Key Insights

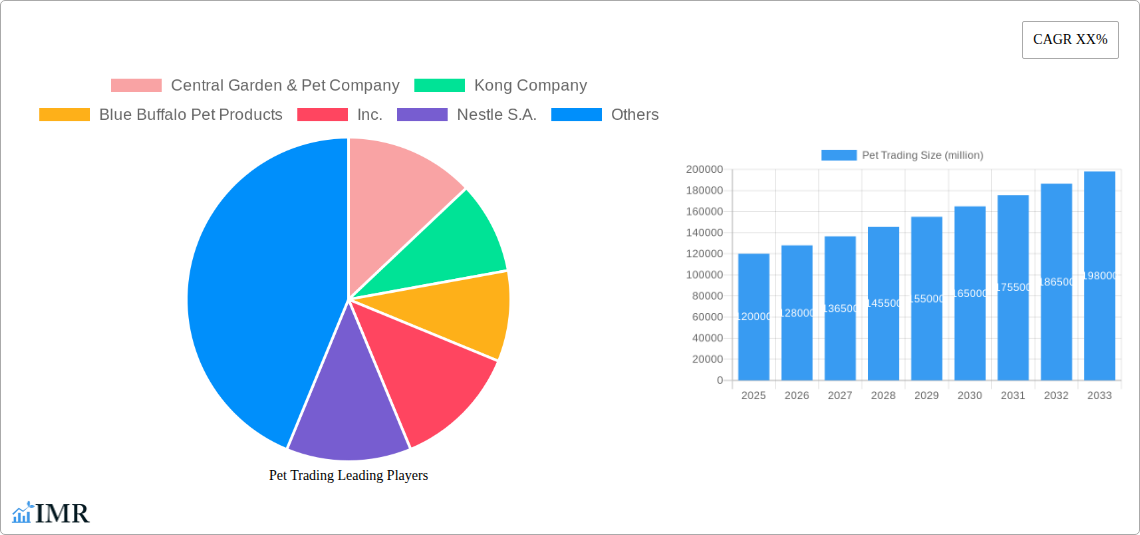

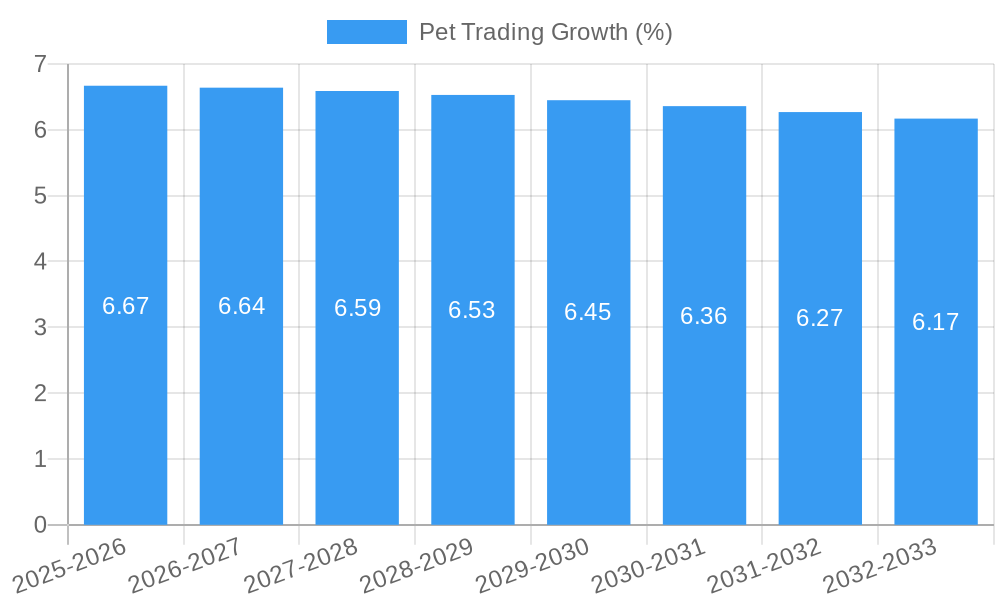

The global pet trading market is poised for significant expansion, projected to reach an estimated XXX billion by 2033, with a robust Compound Annual Growth Rate (CAGR) of XX% from 2019 to 2033. This growth is underpinned by a burgeoning pet ownership trend, driven by the increasing humanization of pets, where animals are viewed as integral family members. This sentiment fuels higher spending on premium products and services, including specialized food, advanced healthcare, and interactive accessories. Key growth drivers include rising disposable incomes, particularly in emerging economies, and the pervasive influence of social media, which constantly showcases the latest pet products and trends, fostering a culture of aspirational pet care. The market’s expansion is also benefiting from advancements in pet e-commerce platforms, offering convenience and wider product selections to consumers.

The pet trading landscape is characterized by a dynamic interplay of segments and influential companies. In terms of application, the "Dog" segment is expected to lead, reflecting higher ownership rates and diversified spending on canine companions. However, the "Cat" segment is also demonstrating strong growth potential, driven by the increasing popularity of smaller, apartment-friendly pets. The "Living Body" segment, encompassing the sale of live animals, is a foundational component, while "Feed" represents a consistently high-spending category due to the necessity of regular purchases. "Others," which includes various accessories, grooming products, and health supplements, is also anticipated to see substantial growth. Leading players like Nestle S.A., Mars Inc., and Petco Animal Supplies, Inc. are strategically investing in product innovation, expanding their retail footprints, and leveraging digital channels to capture market share. Emerging trends such as personalized pet nutrition, subscription-based services, and sustainable pet products are shaping consumer preferences and market strategies.

Here is a compelling, SEO-optimized report description for the Pet Trading market, incorporating high-traffic keywords, parent and child market analysis, and adhering to all specified guidelines:

Pet Trading Market Dynamics & Structure

The global Pet Trading market is characterized by a moderate concentration, with key players like Mars Inc. and Nestle S.A. holding significant market share. Technological innovation, particularly in pet food formulations, interactive pet toys, and smart pet care devices, acts as a primary growth driver. Regulatory frameworks, though evolving, aim to ensure animal welfare and product safety, influencing product development and market entry. Competitive product substitutes range from premium and specialized pet foods to readily available, mass-produced alternatives, impacting pricing strategies and consumer choice. End-user demographics are shifting towards a more affluent and pet-centric population, with increasing demand for high-quality, specialized pet products. Mergers and acquisitions (M&A) trends indicate consolidation within the industry, with companies like Petco Animal Supplies, Inc. and PetSmart Inc. actively pursuing strategic acquisitions to expand their portfolios and market reach.

- Market Concentration: Moderate to High, with leading players dominating key segments.

- Technological Innovation: Focus on advanced pet nutrition, interactive accessories, and health monitoring devices.

- Regulatory Frameworks: Emphasis on food safety, labeling, and ethical sourcing.

- Competitive Product Substitutes: Wide spectrum from premium to value-oriented products.

- End-User Demographics: Growing "pet humanization" trend, increasing disposable income for pet care.

- M&A Trends: Strategic acquisitions for market expansion and product diversification.

Pet Trading Growth Trends & Insights

The global Pet Trading market is poised for substantial growth, driven by an expanding pet population and a discernible shift in consumer spending towards premium pet products. The pet food segment, a cornerstone of the industry, is experiencing rapid evolution with a focus on natural, organic, and breed-specific formulations, reflecting increasing consumer awareness regarding pet health and nutrition. The pet accessories and supplies segment is also thriving, fueled by demand for innovative and specialized products, from advanced grooming tools to smart feeding systems. This market evolution is underpinned by a consistent Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2019 to 2024, with projections indicating a continued upward trajectory. The base year of 2025 is estimated to see a market size of $210,000 million, with a forecast to reach $350,000 million by 2033. Adoption rates for specialized pet health products and subscription-based pet services are also on the rise, signaling a maturing and increasingly sophisticated consumer base. Technological disruptions, including the integration of AI in pet diagnostics and personalized pet care platforms, are further shaping consumer behavior, pushing the market towards hyper-personalized solutions. The "millennial pet owner" demographic, in particular, is a significant force, prioritizing their pets' well-being and longevity, which translates into higher spending on quality products and services. This trend is projected to sustain the market's growth momentum throughout the forecast period, highlighting the enduring economic significance of the pet care industry. The cat segment, with its growing global presence, and the dog segment, which continues to be the largest consumer base, are key beneficiaries of these trends.

Dominant Regions, Countries, or Segments in Pet Trading

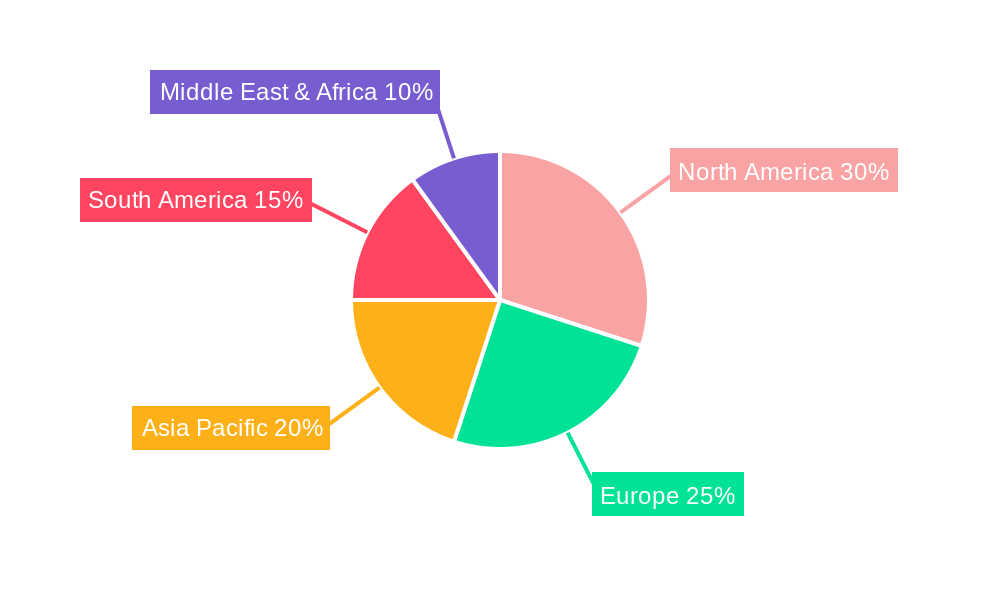

North America currently dominates the global Pet Trading market, driven by a high pet ownership rate and a strong consumer inclination towards premium pet products and services. The United States, in particular, represents a significant market share within this region, fueled by robust economic conditions and a deeply ingrained pet-centric culture. The dog segment consistently leads in terms of market value, reflecting the sheer volume of dog ownership and the extensive availability of specialized products catering to this demographic.

- North America Dominance: High disposable income, strong pet humanization trends, and established retail infrastructure.

- United States: Largest market contributor, with a mature pet care industry and significant spending on premium goods.

- Dominant Segment (Application): Dog, due to high ownership numbers and demand for specialized nutrition and accessories.

- Dominant Segment (Type): Feed, representing the largest share of pet expenditure, driven by the continuous need for sustenance and health-focused options.

- Key Drivers in Dominant Regions:

- Economic Policies: Favorable trade agreements and consumer spending power.

- Infrastructure: Extensive retail networks, including specialized pet stores and e-commerce platforms.

- Consumer Behavior: Increasing willingness to spend on pet health, wellness, and specialized diets.

- Technological Adoption: Early adoption of smart pet devices and advanced pet care solutions.

The pet feed segment is a critical growth driver, with increasing consumer demand for natural, organic, and specialized dietary options. This segment's dominance is further amplified by the Living Body type, which encompasses a broad range of pet health products, veterinary services, and preventative care, all contributing significantly to overall market value. The growth potential in emerging markets, particularly in Asia-Pacific, is substantial, presenting opportunities for expansion and market penetration.

Pet Trading Product Landscape

The Pet Trading product landscape is characterized by a continuous stream of innovations aimed at enhancing pet health, well-being, and owner convenience. Key product categories include advanced pet nutrition, such as grain-free and limited-ingredient diets, and specialized pet food formulations catering to specific life stages and health conditions. The pet accessories segment is witnessing the rise of smart devices, including GPS trackers, automated feeders, and interactive toys that promote physical and mental stimulation. Performance metrics are increasingly focused on the efficacy of health-promoting ingredients, the durability of accessories, and the ease of use for pet owners. Unique selling propositions often revolve around natural ingredients, sustainable sourcing, and technologically advanced features that provide personalized pet care solutions.

Key Drivers, Barriers & Challenges in Pet Trading

Key Drivers:

- Growing Pet Population: An increasing number of households worldwide are adopting pets, driving demand across all product categories.

- Pet Humanization Trend: Owners increasingly view pets as family members, leading to higher spending on premium products and services.

- Technological Advancements: Innovations in pet nutrition, health monitoring devices, and interactive accessories create new market opportunities.

- Economic Growth: Rising disposable incomes in developed and emerging economies support increased pet expenditure.

- E-commerce Expansion: Online platforms provide wider access to a diverse range of pet products and facilitate impulse purchases.

Barriers & Challenges:

- Regulatory Hurdles: Stringent regulations regarding pet food safety, ingredient sourcing, and product labeling can impact market entry and product development.

- Supply Chain Disruptions: Global events and logistical complexities can affect the availability and cost of raw materials and finished products.

- Intense Competition: A crowded market with numerous brands and private labels can lead to price wars and pressure on profit margins.

- Economic Downturns: Recessions or economic instability can lead consumers to cut back on discretionary spending, including premium pet products.

- Consumer Price Sensitivity: While premiumization is a trend, a significant portion of consumers remain price-sensitive, especially in certain segments and regions.

Emerging Opportunities in Pet Trading

Emerging opportunities in the Pet Trading sector are significantly driven by the demand for personalized pet nutrition and the burgeoning market for sustainable and eco-friendly pet products. The integration of AI and IoT in pet health monitoring presents a substantial growth avenue, enabling remote diagnostics and proactive care. Furthermore, the expansion of subscription-based pet services and curated pet boxes caters to the convenience-seeking consumer and fosters brand loyalty. Untapped markets in developing economies, coupled with a growing middle class, offer significant potential for market penetration and growth.

Growth Accelerators in the Pet Trading Industry

Several catalysts are accelerating growth in the Pet Trading industry. Technological breakthroughs in pet food manufacturing, leading to enhanced nutritional profiles and digestibility, are a key driver. Strategic partnerships between pet food manufacturers and veterinary professionals ensure the development of science-backed products. Furthermore, market expansion strategies focusing on emerging economies and the increasing adoption of direct-to-consumer (DTC) models are broadening customer reach and enhancing accessibility. The growing focus on specialty pet foods for pets with specific health needs, such as allergies or digestive sensitivities, is also a significant growth accelerator.

Key Players Shaping the Pet Trading Market

- Central Garden & Pet Company

- Kong Company

- Blue Buffalo Pet Products, Inc.

- Nestle S.A.

- Mars Inc.

- Petco Animal Supplies, Inc.

- Heristo AG

- PetSmart Inc.

- The Colgate-Palmolive Company

- Petmate Holdings Co.

- Champion Pet Foods

- Ancol Pet Products Limited

Notable Milestones in Pet Trading Sector

- 2019: Increased consumer focus on natural and organic pet food ingredients.

- 2020: Surge in e-commerce sales of pet supplies driven by pandemic-related lockdowns.

- 2021: Growing adoption of smart pet devices for health monitoring and activity tracking.

- 2022: Key acquisitions aimed at expanding product portfolios and market reach in specialty pet nutrition.

- 2023: Heightened consumer demand for subscription-based pet services and curated pet boxes.

- 2024: Focus on sustainable packaging and ethically sourced pet product ingredients.

In-Depth Pet Trading Market Outlook

The future outlook for the Pet Trading market remains exceptionally strong, fueled by persistent growth accelerators such as innovative pet health solutions and expanding e-commerce channels. Strategic opportunities lie in leveraging technological advancements to deliver personalized pet care experiences and catering to the growing demand for premium, specialized, and sustainable pet products. The continued "pet humanization" trend, coupled with increasing disposable incomes globally, ensures sustained market growth, making it an attractive sector for investment and innovation.

Pet Trading Segmentation

-

1. Application

- 1.1. Cat

- 1.2. Dog

- 1.3. Others

-

2. Types

- 2.1. Living Body

- 2.2. Feed

- 2.3. Others

Pet Trading Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pet Trading REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Trading Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cat

- 5.1.2. Dog

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Living Body

- 5.2.2. Feed

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pet Trading Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cat

- 6.1.2. Dog

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Living Body

- 6.2.2. Feed

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pet Trading Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cat

- 7.1.2. Dog

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Living Body

- 7.2.2. Feed

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pet Trading Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cat

- 8.1.2. Dog

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Living Body

- 8.2.2. Feed

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pet Trading Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cat

- 9.1.2. Dog

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Living Body

- 9.2.2. Feed

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pet Trading Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cat

- 10.1.2. Dog

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Living Body

- 10.2.2. Feed

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Central Garden & Pet Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kong Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blue Buffalo Pet Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nestle S.A.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Petco Animal Supplies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Heristo AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PetSmart Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Colgate-Palmolive Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Petmate Holdings Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Champion Pet Foods

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ancol Pet Products Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Central Garden & Pet Company

List of Figures

- Figure 1: Global Pet Trading Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pet Trading Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pet Trading Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pet Trading Revenue (million), by Types 2024 & 2032

- Figure 5: North America Pet Trading Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Pet Trading Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pet Trading Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pet Trading Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pet Trading Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pet Trading Revenue (million), by Types 2024 & 2032

- Figure 11: South America Pet Trading Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Pet Trading Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pet Trading Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pet Trading Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pet Trading Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pet Trading Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Pet Trading Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Pet Trading Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pet Trading Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pet Trading Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pet Trading Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pet Trading Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Pet Trading Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Pet Trading Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pet Trading Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pet Trading Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pet Trading Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pet Trading Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Pet Trading Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Pet Trading Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pet Trading Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pet Trading Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pet Trading Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pet Trading Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Pet Trading Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pet Trading Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pet Trading Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Pet Trading Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pet Trading Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pet Trading Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Pet Trading Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pet Trading Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pet Trading Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Pet Trading Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pet Trading Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pet Trading Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Pet Trading Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pet Trading Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pet Trading Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Pet Trading Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pet Trading Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Trading?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Pet Trading?

Key companies in the market include Central Garden & Pet Company, Kong Company, Blue Buffalo Pet Products, Inc., Nestle S.A., Mars Inc., Petco Animal Supplies, Inc., Heristo AG, PetSmart Inc., The Colgate-Palmolive Company, Petmate Holdings Co., Champion Pet Foods, Ancol Pet Products Limited.

3. What are the main segments of the Pet Trading?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Trading," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Trading report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Trading?

To stay informed about further developments, trends, and reports in the Pet Trading, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence