Key Insights

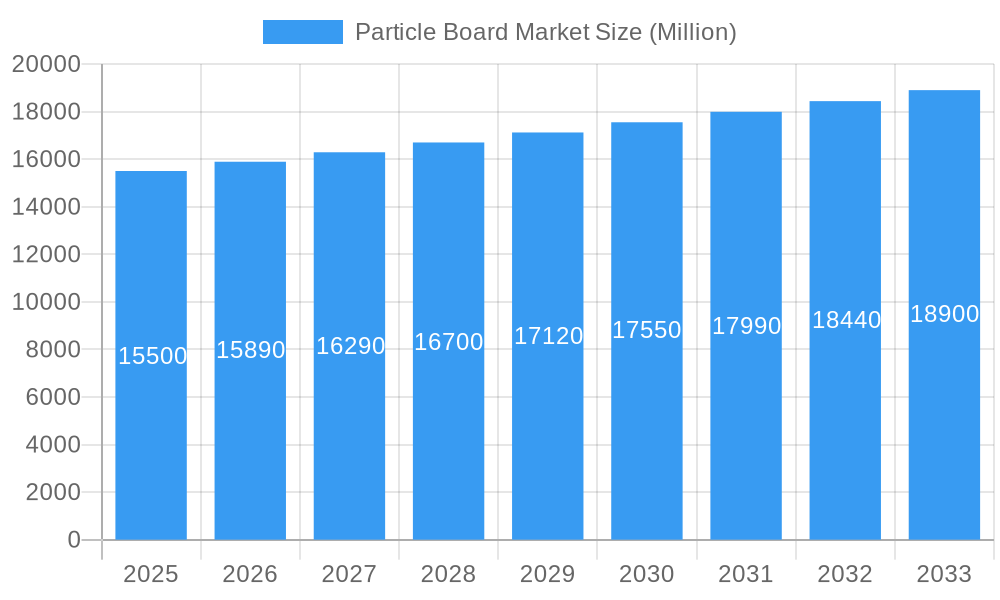

The global Particle Board Market is projected for significant expansion, estimated to reach $21.88 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.8% through 2033. This robust growth is propelled by escalating demand from the construction and furniture industries, fueled by rapid urbanization and an expanding middle class, particularly in Asia Pacific. Particle board's cost-effectiveness and versatility make it a prime material for diverse applications, including interior fittings, cabinetry, shelving, and decorative surfaces. Innovations in manufacturing and sustainable product formulations, incorporating recycled content, further enhance market vitality.

Particle Board Market Market Size (In Billion)

Key market growth catalysts include global infrastructure development and increased residential and commercial construction, especially in emerging economies. The furniture sector's continuous innovation leverages particle board's adaptability and affordability. Challenges include raw material price volatility and competition from alternative engineered wood products. Nevertheless, particle board's inherent advantages, combined with a focus on sustainable materials and efficient space utilization, will drive positive market growth. The forecast period (2025-2033) anticipates sustained market value appreciation driven by technological advancements and expanding end-use applications, reinforcing particle board's essential role across industries.

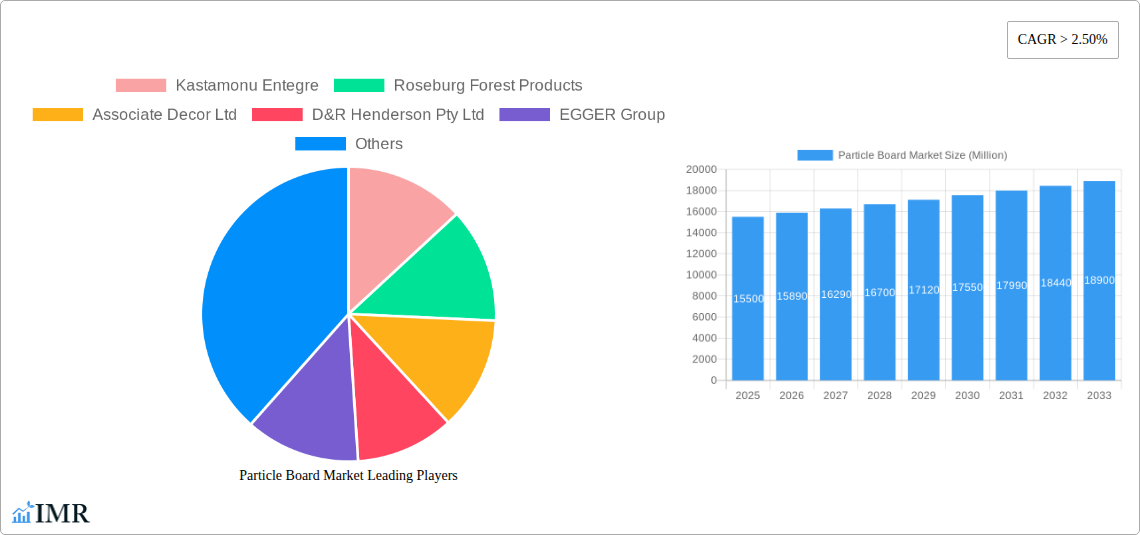

Particle Board Market Company Market Share

Particle Board Market: Global Outlook & Strategic Insights (2019–2033)

Unlock the comprehensive landscape of the global particle board market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides critical insights into market dynamics, growth trends, regional dominance, and key players shaping the industry. Essential for manufacturers, suppliers, investors, and construction and furniture industry professionals seeking to navigate this evolving sector.

Particle Board Market Market Dynamics & Structure

The particle board market, a crucial segment within the broader wood-based panel industry, exhibits a moderately concentrated structure with a few key global players dominating production capacity, alongside a significant number of regional and specialized manufacturers. Technological innovation is a primary driver, focusing on enhanced board strength, moisture resistance, and reduced formaldehyde emissions to meet stringent environmental regulations and evolving consumer demands. Regulatory frameworks, particularly concerning sustainable forestry practices and emissions standards like CARB and E1, significantly influence product development and manufacturing processes, creating barriers for non-compliant producers. Competitive product substitutes, including Medium Density Fibreboard (MDF), High-Density Fibreboard (HDF), plywood, and advanced composite materials, exert constant pressure, necessitating continuous product differentiation and cost optimization. End-user demographics are shifting, with an increasing demand for eco-friendly and durable building materials in both residential and commercial construction, as well as a growing preference for aesthetically pleasing and cost-effective furniture solutions. Mergers and acquisitions (M&A) trends, exemplified by strategic divestitures and plant expansions, are actively reshaping the competitive landscape, aimed at consolidating market share, expanding geographical reach, and optimizing operational efficiencies. For instance, the recent sale of Roseburg's particle board plant to Kronospan signifies consolidation and strategic realignment within the composites industry.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized regional manufacturers.

- Technological Innovation Drivers: Focus on low-emission products, improved strength-to-weight ratios, and enhanced moisture resistance.

- Regulatory Frameworks: Stringent environmental standards (e.g., formaldehyde emissions) impacting production and material sourcing.

- Competitive Product Substitutes: MDF, HDF, plywood, OSB, and engineered wood products.

- End-User Demographics: Growing demand from construction (residential & commercial), furniture manufacturing, and interior design sectors.

- M&A Trends: Strategic acquisitions and divestitures aimed at market consolidation and operational synergies.

Particle Board Market Growth Trends & Insights

The global particle board market is poised for consistent growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033, reaching an estimated market size of $XX Billion units by 2033. This growth trajectory is underpinned by several key trends, including a burgeoning global population, rapid urbanization, and a sustained demand for affordable and versatile building and furniture materials. The construction sector, particularly in emerging economies, serves as a primary engine for this expansion, driven by ongoing infrastructure development and a surge in residential housing projects. Furthermore, the furniture industry's continuous need for cost-effective and easily workable materials fuels demand. Adoption rates for particle board are rising due to its favorable price-to-performance ratio compared to solid wood and other engineered wood products. Technological disruptions, such as advancements in adhesive technologies to reduce formaldehyde emissions and the development of higher-density particle boards with improved structural integrity, are enhancing its appeal and expanding its application scope. Consumer behavior is also evolving, with a growing awareness of sustainability and a preference for materials that offer both environmental benefits and economic value. This shift is encouraging manufacturers to invest in greener production processes and utilize recycled content, further bolstering market penetration. The resurgence of renovation and refurbishment projects in developed economies also contributes significantly to market demand.

- Projected CAGR (2025-2033): ~4.5%

- Estimated Market Size (2033): $XX Billion units

- Key Growth Drivers: Urbanization, infrastructure development, affordable housing initiatives, and the furniture industry's demand.

- Adoption Rate Influencers: Favorable cost-performance, versatility, and increasing environmental consciousness.

- Technological Advancements: Low-VOC adhesives, enhanced durability, and improved structural properties.

- Consumer Behavior Shifts: Preference for sustainable, cost-effective, and aesthetically adaptable materials.

- Market Penetration: Driven by a balance of economic factors, technological improvements, and evolving end-user preferences.

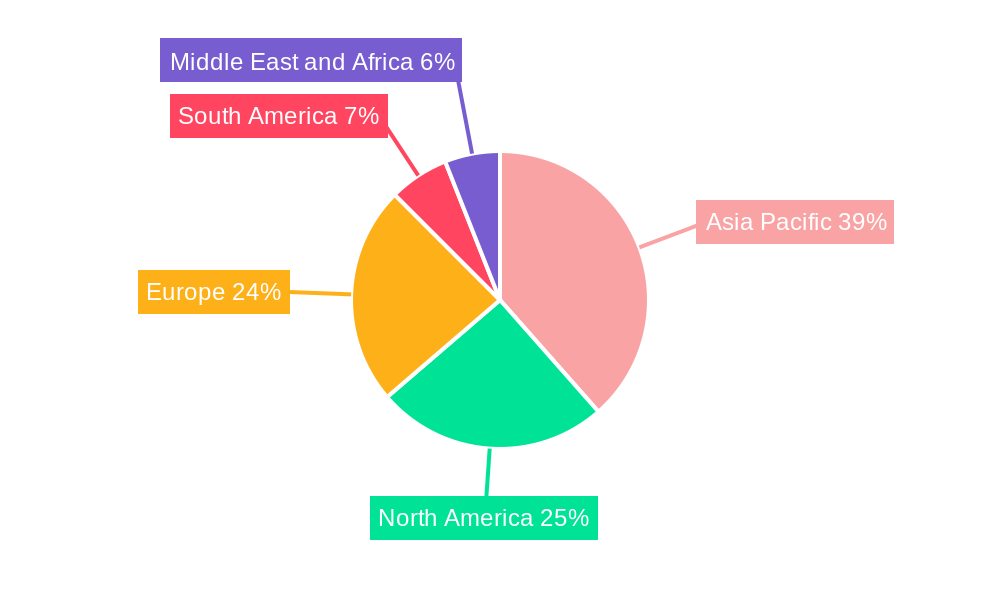

Dominant Regions, Countries, or Segments in Particle Board Market

The Wood (Sawdust, Shavings, Flakes, Chips) segment within the Raw Material category is undeniably the dominant force in the global particle board market, accounting for an estimated 85% of total production volume. This dominance stems from the widespread availability of wood as a primary feedstock, coupled with established industrial forestry practices and efficient wood waste utilization processes. The Construction application segment also leads the market, driven by the insatiable global demand for housing, commercial buildings, and infrastructure projects. Countries with robust construction industries and significant timber resources, such as China, the United States, and European nations, are key contributors to this dominance.

In Asia Pacific, China's massive manufacturing base and ongoing urbanization projects propel its particle board consumption significantly. The region's reliance on wood-based raw materials and its burgeoning construction sector make it a powerhouse in both production and consumption. North America, particularly the United States, benefits from extensive forest resources and a mature construction and furniture market. Its manufacturers are at the forefront of technological innovation, focusing on sustainable practices and higher-performance products. Europe's strong emphasis on environmental regulations and circular economy principles drives the demand for particle board produced with recycled content and low emissions, alongside the continued use of sustainably sourced wood.

- Dominant Raw Material: Wood (Sawdust, Shavings, Flakes, Chips)

- Market Share: ~85%

- Key Drivers: Abundance, cost-effectiveness, established forestry practices, efficient waste utilization.

- Dominant Application: Construction

- Market Drivers: Urbanization, infrastructure development, residential and commercial building boom, renovation activities.

- Leading Regions/Countries:

- Asia Pacific (China): Massive manufacturing capacity, rapid urbanization, substantial construction demand.

- North America (United States): Abundant timber resources, mature construction and furniture markets, technological innovation.

- Europe: Stringent environmental regulations, focus on sustainability and recycled content, strong demand for renovation.

- Growth Potential: Emerging economies in Southeast Asia and Latin America present significant untapped growth opportunities due to increasing infrastructure spending and a rising middle class.

Particle Board Market Product Landscape

The particle board product landscape is characterized by continuous innovation aimed at enhancing performance and expanding application versatility. Modern particle boards offer improved moisture resistance, crucial for applications in kitchens, bathrooms, and exterior-grade uses, achieved through advanced resin formulations and surface treatments. The development of low-formaldehyde emission boards (e.g., E0 and E1 grades) is a significant trend, driven by health consciousness and stringent regulatory requirements, making them ideal for interior applications and furniture. High-density particle boards provide superior screw-holding capacity and structural integrity, suitable for load-bearing applications. Furthermore, advancements in surface finishing technologies allow for a wide array of aesthetic options, including laminates, veneers, and digital printing, enabling particle board to mimic the appearance of solid wood and other premium materials, thus broadening its appeal in furniture and cabinetry.

Key Drivers, Barriers & Challenges in Particle Board Market

Key Drivers: The particle board market is propelled by several key forces. The cost-effectiveness of particle board compared to solid wood makes it an attractive material for a wide range of applications, especially in price-sensitive construction and furniture sectors. Versatility in terms of application, from subflooring and wall sheathing in construction to cabinetry and shelving in furniture, further fuels demand. Technological advancements in resin binders and manufacturing processes are leading to improved product quality, including enhanced durability, moisture resistance, and reduced environmental impact (low formaldehyde emissions), aligning with growing sustainability concerns. The ongoing global urbanization and infrastructure development significantly drives the demand for affordable and readily available building materials like particle board.

Barriers & Challenges: Despite its strengths, the particle board market faces several barriers and challenges. Susceptibility to moisture damage remains a significant concern, requiring protective treatments for certain applications and limiting its use in perpetually wet environments. While improving, perception of lower quality compared to solid wood can sometimes hinder its adoption in premium segments. Fluctuations in the raw material costs, particularly for wood chips and resins, can impact profitability and pricing. Stringent environmental regulations, while driving innovation, also necessitate significant investment in compliance, potentially creating barriers for smaller manufacturers. Finally, intense competition from substitute materials like MDF, plywood, and OSB necessitates continuous product differentiation and cost management.

Emerging Opportunities in Particle Board Market

Emerging opportunities in the particle board market lie in the development of next-generation composite boards that offer superior performance characteristics, such as enhanced fire resistance and even greater moisture impermeability. The increasing focus on the circular economy presents a significant opportunity for particle board manufacturers who can effectively integrate higher percentages of recycled wood waste and develop end-of-life recycling solutions. Growth in the DIY and home improvement sectors offers potential for specialized, easy-to-install particle board products for domestic use. Furthermore, exploring innovative applications in packaging and shipping, particularly for protective dunnage and specialized containers, could open new market avenues. The development of bio-based resins derived from renewable resources offers a pathway to a more sustainable product offering, appealing to environmentally conscious consumers and industries.

Growth Accelerators in the Particle Board Market Industry

Several catalysts are accelerating long-term growth in the particle board industry. Technological breakthroughs in adhesive formulations, particularly the development of formaldehyde-free binders, are not only meeting regulatory demands but also improving indoor air quality and consumer safety, thereby expanding market acceptance. Strategic partnerships between raw material suppliers, particle board manufacturers, and end-users (e.g., furniture brands, construction firms) facilitate product innovation and market penetration by ensuring tailored solutions and predictable supply chains. Market expansion strategies, including targeting emerging economies with developing construction sectors and growing middle classes, provide significant avenues for volume growth. The increasing emphasis on sustainable building practices and green certifications is also a strong accelerator, positioning particle board made from recycled content and with low emissions as a preferred material choice.

Key Players Shaping the Particle Board Market Market

- Kastamonu Entegre

- Roseburg Forest Products

- Associate Decor Ltd

- D&R Henderson Pty Ltd

- EGGER Group

- West Fraser

- Uniboard

- Peter Benson (Plywood) Limited

- Krifor Industries Pvt Ltd

- Georgia-Pacific

- Wanhua Ecoboard Co Ltd

- Timber Products Company

- Boise Cascade

- Century Prowud

- Shirdi Industries Ltd (ASIS India)

- Siam Riso

Notable Milestones in Particle Board Market Sector

- December 2023: Roseburg sold its particle board plant in Simsboro, Louisiana, to Kronospan, reflecting strategic realignments within the composites industry and consolidation among major players.

- July 2022: Kastamonu Entegre collaborated with Siempelkamp to establish a new particle board manufacturing plant in Kastamonu, Turkey, significantly boosting its production capacity for both domestic and international markets.

- January 2022: Roseburg Forest Products announced the closure of its particle board plant in Douglas County, indicating a strategic shift towards investing in new technologies for its western manufacturing operations and a potential refocusing of its product portfolio.

In-Depth Particle Board Market Market Outlook

The particle board market outlook remains robust, driven by ongoing global urbanization, a sustained demand for affordable housing, and continuous innovation in material science. Growth accelerators such as the development of eco-friendly, low-emission boards and the integration of recycled content are poised to enhance its market competitiveness and appeal. Strategic investments in new manufacturing technologies and expansion into emerging economies will be critical for key players. The market is expected to witness further consolidation through M&A activities as companies seek to achieve economies of scale and broaden their product offerings. Opportunities lie in developing high-performance particle boards for specialized applications and in meeting the growing demand for sustainable building materials, positioning the industry for sustained growth and profitability in the coming years.

Particle Board Market Segmentation

-

1. Raw Material

-

1.1. Wood

- 1.1.1. Sawdust

- 1.1.2. Shavings

- 1.1.3. Flakes

- 1.1.4. Chips

- 1.2. Bagasse

- 1.3. Other Raw Materials (Recycled Content)

-

1.1. Wood

-

2. Application

- 2.1. Construction

- 2.2. Furniture

- 2.3. Infrastructure

- 2.4. Other Applications (Packaging and Shipping)

Particle Board Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Southeast Asia

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. NORDIC

- 3.7. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Nigeria

- 5.4. UAE

- 5.5. Rest of Middle East and Africa

Particle Board Market Regional Market Share

Geographic Coverage of Particle Board Market

Particle Board Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Furniture Industry; Easy Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Threat of Medium-density Fiberboard (MDF) as a Substitute; Lower Durability

- 3.4. Market Trends

- 3.4.1. Construction Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Wood

- 5.1.1.1. Sawdust

- 5.1.1.2. Shavings

- 5.1.1.3. Flakes

- 5.1.1.4. Chips

- 5.1.2. Bagasse

- 5.1.3. Other Raw Materials (Recycled Content)

- 5.1.1. Wood

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction

- 5.2.2. Furniture

- 5.2.3. Infrastructure

- 5.2.4. Other Applications (Packaging and Shipping)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Asia Pacific Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Wood

- 6.1.1.1. Sawdust

- 6.1.1.2. Shavings

- 6.1.1.3. Flakes

- 6.1.1.4. Chips

- 6.1.2. Bagasse

- 6.1.3. Other Raw Materials (Recycled Content)

- 6.1.1. Wood

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Construction

- 6.2.2. Furniture

- 6.2.3. Infrastructure

- 6.2.4. Other Applications (Packaging and Shipping)

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. North America Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Wood

- 7.1.1.1. Sawdust

- 7.1.1.2. Shavings

- 7.1.1.3. Flakes

- 7.1.1.4. Chips

- 7.1.2. Bagasse

- 7.1.3. Other Raw Materials (Recycled Content)

- 7.1.1. Wood

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Construction

- 7.2.2. Furniture

- 7.2.3. Infrastructure

- 7.2.4. Other Applications (Packaging and Shipping)

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Europe Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Wood

- 8.1.1.1. Sawdust

- 8.1.1.2. Shavings

- 8.1.1.3. Flakes

- 8.1.1.4. Chips

- 8.1.2. Bagasse

- 8.1.3. Other Raw Materials (Recycled Content)

- 8.1.1. Wood

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Construction

- 8.2.2. Furniture

- 8.2.3. Infrastructure

- 8.2.4. Other Applications (Packaging and Shipping)

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South America Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Wood

- 9.1.1.1. Sawdust

- 9.1.1.2. Shavings

- 9.1.1.3. Flakes

- 9.1.1.4. Chips

- 9.1.2. Bagasse

- 9.1.3. Other Raw Materials (Recycled Content)

- 9.1.1. Wood

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Construction

- 9.2.2. Furniture

- 9.2.3. Infrastructure

- 9.2.4. Other Applications (Packaging and Shipping)

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Middle East and Africa Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Wood

- 10.1.1.1. Sawdust

- 10.1.1.2. Shavings

- 10.1.1.3. Flakes

- 10.1.1.4. Chips

- 10.1.2. Bagasse

- 10.1.3. Other Raw Materials (Recycled Content)

- 10.1.1. Wood

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Construction

- 10.2.2. Furniture

- 10.2.3. Infrastructure

- 10.2.4. Other Applications (Packaging and Shipping)

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kastamonu Entegre

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Roseburg Forest Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Associate Decor Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 D&R Henderson Pty Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EGGER Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 West Fraser

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Uniboard

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Peter Benson (Plywood) Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Krifor Industries Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Georgia-Pacific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wanhua Ecoboard Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Timber Products Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Boise Cascade

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Century Prowud

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Shirdi Industries Ltd (ASIS India)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Siam Riso

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Kastamonu Entegre

List of Figures

- Figure 1: Global Particle Board Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Particle Board Market Volume Breakdown (Square Meters, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 4: Asia Pacific Particle Board Market Volume (Square Meters), by Raw Material 2025 & 2033

- Figure 5: Asia Pacific Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 6: Asia Pacific Particle Board Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 7: Asia Pacific Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 8: Asia Pacific Particle Board Market Volume (Square Meters), by Application 2025 & 2033

- Figure 9: Asia Pacific Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Particle Board Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 12: Asia Pacific Particle Board Market Volume (Square Meters), by Country 2025 & 2033

- Figure 13: Asia Pacific Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Particle Board Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 16: North America Particle Board Market Volume (Square Meters), by Raw Material 2025 & 2033

- Figure 17: North America Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 18: North America Particle Board Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 19: North America Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 20: North America Particle Board Market Volume (Square Meters), by Application 2025 & 2033

- Figure 21: North America Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Particle Board Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 24: North America Particle Board Market Volume (Square Meters), by Country 2025 & 2033

- Figure 25: North America Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Particle Board Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 28: Europe Particle Board Market Volume (Square Meters), by Raw Material 2025 & 2033

- Figure 29: Europe Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 30: Europe Particle Board Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 31: Europe Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 32: Europe Particle Board Market Volume (Square Meters), by Application 2025 & 2033

- Figure 33: Europe Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Particle Board Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Particle Board Market Volume (Square Meters), by Country 2025 & 2033

- Figure 37: Europe Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Particle Board Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 40: South America Particle Board Market Volume (Square Meters), by Raw Material 2025 & 2033

- Figure 41: South America Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 42: South America Particle Board Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 43: South America Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 44: South America Particle Board Market Volume (Square Meters), by Application 2025 & 2033

- Figure 45: South America Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Particle Board Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Particle Board Market Volume (Square Meters), by Country 2025 & 2033

- Figure 49: South America Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Particle Board Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 52: Middle East and Africa Particle Board Market Volume (Square Meters), by Raw Material 2025 & 2033

- Figure 53: Middle East and Africa Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 54: Middle East and Africa Particle Board Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 55: Middle East and Africa Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Particle Board Market Volume (Square Meters), by Application 2025 & 2033

- Figure 57: Middle East and Africa Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Particle Board Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Particle Board Market Volume (Square Meters), by Country 2025 & 2033

- Figure 61: Middle East and Africa Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Particle Board Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 2: Global Particle Board Market Volume Square Meters Forecast, by Raw Material 2020 & 2033

- Table 3: Global Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Particle Board Market Volume Square Meters Forecast, by Application 2020 & 2033

- Table 5: Global Particle Board Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Particle Board Market Volume Square Meters Forecast, by Region 2020 & 2033

- Table 7: Global Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 8: Global Particle Board Market Volume Square Meters Forecast, by Raw Material 2020 & 2033

- Table 9: Global Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Particle Board Market Volume Square Meters Forecast, by Application 2020 & 2033

- Table 11: Global Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Particle Board Market Volume Square Meters Forecast, by Country 2020 & 2033

- Table 13: China Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 15: India Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: India Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 17: Japan Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 19: South Korea Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: South Korea Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 21: Southeast Asia Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Southeast Asia Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 25: Global Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 26: Global Particle Board Market Volume Square Meters Forecast, by Raw Material 2020 & 2033

- Table 27: Global Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Particle Board Market Volume Square Meters Forecast, by Application 2020 & 2033

- Table 29: Global Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Particle Board Market Volume Square Meters Forecast, by Country 2020 & 2033

- Table 31: United States Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: United States Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 33: Canada Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Canada Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 35: Mexico Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Mexico Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 37: Global Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 38: Global Particle Board Market Volume Square Meters Forecast, by Raw Material 2020 & 2033

- Table 39: Global Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Particle Board Market Volume Square Meters Forecast, by Application 2020 & 2033

- Table 41: Global Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Particle Board Market Volume Square Meters Forecast, by Country 2020 & 2033

- Table 43: Germany Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Germany Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 45: United Kingdom Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 47: Italy Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Italy Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 49: France Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: France Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 51: Spain Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Spain Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 53: NORDIC Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: NORDIC Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 55: Rest of Europe Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Europe Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 57: Global Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 58: Global Particle Board Market Volume Square Meters Forecast, by Raw Material 2020 & 2033

- Table 59: Global Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 60: Global Particle Board Market Volume Square Meters Forecast, by Application 2020 & 2033

- Table 61: Global Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 62: Global Particle Board Market Volume Square Meters Forecast, by Country 2020 & 2033

- Table 63: Brazil Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Brazil Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 65: Argentina Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Argentina Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 67: Colombia Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Colombia Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 69: Rest of South America Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Rest of South America Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 71: Global Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 72: Global Particle Board Market Volume Square Meters Forecast, by Raw Material 2020 & 2033

- Table 73: Global Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 74: Global Particle Board Market Volume Square Meters Forecast, by Application 2020 & 2033

- Table 75: Global Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 76: Global Particle Board Market Volume Square Meters Forecast, by Country 2020 & 2033

- Table 77: Saudi Arabia Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Saudi Arabia Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 79: South Africa Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: South Africa Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 81: Nigeria Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Nigeria Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 83: UAE Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: UAE Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Particle Board Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Particle Board Market Volume (Square Meters) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Particle Board Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Particle Board Market?

Key companies in the market include Kastamonu Entegre, Roseburg Forest Products, Associate Decor Ltd, D&R Henderson Pty Ltd, EGGER Group, West Fraser, Uniboard, Peter Benson (Plywood) Limited, Krifor Industries Pvt Ltd, Georgia-Pacific, Wanhua Ecoboard Co Ltd, Timber Products Company, Boise Cascade, Century Prowud, Shirdi Industries Ltd (ASIS India), Siam Riso.

3. What are the main segments of the Particle Board Market?

The market segments include Raw Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Furniture Industry; Easy Availability of Raw Materials.

6. What are the notable trends driving market growth?

Construction Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Threat of Medium-density Fiberboard (MDF) as a Substitute; Lower Durability.

8. Can you provide examples of recent developments in the market?

December 2023: Roseburg sold its particle board plant in Simsboro, Louisiana, to Kronospan. This is because Roseburg is engaged in the composites industry, manufacturing MDF and particle boards at various plants across North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Square Meters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Particle Board Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Particle Board Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Particle Board Market?

To stay informed about further developments, trends, and reports in the Particle Board Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence