Key Insights

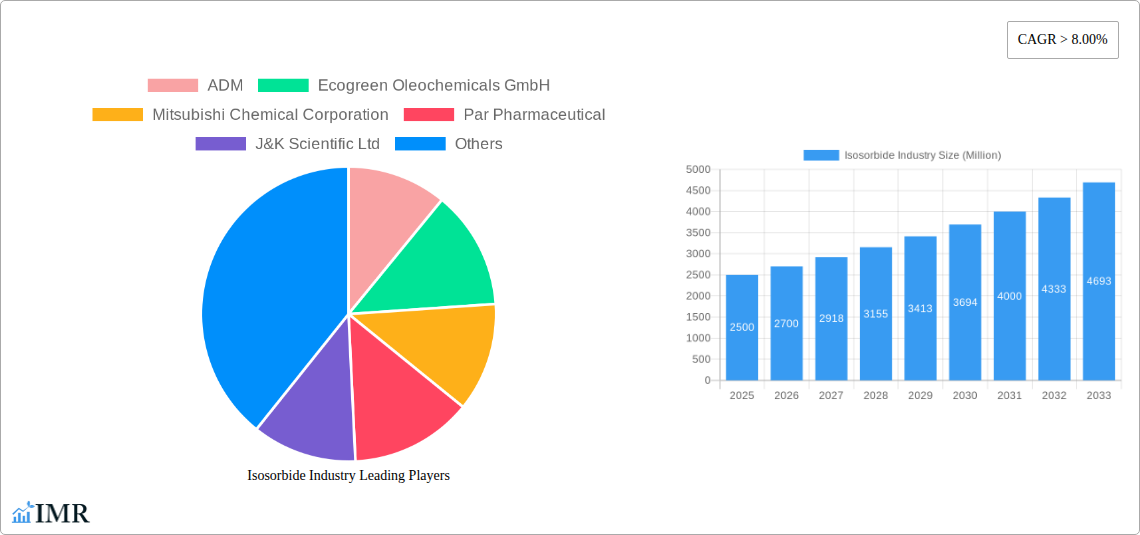

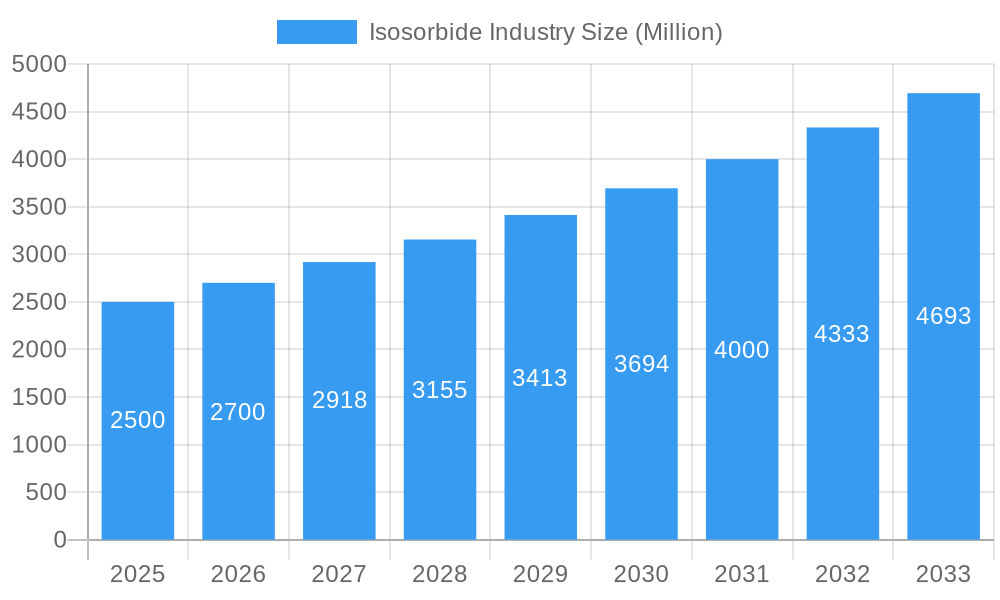

The global Isosorbide market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 8.03%. This growth is propelled by escalating demand across critical application sectors, most notably in the rapidly advancing bio-based polymers and resins segment. Key drivers include the global shift towards sustainable materials and a concerted effort to reduce dependency on petroleum-derived products. Polyethylene isosorbide terephthalate (PEIT), for instance, is gaining prominence for its superior biodegradability and comparable performance to conventional plastics. Additionally, the pharmaceutical sector's use of isosorbide as a vital component in drug development further bolsters market expansion. Despite challenges such as higher production costs compared to traditional alternatives and the necessity for enhanced processing technologies, the long-term outlook remains highly favorable, influenced by increasing regulatory support for bio-based materials and growing consumer preference for eco-friendly solutions. The estimated market size for Isosorbide is $0.69 billion in the base year 2025.

Isosorbide Industry Market Size (In Million)

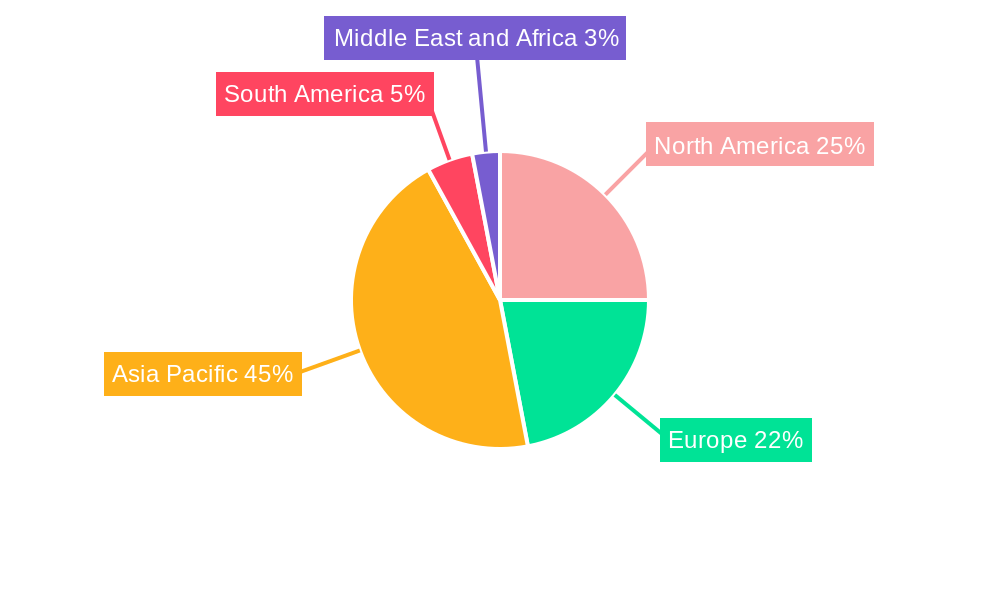

Distinct regional trends characterize the Isosorbide market. The Asia-Pacific region, led by China and India, is anticipated to emerge as the dominant force, fueled by the swift growth of its polymer and resin industries and supportive government policies advocating for sustainable development. North America and Europe also represent crucial markets, driven by robust demand from both the pharmaceutical and polymer industries. However, growth in these regions may be somewhat tempered by elevated manufacturing expenses and rigorous regulatory frameworks. Strategic alliances among leading entities such as ADM, Roquette Frères, and Mitsubishi Chemical Corporation are expected to significantly influence market dynamics, fostering innovation and broadening market penetration. Continued investment in research and development aimed at reducing production costs and improving material attributes is essential for realizing the full market potential of isosorbide.

Isosorbide Industry Company Market Share

Isosorbide Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Isosorbide market, offering crucial insights for businesses and investors. We delve into market dynamics, growth trends, regional dominance, product innovation, and key players, projecting market evolution from 2019 to 2033. The report covers parent markets (polymers, pharmaceuticals) and child markets (specific Isosorbide applications), delivering a granular understanding of this dynamic sector. The Base Year is 2025, with the Forecast Period spanning 2025-2033 and the Historical Period encompassing 2019-2024. Market values are presented in million units.

Isosorbide Industry Market Dynamics & Structure

The Isosorbide market, valued at xx Million in 2024, exhibits a moderately concentrated structure with key players holding significant market share. Technological innovation, particularly in polymer synthesis and pharmaceutical formulation, is a major driver. Stringent regulatory frameworks, especially concerning biodegradability and toxicity, significantly influence market dynamics. Competitive substitutes, such as other bio-based polymers, pose a challenge. End-user demographics heavily impact demand, particularly in the pharmaceuticals and packaging sectors. M&A activity has been moderate, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on improving Isosorbide's performance characteristics (e.g., biodegradability, thermal stability) drives innovation.

- Regulatory Landscape: Stringent regulations regarding biocompatibility and environmental impact influence market growth.

- Competitive Substitutes: PLA, PHA, and other biopolymers present competition.

- M&A Activity: xx deals recorded between 2019 and 2024, primarily focused on expanding production capacity and market reach.

- Innovation Barriers: High R&D costs and complexities associated with scaling up Isosorbide production.

Isosorbide Industry Growth Trends & Insights

The Isosorbide market experienced a CAGR of xx% during 2019-2024, driven by increasing demand from the polymers and pharmaceuticals sectors. Adoption rates are accelerating, particularly in applications requiring biodegradability and renewable resource utilization. Technological advancements in synthesis methods are lowering production costs, boosting market penetration. Consumer preference for sustainable products is a significant factor. The market is expected to maintain a strong growth trajectory, with a projected CAGR of xx% during 2025-2033, reaching a value of xx Million by 2033. Market penetration in specific segments, like PEIT, is expected to significantly increase.

Dominant Regions, Countries, or Segments in Isosorbide Industry

The [Region, e.g., North America] region dominates the Isosorbide market, driven by strong demand from the pharmaceutical and packaging industries. Within this region, [Country, e.g., USA] holds the largest market share. Among the application segments, Polyethylene Isosorbide Terephthalate (PEIT) displays the highest growth potential, followed by Polyurethane and Polyesters Isosorbide Succinate. In the end-user industry, polymers and resins constitute the largest market segment, followed by the pharmaceuticals sector.

- Key Drivers (North America): Strong regulatory support for bio-based materials, established polymer industry infrastructure.

- Dominance Factors (USA): High consumption of polymers and resins, a robust pharmaceutical industry.

- Growth Potential (PEIT): High demand for sustainable packaging materials and the favorable properties of PEIT.

- Market Share (Polymers & Resins): Largest segment, driven by increasing demand for bio-based alternatives to traditional polymers.

Isosorbide Industry Product Landscape

Isosorbide products are primarily categorized by their degree of polymerization and specific applications. Innovations focus on improving the processability, mechanical strength, and biodegradability of Isosorbide-based materials. Key improvements include increased thermal stability and reduced production costs. Unique selling propositions often center on sustainability and biocompatibility, catering to environmentally conscious consumers and industries.

Key Drivers, Barriers & Challenges in Isosorbide Industry

Key Drivers: Increasing demand for bio-based and biodegradable materials, stringent environmental regulations favoring sustainable alternatives, and technological advancements reducing production costs. For instance, the growth of the green chemistry movement strongly supports Isosorbide adoption.

Key Challenges: High initial production costs compared to traditional petroleum-based polymers, limited availability of raw materials (e.g., corn syrup), and competition from established substitutes. Supply chain disruptions can also significantly impact market availability and price stability. These disruptions resulted in a xx% price increase in 2022.

Emerging Opportunities in Isosorbide Industry

Emerging opportunities lie in expanding applications in flexible packaging, biodegradable films, and advanced pharmaceutical formulations. Untapped markets in developing economies present significant growth potential. Further research into novel Isosorbide derivatives could unlock new applications and enhance performance characteristics. The development of high-performance Isosorbide-based composites opens new doors in various sectors.

Growth Accelerators in the Isosorbide Industry

Strategic partnerships between Isosorbide producers and end-user industries are crucial for scaling up production and expanding market reach. Technological breakthroughs, such as more efficient synthesis methods and improved processing technologies, will further accelerate growth. Government incentives and supportive policies promoting the use of bio-based materials will play a crucial role in long-term market expansion.

Key Players Shaping the Isosorbide Industry Market

- ADM

- Ecogreen Oleochemicals GmbH

- Mitsubishi Chemical Corporation

- Par Pharmaceutical

- J&K Scientific Ltd

- TCI Chemicals (India) Pvt Ltd

- Roquette Frères

- Novaphene

- Thermo Fisher Scientific India Pvt Ltd

- J P Laboratories Pvt Ltd

- Jinan Hongbaifeng Industry & Trade Co Ltd

Notable Milestones in Isosorbide Industry Sector

- 2020: Roquette Frères announces expansion of Isosorbide production capacity.

- 2022: Several key players launch new Isosorbide-based products for packaging applications.

- 2023: Significant investment in R&D for developing novel Isosorbide derivatives.

In-Depth Isosorbide Industry Market Outlook

The Isosorbide market is poised for substantial growth, driven by increasing demand for sustainable materials and technological advancements. Strategic partnerships and investments in R&D will further accelerate market expansion. The focus on developing novel applications and improving the performance characteristics of Isosorbide-based products will unlock significant opportunities across diverse industries. The market is expected to witness a steady upward trend, with continued expansion in both established and emerging markets.

Isosorbide Industry Segmentation

-

1. Application

- 1.1. Polyethylene Isosorbide Terephthalate (PEIT)

- 1.2. Polycarbonate

- 1.3. Polyurethane

- 1.4. Polyesters Isosobide Succinate

- 1.5. Isosorbide Diesters

- 1.6. Other Applications

-

2. End-user Industry

- 2.1. Polymers and Resins

- 2.2. Additives

- 2.3. Pharmaceuticals

- 2.4. Other End-user Industries

Isosorbide Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Isosorbide Industry Regional Market Share

Geographic Coverage of Isosorbide Industry

Isosorbide Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Trend of Bio-based Products; Increasing Demand from Pharmaceutical Sector

- 3.3. Market Restrains

- 3.3.1. ; Side Effects of Isosorbide Derivatives on Health; Unfavorable Conditions Arising due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Polymer and Resins Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Isosorbide Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Polyethylene Isosorbide Terephthalate (PEIT)

- 5.1.2. Polycarbonate

- 5.1.3. Polyurethane

- 5.1.4. Polyesters Isosobide Succinate

- 5.1.5. Isosorbide Diesters

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Polymers and Resins

- 5.2.2. Additives

- 5.2.3. Pharmaceuticals

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Isosorbide Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Polyethylene Isosorbide Terephthalate (PEIT)

- 6.1.2. Polycarbonate

- 6.1.3. Polyurethane

- 6.1.4. Polyesters Isosobide Succinate

- 6.1.5. Isosorbide Diesters

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Polymers and Resins

- 6.2.2. Additives

- 6.2.3. Pharmaceuticals

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Isosorbide Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Polyethylene Isosorbide Terephthalate (PEIT)

- 7.1.2. Polycarbonate

- 7.1.3. Polyurethane

- 7.1.4. Polyesters Isosobide Succinate

- 7.1.5. Isosorbide Diesters

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Polymers and Resins

- 7.2.2. Additives

- 7.2.3. Pharmaceuticals

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Isosorbide Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Polyethylene Isosorbide Terephthalate (PEIT)

- 8.1.2. Polycarbonate

- 8.1.3. Polyurethane

- 8.1.4. Polyesters Isosobide Succinate

- 8.1.5. Isosorbide Diesters

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Polymers and Resins

- 8.2.2. Additives

- 8.2.3. Pharmaceuticals

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Isosorbide Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Polyethylene Isosorbide Terephthalate (PEIT)

- 9.1.2. Polycarbonate

- 9.1.3. Polyurethane

- 9.1.4. Polyesters Isosobide Succinate

- 9.1.5. Isosorbide Diesters

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Polymers and Resins

- 9.2.2. Additives

- 9.2.3. Pharmaceuticals

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Isosorbide Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Polyethylene Isosorbide Terephthalate (PEIT)

- 10.1.2. Polycarbonate

- 10.1.3. Polyurethane

- 10.1.4. Polyesters Isosobide Succinate

- 10.1.5. Isosorbide Diesters

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Polymers and Resins

- 10.2.2. Additives

- 10.2.3. Pharmaceuticals

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ecogreen Oleochemicals GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Chemical Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Par Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 J&K Scientific Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TCI Chemicals (India) Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Roquette Frères

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novaphene

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thermo Fisher Scientific India Pvt Ltd *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 J P Laboratories Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jinan Hongbaifeng Industry & Trade Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Isosorbide Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Isosorbide Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: Asia Pacific Isosorbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Isosorbide Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Isosorbide Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Isosorbide Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Isosorbide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Isosorbide Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Isosorbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Isosorbide Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Isosorbide Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Isosorbide Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Isosorbide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Isosorbide Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Isosorbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Isosorbide Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Isosorbide Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Isosorbide Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Isosorbide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Isosorbide Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: South America Isosorbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Isosorbide Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Isosorbide Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Isosorbide Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Isosorbide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Isosorbide Industry Revenue (billion), by Application 2025 & 2033

- Figure 27: Middle East and Africa Isosorbide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Isosorbide Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Isosorbide Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Isosorbide Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Isosorbide Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Isosorbide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Isosorbide Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Isosorbide Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Isosorbide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Isosorbide Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Isosorbide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Isosorbide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Isosorbide Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Isosorbide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Isosorbide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Isosorbide Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Isosorbide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Isosorbide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Isosorbide Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Isosorbide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Isosorbide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Global Isosorbide Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Isosorbide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Isosorbide Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Isosorbide Industry?

The projected CAGR is approximately 8.03%.

2. Which companies are prominent players in the Isosorbide Industry?

Key companies in the market include ADM, Ecogreen Oleochemicals GmbH, Mitsubishi Chemical Corporation, Par Pharmaceutical, J&K Scientific Ltd, TCI Chemicals (India) Pvt Ltd, Roquette Frères, Novaphene, Thermo Fisher Scientific India Pvt Ltd *List Not Exhaustive, J P Laboratories Pvt Ltd, Jinan Hongbaifeng Industry & Trade Co Ltd.

3. What are the main segments of the Isosorbide Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.69 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Trend of Bio-based Products; Increasing Demand from Pharmaceutical Sector.

6. What are the notable trends driving market growth?

Increasing Demand from the Polymer and Resins Segment.

7. Are there any restraints impacting market growth?

; Side Effects of Isosorbide Derivatives on Health; Unfavorable Conditions Arising due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Isosorbide Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Isosorbide Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Isosorbide Industry?

To stay informed about further developments, trends, and reports in the Isosorbide Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence