Key Insights

The global Polyurea Grease market is projected for substantial growth, driven by escalating demand for high-performance lubricants in heavy-duty sectors. Its superior thermal stability, water resistance, and load-carrying capacity make it essential for machinery, automotive, steel, construction, and mining applications. Industrialization, especially in emerging economies, further fuels the need for advanced lubrication to enhance equipment longevity and operational efficiency.

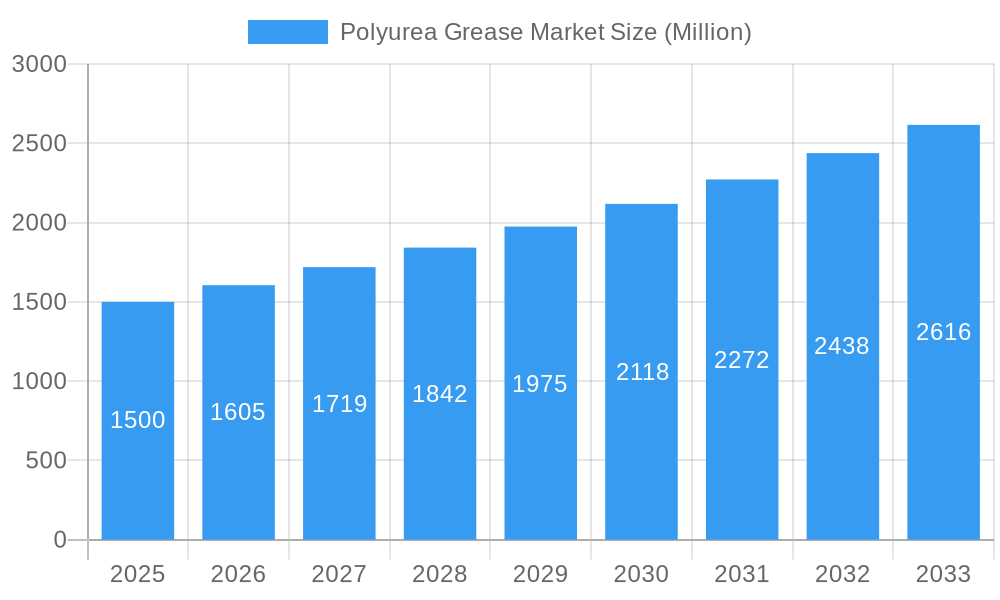

Polyurea Grease Market Market Size (In Million)

Key market drivers include advancements in lubricant formulations, improving shear stability, extreme pressure resistance, and service intervals. Challenges such as raw material price volatility and stringent environmental regulations are present, but the trend towards automation and complex machinery will ensure continued demand for specialized lubricants like polyurea grease.

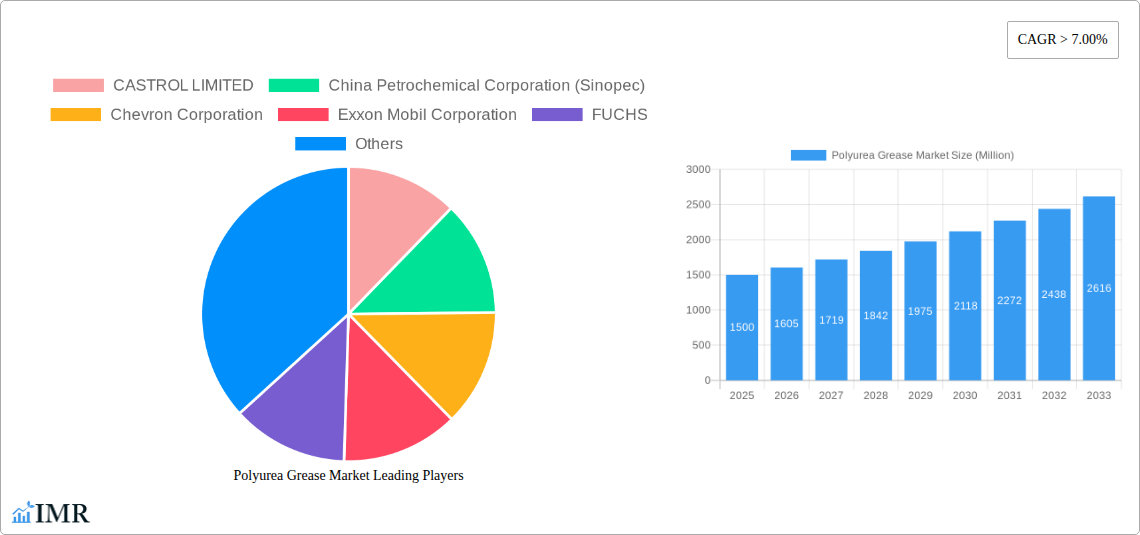

Polyurea Grease Market Company Market Share

Polyurea Grease Market: Comprehensive Analysis & Future Outlook (2019-2033)

This report offers a detailed analysis of the global Polyurea Grease market, a vital lubricant for industrial and automotive applications. Its exceptional properties drive robust demand across diverse end-user industries, providing valuable insights for stakeholders to navigate complexities and capitalize on opportunities.

Parent Market: Lubricants Market Child Markets: Specialty Greases Market, Industrial Lubricants Market

Key Companies: CASTROL LIMITED, China Petrochemical Corporation (Sinopec), Chevron Corporation, Exxon Mobil Corporation, FUCHS, Kluber Lubrication, LUKOIL, PETRONAS Lubricants International, Shell Global, TotalEnergies.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Global Polyurea Grease Market Size: 307.65 million CAGR: 8.61%

Polyurea Grease Market Dynamics & Structure

The Polyurea Grease market is characterized by a moderately concentrated structure, with a few leading global players holding significant market shares. Technological innovation is a primary driver, fueled by the relentless pursuit of enhanced performance, extended service life, and improved environmental sustainability in lubrication solutions. Stringent regulatory frameworks governing industrial emissions and workplace safety also indirectly influence product development, favoring greases with lower environmental impact and better safety profiles.

- Market Concentration: Dominated by a mix of multinational lubricant giants and specialized grease manufacturers.

- Technological Innovation Drivers: Development of high-temperature, extreme-pressure, and biodegradable polyurea greases.

- Regulatory Frameworks: Impacting formulations for improved environmental compliance and worker safety.

- Competitive Product Substitutes: Competition from other high-performance grease thickeners like lithium complex and calcium sulfonate.

- End-User Demographics: Growing demand from heavy industries, automotive, and machinery sectors.

- M&A Trends: Strategic acquisitions and partnerships aimed at expanding product portfolios and geographical reach. For instance, the historical period saw several minor regional players being acquired by larger entities seeking to consolidate their position. The estimated volume of M&A deals in the past five years is in the range of 20-30, with deal values ranging from xx million to xx million dollars.

Polyurea Grease Market Growth Trends & Insights

The global Polyurea Grease market is poised for substantial growth, driven by increasing industrialization, automotive production, and infrastructure development worldwide. The market's evolution is closely tied to advancements in lubricant technology and the growing awareness of the importance of high-performance greases in optimizing machinery efficiency and longevity. As industries continue to push the boundaries of operating conditions, the demand for polyurea grease, with its superior properties like excellent thermal stability and water resistance, is set to escalate. The adoption rate of advanced lubrication solutions is steadily increasing across key sectors.

The forecast period is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% to 6.0%, propelling the market size from an estimated xx billion dollars in 2025 to xx billion dollars by 2033. This growth trajectory is underpinned by several key trends. Firstly, the expansion of manufacturing and machinery sectors, particularly in emerging economies, is creating a robust demand for industrial lubricants, including polyurea grease. Secondly, the automotive industry's focus on longer service intervals and improved fuel efficiency necessitates the use of high-performance greases that can withstand extreme conditions. Consumer behavior is shifting towards prioritizing durability and reduced maintenance, further boosting the appeal of polyurea-based lubricants. Technological disruptions, such as the development of synthetic base oils and novel additive packages, are enhancing the performance characteristics of polyurea greases, making them indispensable for specialized applications. Market penetration of high-performance polyurea greases is projected to increase significantly as end-users recognize their cost-effectiveness in the long run, despite a potentially higher initial investment compared to conventional greases.

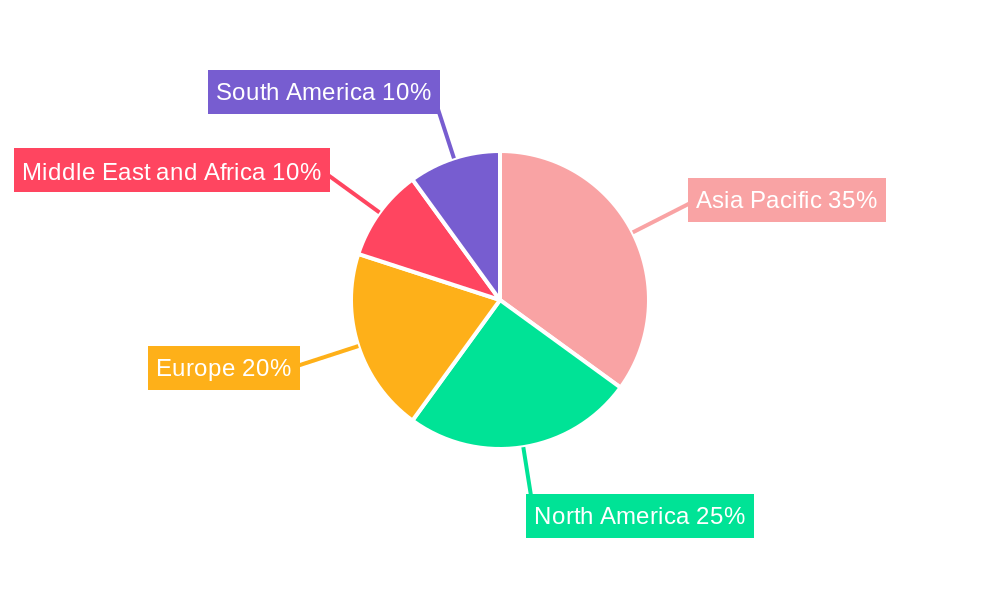

Dominant Regions, Countries, or Segments in Polyurea Grease Market

The Machinery and Manufacturing sector consistently emerges as the dominant end-user industry driving the growth of the global Polyurea Grease market. This segment's pervasive need for reliable lubrication across a vast array of industrial equipment, from heavy-duty production lines to precision machinery, fuels substantial and sustained demand. The relentless pursuit of operational efficiency, reduced downtime, and extended equipment lifespan in manufacturing environments makes polyurea grease an indispensable component.

- Machinery and Manufacturing: This segment is expected to hold a market share of approximately 28-32% in 2025, driven by the expansion of global manufacturing hubs and the increasing automation of production processes. Key growth drivers include the need for high-temperature and extreme-pressure resistance in demanding industrial applications.

- Construction: The burgeoning infrastructure development worldwide, particularly in developing economies, propels the demand for polyurea greases in heavy construction machinery, offering superior protection against dirt, water, and heavy loads. This segment is estimated to contribute around 18-22% of the market share.

- Automotive: While not as dominant as machinery, the automotive sector, with its increasing demand for greases in chassis, bearings, and CV joints, plays a significant role. The trend towards longer service intervals and electric vehicle components offers new avenues for growth, contributing approximately 15-19% to the market.

- Steel: The steel industry's requirement for robust lubrication solutions for rolling mills, furnaces, and heavy machinery in harsh environments makes it a consistent consumer, accounting for an estimated 12-15% of the market.

- Mining: The challenging operational conditions in mining, involving extreme temperatures, heavy loads, and abrasive elements, necessitate the use of high-performance polyurea greases, contributing around 8-11% to the market share.

- Other End-user Industries: This category includes applications in power generation, marine, and aerospace, which collectively represent the remaining market share, driven by niche but critical lubrication needs.

The dominance of the Machinery and Manufacturing sector is further reinforced by robust economic policies supporting industrial growth and significant investments in modernization and technological upgrades within these industries. The Asia-Pacific region, with its burgeoning manufacturing base, is a key contributor to this dominance, showcasing substantial market share and high growth potential.

Polyurea Grease Market Product Landscape

The Polyurea Grease market is defined by continuous product innovation focused on enhancing performance under extreme conditions. Manufacturers are developing advanced formulations that offer superior thermal stability, exceptional water washout resistance, and robust protection against extreme pressure (EP) and wear. These developments cater to increasingly demanding applications in industries like heavy machinery, automotive, and steel. Unique selling propositions often revolve around extended re-greasing intervals, compatibility with various materials, and improved environmental profiles, such as reduced toxicity and biodegradability. Technological advancements in base oil synthesis and additive packages are key to achieving these enhanced performance metrics.

Key Drivers, Barriers & Challenges in Polyurea Grease Market

Key Drivers:

- Industrial Growth & Automation: Expansion of manufacturing, machinery, and automation sectors globally.

- Demand for High-Performance Lubrication: Need for greases with superior thermal stability, water resistance, and EP properties.

- Automotive Industry Advancements: Longer service intervals and evolving component requirements.

- Infrastructure Development: Increased use in heavy construction and mining equipment.

- Technological Innovation: Development of advanced formulations and additive packages.

Key Barriers & Challenges:

- High Initial Cost: Polyurea greases can be more expensive than conventional greases.

- Availability of Substitutes: Competition from other high-performance grease thickeners.

- Supply Chain Disruptions: Fluctuations in raw material prices and availability can impact production and cost.

- Limited Awareness in Niche Applications: In some smaller industries, awareness of polyurea grease benefits might be limited.

- Environmental Regulations: Stringent regulations can pose challenges for formulation and disposal, though also drive innovation. Quantifiable impacts include potential increases in production costs by 5-10% due to new regulatory compliance.

Emerging Opportunities in Polyurea Grease Market

Emerging opportunities in the Polyurea Grease market lie in the development of specialized formulations for the burgeoning electric vehicle (EV) sector, focusing on thermal management and electrical insulation properties. Untapped markets in regions undergoing rapid industrialization, particularly in Southeast Asia and Africa, present significant growth potential. Furthermore, the increasing focus on sustainable and bio-based lubricants offers an avenue for eco-friendly polyurea grease alternatives. The demand for greases with extended service life in harsh environments, such as offshore oil and gas exploration, also presents a lucrative opportunity for high-performance polyurea products.

Growth Accelerators in the Polyurea Grease Market Industry

Long-term growth in the Polyurea Grease market is being catalyzed by significant technological breakthroughs in additive chemistry and base oil synthesis, leading to enhanced lubrication performance under extreme conditions. Strategic partnerships between lubricant manufacturers and equipment OEMs are accelerating product development and market penetration. Furthermore, strategic market expansion into developing economies, driven by rising industrial output and automotive sales, is a key growth accelerator. Investments in research and development to create more environmentally friendly and longer-lasting polyurea grease formulations are also contributing to sustained market expansion.

Key Players Shaping the Polyurea Grease Market Market

- CASTROL LIMITED

- China Petrochemical Corporation (Sinopec)

- Chevron Corporation

- Exxon Mobil Corporation

- FUCHS

- Kluber Lubrication

- LUKOIL

- PETRONAS Lubricants International

- Shell Global

- TotalEnergies

Notable Milestones in Polyurea Grease Market Sector

- March 2023: Chevron Corporation expanded its portfolio with the launch of new grease products. The company's new portfolio includes heavy-duty multi-purpose greases for extreme-pressure and other applications. This product expansion enhances Chevron's offering in high-demand industrial and automotive segments.

- November 2022: Shell Global completed the expansion of its lubricant blending plant on Indonesia's Java island. The plant expansion doubled the production capacity to 300 million liters (270,000 metric tons) per year. This strategic move bolsters Shell's supply chain capabilities and market reach in the Asia-Pacific region, particularly for lubricants like polyurea grease.

In-Depth Polyurea Grease Market Market Outlook

The future outlook for the Polyurea Grease market is exceptionally positive, driven by sustained industrial expansion, technological innovation, and a growing emphasis on operational efficiency and equipment longevity. Key growth accelerators include the continuous development of advanced, high-performance formulations that meet increasingly stringent industry demands, particularly in sectors like heavy machinery and automotive. Strategic partnerships and a focus on expanding market reach into emerging economies will further fuel demand. The market is also well-positioned to capitalize on the global shift towards more sustainable lubrication solutions, with opportunities to develop and market eco-friendly polyurea grease variants. The continued investment in R&D by major players will ensure a pipeline of innovative products, solidifying polyurea grease's position as a critical lubricant in diverse applications.

Polyurea Grease Market Segmentation

-

1. End-user Industry

- 1.1. Machinery and Manufacturing

- 1.2. Construction

- 1.3. Automotive

- 1.4. Steel

- 1.5. Mining

- 1.6. Other End-user Industries

Polyurea Grease Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polyurea Grease Market Regional Market Share

Geographic Coverage of Polyurea Grease Market

Polyurea Grease Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Automotive End-User Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Machinery and Manufacturing

- 5.1.2. Construction

- 5.1.3. Automotive

- 5.1.4. Steel

- 5.1.5. Mining

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Machinery and Manufacturing

- 6.1.2. Construction

- 6.1.3. Automotive

- 6.1.4. Steel

- 6.1.5. Mining

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Machinery and Manufacturing

- 7.1.2. Construction

- 7.1.3. Automotive

- 7.1.4. Steel

- 7.1.5. Mining

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Machinery and Manufacturing

- 8.1.2. Construction

- 8.1.3. Automotive

- 8.1.4. Steel

- 8.1.5. Mining

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Machinery and Manufacturing

- 9.1.2. Construction

- 9.1.3. Automotive

- 9.1.4. Steel

- 9.1.5. Mining

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Machinery and Manufacturing

- 10.1.2. Construction

- 10.1.3. Automotive

- 10.1.4. Steel

- 10.1.5. Mining

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CASTROL LIMITED

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Petrochemical Corporation (Sinopec)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FUCHS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kluber Lubrication

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LUKOIL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PETRONAS Lubricants International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shell Global

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TotalEnergies*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CASTROL LIMITED

List of Figures

- Figure 1: Global Polyurea Grease Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 5: Asia Pacific Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 7: North America Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 11: Europe Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 15: South America Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Polyurea Grease Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: China Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: India Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Japan Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: United States Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Canada Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Germany Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: France Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Brazil Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyurea Grease Market?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the Polyurea Grease Market?

Key companies in the market include CASTROL LIMITED, China Petrochemical Corporation (Sinopec), Chevron Corporation, Exxon Mobil Corporation, FUCHS, Kluber Lubrication, LUKOIL, PETRONAS Lubricants International, Shell Global, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Polyurea Grease Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.65 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Automotive End-User Industry.

7. Are there any restraints impacting market growth?

Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers.

8. Can you provide examples of recent developments in the market?

In March 2023, Chevron Corporation expanded its portfolio with the launch of new grease products. The company's new portfolio includes heavy-duty multi-purpose greases for extreme-pressure and other applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyurea Grease Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyurea Grease Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyurea Grease Market?

To stay informed about further developments, trends, and reports in the Polyurea Grease Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence