Key Insights

The China Mammography Market is poised for significant expansion, projected to reach a substantial $121.25 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 11.24% through 2033. This robust growth is underpinned by a confluence of critical drivers, including the escalating prevalence of breast cancer, a heightened awareness among the female population regarding early detection, and the increasing adoption of advanced digital mammography systems. Government initiatives focused on improving healthcare infrastructure and promoting regular health screenings are further bolstering market penetration. The demand for sophisticated diagnostic tools, particularly within hospitals and specialized diagnostic centers, is a key influencer, driving investments in cutting-edge mammography technologies. The market's trajectory indicates a strong preference for digital systems due to their superior image quality, reduced radiation exposure, and enhanced diagnostic accuracy compared to traditional analog counterparts.

Mammography Market in China Market Size (In Million)

Furthermore, emerging trends such as the integration of Artificial Intelligence (AI) in mammography for improved image analysis and the growing adoption of Breast Tomosynthesis (3D mammography) for more precise detection of abnormalities are shaping the market landscape. While the market is experiencing strong growth, certain restraints, such as the high initial cost of advanced equipment and the need for skilled personnel to operate and interpret complex systems, may present challenges. However, the overarching demand for comprehensive breast cancer screening solutions, coupled with continuous technological advancements and a growing patient base seeking reliable diagnostic services, ensures a dynamic and expanding future for the China Mammography Market. The significant investment in healthcare infrastructure across major regions, particularly in developed economies, is anticipated to drive this growth.

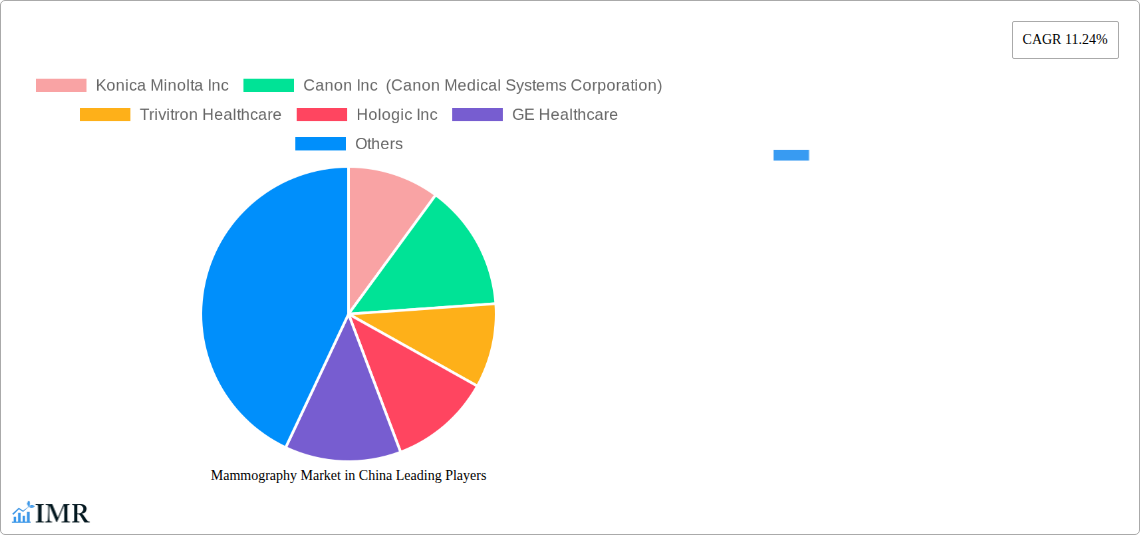

Mammography Market in China Company Market Share

This report offers an in-depth analysis of the Mammography Market in China, providing critical insights into market dynamics, growth trends, technological innovations, and competitive landscapes. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study is an essential resource for stakeholders seeking to understand and capitalize on opportunities within China's rapidly evolving healthcare sector. We delve into the China Breast Imaging Market, Digital Mammography China, AI in Mammography China, and Breast Tomosynthesis Market China, presenting a granular view of segment performance and future projections.

Mammography Market in China Market Dynamics & Structure

The Mammography Market in China is characterized by a dynamic and evolving structure, marked by increasing market concentration among key players and a robust drive towards technological innovation. Regulatory frameworks are continuously adapting to incorporate advanced diagnostic tools, influencing market entry and product approval processes. Competitive substitutes, primarily in the form of advanced imaging technologies and evolving screening protocols, are prompting manufacturers to enhance their product offerings. End-user demographics are shifting, with a growing emphasis on early detection and preventative healthcare driving demand. Mergers and acquisitions (M&A) trends, though not yet at a fever pitch, indicate a strategic consolidation approach by leading companies aiming to expand their market footprint and technological portfolios.

- Market Concentration: Dominance by a few key international and domestic players, with increasing consolidation efforts anticipated.

- Technological Innovation Drivers: A strong push towards AI-powered diagnostics, higher resolution imaging, and integrated workflow solutions.

- Regulatory Frameworks: Evolving standards for medical device approval, with a focus on safety, efficacy, and clinical validation.

- Competitive Product Substitutes: Advancements in ultrasound and MRI for breast imaging, necessitating continuous innovation in mammography.

- End-User Demographics: Growing demand from public hospitals, private specialty clinics, and dedicated diagnostic centers, driven by increasing cancer screening initiatives.

- M&A Trends: Emerging strategic acquisitions aimed at bolstering product portfolios and market access.

Mammography Market in China Growth Trends & Insights

The Mammography Market in China is poised for significant expansion, driven by a confluence of factors including increasing healthcare expenditure, rising awareness of breast cancer, and government initiatives promoting early detection. The market size is projected to grow substantially, fueled by the accelerated adoption of digital mammography systems and the burgeoning interest in advanced technologies like breast tomosynthesis and AI-powered screening solutions. Technological disruptions, such as the integration of artificial intelligence for enhanced diagnostic accuracy and efficiency, are rapidly transforming the screening landscape. Consumer behavior is shifting towards proactive health management, with a greater willingness to undergo regular screenings, particularly among urban populations. The China Mammography Screening Market is expected to witness robust growth as screening programs become more widespread and accessible.

The CAGR (Compound Annual Growth Rate) for the Mammography Market in China is estimated to be approximately XX% during the forecast period. This growth is largely attributable to the increasing prevalence of breast cancer, which necessitates early and accurate diagnosis. The market penetration of digital mammography systems is steadily rising, supplanting older analog technologies. This shift is driven by the superior image quality, reduced radiation dose, and enhanced workflow efficiency offered by digital solutions. Furthermore, the emergence of AI in mammography, exemplified by recent regulatory approvals, promises to further revolutionize screening processes by assisting radiologists in identifying subtle abnormalities and improving diagnostic speed. The demand for 3D Mammography China (Breast Tomosynthesis) is also on an upward trajectory, offering improved detection rates for dense breast tissue and reducing recall rates. This trend is supported by a growing understanding among healthcare providers and patients of the clinical advantages of tomosynthesis. The overall market trajectory indicates a strong commitment from China's healthcare sector to adopt state-of-the-art diagnostic imaging technologies to combat breast cancer effectively. The market is expected to reach an estimated value of $XXX Million by 2033, a significant increase from its current valuation.

Dominant Regions, Countries, or Segments in Mammography Market in China

Within the Mammography Market in China, Digital Systems and Breast Tomosynthesis are emerging as dominant segments, significantly outperforming traditional Analog Systems. The Hospitals segment, owing to their comprehensive healthcare infrastructure and higher patient volumes, represents the largest end-user category. Economically advanced regions, particularly in Eastern China such as Shanghai, Beijing, and Guangdong Province, are leading the market due to higher disposable incomes, greater awareness of breast cancer screening, and the presence of advanced healthcare facilities. These regions benefit from strong government support for healthcare modernization, increased investment in medical infrastructure, and a higher concentration of skilled radiologists.

- Dominant Product Type:

- Digital Systems: Characterized by superior image quality, reduced radiation exposure, and digital archiving capabilities, leading to widespread adoption.

- Breast Tomosynthesis: Gaining rapid traction due to its enhanced diagnostic accuracy for dense breast tissue and reduced false positives, driving significant growth.

- Dominant End-User:

- Hospitals: Account for the largest share due to their comprehensive screening programs, inpatient services, and advanced diagnostic capabilities.

- Dominant Regions/Provinces:

- Eastern China (e.g., Shanghai, Beijing, Guangdong): Exhibit the highest market share and growth potential due to advanced economic development, robust healthcare infrastructure, and concentrated populations.

The dominance of digital systems and breast tomosynthesis is directly linked to their superior clinical utility and the growing demand for early and accurate breast cancer detection. XX% of new mammography installations are projected to be digital systems. Breast tomosynthesis, while still a newer technology, is expected to witness a CAGR of XX% in the coming years. The increasing investment in advanced imaging equipment by both public and private healthcare institutions in major urban centers fuels this segment's growth. Furthermore, government initiatives aimed at improving breast cancer screening rates, especially in economically developed areas, further bolster the demand for these advanced technologies. The China Digital Mammography Market is therefore a key growth engine, with tomosynthesis playing an increasingly crucial role in advanced diagnostics.

Mammography Market in China Product Landscape

The product landscape for the Mammography Market in China is marked by continuous innovation, focusing on enhancing diagnostic accuracy, patient comfort, and workflow efficiency. Key product types include advanced digital mammography systems, 3D breast tomosynthesis units, and emerging AI-powered screening software. These innovations are driven by the need for earlier detection of breast cancer, especially in women with dense breast tissue, and the desire to reduce radiation exposure. Manufacturers are emphasizing the integration of AI for automated image analysis, lesion detection, and risk stratification. The performance metrics of these systems are continuously improving, with higher resolution imaging, faster scan times, and more intuitive user interfaces becoming standard.

Key Drivers, Barriers & Challenges in Mammography Market in China

Key Drivers

The Mammography Market in China is propelled by several key drivers, including the rising incidence of breast cancer, increasing government focus on public health and early detection initiatives, and growing healthcare expenditure. The expanding middle class and rising disposable incomes contribute to greater demand for advanced medical diagnostics. Furthermore, technological advancements, particularly in digital mammography and breast tomosynthesis, coupled with the integration of AI, are significantly enhancing diagnostic capabilities and driving market growth.

Barriers & Challenges

Despite robust growth prospects, the market faces several barriers and challenges. The high cost of advanced mammography equipment can be a significant hurdle for smaller clinics and hospitals, particularly in less developed regions. Stringent regulatory approval processes, though essential for patient safety, can also lead to longer product launch timelines. Fierce competition among both domestic and international players can lead to price pressures. Additionally, a shortage of adequately trained radiologists to operate and interpret complex imaging data can limit the full utilization of advanced technologies. Supply chain disruptions and the need for robust after-sales service infrastructure also present ongoing challenges. The estimated impact of these challenges could slow market expansion by approximately XX%.

Emerging Opportunities in Mammography Market in China

Emerging opportunities in the Mammography Market in China lie in the untapped potential of rural and semi-urban areas where access to advanced screening facilities is limited. The increasing adoption of AI-powered screening software presents a significant opportunity for enhancing diagnostic efficiency and accuracy across a wider patient base. Furthermore, the development of more affordable and portable mammography devices could democratize access to screening. The growing trend of personalized medicine also opens avenues for integrating mammography data with other biomarkers for tailored breast cancer risk assessment and management.

Growth Accelerators in the Mammography Market in China Industry

Catalysts driving long-term growth in the Mammography Market in China industry include continuous technological breakthroughs in imaging resolution and AI integration, leading to improved diagnostic outcomes. Strategic partnerships between international technology providers and Chinese healthcare companies are accelerating market penetration and localized product development. Government-backed initiatives to expand national breast cancer screening programs and subsidize advanced medical equipment further fuel growth. The increasing emphasis on preventative healthcare and the rising demand for high-quality diagnostic services are also significant growth accelerators.

Key Players Shaping the Mammography Market in China Market

- Konica Minolta Inc

- Canon Inc (Canon Medical Systems Corporation)

- Trivitron Healthcare

- Hologic Inc

- GE Healthcare

- Siemens Healthineers AG

- Koninklijke Philips NV

- General Medical Merate SpA

- Carestream Health Inc

- Fujifilm Holdings Corporation

Notable Milestones in Mammography Market in China Sector

- January 2023: Deepwise Technology Co. Ltd.'s artificial intelligence (AI) device mammography screening software was approved in China. The company claims this is the first and only AI medical device approved for breast cancer in China, signaling a major advancement in AI-driven diagnostics.

- September 2022: Shenzhen Anke's new generation of Xinxin digital mammary gland machine was approved for listing in China. The product boasts digital mammography, digital mammography tomography, and digital mammography breast tomosynthesis 2D imaging functions, enhancing diagnostic capabilities and offering a comprehensive imaging solution.

In-Depth Mammography Market in China Market Outlook

The future outlook for the Mammography Market in China is exceptionally promising, driven by sustained government support for healthcare modernization and an increasing public health consciousness. Growth accelerators such as continued advancements in AI for mammography, making screening more accessible and accurate, will play a pivotal role. Strategic collaborations between global leaders and local enterprises are expected to foster innovation and expand market reach. The increasing demand for 3D breast tomosynthesis solutions, coupled with the ongoing digital transformation of healthcare infrastructure, will ensure a robust and dynamic market. Opportunities in developing user-friendly and cost-effective solutions for underserved regions will further broaden market penetration. The commitment to early breast cancer detection and improved patient outcomes positions China as a significant global player in the mammography landscape.

Mammography Market in China Segmentation

-

1. Product Type

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Other Product Types

-

2. End-User

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

Mammography Market in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

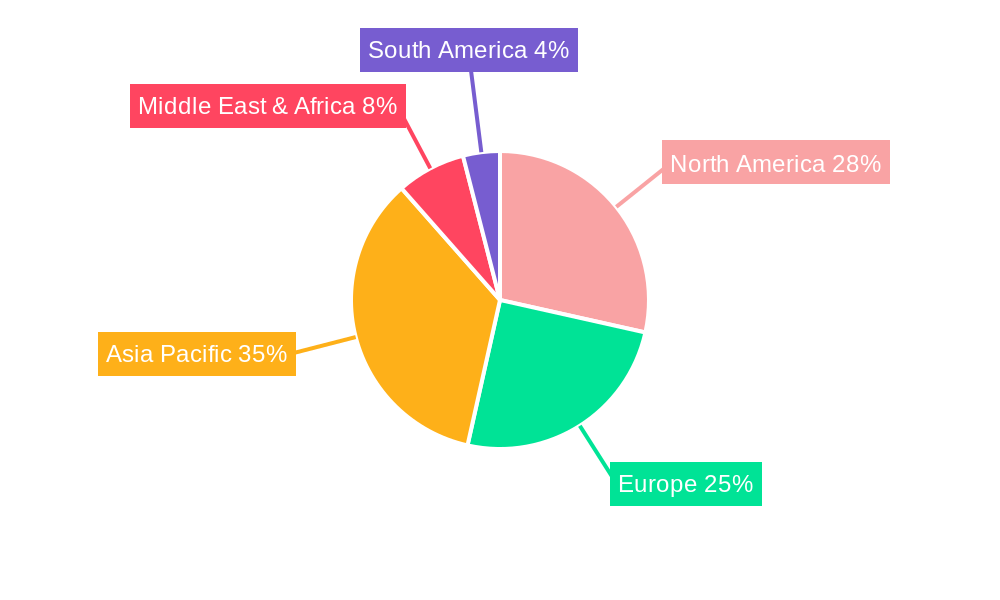

Mammography Market in China Regional Market Share

Geographic Coverage of Mammography Market in China

Mammography Market in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging; Investment from Various Organizations in Breast Cancer Screening Campaigns

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects from Radiation Exposure; Lack of Proper Reimbursement for Breast Cancer Screening

- 3.4. Market Trends

- 3.4.1. Specialty Clinics Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mammography Market in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Mammography Market in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Digital Systems

- 6.1.2. Analog Systems

- 6.1.3. Breast Tomosynthesis

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Hospitals

- 6.2.2. Specialty Clinics

- 6.2.3. Diagnostic Centers

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Mammography Market in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Digital Systems

- 7.1.2. Analog Systems

- 7.1.3. Breast Tomosynthesis

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Hospitals

- 7.2.2. Specialty Clinics

- 7.2.3. Diagnostic Centers

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Mammography Market in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Digital Systems

- 8.1.2. Analog Systems

- 8.1.3. Breast Tomosynthesis

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Hospitals

- 8.2.2. Specialty Clinics

- 8.2.3. Diagnostic Centers

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Mammography Market in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Digital Systems

- 9.1.2. Analog Systems

- 9.1.3. Breast Tomosynthesis

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Hospitals

- 9.2.2. Specialty Clinics

- 9.2.3. Diagnostic Centers

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Mammography Market in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Digital Systems

- 10.1.2. Analog Systems

- 10.1.3. Breast Tomosynthesis

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Hospitals

- 10.2.2. Specialty Clinics

- 10.2.3. Diagnostic Centers

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Konica Minolta Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Canon Inc (Canon Medical Systems Corporation)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Trivitron Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hologic Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GE Healthcare

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens Healthineers AG*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke Philips NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Medical Merate SpA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Carestream Health Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fujifilm Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Global Mammography Market in China Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mammography Market in China Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Mammography Market in China Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Mammography Market in China Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America Mammography Market in China Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Mammography Market in China Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Mammography Market in China Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Mammography Market in China Revenue (Million), by Product Type 2025 & 2033

- Figure 9: South America Mammography Market in China Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Mammography Market in China Revenue (Million), by End-User 2025 & 2033

- Figure 11: South America Mammography Market in China Revenue Share (%), by End-User 2025 & 2033

- Figure 12: South America Mammography Market in China Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Mammography Market in China Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Mammography Market in China Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Mammography Market in China Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Mammography Market in China Revenue (Million), by End-User 2025 & 2033

- Figure 17: Europe Mammography Market in China Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Europe Mammography Market in China Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Mammography Market in China Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Mammography Market in China Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Mammography Market in China Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Mammography Market in China Revenue (Million), by End-User 2025 & 2033

- Figure 23: Middle East & Africa Mammography Market in China Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East & Africa Mammography Market in China Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Mammography Market in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Mammography Market in China Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Mammography Market in China Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Mammography Market in China Revenue (Million), by End-User 2025 & 2033

- Figure 29: Asia Pacific Mammography Market in China Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific Mammography Market in China Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Mammography Market in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mammography Market in China Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Mammography Market in China Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global Mammography Market in China Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Mammography Market in China Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Mammography Market in China Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Mammography Market in China Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Mammography Market in China Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Mammography Market in China Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Mammography Market in China Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Mammography Market in China Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Mammography Market in China Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Global Mammography Market in China Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Mammography Market in China Revenue Million Forecast, by Product Type 2020 & 2033

- Table 29: Global Mammography Market in China Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global Mammography Market in China Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Mammography Market in China Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Mammography Market in China Revenue Million Forecast, by End-User 2020 & 2033

- Table 39: Global Mammography Market in China Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Mammography Market in China Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mammography Market in China?

The projected CAGR is approximately 11.24%.

2. Which companies are prominent players in the Mammography Market in China?

Key companies in the market include Konica Minolta Inc, Canon Inc (Canon Medical Systems Corporation), Trivitron Healthcare, Hologic Inc, GE Healthcare, Siemens Healthineers AG*List Not Exhaustive, Koninklijke Philips NV, General Medical Merate SpA, Carestream Health Inc, Fujifilm Holdings Corporation.

3. What are the main segments of the Mammography Market in China?

The market segments include Product Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 121.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging; Investment from Various Organizations in Breast Cancer Screening Campaigns.

6. What are the notable trends driving market growth?

Specialty Clinics Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects from Radiation Exposure; Lack of Proper Reimbursement for Breast Cancer Screening.

8. Can you provide examples of recent developments in the market?

January 2023: Deepwise Technology Co. Ltd.'s artificial intelligence (AI) device mammography screening software was approved in China. The company claims this is the first and only AI medical device approved for breast cancer in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mammography Market in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mammography Market in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mammography Market in China?

To stay informed about further developments, trends, and reports in the Mammography Market in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence