Key Insights

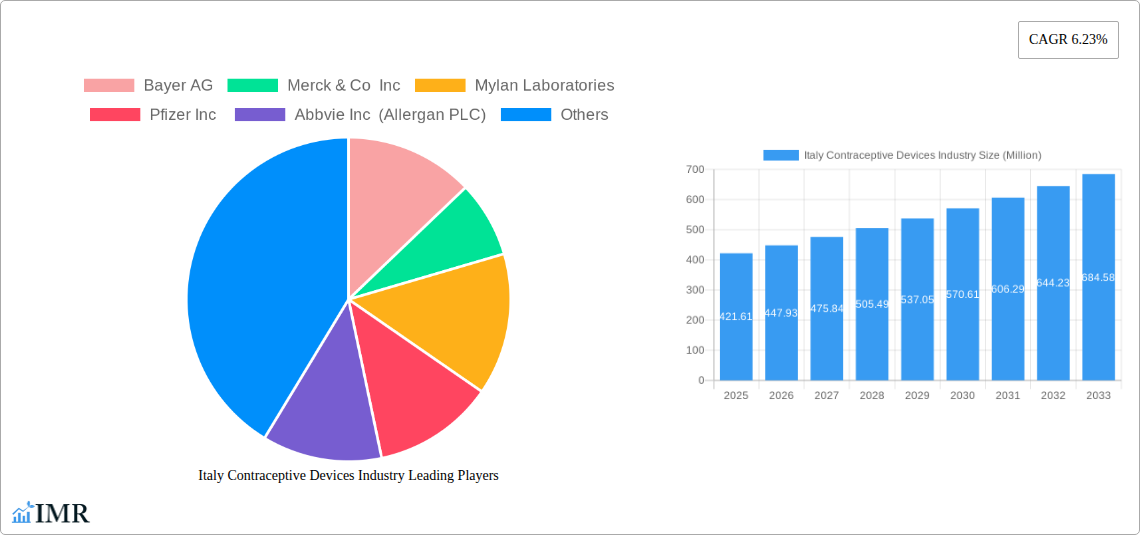

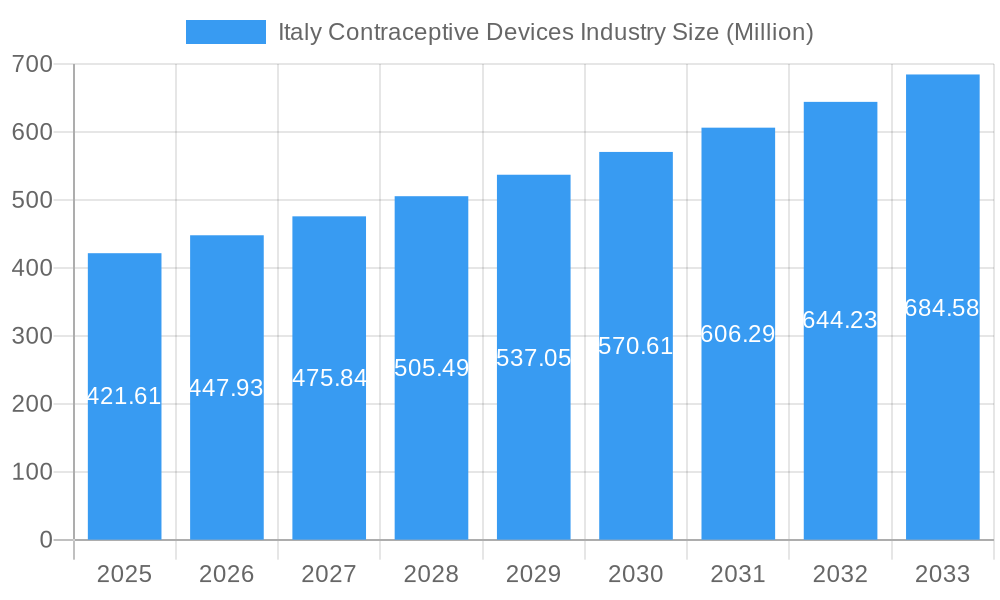

The Italian contraceptive devices market is poised for robust growth, with a current market size of approximately USD 421.61 million in 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 6.23% throughout the forecast period of 2025-2033. Key drivers fueling this upward trajectory include increasing awareness and accessibility of various contraceptive methods, evolving societal attitudes towards family planning, and the rising prevalence of sexually transmitted infections (STIs) necessitating consistent and reliable barrier methods. Furthermore, government initiatives promoting reproductive health and the growing demand for longer-acting reversible contraceptives (LARCs) like IUDs and vaginal rings are significant contributors to market expansion. Technological advancements leading to the development of more user-friendly and effective devices also play a crucial role in attracting a wider consumer base.

Italy Contraceptive Devices Industry Market Size (In Million)

The market segmentation reveals a dynamic landscape, with condoms and Intrauterine Devices (IUDs) likely to dominate the Type segment, catering to both immediate and long-term family planning needs. The Female segment is expected to represent the larger share, given the prevalent focus on female-controlled contraception. However, the Male segment, particularly condoms, will remain a cornerstone of the market. Key players like Bayer AG, Merck & Co. Inc., and Pfizer Inc. are actively investing in research and development and strategic partnerships to capture a significant market share. The market will also see substantial growth in Europe, with Italy being a notable contributor to this trend, reflecting a sustained focus on reproductive healthcare and a mature consumer base actively seeking reliable contraceptive solutions.

Italy Contraceptive Devices Industry Company Market Share

Italy Contraceptive Devices Industry Report: Market Dynamics, Growth Trends, and Competitive Landscape (2019-2033)

This comprehensive report offers an in-depth analysis of the Italy Contraceptive Devices Industry, providing critical insights into market dynamics, growth drivers, emerging opportunities, and the competitive landscape. Covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving Italian contraceptive market. We present all market values in Million units for clear quantitative analysis.

Italy Contraceptive Devices Industry Market Dynamics & Structure

The Italy Contraceptive Devices Industry is characterized by a moderate market concentration, with key players like Bayer AG, Merck & Co Inc, Mylan Laboratories, Pfizer Inc, Abbvie Inc (Allergan PLC), Cooper Surgical Inc, Reckitt Benckiser, and DKT International holding significant market shares. Technological innovation is a primary driver, particularly in the development of user-friendly and highly effective devices, such as advanced Intra Uterine Devices (IUDs) and novel vaginal rings. Regulatory frameworks, overseen by national health authorities, ensure product safety and efficacy, influencing market entry and product development. Competitive product substitutes, ranging from traditional methods to newer hormonal and barrier options, necessitate continuous innovation and differentiated product offerings. End-user demographics, influenced by evolving societal attitudes towards family planning, increasing awareness, and access to healthcare, play a crucial role in shaping demand. Merger and acquisition (M&A) trends are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, strategic acquisitions can lead to a consolidated market share. Barriers to innovation often stem from stringent regulatory approvals and the high cost of research and development.

- Market Concentration: Moderate, with key players dominating specific segments.

- Technological Innovation: Focus on IUDs, vaginal rings, and long-acting reversible contraceptives (LARCs).

- Regulatory Frameworks: Emphasis on product safety, efficacy, and patient information.

- Competitive Substitutes: Diverse range from condoms to hormonal implants.

- End-User Demographics: Influenced by education, income, and access to reproductive health services.

- M&A Trends: Strategic acquisitions for portfolio expansion and market consolidation.

- Innovation Barriers: Stringent approval processes and R&D costs.

Italy Contraceptive Devices Industry Growth Trends & Insights

The Italy Contraceptive Devices Industry is poised for steady growth, driven by a confluence of socioeconomic factors and technological advancements. The market size is projected to expand significantly over the forecast period (2025–2033), fueled by increasing awareness of family planning and a growing preference for convenient and effective contraceptive methods. Adoption rates for Long-Acting Reversible Contraceptives (LARCs), including IUDs and contraceptive implants, are expected to rise as healthcare providers and consumers recognize their high efficacy and user convenience. Technological disruptions are continuously reshaping the landscape, with ongoing research and development yielding newer, safer, and more user-friendly contraceptive devices. For example, the introduction of smaller, more adaptable IUDs and the development of potentially longer-lasting vaginal rings are key innovations.

Consumer behavior shifts are also playing a pivotal role. There's a growing demand for contraception that offers discretion, ease of use, and minimal side effects. This trend is prompting manufacturers to invest in products that align with these preferences. The increasing empowerment of women and greater emphasis on reproductive health rights are further contributing to higher adoption rates of modern contraceptive methods. Furthermore, government initiatives and public health campaigns aimed at promoting responsible family planning and reducing unintended pregnancies are creating a supportive ecosystem for market growth. The CAGR is predicted to be approximately 4.5% during the forecast period, indicating a robust expansion trajectory. Market penetration for modern contraceptive methods is expected to deepen, particularly among younger demographics and in regions with historically lower access to comprehensive reproductive healthcare services. The transition from traditional methods to more reliable and reversible options underscores a broader societal shift towards proactive reproductive health management.

Dominant Regions, Countries, or Segments in Italy Contraceptive Devices Industry

Within the Italy Contraceptive Devices Industry, the Intra Uterine Device (IUD) segment is emerging as a dominant force, significantly driving market growth. This ascendancy is attributed to several key factors, including their high efficacy, long-acting nature, and increasing acceptance among women seeking reliable and reversible contraception. The IUD market is further segmented into hormonal IUDs and copper IUDs, both of which are experiencing robust demand. Hormonal IUDs, known for their ability to reduce menstrual bleeding and cramping, are particularly attractive to a growing segment of the female population.

The growth potential for IUDs is further amplified by evolving medical recommendations and a greater emphasis on Long-Acting Reversible Contraceptives (LARCs) by healthcare professionals. Economic policies in Italy that support access to reproductive healthcare services, including subsidies for contraceptive devices, also contribute to the expanding market share of IUDs. Infrastructure development, such as increased availability of trained healthcare providers capable of IUD insertion and removal, ensures that these devices can be effectively delivered to a wider population.

- Dominant Segment: Intra Uterine Device (IUD)

- Sub-segments: Hormonal IUDs, Copper IUDs

- Key Drivers:

- High efficacy rates (over 99%)

- Long-acting reversible nature (up to 5-10 years depending on type)

- Increasing recommendation of LARCs by healthcare professionals

- Growing preference for discreet and convenient contraception

- Supportive economic policies and healthcare access initiatives

- Expanding network of trained healthcare providers

While IUDs are leading the charge, the Condoms segment, catering to both male and female users, remains a significant and foundational part of the market, driven by accessibility and widespread awareness. However, the growth trajectory of IUDs is currently outpacing that of condoms, indicating a shift towards more advanced contraceptive solutions. The Vaginal Rings segment is also experiencing notable growth, driven by innovations in delivery systems and user convenience. The Female gender segment, in terms of contraceptive needs and product utilization, represents the larger portion of the market, though male contraceptives are a growing area of interest and development.

Italy Contraceptive Devices Industry Product Landscape

The product landscape of the Italy Contraceptive Devices Industry is dynamic, marked by continuous innovation aimed at enhancing efficacy, user-friendliness, and safety. Intra Uterine Devices (IUDs) are at the forefront, with advancements in miniaturization and material science leading to smaller, more adaptable devices that minimize discomfort during insertion. Hormonal IUDs are also evolving, offering precise hormone release for improved contraceptive effect and potential management of menstrual disorders. Condoms are seeing innovations in materials, such as ultra-thin latex and non-latex alternatives, improving sensitivity and catering to specific user needs and allergies. Vaginal rings are being developed for longer wear durations and novel drug delivery mechanisms beyond contraception. The focus across all product categories is on achieving higher patient adherence and satisfaction through discreet, convenient, and reliable solutions.

Key Drivers, Barriers & Challenges in Italy Contraceptive Devices Industry

Key Drivers: The Italy Contraceptive Devices Industry is propelled by several key drivers, including increasing awareness of sexual and reproductive health, a growing demand for effective and long-acting reversible contraceptives (LARCs), and supportive government policies promoting family planning. Technological advancements in product design and efficacy, coupled with evolving societal attitudes towards contraception, further fuel market growth.

Barriers & Challenges: Despite the positive outlook, the industry faces several barriers and challenges. Stringent regulatory approval processes can slow down the market entry of new products. High manufacturing costs and the need for extensive clinical trials represent significant financial hurdles. Additionally, cultural taboos and insufficient access to comprehensive reproductive health education in certain demographics can limit adoption rates. Supply chain disruptions and competition from both established and emerging players also pose challenges, requiring strategic inventory management and competitive pricing strategies.

Emerging Opportunities in Italy Contraceptive Devices Industry

Emerging opportunities in the Italy Contraceptive Devices Industry lie in the development of user-centric innovations and the expansion of access. There is a significant opportunity for novel male contraceptive methods, which have historically been underdeveloped. Furthermore, the increasing demand for discreet and long-term reversible contraception presents a fertile ground for advanced IUDs and implants with improved efficacy and reduced side effects. Digital health integration, offering apps for tracking menstrual cycles and contraceptive adherence, also represents a promising avenue. Tapping into underserved rural or socioeconomically disadvantaged populations with accessible and affordable contraceptive solutions is another key opportunity, aligning with broader public health goals.

Growth Accelerators in the Italy Contraceptive Devices Industry Industry

The long-term growth of the Italy Contraceptive Devices Industry is being significantly accelerated by several strategic catalysts. Continuous technological breakthroughs, particularly in materials science and drug delivery systems, are leading to more effective and user-friendly products. Strategic partnerships between pharmaceutical companies and device manufacturers are fostering synergistic development and market penetration. Furthermore, aggressive market expansion strategies, including increased investment in awareness campaigns and educational outreach programs, are broadening the consumer base and driving demand for modern contraceptive methods. The increasing focus by healthcare systems on preventative healthcare and reproductive well-being also serves as a major accelerator.

Key Players Shaping the Italy Contraceptive Devices Industry Market

- Bayer AG

- Merck & Co Inc

- Mylan Laboratories

- Pfizer Inc

- Abbvie Inc (Allergan PLC)

- Cooper Surgical Inc

- Reckitt Benckiser

- DKT International

Notable Milestones in Italy Contraceptive Devices Industry Sector

- July 2022: Perrigo Company announced the decision by the US FDA to approve a daily birth control pill for over-the-counter (OTC) sale, indicating a broader trend towards increased accessibility of contraceptive methods.

- March 2021: Mithra commercially launched the vaginal contraceptive ring Myring in Italy, adding to the company's geographic extension and supply of contraceptive products, highlighting product innovation and market expansion.

In-Depth Italy Contraceptive Devices Industry Market Outlook

The future outlook for the Italy Contraceptive Devices Industry is exceptionally promising, driven by a synergistic blend of innovation and societal progress. Growth accelerators, including ongoing research into more discreet, longer-lasting, and reversible contraceptive options, will continue to shape market dynamics. Strategic partnerships and increasing investment in public health initiatives aimed at enhancing reproductive health awareness and access will further solidify market expansion. The industry is well-positioned to capitalize on evolving consumer preferences for autonomy and informed choices in family planning, translating into sustained demand and a robust market trajectory throughout the forecast period.

Italy Contraceptive Devices Industry Segmentation

-

1. Type

- 1.1. Condoms

- 1.2. Diaphragms

- 1.3. Cervical Caps

- 1.4. Sponges

- 1.5. Vaginal Rings

- 1.6. Intra Uterine Device (IUD)

- 1.7. Other Types

-

2. Gender

- 2.1. Male

- 2.2. Female

Italy Contraceptive Devices Industry Segmentation By Geography

- 1. Italy

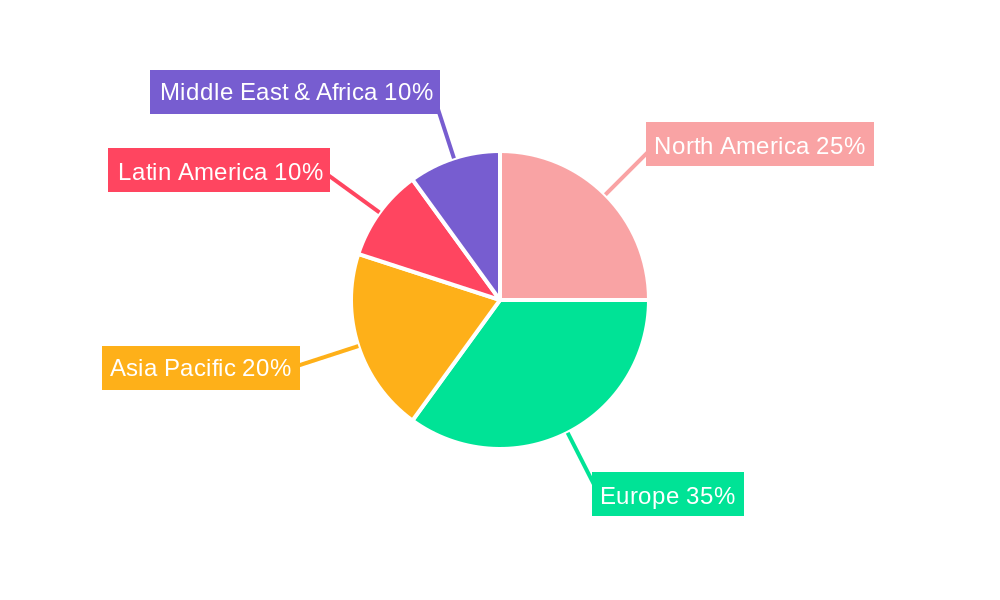

Italy Contraceptive Devices Industry Regional Market Share

Geographic Coverage of Italy Contraceptive Devices Industry

Italy Contraceptive Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness about Sexually Transmitted Diseases (STDs); Rising Rate of Unintended Pregnancies

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated With the Use of Contraceptive Devices

- 3.4. Market Trends

- 3.4.1. Condom Segment is Expected to Dominate the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Contraceptive Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condoms

- 5.1.2. Diaphragms

- 5.1.3. Cervical Caps

- 5.1.4. Sponges

- 5.1.5. Vaginal Rings

- 5.1.6. Intra Uterine Device (IUD)

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mylan Laboratories

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pfizer Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbvie Inc (Allergan PLC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cooper Surgical Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reckitt Benckiser

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DKT International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Italy Contraceptive Devices Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Contraceptive Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Contraceptive Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Italy Contraceptive Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Italy Contraceptive Devices Industry Revenue Million Forecast, by Gender 2020 & 2033

- Table 4: Italy Contraceptive Devices Industry Volume K Unit Forecast, by Gender 2020 & 2033

- Table 5: Italy Contraceptive Devices Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Italy Contraceptive Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Italy Contraceptive Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Italy Contraceptive Devices Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Italy Contraceptive Devices Industry Revenue Million Forecast, by Gender 2020 & 2033

- Table 10: Italy Contraceptive Devices Industry Volume K Unit Forecast, by Gender 2020 & 2033

- Table 11: Italy Contraceptive Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Italy Contraceptive Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Contraceptive Devices Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Italy Contraceptive Devices Industry?

Key companies in the market include Bayer AG, Merck & Co Inc, Mylan Laboratories, Pfizer Inc , Abbvie Inc (Allergan PLC), Cooper Surgical Inc, Reckitt Benckiser, DKT International.

3. What are the main segments of the Italy Contraceptive Devices Industry?

The market segments include Type, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 421.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness about Sexually Transmitted Diseases (STDs); Rising Rate of Unintended Pregnancies.

6. What are the notable trends driving market growth?

Condom Segment is Expected to Dominate the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects Associated With the Use of Contraceptive Devices.

8. Can you provide examples of recent developments in the market?

July 2022: Perrigo Company announced the decision by the US FDA to approve a daily birth control pill for over-the-counter (OTC) sale.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Contraceptive Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Contraceptive Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Contraceptive Devices Industry?

To stay informed about further developments, trends, and reports in the Italy Contraceptive Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence