation of genetic data are also key trends shaping the market's future. The market is witnessing a significant surge in the use of genomics and bioinformatics tools, enabling more sophisticated analysis and identification of individuals.

Dominant Regions, Countries, or Segments in Human Identification Market

North America currently stands as the dominant region in the Human Identification Market, driven by a confluence of factors including robust government funding for forensic science, high adoption rates of advanced technologies, and a strong presence of leading market players. The United States, in particular, accounts for a significant share of this dominance, propelled by extensive use of DNA databases like CODIS for criminal investigations and a mature market for paternity testing services.

Within the Technology segment, Polymerase Chain Reaction (PCR) remains a cornerstone technology due to its established reliability and cost-effectiveness for routine DNA profiling. However, Next Generation Sequencing (NGS) is rapidly gaining traction, offering unparalleled throughput and the ability to analyze degraded or low-quantity DNA samples, which is critical in challenging forensic scenarios. The Product & Service segment is led by Assay Kits and Reagents, which form the consumable backbone of DNA analysis, followed closely by Instruments that are essential for performing various DNA extraction and profiling techniques. The Application segment is significantly propelled by Forensic Applications, where DNA profiling plays a pivotal role in crime solving and exonerations. Paternity Testing is another substantial driver, serving both legal and social needs.

Key Drivers in North America:

- Government Funding & Initiatives: Substantial investments in law enforcement and forensic science infrastructure.

- Technological Adoption: Early and widespread integration of advanced DNA technologies.

- Established Databases: Extensive national DNA databases for criminal justice applications.

- Consumer Awareness: High public awareness and demand for genetic testing services.

Dominance Factors:

- Market Share: North America commands an estimated 35-40% of the global market share.

- Growth Potential: Continued investment in forensic capabilities and expansion of direct-to-consumer genetic testing services ensure sustained growth.

- Research & Development: Presence of leading research institutions and companies fostering continuous innovation.

The Asia Pacific region is emerging as a significant growth market, driven by increasing crime rates, government focus on improving forensic capabilities, and a growing middle class with disposable income for paternity and ancestry testing. Initiatives to establish national DNA databases in countries like China and India are also contributing to market expansion.

Human Identification Market Product Landscape

The Human Identification Market's product landscape is characterized by continuous innovation aimed at improving speed, accuracy, and cost-effectiveness. Key product developments focus on miniaturized and automated DNA extraction and purification systems, enabling higher throughput and reduced sample handling. Advances in PCR and NGS technologies have led to the development of more sensitive assay kits capable of analyzing minute quantities of DNA, even from degraded samples. Software solutions are increasingly incorporating AI and machine learning for faster and more accurate interpretation of complex genetic data, aiding in both forensic analysis and clinical diagnostics. Unique selling propositions lie in the development of integrated platforms that streamline the entire workflow from sample to result, offering comprehensive solutions for laboratories and law enforcement agencies.

Key Drivers, Barriers & Challenges in Human Identification Market

Key Drivers:

- Technological Advancements: Continuous innovation in PCR, NGS, and Rapid DNA Analysis technologies.

- Increasing Crime Rates & Need for Forensics: Growing demand for DNA profiling in criminal investigations and victim identification.

- Expanding Paternity Testing Market: Rising awareness and demand for accurate DNA-based paternity and familial relationship testing.

- Government Initiatives: Investments in forensic infrastructure and the establishment of national DNA databases.

- Personalized Medicine & Research: Growing applications in genetic research and personalized health.

Barriers & Challenges:

- High Initial Investment: The cost of advanced instrumentation and software can be a significant barrier for smaller laboratories.

- Regulatory Hurdles: Stringent regulations and the need for accreditations can prolong market entry.

- Ethical Concerns & Data Privacy: Public perception and legal frameworks surrounding the collection and storage of DNA data.

- Skilled Workforce Shortage: A demand for highly trained personnel to operate advanced genetic analysis equipment.

- Sample Degradation & Contamination: Challenges in obtaining usable DNA from aged or compromised samples in forensic settings.

Emerging Opportunities in Human Identification Market

Emerging opportunities in the Human Identification Market lie in the expansion of direct-to-consumer (DTC) genetic testing for ancestry, health predispositions, and personalized wellness. The increasing integration of forensic DNA technology in public health for disease outbreak tracking and identifying disease carriers presents a significant avenue. Furthermore, the development of field-deployable rapid DNA analysis devices for on-site identification in disaster zones or law enforcement operations offers immense potential. Advances in non-invasive DNA collection methods and the application of artificial intelligence for predictive genetics are also poised to reshape the market. Untapped markets in developing regions with growing demand for forensic and diagnostic services are ripe for expansion.

Growth Accelerators in the Human Identification Market Industry

Several catalysts are accelerating the long-term growth of the Human Identification Market. Technological breakthroughs, particularly in improving the speed and accuracy of DNA sequencing and analysis, are paramount. Strategic partnerships between technology providers, research institutions, and end-users are fostering innovation and market penetration. Market expansion strategies, including the development of more affordable and user-friendly solutions, are driving adoption in emerging economies. The increasing recognition of DNA profiling's utility beyond criminal justice, such as in resolving historical mysteries and aiding in medical diagnostics, further fuels growth. The growing emphasis on bio-surveillance and public safety initiatives will also play a crucial role in market expansion.

Key Players Shaping the Human Identification Market Market

- Laboratory Corporation of America Holdings

- Eurofins Scientific

- GE Healthcare

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Qiagen N V

- Autogen Inc.

- Hamilton Company

- Agilent Technologies Inc.

- Illumina Inc.

Notable Milestones in Human Identification Market Sector

- May 2022: The Denver Office of the Medical Examiner received a USD 386,000 federal grant to purchase an in-house rapid DNA processor, enabling genetic-test results in hours for faster victim identification in mass casualty events or identification of family members of unidentified bodies.

- January 2022: A Stanford-led research team established the first Guinness World Record for the fastest DNA sequencing technique, sequencing the human genome in 5 hours and 2 minutes, significantly impacting turnaround times for complex identification.

In-Depth Human Identification Market Market Outlook

The future outlook for the Human Identification Market is exceptionally promising, driven by persistent innovation and expanding applications. Growth accelerators such as the continuous refinement of NGS technologies, making them more accessible and cost-effective, will democratize advanced genetic analysis. Strategic collaborations, especially in developing regions, will unlock new market potential for forensic and diagnostic solutions. The increasing consumer interest in personal genomics for health and ancestry will fuel the direct-to-consumer segment. Furthermore, the growing emphasis on national security and public health preparedness, coupled with advancements in bioinformatics and AI for rapid data interpretation, positions the Human Identification Market for sustained and substantial growth in the coming years.

Human Identification Market Segmentation

-

1. Technology

- 1.1. Polymerase Chain Reaction (PCR)

- 1.2. Next Generation Sequencing (NGS)

- 1.3. Nucleic Acid Purification and Extraction

- 1.4. Capillary Electrophoresis

- 1.5. Rapid DNA Analysis

- 1.6. Other Technologies

-

2. Product & Service

- 2.1. Instruments

- 2.2. Assay Kits and Reagents

- 2.3. Software and Services

-

3. Application

- 3.1. Forensic Applications

- 3.2. Paternity Testing

- 3.3. Other Applications

Human Identification Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Human Identification Market Regional Market Share

Geographic Coverage of Human Identification Market

Human Identification Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in Human Identification System; Increasing Demand for Reducing the Time and Cost of DNA Analysis; Government Initiatives and Support

- 3.3. Market Restrains

- 3.3.1. Expensive Instruments; Shortage of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Forensic Applications Segment is Expected to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Polymerase Chain Reaction (PCR)

- 5.1.2. Next Generation Sequencing (NGS)

- 5.1.3. Nucleic Acid Purification and Extraction

- 5.1.4. Capillary Electrophoresis

- 5.1.5. Rapid DNA Analysis

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Product & Service

- 5.2.1. Instruments

- 5.2.2. Assay Kits and Reagents

- 5.2.3. Software and Services

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Forensic Applications

- 5.3.2. Paternity Testing

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Polymerase Chain Reaction (PCR)

- 6.1.2. Next Generation Sequencing (NGS)

- 6.1.3. Nucleic Acid Purification and Extraction

- 6.1.4. Capillary Electrophoresis

- 6.1.5. Rapid DNA Analysis

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Product & Service

- 6.2.1. Instruments

- 6.2.2. Assay Kits and Reagents

- 6.2.3. Software and Services

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Forensic Applications

- 6.3.2. Paternity Testing

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Polymerase Chain Reaction (PCR)

- 7.1.2. Next Generation Sequencing (NGS)

- 7.1.3. Nucleic Acid Purification and Extraction

- 7.1.4. Capillary Electrophoresis

- 7.1.5. Rapid DNA Analysis

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Product & Service

- 7.2.1. Instruments

- 7.2.2. Assay Kits and Reagents

- 7.2.3. Software and Services

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Forensic Applications

- 7.3.2. Paternity Testing

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Polymerase Chain Reaction (PCR)

- 8.1.2. Next Generation Sequencing (NGS)

- 8.1.3. Nucleic Acid Purification and Extraction

- 8.1.4. Capillary Electrophoresis

- 8.1.5. Rapid DNA Analysis

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Product & Service

- 8.2.1. Instruments

- 8.2.2. Assay Kits and Reagents

- 8.2.3. Software and Services

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Forensic Applications

- 8.3.2. Paternity Testing

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Polymerase Chain Reaction (PCR)

- 9.1.2. Next Generation Sequencing (NGS)

- 9.1.3. Nucleic Acid Purification and Extraction

- 9.1.4. Capillary Electrophoresis

- 9.1.5. Rapid DNA Analysis

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Product & Service

- 9.2.1. Instruments

- 9.2.2. Assay Kits and Reagents

- 9.2.3. Software and Services

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Forensic Applications

- 9.3.2. Paternity Testing

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Polymerase Chain Reaction (PCR)

- 10.1.2. Next Generation Sequencing (NGS)

- 10.1.3. Nucleic Acid Purification and Extraction

- 10.1.4. Capillary Electrophoresis

- 10.1.5. Rapid DNA Analysis

- 10.1.6. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Product & Service

- 10.2.1. Instruments

- 10.2.2. Assay Kits and Reagents

- 10.2.3. Software and Services

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Forensic Applications

- 10.3.2. Paternity Testing

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Laboratory Corporation of America Holdings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott Laboratories

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qiagen N V *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Autogen Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hamilton Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent TechnologiesInc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Illumina Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Laboratory Corporation of America Holdings

List of Figures

- Figure 1: Global Human Identification Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 5: North America Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 6: North America Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Human Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 13: Europe Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 14: Europe Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Human Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 19: Asia Pacific Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 21: Asia Pacific Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 22: Asia Pacific Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Human Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 29: Middle East and Africa Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 30: Middle East and Africa Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Middle East and Africa Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Human Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 35: South America Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: South America Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 37: South America Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 38: South America Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 39: South America Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Human Identification Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 3: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Human Identification Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 7: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 14: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 23: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 24: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 33: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 34: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 40: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 41: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Human Identification Market?

The projected CAGR is approximately 11.64%.

2. Which companies are prominent players in the Human Identification Market?

Key companies in the market include Laboratory Corporation of America Holdings, Eurofins Scientific, GE Healthcare, Thermo Fisher Scientific Inc, Abbott Laboratories, Qiagen N V *List Not Exhaustive, Autogen Inc, Hamilton Company, Agilent TechnologiesInc, Illumina Inc.

3. What are the main segments of the Human Identification Market?

The market segments include Technology, Product & Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in Human Identification System; Increasing Demand for Reducing the Time and Cost of DNA Analysis; Government Initiatives and Support.

6. What are the notable trends driving market growth?

Forensic Applications Segment is Expected to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Instruments; Shortage of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

May 2022: the Denver Office of the Medical Examiner received a USD 386,000 federal grant to purchase an in-house rapid DNA processor - technology that can produce genetic-test results in a matter of hours, allowing for faster identification of victims in mass casualty events or assisting in the identification of family members of unidentified bodies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Human Identification Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Human Identification Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Human Identification Market?

To stay informed about further developments, trends, and reports in the Human Identification Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence