Key Insights

The global Nasolacrimal Stent market is projected to reach an estimated $160.2 million by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This growth is driven by the rising incidence of lacrimal duct obstructions, associated with an aging demographic, ocular infections, and post-operative issues. Innovations in stent materials and design, enhancing patient outcomes and minimizing invasiveness, are also key factors. The market is segmented into Monocanalicular and Bicanalicular Lacrimal Duct Stent Tubes, with Monocanalicular stents anticipated to lead due to their ease of implantation and accelerated recovery. Hospitals and specialized ophthalmic clinics are primary end-users, influenced by the increasing frequency of dacryocystorhinostomy (DCR) procedures and the adoption of advanced surgical methods.

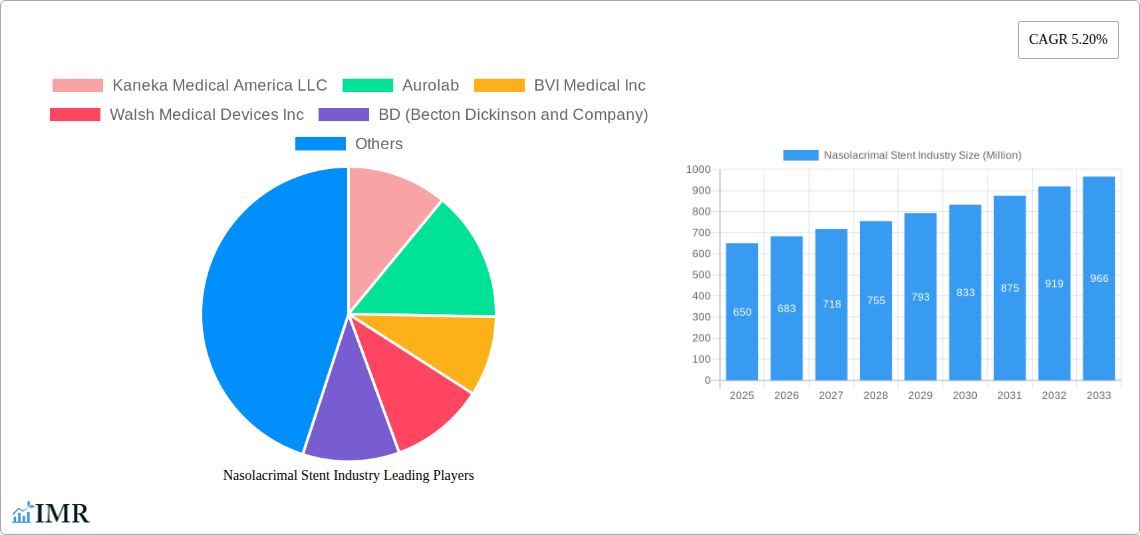

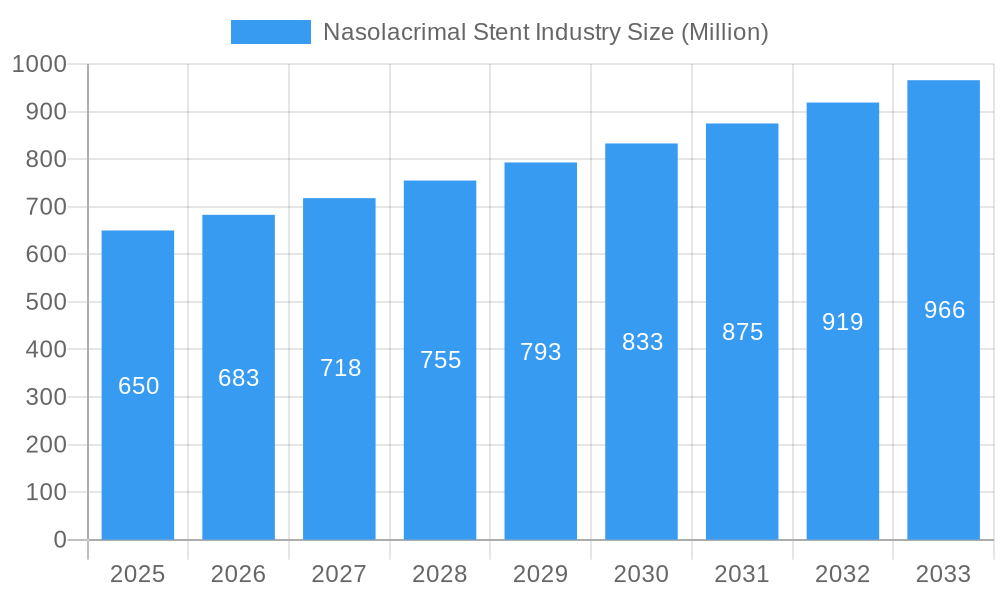

Nasolacrimal Stent Industry Market Size (In Million)

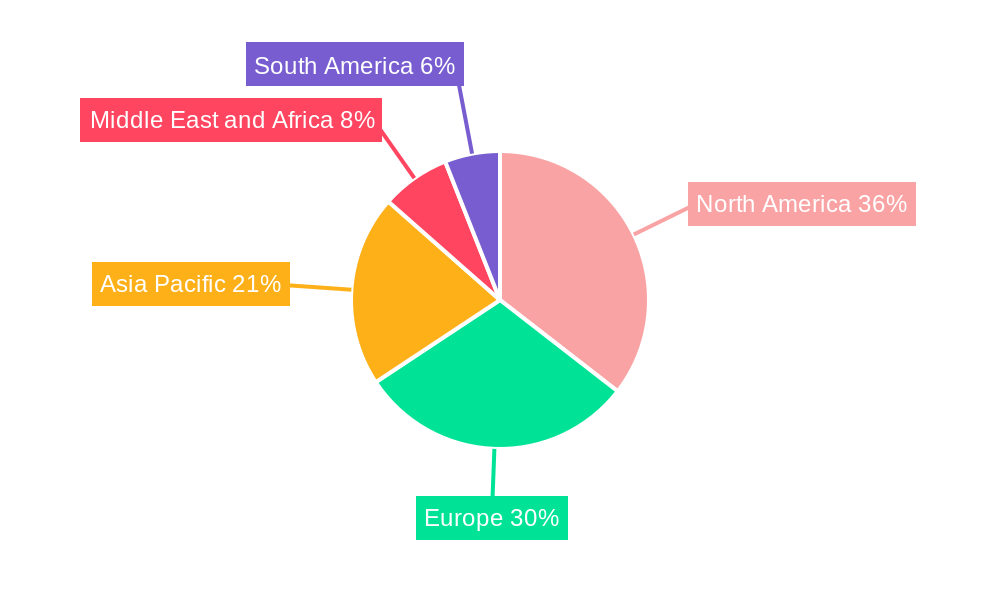

Geographically, North America is anticipated to retain its leading market share, attributed to a developed healthcare infrastructure, high consumer spending power, and a strong focus on advanced ophthalmology. Europe follows, with Germany and the UK being significant contributors due to their advanced healthcare systems and growing adoption of minimally invasive techniques. The Asia Pacific region offers substantial growth potential, fueled by a burgeoning middle class, increasing healthcare investment, and heightened awareness of ocular health conditions in key markets like China, India, and Japan. Market challenges include the cost of advanced stent technologies, the availability of proficient ophthalmic surgeons, and rigorous regulatory processes for new product approvals. Nevertheless, persistent demand for effective tear duct disorder treatments and continuous industry innovation are expected to overcome these obstacles.

Nasolacrimal Stent Industry Company Market Share

Nasolacrimal Stent Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Nasolacrimal Stent Industry. Leveraging high-traffic keywords and a detailed market structure, this report offers actionable insights for industry professionals, investors, and stakeholders. We delve into the intricacies of the parent and child markets, presenting all values in Million Units for clear comprehension. Our study covers the period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, including historical data from 2019-2024.

Nasolacrimal Stent Industry Market Dynamics & Structure

The Nasolacrimal Stent Industry exhibits a moderately consolidated market structure, with key players focusing on technological advancements and strategic partnerships to maintain a competitive edge. Innovation in biomaterials and stent design remains a primary driver, leading to the development of less invasive and more effective treatment options for nasolacrimal duct obstruction. Regulatory frameworks, while generally supportive of medical device approvals, introduce stringent testing and validation requirements, acting as both a quality assurance mechanism and a barrier to entry for new entrants. Competitive product substitutes, such as dacryocystorhinostomy (DCR) surgery, present an alternative but often involve higher costs and longer recovery times, thus bolstering the demand for nasolacrimal stents. End-user demographics, primarily aging populations and individuals with chronic dry eye conditions, are steadily expanding the market's reach. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios and geographic presence. For instance, the market saw an estimated 2 M&A deals in the historical period, indicating consolidation efforts. Barriers to innovation include the high cost of research and development and the need for extensive clinical trials to demonstrate safety and efficacy.

- Market Concentration: Moderately consolidated, with a few key players holding significant market share.

- Technological Innovation Drivers: Advancements in biomaterials, stent design, and minimally invasive techniques.

- Regulatory Frameworks: Stringent approval processes for new devices, ensuring patient safety and efficacy.

- Competitive Product Substitutes: Dacryocystorhinostomy (DCR) surgery, traditional probing and irrigation.

- End-User Demographics: Aging population, individuals with dry eye syndrome, and lacrimal duct obstructions.

- M&A Trends: Strategic acquisitions to expand market share and product offerings. Estimated 2 M&A deals in the historical period.

- Innovation Barriers: High R&D costs, lengthy clinical trial durations, and regulatory hurdles.

Nasolacrimal Stent Industry Growth Trends & Insights

The Nasolacrimal Stent Industry is poised for robust growth, driven by a confluence of factors including increasing prevalence of lacrimal duct disorders, rising awareness among patients and healthcare professionals, and continuous technological innovations. The market size is projected to expand from an estimated xx Million Units in the base year 2025 to xxx Million Units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. Adoption rates of nasolacrimal stents are steadily increasing as they offer a less invasive and more effective alternative to traditional surgical interventions for conditions like epiphora and dacryocystitis. Technological disruptions, such as the development of bioresorbable stents and advanced delivery systems, are significantly enhancing patient outcomes and procedural efficiency. Consumer behavior shifts are also playing a crucial role, with patients increasingly seeking out minimally invasive treatments with faster recovery times. The market penetration of nasolacrimal stents is expected to grow from an estimated 45% in 2025 to over 60% by 2033 in developed economies. This growth is further supported by the increasing disposable income in emerging economies, allowing for greater access to advanced ophthalmic treatments. The integration of artificial intelligence in diagnostic tools for precise identification of obstruction sites also contributes to improved treatment planning and stent placement.

Dominant Regions, Countries, or Segments in Nasolacrimal Stent Industry

The Monocanalicular Lacrimal Duct Stent Tube segment is anticipated to be the dominant product type within the Nasolacrimal Stent Industry, driven by its ease of insertion and reduced invasiveness compared to bicanalicular stents. In the forecast period, this segment is expected to capture an estimated 65% of the total market share. Ophthalmic Clinics are projected to be the leading end-user segment, accounting for approximately 55% of the market revenue, owing to their specialized focus on eye care and the higher frequency of lacrimal duct procedures performed in these settings.

North America is expected to emerge as the dominant region, driven by factors such as high healthcare expenditure, advanced technological infrastructure, and a strong emphasis on patient-centric care. The region's significant market share is also attributed to the presence of leading medical device manufacturers and robust research and development activities.

- Dominant Product Type: Monocanalicular Lacrimal Duct Stent Tube

- Key Drivers: Minimally invasive nature, simpler insertion procedure, reduced patient discomfort.

- Market Share Projection: Estimated 65% of the total product type market by 2033.

- Dominant End User: Ophthalmic Clinics

- Key Drivers: Specialized eye care, higher volume of lacrimal procedures, advanced diagnostic and treatment capabilities.

- Market Share Projection: Estimated 55% of the total end-user market by 2033.

- Dominant Region: North America

- Key Drivers: High healthcare spending, advanced medical technology adoption, strong presence of key market players, supportive regulatory environment.

- Market Share Projection: Estimated 40% of the global market by 2033.

Nasolacrimal Stent Industry Product Landscape

The product landscape of the Nasolacrimal Stent Industry is characterized by continuous innovation aimed at improving patient outcomes and procedural efficiency. Key product advancements include the development of bioresorbable stents that eliminate the need for secondary removal, thereby minimizing patient trauma and healthcare costs. The introduction of self-retaining monocanalicular stents, such as the LacriJet, preloaded on single-use injectors, has significantly simplified the implantation process for ophthalmologists. These innovations focus on enhanced biocompatibility, optimal flexibility, and secure placement to prevent migration. Applications range from treating congenital nasolacrimal duct obstruction to addressing acquired obstructions caused by trauma, inflammation, or aging. Performance metrics are evaluated based on patency rates, complication incidence, and patient comfort.

Key Drivers, Barriers & Challenges in Nasolacrimal Stent Industry

Key Drivers:

- Increasing Prevalence of Lacrimal Duct Disorders: Aging populations and rising incidence of conditions like epiphora and dacryocystitis fuel demand for effective treatment solutions.

- Technological Advancements: Development of minimally invasive, bioresorbable, and user-friendly stent designs enhances treatment efficacy and patient experience.

- Growing Awareness and Diagnosis: Improved diagnostic tools and increased patient awareness lead to earlier and more frequent interventions.

- Minimally Invasive Procedure Preference: Patients and surgeons increasingly favor less invasive treatments over traditional surgery.

Barriers & Challenges:

- Stringent Regulatory Approvals: Obtaining clearance for new medical devices involves extensive clinical trials and can be time-consuming and costly.

- High Research and Development Costs: Significant investment is required for innovation and development of advanced stent technologies.

- Reimbursement Policies: Inconsistent or inadequate reimbursement from healthcare payers can impact market adoption in certain regions.

- Competition from Alternatives: Although less invasive, stents compete with surgical interventions and other non-stent treatments.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and finished products, leading to potential stockouts. This was observed to cause an estimated 5% increase in lead times during the historical period.

Emerging Opportunities in Nasolacrimal Stent Industry

Emerging opportunities in the Nasolacrimal Stent Industry lie in the development of smart stents with integrated drug delivery capabilities to treat associated inflammation or infections simultaneously. The expansion into emerging economies, where the prevalence of lacrimal duct disorders is rising but access to advanced treatments is limited, presents a significant untapped market. Furthermore, the development of novel stent materials with enhanced biodegradability and reduced inflammatory responses will cater to a growing demand for patient comfort and safety. The increasing adoption of telemedicine and remote patient monitoring could also open avenues for follow-up care and management of patients post-stenting.

Growth Accelerators in the Nasolacrimal Stent Industry Industry

The long-term growth of the Nasolacrimal Stent Industry will be significantly accelerated by continued technological breakthroughs in biomaterials and nanotechnology, leading to the creation of highly biocompatible and precisely engineered stents. Strategic partnerships between stent manufacturers and ophthalmic surgical device companies can streamline market penetration and distribution channels. Moreover, initiatives aimed at increasing healthcare access and affordability in underserved regions, coupled with targeted educational programs for healthcare professionals on the benefits of nasolacrimal stenting, will serve as powerful growth catalysts. The ongoing research into personalized medicine approaches for lacrimal duct obstruction treatment will also drive innovation and market expansion.

Key Players Shaping the Nasolacrimal Stent Industry Market

- Kaneka Medical America LLC

- Aurolab

- BVI Medical Inc

- Walsh Medical Devices Inc

- BD (Becton Dickinson and Company)

- Gunther Weiss Scientific Glassblowing Co Inc

- Surtex Instruments Limited

- ZEISS (FCI Ophthalmics)

- Bess Medizintechnik GmbH

Notable Milestones in Nasolacrimal Stent Industry Sector

- May 2022: AffaMed Therapeutics held a DEXTENZA launch and Advisory Board Meeting in Macau. DEXTENZA resorbs and exits the nasolacrimal system without the need for removal. This product innovation signifies a shift towards bioresorbable solutions.

- February 2021: FCI Ophthalmics launched the LacriJet in the United States. It is the first, self-retaining monocanalicular nasolacrimal intubation preloaded on a single-use injector, according to FCI Ophthalmics. This launch highlighted advancements in delivery systems and ease of use.

In-Depth Nasolacrimal Stent Industry Market Outlook

The future market potential for the Nasolacrimal Stent Industry is exceptionally promising, driven by sustained innovation and increasing global demand for effective lacrimal duct treatments. Strategic opportunities lie in focusing on the development of next-generation bioresorbable and drug-eluting stents, which address unmet clinical needs and enhance patient compliance. Market expansion into Asia-Pacific and Latin American regions, where the prevalence of nasolacrimal duct obstructions is high and healthcare infrastructure is developing, presents a significant growth avenue. Collaboration with research institutions and a proactive approach to navigating evolving regulatory landscapes will be crucial for capitalizing on these opportunities and solidifying market leadership. The projected market size is expected to reach approximately $XXX Million by 2033.

Nasolacrimal Stent Industry Segmentation

-

1. Product Type

- 1.1. Monocanalicular Lacrimal Duct Stent Tube

- 1.2. Bicanalicular Lacrimal Duct Stent Tube

-

2. End User

- 2.1. Hospitals

- 2.2. Ophthalmic Clinics

- 2.3. Other End Users

Nasolacrimal Stent Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Nasolacrimal Stent Industry Regional Market Share

Geographic Coverage of Nasolacrimal Stent Industry

Nasolacrimal Stent Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Patient Pool for Nasolacrimal Duct Obstruction; Rising Demand for Treatments with Minimal Invasions and Better Success Rates

- 3.3. Market Restrains

- 3.3.1. Complications Associated with Stent Tubes

- 3.4. Market Trends

- 3.4.1. Bicanalicular Lacrimal Duct Stent Tube is Expected to Hold Significant Share in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nasolacrimal Stent Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Monocanalicular Lacrimal Duct Stent Tube

- 5.1.2. Bicanalicular Lacrimal Duct Stent Tube

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Ophthalmic Clinics

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Nasolacrimal Stent Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Monocanalicular Lacrimal Duct Stent Tube

- 6.1.2. Bicanalicular Lacrimal Duct Stent Tube

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Ophthalmic Clinics

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Nasolacrimal Stent Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Monocanalicular Lacrimal Duct Stent Tube

- 7.1.2. Bicanalicular Lacrimal Duct Stent Tube

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Ophthalmic Clinics

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Nasolacrimal Stent Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Monocanalicular Lacrimal Duct Stent Tube

- 8.1.2. Bicanalicular Lacrimal Duct Stent Tube

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Ophthalmic Clinics

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Nasolacrimal Stent Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Monocanalicular Lacrimal Duct Stent Tube

- 9.1.2. Bicanalicular Lacrimal Duct Stent Tube

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Ophthalmic Clinics

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Nasolacrimal Stent Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Monocanalicular Lacrimal Duct Stent Tube

- 10.1.2. Bicanalicular Lacrimal Duct Stent Tube

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Ophthalmic Clinics

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kaneka Medical America LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aurolab

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BVI Medical Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Walsh Medical Devices Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BD (Becton Dickinson and Company)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gunther Weiss Scientific Glassblowing Co Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Surtex Instruments Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZEISS (FCI Ophthalmics)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bess Medizintechnik GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Kaneka Medical America LLC

List of Figures

- Figure 1: Global Nasolacrimal Stent Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Nasolacrimal Stent Industry Volume Breakdown (k unit, %) by Region 2025 & 2033

- Figure 3: North America Nasolacrimal Stent Industry Revenue (million), by Product Type 2025 & 2033

- Figure 4: North America Nasolacrimal Stent Industry Volume (k unit), by Product Type 2025 & 2033

- Figure 5: North America Nasolacrimal Stent Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Nasolacrimal Stent Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Nasolacrimal Stent Industry Revenue (million), by End User 2025 & 2033

- Figure 8: North America Nasolacrimal Stent Industry Volume (k unit), by End User 2025 & 2033

- Figure 9: North America Nasolacrimal Stent Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Nasolacrimal Stent Industry Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Nasolacrimal Stent Industry Revenue (million), by Country 2025 & 2033

- Figure 12: North America Nasolacrimal Stent Industry Volume (k unit), by Country 2025 & 2033

- Figure 13: North America Nasolacrimal Stent Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Nasolacrimal Stent Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Nasolacrimal Stent Industry Revenue (million), by Product Type 2025 & 2033

- Figure 16: Europe Nasolacrimal Stent Industry Volume (k unit), by Product Type 2025 & 2033

- Figure 17: Europe Nasolacrimal Stent Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Nasolacrimal Stent Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Nasolacrimal Stent Industry Revenue (million), by End User 2025 & 2033

- Figure 20: Europe Nasolacrimal Stent Industry Volume (k unit), by End User 2025 & 2033

- Figure 21: Europe Nasolacrimal Stent Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Nasolacrimal Stent Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Nasolacrimal Stent Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Europe Nasolacrimal Stent Industry Volume (k unit), by Country 2025 & 2033

- Figure 25: Europe Nasolacrimal Stent Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Nasolacrimal Stent Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Nasolacrimal Stent Industry Revenue (million), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Nasolacrimal Stent Industry Volume (k unit), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Nasolacrimal Stent Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Nasolacrimal Stent Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Nasolacrimal Stent Industry Revenue (million), by End User 2025 & 2033

- Figure 32: Asia Pacific Nasolacrimal Stent Industry Volume (k unit), by End User 2025 & 2033

- Figure 33: Asia Pacific Nasolacrimal Stent Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Nasolacrimal Stent Industry Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Nasolacrimal Stent Industry Revenue (million), by Country 2025 & 2033

- Figure 36: Asia Pacific Nasolacrimal Stent Industry Volume (k unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Nasolacrimal Stent Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Nasolacrimal Stent Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Nasolacrimal Stent Industry Revenue (million), by Product Type 2025 & 2033

- Figure 40: Middle East and Africa Nasolacrimal Stent Industry Volume (k unit), by Product Type 2025 & 2033

- Figure 41: Middle East and Africa Nasolacrimal Stent Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East and Africa Nasolacrimal Stent Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East and Africa Nasolacrimal Stent Industry Revenue (million), by End User 2025 & 2033

- Figure 44: Middle East and Africa Nasolacrimal Stent Industry Volume (k unit), by End User 2025 & 2033

- Figure 45: Middle East and Africa Nasolacrimal Stent Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Nasolacrimal Stent Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Nasolacrimal Stent Industry Revenue (million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Nasolacrimal Stent Industry Volume (k unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Nasolacrimal Stent Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Nasolacrimal Stent Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Nasolacrimal Stent Industry Revenue (million), by Product Type 2025 & 2033

- Figure 52: South America Nasolacrimal Stent Industry Volume (k unit), by Product Type 2025 & 2033

- Figure 53: South America Nasolacrimal Stent Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: South America Nasolacrimal Stent Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: South America Nasolacrimal Stent Industry Revenue (million), by End User 2025 & 2033

- Figure 56: South America Nasolacrimal Stent Industry Volume (k unit), by End User 2025 & 2033

- Figure 57: South America Nasolacrimal Stent Industry Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Nasolacrimal Stent Industry Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Nasolacrimal Stent Industry Revenue (million), by Country 2025 & 2033

- Figure 60: South America Nasolacrimal Stent Industry Volume (k unit), by Country 2025 & 2033

- Figure 61: South America Nasolacrimal Stent Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Nasolacrimal Stent Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nasolacrimal Stent Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Nasolacrimal Stent Industry Revenue million Forecast, by End User 2020 & 2033

- Table 4: Global Nasolacrimal Stent Industry Volume k unit Forecast, by End User 2020 & 2033

- Table 5: Global Nasolacrimal Stent Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Region 2020 & 2033

- Table 7: Global Nasolacrimal Stent Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Product Type 2020 & 2033

- Table 9: Global Nasolacrimal Stent Industry Revenue million Forecast, by End User 2020 & 2033

- Table 10: Global Nasolacrimal Stent Industry Volume k unit Forecast, by End User 2020 & 2033

- Table 11: Global Nasolacrimal Stent Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Country 2020 & 2033

- Table 13: United States Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 19: Global Nasolacrimal Stent Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 20: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Product Type 2020 & 2033

- Table 21: Global Nasolacrimal Stent Industry Revenue million Forecast, by End User 2020 & 2033

- Table 22: Global Nasolacrimal Stent Industry Volume k unit Forecast, by End User 2020 & 2033

- Table 23: Global Nasolacrimal Stent Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Country 2020 & 2033

- Table 25: Germany Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Germany Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 29: France Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: France Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Italy Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Spain Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 37: Global Nasolacrimal Stent Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 38: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Nasolacrimal Stent Industry Revenue million Forecast, by End User 2020 & 2033

- Table 40: Global Nasolacrimal Stent Industry Volume k unit Forecast, by End User 2020 & 2033

- Table 41: Global Nasolacrimal Stent Industry Revenue million Forecast, by Country 2020 & 2033

- Table 42: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Country 2020 & 2033

- Table 43: China Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: China Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Japan Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 47: India Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: India Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Australia Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 55: Global Nasolacrimal Stent Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 56: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Product Type 2020 & 2033

- Table 57: Global Nasolacrimal Stent Industry Revenue million Forecast, by End User 2020 & 2033

- Table 58: Global Nasolacrimal Stent Industry Volume k unit Forecast, by End User 2020 & 2033

- Table 59: Global Nasolacrimal Stent Industry Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Country 2020 & 2033

- Table 61: GCC Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: GCC Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 67: Global Nasolacrimal Stent Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 68: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Product Type 2020 & 2033

- Table 69: Global Nasolacrimal Stent Industry Revenue million Forecast, by End User 2020 & 2033

- Table 70: Global Nasolacrimal Stent Industry Volume k unit Forecast, by End User 2020 & 2033

- Table 71: Global Nasolacrimal Stent Industry Revenue million Forecast, by Country 2020 & 2033

- Table 72: Global Nasolacrimal Stent Industry Volume k unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Nasolacrimal Stent Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Nasolacrimal Stent Industry Volume (k unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nasolacrimal Stent Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Nasolacrimal Stent Industry?

Key companies in the market include Kaneka Medical America LLC, Aurolab, BVI Medical Inc, Walsh Medical Devices Inc, BD (Becton Dickinson and Company), Gunther Weiss Scientific Glassblowing Co Inc, Surtex Instruments Limited, ZEISS (FCI Ophthalmics), Bess Medizintechnik GmbH.

3. What are the main segments of the Nasolacrimal Stent Industry?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 160.2 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Patient Pool for Nasolacrimal Duct Obstruction; Rising Demand for Treatments with Minimal Invasions and Better Success Rates.

6. What are the notable trends driving market growth?

Bicanalicular Lacrimal Duct Stent Tube is Expected to Hold Significant Share in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Complications Associated with Stent Tubes.

8. Can you provide examples of recent developments in the market?

In May 2022, AffaMed Therapeutics held a DEXTENZA launch and Advisory Board Meeting in Macau. DEXTENZA resorbs and exits the nasolacrimal system without the need for removal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in k unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nasolacrimal Stent Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nasolacrimal Stent Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nasolacrimal Stent Industry?

To stay informed about further developments, trends, and reports in the Nasolacrimal Stent Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence