Key Insights

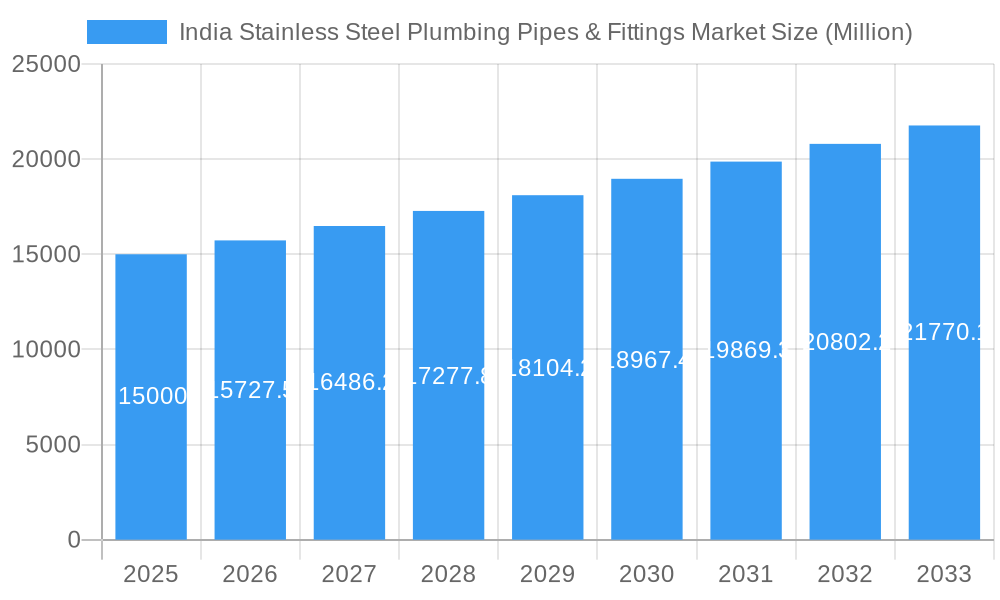

The Indian Stainless Steel Plumbing Pipes and Fittings market is poised for substantial expansion, propelled by rapid urbanization, rising disposable incomes, and a growing preference for hygienic, durable plumbing systems. The market was valued at ₹88.1 billion in the base year 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% from 2025 to 2033. This growth is driven by increased construction activities in both residential and non-residential sectors, particularly in burgeoning urban centers. Stainless steel's inherent corrosion resistance, longevity, and low maintenance requirements are key adoption drivers. The market is segmented by sales channel (retail, e-commerce, direct), pipe type (seamless, welded, fabricated), market structure (organized, unorganized), and end-user industry (residential, non-residential). E-commerce channels are witnessing accelerated growth, reflecting shifts in consumer purchasing behavior and advancements in India's online retail infrastructure. While the organized sector dominates, the unorganized sector remains a significant contributor, especially in tier-2 and tier-3 cities. Market expansion is moderately influenced by fluctuations in raw material costs and competitive pressures from alternative materials. Nevertheless, sustained infrastructure development and a rising demand for premium plumbing solutions ensure a positive long-term outlook.

India Stainless Steel Plumbing Pipes & Fittings Market Market Size (In Billion)

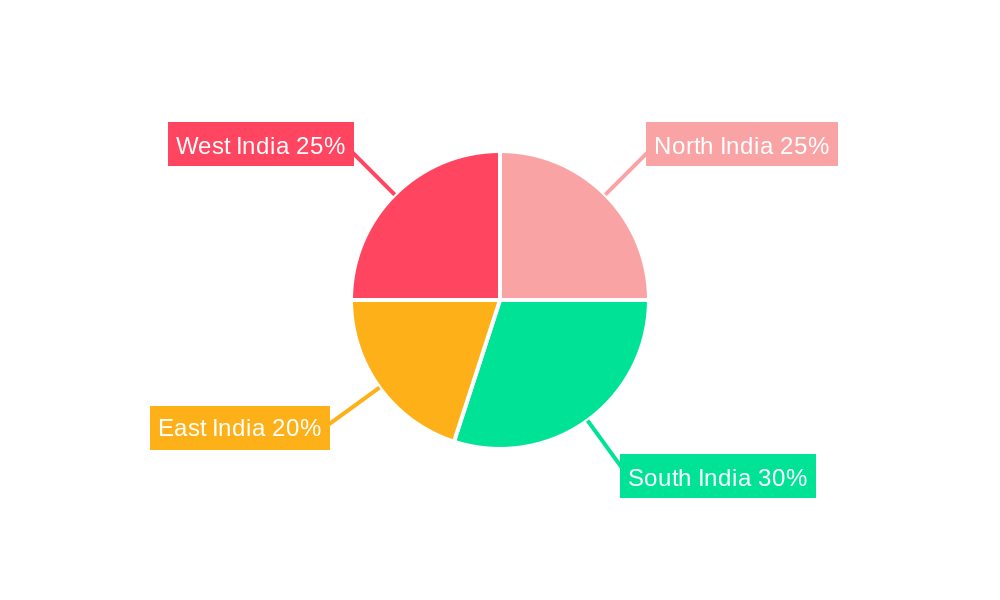

Key market participants include Umiyatubes Private Limited, Vishal Steel India, Jindal Stainless Ltd, Ratnamani Metals & Tubes Limited, Nippon Steel Corporation, Geberit Plumbing Technology India Private Limited, Viega India Private Limited, Steel Tubes India, APL Apollo, Maharashtra Seamless Ltd, and Sachiya Steel International. Regional growth disparities are evident, with the Southern and Western regions exhibiting higher growth rates due to robust economic activity and increased real estate development. Northern and Eastern India present considerable future growth potential driven by ongoing urbanization and government infrastructure development initiatives. This indicates significant opportunities for both established players and new entrants to leverage market expansion by targeting specific segments and geographies, and by implementing innovative marketing and distribution strategies.

India Stainless Steel Plumbing Pipes & Fittings Market Company Market Share

India Stainless Steel Plumbing Pipes & Fittings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Stainless Steel Plumbing Pipes & Fittings market, encompassing market dynamics, growth trends, regional performance, product landscape, and competitive analysis. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. This analysis is crucial for businesses operating within the broader Indian building materials market and the specific stainless steel pipes and fittings segment.

India Stainless Steel Plumbing Pipes & Fittings Market Market Dynamics & Structure

The Indian stainless steel plumbing pipes and fittings market is characterized by a dynamic interplay of factors influencing its growth trajectory. Market concentration is moderate, with several key players vying for market share. Technological innovation, particularly in areas like corrosion resistance and improved durability, is a crucial driver. The regulatory landscape, including building codes and standards, significantly impacts market practices. Competitive pressure from substitute materials like PVC and CPVC pipes exists but is balanced by the inherent advantages of stainless steel, such as hygiene and longevity. End-user demographics, particularly the growth of the middle class and urbanization, fuel demand. Furthermore, M&A activity, as seen in recent deals, indicates a trend towards consolidation within the industry.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on enhanced corrosion resistance, seamless welding techniques, and smart plumbing solutions.

- Regulatory Framework: Adherence to IS codes and BIS standards influences product specifications and quality.

- Competitive Substitutes: PVC, CPVC, and galvanized steel pipes pose competition.

- End-User Demographics: Urbanization and rising disposable incomes drive market growth.

- M&A Trends: Consolidation through acquisitions and mergers, as exemplified by Maharashtra Seamless Ltd.'s acquisition of United Seamless Tubular Private Limited in February 2022.

India Stainless Steel Plumbing Pipes & Fittings Market Growth Trends & Insights

The Indian stainless steel plumbing pipes and fittings market has witnessed significant growth over the historical period (2019-2024). Driven by robust infrastructure development, rising construction activity, and increasing preference for durable and hygienic plumbing systems, the market size has expanded considerably. This growth trajectory is expected to continue throughout the forecast period (2025-2033), although at a slightly moderated pace compared to the historical period. The adoption rate of stainless steel pipes and fittings is increasing, particularly in premium residential and commercial projects. Technological disruptions, such as the introduction of advanced manufacturing techniques and smart plumbing systems, are further accelerating market expansion. Changes in consumer behavior, including a growing preference for eco-friendly and long-lasting products, are positively influencing demand. The market is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period.

Dominant Regions, Countries, or Segments in India Stainless Steel Plumbing Pipes & Fittings Market

The market is expected to witness robust growth across various segments and regions. While detailed regional breakdown is beyond the scope of this description, the analysis will reveal regional variations influenced by construction activity and economic development. Regarding segments:

- Sales Channel: The retail channel dominates, followed by the direct sales channel, while e-commerce continues to grow.

- Type: Seamless pipes enjoy higher market share due to superior strength and durability compared to welded and fabricated pipes.

- Market Structure: The organized sector holds a significant share, while the unorganized sector also plays a role.

- End-user Industry: The residential sector is the largest consumer, followed by non-residential segments like commercial buildings and industrial facilities. Rapid urbanization in metropolitan areas like Mumbai, Delhi, Bengaluru, and Hyderabad will drive significant growth in these sectors.

Key drivers include favorable government policies promoting affordable housing, infrastructure development projects, and rising private investments in construction. The dominance of certain segments and regions is based on factors such as infrastructure development, purchasing power, and access to organized retail networks.

India Stainless Steel Plumbing Pipes & Fittings Market Product Landscape

The Indian market offers a range of stainless steel plumbing pipes and fittings, catering to diverse needs and preferences. Products vary in terms of grade, diameter, surface finish, and application-specific design. Seamless pipes, owing to their superior strength and durability, are widely preferred for high-pressure applications. Welded and fabricated pipes find use in less demanding applications. Manufacturers emphasize enhanced corrosion resistance, hygienic properties, and easy installation as key selling points. Technological advancements are focused on optimizing manufacturing processes, improving material properties, and developing innovative designs to meet the evolving requirements of the construction industry.

Key Drivers, Barriers & Challenges in India Stainless Steel Plumbing Pipes & Fittings Market

Key Drivers:

- Increasing urbanization and infrastructure development.

- Growing preference for hygienic and durable plumbing solutions.

- Favorable government policies promoting affordable housing and infrastructure projects.

Key Challenges:

- Fluctuations in raw material prices (stainless steel) impacting production costs.

- Competition from substitute materials like PVC and CPVC.

- Supply chain disruptions due to logistical challenges, potentially resulting in a xx% increase in lead times.

Emerging Opportunities in India Stainless Steel Plumbing Pipes & Fittings Market

- Growth of affordable housing schemes: Opening up new markets in the lower-income segments.

- Smart plumbing solutions: Integrating technology for water management and efficiency.

- Expansion into rural areas: Capturing demand in emerging markets.

Growth Accelerators in the India Stainless Steel Plumbing Pipes & Fittings Market Industry

Sustained growth will be driven by ongoing infrastructure investments, the increasing adoption of sustainable building practices, and technological innovations that enhance the performance and cost-effectiveness of stainless steel plumbing systems. Strategic partnerships between manufacturers and builders will further accelerate market penetration, leading to a projected xx% market expansion by 2033.

Key Players Shaping the India Stainless Steel Plumbing Pipes & Fittings Market Market

- Umiyatubes Private Limited

- Vishal Steel India

- Jindal Stainless Ltd

- Ratnamani Metals & Tubes Limited

- Nippon Steel Corporation

- Geberit Plumbing Technology India Private Limited

- Viega India Private Limited

- Steel Tubes India

- APL Apollo

- Maharashtra Seamless Ltd

- Sachiya Steel International

Notable Milestones in India Stainless Steel Plumbing Pipes & Fittings Market Sector

- April 2022: Jindal Stainless Limited's planned capacity expansion to 25.2 MTPA by 2030 signals significant investment in the Indian stainless steel industry, potentially increasing market supply and competitiveness.

- February 2022: Maharashtra Seamless Ltd.'s acquisition of United Seamless Tubular Private Limited consolidates market share and strengthens its position in the seamless pipes and tubes segment.

In-Depth India Stainless Steel Plumbing Pipes & Fittings Market Market Outlook

The future of the Indian stainless steel plumbing pipes and fittings market appears promising. Continued urbanization, rising disposable incomes, and government support for infrastructure development will drive long-term growth. Technological advancements, including the development of innovative products and efficient manufacturing processes, will enhance market competitiveness. Strategic partnerships and expansion into untapped markets will further propel market expansion, creating significant opportunities for industry players. The market's potential for growth remains significant, with strategic positioning and innovation paving the way for long-term success.

India Stainless Steel Plumbing Pipes & Fittings Market Segmentation

-

1. Type

- 1.1. Seamless

- 1.2. Welded

- 1.3. Fabricated

-

2. Market Structure

- 2.1. Organized

- 2.2. Unorganized

-

3. End-user Industry

- 3.1. Residential

- 3.2. Non-residential

-

4. Sales Channel

- 4.1. Retail

- 4.2. E-commerce

- 4.3. Direct

India Stainless Steel Plumbing Pipes & Fittings Market Segmentation By Geography

- 1. India

India Stainless Steel Plumbing Pipes & Fittings Market Regional Market Share

Geographic Coverage of India Stainless Steel Plumbing Pipes & Fittings Market

India Stainless Steel Plumbing Pipes & Fittings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Residential and Non-residential Industry; High Temperature and Corrosion Resistance Compared to Available Counterparts

- 3.3. Market Restrains

- 3.3.1. Increasing Polymer-based Substitutes such as PVC

- 3.4. Market Trends

- 3.4.1. Growing Demand for Stainless-Steel Welded Pipes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Stainless Steel Plumbing Pipes & Fittings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Seamless

- 5.1.2. Welded

- 5.1.3. Fabricated

- 5.2. Market Analysis, Insights and Forecast - by Market Structure

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Non-residential

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Retail

- 5.4.2. E-commerce

- 5.4.3. Direct

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Umiyatubes Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vishal Steel India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jindal Stainless Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ratnamani Metals & Tubes Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Steel Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Geberit Plumbing Technology India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Viega India Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Steel Tubes India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 APL Apollo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Maharashtra Seamless Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sachiya Steel International

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Umiyatubes Private Limited

List of Figures

- Figure 1: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Stainless Steel Plumbing Pipes & Fittings Market Share (%) by Company 2025

List of Tables

- Table 1: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by Market Structure 2020 & 2033

- Table 3: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 5: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by Market Structure 2020 & 2033

- Table 8: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 10: India Stainless Steel Plumbing Pipes & Fittings Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Stainless Steel Plumbing Pipes & Fittings Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the India Stainless Steel Plumbing Pipes & Fittings Market?

Key companies in the market include Umiyatubes Private Limited, Vishal Steel India, Jindal Stainless Ltd*List Not Exhaustive, Ratnamani Metals & Tubes Limited, Nippon Steel Corporation, Geberit Plumbing Technology India Private Limited, Viega India Private Limited, Steel Tubes India, APL Apollo, Maharashtra Seamless Ltd, Sachiya Steel International.

3. What are the main segments of the India Stainless Steel Plumbing Pipes & Fittings Market?

The market segments include Type, Market Structure, End-user Industry, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Residential and Non-residential Industry; High Temperature and Corrosion Resistance Compared to Available Counterparts.

6. What are the notable trends driving market growth?

Growing Demand for Stainless-Steel Welded Pipes.

7. Are there any restraints impacting market growth?

Increasing Polymer-based Substitutes such as PVC.

8. Can you provide examples of recent developments in the market?

April 2022: Jindal Stainless Limited (JSL) planned to expand the capacity of the steel plant to 25.2 MTPA at Angul, Odhisha, by 2030. This capacity expansion is expected to increase JSPL's investment in Odisha to more than INR 1,25,000 crore (USD 15,875 million) from INR 45,000 crore (USD 5,715 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Stainless Steel Plumbing Pipes & Fittings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Stainless Steel Plumbing Pipes & Fittings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Stainless Steel Plumbing Pipes & Fittings Market?

To stay informed about further developments, trends, and reports in the India Stainless Steel Plumbing Pipes & Fittings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence