Key Insights

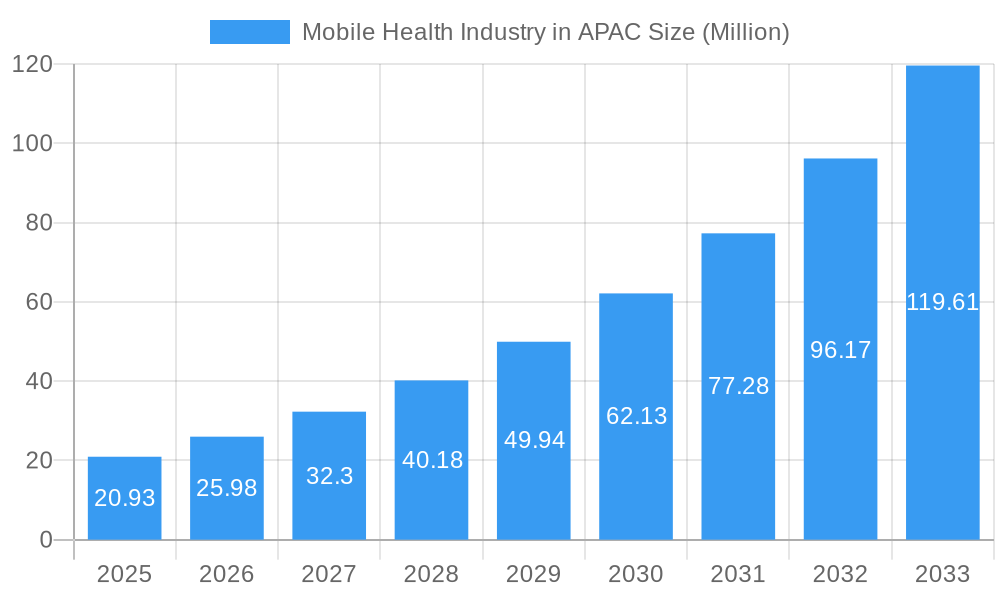

The Mobile Health (mHealth) industry in the Asia-Pacific (APAC) region is poised for exceptional growth, projected to reach a substantial market size of USD 20.93 billion by 2025. This rapid expansion is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 24.22%, indicating a robust and dynamic market. Key drivers for this surge include the increasing adoption of smartphones and wearable devices across diverse demographics, a growing awareness of preventive healthcare, and the significant investments being made in digital health infrastructure by both governments and private entities. The demand for remote patient monitoring devices, diagnostic services, and wellness solutions is escalating, driven by an aging population, the rising prevalence of chronic diseases, and a desire for convenient and accessible healthcare. Furthermore, the burgeoning tech-savvy population and supportive government initiatives aimed at improving healthcare accessibility are creating a fertile ground for mHealth innovation and market penetration throughout the APAC region, including major economies like China, India, and Japan.

Mobile Health Industry in APAC Market Size (In Million)

The mHealth ecosystem in APAC is characterized by a diversified service and device landscape. Monitoring services, diagnostic services, and treatment services are witnessing significant uptake, complemented by a growing segment of wellness and fitness solutions. On the device front, blood glucose monitors, cardiac monitors, and remote patient monitoring devices are leading the charge, enabled by advancements in sensor technology and miniaturization. Mobile operators, healthcare providers, and application/content players are key stakeholders actively shaping this market, collaborating to deliver integrated and personalized mHealth experiences. While the market shows immense promise, potential restraints such as data privacy concerns, regulatory hurdles in certain sub-regions, and the need for greater digital literacy among specific population groups need to be strategically addressed to ensure sustained and equitable growth. Nevertheless, the strong underlying demand and the continuous evolution of technology position mHealth as a transformative force in the APAC healthcare landscape.

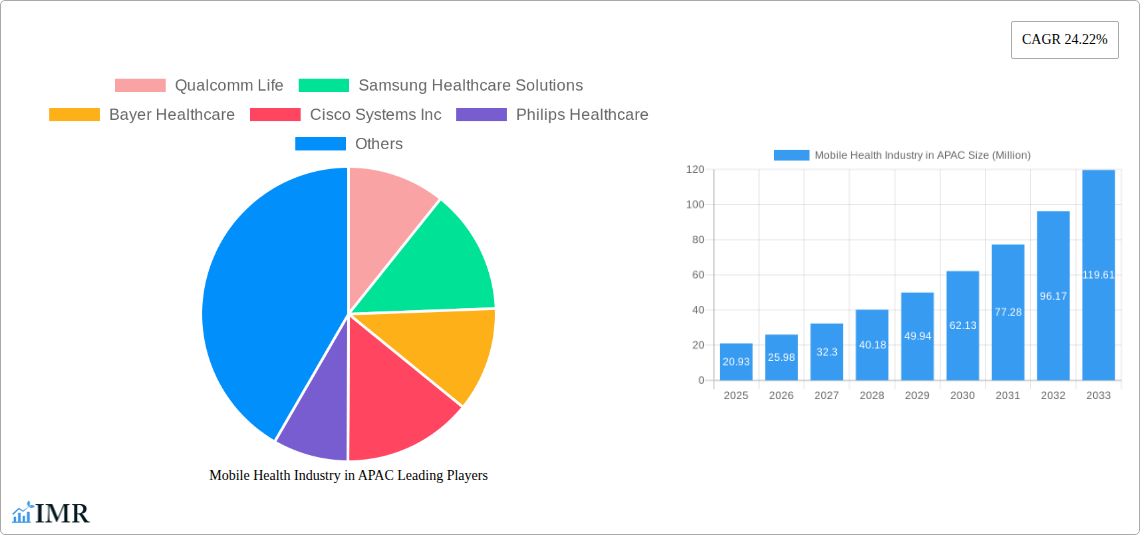

Mobile Health Industry in APAC Company Market Share

Mobile Health Industry in APAC: Unlocking Growth and Innovation

This comprehensive report provides an in-depth analysis of the rapidly expanding Mobile Health (mHealth) industry in the Asia-Pacific (APAC) region. Spanning from 2019 to 2033, with a base year of 2025, this study offers critical insights into market dynamics, growth trends, dominant segments, product innovations, and key challenges. Leveraging high-traffic keywords such as "APAC mHealth market," "digital health Asia," and "telemedicine APAC," this report is optimized for maximum search engine visibility, catering to industry professionals, investors, and stakeholders seeking to navigate this dynamic landscape. We delve into the parent and child market structures, offering granular detail on service types, device types, stakeholders, and geographical breakdowns across China, Japan, India, Australia, South Korea, and the Rest of Asia-Pacific. All values are presented in Million units, with no placeholders used.

Mobile Health Industry in APAC Market Dynamics & Structure

The APAC mobile health market is characterized by a moderately concentrated structure, driven by a blend of established healthcare giants and agile digital health startups. Technological innovation is a primary engine, with advancements in wearable technology, AI-powered diagnostics, and secure cloud platforms fueling market expansion. Regulatory frameworks are evolving, with governments increasingly recognizing the potential of mHealth to improve healthcare access and affordability, though variations across countries present both opportunities and hurdles. Competitive product substitutes are emerging rapidly, ranging from advanced diagnostic apps to sophisticated remote patient monitoring systems, intensifying the need for differentiation and value-added services. End-user demographics are shifting towards a more tech-savvy population, particularly among younger generations and those with chronic conditions, who are actively seeking convenient and personalized health solutions. Mergers and acquisitions (M&A) are on the rise as larger players seek to acquire innovative technologies and expand their market reach.

- Market Concentration: A mix of large multinational corporations and a growing number of local startups.

- Technological Innovation Drivers: Wearable sensors, AI/ML in diagnostics, secure data platforms, 5G connectivity.

- Regulatory Frameworks: Emerging government initiatives for digital health adoption, data privacy regulations.

- Competitive Product Substitutes: Remote patient monitoring, telemedicine platforms, wellness apps, AI diagnostic tools.

- End-User Demographics: Growing adoption among chronic disease patients, aging populations, and tech-savvy millennials.

- M&A Trends: Increased consolidation for technology acquisition and market penetration.

Mobile Health Industry in APAC Growth Trends & Insights

The APAC mobile health market is poised for exponential growth, driven by a confluence of factors that are reshaping healthcare delivery and consumer behavior. The market size is projected to witness a significant expansion, fueled by increasing smartphone penetration, a growing digitally connected population, and a heightened awareness of health and wellness. Adoption rates are accelerating across various mHealth service types, with Monitoring Services and Wellness and Fitness Solutions leading the charge. Technological disruptions, including the proliferation of advanced sensors in wearable devices and the integration of artificial intelligence in diagnostic tools, are fundamentally altering how healthcare is accessed and managed. Consumer behavior shifts are evident, with individuals increasingly proactive in managing their health through digital channels, seeking personalized insights, and embracing remote care options. The CAGR for the forecast period is estimated to be xx%, reflecting a robust and sustained growth trajectory. Market penetration is expected to rise from xx% in 2024 to an estimated xx% by 2033. The historical period (2019-2024) witnessed steady growth, laying the groundwork for the accelerated expansion anticipated in the coming years. The Estimated Year 2025 marks a pivotal point, with continued strong performance and the solidification of key market trends.

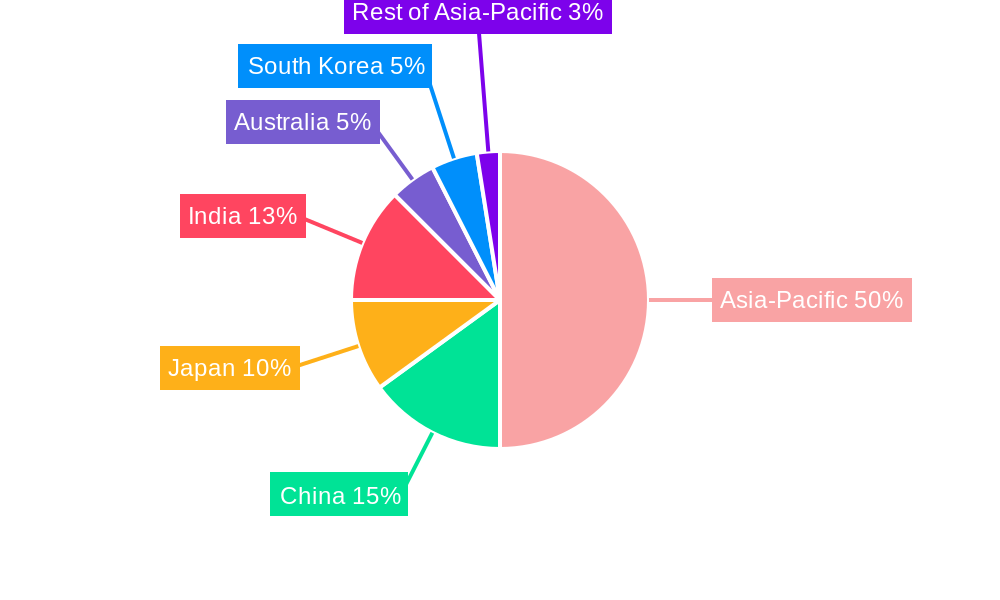

Dominant Regions, Countries, or Segments in Mobile Health Industry in APAC

The APAC mobile health market’s dominance is multifaceted, with China emerging as a leading force in terms of market size and adoption, driven by its vast population, rapid digital infrastructure development, and significant government investment in healthcare innovation. Monitoring Services represent the dominant service type, encompassing remote patient monitoring, chronic disease management, and post-operative care, facilitated by a surge in connected devices and a growing need for continuous health oversight. Within Device Type, Remote Patient Monitoring Devices are experiencing unparalleled growth, closely followed by Cardiac Monitors and Blood Glucose Monitors, reflecting the prevalence of cardiovascular diseases and diabetes across the region. From a Stakeholder perspective, Healthcare Providers are increasingly adopting mHealth solutions to improve efficiency, patient outcomes, and reach, while Mobile Operators are playing a crucial role in enabling connectivity and offering bundled mHealth services.

- Dominant Country: China, due to its large population, robust digital ecosystem, and government support for digital health initiatives.

- Dominant Service Type: Monitoring Services, driven by the increasing demand for remote patient management and chronic disease care.

- Dominant Device Type: Remote Patient Monitoring Devices, followed by Cardiac Monitors and Blood Glucose Monitors, addressing major health concerns.

- Dominant Stakeholder: Healthcare Providers, actively integrating mHealth into their service delivery models for enhanced patient care and operational efficiency.

- Key Drivers for Dominance:

- Economic Policies: Government incentives and funding for digital health innovation.

- Infrastructure: Widespread availability of high-speed internet and mobile networks.

- Healthcare Needs: High prevalence of chronic diseases and an aging population.

- Consumer Demand: Growing acceptance and preference for convenient, technology-enabled healthcare solutions.

- Market Share & Growth Potential: China holds an estimated xx% of the APAC mHealth market share in 2025, with a projected CAGR of xx% during the forecast period. India and South Korea also exhibit strong growth potential.

Mobile Health Industry in APAC Product Landscape

The APAC mobile health product landscape is characterized by a rapid influx of innovative solutions designed to enhance accessibility, personalization, and proactive health management. Wearable devices, including smartwatches and fitness trackers equipped with advanced biosensors, are at the forefront, offering real-time data on vital signs, activity levels, and sleep patterns. Diagnostic services are being revolutionized by AI-powered applications that can analyze medical images, predict disease risks, and provide preliminary diagnoses, complementing traditional healthcare pathways. Treatment services are increasingly delivered remotely through telemedicine platforms, virtual consultations, and remote drug adherence monitoring systems. Wellness and fitness solutions are flourishing, with a plethora of apps offering personalized workout plans, nutrition guidance, and mental wellness support. The integration of these diverse product categories is creating a comprehensive mHealth ecosystem. Unique selling propositions often lie in the accuracy of data collection, the intuitiveness of user interfaces, the security of data handling, and the seamless integration with existing healthcare systems. Technological advancements are focusing on miniaturization of sensors, enhanced battery life for devices, and the development of sophisticated algorithms for predictive analytics.

Key Drivers, Barriers & Challenges in Mobile Health Industry in APAC

Key Drivers:

- Technological Advancements: The continuous evolution of mobile technology, including 5G, AI, IoT, and wearable sensors, is fundamentally enabling new mHealth applications and improving existing ones.

- Rising Chronic Disease Burden: The increasing prevalence of non-communicable diseases like diabetes, cardiovascular issues, and respiratory ailments across APAC necessitates continuous monitoring and remote management solutions.

- Growing Smartphone Penetration & Digital Literacy: The widespread availability of affordable smartphones and an increasing comfort level with digital technologies among the population are key enablers for mHealth adoption.

- Government Initiatives & Support: Many APAC governments are actively promoting digital health as a means to improve healthcare access, reduce costs, and enhance public health outcomes, providing regulatory frameworks and funding.

- Aging Population: The demographic shift towards an older population in many APAC countries is driving demand for remote care, chronic disease management, and assistive technologies.

Key Barriers & Challenges:

- Data Privacy & Security Concerns: Ensuring the secure collection, storage, and transmission of sensitive health data is paramount and a significant concern for both users and providers, with varying regulatory landscapes across the region.

- Regulatory Hurdles & Inconsistencies: Navigating the diverse and sometimes fragmented regulatory environments for medical devices and digital health services across different APAC countries can be complex and time-consuming for market entry.

- Interoperability Issues: The lack of seamless integration between different mHealth platforms, devices, and existing electronic health record (EHR) systems hinders widespread adoption and data utilization.

- Digital Divide & Infrastructure Gaps: While smartphone penetration is high, disparities in internet access, affordability, and digital literacy in certain rural or underserved areas can create barriers to equitable access to mHealth services.

- Reimbursement Policies: The absence of clear and consistent reimbursement policies for mHealth services from public and private insurers in many APAC countries can limit commercial viability and adoption by healthcare providers.

Emerging Opportunities in Mobile Health Industry in APAC

Emerging opportunities within the APAC mobile health sector are vast and rapidly evolving. The increasing demand for personalized preventative care presents a significant opening for AI-driven wellness and fitness platforms that offer tailored advice and lifestyle recommendations. The expansion of mental health support through teletherapy and mindfulness applications is another burgeoning area, addressing a growing societal need. Furthermore, the untapped potential in rural and remote regions, where access to traditional healthcare is limited, offers a prime market for telemedicine and remote monitoring solutions. The integration of mHealth with other emerging technologies, such as virtual reality (VR) for rehabilitation and augmented reality (AR) for surgical assistance, also presents exciting future avenues. The growing elderly population is also a key demographic for opportunities in remote elderly care monitoring and assistive technologies.

Growth Accelerators in the Mobile Health Industry in APAC Industry

Several key catalysts are accelerating the growth of the mobile health industry in APAC. Technological breakthroughs, particularly in areas like miniaturized biosensors, advanced AI for diagnostics, and the widespread deployment of 5G networks, are continuously enhancing the capabilities and accessibility of mHealth solutions. Strategic partnerships between technology companies, healthcare providers, and pharmaceutical firms are crucial for creating integrated ecosystems and expanding market reach. For instance, collaborations aimed at developing specialized mHealth platforms for chronic disease management or remote patient care are gaining momentum. Market expansion strategies, including localized product development tailored to specific regional needs and cultural preferences, are also proving effective. Furthermore, increasing investments from venture capitalists and government funding initiatives are providing the financial impetus for innovation and scaling of mHealth enterprises across the APAC region.

Key Players Shaping the Mobile Health Industry in APAC Market

- Qualcomm Life

- Samsung Healthcare Solutions

- Bayer Healthcare

- Cisco Systems Inc

- Philips Healthcare

- Medtronic PLC

- Omron Corporation

- Cerner Corporation

- Johnson & Johnson

- AT&T Inc

Notable Milestones in Mobile Health Industry in APAC Sector

- 2019/08: China launches national guidelines for telemedicine, accelerating digital health adoption.

- 2020/03: South Korea sees a surge in demand for remote patient monitoring due to COVID-19.

- 2021/01: India's government introduces initiatives to promote digital health infrastructure and services.

- 2021/06: Philips Healthcare expands its telehealth offerings in Southeast Asia.

- 2022/04: Samsung launches new wearable devices with advanced health monitoring features.

- 2022/11: Omron Corporation partners with a major APAC healthcare provider for remote cardiac monitoring.

- 2023/02: Medtronic PLC invests in APAC-based digital health startups.

- 2023/07: Australia pilots expanded telehealth services, demonstrating successful integration into primary care.

- 2024/01: Cisco Systems Inc. announces enhanced secure network solutions for healthcare providers in APAC.

- 2024/05: Bayer Healthcare collaborates on AI-driven diagnostic tools for chronic diseases in Japan.

In-Depth Mobile Health Industry in APAC Market Outlook

The APAC mobile health market outlook is exceptionally promising, driven by ongoing technological innovation, expanding healthcare needs, and supportive government policies. The growth accelerators discussed, including advancements in AI, 5G connectivity, and strategic partnerships, will continue to fuel market expansion. Emerging opportunities in preventative care, mental wellness, and underserved rural regions present significant untapped potential. The continued focus on personalized medicine and patient-centric care models will further drive the adoption of sophisticated mHealth solutions. Stakeholders are advised to focus on interoperability, data security, and localized strategies to capitalize on the immense growth prospects within this dynamic and transformative industry. The shift towards value-based healthcare will also encourage the integration of mHealth to improve patient outcomes and operational efficiencies.

Mobile Health Industry in APAC Segmentation

-

1. Service Type

- 1.1. Monitoring Services

- 1.2. Diagnostic Services

- 1.3. Treatment Services

- 1.4. Wellness and Fitness Solutions

- 1.5. Other Service Types

-

2. Device Type

- 2.1. Blood Glucose Monitors

- 2.2. Cardiac Monitors

- 2.3. Hemodynamic Monitors

- 2.4. Neurological Monitors

- 2.5. Respiratory Monitors

- 2.6. Body and Temperature Monitors

- 2.7. Remote Patient Monitoring Devices

- 2.8. Other Device Types

-

3. Stakeholder

- 3.1. Mobile Operators

- 3.2. Healthcare Providers

- 3.3. Application/Content Players

- 3.4. Other Stakeholders

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. Japan

- 4.1.3. India

- 4.1.4. Australia

- 4.1.5. South Korea

- 4.1.6. Rest of Asia-Pacific

-

4.1. Asia-Pacific

Mobile Health Industry in APAC Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. South Korea

- 1.6. Rest of Asia Pacific

Mobile Health Industry in APAC Regional Market Share

Geographic Coverage of Mobile Health Industry in APAC

Mobile Health Industry in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Usage of Smartphones

- 3.2.2 Tablets

- 3.2.3 and Mobile Technology in Healthcare; Increased Need for Point-of-care Diagnosis and Treatment

- 3.3. Market Restrains

- 3.3.1. Data Security Issues; Stringent Regulatory Policies for mHealth Applications

- 3.4. Market Trends

- 3.4.1. Neurological Monitors are Expected to Register a High Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Health Industry in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Monitoring Services

- 5.1.2. Diagnostic Services

- 5.1.3. Treatment Services

- 5.1.4. Wellness and Fitness Solutions

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Blood Glucose Monitors

- 5.2.2. Cardiac Monitors

- 5.2.3. Hemodynamic Monitors

- 5.2.4. Neurological Monitors

- 5.2.5. Respiratory Monitors

- 5.2.6. Body and Temperature Monitors

- 5.2.7. Remote Patient Monitoring Devices

- 5.2.8. Other Device Types

- 5.3. Market Analysis, Insights and Forecast - by Stakeholder

- 5.3.1. Mobile Operators

- 5.3.2. Healthcare Providers

- 5.3.3. Application/Content Players

- 5.3.4. Other Stakeholders

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. Japan

- 5.4.1.3. India

- 5.4.1.4. Australia

- 5.4.1.5. South Korea

- 5.4.1.6. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Qualcomm Life

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Healthcare Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Philips Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Omron Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cerner Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Johnson & Johnson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AT&T Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Qualcomm Life

List of Figures

- Figure 1: Global Mobile Health Industry in APAC Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Service Type 2025 & 2033

- Figure 3: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Device Type 2025 & 2033

- Figure 5: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Stakeholder 2025 & 2033

- Figure 7: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Stakeholder 2025 & 2033

- Figure 8: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Geography 2025 & 2033

- Figure 9: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Asia Pacific Mobile Health Industry in APAC Revenue (Million), by Country 2025 & 2033

- Figure 11: Asia Pacific Mobile Health Industry in APAC Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mobile Health Industry in APAC Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Mobile Health Industry in APAC Revenue Million Forecast, by Device Type 2020 & 2033

- Table 3: Global Mobile Health Industry in APAC Revenue Million Forecast, by Stakeholder 2020 & 2033

- Table 4: Global Mobile Health Industry in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Global Mobile Health Industry in APAC Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Mobile Health Industry in APAC Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Global Mobile Health Industry in APAC Revenue Million Forecast, by Device Type 2020 & 2033

- Table 8: Global Mobile Health Industry in APAC Revenue Million Forecast, by Stakeholder 2020 & 2033

- Table 9: Global Mobile Health Industry in APAC Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Mobile Health Industry in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: India Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Australia Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Asia Pacific Mobile Health Industry in APAC Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Health Industry in APAC?

The projected CAGR is approximately 24.22%.

2. Which companies are prominent players in the Mobile Health Industry in APAC?

Key companies in the market include Qualcomm Life, Samsung Healthcare Solutions, Bayer Healthcare, Cisco Systems Inc, Philips Healthcare, Medtronic PLC, Omron Corporation, Cerner Corporation, Johnson & Johnson, AT&T Inc.

3. What are the main segments of the Mobile Health Industry in APAC?

The market segments include Service Type, Device Type, Stakeholder, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Smartphones. Tablets. and Mobile Technology in Healthcare; Increased Need for Point-of-care Diagnosis and Treatment.

6. What are the notable trends driving market growth?

Neurological Monitors are Expected to Register a High Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Data Security Issues; Stringent Regulatory Policies for mHealth Applications.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Health Industry in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Health Industry in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Health Industry in APAC?

To stay informed about further developments, trends, and reports in the Mobile Health Industry in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence