Key Insights

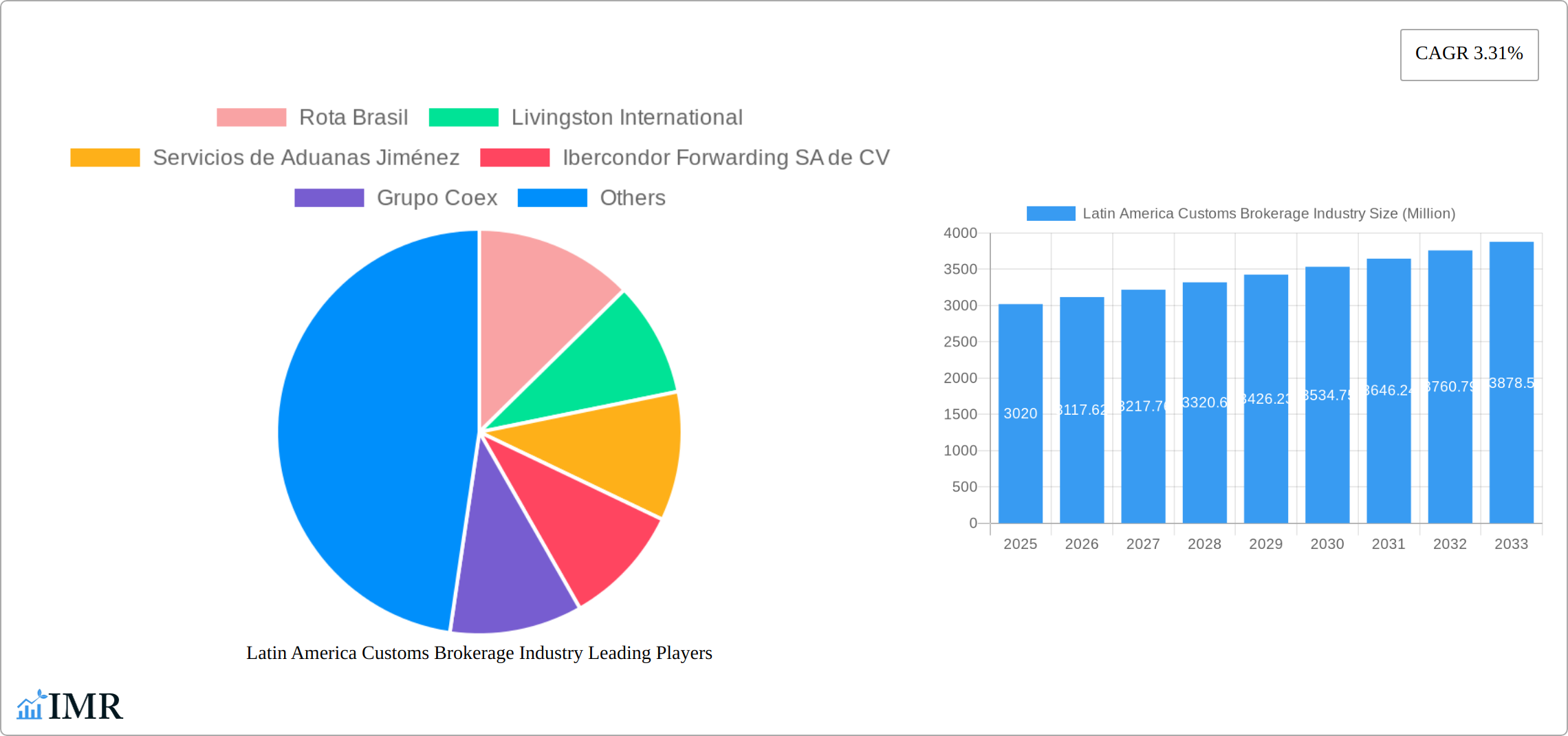

The Latin American customs brokerage industry, valued at $3.02 billion in 2025, is projected to experience steady growth, driven by a compound annual growth rate (CAGR) of 3.31% from 2025 to 2033. This expansion is fueled by several key factors. The rising e-commerce penetration across the region significantly increases the volume of cross-border shipments, demanding efficient customs brokerage services. Furthermore, the increasing complexity of international trade regulations necessitates specialized expertise, boosting demand for professional brokerage firms. Growth in key end-user sectors like automotive, FMCG, and technology also contributes to market expansion. Brazil, Mexico, and Chile represent the largest markets, reflecting their robust economies and significant import-export activities. However, challenges remain, including bureaucratic hurdles and varying regulatory frameworks across Latin American countries. While the presence of established international players like Deutsche Post DHL Group and DSV Panalpina AS indicates market maturity, opportunities abound for smaller, localized firms specializing in specific niches or regions. The market's segmentation across various modes of transport (ocean, air, land) and end-user industries presents further diversification opportunities for market players. The continued expansion of cross-border e-commerce and the ongoing need for specialized customs expertise will likely maintain a positive growth trajectory for the Latin American customs brokerage market in the coming years.

Latin America Customs Brokerage Industry Market Size (In Billion)

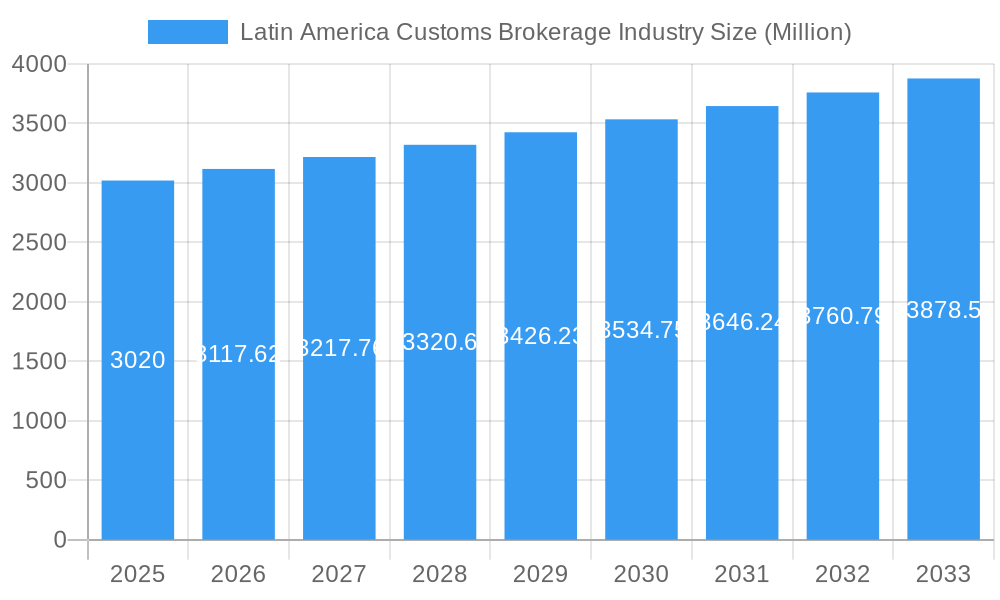

The industry's competitive landscape is characterized by a mix of large multinational corporations and smaller, regional players. While established players leverage their global network and expertise, smaller firms often thrive by offering personalized services and deep understanding of local regulations. This dynamic landscape presents both challenges and opportunities for all participants. Future growth will depend on factors like regulatory reforms, infrastructure development, and the continued growth of e-commerce within Latin America. Furthermore, the ability of brokerage firms to adapt to technological advancements, such as automation and digitalization of customs processes, will be crucial for maintaining a competitive edge. Companies like Rota Brasil, Livingston International, and Expeditors International are key players already strategically positioned to capitalize on these trends. The projected growth rate suggests a promising outlook for the Latin American customs brokerage market, provided industry players navigate regulatory complexities and adopt innovative solutions.

Latin America Customs Brokerage Industry Company Market Share

Latin America Customs Brokerage Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Latin America customs brokerage industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market.

Keywords: Latin America Customs Brokerage, Customs Brokerage Market, Mexico Customs Brokerage, Brazil Customs Brokerage, Chile Customs Brokerage, Colombia Customs Brokerage, Panama Customs Brokerage, Ocean Freight Forwarding, Air Freight Forwarding, Land Transport, FMCG Logistics, Automotive Logistics, Retail Logistics, Technology Logistics, Market Size, Market Share, Market Growth, Rota Brasil, Livingston International, Expeditors International, DHL, Market Analysis, Industry Report, Market Forecast

Latin America Customs Brokerage Industry Market Dynamics & Structure

The Latin American customs brokerage market is characterized by a moderate level of concentration, with several large multinational players alongside numerous smaller, regional operators. The market size in 2025 is estimated at $XX billion. Technological innovation, while present, faces barriers such as inconsistent digital infrastructure across the region and varying levels of government adoption of digital customs processes. Regulatory frameworks differ significantly between countries, creating complexities for operators. The market sees considerable competitive pressure, particularly from larger, integrated logistics providers offering bundled services. M&A activity has been modest, with approximately XX deals in the last five years, driven by the desire for expansion into new markets and service diversification.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of approximately xx.

- Technological Innovation: Driven by automation, digitalization, and data analytics, but hampered by infrastructure limitations.

- Regulatory Frameworks: Vary widely across countries, requiring specialized knowledge and compliance expertise.

- Competitive Landscape: Intense competition from both established players and new entrants, with price and service differentiation being key.

- M&A Activity: XX deals recorded between 2020-2025, primarily focused on expansion and service diversification.

Latin America Customs Brokerage Industry Growth Trends & Insights

The Latin American customs brokerage market has experienced steady growth over the past years, driven primarily by expanding trade volumes and the increasing complexity of cross-border regulations. The market size is projected to reach $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This growth is fuelled by the rise of e-commerce, the increasing globalization of supply chains, and a growing demand for specialized logistics services. Technological advancements such as blockchain and AI are beginning to transform operations, although adoption rates remain moderate due to the previously mentioned infrastructural challenges and concerns over data security. Consumer behavior is shifting towards greater transparency and traceability in supply chains.

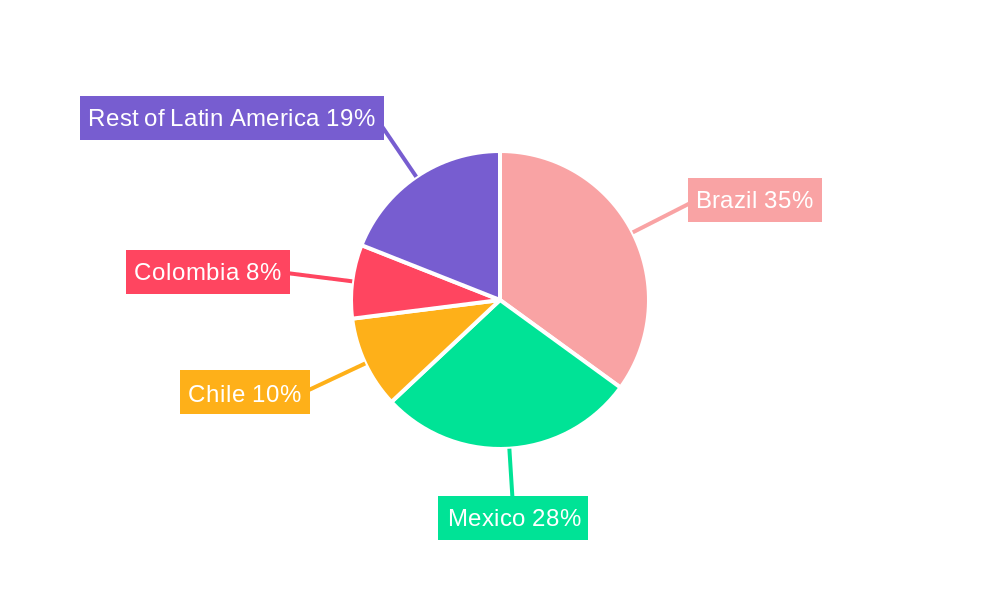

Dominant Regions, Countries, or Segments in Latin America Customs Brokerage Industry

Mexico and Brazil represent the largest segments of the Latin American customs brokerage market, contributing approximately XX% and XX% of the total market value respectively in 2025. The high volume of trade and robust economic activity in these countries drive significant demand for customs brokerage services. Within the transport modes, ocean freight dominates, accounting for approximately XX% of market share. In terms of end-users, the FMCG, Automotive, and Retail sectors are the most significant, reflecting the large presence of multinational companies and growing domestic consumption.

- Leading Countries: Mexico and Brazil.

- Leading Transport Mode: Ocean Freight.

- Leading End-User Segments: FMCG, Automotive, and Retail.

- Key Growth Drivers: Increasing trade volumes, e-commerce growth, and the growing need for efficient and secure supply chains.

Latin America Customs Brokerage Industry Product Landscape

The Latin America customs brokerage industry offers a comprehensive suite of services designed to facilitate seamless international trade. Beyond foundational customs clearance, the landscape now encompasses highly specialized solutions, including expert regulatory compliance guidance, innovative trade finance facilitation, and sophisticated supply chain optimization strategies. The industry is witnessing a wave of product advancements, prominently featuring the integration of advanced digital platforms. These platforms empower clients with unprecedented real-time visibility into their shipment statuses, leverage advanced data analytics for proactive risk management, and deploy AI-powered solutions to automate and streamline repetitive tasks, thereby boosting operational efficiency. The paramount selling propositions revolve around significantly reduced processing times, tangible cost optimization, bolstered compliance assurance, and demonstrably improved supply chain efficiency.

Key Drivers, Barriers & Challenges in Latin America Customs Brokerage Industry

Key Drivers: The burgeoning expansion of e-commerce and the continuous growth of cross-border trade are fundamental drivers fueling the demand for expert customs brokerage services. Concurrently, the escalating complexity and dynamic nature of regulatory environments across Latin America necessitate specialized knowledge and support. Government-led initiatives aimed at simplifying and accelerating customs procedures are also playing a pivotal role in stimulating market growth and adoption.

Challenges: A significant hurdle remains the inherent inconsistency of regulatory frameworks across different Latin American nations, creating a complex operational patchwork. Furthermore, underdeveloped infrastructure in certain regions can lead to considerable operational bottlenecks and delays. The market is characterized by intense competition from both established global players and agile new entrants, compelling businesses to engage in perpetual innovation and rigorous cost optimization. The pervasive impact of supply chain disruptions, often exacerbated by geopolitical instability and unforeseen global events, also poses a substantial operational challenge.

Emerging Opportunities in Latin America Customs Brokerage Industry

Untapped opportunities exist in smaller Latin American markets with expanding trade, specifically focusing on specialized sectors such as pharmaceuticals and perishable goods. Technological advancements, such as blockchain technology for enhanced transparency and traceability in supply chains, offer considerable opportunities for innovation. Growing demand for value-added services such as compliance consulting and supply chain risk management provides another avenue for growth.

Growth Accelerators in the Latin America Customs Brokerage Industry

Strategic alliances and collaborations with leading technology providers are paramount for accelerating long-term growth, enabling the widespread adoption of advanced automation and digitalization tools. Identifying and successfully penetrating underserved markets, while simultaneously developing specialized service offerings tailored for niche industry sectors, presents a significant and promising opportunity for expansion. Continuous and substantial investment in cultivating a highly skilled and adaptable workforce, equipped to expertly navigate the intricacies of diverse and evolving regulatory landscapes, is an indispensable factor for sustained success.

Key Players Shaping the Latin America Customs Brokerage Industry Market

- Rota Brasil

- Livingston International

- Servicios de Aduanas Jiménez

- Ibercondor Forwarding SA de CV

- Grupo Coex

- Expeditors International

- Elemar

- Deutsche Post DHL Group

- Aduana Cordero

- Grupo Ei

- Farrow

- DSV Panalpina AS

- Several other regional and specialized players contributing significantly to the market. (Information on smaller and medium-scale players is often country-specific and vital for comprehensive market understanding).

Notable Milestones in Latin America Customs Brokerage Industry Sector

- 2020: Implementation of new customs regulations in Mexico, impacting the operational procedures of brokerage firms.

- 2021: Launch of a new digital customs platform in Brazil, streamlining clearance processes.

- 2022: Merger of two major brokerage firms in Chile, consolidating market share.

- 2023: Increased investment in technology solutions by several major players, aiming for improved efficiency and transparency.

- 2024: Significant adoption of blockchain technology by some leading companies for improved supply chain security.

In-Depth Latin America Customs Brokerage Industry Market Outlook

The Latin American customs brokerage market is strategically positioned for robust and sustained growth. This trajectory is underpinned by the consistent increase in international trade volumes, the transformative impact of technological advancements, and the persistent expansion of the e-commerce sector. The future landscape will be significantly shaped by strategic partnerships, dedicated investment in cutting-edge technology, and successful expansion into new and emerging markets. A steadfast focus on delivering specialized services that adeptly cater to evolving consumer demands, coupled with the agile and proactive management of dynamic regulatory changes, will be the defining factors for achieving long-term success and competitive advantage for all stakeholders within this vibrant and rapidly evolving industry.

Latin America Customs Brokerage Industry Segmentation

-

1. Mode of Transport

- 1.1. Ocean

- 1.2. Air

- 1.3. Cross-border Land Transport

-

2. End User

- 2.1. Automotive

- 2.2. Chemicals

- 2.3. FMCG (Fa

- 2.4. Retail (

- 2.5. Fashion and Lifestyle (Apparel and Footwear)

- 2.6. Reefer (

- 2.7. Technology (Consumer Electronics, Home Appliances)

- 2.8. Other End Users

Latin America Customs Brokerage Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Customs Brokerage Industry Regional Market Share

Geographic Coverage of Latin America Customs Brokerage Industry

Latin America Customs Brokerage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Increase in Ocean Freight

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Customs Brokerage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Ocean

- 5.1.2. Air

- 5.1.3. Cross-border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Chemicals

- 5.2.3. FMCG (Fa

- 5.2.4. Retail (

- 5.2.5. Fashion and Lifestyle (Apparel and Footwear)

- 5.2.6. Reefer (

- 5.2.7. Technology (Consumer Electronics, Home Appliances)

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rota Brasil

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Livingston International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Servicios de Aduanas Jiménez

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ibercondor Forwarding SA de CV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grupo Coex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Expeditors International**List Not Exhaustive 6 3 Other Companies (Key Information/Overview - List of Key Small to Medium-scale Players in Each Country

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elemar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deutsche Post DHL Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aduana Cordero

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grupo Ei

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Farrow

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DSV Panalpina AS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rota Brasil

List of Figures

- Figure 1: Latin America Customs Brokerage Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Customs Brokerage Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Customs Brokerage Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Latin America Customs Brokerage Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Latin America Customs Brokerage Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Customs Brokerage Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 5: Latin America Customs Brokerage Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Latin America Customs Brokerage Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Customs Brokerage Industry?

The projected CAGR is approximately 3.31%.

2. Which companies are prominent players in the Latin America Customs Brokerage Industry?

Key companies in the market include Rota Brasil, Livingston International, Servicios de Aduanas Jiménez, Ibercondor Forwarding SA de CV, Grupo Coex, Expeditors International**List Not Exhaustive 6 3 Other Companies (Key Information/Overview - List of Key Small to Medium-scale Players in Each Country, Elemar, Deutsche Post DHL Group, Aduana Cordero, Grupo Ei, Farrow, DSV Panalpina AS.

3. What are the main segments of the Latin America Customs Brokerage Industry?

The market segments include Mode of Transport, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.02 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Increase in Ocean Freight.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Customs Brokerage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Customs Brokerage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Customs Brokerage Industry?

To stay informed about further developments, trends, and reports in the Latin America Customs Brokerage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence