Key Insights

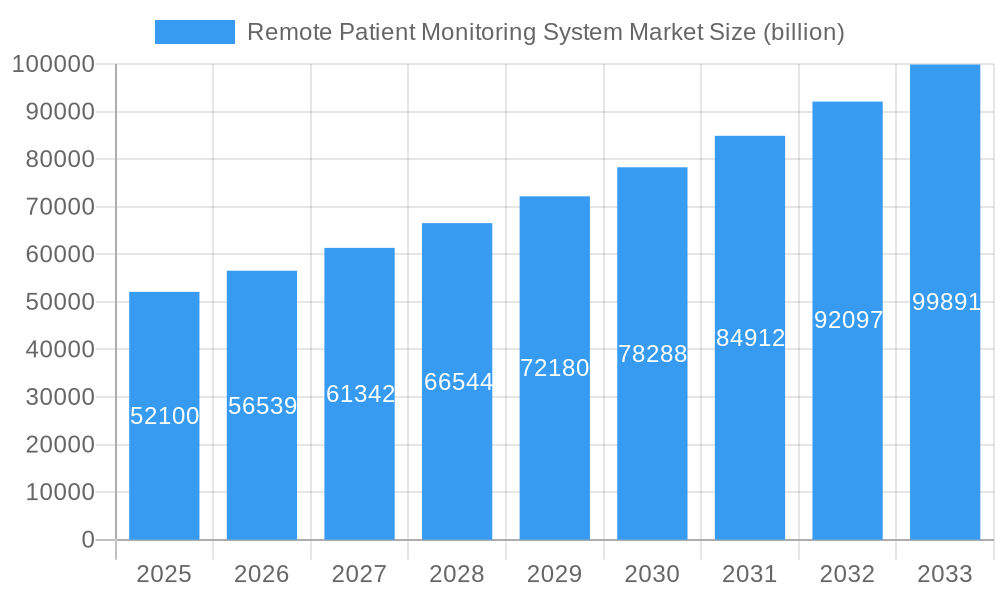

The global Remote Patient Monitoring (RPM) System Market is poised for substantial expansion, projected to reach an impressive market size of approximately $52.1 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 8.54%. This growth is largely fueled by escalating rates of chronic diseases, including cardiovascular ailments and diabetes, which necessitate continuous monitoring and proactive management. The increasing adoption of telehealth and the growing demand for home-based healthcare solutions further bolster market expansion. Technological advancements, such as the integration of AI and IoT in RPM devices, are enhancing their accuracy, usability, and data analysis capabilities, making them indispensable tools for healthcare providers and patients alike. The shift towards value-based healthcare models, which prioritize patient outcomes and cost-effectiveness, also favors the widespread implementation of RPM systems, as they demonstrably contribute to improved patient care and reduced hospital readmissions.

Remote Patient Monitoring System Market Market Size (In Billion)

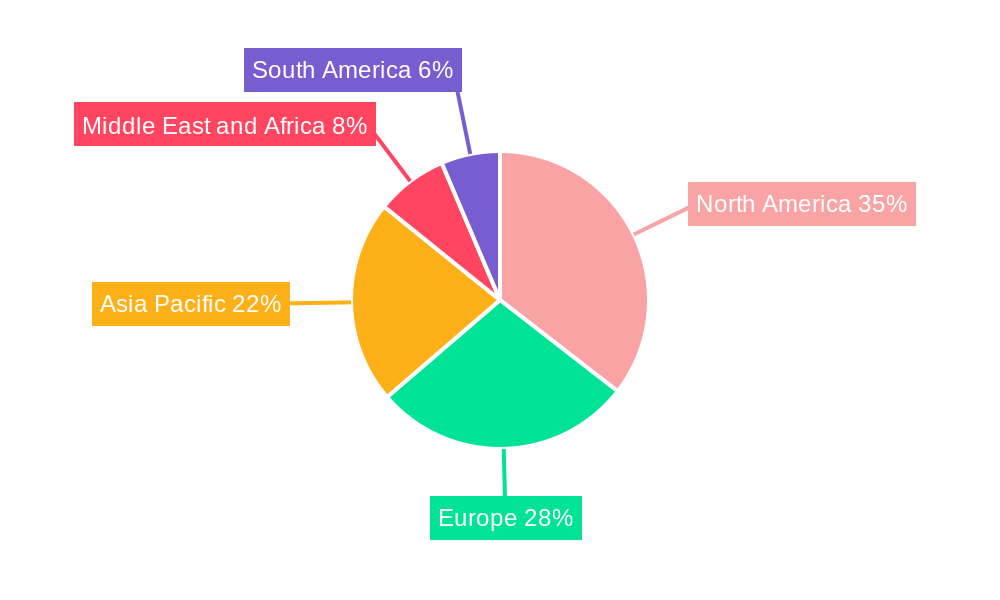

The RPM market is characterized by diverse device types, with Heart Monitors and Multi-parameter Monitors leading the charge due to their critical role in managing prevalent chronic conditions. The application spectrum is equally broad, with Cardiovascular Diseases and Cancer Treatment emerging as key areas where RPM systems are making a significant impact, offering enhanced treatment efficacy and patient well-being. Home care settings represent a rapidly growing end-user segment, reflecting a societal preference for convenient and personalized healthcare delivery. Geographically, North America, led by the United States, currently dominates the market, owing to advanced healthcare infrastructure and early adoption of technology. However, the Asia Pacific region is expected to witness the fastest growth, driven by a large population, increasing healthcare expenditure, and a rising awareness of the benefits of remote monitoring, particularly in emerging economies like China and India. Despite the promising outlook, challenges such as data security concerns, regulatory hurdles, and the initial cost of implementation for some advanced systems may present moderate restraints to an even more accelerated growth trajectory.

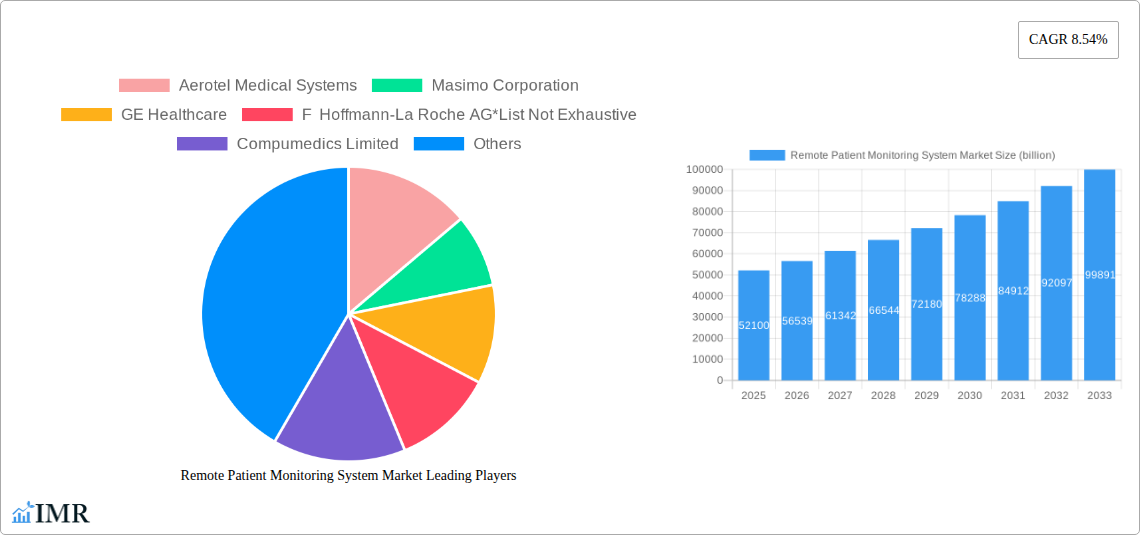

Remote Patient Monitoring System Market Company Market Share

Remote Patient Monitoring System Market: Comprehensive Industry Analysis & Future Outlook (2019-2033)

Unlock the future of healthcare delivery with our in-depth report on the Remote Patient Monitoring (RPM) System Market. This comprehensive analysis, covering the period from 2019 to 2033 with a base year of 2025, provides unparalleled insights into market dynamics, growth trends, and strategic opportunities. Discover how advancements in connected health technologies, driven by increasing prevalence of chronic diseases and a growing demand for patient-centric care, are reshaping healthcare delivery models globally. Our report delves into the intricate workings of the RPM ecosystem, examining key segments, influential players, and the technological innovations that are setting new benchmarks.

This report is meticulously crafted for industry professionals, investors, and stakeholders seeking to capitalize on the burgeoning RPM market. We offer a granular examination of the market's structure, competitive landscape, and the crucial factors influencing its trajectory. From vital signs monitoring to chronic disease management, explore the full spectrum of RPM applications and technologies that are driving significant transformation in patient care and healthcare economics.

Remote Patient Monitoring System Market Market Dynamics & Structure

The Remote Patient Monitoring System Market is characterized by a dynamic interplay of technological advancements, evolving regulatory landscapes, and shifting end-user demands. Market concentration varies across different sub-segments, with some areas exhibiting consolidation by major players while others remain fragmented with numerous innovative startups. Key drivers of technological innovation include the miniaturization of sensors, advancements in wireless communication (5G, IoT), and the integration of artificial intelligence and machine learning for data analytics and predictive insights. Regulatory frameworks, such as HIPAA in the US and GDPR in Europe, play a crucial role in shaping data security, privacy, and interoperability standards, influencing product development and market entry strategies. Competitive product substitutes include traditional in-person consultations and less sophisticated monitoring devices, but the increasing efficacy and convenience of RPM are steadily eroding their market share. End-user demographics are expanding beyond elderly populations to include younger individuals managing chronic conditions and fitness enthusiasts, fueling demand for a broader range of RPM solutions. Mergers and acquisitions (M&A) trends indicate a strategic drive towards market consolidation, product portfolio expansion, and geographical reach enhancement.

- Market Concentration: Moderate to high in established segments like cardiovascular monitoring, with emerging segments showing higher fragmentation.

- Technological Innovation Drivers: Miniaturization, IoT integration, AI/ML for data analytics, 5G connectivity, cloud computing.

- Regulatory Frameworks: HIPAA, GDPR, FDA guidelines shaping data security, privacy, and device approvals.

- Competitive Product Substitutes: Traditional medical visits, basic health tracking devices, telehealth platforms without integrated monitoring.

- End-User Demographics: Growing adoption among chronic disease patients (cardiovascular, diabetes, respiratory), elderly population, post-operative care patients, and wellness-focused individuals.

- M&A Trends: Increasing number of strategic acquisitions by larger healthcare technology companies to enhance their RPM offerings and market presence. Deal volumes are projected to see sustained growth.

Remote Patient Monitoring System Market Growth Trends & Insights

The Remote Patient Monitoring System Market is poised for robust expansion, projected to reach $XX billion by 2025 and surge to $XX billion by 2033, exhibiting a compound annual growth rate (CAGR) of XX% during the forecast period of 2025–2033. This substantial growth is fueled by a confluence of factors, including the escalating global burden of chronic diseases such as cardiovascular conditions, diabetes, and respiratory ailments. The increasing need for continuous patient oversight, proactive disease management, and a shift towards value-based care models are significant market accelerators. Technological advancements in connected medical devices, wearables, and sophisticated data analytics platforms are enabling more accurate and timely patient monitoring, thereby improving clinical outcomes and reducing healthcare costs. Furthermore, the growing acceptance and adoption of telehealth and mHealth solutions by both patients and healthcare providers, significantly amplified by the COVID-19 pandemic, have created a fertile ground for RPM integration.

Consumer behavior is also evolving, with a growing preference for home-based care and personalized health management. Patients are increasingly seeking convenient and accessible healthcare solutions that empower them to actively participate in their own well-being. This trend is further bolstered by an aging global population, which necessitates more efficient and less intrusive methods of healthcare delivery. Government initiatives and favorable reimbursement policies in various regions are also playing a pivotal role in driving the adoption of RPM systems, incentivizing healthcare providers to invest in and implement these technologies. The seamless integration of RPM devices with electronic health records (EHRs) and other healthcare IT infrastructure is also a crucial factor, enhancing data accessibility and facilitating collaborative care. The market penetration of RPM devices is expected to witness a significant uplift, moving from approximately XX% in 2023 to an estimated XX% by 2030, reflecting the widespread integration of these solutions across diverse healthcare settings. The market size evolution indicates a consistent upward trajectory, moving from an estimated $XX billion in 2019 to $XX billion in 2024, setting the stage for accelerated growth in the subsequent forecast period.

Dominant Regions, Countries, or Segments in Remote Patient Monitoring System Market

The Remote Patient Monitoring System Market is experiencing significant growth, with the Cardiovascular Diseases application segment emerging as a dominant force, projected to hold a substantial market share of XX% by 2025. This dominance is attributed to the high prevalence of cardiovascular diseases globally, coupled with the critical need for continuous monitoring of vital signs such as heart rate, blood pressure, and ECG for effective management and early intervention. Heart monitors, a key type of device within the RPM ecosystem, are instrumental in this segment, expected to capture XX% of the device type market by 2025.

North America, particularly the United States, is anticipated to remain the leading region in the RPM market, accounting for an estimated XX% of the global market share in 2025. This leadership is driven by a robust healthcare infrastructure, favorable reimbursement policies for telehealth and RPM services, a high adoption rate of advanced medical technologies, and a significant concentration of chronic disease patients. The presence of key market players and substantial investments in healthcare IT further bolster its leading position.

Dominant Application Segment: Cardiovascular Diseases

- Key Drivers: High global prevalence of heart conditions, critical need for continuous monitoring (ECG, blood pressure, heart rate), proactive management of heart failure and arrhythmias.

- Market Share (Projected 2025): XX%

- Growth Potential: Sustained high demand due to aging population and lifestyle factors.

Dominant Device Type: Heart Monitors

- Key Drivers: Essential for cardiovascular disease management, technological advancements in wearable ECG, Holter monitors, and implantable cardiac devices.

- Market Share (Projected 2025): XX%

- Impact: Direct correlation with the growth of the cardiovascular disease application segment.

Dominant Region: North America (primarily the United States)

- Key Drivers: Advanced healthcare infrastructure, favorable reimbursement policies for RPM, high adoption of technology, strong presence of key players, significant chronic disease burden.

- Market Share (Projected 2025): XX%

- Growth Potential: Continued innovation and market expansion due to supportive ecosystem.

Within the End-User segment, Home Care Settings are projected to witness the most rapid expansion, driven by patient preference for comfort and convenience, and healthcare systems' focus on reducing hospital readmissions. This segment is expected to grow at a CAGR of XX% during the forecast period.

- Dominant End-User Segment (Growth): Home Care Settings

- Key Drivers: Patient preference for home-based care, cost-effectiveness for healthcare providers, aging population, focus on chronic disease management outside hospitals.

- Growth Rate (CAGR 2025-2033): XX%

- Impact: Driving innovation in user-friendly, consumer-grade RPM devices and platforms.

Other significant contributors to market growth include the Diabetes Treatment application segment and the increasing adoption of Multi-parameter Monitors that offer comprehensive physiological data collection. The growth in these areas is directly linked to the increasing incidence of these conditions and the demand for integrated health management solutions.

Remote Patient Monitoring System Market Product Landscape

The product landscape of the Remote Patient Monitoring System Market is characterized by continuous innovation, focusing on enhanced accuracy, user-friendliness, and seamless data integration. Key product developments include advanced wearable biosensors capable of real-time tracking of a wider array of physiological parameters, smart devices with integrated AI for preliminary data analysis and alerts, and cloud-based platforms that facilitate secure data storage, remote access, and interoperability with Electronic Health Records (EHRs). Innovations in Heart Monitors are leading to miniaturized, non-invasive devices with extended battery life and improved signal quality for accurate ECG and heart rate monitoring. Similarly, Breath Monitors are evolving to provide precise respiratory rate and oxygen saturation data for patients with chronic respiratory conditions. The integration of multi-parameter monitors allows for the simultaneous tracking of blood pressure, glucose levels, temperature, and oxygen saturation, offering a holistic view of a patient's health status. The unique selling propositions of leading products often lie in their diagnostic accuracy, ease of use for patients of all ages, and robust data security features, ensuring compliance with stringent healthcare regulations. Technological advancements are also enabling personalized alerts and early detection of potential health deterioration, a critical factor in improving patient outcomes and reducing hospitalizations.

Key Drivers, Barriers & Challenges in Remote Patient Monitoring System Market

Key Drivers: The Remote Patient Monitoring System Market is propelled by a confluence of powerful factors. The escalating global burden of chronic diseases, including cardiovascular conditions, diabetes, and respiratory disorders, necessitates continuous and proactive patient management, making RPM solutions indispensable. The growing elderly population, who often require specialized care and are more susceptible to health complications, further fuels demand. Technological advancements, such as the miniaturization of sensors, the advent of IoT and 5G connectivity, and the integration of AI/ML for data analytics, are enhancing the accuracy, efficiency, and capabilities of RPM devices. Favorable reimbursement policies and government initiatives promoting telehealth and remote care adoption in various regions significantly incentivize healthcare providers and patients. The increasing preference for home-based care, driven by convenience and cost-effectiveness, is a major consumer-led driver.

Barriers & Challenges: Despite its promising growth, the Remote Patient Monitoring System Market faces several significant barriers and challenges. High upfront costs associated with implementing RPM infrastructure, including devices, software platforms, and training, can be a deterrent for some healthcare providers, especially smaller clinics or those in resource-limited settings. Interoperability issues between different RPM devices, software platforms, and existing EHR systems can hinder seamless data flow and integration, leading to fragmented patient data. Data security and privacy concerns remain paramount, with the risk of cyberattacks and unauthorized access to sensitive patient information requiring robust security measures and strict adherence to regulations like HIPAA and GDPR. Lack of standardized regulations across different geographical regions can create complexities for manufacturers and healthcare providers operating internationally. Patient adherence and digital literacy can also pose challenges, particularly for older adults or individuals with limited technological proficiency, impacting the effective utilization of RPM devices. Lastly, reimbursement uncertainties and variations in payment policies across different insurance providers and geographical locations can affect the financial viability of RPM services.

Emerging Opportunities in Remote Patient Monitoring System Market

Emerging opportunities in the Remote Patient Monitoring System Market are ripe for exploration. The expansion of RPM into preventive care and wellness monitoring presents a significant untapped market. As consumer health awareness grows, there is increasing demand for devices that track fitness, sleep patterns, and nutritional intake, moving beyond disease management to proactive health optimization. The integration of RPM with mental health services, offering remote monitoring of mood, sleep, and behavioral patterns, is another promising avenue, particularly for managing conditions like depression and anxiety. Furthermore, the development of AI-powered predictive analytics platforms that can forecast potential health crises based on real-time RPM data offers immense potential for early intervention and personalized treatment plans. The growing adoption of RPM in post-operative care and rehabilitation allows patients to recover at home with continuous monitoring, reducing hospital stays and associated costs. Opportunities also lie in developing specialized RPM solutions for rare diseases and pediatric care, addressing unique monitoring needs. The expansion of RPM into underserved rural areas through partnerships with local healthcare providers and community health workers can also unlock significant growth potential.

Growth Accelerators in the Remote Patient Monitoring System Market Industry

Several key catalysts are accelerating the growth of the Remote Patient Monitoring System Market. The ongoing digital transformation in healthcare, driven by the widespread adoption of telehealth and mHealth technologies, has created an infrastructure conducive to RPM. Significant advancements in sensor technology, enabling smaller, more accurate, and less intrusive devices, are making RPM more accessible and acceptable to a broader patient population. The increasing focus on value-based care models by governments and healthcare payers, which emphasize patient outcomes and cost-efficiency, strongly supports the adoption of RPM for chronic disease management and early intervention. Strategic partnerships between technology companies, healthcare providers, and pharmaceutical firms are fostering innovation and accelerating the development and deployment of integrated RPM solutions. Government initiatives and supportive reimbursement policies, particularly in developed nations, are providing crucial financial impetus for the adoption of RPM technologies. Finally, the growing patient demand for convenient, personalized, and home-based healthcare is a powerful market pull that continuously drives innovation and market expansion.

Key Players Shaping the Remote Patient Monitoring System Market Market

- Aerotel Medical Systems

- Masimo Corporation

- GE Healthcare

- F Hoffmann-La Roche AG

- Compumedics Limited

- Abbott Laboratories

- Philips Healthcare

- Medtronic PLC

- Omron Corporation

- Dragerwerk AG & Co KGaA

- OSI Systems Inc

- Boston Scientific Corporation

- AMD Global Telemedicine

- Nihon Kohden Corporation

- Baxter International Inc

Notable Milestones in Remote Patient Monitoring System Market Sector

- September 2022: Watertown Regional Medical Center (WRMC) launched a new remote care management program for patients with chronic conditions like hypertension (high blood pressure) and heart failure. This initiative significantly expanded the reach of RPM for managing prevalent chronic diseases.

- February 2022: Healthnet Global, a subsidiary of Apollo Hospitals, introduced Automaid, a smart in-patient room automation system capable of remote patient monitoring and triaging. This development highlighted the integration of RPM within broader hospital automation solutions, enhancing in-patient care efficiency.

In-Depth Remote Patient Monitoring System Market Market Outlook

The future outlook for the Remote Patient Monitoring System Market is exceptionally promising, driven by sustained innovation and expanding applications. The continued integration of Artificial Intelligence and Machine Learning will unlock advanced predictive analytics, enabling proactive healthcare interventions and personalized treatment pathways. The development of more sophisticated, wearable, and implantable sensors will further enhance data accuracy and expand the scope of monitored physiological parameters. Growth accelerators, such as favorable reimbursement policies and a global push towards value-based healthcare, will continue to incentivize adoption across diverse healthcare settings. Opportunities in emerging markets, particularly in Asia-Pacific and Latin America, present significant untapped potential. The increasing demand for integrated care solutions, connecting RPM data with electronic health records and other health management platforms, will foster greater interoperability and a more holistic approach to patient care. Strategic collaborations and mergers will likely shape the competitive landscape, leading to more comprehensive and end-to-end RPM solutions, ultimately driving improved patient outcomes and a more efficient global healthcare system. The market is poised to transform from a niche segment into a foundational element of modern healthcare delivery.

Remote Patient Monitoring System Market Segmentation

-

1. Type of Device

- 1.1. Heart Monitors

- 1.2. Breath Monitors

- 1.3. Hematology Monitors

- 1.4. Multi-parameter Monitors

- 1.5. Other Types of Devices

-

2. Application

- 2.1. Cancer Treatment

- 2.2. Cardiovascular Diseases

- 2.3. Diabetes Treatment

- 2.4. Sleep Disorder

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End-User

- 3.1. Home Care Settings

- 3.2. Hospitals/Clinics

- 3.3. Other End-Users

Remote Patient Monitoring System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Remote Patient Monitoring System Market Regional Market Share

Geographic Coverage of Remote Patient Monitoring System Market

Remote Patient Monitoring System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases Due to Lifestyle Changes and Increasing Geriatric Population; Growing Demand for Home-based Monitoring Devices; Technological Advancements in Remote Patient Monitoring (RPM) Devices

- 3.3. Market Restrains

- 3.3.1. Resistance from Healthcare Industry Professionals; Stringent Regulatory Framework; Lack of Proper Reimbursement

- 3.4. Market Trends

- 3.4.1. The Multi-parameter Monitors Segment is Expected to Register Significant Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Remote Patient Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Heart Monitors

- 5.1.2. Breath Monitors

- 5.1.3. Hematology Monitors

- 5.1.4. Multi-parameter Monitors

- 5.1.5. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer Treatment

- 5.2.2. Cardiovascular Diseases

- 5.2.3. Diabetes Treatment

- 5.2.4. Sleep Disorder

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Home Care Settings

- 5.3.2. Hospitals/Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North America Remote Patient Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Heart Monitors

- 6.1.2. Breath Monitors

- 6.1.3. Hematology Monitors

- 6.1.4. Multi-parameter Monitors

- 6.1.5. Other Types of Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cancer Treatment

- 6.2.2. Cardiovascular Diseases

- 6.2.3. Diabetes Treatment

- 6.2.4. Sleep Disorder

- 6.2.5. Weight Management and Fitness Monitoring

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Home Care Settings

- 6.3.2. Hospitals/Clinics

- 6.3.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. Europe Remote Patient Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Heart Monitors

- 7.1.2. Breath Monitors

- 7.1.3. Hematology Monitors

- 7.1.4. Multi-parameter Monitors

- 7.1.5. Other Types of Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cancer Treatment

- 7.2.2. Cardiovascular Diseases

- 7.2.3. Diabetes Treatment

- 7.2.4. Sleep Disorder

- 7.2.5. Weight Management and Fitness Monitoring

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Home Care Settings

- 7.3.2. Hospitals/Clinics

- 7.3.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Asia Pacific Remote Patient Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Heart Monitors

- 8.1.2. Breath Monitors

- 8.1.3. Hematology Monitors

- 8.1.4. Multi-parameter Monitors

- 8.1.5. Other Types of Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cancer Treatment

- 8.2.2. Cardiovascular Diseases

- 8.2.3. Diabetes Treatment

- 8.2.4. Sleep Disorder

- 8.2.5. Weight Management and Fitness Monitoring

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Home Care Settings

- 8.3.2. Hospitals/Clinics

- 8.3.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Middle East and Africa Remote Patient Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 9.1.1. Heart Monitors

- 9.1.2. Breath Monitors

- 9.1.3. Hematology Monitors

- 9.1.4. Multi-parameter Monitors

- 9.1.5. Other Types of Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cancer Treatment

- 9.2.2. Cardiovascular Diseases

- 9.2.3. Diabetes Treatment

- 9.2.4. Sleep Disorder

- 9.2.5. Weight Management and Fitness Monitoring

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Home Care Settings

- 9.3.2. Hospitals/Clinics

- 9.3.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 10. South America Remote Patient Monitoring System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 10.1.1. Heart Monitors

- 10.1.2. Breath Monitors

- 10.1.3. Hematology Monitors

- 10.1.4. Multi-parameter Monitors

- 10.1.5. Other Types of Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Cancer Treatment

- 10.2.2. Cardiovascular Diseases

- 10.2.3. Diabetes Treatment

- 10.2.4. Sleep Disorder

- 10.2.5. Weight Management and Fitness Monitoring

- 10.2.6. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Home Care Settings

- 10.3.2. Hospitals/Clinics

- 10.3.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aerotel Medical Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Masimo Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann-La Roche AG*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Compumedics Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abbott Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Philips Healthcare

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Medtronic PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Omron Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dragerwerk AG & Co KGaA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OSI Systems Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Boston Scientific Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AMD Global Telemedicine

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nihon Kohden Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Baxter International Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Aerotel Medical Systems

List of Figures

- Figure 1: Global Remote Patient Monitoring System Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Remote Patient Monitoring System Market Revenue (undefined), by Type of Device 2025 & 2033

- Figure 3: North America Remote Patient Monitoring System Market Revenue Share (%), by Type of Device 2025 & 2033

- Figure 4: North America Remote Patient Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Remote Patient Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Remote Patient Monitoring System Market Revenue (undefined), by End-User 2025 & 2033

- Figure 7: North America Remote Patient Monitoring System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Remote Patient Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Remote Patient Monitoring System Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Remote Patient Monitoring System Market Revenue (undefined), by Type of Device 2025 & 2033

- Figure 11: Europe Remote Patient Monitoring System Market Revenue Share (%), by Type of Device 2025 & 2033

- Figure 12: Europe Remote Patient Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: Europe Remote Patient Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Remote Patient Monitoring System Market Revenue (undefined), by End-User 2025 & 2033

- Figure 15: Europe Remote Patient Monitoring System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Remote Patient Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Remote Patient Monitoring System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Remote Patient Monitoring System Market Revenue (undefined), by Type of Device 2025 & 2033

- Figure 19: Asia Pacific Remote Patient Monitoring System Market Revenue Share (%), by Type of Device 2025 & 2033

- Figure 20: Asia Pacific Remote Patient Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Asia Pacific Remote Patient Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Remote Patient Monitoring System Market Revenue (undefined), by End-User 2025 & 2033

- Figure 23: Asia Pacific Remote Patient Monitoring System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Remote Patient Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Remote Patient Monitoring System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Remote Patient Monitoring System Market Revenue (undefined), by Type of Device 2025 & 2033

- Figure 27: Middle East and Africa Remote Patient Monitoring System Market Revenue Share (%), by Type of Device 2025 & 2033

- Figure 28: Middle East and Africa Remote Patient Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Remote Patient Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Remote Patient Monitoring System Market Revenue (undefined), by End-User 2025 & 2033

- Figure 31: Middle East and Africa Remote Patient Monitoring System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East and Africa Remote Patient Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Remote Patient Monitoring System Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Remote Patient Monitoring System Market Revenue (undefined), by Type of Device 2025 & 2033

- Figure 35: South America Remote Patient Monitoring System Market Revenue Share (%), by Type of Device 2025 & 2033

- Figure 36: South America Remote Patient Monitoring System Market Revenue (undefined), by Application 2025 & 2033

- Figure 37: South America Remote Patient Monitoring System Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Remote Patient Monitoring System Market Revenue (undefined), by End-User 2025 & 2033

- Figure 39: South America Remote Patient Monitoring System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: South America Remote Patient Monitoring System Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Remote Patient Monitoring System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Type of Device 2020 & 2033

- Table 2: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Type of Device 2020 & 2033

- Table 6: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 8: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Type of Device 2020 & 2033

- Table 13: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 15: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Type of Device 2020 & 2033

- Table 23: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 25: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Type of Device 2020 & 2033

- Table 33: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 35: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Type of Device 2020 & 2033

- Table 40: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 41: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 42: Global Remote Patient Monitoring System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Remote Patient Monitoring System Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Remote Patient Monitoring System Market?

The projected CAGR is approximately 19.8%.

2. Which companies are prominent players in the Remote Patient Monitoring System Market?

Key companies in the market include Aerotel Medical Systems, Masimo Corporation, GE Healthcare, F Hoffmann-La Roche AG*List Not Exhaustive, Compumedics Limited, Abbott Laboratories, Philips Healthcare, Medtronic PLC, Omron Corporation, Dragerwerk AG & Co KGaA, OSI Systems Inc, Boston Scientific Corporation, AMD Global Telemedicine, Nihon Kohden Corporation, Baxter International Inc.

3. What are the main segments of the Remote Patient Monitoring System Market?

The market segments include Type of Device, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases Due to Lifestyle Changes and Increasing Geriatric Population; Growing Demand for Home-based Monitoring Devices; Technological Advancements in Remote Patient Monitoring (RPM) Devices.

6. What are the notable trends driving market growth?

The Multi-parameter Monitors Segment is Expected to Register Significant Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

Resistance from Healthcare Industry Professionals; Stringent Regulatory Framework; Lack of Proper Reimbursement.

8. Can you provide examples of recent developments in the market?

September 2022- Watertown Regional Medical Center (WRMC) launched a new remote care management program for patients with chronic conditions like hypertension (high blood pressure) and heart failure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Remote Patient Monitoring System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Remote Patient Monitoring System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Remote Patient Monitoring System Market?

To stay informed about further developments, trends, and reports in the Remote Patient Monitoring System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence