Key Insights

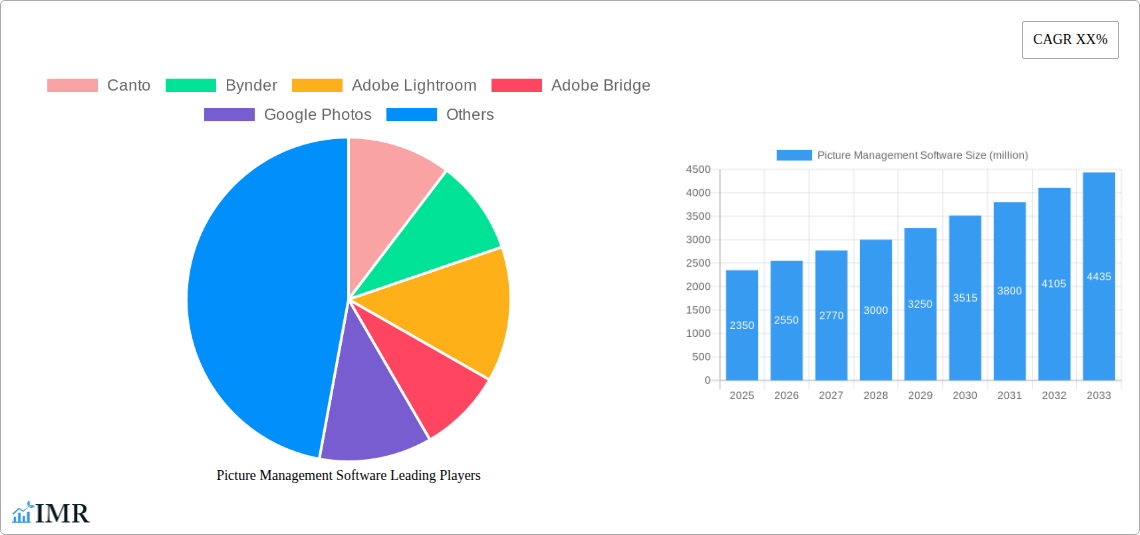

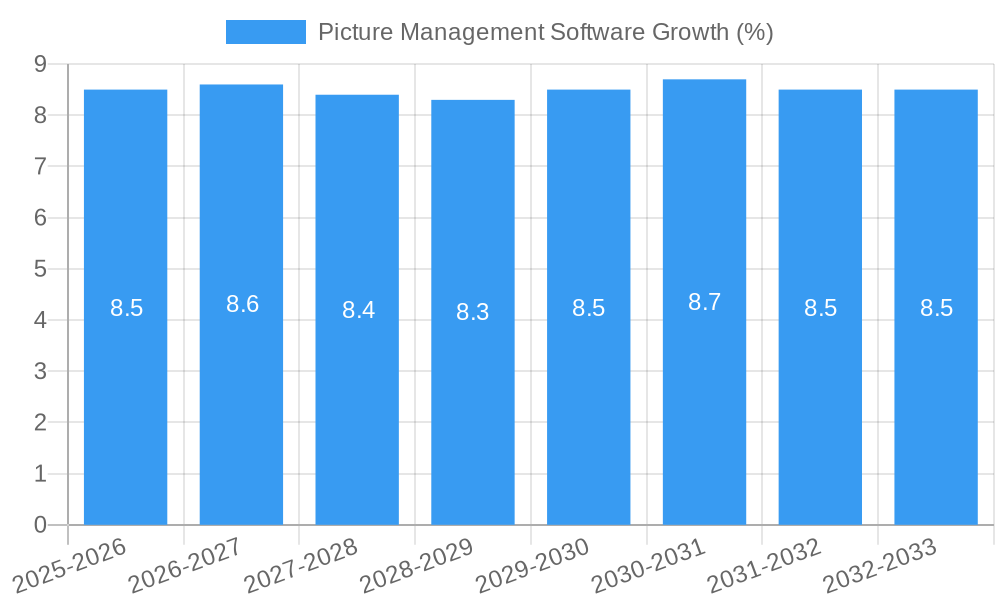

The global Picture Management Software market is poised for significant expansion, projected to reach an estimated USD 2,350 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025-2033. This growth is primarily fueled by the escalating volume of digital images generated daily, driven by the widespread adoption of smartphones and digital cameras for both personal and professional use. The increasing demand for efficient organization, editing, and sharing of visual content across various applications, including personal archiving and commercial asset management, is a key determinant of market expansion. Furthermore, the growing integration of AI-powered features such as intelligent tagging, facial recognition, and automated editing workflows is enhancing user experience and driving adoption. The shift towards cloud-based solutions is also a significant trend, offering enhanced accessibility, storage, and collaboration capabilities, thereby contributing to market growth.

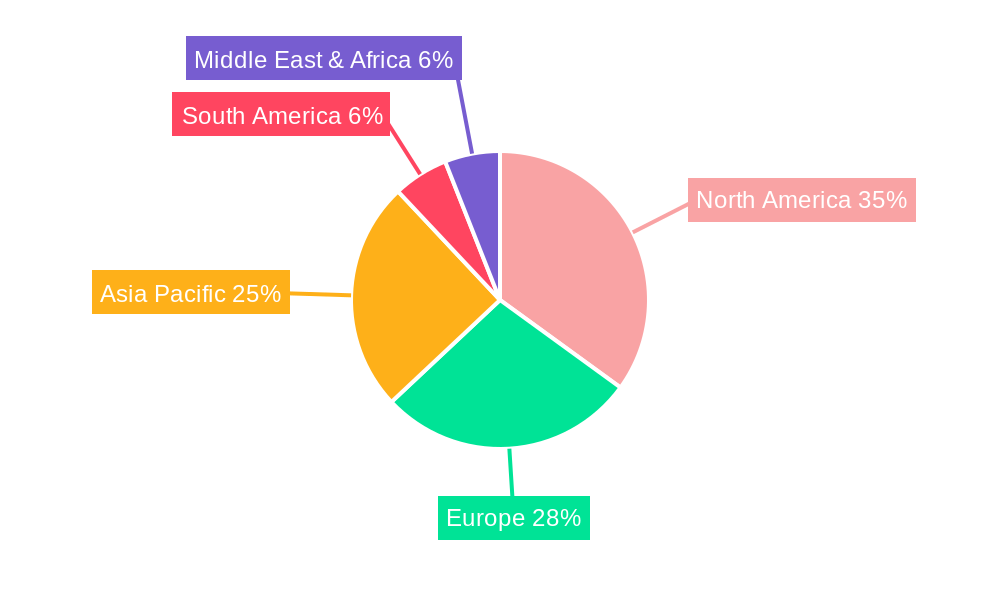

The market is segmented into domestic and commercial applications, with both segments showing promising growth. While domestic users seek intuitive tools for managing personal photo libraries, the commercial sector is increasingly leveraging sophisticated picture management software for digital asset management (DAM), marketing campaigns, and brand consistency. The market will witness a balanced growth across online and offline distribution channels, with online platforms offering greater convenience and accessibility, while offline solutions cater to specific enterprise needs or environments with limited internet connectivity. Geographically, North America currently leads the market, driven by a high concentration of creative professionals and early adoption of digital technologies. However, the Asia Pacific region is expected to exhibit the fastest growth due to rapid digitalization, a burgeoning middle class with increased disposable income for digital devices, and the growing prevalence of e-commerce and digital marketing activities. Key restraints include concerns over data security and privacy, alongside the initial investment costs associated with some advanced software solutions, though these are increasingly being offset by subscription-based models.

Picture Management Software Market Dynamics & Structure

The global Picture Management Software market is characterized by a moderately concentrated landscape, with key players like Canto, Bynder, Adobe Lightroom, and Adobe Bridge leveraging technological innovation and strategic acquisitions to maintain market leadership. The estimated market size of $15,500 million in 2025 underscores significant growth potential. Technological advancements, particularly in AI-driven organization and cloud integration, act as primary innovation drivers, pushing competitors to offer sophisticated features. Regulatory frameworks are generally supportive, focusing on data privacy and intellectual property rights. Competitive product substitutes, including generic file management systems and emerging niche solutions, pose a challenge, but dedicated picture management software often offers superior functionality. End-user demographics are broadening, encompassing both domestic users seeking to organize personal photo libraries and commercial entities requiring robust digital asset management (DAM) solutions. Merger and acquisition (M&A) trends are prevalent, with companies consolidating to expand their product portfolios and geographical reach. For instance, several smaller DAM providers have been acquired by larger software suites, aiming to integrate advanced picture management capabilities. The market also sees a growing demand for online, cloud-based solutions, driven by accessibility and collaboration needs, though offline solutions still hold a significant share, particularly in enterprise environments. Barriers to entry include the high cost of R&D for advanced AI features and the need for extensive integration capabilities with existing business workflows. The market share of leading vendors is estimated to be around 65% held by the top five players, with Canto and Bynder showing strong growth in the commercial segment.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized vendors.

- Technological Innovation Drivers: AI-powered tagging, automated organization, cloud synchronization, and integration with creative tools.

- Regulatory Frameworks: Focus on data privacy (GDPR, CCPA) and digital rights management.

- Competitive Product Substitutes: General file explorers, cloud storage services with basic photo features, and specialized graphic design tools.

- End-User Demographics: Individuals, small to medium-sized businesses (SMBs), large enterprises, creative agencies, marketing departments, and photography professionals.

- M&A Trends: Consolidation to acquire new technologies, expand customer bases, and enhance market reach.

Picture Management Software Growth Trends & Insights

The Picture Management Software market is poised for substantial expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033, reaching an estimated $38,000 million by the end of the forecast period. This robust growth is fueled by the ever-increasing volume of digital imagery generated daily, from personal photos and videos captured on smartphones to professional assets managed by businesses. Adoption rates are accelerating across both domestic and commercial segments, driven by the undeniable need for efficient organization, easy retrieval, and seamless sharing of visual content. The shift towards online, cloud-based solutions has been a significant technological disruption, offering enhanced accessibility, collaboration features, and scalability that traditional offline methods cannot match. Google Photos, for instance, has democratized basic picture management for millions of domestic users, while platforms like Bynder and Canto cater to the complex DAM requirements of commercial enterprises, managing vast libraries of marketing collateral, brand assets, and product imagery. Consumer behavior has also evolved; users expect intuitive interfaces, AI-driven capabilities like facial recognition and smart categorization, and the ability to access their visual libraries from any device. This has created a demand for software that not only stores but actively manages and enhances the user's digital photographic experience. The integration of picture management software with other creative tools and marketing platforms, such as Adobe Creative Cloud and various social media management systems, is another key trend enhancing its value proposition. Furthermore, the growing emphasis on visual marketing and brand consistency for businesses is a major impetus for commercial adoption. The historical period from 2019 to 2024 saw steady growth, with market penetration increasing from 25% to 40%, setting a strong foundation for the accelerated growth anticipated in the coming years. The estimated market size for 2025 is $15,500 million, with significant contributions from both online and offline solutions, though the online segment is exhibiting a faster growth trajectory.

Dominant Regions, Countries, or Segments in Picture Management Software

North America currently stands as the dominant region in the Picture Management Software market, projected to hold a significant market share of 38% by 2025, with an estimated market value of $5,890 million. This dominance is driven by several key factors, including high adoption rates of advanced technologies, a robust digital economy, and a strong presence of leading software providers and creative industries. The commercial segment is the primary growth driver within North America, fueled by enterprises across sectors like marketing, advertising, media, and e-commerce that rely heavily on Digital Asset Management (DAM) solutions for brand consistency and efficient content workflow. The United States, in particular, is the leading country, benefiting from a large user base, substantial investment in R&D, and a mature market for cloud-based services. Key drivers in this region include supportive government initiatives for digital transformation, advanced internet infrastructure enabling seamless online access, and a strong demand for sophisticated features like AI-powered metadata generation and version control.

- Dominant Region: North America (38% market share in 2025)

- Key Country: United States

- Primary Growth Driver: Commercial Segment

- Key Drivers:

- High adoption of cloud-based DAM solutions.

- Presence of major creative and marketing industries.

- Strong investment in AI and automation technologies.

- Well-developed digital infrastructure.

- Consumer demand for advanced organizational features.

The online segment within North America is particularly strong, accounting for an estimated 70% of the regional market value. This preference for online solutions is attributed to the need for remote collaboration, scalability, and easier integration with other business systems. For instance, companies like Canto and Bynder have a strong foothold in the commercial segment, offering comprehensive online DAM platforms that cater to the complex needs of large enterprises. The domestic segment also contributes significantly, with platforms like Google Photos and Adobe Lightroom being widely used for personal photo management. The forecast period is expected to see continued growth, with North America maintaining its leading position, although other regions like Europe and Asia-Pacific are expected to exhibit higher CAGRs as they catch up in terms of digital transformation and cloud adoption. The competitive landscape within North America is intense, with vendors continuously innovating to meet evolving customer demands for user experience, integration capabilities, and advanced AI features.

Picture Management Software Product Landscape

The Picture Management Software product landscape is dynamic and innovation-driven. Leading solutions like Canto and Bynder offer comprehensive cloud-based Digital Asset Management (DAM) systems with robust features for asset ingestion, organization, search, collaboration, and distribution. Adobe Lightroom and Adobe Bridge, while often used in conjunction, provide powerful tools for professional photographers and designers, focusing on non-destructive editing, cataloging, and advanced metadata management. Movavi Photo Manager and MAGIX Photo Manager offer user-friendly interfaces for domestic users and small businesses, emphasizing ease of use, intelligent tagging, and basic editing capabilities. Cloudwards, while not a direct software vendor, provides valuable insights and comparisons of various cloud-based photo management services. ACDSee and Phototheca offer strong desktop-based solutions with advanced cataloging and editing features, appealing to users who prefer offline management or have large local libraries. The performance metrics for these solutions are evaluated based on search speed, AI accuracy for tagging and recognition, ease of use, integration capabilities, and overall asset management efficiency. Unique selling propositions often lie in specialized AI algorithms, seamless integration with creative workflows, and advanced security features for enterprise clients.

Key Drivers, Barriers & Challenges in Picture Management Software

Key Drivers:

- Explosion of Digital Content: The exponential growth in the volume of images and videos generated by individuals and businesses necessitates efficient management solutions.

- Advancements in AI and Machine Learning: AI-powered tagging, facial recognition, and automated categorization significantly improve organization and searchability, driving adoption.

- Demand for Cloud-Based Solutions: Increased reliance on cloud services for accessibility, scalability, collaboration, and disaster recovery fuels the growth of online picture management software.

- Visual Marketing and Brand Management: Businesses are increasingly using visual content for marketing, making robust DAM systems crucial for brand consistency and asset control.

- Improving User Experience: Intuitive interfaces and streamlined workflows in software like Movavi Photo Manager and Google Photos attract a broader user base.

Barriers & Challenges:

- Data Security and Privacy Concerns: Handling sensitive personal and corporate visual data raises concerns about breaches and compliance with regulations like GDPR and CCPA.

- High Implementation and Integration Costs: For large enterprises, integrating DAM systems with existing IT infrastructure can be complex and expensive, presenting a barrier to adoption.

- Competition from Generic File Management: While specialized, picture management software faces competition from more generic file storage and management tools.

- Learning Curve for Advanced Features: Some sophisticated DAM systems can have a steeper learning curve for users not familiar with digital asset management principles.

- Perpetual Licensing vs. Subscription Models: The shift towards subscription models can be a barrier for some organizations accustomed to perpetual licenses.

Emerging Opportunities in Picture Management Software

Emerging opportunities in the Picture Management Software market are largely centered around the continued integration of Artificial Intelligence and Machine Learning, offering more sophisticated auto-tagging, content analysis, and even predictive capabilities for content usage. The growing demand for video asset management alongside still images presents a significant untapped market for integrated solutions. Furthermore, the expansion of Picture Management Software into niche industries such as healthcare (for medical imaging), legal (for evidence management), and manufacturing (for product visualization) offers substantial growth avenues. The development of more intuitive and user-friendly interfaces for mobile-first users and the creation of AI-powered personalized content discovery experiences are also key opportunities that will drive future market expansion.

Growth Accelerators in the Picture Management Software Industry

Several key catalysts are driving long-term growth in the Picture Management Software industry. Technological breakthroughs, particularly in edge computing for on-device AI processing and advancements in cloud infrastructure, are enhancing the performance and accessibility of these solutions. Strategic partnerships between software providers and hardware manufacturers (e.g., camera companies) or other software vendors (e.g., CRM or project management tools) are expanding the ecosystem and value proposition of picture management tools. Market expansion strategies targeting underserved regions and industries, coupled with increased awareness of the benefits of efficient digital asset management, are also significant growth accelerators. The growing emphasis on visual storytelling in all forms of communication further solidifies the need for robust picture management capabilities.

Key Players Shaping the Picture Management Software Market

- Canto

- Bynder

- Adobe Lightroom

- Adobe Bridge

- Google Photos

- Movavi Photo Manager

- MAGIX Photo Manager

- Phototheca

- ACDSee

Notable Milestones in Picture Management Software Sector

- 2019: Adobe Lightroom CC (cloud-based) gains significant traction with enhanced AI-powered search capabilities.

- 2020: Canto solidifies its enterprise DAM offering with advanced brand management features and increased integration options.

- 2021: Bynder expands its global presence and acquires Webdam to strengthen its position in the DAM market.

- 2022: Google Photos introduces expanded storage options and more sophisticated AI editing tools, further engaging domestic users.

- 2023: Movavi Photo Manager and MAGIX Photo Manager release updated versions with improved performance and AI-driven organization features.

- 2024: Increased focus on video asset management within existing picture management platforms and the rise of specialized AI tagging services.

In-Depth Picture Management Software Market Outlook

The future outlook for the Picture Management Software market remains exceptionally bright, with growth accelerators like AI advancements, cloud adoption, and the increasing reliance on visual content expected to propel sustained expansion. Strategic opportunities lie in developing more integrated solutions that encompass both image and video management, catering to the evolving needs of content creators and businesses. Market players will likely focus on enhancing AI capabilities for deeper content analysis, personalization, and automation, alongside expanding into new industry verticals. The continued evolution of cloud infrastructure and edge computing will further democratize access to powerful picture management tools, ensuring that the market remains dynamic and innovative for the foreseeable future.

Picture Management Software Segmentation

-

1. Application

- 1.1. Domestic

- 1.2. Commercial

-

2. Types

- 2.1. Online

- 2.2. Offline

Picture Management Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Picture Management Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Picture Management Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Domestic

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Picture Management Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Domestic

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Picture Management Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Domestic

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Picture Management Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Domestic

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Picture Management Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Domestic

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Picture Management Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Domestic

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Canto

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bynder

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Adobe Lightroom

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Adobe Bridge

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google Photos

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Movavi Photo Manager

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cloudwards

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MAGIX Photo Manager

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Phototheca

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ACDSee

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Canto

List of Figures

- Figure 1: Global Picture Management Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Picture Management Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Picture Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Picture Management Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Picture Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Picture Management Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Picture Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Picture Management Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Picture Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Picture Management Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Picture Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Picture Management Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Picture Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Picture Management Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Picture Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Picture Management Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Picture Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Picture Management Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Picture Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Picture Management Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Picture Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Picture Management Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Picture Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Picture Management Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Picture Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Picture Management Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Picture Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Picture Management Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Picture Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Picture Management Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Picture Management Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Picture Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Picture Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Picture Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Picture Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Picture Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Picture Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Picture Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Picture Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Picture Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Picture Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Picture Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Picture Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Picture Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Picture Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Picture Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Picture Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Picture Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Picture Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Picture Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Picture Management Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Picture Management Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Picture Management Software?

Key companies in the market include Canto, Bynder, Adobe Lightroom, Adobe Bridge, Google Photos, Movavi Photo Manager, Cloudwards, MAGIX Photo Manager, Phototheca, ACDSee.

3. What are the main segments of the Picture Management Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Picture Management Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Picture Management Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Picture Management Software?

To stay informed about further developments, trends, and reports in the Picture Management Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence