Key Insights

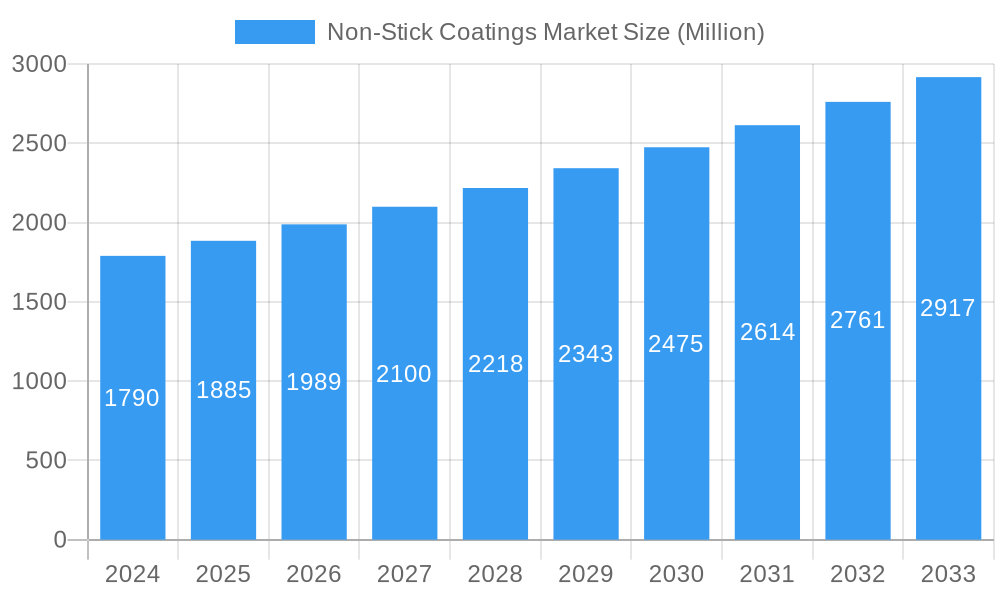

The global Non-Stick Coatings Market is projected to experience robust growth, reaching a significant valuation with a compound annual growth rate (CAGR) of 5.32%. This expansion is fueled by a confluence of factors, including the increasing demand for convenience and durability in household cookware, driven by evolving consumer lifestyles and a growing middle class in emerging economies. Beyond the kitchen, the non-stick coatings find extensive application in diverse industrial sectors. The food processing industry leverages these coatings for enhanced efficiency and hygiene, while the medical sector utilizes them in surgical instruments and implants for improved patient outcomes and reduced complications. Furthermore, the electrical and electronics industry benefits from their insulating and protective properties, and the automotive sector employs them to reduce friction and wear in various components. Key market drivers include technological advancements leading to more durable, safer, and environmentally friendly coating formulations, alongside a rising global awareness of the benefits of non-stick surfaces in reducing oil consumption in cooking.

Non-Stick Coatings Market Market Size (In Billion)

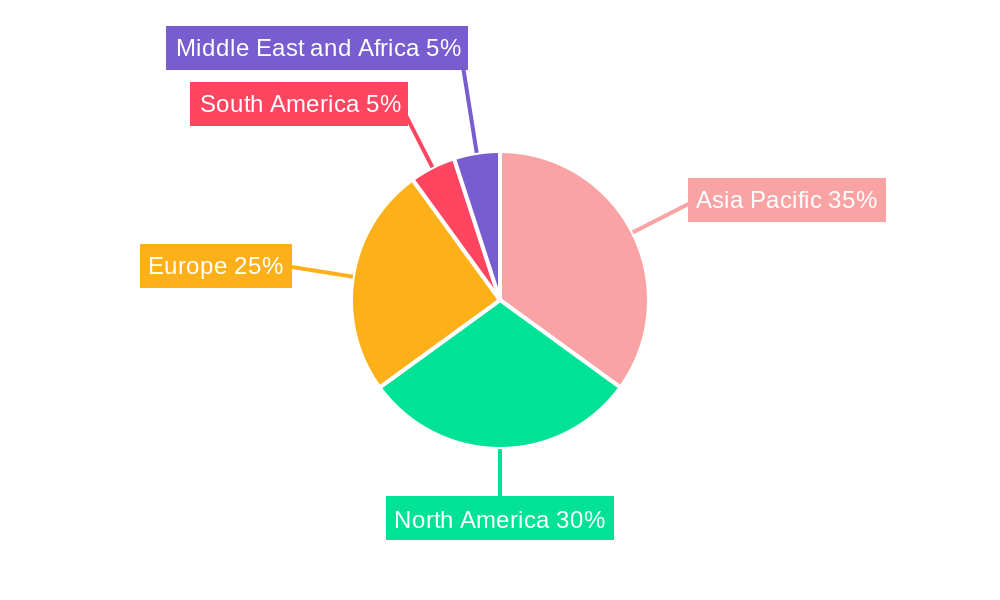

The market is segmented by type, with fluoropolymers continuing to dominate due to their proven performance and wide range of applications. However, advancements in ceramic and silicone-based coatings are presenting compelling alternatives, offering enhanced heat resistance and eco-friendly profiles, respectively. Geographically, the Asia Pacific region is anticipated to be the fastest-growing market, propelled by rapid industrialization, increasing disposable incomes, and a burgeoning consumer base in countries like China and India. North America and Europe remain significant markets, driven by established demand in premium cookware and a strong presence of key industry players. Challenges such as fluctuating raw material prices and the stringent regulatory landscape concerning certain chemical compounds in coatings could present moderate restraints. Nevertheless, ongoing innovation in sustainable coating solutions and the continuous exploration of new applications are expected to pave the way for sustained market expansion.

Non-Stick Coatings Market Company Market Share

This in-depth report provides a comprehensive analysis of the global Non-Stick Coatings Market, a critical sector driven by innovation in fluoropolymer coatings, ceramic coatings, and silicone coatings. Explore the burgeoning demand across diverse applications, including cookware, food processing, medical devices, and automotive components. With a study period spanning from 2019 to 2033, this report offers invaluable insights into market dynamics, growth trends, regional dominance, and the competitive landscape, essential for strategic decision-making.

Non-Stick Coatings Market Market Dynamics & Structure

The Non-Stick Coatings Market exhibits a dynamic and evolving structure, influenced by a confluence of factors. Market concentration is moderate, with established players like Daikin Industries Ltd, The Chemours Company, and 3M holding significant shares, particularly in the fluoropolymer coatings segment. However, the emergence of specialized manufacturers focusing on ceramic coatings and eco-friendly alternatives is increasing competition. Technological innovation remains a primary driver, with ongoing research into advanced formulations offering enhanced durability, thermal resistance, and environmental sustainability. Regulatory frameworks, particularly concerning PFOA and PFOS, continue to shape product development, pushing for safer and greener alternatives. Competitive product substitutes, such as advanced ceramic materials and specialized silicone-based solutions, are gaining traction, especially in high-temperature industrial applications. End-user demographics are shifting, with a growing demand for premium, durable, and easy-to-maintain cookware and an increasing need for high-performance non-stick solutions in the medical and electrical and electronics sectors. Mergers and acquisitions (M&A) are a notable trend, as larger corporations seek to expand their product portfolios and market reach. For instance, the acquisition of smaller, innovative coating companies by established chemical giants aims to consolidate market leadership and leverage synergistic capabilities. The barrier to entry is relatively high due to the significant R&D investment required and the stringent quality control necessary for industrial-grade coatings.

Non-Stick Coatings Market Growth Trends & Insights

The Non-Stick Coatings Market is poised for robust growth, driven by increasing consumer demand for convenience and durability in everyday products, alongside escalating industrial requirements for specialized functional surfaces. The market size is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) of approximately 6.2% from the base year of 2025 through to 2033, reaching an estimated value of $XX Million units in 2025, and projected to grow to $XX Million units by 2033. The adoption rate of advanced non-stick technologies is accelerating across various sectors. In the cookware segment, consumers are increasingly prioritizing healthier cooking options and longer-lasting products, boosting the demand for high-quality PTFE and ceramic-based coatings. The food processing industry relies heavily on non-stick surfaces for efficient operations, reducing food waste and facilitating easy cleaning, thereby contributing to sustained market expansion. Technological disruptions, such as the development of novel ceramic coatings with superior scratch resistance and temperature stability, are reshaping the competitive landscape. Furthermore, the integration of non-stick coatings in medical devices, particularly in surgical instruments and implants, is a rapidly growing area due to their biocompatibility and ability to prevent tissue adhesion. Consumer behavior shifts towards sustainable and eco-friendly products are also influencing market trends, prompting manufacturers to invest in developing PFOA-free and greener coating formulations. The electrical and electronics sector sees increasing application of non-stick coatings for insulation and protective layers in components, further fueling market growth.

Dominant Regions, Countries, or Segments in Non-Stick Coatings Market

The Non-Stick Coatings Market is experiencing significant growth, with the Fluoropolymer segment, particularly within the cookware application, emerging as a dominant force. North America and Europe currently lead the market due to established industrial bases and high consumer spending power. However, the Asia-Pacific region, driven by rapid industrialization and a burgeoning middle class, presents the most substantial growth potential. Countries like China and India are witnessing an unprecedented surge in demand for non-stick cookware and a rapid expansion in their food processing and industrial machinery sectors, necessitating advanced non-stick solutions. Economic policies in these regions are often geared towards fostering manufacturing growth, supported by infrastructure development and increasing disposable incomes. The dominance of Fluoropolymer coatings is attributed to their exceptional non-stick properties, thermal stability, and chemical resistance, making them ideal for a wide array of applications. Within cookware, the preference for high-performance, durable, and easy-to-clean items directly translates to sustained demand for fluoropolymers. The food processing industry also heavily relies on these coatings for their sanitary properties and their ability to prevent sticking during high-temperature cooking and baking processes. Furthermore, the growing adoption of advanced medical devices and components in Asia-Pacific, requiring biocompatible and sterile non-stick surfaces, is a key growth driver. The robust expansion of the automotive industry, with an increasing need for non-stick coatings in engine components for friction reduction and improved efficiency, further bolsters the dominance of this segment. The market share of Fluoropolymer coatings in the overall Non-Stick Coatings Market is estimated to be around 55% in 2025, with a projected CAGR of 6.5% through 2033.

Non-Stick Coatings Market Product Landscape

The product landscape of the Non-Stick Coatings Market is characterized by continuous innovation and diversification. Key product innovations revolve around enhancing the performance and sustainability of coatings. Fluoropolymer coatings, such as PTFE and PFA, remain industry standards, offering excellent chemical resistance and thermal stability. However, newer generations are PFOA-free and exhibit improved scratch resistance. Ceramic coatings are gaining significant traction due to their natural, non-toxic properties and ability to withstand high temperatures without degrading. These are often reinforced with inorganic fillers for enhanced durability. Silicone coatings are utilized for their flexibility, high-temperature resistance, and ease of application, particularly in industrial settings and for specialized cookware. The Other Types segment encompasses hybrid formulations and advanced material coatings designed for niche applications demanding extreme performance. Applications are expanding beyond traditional cookware, with notable growth in medical implants, aerospace components, and industrial fabrics due to their unique surface properties. Performance metrics such as adhesion strength, thermal cycling resistance, and abrasion resistance are continuously being improved, offering manufacturers and end-users enhanced value and longevity.

Key Drivers, Barriers & Challenges in Non-Stick Coatings Market

Key Drivers:

- Growing Consumer Demand for Convenience and Durability: The increasing preference for cookware and kitchenware that is easy to clean and long-lasting fuels demand for advanced non-stick solutions.

- Expanding Applications in Industrial Sectors: The need for efficient and hygienic surfaces in food processing, coupled with performance enhancements in medical devices, automotive components, and electrical and electronics, are significant growth catalysts.

- Technological Advancements: Development of PFOA-free, eco-friendly, and higher-performance ceramic and silicone coatings is opening new market avenues.

- Rising Disposable Incomes: Particularly in emerging economies, increased purchasing power translates to higher demand for premium kitchenware and durable goods.

Barriers & Challenges:

- Environmental Regulations: Stringent regulations regarding the use of certain fluorochemicals, such as PFOA and PFOS, necessitate significant R&D investment in alternative formulations, increasing production costs.

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials like fluoropolymers and specialty chemicals can impact manufacturing costs and profit margins.

- High Initial Investment: Developing and implementing advanced non-stick coating technologies requires substantial capital expenditure in R&D and manufacturing infrastructure.

- Competition from Substitute Materials: The emergence of advanced ceramic materials and other surface treatments poses a competitive threat in certain applications.

- Supply Chain Disruptions: Global supply chain issues can lead to delays in raw material procurement and finished product delivery, impacting market stability.

Emerging Opportunities in Non-Stick Coatings Market

Emerging opportunities in the Non-Stick Coatings Market lie in the development of sustainable and bio-based coatings that cater to the growing environmental consciousness of consumers and industries. The expansion of non-stick applications in the renewable energy sector, such as coatings for solar panel components to enhance efficiency, presents a significant untapped market. Furthermore, advancements in nanotechnology are paving the way for superhydrophobic and oleophobic coatings with unparalleled anti-fouling and self-cleaning properties, opening doors for novel applications in textiles, architecture, and electronics. The increasing demand for specialized coatings in additive manufacturing (3D printing) for improved printability and surface finish is another area ripe for innovation. The medical sector's continuous need for biocompatible, anti-microbial, and low-friction coatings for implants and surgical tools offers substantial growth potential.

Growth Accelerators in the Non-Stick Coatings Market Industry

Long-term growth in the Non-Stick Coatings Market will be significantly accelerated by breakthroughs in materials science, particularly in the development of novel ceramic and composite coatings offering superior thermal resistance and durability. Strategic partnerships between chemical manufacturers and end-user industries, such as collaborations between coating suppliers and cookware brands or medical device manufacturers, will drive product innovation and market penetration. Expanding into emerging economies with targeted product offerings that address local needs and price sensitivities will also serve as a key growth accelerator. The increasing adoption of Industry 4.0 principles, leading to more efficient manufacturing processes and enhanced quality control for non-stick coatings, will further propel market expansion. Furthermore, a growing focus on circular economy principles, leading to the development of recyclable or biodegradable non-stick coatings, will be a significant driver of future growth.

Key Players Shaping the Non-Stick Coatings Market Market

- Metal Coatings

- Resonac Holdings Corporation

- Metallic Bonds Ltd

- Daikin Industries Ltd

- The Chemours Company

- 3M

- PPG Industries Inc

- Weilburger

- Cavero Coatings

- AAA Industries

Notable Milestones in Non-Stick Coatings Market Sector

- 2020: Launch of a new range of PFOA-free ceramic non-stick coatings by major manufacturers, addressing growing environmental concerns and regulatory pressures.

- 2021: Significant investment in R&D by leading companies to develop advanced fluoropolymer coatings with enhanced scratch and abrasion resistance, targeting industrial applications.

- 2022: Expansion of non-stick coating applications in the medical device sector, with increased adoption for surgical instruments and implants due to improved biocompatibility and reduced tissue adhesion.

- 2023: Introduction of novel hybrid coatings combining fluoropolymer and ceramic properties for superior performance in high-temperature food processing applications.

- 2024: Strategic acquisitions and partnerships aimed at consolidating market share and expanding technological capabilities in the Non-Stick Coatings Market.

In-Depth Non-Stick Coatings Market Market Outlook

The Non-Stick Coatings Market is projected for sustained and dynamic growth, fueled by continuous innovation and expanding application horizons. The future outlook is strongly influenced by the increasing demand for sustainable and eco-friendly solutions, pushing the development of bio-based and non-toxic coatings. The integration of advanced materials and nanotechnology promises to unlock new performance capabilities, leading to revolutionary applications in diverse sectors, from advanced manufacturing to smart textiles. Strategic collaborations and aggressive R&D investments by key players will be crucial in navigating evolving regulatory landscapes and capturing emerging market opportunities. The market's trajectory points towards greater specialization, with tailored solutions for niche industrial needs and a continued emphasis on high-performance, durable, and environmentally responsible non-stick technologies, ensuring its vital role across multiple industries.

Non-Stick Coatings Market Segmentation

-

1. Type

- 1.1. Fluoropolymer

- 1.2. Ceramic

- 1.3. Silicone

- 1.4. Other Types

-

2. Application

- 2.1. Cookware

- 2.2. Food Processing

- 2.3. Fabrics and Carpets

- 2.4. Medical

- 2.5. Electrical and Electronics

- 2.6. Industrial Machinery

- 2.7. Automotive

- 2.8. Other Applications

Non-Stick Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Nordic

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Nigeria

- 5.4. Qatar

- 5.5. Egypt

- 5.6. United Arab Emirates

- 5.7. Rest of Middle East and Africa

Non-Stick Coatings Market Regional Market Share

Geographic Coverage of Non-Stick Coatings Market

Non-Stick Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Non-stick Cookware; Increasing Use of UV-cured Sol-gel Coatings; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Health Hazards of Using Non-stick Cookware; Other Restraints

- 3.4. Market Trends

- 3.4.1. Cookware Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-Stick Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fluoropolymer

- 5.1.2. Ceramic

- 5.1.3. Silicone

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cookware

- 5.2.2. Food Processing

- 5.2.3. Fabrics and Carpets

- 5.2.4. Medical

- 5.2.5. Electrical and Electronics

- 5.2.6. Industrial Machinery

- 5.2.7. Automotive

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Non-Stick Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fluoropolymer

- 6.1.2. Ceramic

- 6.1.3. Silicone

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cookware

- 6.2.2. Food Processing

- 6.2.3. Fabrics and Carpets

- 6.2.4. Medical

- 6.2.5. Electrical and Electronics

- 6.2.6. Industrial Machinery

- 6.2.7. Automotive

- 6.2.8. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Non-Stick Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fluoropolymer

- 7.1.2. Ceramic

- 7.1.3. Silicone

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cookware

- 7.2.2. Food Processing

- 7.2.3. Fabrics and Carpets

- 7.2.4. Medical

- 7.2.5. Electrical and Electronics

- 7.2.6. Industrial Machinery

- 7.2.7. Automotive

- 7.2.8. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Non-Stick Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fluoropolymer

- 8.1.2. Ceramic

- 8.1.3. Silicone

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cookware

- 8.2.2. Food Processing

- 8.2.3. Fabrics and Carpets

- 8.2.4. Medical

- 8.2.5. Electrical and Electronics

- 8.2.6. Industrial Machinery

- 8.2.7. Automotive

- 8.2.8. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Non-Stick Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fluoropolymer

- 9.1.2. Ceramic

- 9.1.3. Silicone

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cookware

- 9.2.2. Food Processing

- 9.2.3. Fabrics and Carpets

- 9.2.4. Medical

- 9.2.5. Electrical and Electronics

- 9.2.6. Industrial Machinery

- 9.2.7. Automotive

- 9.2.8. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Non-Stick Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fluoropolymer

- 10.1.2. Ceramic

- 10.1.3. Silicone

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Cookware

- 10.2.2. Food Processing

- 10.2.3. Fabrics and Carpets

- 10.2.4. Medical

- 10.2.5. Electrical and Electronics

- 10.2.6. Industrial Machinery

- 10.2.7. Automotive

- 10.2.8. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Metal Coatings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Resonac Holdings Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Metallic Bonds Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Daikin Industries Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Chemours Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PPG Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Weilburger*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cavero Coatings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AAA Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Metal Coatings

List of Figures

- Figure 1: Global Non-Stick Coatings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Non-Stick Coatings Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Non-Stick Coatings Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Non-Stick Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Non-Stick Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Non-Stick Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Non-Stick Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Non-Stick Coatings Market Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Non-Stick Coatings Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Non-Stick Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Non-Stick Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Non-Stick Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Non-Stick Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Non-Stick Coatings Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Non-Stick Coatings Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Non-Stick Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Non-Stick Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Non-Stick Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Non-Stick Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Non-Stick Coatings Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Non-Stick Coatings Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Non-Stick Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Non-Stick Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Non-Stick Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Non-Stick Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Non-Stick Coatings Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Non-Stick Coatings Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Non-Stick Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Non-Stick Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Non-Stick Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Non-Stick Coatings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-Stick Coatings Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Non-Stick Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Non-Stick Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Non-Stick Coatings Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Non-Stick Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Non-Stick Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Thailand Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Non-Stick Coatings Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Non-Stick Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Non-Stick Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United States Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of North America Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Non-Stick Coatings Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Non-Stick Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Non-Stick Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Germany Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Italy Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Nordic Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Turkey Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Russia Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Non-Stick Coatings Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Non-Stick Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Non-Stick Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Brazil Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Argentina Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Colombia Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Non-Stick Coatings Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Non-Stick Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Non-Stick Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 45: Saudi Arabia Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Africa Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Nigeria Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Qatar Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Egypt Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: United Arab Emirates Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East and Africa Non-Stick Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Stick Coatings Market?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the Non-Stick Coatings Market?

Key companies in the market include Metal Coatings, Resonac Holdings Corporation, Metallic Bonds Ltd, Daikin Industries Ltd, The Chemours Company, 3M, PPG Industries Inc, Weilburger*List Not Exhaustive, Cavero Coatings, AAA Industries.

3. What are the main segments of the Non-Stick Coatings Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Non-stick Cookware; Increasing Use of UV-cured Sol-gel Coatings; Other Drivers.

6. What are the notable trends driving market growth?

Cookware Application to Dominate the Market.

7. Are there any restraints impacting market growth?

Health Hazards of Using Non-stick Cookware; Other Restraints.

8. Can you provide examples of recent developments in the market?

Recent developments pertaining to the market studied will be covered in the full report.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-Stick Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-Stick Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-Stick Coatings Market?

To stay informed about further developments, trends, and reports in the Non-Stick Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence