Key Insights

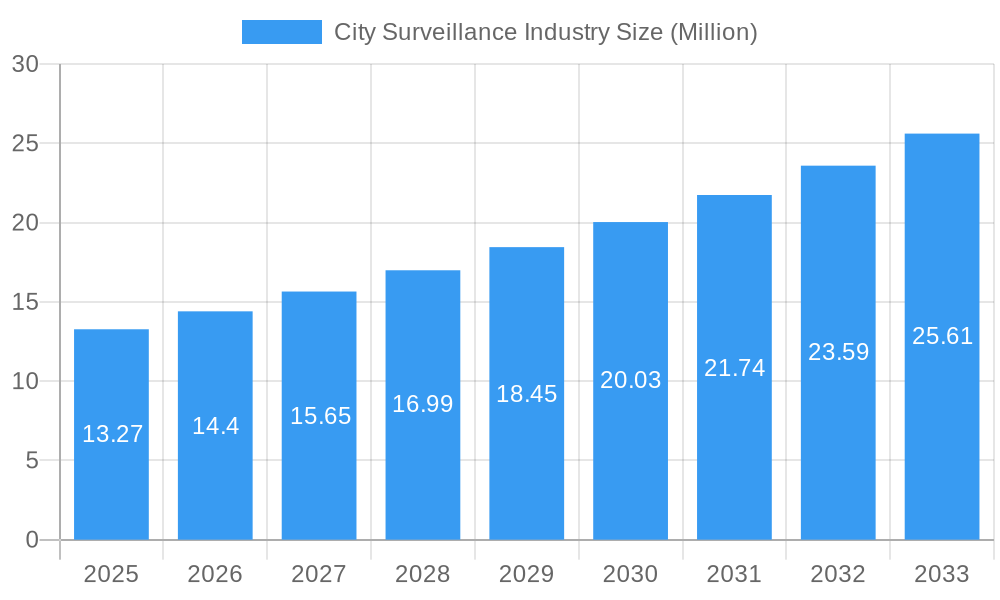

The City Surveillance Industry is poised for significant expansion, with a current market size of USD 13.27 Million and a projected Compound Annual Growth Rate (CAGR) of 8.50% from 2025 to 2033. This robust growth is driven by an increasing global focus on public safety and security, spurred by rising urbanization rates and the need to mitigate crime and terrorism. Governments worldwide are investing heavily in smart city initiatives, which prominently feature advanced video surveillance systems as a core component. The integration of Artificial Intelligence (AI) and machine learning in video analytics is a pivotal trend, enabling real-time threat detection, facial recognition, crowd analysis, and anomaly detection with unprecedented accuracy. Furthermore, the development of sophisticated camera technologies, including high-resolution imaging, thermal capabilities, and panoramic views, alongside enhanced storage solutions and integrated Video Management Systems (VMS), are collectively propelling market forward. The demand for comprehensive and intelligent surveillance solutions to ensure public safety and streamline urban operations is the primary catalyst for this projected market surge.

City Surveillance Industry Market Size (In Million)

Key drivers behind this upward trajectory include escalating concerns over public safety, the proliferation of smart city projects, and advancements in surveillance technology. Trends such as the adoption of AI-powered video analytics, cloud-based VMS, and the increasing deployment of IoT devices for integrated security infrastructure are reshaping the market landscape. However, challenges such as data privacy concerns, high initial implementation costs, and the need for robust cybersecurity measures to protect sensitive surveillance data could temper the growth rate in certain regions. Despite these restraints, the persistent demand for effective crime prevention, traffic management, and emergency response systems will continue to fuel innovation and market penetration. The industry is characterized by a competitive environment with key players investing in research and development to offer more intelligent, integrated, and scalable surveillance solutions for urban environments.

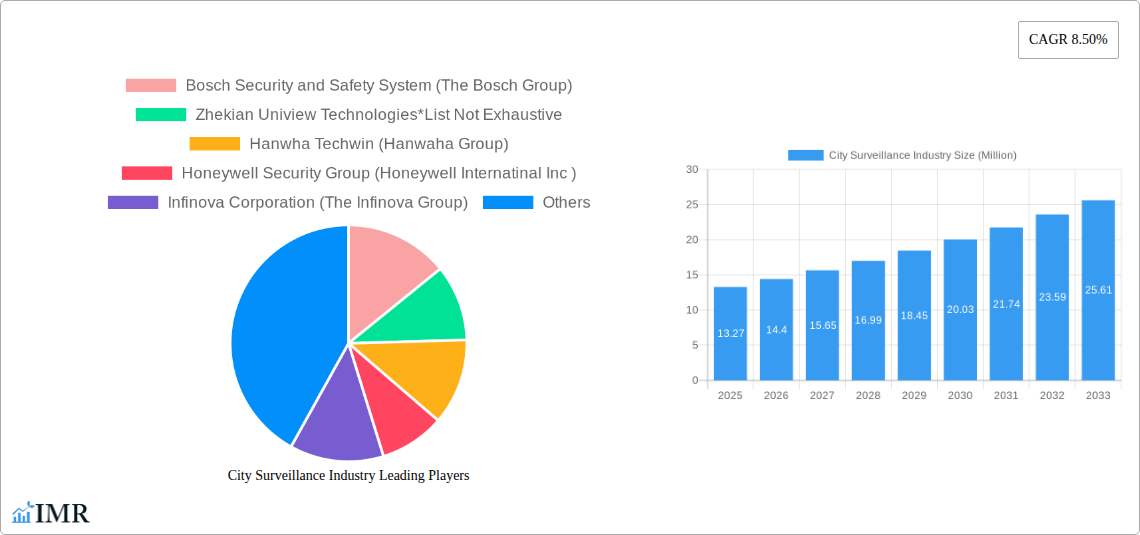

City Surveillance Industry Company Market Share

City Surveillance Industry Report: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global City Surveillance Industry, offering critical insights into market dynamics, growth trajectories, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this study is essential for stakeholders seeking to understand market concentration, technological advancements, and emerging opportunities. The report delves into parent and child market segments, providing a holistic view of the industry's evolution and future potential. Values are presented in Million units for clarity and ease of understanding.

City Surveillance Industry Market Dynamics & Structure

The City Surveillance Industry is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and a diverse range of end-user needs. Market concentration varies across key segments, with dominant players vying for market share through continuous product development and strategic partnerships. Technological innovation, particularly in areas like AI-powered video analytics and advanced camera sensor technology, acts as a primary driver, enhancing surveillance capabilities and efficiency. Regulatory frameworks, such as data privacy laws and public safety mandates, significantly influence market adoption and product design. Competitive product substitutes, including private security services and alternative monitoring solutions, present a moderating influence on market growth. End-user demographics, ranging from municipal governments and law enforcement agencies to transportation authorities and critical infrastructure operators, shape demand patterns. Mergers and acquisitions (M&A) are a notable trend, as larger entities consolidate market presence and acquire innovative technologies. For instance, the M&A landscape saw xx significant deals in the historical period, indicating a strong consolidation drive. Innovation barriers, such as the high cost of R&D and the need for robust cybersecurity measures, are also crucial considerations.

- Market Concentration: Moderate to High in Camera and Video Analytics segments, moderate in VMS and Storage.

- Technological Innovation Drivers: AI, IoT integration, cloud computing, high-resolution imaging, edge computing.

- Regulatory Frameworks: Data privacy laws (GDPR, CCPA), public safety standards, interoperability mandates.

- Competitive Product Substitutes: Private security personnel, alarm systems, access control solutions.

- End-User Demographics: Municipalities, law enforcement, transportation, critical infrastructure, smart city initiatives.

- M&A Trends: Consolidation of smaller players, acquisition of technology-focused startups, strategic alliances.

- Innovation Barriers: High R&D costs, cybersecurity concerns, data storage and management complexity, public perception.

City Surveillance Industry Growth Trends & Insights

The global City Surveillance Industry is poised for robust growth, driven by increasing urbanization, rising crime rates, and a growing emphasis on public safety and smart city initiatives. The market size is projected to expand from approximately $XX,XXX Million in 2019 to an estimated $XX,XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period. This upward trajectory is fueled by the escalating adoption of advanced surveillance technologies, including AI-powered video analytics for real-time threat detection, anomaly identification, and predictive policing. The penetration of high-definition cameras and intelligent video management systems (VMS) is also on the rise, enabling more effective monitoring and evidence collection. Consumer behavior shifts are leaning towards integrated, scalable, and cloud-based surveillance solutions that offer remote accessibility and enhanced data analysis capabilities. Technological disruptions, such as the widespread implementation of 5G networks, are further accelerating the deployment of real-time, high-bandwidth surveillance systems. Adoption rates for AI-driven analytics are expected to witness a CAGR of XX.X% during the forecast period. The market penetration of integrated smart city surveillance solutions is projected to reach XX% by 2033.

- Market Size Evolution: Projected growth from $XX,XXX Million (2019) to $XX,XXX Million (2033).

- CAGR: XX.X% (2025-2033).

- Adoption Rates: Increasing adoption of AI, IoT, and cloud-based solutions.

- Technological Disruptions: 5G implementation, edge computing, advancements in sensor technology.

- Consumer Behavior Shifts: Demand for integrated, scalable, remote, and data-driven surveillance.

- Market Penetration: Significant growth in smart city and AI-integrated surveillance systems.

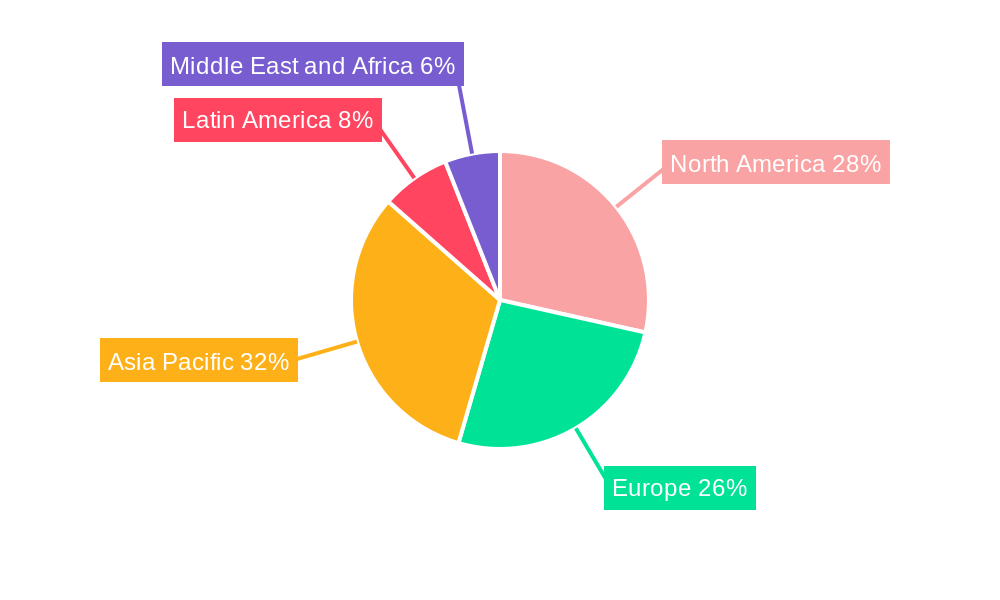

Dominant Regions, Countries, or Segments in City Surveillance Industry

The Camera segment is identified as the dominant force driving growth within the City Surveillance Industry, commanding an estimated market share of XX% in 2025 and projected to reach XX% by 2033. This dominance is attributed to the fundamental role of cameras as the primary data acquisition devices in any surveillance system. Key drivers for the camera segment's growth include ongoing advancements in imaging technology, such as higher resolutions (4K and beyond), improved low-light performance, wider dynamic range (WDR), and the integration of AI capabilities at the edge. The increasing demand for specialized cameras, including PTZ (Pan-Tilt-Zoom), thermal, and panoramic cameras, further fuels this segment's expansion. North America is the leading region, holding an estimated XX% of the global market share in 2025, driven by substantial investments in public safety infrastructure, smart city initiatives, and a strong demand for advanced security solutions from federal and local government bodies. The United States, in particular, represents a significant market within North America due to its large urban centers and proactive approach to adopting new technologies for crime prevention and urban management. Economic policies that prioritize national security and smart city development, coupled with robust infrastructure development, are key factors contributing to North America's dominance. Asia Pacific is emerging as a high-growth region, driven by rapid urbanization, government investments in smart cities, and a burgeoning manufacturing base for surveillance equipment.

- Dominant Segment: Camera (estimated XX% market share in 2025).

- Key Drivers: High-resolution imaging, AI integration, specialized camera types (PTZ, thermal), improved low-light performance.

- Growth Potential: Continuous innovation in sensor technology and edge computing.

- Leading Region: North America (estimated XX% market share in 2025).

- Key Drivers: Government investments in public safety, smart city projects, strong technological adoption.

- Dominant Country (within region): United States.

- Emerging High-Growth Region: Asia Pacific.

- Key Drivers: Rapid urbanization, smart city initiatives, expanding manufacturing capabilities.

City Surveillance Industry Product Landscape

The City Surveillance Industry's product landscape is continuously evolving with groundbreaking innovations and expanded applications. High-resolution cameras, such as Hangzhou Hikvision Digital Technology Co. Ltd's new DeepinView bullet network cameras with TandemVu technology, exemplify the trend towards enhanced situational awareness, capable of simultaneously monitoring large scenes and close-up details. The integration of AI at the edge in cameras allows for real-time analysis and reduces bandwidth requirements. Video Management Systems (VMS) are becoming more sophisticated, offering advanced analytics, seamless integration with other security systems, and cloud-based deployment options for scalability and remote access. Storage solutions are advancing to handle the massive data generated by high-definition surveillance, with an increasing reliance on high-capacity HDDs, SSDs, and cloud storage. Video analytics software is at the forefront of intelligence, enabling object detection, facial recognition, crowd analysis, and behavioral pattern identification. Nice Systems Limited offers solutions that integrate security and automation, showcasing the expanding use cases.

Key Drivers, Barriers & Challenges in City Surveillance Industry

Key Drivers: The City Surveillance Industry is propelled by several critical factors. Increasing urbanization and the subsequent rise in public safety concerns worldwide are primary drivers. Government initiatives focused on smart city development and national security mandates also significantly boost market growth. Technological advancements, particularly in AI, machine learning, and IoT integration, enable more intelligent and effective surveillance solutions. The declining cost of hardware components and the increasing availability of cloud-based services make advanced surveillance systems more accessible.

- Drivers:

- Urbanization and Public Safety Demands

- Smart City Initiatives and Government Funding

- Technological Advancements (AI, IoT, Edge Computing)

- Decreasing Hardware Costs

- Growing Awareness of Security Threats

Barriers & Challenges: Despite its growth potential, the industry faces significant challenges. Stringent data privacy regulations and public concerns over surveillance can create adoption hurdles. The complexity of integrating disparate systems and ensuring interoperability between various hardware and software components poses a technical challenge. High initial investment costs for comprehensive city-wide deployments can be a barrier for some municipalities. Cybersecurity threats and the risk of data breaches are constant concerns, requiring robust security measures. Supply chain disruptions, as experienced globally, can also impact the availability and cost of components.

- Challenges:

- Data Privacy Concerns and Regulatory Hurdles

- System Integration and Interoperability Issues

- High Initial Deployment Costs

- Cybersecurity Threats and Data Breach Risks

- Supply Chain Volatility

Emerging Opportunities in City Surveillance Industry

Emerging opportunities in the City Surveillance Industry lie in the expansion of AI-powered analytics for predictive policing and proactive threat mitigation. The integration of surveillance systems with other smart city infrastructure, such as traffic management and emergency response, presents significant growth potential. The development of privacy-preserving surveillance technologies, incorporating anonymization and differential privacy techniques, is another key area. Furthermore, the growing demand for cloud-native VMS solutions and edge computing capabilities for real-time processing at the device level opens new avenues. The application of surveillance technology in emerging sectors like intelligent transportation systems and public health monitoring also offers promising prospects.

Growth Accelerators in the City Surveillance Industry Industry

Several factors are accelerating the growth of the City Surveillance Industry. The continuous innovation in camera sensor technology, enabling higher resolution and better low-light performance, is a significant accelerator. The widespread adoption of AI and machine learning algorithms for advanced video analytics, such as facial recognition and anomaly detection, is transforming surveillance capabilities. The development and deployment of 5G networks provide the necessary bandwidth for real-time, high-definition video streaming, enabling more responsive and effective surveillance. Strategic partnerships between technology providers and government bodies are crucial for facilitating large-scale deployments and driving market expansion. The increasing global focus on smart city development and public safety further acts as a powerful catalyst for sustained growth.

Key Players Shaping the City Surveillance Industry Market

- Bosch Security and Safety System (The Bosch Group)

- Zhejiang Uniview Technologies

- Hanwha Techwin (Hanwha Group)

- Honeywell Security Group (Honeywell International Inc)

- Infinova Corporation (The Infinova Group)

- Nice Systems Limited

- Cisco Systems Inc

- Verint Systems

- Genetec Inc

- Axon Enterprise Inc

- NEC Corporation

- Qognify Inc (Battery Ventures)

- Agent Video Intelligence Ltd

- Avigilon Corporation (Motorola Solutions Inc)

- Hangzhou Hikvision Digital Technology Co Ltd

- Axis Communications (Canon Inc)

- CP Plus

- Dahua Technology Co Ltd

- Panasonic Corporation

Notable Milestones in City Surveillance Industry Sector

- July 2022: Hangzhou Hikvision Digital Technology Co. Ltd launched new DeepinView bullet network cameras with TandemVu technology, expanding its capabilities for monitoring large scenes and close-up details simultaneously, enhancing situational awareness and security.

- March 2022: Hanwha Techwin introduced the new Wisenet A Series of low-cost cameras and network video recorders, designed for cost-conscious projects, combining NDAA-compliant devices with renowned imaging technology.

In-Depth City Surveillance Industry Market Outlook

The future outlook for the City Surveillance Industry is exceptionally bright, fueled by a convergence of technological advancements and growing global demands for enhanced security and efficient urban management. Growth accelerators such as the ubiquitous integration of AI in video analytics, the deployment of next-generation communication networks like 5G, and the expansion of smart city ecosystems will continue to shape the market. Strategic partnerships and the development of interoperable, scalable, and cloud-native solutions are key to unlocking future market potential. Stakeholders can anticipate sustained growth driven by ongoing innovation in camera technology, advanced analytics, and integrated surveillance platforms designed to address evolving security challenges and improve the quality of urban life. The industry is on a trajectory to become an indispensable component of modern urban infrastructure.

City Surveillance Industry Segmentation

-

1. Component

- 1.1. Camera

- 1.2. Storage

- 1.3. Video Management System

- 1.4. Video Analytics

City Surveillance Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

City Surveillance Industry Regional Market Share

Geographic Coverage of City Surveillance Industry

City Surveillance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Spending on Surveillance in Major Cities Across the World; Diminishing IP Camera Prices

- 3.2.2 Coupled with Technological Advancements in Analytics and Software; Growing Security Threat and Smart City Growth Prompting Governments and City Administrations to Adopt Innovative Surveillance Solutions

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Camera Segment to Hold Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Camera

- 5.1.2. Storage

- 5.1.3. Video Management System

- 5.1.4. Video Analytics

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Camera

- 6.1.2. Storage

- 6.1.3. Video Management System

- 6.1.4. Video Analytics

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Camera

- 7.1.2. Storage

- 7.1.3. Video Management System

- 7.1.4. Video Analytics

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Camera

- 8.1.2. Storage

- 8.1.3. Video Management System

- 8.1.4. Video Analytics

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Camera

- 9.1.2. Storage

- 9.1.3. Video Management System

- 9.1.4. Video Analytics

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Camera

- 10.1.2. Storage

- 10.1.3. Video Management System

- 10.1.4. Video Analytics

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bosch Security and Safety System (The Bosch Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zhekian Uniview Technologies*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hanwha Techwin (Hanwaha Group)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell Security Group (Honeywell Internatinal Inc )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Infinova Corporation (The Infinova Group)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nice Systems Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cisco Systems Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Verint Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Genetec Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Axon Enterprise Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NEC Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Qognify Inc (Battery Ventures)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Agent Video Intelligence Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Avigilon Corporation (Motorola Solutions Inc )

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hangzhou Hikvision Digital Technology Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Axis Communications (Canon Inc )

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 CP Plus

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Dahua Technology Co Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Panasonic Corporation

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Bosch Security and Safety System (The Bosch Group)

List of Figures

- Figure 1: Global City Surveillance Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 7: Europe City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 8: Europe City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Asia Pacific City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Asia Pacific City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 15: Latin America City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Latin America City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Middle East and Africa City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Middle East and Africa City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global City Surveillance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the City Surveillance Industry?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the City Surveillance Industry?

Key companies in the market include Bosch Security and Safety System (The Bosch Group), Zhekian Uniview Technologies*List Not Exhaustive, Hanwha Techwin (Hanwaha Group), Honeywell Security Group (Honeywell Internatinal Inc ), Infinova Corporation (The Infinova Group), Nice Systems Limited, Cisco Systems Inc, Verint Systems, Genetec Inc, Axon Enterprise Inc, NEC Corporation, Qognify Inc (Battery Ventures), Agent Video Intelligence Ltd, Avigilon Corporation (Motorola Solutions Inc ), Hangzhou Hikvision Digital Technology Co Ltd, Axis Communications (Canon Inc ), CP Plus, Dahua Technology Co Ltd, Panasonic Corporation.

3. What are the main segments of the City Surveillance Industry?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending on Surveillance in Major Cities Across the World; Diminishing IP Camera Prices. Coupled with Technological Advancements in Analytics and Software; Growing Security Threat and Smart City Growth Prompting Governments and City Administrations to Adopt Innovative Surveillance Solutions.

6. What are the notable trends driving market growth?

Camera Segment to Hold Largest Market Share.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

July 2022 - The Hangzhou Hikvision Digital Technology Co. Ltd has launched the new DeepinViewbullet network cameras with TandemVutechnology, expanding the reach of TandemVutechnology from PTZ units to bullet-styled models. These new cameras will be able to monitor large scenes and close-up details simultaneously, maintaining both viewpoints for improved situational awareness and security capability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "City Surveillance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the City Surveillance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the City Surveillance Industry?

To stay informed about further developments, trends, and reports in the City Surveillance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence