Key Insights

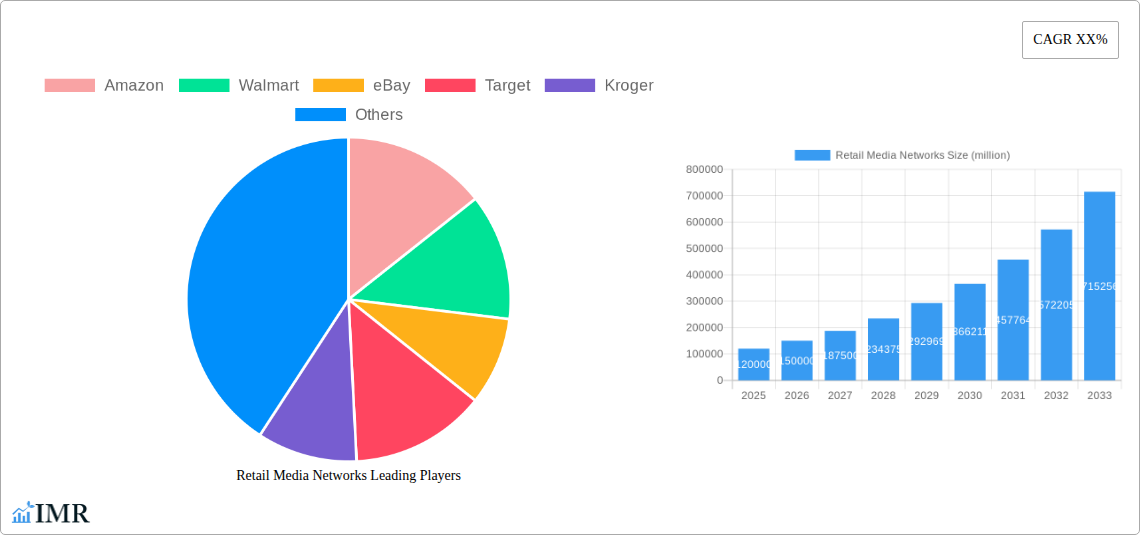

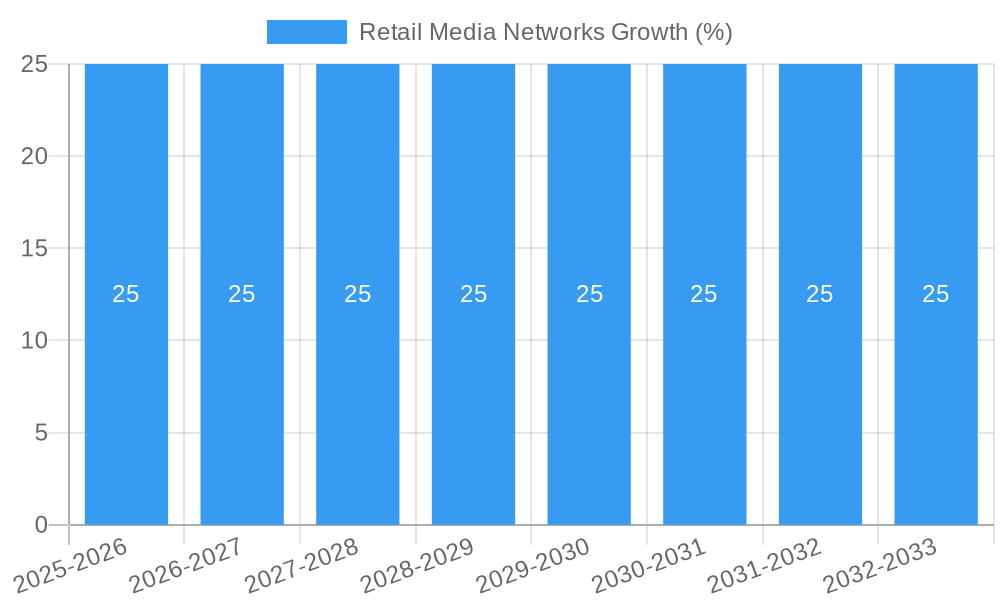

The Retail Media Networks market is poised for substantial growth, projected to reach a market size of approximately $120,000 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 25% over the forecast period (2025-2033). This impressive expansion is primarily fueled by the increasing demand for personalized advertising experiences within the retail sector. Major retailers like Amazon, Walmart, and Alibaba are leveraging their vast customer data to offer highly targeted advertising solutions to brands, enhancing campaign effectiveness and driving significant revenue streams. The "cookieless future" further amplifies the importance of first-party data, positioning retail media networks as a prime channel for advertisers seeking direct engagement with consumers at the point of purchase. The convenience and efficiency offered by these networks, where consumers can discover and purchase products seamlessly, are key drivers of their adoption.

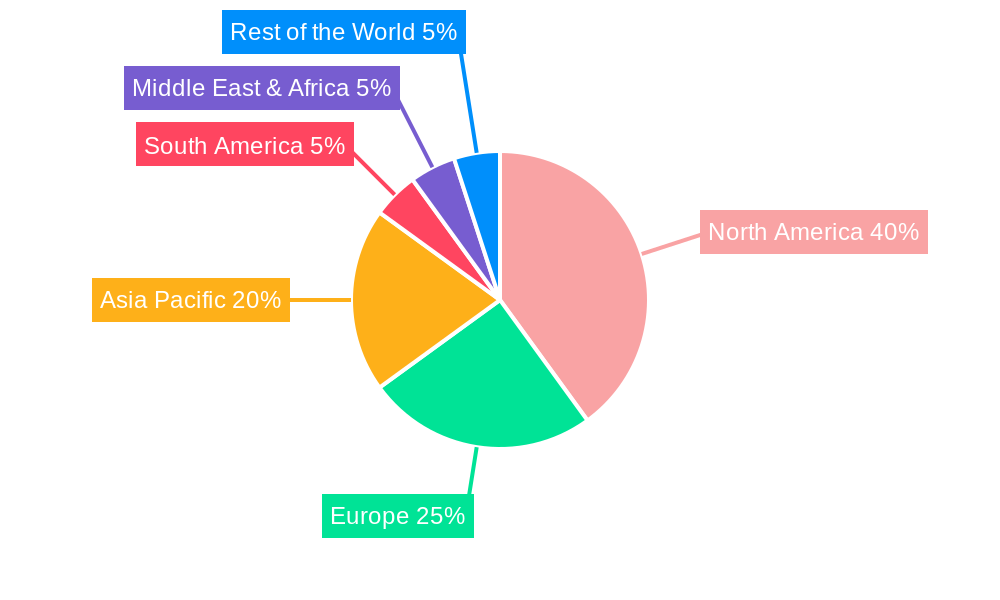

The market's trajectory is significantly influenced by emerging trends such as the integration of AI and machine learning for advanced audience segmentation and campaign optimization, alongside the growing adoption of omnichannel advertising strategies. While the market presents immense opportunities, certain restraints, such as data privacy concerns and the need for robust measurement capabilities, need to be addressed. The primary applications within this market span Consumer Goods and Catering, with advertising types predominantly categorized as Search Ads and Display Ads. Geographically, North America is expected to lead the market due to the early adoption and maturity of retail media networks by major players like Amazon and Walmart. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by the rapid digitalization of retail and the increasing presence of e-commerce giants like Alibaba and JD.com. Europe and other emerging markets also present substantial growth potential as more retailers embrace this innovative advertising model.

Retail Media Networks Market: Comprehensive Growth Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Retail Media Networks market, covering its dynamics, growth trajectory, key players, and future potential. Delve into the intricacies of this rapidly evolving sector, understanding how giants like Amazon, Walmart, eBay, Target, Kroger, and Alibaba are reshaping the digital advertising landscape for consumer goods, catering, and beyond.

Retail Media Networks Market Dynamics & Structure

The Retail Media Networks market is characterized by a moderate to high level of concentration, with major e-commerce platforms and brick-and-mortar retailers increasingly investing in their advertising capabilities. Technological innovation is a primary driver, fueled by advancements in data analytics, AI-powered targeting, and sophisticated ad serving technologies. Regulatory frameworks, while still developing, are beginning to address data privacy concerns, potentially influencing targeting capabilities and ad transparency. Competitive product substitutes include traditional digital advertising channels like social media ads and search engine marketing, as well as in-store advertising. End-user demographics are broad, encompassing brand manufacturers, product suppliers, and service providers across various consumer-facing industries. Mergers and acquisitions (M&A) activity is present, particularly in the acquisition of ad-tech companies and data providers to bolster platform offerings.

- Market Concentration: Dominated by top retail players, with a growing number of mid-tier retailers and emerging platforms entering the space.

- Technological Innovation Drivers: Emphasis on first-party data utilization, programmatic advertising, and personalized ad experiences.

- Regulatory Frameworks: Evolving privacy regulations (e.g., GDPR, CCPA) impacting data collection and ad targeting.

- Competitive Product Substitutes: Traditional digital advertising channels, content marketing, and influencer marketing.

- End-User Demographics: Primarily B2B audience including CPG brands, FMCG companies, and automotive manufacturers.

- M&A Trends: Strategic acquisitions aimed at enhancing data capabilities, ad technology stacks, and audience reach. Anticipated M&A volume of approximately 15-20 deals annually during the forecast period.

Retail Media Networks Growth Trends & Insights

The Retail Media Networks market is poised for substantial growth, driven by the increasing volume of first-party data available to retailers and the effectiveness of these networks in driving purchase intent. The global market size for Retail Media Networks is projected to surge from approximately $25,000 million in the historical period to an estimated $150,000 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 18-20%. Adoption rates are rapidly increasing as brands recognize the unparalleled ability of retail media to target consumers at the point of purchase, bridging the gap between ad exposure and conversion. Technological disruptions, such as the deprecation of third-party cookies, are acting as a significant tailwind, pushing advertisers towards privacy-compliant, data-rich environments offered by retail media. Consumer behavior shifts towards online shopping and a preference for personalized, relevant advertising further bolster this trend. The ability to leverage shopper data for hyper-targeted campaigns, product recommendations, and inventory-aware advertising is a key differentiator.

Dominant Regions, Countries, or Segments in Retail Media Networks

The Consumer Goods segment, within the Application category, stands out as the dominant force driving growth in the Retail Media Networks market. This dominance is primarily attributed to the sheer volume of transactions and the established digital advertising budgets of consumer packaged goods (CPG) and fast-moving consumer goods (FMCG) companies. These sectors consistently invest in reaching shoppers at various stages of the purchase journey. Within the Types category, Search Ads are currently the leading format, capitalizing on the high intent of shoppers actively searching for products on retail platforms.

North America, particularly the United States, leads in market share and adoption rates due to the early and aggressive investment by major retailers like Amazon and Walmart in their respective retail media networks. Key drivers for this dominance include:

- High E-commerce Penetration: A mature online retail ecosystem.

- Advanced Data Infrastructure: Sophisticated capabilities in collecting and analyzing shopper data.

- Large Retailer Investments: Significant capital allocation by major players to build and enhance their ad platforms.

- Brand Demand: Strong demand from CPG brands seeking to influence purchase decisions at the point of sale.

The APAC region, led by China and the presence of Alibaba, is a rapidly growing market with immense potential, driven by its massive online consumer base and increasing sophistication of e-commerce advertising. Europe also presents significant opportunities, with a growing number of retailers establishing their networks and brands increasing their spend. The growth in Catering and Other segments, while smaller, is also anticipated, driven by specialized retail media offerings tailored to those industries.

Retail Media Networks Product Landscape

The Retail Media Networks product landscape is characterized by a suite of sophisticated advertising solutions designed to leverage first-party shopper data. Key offerings include on-site sponsored product listings (search ads) that appear prominently in search results, offering brands increased visibility and driving higher click-through rates. Display ads, including banner ads and video placements across retail websites and apps, provide opportunities for brand building and product discovery. Performance metrics are highly focused on return on ad spend (ROAS), conversion rates, and incremental sales, directly attributable to ad campaigns. Unique selling propositions revolve around the ability to target shoppers at the critical moment of purchase decision-making. Technological advancements include AI-driven audience segmentation, personalized product recommendations, and advanced attribution models that connect ad exposure to offline and online sales.

Key Drivers, Barriers & Challenges in Retail Media Networks

Key Drivers:

- First-Party Data Advantage: Retailers' access to rich, transaction-level shopper data.

- Closed-Loop Measurement: Ability to directly link ad spend to actual sales.

- High Purchase Intent: Targeting consumers actively shopping for products.

- Cookieless Future: Provides a privacy-compliant alternative to third-party cookies.

- Brand Demand for Performance: Growing preference for measurable advertising outcomes.

Barriers & Challenges:

- Data Privacy Regulations: Navigating evolving privacy laws and ensuring compliance.

- Measurement Standardization: Lack of universal measurement standards across different networks.

- Ad Fraud & Transparency: Ensuring ad viewability and preventing fraudulent activity.

- Scalability & Integration: Challenges for smaller retailers to build and manage robust networks.

- Talent Gap: Need for skilled professionals in data analytics and ad operations.

- Competition from Established Channels: Ongoing competition from social media and search engines.

Emerging Opportunities in Retail Media Networks

Emerging opportunities in the Retail Media Networks sector lie in the expansion beyond traditional product advertising to include sponsored content, influencer collaborations within retail environments, and personalized offer delivery through loyalty programs. The growth of connected TV (CTV) advertising integrated with retail data presents a significant untapped market. Furthermore, the development of off-site advertising capabilities, allowing retailers to extend their ad networks to other platforms while still leveraging their first-party data, is a key growth avenue. Personalization at scale, beyond basic product recommendations, and the integration of augmented reality (AR) experiences for product visualization within ad units, also represent promising frontiers.

Growth Accelerators in the Retail Media Networks Industry

Catalysts for long-term growth in the Retail Media Networks industry include the ongoing digitization of retail, with more transactions occurring online, thereby expanding the data pool. Strategic partnerships between retailers and third-party data providers are accelerating network development. Market expansion strategies by major players into new geographies and the development of self-serve advertising platforms are also crucial. The increasing adoption of programmatic buying and the rise of audience extension solutions will further fuel growth by allowing brands to reach relevant shoppers beyond the retailer's own properties. Continuous investment in AI and machine learning to enhance targeting accuracy and campaign optimization will remain a key accelerator.

Key Players Shaping the Retail Media Networks Market

- Amazon

- Walmart

- eBay

- Target

- Kroger

- Alibaba

Notable Milestones in Retail Media Networks Sector

- 2019: Walmart launches Walmart Connect, its in-house media business.

- 2020: Target announces the rebranding of its media group to Roundel, consolidating its advertising efforts.

- 2021: Amazon's advertising revenue surpasses $31 billion, highlighting its dominant position.

- 2022: Kroger partners with HomeAway to expand its retail media capabilities.

- 2023: eBay introduces new advertising tools for sellers to boost product visibility.

- 2024 (Projected): Increasing investment in AI-powered targeting and measurement solutions by major players.

- 2025 (Projected): Further integration of off-site advertising capabilities and expansion into new verticals.

In-Depth Retail Media Networks Market Outlook

The future outlook for Retail Media Networks is exceptionally positive, with continued strong growth projected over the forecast period. The inherent advantage of first-party data and closed-loop measurement will solidify their position as a critical advertising channel for brands. Growth accelerators such as technological advancements in AI, expanding programmatic capabilities, and a greater focus on audience extension will drive further adoption. Strategic opportunities lie in enhancing personalization, developing innovative ad formats, and expanding into new retail categories and geographies. The increasing shift away from third-party cookies will only amplify the appeal and necessity of retail media networks for effective, privacy-compliant advertising.

Retail Media Networks Segmentation

-

1. Application

- 1.1. Consumer Goods

- 1.2. Catering

- 1.3. Other

-

2. Types

- 2.1. Search Ads

- 2.2. Display Ads

Retail Media Networks Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Retail Media Networks REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Media Networks Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Goods

- 5.1.2. Catering

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Search Ads

- 5.2.2. Display Ads

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Retail Media Networks Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Goods

- 6.1.2. Catering

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Search Ads

- 6.2.2. Display Ads

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Retail Media Networks Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Goods

- 7.1.2. Catering

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Search Ads

- 7.2.2. Display Ads

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Retail Media Networks Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Goods

- 8.1.2. Catering

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Search Ads

- 8.2.2. Display Ads

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Retail Media Networks Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Consumer Goods

- 9.1.2. Catering

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Search Ads

- 9.2.2. Display Ads

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Retail Media Networks Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Consumer Goods

- 10.1.2. Catering

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Search Ads

- 10.2.2. Display Ads

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amazon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Walmart

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 eBay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Target

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kroger

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alibaba

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Amazon

List of Figures

- Figure 1: Global Retail Media Networks Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Retail Media Networks Revenue (million), by Application 2024 & 2032

- Figure 3: North America Retail Media Networks Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Retail Media Networks Revenue (million), by Types 2024 & 2032

- Figure 5: North America Retail Media Networks Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Retail Media Networks Revenue (million), by Country 2024 & 2032

- Figure 7: North America Retail Media Networks Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Retail Media Networks Revenue (million), by Application 2024 & 2032

- Figure 9: South America Retail Media Networks Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Retail Media Networks Revenue (million), by Types 2024 & 2032

- Figure 11: South America Retail Media Networks Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Retail Media Networks Revenue (million), by Country 2024 & 2032

- Figure 13: South America Retail Media Networks Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Retail Media Networks Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Retail Media Networks Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Retail Media Networks Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Retail Media Networks Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Retail Media Networks Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Retail Media Networks Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Retail Media Networks Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Retail Media Networks Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Retail Media Networks Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Retail Media Networks Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Retail Media Networks Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Retail Media Networks Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Retail Media Networks Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Retail Media Networks Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Retail Media Networks Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Retail Media Networks Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Retail Media Networks Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Retail Media Networks Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Retail Media Networks Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Retail Media Networks Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Retail Media Networks Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Retail Media Networks Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Retail Media Networks Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Retail Media Networks Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Retail Media Networks Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Retail Media Networks Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Retail Media Networks Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Retail Media Networks Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Retail Media Networks Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Retail Media Networks Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Retail Media Networks Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Retail Media Networks Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Retail Media Networks Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Retail Media Networks Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Retail Media Networks Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Retail Media Networks Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Retail Media Networks Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Retail Media Networks Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Media Networks?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Retail Media Networks?

Key companies in the market include Amazon, Walmart, eBay, Target, Kroger, Alibaba.

3. What are the main segments of the Retail Media Networks?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Media Networks," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Media Networks report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Media Networks?

To stay informed about further developments, trends, and reports in the Retail Media Networks, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence