Key Insights

The Middle East Polyethylene Market is poised for robust growth, with an estimated market size of USD 120 billion in 2024. This expansion is driven by a CAGR of 5.5% over the forecast period, indicating a steady upward trajectory. The region's significant petrochemical production capacity, coupled with burgeoning domestic demand from key end-user industries, forms the bedrock of this growth. The Packaging sector, a primary consumer of polyethylene for flexible films, rigid containers, and other packaging solutions, is a major contributor. Similarly, the Building and Construction industry's increasing need for pipes, conduit, and insulation materials, along with the Transportation sector's demand for lightweight components and films, are significant growth enablers. Furthermore, the Electrical and Electronics industry's reliance on polyethylene for wire and cable insulation and the Agriculture sector's use in greenhouse films and irrigation systems are also pivotal. The availability of abundant raw materials and competitive production costs in the Middle East further fortifies its position as a key global supplier and consumer of polyethylene.

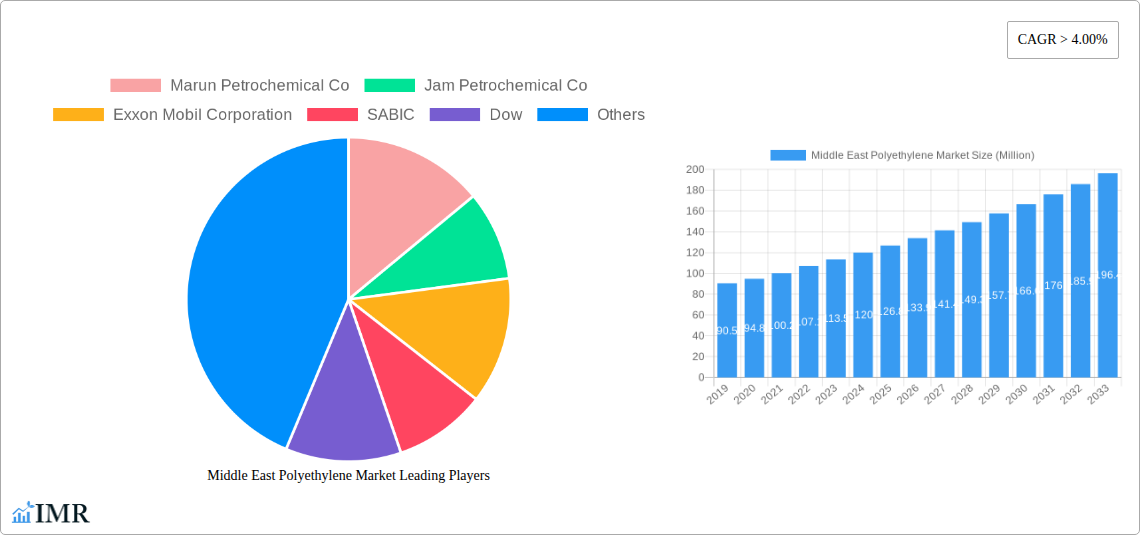

Middle East Polyethylene Market Market Size (In Million)

The market's trajectory is further shaped by several key trends and drivers. Advancements in polyethylene grades, particularly in the realm of HDPE, LDPE, and LLDPE, catering to specific application needs such as enhanced durability, flexibility, and barrier properties, are driving innovation. The increasing adoption of advanced manufacturing techniques like blow molding, films and sheets extrusion, and injection molding, which are highly dependent on polyethylene, are also fueling market expansion. Despite these positive trends, certain restraints could impact the market's full potential. These include fluctuating raw material prices, environmental regulations concerning plastic waste, and the growing preference for sustainable alternatives in certain applications. However, the inherent versatility and cost-effectiveness of polyethylene, especially in a region with strong petrochemical infrastructure, are expected to mitigate these challenges, ensuring sustained market development through 2033.

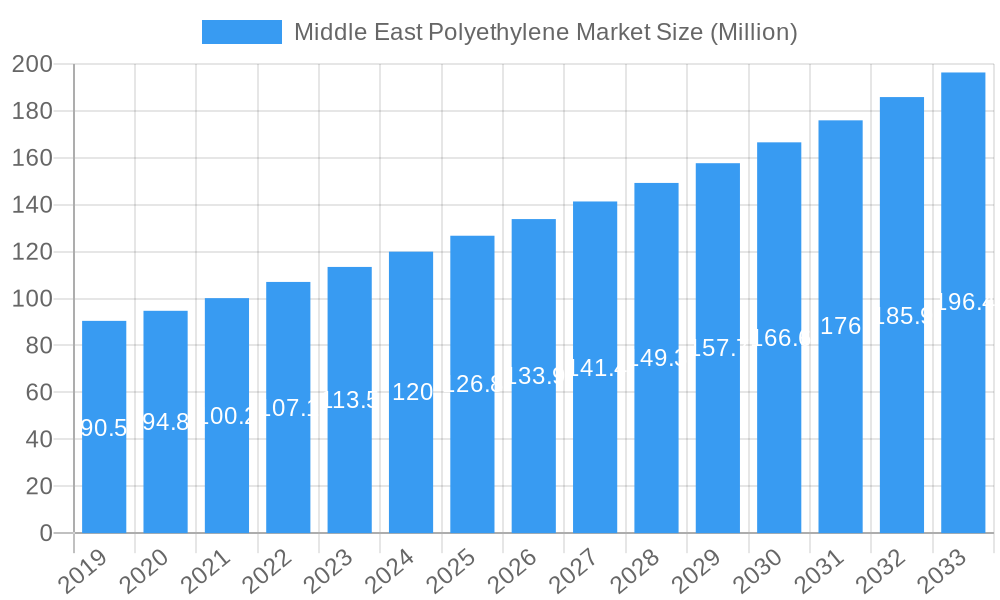

Middle East Polyethylene Market Company Market Share

This in-depth report provides a definitive analysis of the Middle East Polyethylene Market, a critical sector within the global petrochemical industry. Spanning the historical period of 2019-2024 and projecting to 2033, with a base and estimated year of 2025, this report offers unparalleled insights into market dynamics, growth trends, regional dominance, product innovation, key players, and emerging opportunities. We meticulously examine parent and child markets, leveraging high-traffic keywords such as "Middle East Polyethylene," "HDPE Market," "LLDPE Market," "Polyethylene Applications," "Petrochemical Industry Saudi Arabia," and "GCC Polyethylene," to ensure maximum search engine visibility. This report is designed for industry professionals, investors, and strategists seeking a comprehensive understanding of this vital market.

Middle East Polyethylene Market Market Dynamics & Structure

The Middle East Polyethylene Market is characterized by a dynamic and evolving structure, heavily influenced by large-scale production capacities and strategic investments. Market concentration remains significant, with key players like SABIC and Exxon Mobil Corporation holding substantial market shares. Technological innovation is a primary driver, particularly in developing advanced grades of High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Linear Low-Density Polyethylene (LLDPE) with enhanced performance characteristics. Regulatory frameworks, while generally supportive of industrial growth, often focus on environmental compliance and sustainability initiatives, impacting production processes and product development. Competitive product substitutes, such as polypropylene, present an ongoing challenge, driving the need for continuous product differentiation and cost-effectiveness. End-user demographics are shifting, with increasing demand from burgeoning packaging, construction, and automotive sectors across the GCC and wider Middle East region. Mergers and acquisitions (M&A) activity, though not currently at peak levels, remain a strategic tool for market consolidation and vertical integration.

- Market Concentration: Dominated by major petrochemical giants with significant production capacities.

- Technological Innovation Drivers: Focus on high-performance grades, sustainability, and cost optimization.

- Regulatory Frameworks: Emphasis on environmental standards and export-oriented policies.

- Competitive Product Substitutes: Continuous competition from polypropylene and other polymers.

- End-user Demographics: Growing demand from packaging, construction, and automotive industries.

- M&A Trends: Strategic acquisitions for market share expansion and portfolio diversification.

Middle East Polyethylene Market Growth Trends & Insights

The Middle East Polyethylene Market is poised for robust growth, driven by a confluence of economic development, infrastructure expansion, and increasing consumer demand. Leveraging data and forecasts, this analysis projects a significant market size evolution from its current standing. The adoption rates for various polyethylene grades are expected to climb steadily, fueled by their versatility and cost-effectiveness across numerous applications. Technological disruptions, such as advancements in catalyst technology and recycling processes, are reshaping the market landscape, leading to improved product performance and enhanced sustainability profiles. Consumer behavior shifts, particularly the growing preference for convenient and sustainable packaging solutions, are directly impacting demand for polyethylene films and containers. These trends are expected to contribute to a healthy Compound Annual Growth Rate (CAGR) throughout the forecast period.

- Market Size Evolution: Projected to witness substantial expansion driven by increasing production and demand.

- Adoption Rates: Steady increase in the adoption of HDPE, LDPE, and LLDPE across diverse applications.

- Technological Disruptions: Innovations in catalysis, processing, and recycling enhancing product capabilities and sustainability.

- Consumer Behavior Shifts: Growing demand for lightweight, durable, and eco-friendly packaging solutions.

- CAGR: Expected to register a strong Compound Annual Growth Rate between 2025 and 2033.

- Market Penetration: Deepening penetration into traditional and emerging end-user industries.

Dominant Regions, Countries, or Segments in Middle East Polyethylene Market

The Middle East Polyethylene Market is largely dominated by Saudi Arabia, due to its extensive petrochemical infrastructure, strategic location, and significant production capacity. Within the Product Type segment, LLDPE is projected to be a key growth driver, followed closely by HDPE. For Applications, Films and Sheets are expected to maintain their leading position, driven by the robust packaging industry, while Pipes and Conduit will witness significant expansion due to ongoing infrastructure development. In terms of End-user Industries, the Packaging sector will continue to be the largest consumer of polyethylene, closely followed by Building and Construction.

- Dominant Country: Saudi Arabia, with its vast reserves of oil and gas, is the leading producer and exporter of polyethylene.

- Product Type Dominance:

- LLDPE: Anticipated to experience substantial growth due to its superior strength and flexibility in film applications.

- HDPE: Continues to dominate in applications requiring rigidity and chemical resistance, such as pipes and containers.

- Application Dominance:

- Films and Sheets: The cornerstone of the packaging industry, driving consistent demand.

- Pipes and Conduit: Accelerated growth due to extensive infrastructure projects and water management initiatives.

- Injection Molding: Robust demand from the automotive and consumer goods sectors.

- End-user Industry Dominance:

- Packaging: The largest end-user, encompassing food and beverage, consumer goods, and industrial packaging.

- Building and Construction: Significant demand for pipes, insulation, and other construction materials.

- Transportation: Growing use in lightweight automotive components.

Middle East Polyethylene Market Product Landscape

The Middle East Polyethylene Market product landscape is characterized by a continuous stream of innovations aimed at enhancing performance and meeting evolving industry demands. Companies are actively developing advanced grades of HDPE, LDPE, and LLDPE with improved tensile strength, impact resistance, and thermal stability. These advancements are directly enabling new applications and improving existing ones, such as high-barrier films for food packaging, durable pipes for infrastructure projects, and lightweight components for the automotive sector. The focus is on creating polyethylene resins that offer superior processing characteristics and greater sustainability credentials, including those suitable for recycling and biopolymer blends.

Key Drivers, Barriers & Challenges in Middle East Polyethylene Market

Key Drivers: The Middle East Polyethylene Market is propelled by strong drivers including the region's abundant and cost-competitive feedstock availability (natural gas and crude oil), significant governmental support for petrochemical sector expansion, and robust demand from burgeoning domestic and international end-user industries like packaging and construction. Technological advancements in polymerization processes are also contributing to improved product quality and efficiency.

Barriers & Challenges: Despite the positive outlook, the market faces challenges such as increasing global competition, volatility in crude oil prices impacting feedstock costs, and growing environmental concerns and regulatory pressures related to plastic waste management and sustainability. Supply chain disruptions and geopolitical uncertainties can also pose significant hurdles.

Emerging Opportunities in Middle East Polyethylene Market

Emerging opportunities within the Middle East Polyethylene Market lie in the development of specialized polyethylene grades for high-value applications, such as advanced films for medical packaging and biodegradable polyethylene compounds. The growing emphasis on a circular economy presents opportunities for investment in advanced recycling technologies and the production of recycled polyethylene (rPE) resins. Furthermore, expanding into new export markets and catering to the rising demand for sustainable packaging solutions will be crucial for future growth.

Growth Accelerators in the Middle East Polyethylene Market Industry

Several key catalysts are accelerating growth in the Middle East Polyethylene Market. Strategic investments in downstream industries, aiming to add value to basic petrochemicals, are creating new demand centers. Technological breakthroughs in catalysis and process efficiency are leading to cost reductions and improved product quality. Furthermore, government initiatives promoting industrial diversification and the development of free trade zones are enhancing export competitiveness and attracting foreign investment, solidifying the region's position as a global petrochemical hub.

Key Players Shaping the Middle East Polyethylene Market Market

- Marun Petrochemical Co

- Jam Petrochemical Co

- Exxon Mobil Corporation

- SABIC

- Dow

- Saudi Polymers Company (Chevron & SABIC)

- Amir Kabir Petrochemical Co (AKPC)

- Ilam Petrochemical

- Saudi Ethylene and Polyethylene Co (Tasnee)

- Sharq - Eastern Petrochemical Co (SDPC)

- LyondellBasell Industries Holdings BV

Notable Milestones in Middle East Polyethylene Market Sector

- November 2022: SABIC partnered with Guangdong Jinming Machinery Co. Ltd (a plastic packaging equipment manufacturer) and Bolsas de los Altos (a leading plastic film and packaging converter). This agreement allows SABIC polyolefin resin products, including polyethylene resin offers from Gulf Coast Growth Ventures (GCGV) and TRUCIRCLETM, to be tested and validated, enhancing product development and market acceptance.

- September 2021: SABIC announced the development of a new technology and range of dedicated polyethylene (PE) and polypropylene (PP) resins. This represents a substantial advancement in the performance profile of polyolefin pressure pipes, developed in collaboration with Tecnomatic and aquatherm, key specialists in pipe manufacture, signaling innovation in the pipes and conduit segment.

In-Depth Middle East Polyethylene Market Market Outlook

The Middle East Polyethylene Market is projected to experience sustained growth, driven by strong fundamental demand and strategic industry developments. The ongoing investments in infrastructure and the expanding packaging sector will continue to fuel consumption of HDPE, LDPE, and LLDPE. The industry's commitment to innovation, particularly in sustainability and specialized product grades, will create new market niches and opportunities. Strategic partnerships and collaborations, exemplified by recent milestones, will further enhance market competitiveness and facilitate the adoption of advanced technologies. The region is well-positioned to capitalize on global demand for polyethylene, cementing its status as a pivotal player in the international petrochemical landscape.

Middle East Polyethylene Market Segmentation

-

1. Product Type

- 1.1. HDPE

- 1.2. LDPE

- 1.3. LLDPE

- 1.4. Other Product Types

-

2. Application

- 2.1. Blow Molding

- 2.2. Films and Sheets

- 2.3. Injection Molding

- 2.4. Pipes and Conduit

- 2.5. Wires and Cables

- 2.6. Other Applications

-

3. End-user Industry

- 3.1. Packaging

- 3.2. Transportation

- 3.3. Electrical and Electronics

- 3.4. Building and Construction

- 3.5. Agriculture

- 3.6. Other End-user Industries

Middle East Polyethylene Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Polyethylene Market Regional Market Share

Geographic Coverage of Middle East Polyethylene Market

Middle East Polyethylene Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from a Diverse Range of End-user Industries; Growth in Industrial Applications such as Primarily Packing Automotive and Electrical Replacement Part

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes such as Polypropylene and Polyethylene Terephthalate Products; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand in the Building and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Polyethylene Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. HDPE

- 5.1.2. LDPE

- 5.1.3. LLDPE

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Blow Molding

- 5.2.2. Films and Sheets

- 5.2.3. Injection Molding

- 5.2.4. Pipes and Conduit

- 5.2.5. Wires and Cables

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Packaging

- 5.3.2. Transportation

- 5.3.3. Electrical and Electronics

- 5.3.4. Building and Construction

- 5.3.5. Agriculture

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marun Petrochemical Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jam Petrochemical Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SABIC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dow

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Polymers Company (Chevron & SABIC)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amir Kabir Petrochemical Co (AKPC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ilam Petrochemical

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Ethylene and Polyethylene Co (Tasnee)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sharq - Eastern Petrochemical Co (SDPC)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LyondellBasell Industries Holdings BV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Marun Petrochemical Co

List of Figures

- Figure 1: Middle East Polyethylene Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Polyethylene Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Polyethylene Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Middle East Polyethylene Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Middle East Polyethylene Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Middle East Polyethylene Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Middle East Polyethylene Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Middle East Polyethylene Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Middle East Polyethylene Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Middle East Polyethylene Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Middle East Polyethylene Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Middle East Polyethylene Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: Middle East Polyethylene Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Middle East Polyethylene Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: Middle East Polyethylene Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Middle East Polyethylene Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Middle East Polyethylene Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Middle East Polyethylene Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Saudi Arabia Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: United Arab Emirates Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: United Arab Emirates Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Israel Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Israel Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Qatar Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Qatar Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Kuwait Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Kuwait Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Oman Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Oman Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Bahrain Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Bahrain Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Jordan Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Jordan Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Lebanon Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Lebanon Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Polyethylene Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Middle East Polyethylene Market?

Key companies in the market include Marun Petrochemical Co, Jam Petrochemical Co, Exxon Mobil Corporation, SABIC, Dow, Saudi Polymers Company (Chevron & SABIC), Amir Kabir Petrochemical Co (AKPC), Ilam Petrochemical, Saudi Ethylene and Polyethylene Co (Tasnee), Sharq - Eastern Petrochemical Co (SDPC), LyondellBasell Industries Holdings BV.

3. What are the main segments of the Middle East Polyethylene Market?

The market segments include Product Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from a Diverse Range of End-user Industries; Growth in Industrial Applications such as Primarily Packing Automotive and Electrical Replacement Part.

6. What are the notable trends driving market growth?

Increasing Demand in the Building and Construction Industry.

7. Are there any restraints impacting market growth?

Availability of Substitutes such as Polypropylene and Polyethylene Terephthalate Products; Other Restraints.

8. Can you provide examples of recent developments in the market?

November 2022: SABIC partnered with Guangdong Jinming Machinery Co. Ltd, a plastic packaging equipment manufacturer, and Bolsas de los Altos, a leading plastic film and packaging converter. The agreement will allow SABIC polyolefin resin products, as well as polyethylene resin offers from Gulf Coast Growth Ventures (GCGV) and TRUCIRCLETM, to be tested and validated.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Polyethylene Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Polyethylene Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Polyethylene Market?

To stay informed about further developments, trends, and reports in the Middle East Polyethylene Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence