Key Insights

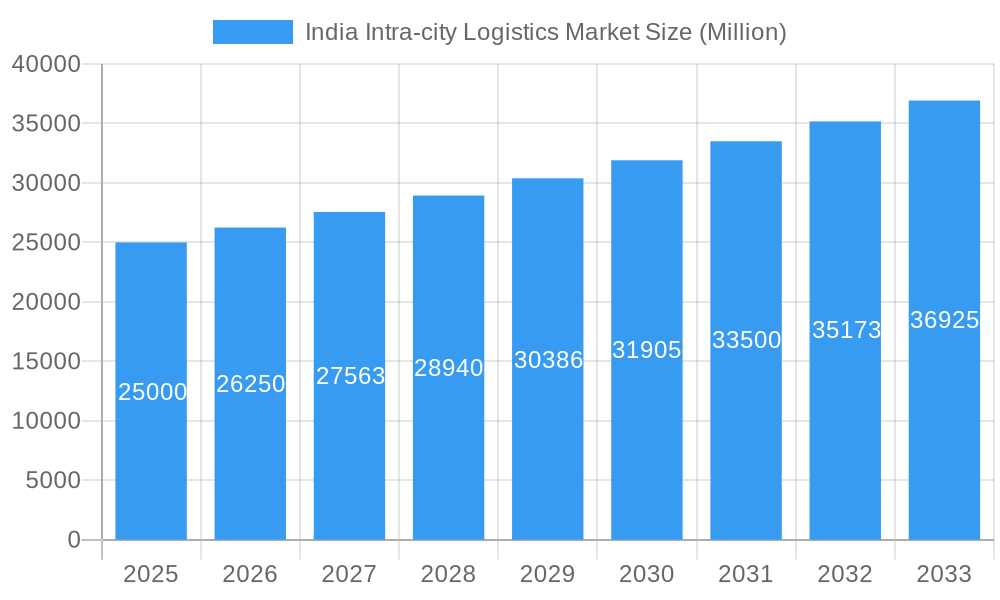

The India intra-city logistics market is experiencing robust growth, driven by the burgeoning e-commerce sector, rapid urbanization, and increasing consumer demand for faster deliveries. The market, valued at approximately ₹XX million in 2025 (assuming a logical estimate based on the provided CAGR of >5% and unspecified market size XX), is projected to witness a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. Key drivers include the expansion of online retail platforms, the rise of quick commerce models emphasizing rapid delivery within cities, and the increasing adoption of technology-enabled logistics solutions. Significant trends shaping the market include the integration of advanced technologies like AI, IoT, and big data analytics for improved efficiency and route optimization, the growing preference for sustainable and eco-friendly delivery options, and the emergence of specialized services catering to specific industry needs such as healthcare and food delivery. While challenges remain, such as infrastructure limitations in certain areas and fluctuating fuel prices, the overall market outlook remains positive, fueled by continuous innovation and the expanding reach of e-commerce across diverse Indian cities.

India Intra-city Logistics Market Market Size (In Billion)

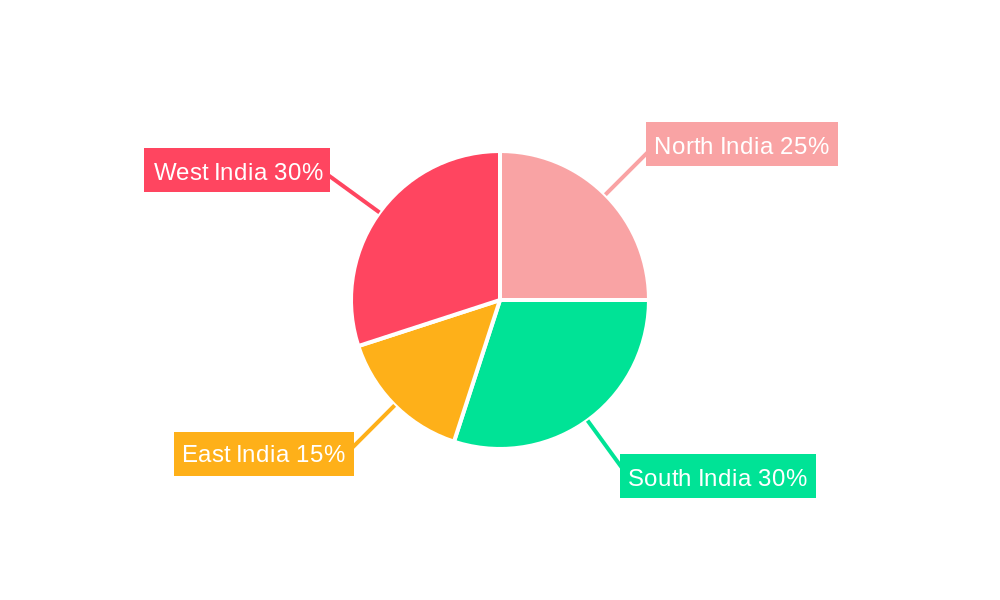

The market segmentation reveals significant opportunities across various city tiers. Metropolitan cities like Delhi, Mumbai, Bangalore, Hyderabad, and Chennai dominate the market share due to high population density and substantial e-commerce activity. However, the "Others" segment, encompassing smaller cities and towns, is poised for substantial growth, reflecting the increasing penetration of online retail into previously underserved areas. Service-wise, Transportation forms the largest segment, followed by warehousing and distribution, and value-added services like last-mile delivery and reverse logistics. The competitive landscape is characterized by a mix of established players like DTDC and Ecom Express, alongside rapidly growing tech-enabled startups like Shadowfax, Porter, and cityXfer, indicating a dynamic and competitive market environment. The regional breakdown showcases significant variations, with South and West India potentially exhibiting faster growth rates due to the concentration of major tech hubs and e-commerce operations. The forecast period (2025-2033) presents lucrative prospects for established and emerging players seeking to capitalize on the expanding market and emerging trends.

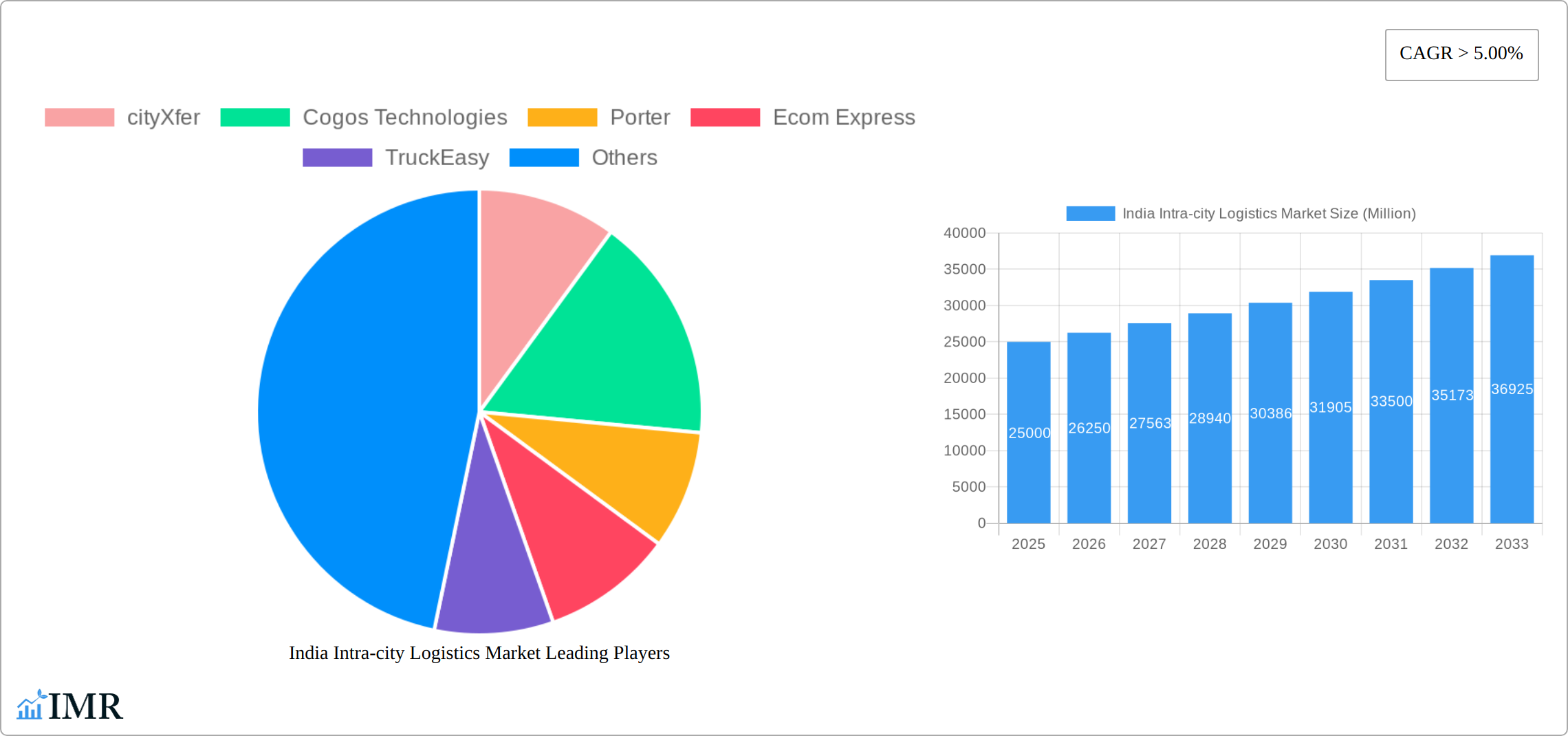

India Intra-city Logistics Market Company Market Share

India Intra-city Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India intra-city logistics market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is crucial for businesses, investors, and policymakers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market is segmented by city (Delhi, Bangalore, Mumbai, Hyderabad, Chennai, Others) and service (Transportation, Warehousing and Distribution, Value-added Services).

India Intra-city Logistics Market Dynamics & Structure

The Indian intra-city logistics market is characterized by high fragmentation, with numerous small and medium-sized enterprises (SMEs) competing alongside larger players. Market concentration is relatively low, with the top five players holding a combined market share of approximately xx%. Technological innovation, particularly in areas like route optimization software, real-time tracking, and automated warehousing, is a key driver of growth. However, challenges remain, including the lack of standardized infrastructure, regulatory hurdles, and the need for skilled labor. Mergers and acquisitions (M&A) activity is increasing, reflecting the consolidation trend within the sector. Recent deals like Mahindra Logistics' acquisition of Whizzard highlight this trend.

Key Dynamics:

- Market Concentration: Low, with significant fragmentation. Top 5 players hold xx% market share (2024).

- Technological Innovation: Focus on route optimization, real-time tracking, and automation.

- Regulatory Framework: Complex and evolving, posing challenges for businesses.

- Competitive Product Substitutes: Limited, with most services being specialized.

- End-User Demographics: Diverse, including e-commerce businesses, FMCG companies, and individual consumers.

- M&A Trends: Increasing consolidation, with several significant acquisitions in recent years. Deal volume increased by xx% from 2022 to 2023.

India Intra-city Logistics Market Growth Trends & Insights

The Indian intra-city logistics market is experiencing robust growth, driven by the burgeoning e-commerce sector, rapid urbanization, and increasing consumer demand for faster delivery. The market size is estimated at xx million units in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is projected to continue during the forecast period (2025-2033), reaching xx million units by 2033. Market penetration is increasing, particularly in metropolitan areas. Technological disruptions, such as the adoption of electric vehicles and the use of AI-powered route optimization, are further accelerating market expansion. Consumer behavior shifts toward convenience and on-demand services are also significantly impacting growth.

Dominant Regions, Countries, or Segments in India Intra-city Logistics Market

The intra-city logistics market in India is primarily driven by its major metropolitan hubs, with Delhi, Mumbai, Bangalore, Hyderabad, and Chennai leading the charge. Delhi commands the largest market share, propelled by its substantial e-commerce ecosystem and high population density. Bangalore, with its thriving IT sector and strong consumer base, also holds a significant position. In terms of service segments, Transportation currently represents the largest share, followed closely by Warehousing and Distribution. However, Value-added services are exhibiting the most rapid growth, indicating an escalating demand for tailored and advanced logistics solutions.

Key Drivers:

- Robust Economic Expansion: India's consistent GDP growth underpins the escalating need for efficient and timely logistics services.

- Explosive E-commerce Growth: The relentless surge in online retail significantly amplifies the demand for swift and reliable intra-city delivery networks.

- Accelerated Urbanization: The increasing concentration of populations in urban centers inherently creates greater logistical complexity and a heightened demand for localized delivery solutions.

- Supportive Government Policies: Strategic government focus on enhancing infrastructure and optimizing logistics efficiency plays a crucial role in market development.

Dominant Segments (Illustrative Market Share):

- By City: Delhi (approx. 25% market share), Bangalore (approx. 20%), Mumbai (approx. 18%), Hyderabad (approx. 15%), Chennai (approx. 12%), Others (approx. 10%).

- By Service: Transportation (approx. 45% market share), Warehousing and Distribution (approx. 35%), Value-added Services (approx. 20%).

India Intra-city Logistics Market Product Landscape

The product landscape within the India intra-city logistics market is exceptionally diverse and continuously evolving. It encompasses a broad spectrum of services, including rapid express deliveries, convenient same-day delivery options, specialized temperature-controlled transportation for sensitive goods, and sophisticated warehousing solutions tailored to specific needs. Technological integration is a defining characteristic, leading to the introduction of groundbreaking products and services. These include advanced AI-powered route optimization software that minimizes delivery times and fuel consumption, real-time tracking systems offering unparalleled visibility to clients, and the adoption of automated guided vehicles (AGVs) for enhanced efficiency within warehouse operations. These innovations not only boost operational efficiency and reduce costs but also significantly elevate service quality, thereby strengthening the unique competitive advantages of various market players.

Key Drivers, Barriers & Challenges in India Intra-city Logistics Market

Key Drivers:

- E-commerce growth: fuels demand for fast, reliable last-mile delivery.

- Urbanization and rising population: necessitates efficient intra-city logistics.

- Technological advancements: improve efficiency and reduce costs.

Challenges & Restraints:

- Infrastructure limitations: Poor road conditions and traffic congestion hinder efficiency.

- Regulatory complexities: Varying regulations across cities pose challenges.

- High fuel costs: Increase operational expenses.

- Driver shortages and high driver turnover: affect service reliability.

Emerging Opportunities in India Intra-city Logistics Market

The Indian intra-city logistics market is ripe with burgeoning opportunities, particularly in the following areas:

- Geographic Expansion to Tier 2 and Tier 3 Cities: Significant untapped potential exists in these developing urban centers, offering substantial growth prospects beyond the primary metropolitan areas.

- Development of Niche & Specialized Logistics Solutions: A growing demand for industry-specific logistics services, such as those required for the healthcare, pharmaceutical, and perishable goods sectors, presents a key area for innovation and specialization.

- Integration of Cutting-Edge Technologies: The incorporation of emerging technologies like blockchain promises to enhance transparency, traceability, and security throughout the logistics chain, building greater trust with stakeholders.

- Emphasis on Sustainable and Green Logistics: There is a substantial and growing opportunity in adopting environmentally friendly practices, including the deployment of electric vehicles (EVs) and the implementation of eco-conscious operational strategies.

Growth Accelerators in the India Intra-city Logistics Market Industry

The sustained expansion of the India intra-city logistics market will be significantly propelled by a confluence of factors. The ongoing and anticipated surge in e-commerce penetration will continue to be a primary driver. Complementing this, substantial government investments in infrastructure development, aimed at improving road networks and creating logistical hubs, will further enhance efficiency. Continuous technological innovation, leading to more sophisticated and cost-effective solutions, will be crucial. Furthermore, strategic partnerships and collaborations between logistics providers and e-commerce giants will foster synergistic growth. The accelerating adoption of electric vehicles for last-mile deliveries and the proactive development of smart city initiatives will also play a pivotal role in accelerating the market's trajectory.

Key Players Shaping the India Intra-city Logistics Market Market

- cityXfer

- Cogos Technologies

- Porter

- Ecom Express

- TruckEasy

- DTDC

- FM Logistic India

- Lets Transport

- Shadowfax

- Blowhorn

- Deliverant

- Zylofon Logistics

Notable Milestones in India Intra-city Logistics Market Sector

- July 2022: Bengaluru-based COGOS Technologies acquired Porter's FMCG modern trade business.

- November 2022: Mahindra Logistics acquired delivery services provider Whizzard.

In-Depth India Intra-city Logistics Market Market Outlook

The India intra-city logistics market holds immense potential for growth, driven by continued urbanization, technological advancements, and the expansion of e-commerce. Strategic partnerships, investments in technology, and a focus on sustainable practices will be crucial for players seeking to capitalize on the numerous opportunities within this dynamic sector. The market is poised for significant expansion in the coming years, with significant potential for both established players and new entrants.

India Intra-city Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Distribution

- 1.3. Value-added Services

-

2. City

- 2.1. Delhi

- 2.2. Bangalore

- 2.3. Mumbai

- 2.4. Hyderabad

- 2.5. Chennai

- 2.6. Others

India Intra-city Logistics Market Segmentation By Geography

- 1. India

India Intra-city Logistics Market Regional Market Share

Geographic Coverage of India Intra-city Logistics Market

India Intra-city Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industrial Growth Supporting the Market; Global Trade Driving the Market

- 3.3. Market Restrains

- 3.3.1. Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Intra-city Logistics from Tier-2 and Tier- 3 Cities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Intra-city Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Distribution

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Delhi

- 5.2.2. Bangalore

- 5.2.3. Mumbai

- 5.2.4. Hyderabad

- 5.2.5. Chennai

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 cityXfer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cogos Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Porter

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecom Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TruckEasy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DTDC**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FM Logistic India

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lets Transport

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shadowfax

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Blowhorn

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 cityXfer

List of Figures

- Figure 1: India Intra-city Logistics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Intra-city Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: India Intra-city Logistics Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 2: India Intra-city Logistics Market Revenue undefined Forecast, by City 2020 & 2033

- Table 3: India Intra-city Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Intra-city Logistics Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 5: India Intra-city Logistics Market Revenue undefined Forecast, by City 2020 & 2033

- Table 6: India Intra-city Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Intra-city Logistics Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the India Intra-city Logistics Market?

Key companies in the market include cityXfer, Cogos Technologies, Porter, Ecom Express, TruckEasy, DTDC**List Not Exhaustive, FM Logistic India, Lets Transport, Shadowfax, Blowhorn.

3. What are the main segments of the India Intra-city Logistics Market?

The market segments include Service, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Industrial Growth Supporting the Market; Global Trade Driving the Market.

6. What are the notable trends driving market growth?

Growing Demand for Intra-city Logistics from Tier-2 and Tier- 3 Cities.

7. Are there any restraints impacting market growth?

Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market.

8. Can you provide examples of recent developments in the market?

November 2022 - Mahindra Logistics acquired delivery services provider Whizzard. Mahindra Logistic's current last-mile delivery business and its electric vehicle-based delivery services would be enhanced by the acquisition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Intra-city Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Intra-city Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Intra-city Logistics Market?

To stay informed about further developments, trends, and reports in the India Intra-city Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence