Key Insights

India's Liquid Silicone Rubber (LSR) market is poised for substantial expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 7%. With a market size of $1.28 billion in the base year 2024, key growth drivers include the automotive sector's increasing adoption of LSR for components like seals and gaskets, the electronics industry's use in encapsulation and molding, and the healthcare sector's demand for biocompatible LSR in medical devices. The growing consumer goods market, particularly for personal care and home appliances, also contributes significantly due to LSR's inherent flexibility, durability, and temperature resistance. While specific market segmentation data is limited, the automotive and electronics industries are anticipated to hold dominant market shares. Future growth, from 2025 to 2033, will be fueled by advancements in LSR formulations and expanding manufacturing capabilities within India. Prominent players such as Dow Corning, Elkem Silicones, Momentive Performance Materials, and Wacker Chemicals are strategically positioned to benefit from this upward trend.

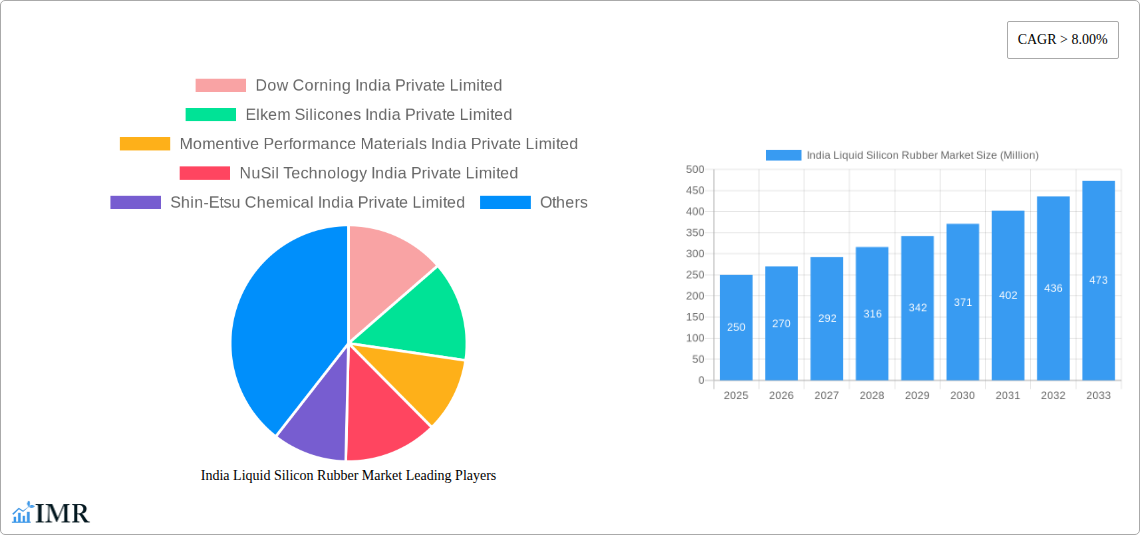

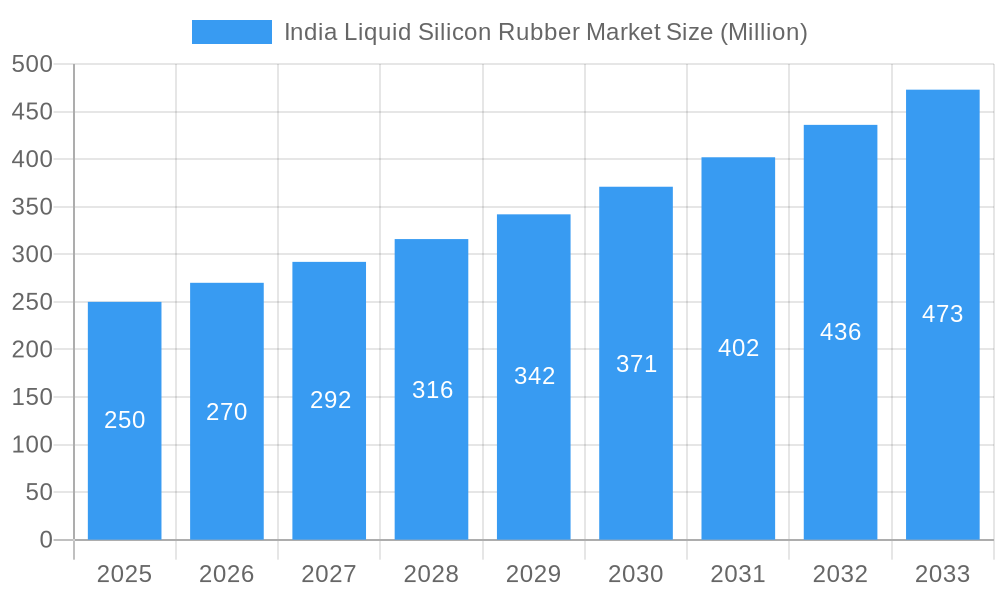

India Liquid Silicon Rubber Market Market Size (In Billion)

The competitive environment features a mix of domestic and international manufacturers, underscoring the market's investment appeal. Potential growth restraints, including raw material price volatility and regulatory compliance, are expected to be mitigated by strong market demand. Future market expansion will depend on continuous innovation in LSR technology, the development of new application areas, and a commitment to sustainable manufacturing practices.

India Liquid Silicon Rubber Market Company Market Share

India Liquid Silicon Rubber Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India liquid silicon rubber market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and stakeholders. The market is segmented by type, application, and region, providing a granular view of the market's structure and potential. The total market size is valued at xx Million USD in 2025 and is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period.

India Liquid Silicon Rubber Market Market Dynamics & Structure

The India liquid silicon rubber market is characterized by moderate concentration, with several major players and a number of smaller regional players. Technological innovation, particularly in high-performance materials and sustainable manufacturing processes, is a key driver. Stringent regulatory frameworks regarding material safety and environmental impact are shaping market dynamics. Competitive substitutes, such as thermoplastic elastomers (TPEs), pose challenges, while the growing demand from key end-use sectors such as automotive, healthcare, and electronics is boosting market growth. Mergers and acquisitions (M&A) activity within the sector remains moderate, with occasional strategic alliances shaping the competitive landscape.

- Market Concentration: Moderately concentrated, with a top 5 market share of approximately xx%.

- Technological Innovation: Focus on improving thermal conductivity, UV resistance, and biocompatibility.

- Regulatory Framework: Compliance with RoHS, REACH, and other relevant regulations.

- Competitive Substitutes: TPEs and other elastomers offer competition in certain applications.

- End-User Demographics: Strong growth driven by automotive, healthcare, and electronics sectors.

- M&A Activity: xx M&A deals observed in the period 2019-2024, primarily focused on expanding regional presence and product portfolios.

India Liquid Silicon Rubber Market Growth Trends & Insights

The India liquid silicon rubber market has witnessed steady growth over the past few years, driven by increasing industrialization, rising disposable incomes, and growing demand from various end-use sectors. The automotive industry, particularly the burgeoning electric vehicle (EV) segment, is a major driver of market growth. Adoption rates are increasing, especially in applications requiring high durability, flexibility, and chemical resistance. Technological advancements in silicone formulations are leading to superior performance characteristics, further boosting market adoption. Shifting consumer preferences towards eco-friendly products are also impacting the demand for sustainable silicone rubber solutions. The market size is projected to expand significantly, propelled by factors such as infrastructure development and government initiatives promoting industrial growth.

- Market Size Evolution: Experienced a xx% CAGR during 2019-2024, projected to grow at xx% CAGR from 2025-2033.

- Adoption Rates: Increasing adoption in automotive, healthcare, and electronics due to superior performance characteristics.

- Technological Disruptions: Advancements in silicone formulations, leading to enhanced properties.

- Consumer Behavior Shifts: Growing preference for sustainable and eco-friendly materials.

Dominant Regions, Countries, or Segments in India Liquid Silicon Rubber Market

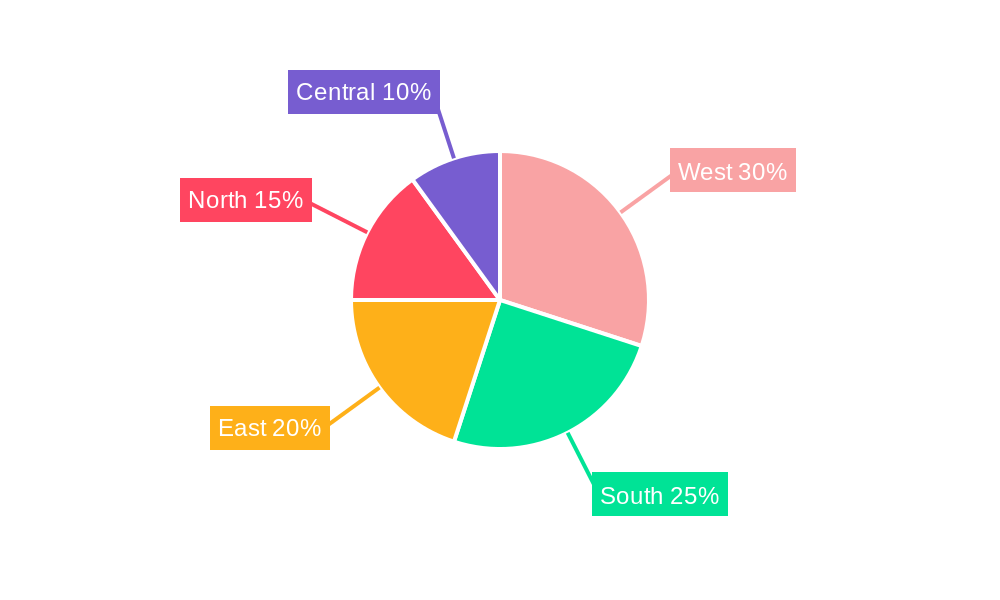

The western and southern regions of India currently dominate the liquid silicone rubber market due to a high concentration of manufacturing facilities, strong automotive and electronics industries, and supportive government policies. Maharashtra and Tamil Nadu are leading states due to their advanced industrial infrastructure and a large consumer base. The automotive segment is the leading end-use application, driven by the rising demand for automobiles, particularly two-wheelers and passenger cars. Growth is further accelerated by strong government initiatives promoting domestic manufacturing and attracting foreign investment.

- Key Drivers:

- Strong automotive and electronics industries

- Favorable government policies and infrastructure development

- High population density and increasing disposable incomes

- Dominance Factors:

- Concentration of manufacturing facilities in certain regions

- High demand from key end-use sectors

- Government incentives promoting domestic manufacturing

India Liquid Silicon Rubber Market Product Landscape

Liquid silicone rubber products are available in a wide range of viscosities, curing systems (addition and condensation), and hardness. Innovations focus on enhancing thermal conductivity, electrical insulation properties, and biocompatibility. Advancements include the development of low-temperature curing silicones for faster processing and improved sustainability features, including lower volatile organic compound (VOC) emissions. Unique selling propositions often focus on tailored performance characteristics to meet specific application requirements.

Key Drivers, Barriers & Challenges in India Liquid Silicon Rubber Market

Key Drivers:

- The burgeoning automotive industry, particularly the EV segment, fuels demand for high-performance liquid silicone rubber components.

- Growth in the healthcare sector drives the need for biocompatible silicone rubber for medical devices.

- Increasing demand for durable and versatile materials in the electronics industry creates opportunities.

Key Challenges and Restraints:

- Fluctuations in raw material prices pose significant challenges to profitability.

- Stringent regulatory compliance and environmental concerns impact manufacturing costs.

- Intense competition from both domestic and international players adds pressure.

- Supply chain disruptions can impact production and delivery timelines.

Emerging Opportunities in India Liquid Silicon Rubber Market

Emerging opportunities lie in the growing renewable energy sector, particularly solar power and wind turbines, which require high-performance sealing materials. The increasing adoption of 3D printing technologies offers potential for customized silicone rubber products. Expansion into niche markets, like personal care and cosmetics, represents another promising area. Finally, focusing on sustainable and eco-friendly silicone rubber solutions can attract environmentally conscious customers.

Growth Accelerators in the India Liquid Silicon Rubber Market Industry

Technological advancements in silicone formulation, leading to enhanced properties like higher thermal conductivity and improved biocompatibility, are significant growth accelerators. Strategic partnerships between silicone manufacturers and end-use industries enable tailored solutions and enhance market penetration. Government initiatives promoting industrial growth and attracting foreign investment create a favorable business environment.

Key Players Shaping the India Liquid Silicon Rubber Market Market

- Dow Corning India Private Limited

- Elkem Silicones India Private Limited

- Momentive Performance Materials India Private Limited

- NuSil Technology India Private Limited

- Shin-Etsu Chemical India Private Limited

- Silicones India Private Limited

- Stockwell Elastomerics India Private Limited

- Specialty Silicone Products India Private Limited

- Wacker Chemicals India Private Limited

*List Not Exhaustive

Notable Milestones in India Liquid Silicon Rubber Market Sector

July 2022: WACKER opened a new silicone production site in Panagarh, India, expanding its manufacturing capacity and enhancing its presence in the Indian market. This signifies a major investment in the country's silicone rubber sector and strengthens its position to cater to growing local demands, particularly in the medical, electromobility, and power transmission sectors.

April 2022: Shin-Etsu Chemical Co., Ltd. launched a new line of silicone rubber sheets with thermal interface materials for electric vehicle parts. This innovation addresses the critical need for efficient heat dissipation in high-voltage EV components, solidifying the company's position in the rapidly growing EV market and signaling a potential increase in demand for specialized silicone rubber products.

In-Depth India Liquid Silicon Rubber Market Market Outlook

The India liquid silicone rubber market is poised for strong growth in the coming years, driven by ongoing industrialization, technological advancements, and supportive government policies. The increasing demand from key end-use sectors, particularly automotive and healthcare, will continue to fuel market expansion. Strategic investments in research and development, focused on developing sustainable and high-performance materials, will further propel market growth. Companies that successfully leverage technological advancements and adapt to evolving consumer preferences will be best positioned for long-term success.

India Liquid Silicon Rubber Market Segmentation

-

1. Type

- 1.1. Food Grade LSR

- 1.2. Industrial Grade LSR

- 1.3. Medical Grade LSR

-

2. End-user Industry

- 2.1. Healthcare and Medical Devices

- 2.2. Automotive

- 2.3. Electrical and Electronics

- 2.4. Consumer Goods

- 2.5. Beauty and Personal Care

- 2.6. Other End-user Industries

India Liquid Silicon Rubber Market Segmentation By Geography

- 1. India

India Liquid Silicon Rubber Market Regional Market Share

Geographic Coverage of India Liquid Silicon Rubber Market

India Liquid Silicon Rubber Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand from Food Processing and Packaging Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Demand from Food Processing and Packaging Industries; Other Drivers

- 3.4. Market Trends

- 3.4.1. Strong Demand for Medical Grade Liquid Silicone Rubber (LSR)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Liquid Silicon Rubber Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Food Grade LSR

- 5.1.2. Industrial Grade LSR

- 5.1.3. Medical Grade LSR

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare and Medical Devices

- 5.2.2. Automotive

- 5.2.3. Electrical and Electronics

- 5.2.4. Consumer Goods

- 5.2.5. Beauty and Personal Care

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dow Corning India Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elkem Silicones India Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Momentive Performance Materials India Private Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NuSil Technology India Private Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shin-Etsu Chemical India Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silicones India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silicones India Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stockwell Elastomerics India Private Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Specialty Silicone Products India Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wacker Chemicals India Private Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dow Corning India Private Limited

List of Figures

- Figure 1: India Liquid Silicon Rubber Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Liquid Silicon Rubber Market Share (%) by Company 2025

List of Tables

- Table 1: India Liquid Silicon Rubber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Liquid Silicon Rubber Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: India Liquid Silicon Rubber Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Liquid Silicon Rubber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: India Liquid Silicon Rubber Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Liquid Silicon Rubber Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Liquid Silicon Rubber Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the India Liquid Silicon Rubber Market?

Key companies in the market include Dow Corning India Private Limited, Elkem Silicones India Private Limited, Momentive Performance Materials India Private Limited, NuSil Technology India Private Limited, Shin-Etsu Chemical India Private Limited, Silicones India Private Limited, Silicones India Private Limited, Stockwell Elastomerics India Private Limited, Specialty Silicone Products India Private Limited, Wacker Chemicals India Private Limited*List Not Exhaustive.

3. What are the main segments of the India Liquid Silicon Rubber Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand from Food Processing and Packaging Industries; Other Drivers.

6. What are the notable trends driving market growth?

Strong Demand for Medical Grade Liquid Silicone Rubber (LSR).

7. Are there any restraints impacting market growth?

Demand from Food Processing and Packaging Industries; Other Drivers.

8. Can you provide examples of recent developments in the market?

July 2022: WACKER opened a new silicone production site in Panagarh, India. The plant will manufacture silicone rubber and ready-to-use compounds for medical technology, electromobility, and electrical transmission & distribution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Liquid Silicon Rubber Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Liquid Silicon Rubber Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Liquid Silicon Rubber Market?

To stay informed about further developments, trends, and reports in the India Liquid Silicon Rubber Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence