Key Insights

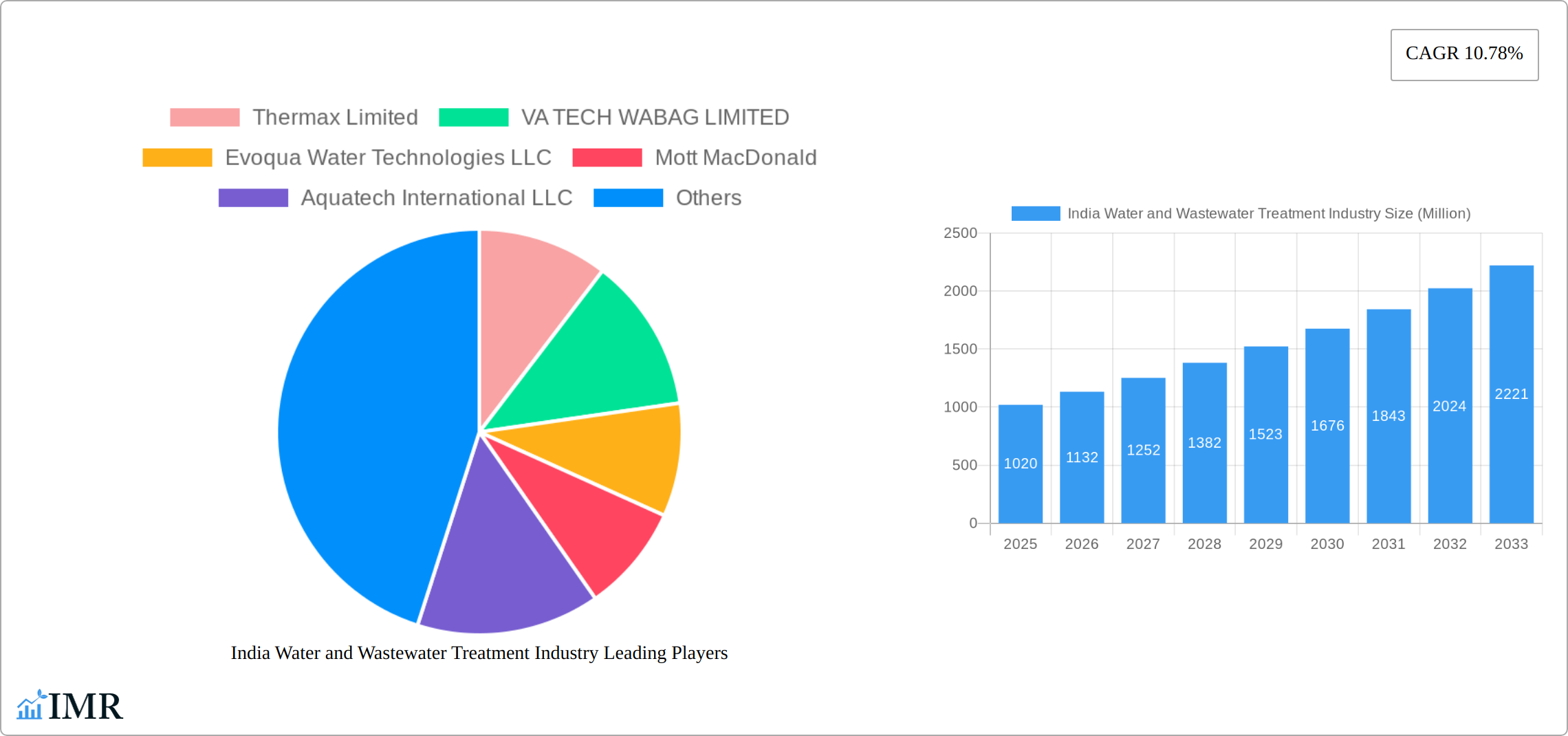

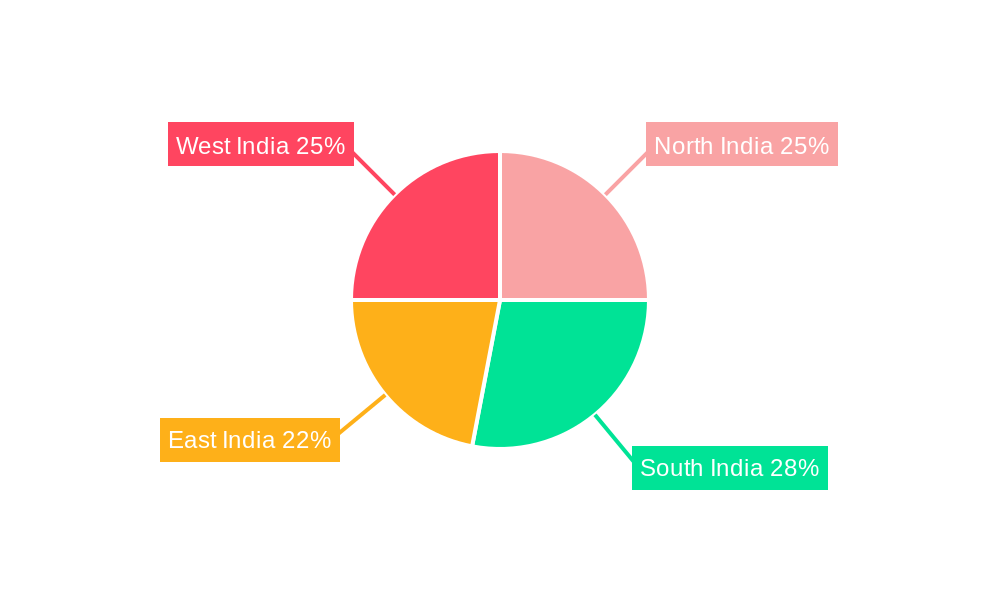

The Indian water and wastewater treatment market, valued at approximately $1.02 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.78% from 2025 to 2033. This expansion is driven by several factors. Increasing urbanization and industrialization lead to higher water demands and greater wastewater generation, necessitating advanced treatment solutions. Stringent government regulations aimed at improving water quality and sanitation are further stimulating market growth. The rising prevalence of waterborne diseases underscores the need for effective treatment infrastructure, boosting investment in both municipal and industrial projects. Furthermore, technological advancements in treatment processes, such as membrane filtration and advanced oxidation processes, are enhancing efficiency and reducing operational costs. The market is segmented by treatment equipment (process control equipment, pumps) and end-user industries (municipal, food and beverage, pulp and paper, oil and gas, healthcare, poultry and agriculture, chemical and petrochemical, others). Key players like Thermax Limited, VA Tech Wabag Limited, and Evoqua Water Technologies are driving innovation and competition. Regional variations exist within India, with potential for significant growth across all regions (North, South, East, and West), driven by varying levels of urbanization and industrial development.

India Water and Wastewater Treatment Industry Market Size (In Billion)

The forecast period (2025-2033) suggests a significant market expansion. Growth will likely be influenced by government initiatives promoting water conservation and infrastructure development, along with private sector investments in water treatment projects. Challenges remain, including infrastructure limitations, funding constraints for large-scale projects, and the need for skilled workforce development. However, the overall outlook for the Indian water and wastewater treatment market remains exceptionally positive, driven by increasing environmental awareness and a rising commitment to sustainable water management practices. The market is expected to surpass $3 billion by 2033, presenting substantial opportunities for both established and emerging players.

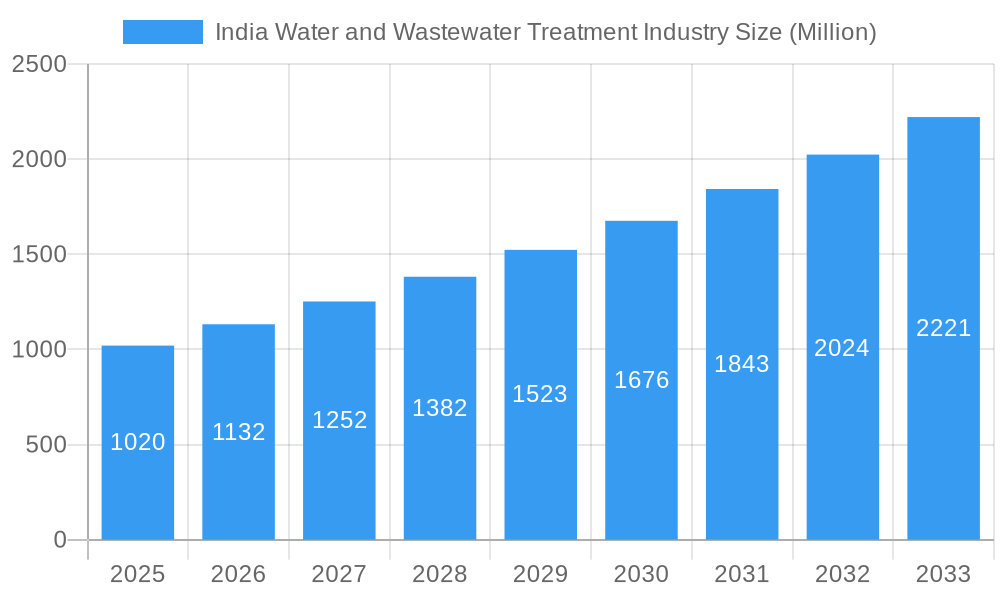

India Water and Wastewater Treatment Industry Company Market Share

India Water and Wastewater Treatment Industry Market Report: 2019-2033

This comprehensive report offers an in-depth analysis of the burgeoning India water and wastewater treatment industry, providing invaluable insights for industry professionals, investors, and strategic planners. With a focus on market dynamics, growth trends, and key players, this report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The report segments the market by treatment equipment (Process Control Equipment, Pumps), end-user industry (Municipal, Food and Beverage, Pulp and Paper, Oil and Gas, Healthcare, Poultry and Agriculture, Chemical and Petrochemical, Other End-user Industries), and key players, providing a granular understanding of this vital sector.

India Water and Wastewater Treatment Industry Market Dynamics & Structure

The Indian water and wastewater treatment market is characterized by a moderately fragmented structure with both large multinational corporations and smaller domestic players vying for market share. Technological innovation, driven by the need for efficient and sustainable solutions, is a key driver. Stringent regulatory frameworks, aimed at improving water quality and managing wastewater effectively, are shaping industry practices. Competitive pressure from substitute technologies and increasing demand from diverse end-user industries further influence the market dynamics. The market has witnessed several mergers and acquisitions (M&A) in recent years, reflecting consolidation and strategic expansion efforts.

- Market Concentration: Moderately fragmented, with a few large players holding significant shares but numerous smaller players also contributing. (Market share data will be provided in the full report, estimated xx% for top 5 players in 2025).

- Technological Innovation: Focus on advanced technologies like membrane filtration, UV disinfection, and AI-driven process optimization. (Further details on specific technologies and their market penetration will be provided.)

- Regulatory Framework: Stringent environmental regulations driving investment in advanced treatment technologies and sustainable practices. (Specific regulations and their impact will be detailed in the full report).

- Competitive Substitutes: Emerging technologies such as decentralized treatment systems and water reuse solutions present competitive pressures. (Comparative analysis of substitute technologies will be included).

- M&A Trends: Increased M&A activity observed in recent years, indicating consolidation and strategic expansion within the industry. (Number and value of M&A deals in the historical period will be presented).

- End-User Demographics: Growing urbanization and industrialization are driving demand across various sectors, especially the municipal and industrial segments. (Analysis of end-user demand across sectors will be detailed).

India Water and Wastewater Treatment Industry Growth Trends & Insights

The Indian water and wastewater treatment market is experiencing robust and sustained expansion, propelled by a confluence of powerful forces. Rapid urbanization continues to drive demand for efficient municipal wastewater management, while escalating industrialization across diverse sectors necessitates sophisticated industrial wastewater treatment solutions. A heightened national consciousness regarding environmental sustainability and water resource preservation is also playing a pivotal role in shaping market dynamics. Government-led initiatives, including significant investments in water infrastructure development and the 'Jal Jeevan Mission' and 'Swachh Bharat Abhiyan', are acting as substantial catalysts for market growth. Furthermore, the industry is witnessing a transformative wave of technological innovation. The widespread adoption of advanced treatment technologies such as Membrane Bioreactors (MBRs), Reverse Osmosis (RO), and Ultraviolet (UV) disinfection, coupled with the increasing integration of automation and digital solutions, is significantly enhancing operational efficiency, improving water quality, and reducing treatment costs. This technological evolution is not only meeting current demands but also anticipating future needs, positioning India as a key player in advanced water management.

Consumer and industrial preferences are increasingly gravitating towards sustainable, resource-efficient, and environmentally benign water treatment solutions, fostering a demand for green technologies and water recycling systems.

(Specific quantitative data on market size evolution, Compound Annual Growth Rate (CAGR), and market penetration rates for different segments and technologies will be provided in the full report.)

Dominant Regions, Countries, or Segments in India Water and Wastewater Treatment Industry

The Indian water and wastewater treatment market presents a dynamic landscape with significant regional disparities in adoption rates and growth trajectories. The Municipal segment remains the predominant end-user, driven by extensive government programs aimed at enhancing urban sanitation, wastewater collection, and treatment capacity across burgeoning cities. Concurrently, the rapidly expanding Industrial sector is a major growth engine, with key contributions from sectors like Chemical and Petrochemical, Food and Beverage, Pharmaceuticals, and Pulp & Paper, all of which face stringent effluent discharge norms and growing demands for water reuse. Within the treatment equipment domain, segments such as Pumps, Aerators, Filters, and Process Control Equipment are witnessing substantial growth, reflecting the increasing demand for technologically advanced, energy-efficient, and automated solutions that ensure optimal performance and compliance.

- Key Drivers:

- Accelerated urbanization and industrial expansion.

- Significant and sustained government investments in water and wastewater infrastructure projects.

- Increasingly stringent environmental regulations and discharge standards.

- Growing national and global awareness of water scarcity and the critical need for conservation and efficient management.

- Rising demand for high-quality treated water for industrial processes and potable purposes.

- Dominant Segments:

- End-user: Municipal (Projected market value: xx Million USD), Industrial (Projected market value: xx Million USD)

- Treatment Equipment: Pumps (Projected market value: xx Million USD), Process Control & Automation Equipment (Projected market value: xx Million USD), Filtration Systems (Projected market value: xx Million USD)

(Detailed regional breakdown with market share data for each segment, including specific state-level insights and competitive landscape analysis, will be provided in the full report).

India Water and Wastewater Treatment Industry Product Landscape

The product landscape is characterized by a range of advanced treatment technologies, including membrane filtration systems, reverse osmosis (RO), ultrafiltration (UF), and advanced oxidation processes (AOP). These systems cater to diverse applications, delivering efficient water purification and wastewater treatment solutions. Innovations focus on energy efficiency, reduced footprint, and automation to meet the demands of a growing market. Unique selling propositions include tailored solutions, improved performance metrics, and reduced operating costs.

Key Drivers, Barriers & Challenges in India Water and Wastewater Treatment Industry

Key Drivers: The market is significantly propelled by proactive government policies and initiatives focused on water conservation, sanitation improvement, and the creation of robust water infrastructure. The relentless pace of industrialization and urbanization continues to augment the demand for effective wastewater management. Growing environmental consciousness among both the public and industries is a crucial driver, pushing for cleaner production processes and responsible water usage. Technological advancements are providing more efficient, sustainable, and cost-effective treatment solutions, further stimulating market growth.

Key Barriers & Challenges: Despite the positive growth trajectory, the industry faces several hurdles. The high initial capital investment required for setting up advanced treatment plants remains a significant barrier, particularly for smaller municipalities and nascent industries. A notable challenge is the lack of adequate awareness and technical expertise in many smaller urban and rural areas regarding the operation and maintenance of sophisticated water treatment technologies. Inadequate existing infrastructure, especially in remote regions, poses a considerable challenge to widespread implementation. The need for a skilled workforce capable of operating and maintaining advanced systems is paramount. Furthermore, supply chain disruptions, fluctuating raw material costs, and regulatory uncertainties can also impact the pace of market growth and project execution. (Quantitative impact of these challenges on market growth and potential mitigation strategies will be provided in the full report).

Emerging Opportunities in India Water and Wastewater Treatment Industry

The India water and wastewater treatment industry is ripe with burgeoning opportunities. The vast, largely untapped potential in rural areas for improved water and sanitation infrastructure presents a significant growth avenue. The increasing imperative for water conservation is driving a robust demand for advanced water reuse and recycling technologies, transforming wastewater from a liability into a valuable resource. The adoption of smart water management solutions, leveraging the Internet of Things (IoT) and Artificial Intelligence (AI), is opening new frontiers for real-time monitoring, predictive maintenance, process optimization, and enhanced operational efficiency. Innovative applications of these digital technologies are poised to revolutionize how water resources are managed and treated. Furthermore, evolving consumer preferences and corporate social responsibility mandates are fueling the demand for sustainable, green, and circular economy-aligned water treatment solutions, creating a fertile ground for eco-friendly innovations.

Growth Accelerators in the India Water and Wastewater Treatment Industry Industry

Technological breakthroughs in membrane technology, automation, and AI-driven solutions are accelerating market growth. Strategic partnerships between technology providers and infrastructure developers are fostering innovation and expansion. Government policies promoting public-private partnerships (PPPs) and investments in water infrastructure further accelerate market expansion.

Key Players Shaping the India Water and Wastewater Treatment Market

- Thermax Limited

- VA TECH WABAG LIMITED

- Evoqua Water Technologies LLC

- Mott MacDonald

- Aquatech International LLC

- Hitachi Ltd

- DuPont

- Hindustan Dorr-Oliver Ltd

- Suez

- Siemens Water Solutions

- Schlumberger Limited

- Veolia

Notable Milestones in India Water and Wastewater Treatment Industry Sector

- November 2022: WABAG LIMITED secured USD 24.6 million funding from the Asian Development Bank for its water treatment business. This signifies increased investor confidence in the sector.

- August 2022: Launch of the ClearBlack Sewage Treatment Plant by Huliot Pipes, customized for the Indian market, demonstrates the growing focus on wastewater recycling and reuse.

In-Depth India Water and Wastewater Treatment Industry Market Outlook

The Indian water and wastewater treatment market is poised for sustained growth, driven by strong government support, increasing private sector participation, and technological advancements. The focus on sustainable solutions and water reuse presents significant strategic opportunities for businesses to capitalize on this expanding market. The continued investment in infrastructure, coupled with the need to address water scarcity and improve sanitation, will ensure a robust and promising outlook for the years to come.

India Water and Wastewater Treatment Industry Segmentation

-

1. Equipment Type

-

1.1. Treatment Equipment

- 1.1.1. Oil/Water Separation

- 1.1.2. Suspended Solids Removal

- 1.1.3. Dissolved Solids Removal

- 1.1.4. Biological Treatment/Nutrient and Metals Recovery

- 1.1.5. Disinfection/Oxidation

- 1.1.6. Other Treatment Equipment

- 1.2. Process Control Equipment and Pumps

-

1.1. Treatment Equipment

-

2. End-user Industry

- 2.1. Municipal

- 2.2. Food and Beverage

- 2.3. Pulp and Paper

- 2.4. Oil and Gas

- 2.5. Healthcare

- 2.6. Poultry and Agriculture

- 2.7. Chemical and Petrochemical

- 2.8. Other End-user Industries

India Water and Wastewater Treatment Industry Segmentation By Geography

- 1. India

India Water and Wastewater Treatment Industry Regional Market Share

Geographic Coverage of India Water and Wastewater Treatment Industry

India Water and Wastewater Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Diminishing Fresh Water Resources; Growing Wastewater Complexities

- 3.3. Market Restrains

- 3.3.1. High Cost of Water Treatment Technology

- 3.4. Market Trends

- 3.4.1. Treatment Equipment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Water and Wastewater Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Treatment Equipment

- 5.1.1.1. Oil/Water Separation

- 5.1.1.2. Suspended Solids Removal

- 5.1.1.3. Dissolved Solids Removal

- 5.1.1.4. Biological Treatment/Nutrient and Metals Recovery

- 5.1.1.5. Disinfection/Oxidation

- 5.1.1.6. Other Treatment Equipment

- 5.1.2. Process Control Equipment and Pumps

- 5.1.1. Treatment Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Municipal

- 5.2.2. Food and Beverage

- 5.2.3. Pulp and Paper

- 5.2.4. Oil and Gas

- 5.2.5. Healthcare

- 5.2.6. Poultry and Agriculture

- 5.2.7. Chemical and Petrochemical

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Thermax Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 VA TECH WABAG LIMITED

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Evoqua Water Technologies LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mott MacDonald

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aquatech International LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hitachi Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DuPont

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hindustan Dorr-Oliver Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Suez

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siemens Water Solutions

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Schlumberger Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Veolia

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Thermax Limited

List of Figures

- Figure 1: India Water and Wastewater Treatment Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Water and Wastewater Treatment Industry Share (%) by Company 2025

List of Tables

- Table 1: India Water and Wastewater Treatment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: India Water and Wastewater Treatment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: India Water and Wastewater Treatment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Water and Wastewater Treatment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: India Water and Wastewater Treatment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: India Water and Wastewater Treatment Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Water and Wastewater Treatment Industry?

The projected CAGR is approximately 10.78%.

2. Which companies are prominent players in the India Water and Wastewater Treatment Industry?

Key companies in the market include Thermax Limited, VA TECH WABAG LIMITED, Evoqua Water Technologies LLC, Mott MacDonald, Aquatech International LLC, Hitachi Ltd, DuPont, Hindustan Dorr-Oliver Ltd, Suez, Siemens Water Solutions, Schlumberger Limited, Veolia.

3. What are the main segments of the India Water and Wastewater Treatment Industry?

The market segments include Equipment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Diminishing Fresh Water Resources; Growing Wastewater Complexities.

6. What are the notable trends driving market growth?

Treatment Equipment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost of Water Treatment Technology.

8. Can you provide examples of recent developments in the market?

November 2022: WABAG LIMITED signed an agreement with the Asian Development Bank ('ADB') for raising a fund of INR 200 crores (~ USD 24.6 million) through unlisted Non-Convertible Debentures carrying five years and three months tenors. ADB will subscribe to it for over 12 months in its water treatment business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Water and Wastewater Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Water and Wastewater Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Water and Wastewater Treatment Industry?

To stay informed about further developments, trends, and reports in the India Water and Wastewater Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence