Key Insights

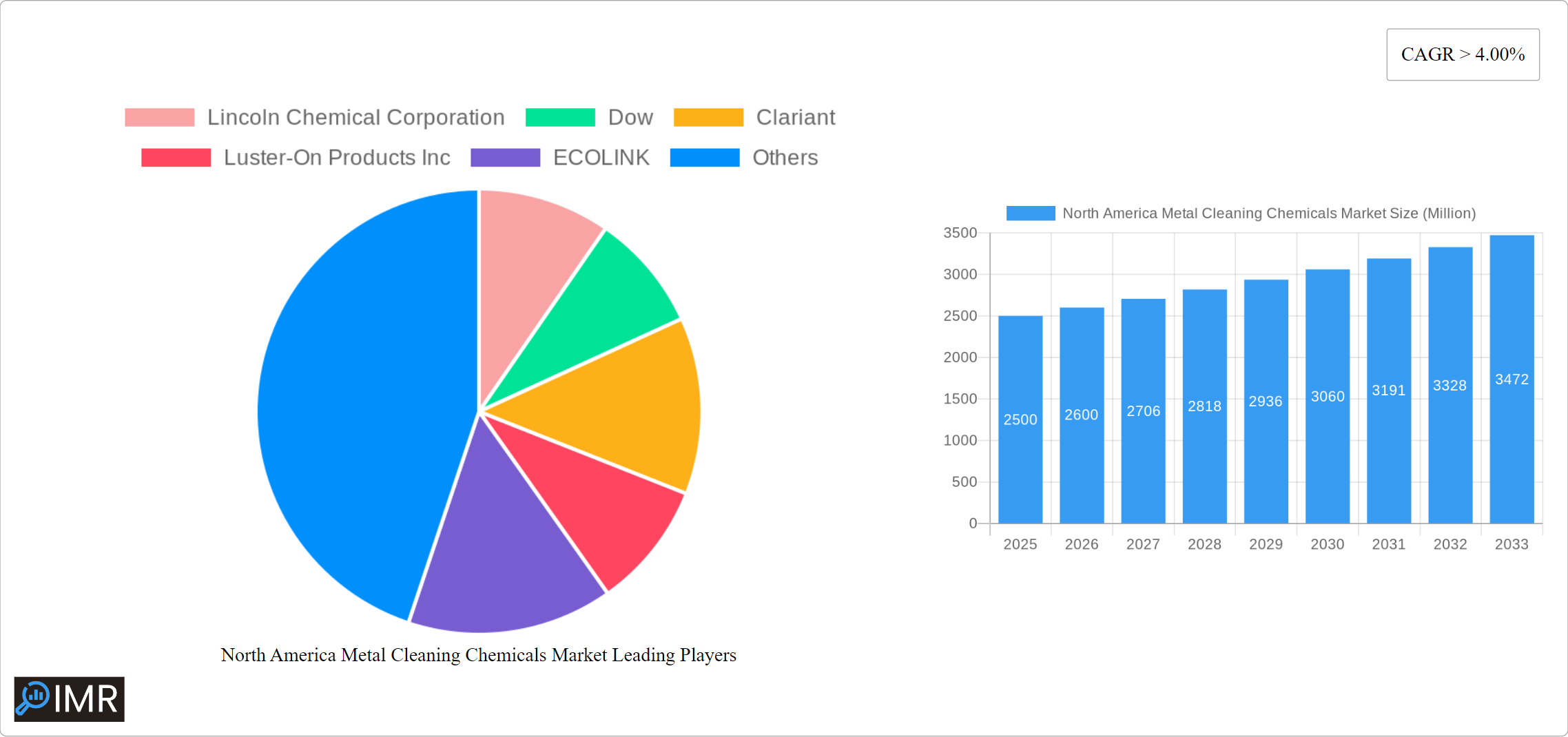

The North America metal cleaning chemicals market, valued at approximately $15.1 billion in 2024, is projected for robust expansion at a Compound Annual Growth Rate (CAGR) exceeding 4.9% from 2024 to 2033. This growth is propelled by escalating demand across key sectors. The transportation industry, encompassing automotive manufacturing and aerospace, requires advanced metal cleaning solutions. Similarly, stringent cleanliness standards in the electronics and electrical sectors, particularly for semiconductor and printed circuit board production, are significant growth drivers. The chemical and pharmaceutical industries' need for specialized agents for equipment sterilization and process optimization further bolsters market expansion. Additionally, evolving environmental regulations are fostering the adoption of eco-friendly and biodegradable cleaning chemicals. The market is segmented by form (aqueous, solvent-based), type (acidic, basic, neutral), functional additives (surfactants, corrosion inhibitors, chelating agents, pH regulators), and end-user industries. Aqueous solutions lead due to their cost-effectiveness and environmental advantages, while acidic formulations maintain a significant share for their efficacy in removing heavy soils and oxides. Leading players such as Dow, Clariant, and 3M are leveraging technological expertise and extensive distribution networks within this competitive environment. Ongoing technological advancements and expanding end-user applications indicate a positive market outlook.

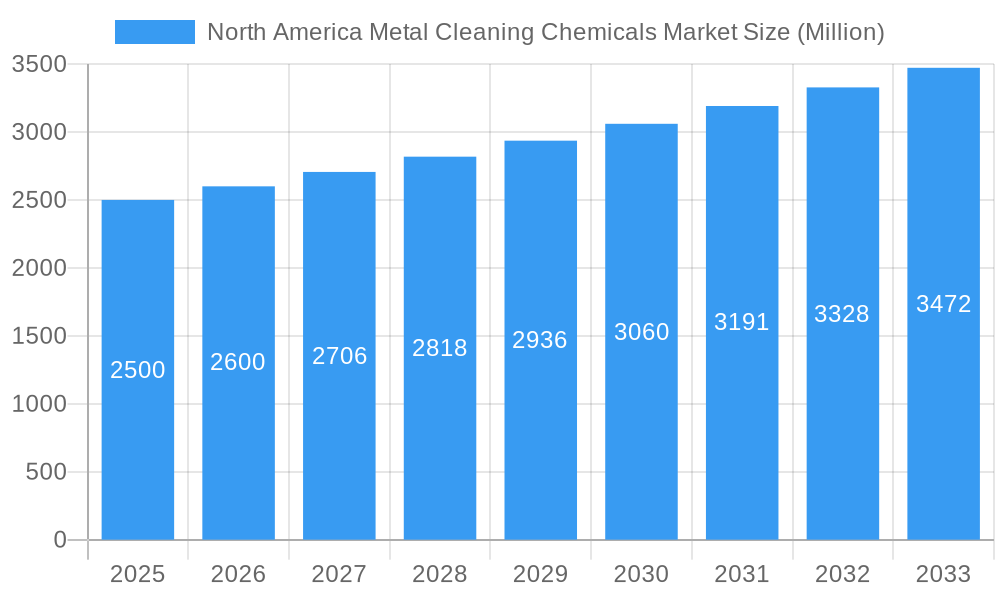

North America Metal Cleaning Chemicals Market Market Size (In Billion)

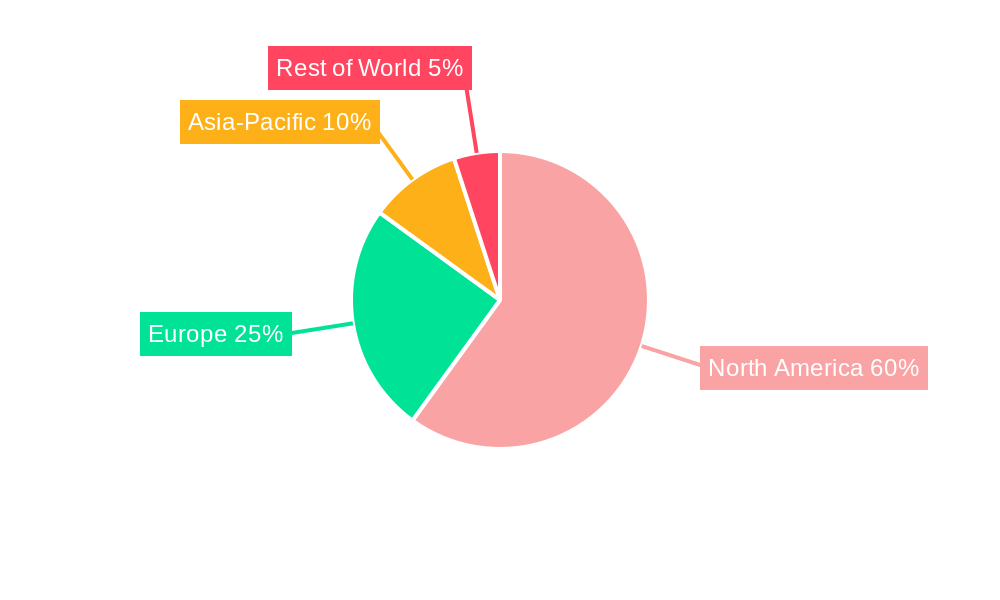

The North American region, including the United States, Canada, and Mexico, holds a substantial global market share, driven by strong industrial activity and the presence of numerous major metal cleaning chemical manufacturers. Challenges to market expansion include fluctuating raw material prices and the potential for stricter environmental mandates. Emerging trends involve the increasing adoption of advanced cleaning technologies like ultrasonic cleaning and electropolishing. The competitive landscape features established multinational corporations and specialized regional entities. Market success hinges on innovation, product diversification, and strategic partnerships to meet diverse end-user needs. Future growth will be shaped by technological innovation, sustainable product development, and the imperative for enhanced operational efficiency across manufacturing sectors.

North America Metal Cleaning Chemicals Market Company Market Share

North America Metal Cleaning Chemicals Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Metal Cleaning Chemicals market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by form (aqueous, solvent), type (acidic, basic, neutral), functional additives (surfactants, corrosion inhibitors, chelating agents, pH regulators), and end-user industries (transportation, electrical and electronics, chemical and pharmaceutical, oil and gas, other). The report’s insights are invaluable for industry professionals, investors, and strategic decision-makers seeking a comprehensive understanding of this dynamic market. The market size is projected to reach xx Million by 2033.

North America Metal Cleaning Chemicals Market Dynamics & Structure

This section delves into the intricate structure of the North America metal cleaning chemicals market, examining key aspects driving its evolution. We analyze market concentration, revealing the dominance of key players and the presence of smaller, niche competitors. Technological innovation, particularly in environmentally friendly formulations, plays a crucial role, as does the regulatory landscape concerning hazardous waste disposal and worker safety. The report also addresses competitive pressures from substitute products and the impact of mergers and acquisitions (M&A) activity.

- Market Concentration: The North American metal cleaning chemicals market exhibits a moderately concentrated structure, with a few large multinational corporations and a multitude of specialized regional players holding significant market shares. The top 5 players are estimated to hold approximately xx% of the market share in 2025.

- Technological Innovation: Ongoing research and development focus on creating more efficient, environmentally friendly, and cost-effective cleaning chemicals. The drive for sustainable solutions and stricter environmental regulations are key drivers in this area. Significant barriers to innovation include high R&D costs and rigorous regulatory approval processes.

- Regulatory Framework: Stringent environmental regulations, including those related to hazardous waste disposal and workplace safety, significantly influence the market. Compliance costs represent a significant challenge for many players.

- M&A Activity: The market has witnessed significant M&A activity in recent years, as larger players seek to expand their product portfolios and market reach. The report analyzes the impact of key acquisitions, such as the 2022 Atotech acquisition by MKS Instruments and the 2021 Coventya acquisition by Element Solutions. We estimate xx M&A deals in the North American market from 2019 to 2024.

- End-User Demographics: The expanding manufacturing sectors, especially in automotive, electronics, and aerospace, are major drivers for market growth, while fluctuations in these sectors directly impact market demand.

North America Metal Cleaning Chemicals Market Growth Trends & Insights

The North America metal cleaning chemicals market is poised for significant growth, driven by a confluence of factors impacting various sectors. This analysis delves into the market's trajectory, leveraging comprehensive data to illuminate key trends and insights. We examine market size fluctuations, the adoption rate of innovative technologies, disruptive technological advancements reshaping the competitive landscape, and evolving consumer preferences, notably the surging demand for sustainable and environmentally responsible solutions. This includes a detailed look at the increasing regulatory pressures pushing for greener alternatives.

The market is projected to experience a robust Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). Market penetration of eco-friendly cleaning chemicals is anticipated to rise substantially from [Insert Updated 2025 Percentage]% in 2025 to [Insert Updated 2033 Percentage]% by 2033. This growth is fueled by the escalating demand for advanced materials across diverse end-use industries, coupled with stringent regulatory compliance mandates that necessitate innovative and sustainable cleaning solutions. Furthermore, increasing awareness of environmental concerns and worker safety is driving the adoption of safer, less toxic cleaning agents.

Dominant Regions, Countries, or Segments in North America Metal Cleaning Chemicals Market

This section identifies the key regions, countries, and market segments within North America that are spearheading the market's expansion. Our analysis considers diverse economic and infrastructural factors within each segment to provide a comprehensive understanding of the market dynamics.

- Leading Region: The [Specific Region - e.g., Midwest] region retains its position as the largest market segment, fueled by robust manufacturing activity in its automotive and electronics industries. [Add further details specific to this region].

- Leading Country: [Specific Country - e.g., The United States] continues to dominate the North American market, leveraging its advanced manufacturing base and high industrial output. [Add detail on specific states or factors within the US].

- Leading Segment (Form): Aqueous-based cleaning chemicals remain the dominant form due to their versatility and cost-effectiveness. However, the solvent-based segment is projected to demonstrate accelerated growth, driven primarily by niche applications in the electronics industry and specific industrial processes requiring superior cleaning capabilities. [Add detail, perhaps on the types of solvents used].

- Leading Segment (Type): Acidic cleaning chemicals maintain the largest market share due to their effectiveness in various cleaning applications. [Specify the types of acidic chemicals]. However, the growth of alkaline and neutral cleaning chemicals is increasing due to [Add reason].

- Leading Segment (Functional Additives): Surfactants continue to be the most prevalent functional additives, enhancing cleaning efficacy. However, the adoption of [mention other additives and their reasons] is growing significantly.

- Leading Segment (End-user Industry): The transportation and electrical and electronics sectors remain dominant, reflecting growing production volumes and the demand for precision cleaning solutions. However, emerging sectors such as [mention other end-user sectors] are showing significant potential for growth.

North America Metal Cleaning Chemicals Market Product Landscape

The North American metal cleaning chemicals market showcases a diverse product landscape encompassing various formulations tailored to specific applications and material types. Innovations focus on enhancing cleaning efficiency, minimizing environmental impact, and improving safety for workers. The development of biodegradable and less toxic chemicals has gained significant traction, alongside improvements in application methods and automated cleaning systems, aimed at improving both efficiency and safety.

Key Drivers, Barriers & Challenges in North America Metal Cleaning Chemicals Market

Key Drivers:

- Increasing demand from the automotive, electronics, and aerospace industries, which require highly precise cleaning processes.

- Stringent environmental regulations promoting the use of environmentally friendly cleaning chemicals.

- Technological advancements leading to higher efficiency and improved cleaning effectiveness.

Key Barriers and Challenges:

- Volatility in raw material prices, significantly impacting production costs.

- Stringent regulatory compliance and safety standards add to operational complexity and cost.

- Intense competition from both established players and emerging companies. We estimate a xx% decrease in profit margins over the next five years due to competitive pressure.

Emerging Opportunities in North America Metal Cleaning Chemicals Market

- Growing demand for sustainable and eco-friendly cleaning solutions.

- Expanding adoption of advanced manufacturing techniques in various industries.

- Untapped potential in niche markets and emerging applications, such as 3D printing and additive manufacturing.

Growth Accelerators in the North America Metal Cleaning Chemicals Market Industry

The long-term growth trajectory of the North America metal cleaning chemicals market is strongly influenced by strategic collaborations between chemical manufacturers and end-users to develop customized cleaning solutions tailored to specific needs. Technological progress continues to drive the creation of highly specialized and efficient cleaning chemicals, offering enhanced performance and reduced environmental impact. Expansion into new markets, notably the renewable energy sector and the burgeoning demand for precision cleaning in cutting-edge technologies like [mention specific emerging technologies], will further propel market expansion. Government regulations and initiatives promoting sustainable practices are also playing a key role in driving growth.

Key Players Shaping the North America Metal Cleaning Chemicals Market Market

- Lincoln Chemical Corporation

- Dow

- Clariant

- Luster-On Products Inc

- ECOLINK

- Eastman Chemical Company

- Delstar Metal Finishing Inc

- Royal Chemical Company

- Nouryon

- Rochester Midland Corp

- Evonik industries

- Chautauqua Chemical Company

- Spartan Chemical Company Inc

- Crest Chemicals

- 3M

- Hubbard-Hall

- Stepan Company

- KYZEN CORPORATION

- Dober

- Quaker Chemical Corporation

- BASF SE

Notable Milestones in North America Metal Cleaning Chemicals Market Sector

- August 2022: MKS Instruments acquired Atotech, strengthening its global presence in metal cleaning chemicals.

- September 2021: Element Solutions Inc. acquired Coventya Holding SAS, expanding its reach into various end-markets.

In-Depth North America Metal Cleaning Chemicals Market Outlook

The future of the North America metal cleaning chemicals market appears promising, driven by ongoing technological advancements and increasing demand from diverse industrial sectors. Strategic investments in R&D and a focus on sustainable and eco-friendly solutions will shape the market's trajectory. Opportunities exist for companies to expand their product portfolios, explore new applications, and capitalize on the growing demand for high-performance cleaning chemicals in emerging technologies. The market is poised for significant expansion, with substantial growth potential for innovative and environmentally conscious players.

North America Metal Cleaning Chemicals Market Segmentation

-

1. Form

- 1.1. Aqueous

- 1.2. Solvent

-

2. Type

- 2.1. Acidic

- 2.2. Basic

- 2.3. Neutral

-

3. Functional Additives

- 3.1. Surfactants

- 3.2. Corrosion Inhibitors

- 3.3. Chelating Agents

- 3.4. PH Regulators

-

4. End-user Industries

- 4.1. Transportation

- 4.2. Electrical and Electronics

- 4.3. Chemical and Pharmaceutical

- 4.4. Oil and Gas

- 4.5. Other End-user Industries

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Mexico

North America Metal Cleaning Chemicals Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Metal Cleaning Chemicals Market Regional Market Share

Geographic Coverage of North America Metal Cleaning Chemicals Market

North America Metal Cleaning Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Environment Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Transportation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Aqueous

- 5.1.2. Solvent

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Acidic

- 5.2.2. Basic

- 5.2.3. Neutral

- 5.3. Market Analysis, Insights and Forecast - by Functional Additives

- 5.3.1. Surfactants

- 5.3.2. Corrosion Inhibitors

- 5.3.3. Chelating Agents

- 5.3.4. PH Regulators

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. Transportation

- 5.4.2. Electrical and Electronics

- 5.4.3. Chemical and Pharmaceutical

- 5.4.4. Oil and Gas

- 5.4.5. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United States North America Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Aqueous

- 6.1.2. Solvent

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Acidic

- 6.2.2. Basic

- 6.2.3. Neutral

- 6.3. Market Analysis, Insights and Forecast - by Functional Additives

- 6.3.1. Surfactants

- 6.3.2. Corrosion Inhibitors

- 6.3.3. Chelating Agents

- 6.3.4. PH Regulators

- 6.4. Market Analysis, Insights and Forecast - by End-user Industries

- 6.4.1. Transportation

- 6.4.2. Electrical and Electronics

- 6.4.3. Chemical and Pharmaceutical

- 6.4.4. Oil and Gas

- 6.4.5. Other End-user Industries

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Canada North America Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Aqueous

- 7.1.2. Solvent

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Acidic

- 7.2.2. Basic

- 7.2.3. Neutral

- 7.3. Market Analysis, Insights and Forecast - by Functional Additives

- 7.3.1. Surfactants

- 7.3.2. Corrosion Inhibitors

- 7.3.3. Chelating Agents

- 7.3.4. PH Regulators

- 7.4. Market Analysis, Insights and Forecast - by End-user Industries

- 7.4.1. Transportation

- 7.4.2. Electrical and Electronics

- 7.4.3. Chemical and Pharmaceutical

- 7.4.4. Oil and Gas

- 7.4.5. Other End-user Industries

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Mexico North America Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Aqueous

- 8.1.2. Solvent

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Acidic

- 8.2.2. Basic

- 8.2.3. Neutral

- 8.3. Market Analysis, Insights and Forecast - by Functional Additives

- 8.3.1. Surfactants

- 8.3.2. Corrosion Inhibitors

- 8.3.3. Chelating Agents

- 8.3.4. PH Regulators

- 8.4. Market Analysis, Insights and Forecast - by End-user Industries

- 8.4.1. Transportation

- 8.4.2. Electrical and Electronics

- 8.4.3. Chemical and Pharmaceutical

- 8.4.4. Oil and Gas

- 8.4.5. Other End-user Industries

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Lincoln Chemical Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Dow

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Clariant

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Luster-On Products Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 ECOLINK

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Eastman Chemical Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Delstar Metal Finishing Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Royal Chemical Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nouryon

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Rochester Midland Corp

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Evonik industries

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Chautauqua Chemical Company

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Spartan Chemical Company Inc

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Crest Chemicals

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 3M

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 Hubbard-Hall

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 Stepan Company*List Not Exhaustive

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.18 KYZEN CORPORATION

- 9.2.18.1. Overview

- 9.2.18.2. Products

- 9.2.18.3. SWOT Analysis

- 9.2.18.4. Recent Developments

- 9.2.18.5. Financials (Based on Availability)

- 9.2.19 Dober

- 9.2.19.1. Overview

- 9.2.19.2. Products

- 9.2.19.3. SWOT Analysis

- 9.2.19.4. Recent Developments

- 9.2.19.5. Financials (Based on Availability)

- 9.2.20 Quaker Chemical Corporation

- 9.2.20.1. Overview

- 9.2.20.2. Products

- 9.2.20.3. SWOT Analysis

- 9.2.20.4. Recent Developments

- 9.2.20.5. Financials (Based on Availability)

- 9.2.21 BASF SE

- 9.2.21.1. Overview

- 9.2.21.2. Products

- 9.2.21.3. SWOT Analysis

- 9.2.21.4. Recent Developments

- 9.2.21.5. Financials (Based on Availability)

- 9.2.1 Lincoln Chemical Corporation

List of Figures

- Figure 1: North America Metal Cleaning Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Metal Cleaning Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 4: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 5: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 8: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 9: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 10: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 11: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 14: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 16: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 17: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 20: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 21: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 22: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 23: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Metal Cleaning Chemicals Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the North America Metal Cleaning Chemicals Market?

Key companies in the market include Lincoln Chemical Corporation, Dow, Clariant, Luster-On Products Inc, ECOLINK, Eastman Chemical Company, Delstar Metal Finishing Inc, Royal Chemical Company, Nouryon, Rochester Midland Corp, Evonik industries, Chautauqua Chemical Company, Spartan Chemical Company Inc, Crest Chemicals, 3M, Hubbard-Hall, Stepan Company*List Not Exhaustive, KYZEN CORPORATION, Dober, Quaker Chemical Corporation, BASF SE.

3. What are the main segments of the North America Metal Cleaning Chemicals Market?

The market segments include Form, Type, Functional Additives, End-user Industries, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries.

6. What are the notable trends driving market growth?

Increasing Usage in the Transportation Industry.

7. Are there any restraints impacting market growth?

Stringent Environment Regulations.

8. Can you provide examples of recent developments in the market?

August 2022: MKS Instruments completed the acquisition of Atotech, a global player in producing surface treatment and processing chemicals for various metals. The acquisition may strengthen the position of MKS Instruments in the metal cleaning market across the world, including North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Metal Cleaning Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Metal Cleaning Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Metal Cleaning Chemicals Market?

To stay informed about further developments, trends, and reports in the North America Metal Cleaning Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence