Key Insights

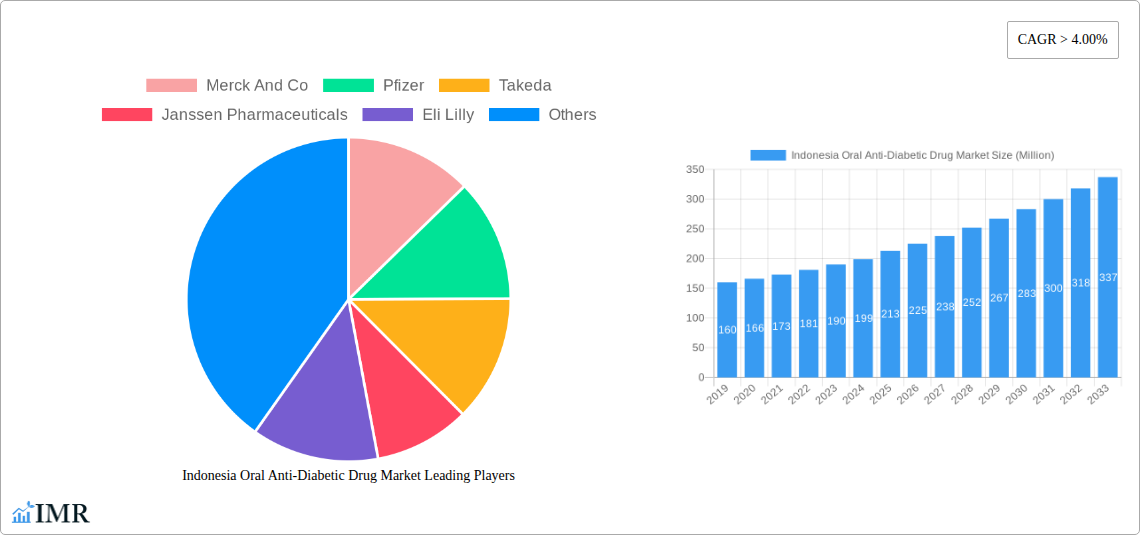

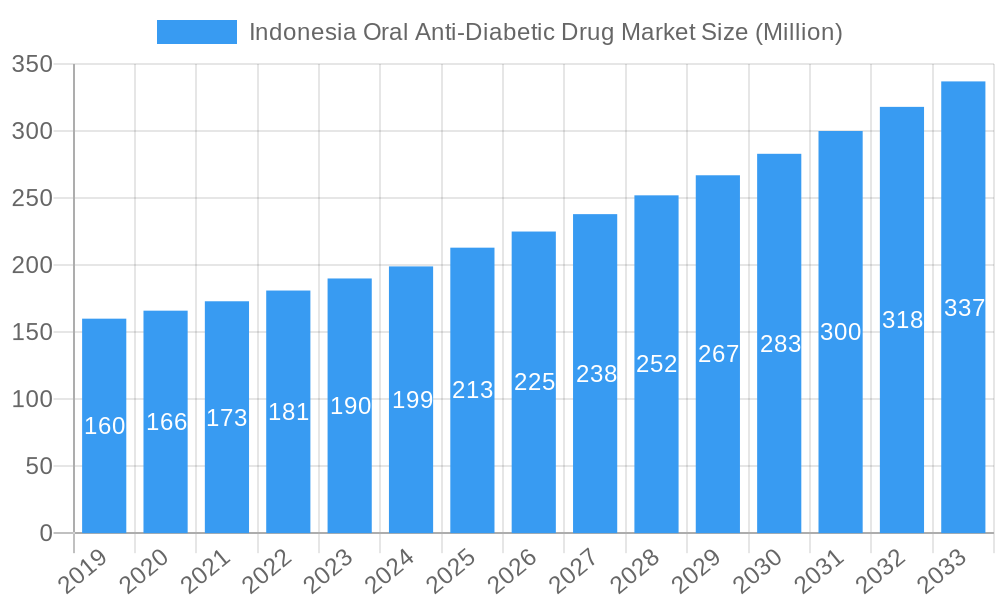

The Indonesian oral anti-diabetic drug market is poised for robust growth, projected to reach USD 213 Million by 2025, expanding at a compound annual growth rate (CAGR) of over 4.00% through 2033. This expansion is fueled by several key drivers, primarily the escalating prevalence of type 2 diabetes within the Indonesian population, driven by lifestyle changes, increasing obesity rates, and an aging demographic. Furthermore, growing health awareness and the accessibility of oral anti-diabetic medications contribute significantly to market penetration. The market is segmented across various product classes, including Biguanides, alpha-glucosidase inhibitors, dopamine D2 receptor agonists, SGLT-2 inhibitors, DPP-4 inhibitors, sulfonylureas, and meglitinides, each catering to specific patient needs and therapeutic approaches. Leading global pharmaceutical companies such as Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, and Astellas are actively involved, driving innovation and expanding market reach through their diverse product portfolios and strategic initiatives.

Indonesia Oral Anti-Diabetic Drug Market Market Size (In Million)

The Indonesian oral anti-diabetic drug market is witnessing significant trends that will shape its trajectory. Increased adoption of newer drug classes like SGLT-2 inhibitors and DPP-4 inhibitors, owing to their improved efficacy and favorable side-effect profiles, is a notable trend. Moreover, a growing emphasis on patient adherence and convenience is promoting the use of oral formulations over injectables. However, the market also faces certain restraints. The affordability of newer, patented drugs remains a concern for a significant portion of the population, potentially limiting widespread adoption. The rise of generic alternatives, while increasing accessibility, can also put pressure on profit margins for branded medications. Additionally, challenges in healthcare infrastructure and patient education regarding diabetes management, particularly in rural areas, can impede market growth. Despite these challenges, the overall outlook for the Indonesian oral anti-diabetic drug market remains highly positive, driven by the persistent and growing need for effective diabetes management solutions.

Indonesia Oral Anti-Diabetic Drug Market Company Market Share

Gain unparalleled insights into the rapidly expanding Indonesia Oral Anti-Diabetic Drug Market, a crucial segment within the broader anti-diabetic drug market. This comprehensive report analyzes market dynamics, growth trajectories, competitive landscapes, and emerging opportunities for oral anti-diabetic medications in Indonesia. Discover the key drivers and challenges shaping the future of diabetes management, and identify strategic avenues for growth in this high-potential market. We forecast the market to reach XX Million Units by 2033, driven by increasing diabetes prevalence and a growing demand for effective, accessible oral therapies.

Indonesia Oral Anti-Diabetic Drug Market Dynamics & Structure

The Indonesia Oral Anti-Diabetic Drug Market is characterized by a dynamic interplay of factors shaping its structure and growth. Market concentration is moderately fragmented, with leading global pharmaceutical players and emerging local manufacturers vying for market share. Technological innovation is a significant driver, with continuous research and development focusing on novel drug classes offering improved efficacy and safety profiles. Regulatory frameworks, while evolving, play a crucial role in drug approval processes and market access. Competitive product substitutes are abundant, ranging from older, established therapies to newer, advanced molecules. End-user demographics are heavily influenced by the rising prevalence of Type 2 Diabetes Mellitus (T2DM) across all age groups, particularly the adult population. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate their market position, expand their product portfolios, and gain access to new distribution channels.

- Market Concentration: Moderate fragmentation with a mix of global and local players.

- Technological Innovation Drivers: Focus on novel drug mechanisms, improved patient adherence, and reduced side effects.

- Regulatory Frameworks: Evolving landscape influencing drug approvals, pricing, and market entry strategies.

- Competitive Product Substitutes: Wide range of oral anti-diabetic drugs, including Biguanides, DPP-4 inhibitors, SGLT-2 inhibitors, and Sulfonylureas.

- End-User Demographics: Driven by increasing T2DM prevalence, aging population, and lifestyle changes.

- M&A Trends: Strategic acquisitions to enhance market presence and product pipelines.

Indonesia Oral Anti-Diabetic Drug Market Growth Trends & Insights

The Indonesia Oral Anti-Diabetic Drug Market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is fueled by a confluence of factors including a steadily increasing diabetes prevalence, which has reached epidemic proportions in Indonesia, coupled with a growing awareness among the population and healthcare providers regarding the importance of effective blood sugar management. The adoption rates of newer oral anti-diabetic drug classes, such as SGLT-2 inhibitors and DPP-4 inhibitors, are steadily rising due to their favorable efficacy and safety profiles, often demonstrating superior outcomes in clinical trials compared to traditional therapies. Technological disruptions are playing a pivotal role, with advancements in drug formulation leading to improved patient adherence and reduced administration complexity. Furthermore, shifts in consumer behavior, driven by a greater emphasis on proactive health management and a demand for patient-centric treatment options, are directly influencing market dynamics. The market size evolution will be closely tracked, with the Base Year 2025 providing a critical benchmark for assessing future performance.

Dominant Regions, Countries, or Segments in Indonesia Oral Anti-Diabetic Drug Market

Within the Indonesia Oral Anti-Diabetic Drug Market, the Biguanides product class stands out as a dominant segment, consistently holding a significant market share. This dominance is attributed to several key drivers. Firstly, Metformin, the most prominent Biguanide, remains a first-line therapy for Type 2 Diabetes Mellitus globally and in Indonesia, owing to its long-standing efficacy, affordability, and well-established safety profile. The economic policies in Indonesia have historically favored the accessibility of essential medicines, and Biguanides, being generics in many cases, align well with these policies. Furthermore, the infrastructure for distributing and dispensing Biguanides is widespread and robust across the archipelago, ensuring easy availability for a vast patient population. The sheer volume of patients diagnosed with T2DM means that the demand for these foundational treatments remains exceptionally high.

- Dominant Segment: Biguanides (primarily Metformin)

- Key Drivers:

- First-line therapy for Type 2 Diabetes.

- Affordability and cost-effectiveness.

- Well-established efficacy and safety profile.

- Extensive distribution networks and accessibility.

- High prevalence of Type 2 Diabetes.

- Market Share Potential: While newer drug classes are gaining traction, Biguanides are expected to maintain their leadership due to their widespread use as foundational therapy.

- Growth Potential: Continued demand driven by increasing diabetes prevalence and their role in combination therapies.

Indonesia Oral Anti-Diabetic Drug Market Product Landscape

The Indonesia Oral Anti-Diabetic Drug Market product landscape is characterized by a diverse range of therapeutic classes designed to manage Type 2 Diabetes. Innovations are focused on enhancing drug efficacy, improving patient adherence, and minimizing adverse effects. Biguanides, particularly Metformin, remain a cornerstone due to their cost-effectiveness and established track record. Newer entrants like SGLT-2 inhibitors and DPP-4 inhibitors are gaining traction, offering advanced mechanisms of action and often demonstrating cardiovascular and renal benefits. Pharmaceutical companies are actively developing combination therapies that leverage the synergistic effects of different drug classes, providing more comprehensive glycemic control for patients. Unique selling propositions often revolve around improved glycemic control, reduced risk of hypoglycemia, and benefits beyond blood sugar reduction, such as weight management or cardiovascular protection. Technological advancements in drug formulation are also leading to more convenient dosing regimens and improved patient compliance.

Key Drivers, Barriers & Challenges in Indonesia Oral Anti-Diabetic Drug Market

Key Drivers: The Indonesia Oral Anti-Diabetic Drug Market is propelled by a surging diabetes prevalence, increasing healthcare expenditure, growing awareness of diabetes complications, and advancements in pharmaceutical research leading to more effective and safer oral medications. Government initiatives promoting public health and access to essential medicines also act as significant accelerators.

Barriers & Challenges: Supply chain disruptions, particularly in a geographically diverse nation like Indonesia, can pose challenges. Stringent regulatory approval processes and pricing controls by the government can impact market entry and profitability. Intense competition from both branded and generic manufacturers, coupled with evolving treatment guidelines and the emergence of newer therapeutic modalities like injectables and continuous glucose monitoring, present ongoing pressures. The high cost of newer, innovative drugs can also be a barrier to widespread adoption, especially in lower-income demographics.

Emerging Opportunities in Indonesia Oral Anti-Diabetic Drug Market

Emerging opportunities in the Indonesia Oral Anti-Diabetic Drug Market lie in the expanding market for combination therapies, which offer enhanced glycemic control and improved patient adherence. There is significant untapped potential in rural and underserved areas, where increasing healthcare access and awareness can drive demand for affordable oral anti-diabetic drugs. The growing focus on personalized medicine also presents an opportunity for drugs that offer specific benefits for particular patient profiles, such as those with comorbid cardiovascular or renal conditions. Furthermore, the ongoing advancements in drug delivery systems and patient support programs can create new avenues for market penetration and patient engagement.

Growth Accelerators in the Indonesia Oral Anti-Diabetic Drug Market Industry

Long-term growth in the Indonesia Oral Anti-Diabetic Drug Market will be significantly accelerated by sustained technological breakthroughs in drug discovery and development, leading to oral medications with improved efficacy, reduced side effects, and additional cardiovascular and renal protective benefits. Strategic partnerships between global pharmaceutical giants and local Indonesian companies are crucial for leveraging market knowledge, distribution networks, and manufacturing capabilities. Market expansion strategies targeting the vast, yet underserved, population segments, coupled with proactive patient education and physician outreach programs, will be vital catalysts for sustained growth. The increasing adoption of digital health solutions and telemedicine platforms will also facilitate better patient monitoring and medication management, further driving the demand for effective oral anti-diabetic drugs.

Key Players Shaping the Indonesia Oral Anti-Diabetic Drug Market Market

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- Sanofi

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Astellas

Notable Milestones in Indonesia Oral Anti-Diabetic Drug Market Sector

- March 2023: Daewoong Pharmaceutical's Envlo (SGLT-2 Drug) initiated its global market entry by filing for product licenses in three ASEAN countries, including a submission of an NDA to Indonesia, the Philippines, and Thailand. This signifies a significant step towards expanding access to advanced diabetes treatments in the region.

- May 2022: Mounjaro (tirzepatide) injection, a groundbreaking drug for improving blood sugar control in adults with type 2 diabetes, received approval as an adjunct to diet and exercise. Clinical studies demonstrated Mounjaro's superior efficacy in improving blood sugar levels compared to other diabetes therapies, signaling a potential shift in treatment paradigms for complex diabetes management.

In-Depth Indonesia Oral Anti-Diabetic Drug Market Market Outlook

The future outlook for the Indonesia Oral Anti-Diabetic Drug Market is exceptionally promising, driven by sustained growth accelerators. Continuous technological innovation will introduce next-generation oral therapies with enhanced efficacy and a broader spectrum of benefits, including cardiovascular and renal protection, thereby appealing to a wider patient demographic and addressing critical unmet needs. Strategic collaborations and partnerships will foster localized manufacturing and distribution, ensuring greater accessibility and affordability across the vast Indonesian archipelago. Proactive market expansion initiatives, coupled with robust educational campaigns targeting both healthcare professionals and patients, will further amplify market penetration. The increasing integration of digital health solutions will revolutionize patient monitoring and adherence, creating a more personalized and effective diabetes management ecosystem. This confluence of factors positions the Indonesia Oral Anti-Diabetic Drug Market for substantial and sustained growth in the coming years.

Indonesia Oral Anti-Diabetic Drug Market Segmentation

-

1. Product Class

- 1.1. Biguanides

- 1.2. alpha-glucosidase inhibitors

- 1.3. dopamine D2 receptor agonists

- 1.4. SGLT-2 inhibitors

- 1.5. DPP-4 inhibitors sulfonylureas

- 1.6. meglitinides

Indonesia Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. Indonesia

Indonesia Oral Anti-Diabetic Drug Market Regional Market Share

Geographic Coverage of Indonesia Oral Anti-Diabetic Drug Market

Indonesia Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Sulfonylureas Segment Occupied the Highest Market Share in the Indonesia Oral Anti-Diabetic Drugs Market in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Class

- 5.1.1. Biguanides

- 5.1.2. alpha-glucosidase inhibitors

- 5.1.3. dopamine D2 receptor agonists

- 5.1.4. SGLT-2 inhibitors

- 5.1.5. DPP-4 inhibitors sulfonylureas

- 5.1.6. meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Product Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AstraZeneca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: Indonesia Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Oral Anti-Diabetic Drug Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Product Class 2020 & 2033

- Table 2: Indonesia Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Product Class 2020 & 2033

- Table 3: Indonesia Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Indonesia Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Product Class 2020 & 2033

- Table 6: Indonesia Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Product Class 2020 & 2033

- Table 7: Indonesia Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Indonesia Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Indonesia Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the Indonesia Oral Anti-Diabetic Drug Market?

The market segments include Product Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 213 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Sulfonylureas Segment Occupied the Highest Market Share in the Indonesia Oral Anti-Diabetic Drugs Market in the current year..

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

March 2023: Daewoong Pharmaceutical's Envlo (SGLT-2 Drug) will enter the global market in full swing by filing for product licenses in three ASEAN countries. Submitted an NDA to Indonesia, the Philippines, and Thailand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the Indonesia Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence