Key Insights

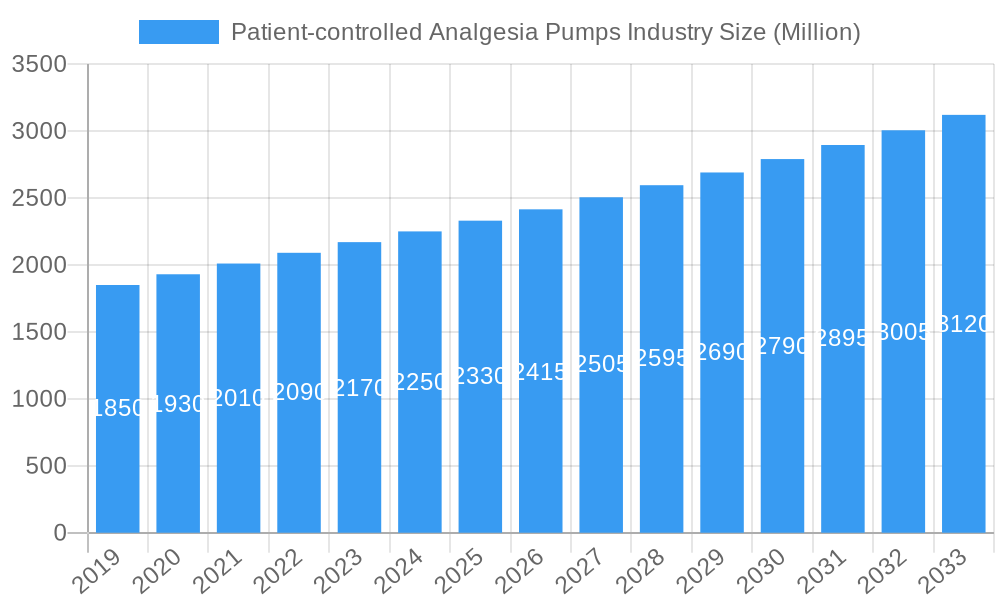

The global Patient-Controlled Analgesia (PCA) Pumps market is projected for significant expansion, with an estimated market size of USD 2.5 billion by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 7% through 2033. This growth is driven by the rising prevalence of chronic pain conditions, including oncology and diabetes, necessitating advanced pain management. An aging global population also contributes to increased demand. Technological advancements are introducing more sophisticated, user-friendly PCA devices with enhanced drug delivery accuracy and remote monitoring. The growing demand for minimally invasive surgery further fuels the PCA pump market by emphasizing effective post-operative pain control for patient recovery. The shift towards cost-effective home-care settings, driven by patient preference, is a substantial growth catalyst, with increasing PCA therapy administered outside traditional hospital environments.

Patient-controlled Analgesia Pumps Industry Market Size (In Billion)

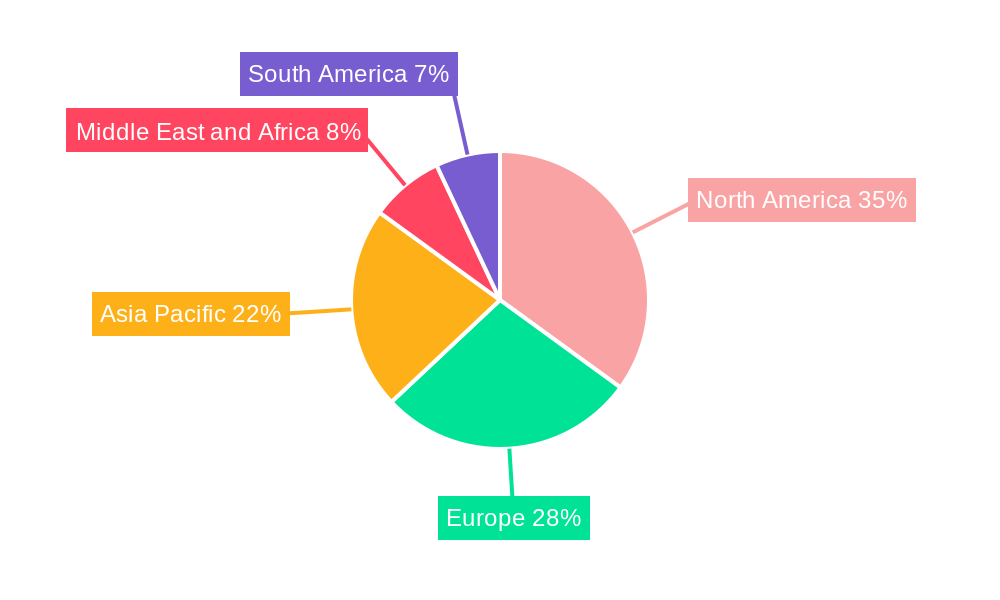

The PCA Pumps market is segmented by product type, application, and end-user. PCA pumps and their accessories form a significant market. Oncology and diabetes are leading applications due to high chronic pain incidence. Neonatology is a growing segment, driven by increased infant survival and the need for effective pain management. Hospitals remain primary end-users, with ambulatory surgical centers and home-care settings rapidly gaining traction. Geographically, North America is expected to lead due to advanced healthcare infrastructure, high technology adoption, and significant investment in pain management research. Europe and Asia Pacific are also anticipated to experience robust growth, fueled by increasing patient populations, expanding healthcare access, and rising awareness of advanced pain management techniques. Key market players are focusing on research and development, strategic collaborations, and mergers and acquisitions to expand product portfolios and global reach.

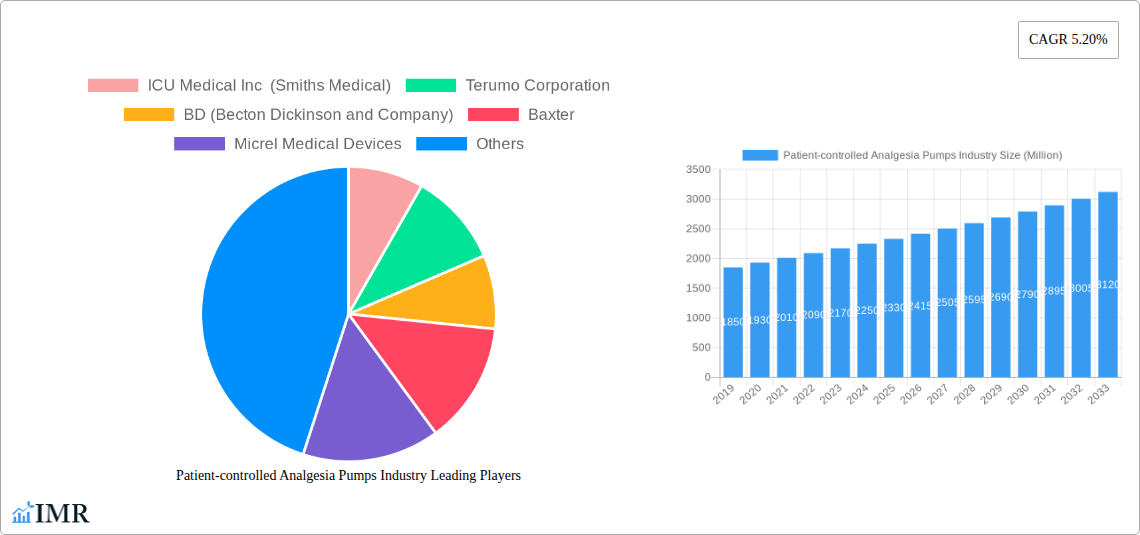

Patient-controlled Analgesia Pumps Industry Company Market Share

This report provides an in-depth analysis of the global Patient-Controlled Analgesia (PCA) pumps market, offering critical insights into market dynamics, growth trajectories, and future potential. Covering the period up to 2033, with a base year of 2025, this study is essential for stakeholders seeking to understand and capitalize on opportunities within the infusion therapy, pain management solutions, and broader medical devices sectors. We meticulously examine PCA pumps market size, market share, and market trends across product types, applications, and end-user segments, including hospitals, ambulatory surgical centers, and home-care settings.

The report delves into the specific segments of syringe infusion pumps, analgesia pumps, and pain management device accessories, integrating high-traffic keywords such as PCA pump market analysis, infusion therapy market growth, oncology pain management devices, diabetes infusion pumps, and neonatal care equipment to ensure maximum search engine visibility and industry professional engagement. All quantitative values are presented in billion units.

Patient-controlled Analgesia Pumps Industry Market Dynamics & Structure

The Patient-controlled Analgesia Pumps Industry exhibits a moderate to highly concentrated market structure, driven by significant technological innovation and stringent regulatory frameworks. Key players are investing heavily in R&D to develop smarter, more intuitive PCA devices, leading to a dynamic competitive landscape. The increasing prevalence of chronic pain conditions and post-operative pain management needs fuels demand, while competitive product substitutes, such as traditional injection methods and alternative pain relief therapies, present a constant challenge. End-user demographics, particularly the aging global population and the rising number of surgical procedures, are key drivers. Mergers and acquisitions (M&A) activity is a notable trend, as larger companies seek to consolidate market share and expand their product portfolios. For instance, the hospital segment remains the dominant end-user due to its high volume of inpatient procedures and chronic disease management.

- Market Concentration: Characterized by a few dominant global players and several regional manufacturers.

- Technological Innovation Drivers: Miniaturization, wireless connectivity, enhanced safety features (e.g., dose error reduction systems), and integration with electronic health records (EHRs).

- Regulatory Frameworks: FDA approvals, CE marking, and other regional regulatory bodies play a crucial role in market entry and product adoption, influencing innovation barriers.

- Competitive Product Substitutes: Traditional syringe drivers, transdermal patches, oral analgesics, and other pain management modalities.

- End-User Demographics: Aging populations, increasing surgical volumes, and rising incidence of chronic pain conditions like cancer and diabetes.

- M&A Trends: Strategic acquisitions aimed at expanding product offerings, geographical reach, and technological capabilities. For example, the acquisition of Hospira by Pfizer Inc significantly impacted the infusion therapy market.

Patient-controlled Analgesia Pumps Industry Growth Trends & Insights

The Patient-controlled Analgesia Pumps Industry is poised for robust growth, projected to witness a significant Compound Annual Growth Rate (CAGR) during the forecast period. This expansion is primarily fueled by an increasing global demand for effective pain management solutions across diverse healthcare settings. The adoption rates of advanced PCA pumps are steadily rising, driven by their ability to provide patients with personalized pain relief, leading to improved patient satisfaction and faster recovery times. Technological disruptions, such as the integration of smart features for remote monitoring and data analytics, are reshaping consumer behavior towards more proactive and technology-assisted healthcare management.

The market size evolution is characterized by a consistent upward trend, supported by the rising incidence of conditions requiring effective pain management, including cancer, diabetes, and post-operative recovery. The oncology segment is a major contributor, with a growing need for sophisticated pain control in cancer patients undergoing chemotherapy and radiation therapy. Similarly, the application in neonatology for pain management in premature infants is expanding due to improved understanding of pain's impact on development. The increasing preference for home-care settings for chronic pain management is also a significant growth driver, enabled by the development of portable and user-friendly PCA devices.

Furthermore, the growing awareness among healthcare providers and patients about the benefits of PCA therapy over traditional pain management methods is accelerating market penetration. The shift towards value-based healthcare models emphasizes outcomes, where PCA pumps demonstrate efficacy in improving patient recovery and reducing hospital stay duration. Market research indicates a growing demand for connected devices that can provide real-time data on patient comfort levels and medication usage, enabling healthcare professionals to make informed adjustments. The overall trend points towards a more patient-centric approach to pain management, with PCA pumps playing a pivotal role. The global PCA pump market size is expected to reach xx million units by 2033, exhibiting a CAGR of xx% from 2025.

Dominant Regions, Countries, or Segments in Patient-controlled Analgesia Pumps Industry

The Patient-controlled Analgesia Pumps Industry is experiencing dynamic growth across various regions and segments, with North America and Europe currently leading in market share and innovation. The dominance of these regions is attributed to well-established healthcare infrastructures, high healthcare spending, advanced technological adoption, and a strong presence of leading medical device manufacturers. The United States stands out as a dominant country, driven by a high volume of surgical procedures, a large aging population, and a robust reimbursement framework for advanced medical technologies.

Within the Product Type segment, PCA Pumps themselves are the primary revenue generators, accounting for a substantial market share due to their direct application in pain management. However, the Pump Accessories segment is also experiencing significant growth, driven by the increasing installed base of PCA pumps and the need for consumables such as IV sets, syringes, and batteries.

The Oncology application segment is a major growth engine, as effective pain management is critical for improving the quality of life for cancer patients. The rising global cancer burden and advancements in chemotherapy and palliative care further bolster this segment. The Neonatology segment, while smaller in market size, is showing promising growth due to the increasing survival rates of premature infants and the critical need for specialized pain management protocols.

In terms of End Users, Hospitals remain the largest segment, owing to their comprehensive facilities and high patient throughput. However, Ambulatory Surgical Centers (ASCs) are a rapidly growing segment, driven by the trend towards outpatient procedures and the need for efficient post-operative pain management in less acute settings. The Home-care Settings segment is also expanding, facilitated by the development of portable, user-friendly PCA devices that enable chronic pain management outside traditional healthcare facilities.

- Leading Region: North America, driven by the US market.

- Key Country Drivers: High healthcare expenditure, advanced research and development, strong regulatory approvals, and a large patient population requiring pain management.

- Dominant Product Type: PCA Pumps, followed by Pump Accessories.

- Leading Application: Oncology, due to the critical need for effective pain control.

- Largest End User: Hospitals, due to high patient volumes and complex care needs.

- Growth Potential: Home-care settings and Ambulatory Surgical Centers are exhibiting significant growth rates.

Patient-controlled Analgesia Pumps Industry Product Landscape

The product landscape for Patient-controlled Analgesia Pumps is characterized by continuous innovation focused on enhancing patient safety, usability, and efficacy. Leading manufacturers are developing smart PCA pumps with advanced features like dose error reduction systems (DERS), wireless connectivity for remote monitoring, and intuitive user interfaces designed for both healthcare professionals and patients. These advancements aim to optimize pain relief while minimizing the risk of adverse events. Key product innovations include infusion pumps with integrated safety software, such as Baxter's Novum IQ syringe infusion pump with Dose IQ Safety Software, which provides enhanced dose control and security. The performance metrics of these devices are continually being refined to ensure accurate and consistent drug delivery, crucial for both acute and chronic pain management.

Key Drivers, Barriers & Challenges in Patient-controlled Analgesia Pumps Industry

The Patient-controlled Analgesia Pumps Industry is propelled by several key drivers. The increasing prevalence of chronic pain conditions such as cancer and diabetes, coupled with a growing aging population susceptible to pain-related ailments, is a primary demand generator. Advances in drug delivery technologies and the development of more sophisticated, user-friendly PCA devices enhance patient comfort and adherence. Furthermore, the rising number of surgical procedures globally, requiring effective post-operative pain management, significantly contributes to market growth. The shift towards home-based care for chronic conditions also fuels demand for portable and connected PCA solutions.

Conversely, several barriers and challenges temper this growth. High acquisition costs of advanced PCA pumps can be a restraint, particularly in developing economies with limited healthcare budgets. Stringent regulatory approvals and the need for clinical validation can prolong product development cycles and increase market entry hurdles. Supply chain disruptions, as experienced globally in recent years, can impact manufacturing and distribution. Additionally, the availability of less expensive, albeit less advanced, pain management alternatives and the need for proper training for healthcare professionals and patients on complex device operation present ongoing challenges.

Emerging Opportunities in Patient-controlled Analgesia Pumps Industry

Emerging opportunities within the Patient-controlled Analgesia Pumps Industry lie in the expanding market for home-care infusion therapy, driven by an aging population and the increasing preference for managing chronic conditions outside traditional hospital settings. The development of wirelessly connected and smart PCA pumps capable of remote monitoring and data analytics presents a significant avenue for growth, enabling better patient management and proactive interventions. Furthermore, the burgeoning markets in emerging economies, particularly in Asia-Pacific and Latin America, offer untapped potential due to rising healthcare expenditure and the growing demand for advanced pain management solutions. Innovative applications in pain management for specific patient populations, such as pediatric and geriatric care, also represent a promising frontier.

Growth Accelerators in the Patient-controlled Analgesia Pumps Industry Industry

Several factors are acting as growth accelerators for the Patient-controlled Analgesia Pumps Industry. Technological breakthroughs in miniaturization and battery life are enabling the development of more portable and discreet PCA devices, ideal for home use and ambulatory settings. Strategic partnerships between medical device manufacturers and pharmaceutical companies are fostering the development of integrated pain management solutions. Market expansion strategies focusing on underserved regions and patient demographics are unlocking new revenue streams. The increasing emphasis on patient-centric care models, where PCA therapy plays a pivotal role in improving patient outcomes and satisfaction, is a significant catalyst. Moreover, ongoing research into new analgesic drugs compatible with PCA delivery systems will further fuel market expansion.

Key Players Shaping the Patient-controlled Analgesia Pumps Industry Market

- ICU Medical Inc (Smiths Medical)

- Terumo Corporation

- BD (Becton Dickinson and Company)

- Baxter

- Micrel Medical Devices

- Avante Health Services

- Ace Medical

- Abbott

- Fresenius SE & Co KGaA

- Pfizer Inc (Hospira)

- B Braun SE

Notable Milestones in Patient-controlled Analgesia Pumps Industry Sector

- August 2022: The US FDA issued 510(k) clearance for Baxter's new Novum IQ syringe infusion pump (SYR) with Dose IQ Safety Software. Baxter is one of the global leaders in infusion therapy and pain management, and the Novum IQ pump is a significant addition to its product portfolio. This milestone underscores the ongoing innovation in safety and usability features within the PCA pump market.

- March 2022: Shanghai MicroPort Lifesciences Co. Ltd received marketing approval from NMPA, China, for its independently-developed AutoEx Chemotherapy Infusion Pump (AutoEx). It is the first approved product in the company's intelligent oncology pain solutions portfolio. This development highlights the growing focus on specialized pain management solutions, particularly for oncology patients, and the increasing market penetration in emerging regions like China.

In-Depth Patient-controlled Analgesia Pumps Industry Market Outlook

The Patient-controlled Analgesia Pumps Industry is set for continued expansion, driven by an escalating global demand for advanced pain management strategies. Future growth will be significantly shaped by technological advancements in smart infusion technology, focusing on enhanced patient safety, remote monitoring capabilities, and seamless integration with digital healthcare ecosystems. The increasing preference for home-based care and ambulatory surgical centers for pain management will further accelerate the adoption of portable and user-friendly PCA devices. Strategic collaborations between device manufacturers and pharmaceutical companies are expected to introduce novel analgesic delivery systems, broadening the scope of applications. Investments in emerging markets, coupled with favorable regulatory environments for innovative medical devices, will present substantial growth opportunities, solidifying the PCA pumps market's vital role in improving patient outcomes and quality of life.

Patient-controlled Analgesia Pumps Industry Segmentation

-

1. Product Type

- 1.1. PCA Pumps

- 1.2. Pump Accessories

-

2. Application

- 2.1. Oncology

- 2.2. Diabetes

- 2.3. Neonatology

- 2.4. Other Applications

-

3. End Users

- 3.1. Hospital

- 3.2. Ambulatory Surgical Centers

- 3.3. Home-care Settings

Patient-controlled Analgesia Pumps Industry Segmentation By Geography

-

1. North America

- 1.1. United states

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Patient-controlled Analgesia Pumps Industry Regional Market Share

Geographic Coverage of Patient-controlled Analgesia Pumps Industry

Patient-controlled Analgesia Pumps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements with Enhanced Safety Features; Rising Prevalence of Chronic Pain Diseases like Cancer and Arthritis

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Resulting in Patient Medication Errors; Stringent Regulatory Framework and Product Recalls

- 3.4. Market Trends

- 3.4.1. Oncology is Expected to Hold the Major Market Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Patient-controlled Analgesia Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. PCA Pumps

- 5.1.2. Pump Accessories

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oncology

- 5.2.2. Diabetes

- 5.2.3. Neonatology

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Hospital

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Home-care Settings

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Patient-controlled Analgesia Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. PCA Pumps

- 6.1.2. Pump Accessories

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Oncology

- 6.2.2. Diabetes

- 6.2.3. Neonatology

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Hospital

- 6.3.2. Ambulatory Surgical Centers

- 6.3.3. Home-care Settings

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Patient-controlled Analgesia Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. PCA Pumps

- 7.1.2. Pump Accessories

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Oncology

- 7.2.2. Diabetes

- 7.2.3. Neonatology

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Hospital

- 7.3.2. Ambulatory Surgical Centers

- 7.3.3. Home-care Settings

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Patient-controlled Analgesia Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. PCA Pumps

- 8.1.2. Pump Accessories

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Oncology

- 8.2.2. Diabetes

- 8.2.3. Neonatology

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Hospital

- 8.3.2. Ambulatory Surgical Centers

- 8.3.3. Home-care Settings

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Patient-controlled Analgesia Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. PCA Pumps

- 9.1.2. Pump Accessories

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Oncology

- 9.2.2. Diabetes

- 9.2.3. Neonatology

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Hospital

- 9.3.2. Ambulatory Surgical Centers

- 9.3.3. Home-care Settings

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Patient-controlled Analgesia Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. PCA Pumps

- 10.1.2. Pump Accessories

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Oncology

- 10.2.2. Diabetes

- 10.2.3. Neonatology

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Hospital

- 10.3.2. Ambulatory Surgical Centers

- 10.3.3. Home-care Settings

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ICU Medical Inc (Smiths Medical)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Terumo Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BD (Becton Dickinson and Company)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Baxter

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Micrel Medical Devices

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Avante Health Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ace Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abbott

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fresenius SE & Co KGaA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfizer Inc (Hospira)*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 B Braun SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 ICU Medical Inc (Smiths Medical)

List of Figures

- Figure 1: Global Patient-controlled Analgesia Pumps Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Patient-controlled Analgesia Pumps Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Patient-controlled Analgesia Pumps Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Patient-controlled Analgesia Pumps Industry Revenue (billion), by End Users 2025 & 2033

- Figure 7: North America Patient-controlled Analgesia Pumps Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 8: North America Patient-controlled Analgesia Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Patient-controlled Analgesia Pumps Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Patient-controlled Analgesia Pumps Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Patient-controlled Analgesia Pumps Industry Revenue (billion), by End Users 2025 & 2033

- Figure 15: Europe Patient-controlled Analgesia Pumps Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 16: Europe Patient-controlled Analgesia Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue (billion), by End Users 2025 & 2033

- Figure 23: Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue (billion), by End Users 2025 & 2033

- Figure 31: Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 32: Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Patient-controlled Analgesia Pumps Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: South America Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Patient-controlled Analgesia Pumps Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Patient-controlled Analgesia Pumps Industry Revenue (billion), by End Users 2025 & 2033

- Figure 39: South America Patient-controlled Analgesia Pumps Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 40: South America Patient-controlled Analgesia Pumps Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Patient-controlled Analgesia Pumps Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United states Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 15: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 25: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 35: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 40: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 42: Global Patient-controlled Analgesia Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Patient-controlled Analgesia Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Patient-controlled Analgesia Pumps Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Patient-controlled Analgesia Pumps Industry?

Key companies in the market include ICU Medical Inc (Smiths Medical), Terumo Corporation, BD (Becton Dickinson and Company), Baxter, Micrel Medical Devices, Avante Health Solutions, Ace Medical, Abbott, Fresenius SE & Co KGaA, Pfizer Inc (Hospira)*List Not Exhaustive, B Braun SE.

3. What are the main segments of the Patient-controlled Analgesia Pumps Industry?

The market segments include Product Type, Application, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements with Enhanced Safety Features; Rising Prevalence of Chronic Pain Diseases like Cancer and Arthritis.

6. What are the notable trends driving market growth?

Oncology is Expected to Hold the Major Market Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness Resulting in Patient Medication Errors; Stringent Regulatory Framework and Product Recalls.

8. Can you provide examples of recent developments in the market?

August 2022: The US FDA issued 510(k) clearance for Baxter's new Novum IQ syringe infusion pump (SYR) with Dose IQ Safety Software. Baxter is one of the global leaders in infusion therapy and pain management, and the Novum IQ pump is a significant addition to its product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Patient-controlled Analgesia Pumps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Patient-controlled Analgesia Pumps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Patient-controlled Analgesia Pumps Industry?

To stay informed about further developments, trends, and reports in the Patient-controlled Analgesia Pumps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence