Key Insights

The Poland Commercial Vehicles Lubricants Market is projected to experience robust growth, driven by an estimated 5.5% CAGR between 2025 and 2033. The market size was valued at approximately 9.53 billion in the base year of 2025. Key growth catalysts include the expansion of Poland's logistics and transportation infrastructure, an increasing fleet of heavy-duty vehicles, and the implementation of stringent emission standards, all of which necessitate high-performance lubricants. Enhanced awareness of preventative maintenance and the benefits of extended lubricant life further contribute to demand for premium formulations.

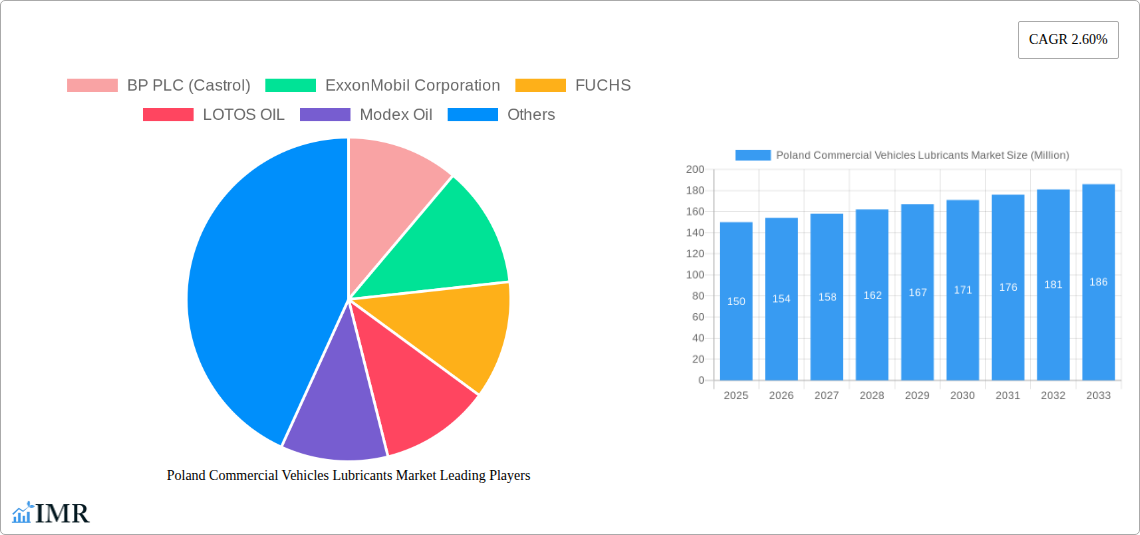

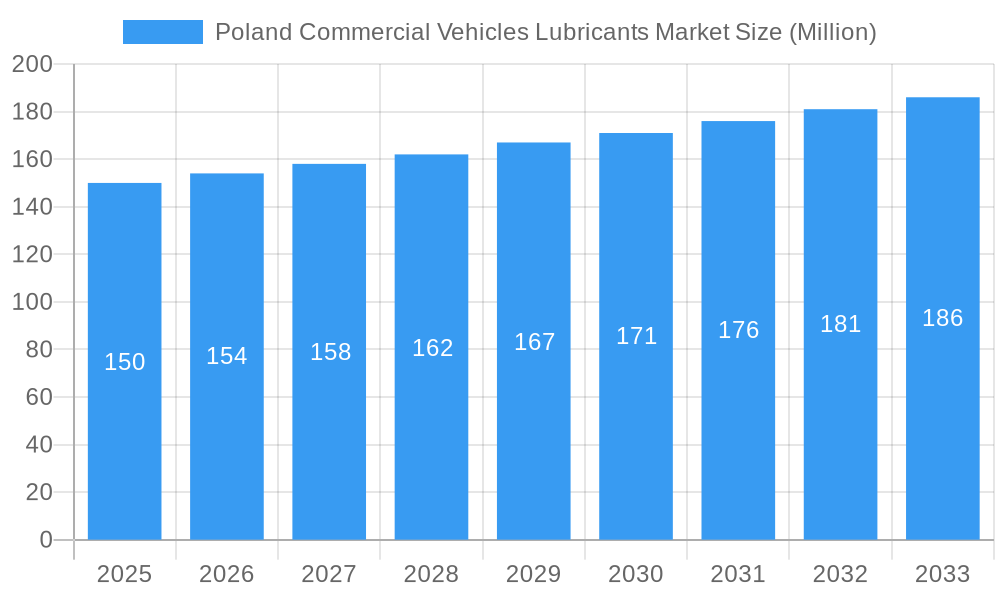

Poland Commercial Vehicles Lubricants Market Market Size (In Billion)

Despite positive growth prospects, the market encounters challenges such as volatility in crude oil prices, which directly influence production costs and lubricant pricing. Economic slowdowns and reduced freight activity also pose potential restraints. The competitive arena features global leaders like BP PLC (Castrol), ExxonMobil Corporation, and Royal Dutch Shell Plc, alongside domestic entities such as LOTOS Oil and PKN ORLEN. These companies are actively pursuing innovation in sustainable and eco-friendly lubricant solutions, and forging strategic alliances to solidify market positions. The market is segmented by lubricant type (e.g., engine oil, gear oil), vehicle application (e.g., heavy-duty trucks, buses), and distribution channels (e.g., OEMs, distributors). Sustained growth hinges on effectively addressing market restraints while leveraging emerging opportunities.

Poland Commercial Vehicles Lubricants Market Company Market Share

Poland Commercial Vehicles Lubricants Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland commercial vehicles lubricants market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year. This analysis is crucial for industry professionals, investors, and businesses seeking to understand and navigate this dynamic market. The report delves into the parent market of the Polish lubricants market and its child market segment focusing on commercial vehicles. Market values are presented in million units.

Poland Commercial Vehicles Lubricants Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends shaping the Poland commercial vehicles lubricants market. The market's structure reveals a moderately concentrated landscape, with key players holding significant market shares. Technological innovation, particularly in the development of environmentally friendly lubricants, is a major driver. Stringent emission regulations are also influencing product development and adoption. The presence of substitute products and the impact of mergers and acquisitions (M&A) activities are considered.

- Market Concentration: xx% market share held by top 5 players (2024).

- Technological Innovation: Focus on improved fuel efficiency, extended drain intervals, and reduced emissions.

- Regulatory Framework: Alignment with EU emission standards driving demand for advanced lubricants.

- Competitive Substitutes: Bio-based lubricants and synthetic oils posing challenges to conventional products.

- M&A Activity: Significant M&A activity, particularly the proposed PKN Orlen acquisition of Lotos in 2021, reshaping the market landscape. A total of xx M&A deals were observed between 2019 and 2024.

- Innovation Barriers: High R&D costs and stringent regulatory approvals present obstacles to innovation.

Poland Commercial Vehicles Lubricants Market Growth Trends & Insights

The Poland commercial vehicles lubricants market has experienced [Growth Rate]% CAGR during the historical period (2019-2024), driven by factors such as increasing commercial vehicle fleet size, rising transportation activity, and stringent emission regulations. The market size is estimated at xx million units in 2025. Technological advancements, such as the adoption of synthetic lubricants and specialized formulations for specific engine types, have fueled growth. Consumer behavior shifts, including a preference for high-performance and eco-friendly lubricants, are also influencing market dynamics. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace, reaching xx million units by 2033, exhibiting a CAGR of xx%. Market penetration of premium lubricants is expected to increase significantly in the coming years. The growing adoption of electric and hybrid commercial vehicles is expected to be a growth impediment for traditional lubricants; however, specialized lubricants for these vehicles will provide a new segment of growth.

Dominant Regions, Countries, or Segments in Poland Commercial Vehicles Lubricants Market

The dominant region within the Poland commercial vehicles lubricants market is [Region Name], driven primarily by [Reason]. This region benefits from a robust transportation infrastructure, high industrial activity, and a large commercial vehicle fleet.

- Key Drivers:

- Strong economic growth and industrial expansion

- Well-developed transportation networks and logistics

- Government initiatives promoting sustainable transportation.

- Dominance Factors:

- High concentration of commercial vehicle manufacturing and operations

- Favorable regulatory environment and supportive government policies

- Strong demand from key end-users.

Poland Commercial Vehicles Lubricants Market Product Landscape

The market offers a diverse range of lubricants, including conventional, semi-synthetic, and fully synthetic oils, catering to various engine types and operational needs. Product innovation focuses on enhanced performance characteristics, such as improved fuel economy, extended drain intervals, and superior wear protection. The rising demand for environmentally friendly lubricants is driving the development of bio-based and low-viscosity options. Unique selling propositions include superior performance at extreme temperatures, extended oil life, and reduced environmental impact.

Key Drivers, Barriers & Challenges in Poland Commercial Vehicles Lubricants Market

Key Drivers:

The growth of the Poland commercial vehicles lubricants market is propelled by factors like rising freight transport, expanding construction activity, and stringent government emission norms. The increasing adoption of advanced engine technologies further fuels demand for specialized lubricants.

Challenges and Restraints:

Fluctuations in crude oil prices, intense competition, and the economic impact of global uncertainties present significant challenges. Strict environmental regulations may also add to production and compliance costs. Supply chain disruptions and potential trade restrictions could additionally impact market growth. The increasing adoption of electric vehicles is likely to negatively impact the market's long term growth.

Emerging Opportunities in Poland Commercial Vehicles Lubricants Market

Emerging opportunities lie in the growing demand for eco-friendly lubricants, specialized formulations for hybrid and electric vehicles, and the expansion into niche market segments. Moreover, leveraging digital technologies for improved supply chain management and enhanced customer service presents significant growth avenues.

Growth Accelerators in the Poland Commercial Vehicles Lubricants Market Industry

Strategic partnerships between lubricant manufacturers and commercial vehicle OEMs, technological breakthroughs in lubricant formulation, and expansion into new market segments are key catalysts for long-term growth.

Key Players Shaping the Poland Commercial Vehicles Lubricants Market Market

- BP PLC (Castrol)

- ExxonMobil Corporation

- FUCHS

- LOTOS OIL

- Modex Oil

- Motul

- PKN ORLEN (ORLEN oil)

- Royal Dutch Shell Plc

- TotalEnergies

- Valvoline Inc

Notable Milestones in Poland Commercial Vehicles Lubricants Market Sector

- May 2021: PKN Orlen proposed the acquisition of Lotos, impacting market consolidation.

- October 2021: Valvoline and Cummins extended their collaboration, strengthening market presence.

- January 2022: ExxonMobil reorganized its business lines, potentially influencing its lubricant offerings.

In-Depth Poland Commercial Vehicles Lubricants Market Market Outlook

The Poland commercial vehicles lubricants market is poised for sustained growth, driven by technological advancements, strategic partnerships, and expanding market segments. The focus on sustainable and high-performance lubricants will shape future market dynamics, presenting lucrative opportunities for innovative players. The increasing adoption of electric and hybrid commercial vehicles will require specialized lubricants and potentially impact overall market demand for traditional lubricant types.

Poland Commercial Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Poland Commercial Vehicles Lubricants Market Segmentation By Geography

- 1. Poland

Poland Commercial Vehicles Lubricants Market Regional Market Share

Geographic Coverage of Poland Commercial Vehicles Lubricants Market

Poland Commercial Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Commercial Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FUCHS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LOTOS OIL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Modex Oil

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Motul

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PKN ORLEN (ORLEN oil)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell Plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valvoline Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: Poland Commercial Vehicles Lubricants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Commercial Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Commercial Vehicles Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Poland Commercial Vehicles Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Poland Commercial Vehicles Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Poland Commercial Vehicles Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Commercial Vehicles Lubricants Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Poland Commercial Vehicles Lubricants Market?

Key companies in the market include BP PLC (Castrol), ExxonMobil Corporation, FUCHS, LOTOS OIL, Modex Oil, Motul, PKN ORLEN (ORLEN oil), Royal Dutch Shell Plc, TotalEnergies, Valvoline Inc.

3. What are the main segments of the Poland Commercial Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.53 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.May 2021: The PKN (Polski Koncern Naftowy) Orlen proposed the acquisition of Lotos, a Polish integrated oil and gas company. Both companies operate in various Central and Eastern European (CEE) countries and the Baltic states, offering a wide range of products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Commercial Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Commercial Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Commercial Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Poland Commercial Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence