Key Insights

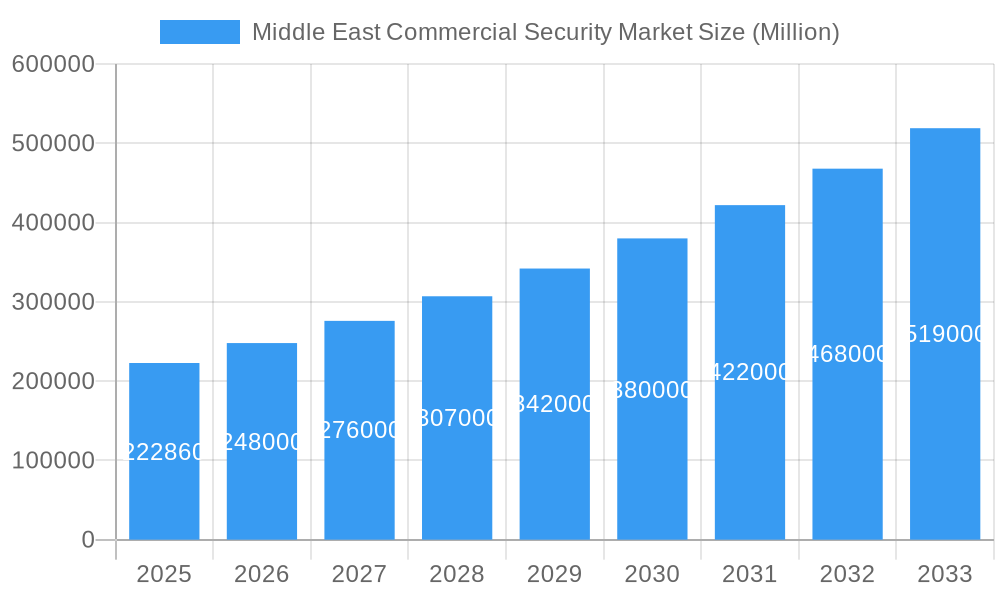

The Middle East commercial security market is poised for significant expansion, driven by a growing emphasis on enhanced safety and security across diverse sectors. With a projected market size of USD 222.86 billion in 2025 and a robust Compound Annual Growth Rate (CAGR) of 11.4%, the market is set to witness substantial value creation throughout the forecast period of 2025-2033. This upward trajectory is fueled by increasing investments in advanced security solutions, including sophisticated video surveillance systems and integrated access control technologies. Furthermore, the rising number of large-scale commercial projects, coupled with a heightened awareness of security threats among businesses and individuals, are key catalysts for this growth. The region's proactive approach to modernizing infrastructure and creating secure environments for its growing populations and burgeoning industries underpins this positive market outlook.

Middle East Commercial Security Market Market Size (In Billion)

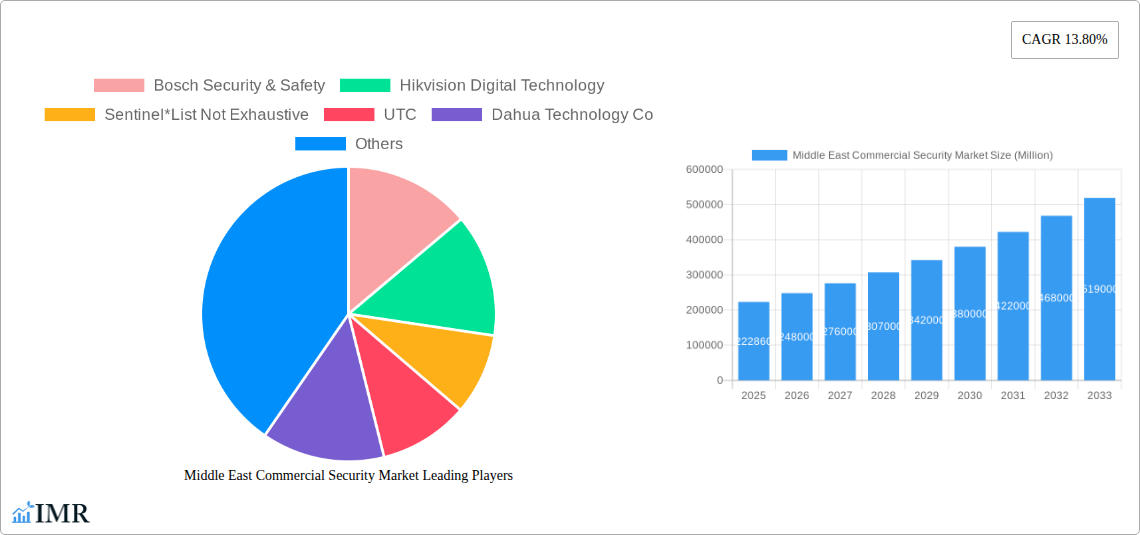

The market's growth is strategically segmented across various end-user types, with industrial, residential, and commercial sectors (including hospitality and education) emerging as primary growth engines. Geographically, the UAE, Saudi Arabia, and Qatar are expected to lead the market, benefiting from significant infrastructure development and government initiatives focused on security and smart city implementations. While the adoption of advanced security technologies presents immense opportunities, potential restraints such as the high initial cost of implementation and the need for skilled professionals to manage complex systems might pose challenges. However, the increasing demand for integrated and intelligent security solutions, coupled with ongoing technological advancements and government support, is expected to outweigh these challenges, ensuring a dynamic and thriving market for commercial security solutions across the Middle East. Key players like Bosch Security & Safety, Hikvision, and Dahua Technology are actively shaping this landscape with their innovative offerings.

Middle East Commercial Security Market Company Market Share

This in-depth report provides a strategic analysis of the Middle East Commercial Security Market, covering a critical study period from 2019 to 2033, with the base and estimated year as 2025, and a forecast period extending from 2025 to 2033. Examining historical trends from 2019 to 2024, this report offers unparalleled insights into market dynamics, growth trajectories, and future potential. We meticulously dissect the market by security type (Video Surveillance, Access Control), end-user type (Industrial, Residential, Commercial – including Hospitality and Education, and Other End-users), and key geographies (UAE, Saudi Arabia, Qatar, Oman, Kuwait, and the Rest of the Middle East). This report is meticulously designed for industry professionals seeking to understand market concentration, technological innovation, regulatory landscapes, competitive strategies, and emerging opportunities within this dynamic region. The estimated market size for the Middle East Commercial Security Market in 2025 is $12.5 billion.

Middle East Commercial Security Market Market Dynamics & Structure

The Middle East Commercial Security Market is characterized by a moderate to high market concentration, with leading players like Bosch Security & Safety, Hikvision Digital Technology, and Dahua Technology Co. holding significant shares. Technological innovation is a primary driver, fueled by the increasing adoption of AI-powered video analytics, IoT-enabled access control systems, and advanced cybersecurity solutions to protect sensitive data. Regulatory frameworks are evolving, with governments in the region increasingly mandating stringent security standards for critical infrastructure and commercial establishments, especially in sectors like oil and gas and smart city projects. Competitive product substitutes exist, ranging from traditional security systems to emerging biometric and behavioral analysis technologies, forcing market players to continuously innovate. End-user demographics are shifting, with a growing demand for integrated security solutions that offer both physical and cyber protection. Merger and acquisition (M&A) trends are notable, as larger companies seek to consolidate market share, acquire innovative technologies, and expand their geographical reach. For instance, recent M&A activities are estimated to have a market impact of approximately $0.8 billion in deal volume during the historical period. Barriers to innovation include the high cost of implementing cutting-edge technologies and the need for skilled personnel to manage and maintain complex security systems.

Middle East Commercial Security Market Growth Trends & Insights

The Middle East Commercial Security Market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of 8.9% from 2025 to 2033. This expansion is driven by a confluence of factors, including increasing urbanization, significant infrastructure development projects, and a heightened awareness of security threats across various sectors. The adoption rate of advanced security solutions, particularly video surveillance and access control systems, is accelerating, with market penetration expected to reach 65% by 2030 for smart security solutions in commercial buildings. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into security systems, are revolutionizing threat detection, anomaly identification, and predictive security. These advancements are transforming traditional security paradigms into proactive and intelligent systems. Consumer behavior is shifting towards a preference for integrated, user-friendly, and remotely manageable security solutions, leading to a surge in demand for cloud-based platforms and mobile accessibility. The market size evolution shows a consistent upward trend, with the market valued at $11.5 billion in 2024 and projected to reach $25.2 billion by 2033. This growth is underpinned by substantial investments in smart city initiatives and large-scale construction projects across the region, creating a continuous demand for sophisticated security infrastructure.

Dominant Regions, Countries, or Segments in Middle East Commercial Security Market

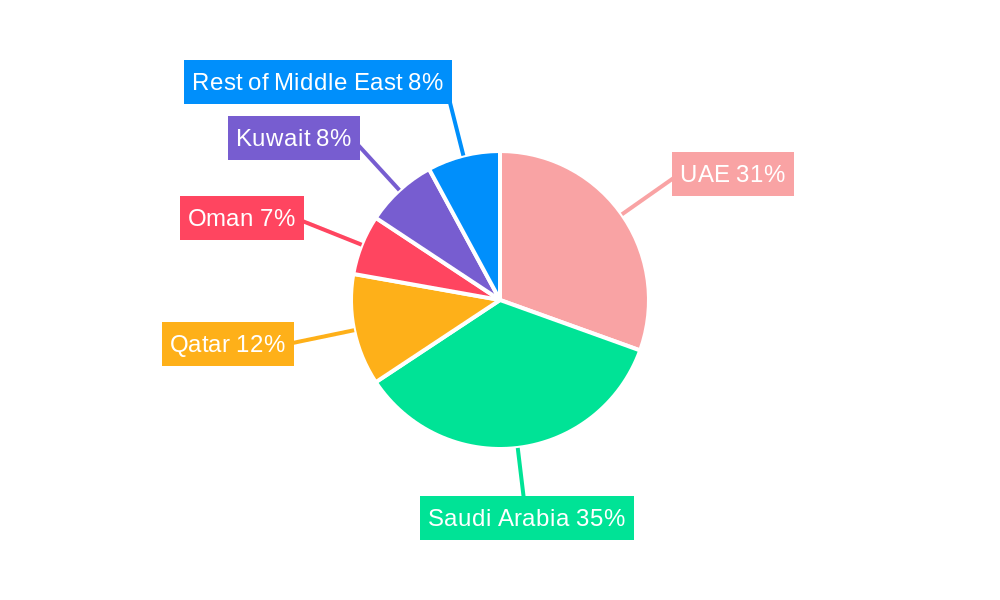

The United Arab Emirates (UAE) and Saudi Arabia are emerging as the dominant geographies within the Middle East Commercial Security Market, collectively accounting for an estimated 55% of the total market share in 2025. This dominance is propelled by substantial government investments in infrastructure development, including smart city projects, hospitality expansion for tourism, and secure commercial complexes. Saudi Arabia, in particular, with its Vision 2030 initiative, is experiencing unprecedented construction and modernization, leading to a significant demand for advanced security solutions across its industrial, commercial, and residential sectors. The UAE's established status as a global hub for business and tourism further fuels the need for high-level commercial security, especially in its hospitality and education segments. Within the security type segment, Video Surveillance holds the largest market share, estimated at 45% in 2025, driven by the increasing need for real-time monitoring, forensic analysis, and AI-powered threat detection. Access Control systems follow closely, representing 30% of the market share, with a growing demand for biometric and smart card technologies to enhance building security. In terms of end-user segments, the Commercial sector, encompassing hospitality, education, and retail, is the largest contributor, expected to command 40% of the market share in 2025, owing to the rise of large-scale commercial developments and the need to secure high-traffic public spaces. The Industrial sector, driven by the oil & gas industry and manufacturing, also presents a substantial market, contributing approximately 25%.

Middle East Commercial Security Market Product Landscape

The product landscape of the Middle East Commercial Security Market is rapidly evolving, marked by the introduction of sophisticated AI-powered video analytics that offer intelligent object detection, facial recognition, and behavioral analysis. Integrated access control systems are increasingly featuring biometric authentication (fingerprint, iris scanning) and smart card technology, alongside mobile credentials for enhanced convenience and security. The market also witnesses the proliferation of cloud-based security management platforms, enabling remote monitoring, data analytics, and seamless integration of various security devices. These innovations emphasize enhanced performance metrics such as higher resolution imaging, faster processing speeds for threat identification, and robust cybersecurity features to protect against data breaches. Unique selling propositions include scalable solutions tailored for diverse commercial needs and predictive analytics capabilities that proactively identify potential security risks.

Key Drivers, Barriers & Challenges in Middle East Commercial Security Market

Key Drivers:

- Surge in Smart City Initiatives: Government-led smart city projects in countries like UAE and Saudi Arabia are driving demand for integrated and intelligent security solutions.

- Escalating Security Concerns: Heightened awareness of terrorism, crime, and data breaches necessitates advanced physical and cybersecurity measures across all commercial sectors.

- Infrastructure Development Boom: Massive investments in new commercial buildings, hospitality, and industrial facilities create a continuous need for state-of-the-art security systems.

- Technological Advancements: The integration of AI, IoT, and cloud computing is enhancing the capabilities and appeal of security products.

Barriers & Challenges:

- High Implementation Costs: The initial investment for advanced security systems can be a significant barrier, especially for small and medium-sized enterprises.

- Skilled Workforce Shortage: A lack of trained professionals to install, operate, and maintain complex security systems poses a challenge.

- Data Privacy Concerns: Increasing data collection by security systems raises privacy issues and requires robust data protection regulations and compliance.

- Cybersecurity Vulnerabilities: While integrated, these systems can be targets for cyberattacks, requiring constant vigilance and updates. The potential impact of a major cyberattack could disrupt operations estimated to cost $X billion.

Emerging Opportunities in Middle East Commercial Security Market

Emerging opportunities in the Middle East Commercial Security Market lie in the burgeoning demand for integrated smart home security solutions that offer seamless control over access, surveillance, and emergency alerts. The growth of the hospitality sector presents a significant avenue for specialized security solutions that enhance guest experience while ensuring safety. Furthermore, the increasing adoption of Internet of Things (IoT) devices across commercial and industrial settings creates a need for robust IoT security management platforms. There is also a growing market for cybersecurity services specifically designed to protect the vast amounts of data generated by these advanced security systems. The untapped potential in the "Rest of the Middle-East" also presents a significant growth frontier as these economies develop.

Growth Accelerators in the Middle East Commercial Security Market Industry

Long-term growth in the Middle East Commercial Security Market is being accelerated by several key factors. The continuous evolution and miniaturization of surveillance technology, coupled with advancements in AI for real-time threat analysis, are making sophisticated security systems more accessible and effective. Strategic partnerships between technology providers, system integrators, and end-users are crucial for developing customized solutions that address specific regional needs. Moreover, government incentives and favorable policies promoting the adoption of advanced security technologies in critical infrastructure and public spaces are significant growth catalysts. The expansion of cloud-based security platforms, offering scalability and cost-effectiveness, further fuels widespread adoption across various commercial segments.

Key Players Shaping the Middle East Commercial Security Market Market

- Bosch Security & Safety

- Hikvision Digital Technology

- Sentinel

- UTC

- Dahua Technology Co

- Avigilon (Motorola)

- Pelco Inc

- Tyco Security Products

- Axis Communications

- Honeywell Security

- FLIR Systems

Notable Milestones in Middle East Commercial Security Market Sector

- 2021: Launch of AI-powered intelligent video analytics by Hikvision, enhancing threat detection capabilities.

- 2022: Bosch Security & Safety unveils new generation of network cameras with superior low-light performance and cybersecurity features.

- 2023: Dahua Technology expands its smart city solutions portfolio with advanced integrated platforms for traffic management and public safety.

- 2024: Avigilon introduces enhanced AI-driven access control solutions for enterprise-level security management.

- 2025: Growing adoption of biometric fusion technologies in high-security commercial facilities across UAE and Saudi Arabia.

In-Depth Middle East Commercial Security Market Market Outlook

The Middle East Commercial Security Market outlook remains exceptionally strong, driven by sustained investment in infrastructure, a relentless focus on national security, and the pervasive integration of smart technologies. Growth accelerators such as AI-powered analytics, cloud-based management platforms, and the expanding IoT ecosystem will continue to shape market offerings. Strategic opportunities are abundant in underserved segments and through the development of more affordable, yet highly effective, integrated security solutions. The market's trajectory indicates a future dominated by intelligent, proactive, and interconnected security systems, with substantial potential for further expansion as regional economies continue to diversify and modernize. The estimated market value by 2033 is projected to exceed $25.2 billion.

Middle East Commercial Security Market Segmentation

-

1. Security Type

- 1.1. Video Su

- 1.2. Access C

-

2. End-user Type

- 2.1. Industri

- 2.2. Residential

- 2.3. Commercial (Hospitality, Education, etc)

- 2.4. Other End-users

-

3. Geography

- 3.1. UAE

- 3.2. Saudi Arabia

- 3.3. Qatar

- 3.4. Oman

- 3.5. Kuwait

- 3.6. Rest of Middle-East

Middle East Commercial Security Market Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. Qatar

- 4. Oman

- 5. Kuwait

- 6. Rest of Middle East

Middle East Commercial Security Market Regional Market Share

Geographic Coverage of Middle East Commercial Security Market

Middle East Commercial Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Changes in Regulatory Standards have Prompted Agencies to put in Place Security Systems with Storage Capabilities; Dynamic Nature of the Security Threats; Strong Investments in the Infrastructural Sector in Emerging Markets such as Qatar

- 3.3. Market Restrains

- 3.3.1. Technical Complications

- 3.4. Market Trends

- 3.4.1. Growing Investment in Infrastructure is Expected to Cater Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Commercial Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 5.1.1. Video Su

- 5.1.2. Access C

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Industri

- 5.2.2. Residential

- 5.2.3. Commercial (Hospitality, Education, etc)

- 5.2.4. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. Qatar

- 5.3.4. Oman

- 5.3.5. Kuwait

- 5.3.6. Rest of Middle-East

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. UAE

- 5.4.2. Saudi Arabia

- 5.4.3. Qatar

- 5.4.4. Oman

- 5.4.5. Kuwait

- 5.4.6. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 6. UAE Middle East Commercial Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Security Type

- 6.1.1. Video Su

- 6.1.2. Access C

- 6.2. Market Analysis, Insights and Forecast - by End-user Type

- 6.2.1. Industri

- 6.2.2. Residential

- 6.2.3. Commercial (Hospitality, Education, etc)

- 6.2.4. Other End-users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. UAE

- 6.3.2. Saudi Arabia

- 6.3.3. Qatar

- 6.3.4. Oman

- 6.3.5. Kuwait

- 6.3.6. Rest of Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Security Type

- 7. Saudi Arabia Middle East Commercial Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Security Type

- 7.1.1. Video Su

- 7.1.2. Access C

- 7.2. Market Analysis, Insights and Forecast - by End-user Type

- 7.2.1. Industri

- 7.2.2. Residential

- 7.2.3. Commercial (Hospitality, Education, etc)

- 7.2.4. Other End-users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. UAE

- 7.3.2. Saudi Arabia

- 7.3.3. Qatar

- 7.3.4. Oman

- 7.3.5. Kuwait

- 7.3.6. Rest of Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Security Type

- 8. Qatar Middle East Commercial Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Security Type

- 8.1.1. Video Su

- 8.1.2. Access C

- 8.2. Market Analysis, Insights and Forecast - by End-user Type

- 8.2.1. Industri

- 8.2.2. Residential

- 8.2.3. Commercial (Hospitality, Education, etc)

- 8.2.4. Other End-users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. UAE

- 8.3.2. Saudi Arabia

- 8.3.3. Qatar

- 8.3.4. Oman

- 8.3.5. Kuwait

- 8.3.6. Rest of Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Security Type

- 9. Oman Middle East Commercial Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Security Type

- 9.1.1. Video Su

- 9.1.2. Access C

- 9.2. Market Analysis, Insights and Forecast - by End-user Type

- 9.2.1. Industri

- 9.2.2. Residential

- 9.2.3. Commercial (Hospitality, Education, etc)

- 9.2.4. Other End-users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. UAE

- 9.3.2. Saudi Arabia

- 9.3.3. Qatar

- 9.3.4. Oman

- 9.3.5. Kuwait

- 9.3.6. Rest of Middle-East

- 9.1. Market Analysis, Insights and Forecast - by Security Type

- 10. Kuwait Middle East Commercial Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Security Type

- 10.1.1. Video Su

- 10.1.2. Access C

- 10.2. Market Analysis, Insights and Forecast - by End-user Type

- 10.2.1. Industri

- 10.2.2. Residential

- 10.2.3. Commercial (Hospitality, Education, etc)

- 10.2.4. Other End-users

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. UAE

- 10.3.2. Saudi Arabia

- 10.3.3. Qatar

- 10.3.4. Oman

- 10.3.5. Kuwait

- 10.3.6. Rest of Middle-East

- 10.1. Market Analysis, Insights and Forecast - by Security Type

- 11. Rest of Middle East Middle East Commercial Security Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Security Type

- 11.1.1. Video Su

- 11.1.2. Access C

- 11.2. Market Analysis, Insights and Forecast - by End-user Type

- 11.2.1. Industri

- 11.2.2. Residential

- 11.2.3. Commercial (Hospitality, Education, etc)

- 11.2.4. Other End-users

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. UAE

- 11.3.2. Saudi Arabia

- 11.3.3. Qatar

- 11.3.4. Oman

- 11.3.5. Kuwait

- 11.3.6. Rest of Middle-East

- 11.1. Market Analysis, Insights and Forecast - by Security Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Bosch Security & Safety

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hikvision Digital Technology

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sentinel*List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 UTC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dahua Technology Co

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Avilgon (Motorola)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pelco Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Tyco Security Products

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Axis Communications

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Honeywell Security

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 FLIR Systems

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Bosch Security & Safety

List of Figures

- Figure 1: Middle East Commercial Security Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Commercial Security Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Commercial Security Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 2: Middle East Commercial Security Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 3: Middle East Commercial Security Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Middle East Commercial Security Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Middle East Commercial Security Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 6: Middle East Commercial Security Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 7: Middle East Commercial Security Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Middle East Commercial Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Middle East Commercial Security Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 10: Middle East Commercial Security Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 11: Middle East Commercial Security Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Middle East Commercial Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Middle East Commercial Security Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 14: Middle East Commercial Security Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 15: Middle East Commercial Security Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Middle East Commercial Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Middle East Commercial Security Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 18: Middle East Commercial Security Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 19: Middle East Commercial Security Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle East Commercial Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Middle East Commercial Security Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 22: Middle East Commercial Security Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 23: Middle East Commercial Security Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Middle East Commercial Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Middle East Commercial Security Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 26: Middle East Commercial Security Market Revenue undefined Forecast, by End-user Type 2020 & 2033

- Table 27: Middle East Commercial Security Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Middle East Commercial Security Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Commercial Security Market?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the Middle East Commercial Security Market?

Key companies in the market include Bosch Security & Safety, Hikvision Digital Technology, Sentinel*List Not Exhaustive, UTC, Dahua Technology Co, Avilgon (Motorola), Pelco Inc, Tyco Security Products, Axis Communications, Honeywell Security, FLIR Systems.

3. What are the main segments of the Middle East Commercial Security Market?

The market segments include Security Type, End-user Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Favorable Changes in Regulatory Standards have Prompted Agencies to put in Place Security Systems with Storage Capabilities; Dynamic Nature of the Security Threats; Strong Investments in the Infrastructural Sector in Emerging Markets such as Qatar.

6. What are the notable trends driving market growth?

Growing Investment in Infrastructure is Expected to Cater Market Growth.

7. Are there any restraints impacting market growth?

Technical Complications.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Commercial Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Commercial Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Commercial Security Market?

To stay informed about further developments, trends, and reports in the Middle East Commercial Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence