Key Insights

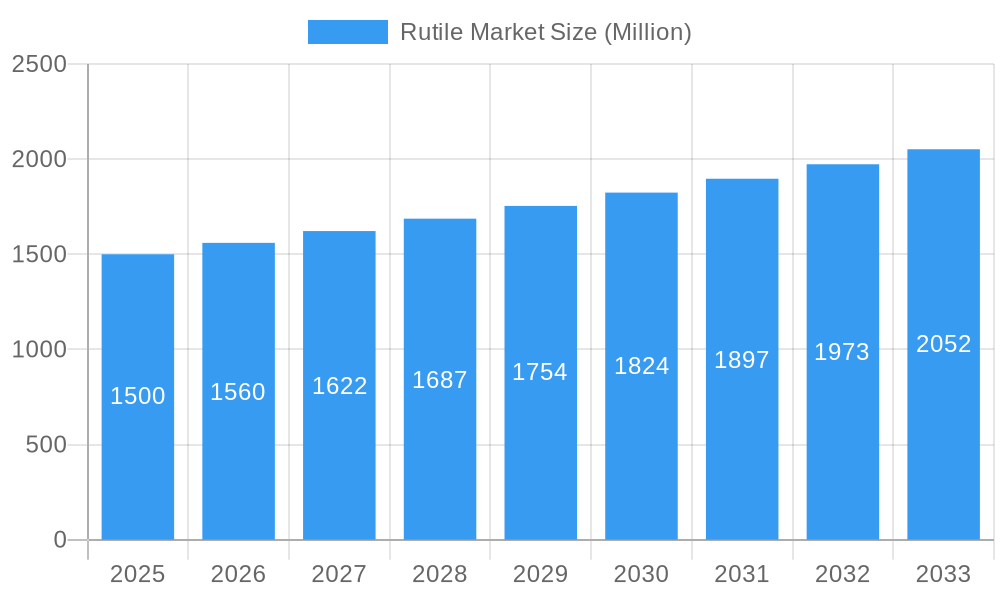

The global rutile market is forecast to reach 1401.75 million by 2025, with a projected compound annual growth rate (CAGR) of 3.28% from 2025 to 2033. This growth is propelled by escalating demand for titanium dioxide (TiO2), a vital pigment in paints, coatings, plastics, and paper. Key drivers include the expansion of the construction and automotive sectors, alongside the increasing need for premium white pigments across diverse applications. Technological innovations in TiO2 production and advancements in sustainable sourcing are also influencing market dynamics. Major industry players, including Iluka Resources Limited, Tronox Holdings PLC, and Rio Tinto, are actively pursuing production optimization and market expansion. However, raw material price volatility and environmental regulations present ongoing challenges.

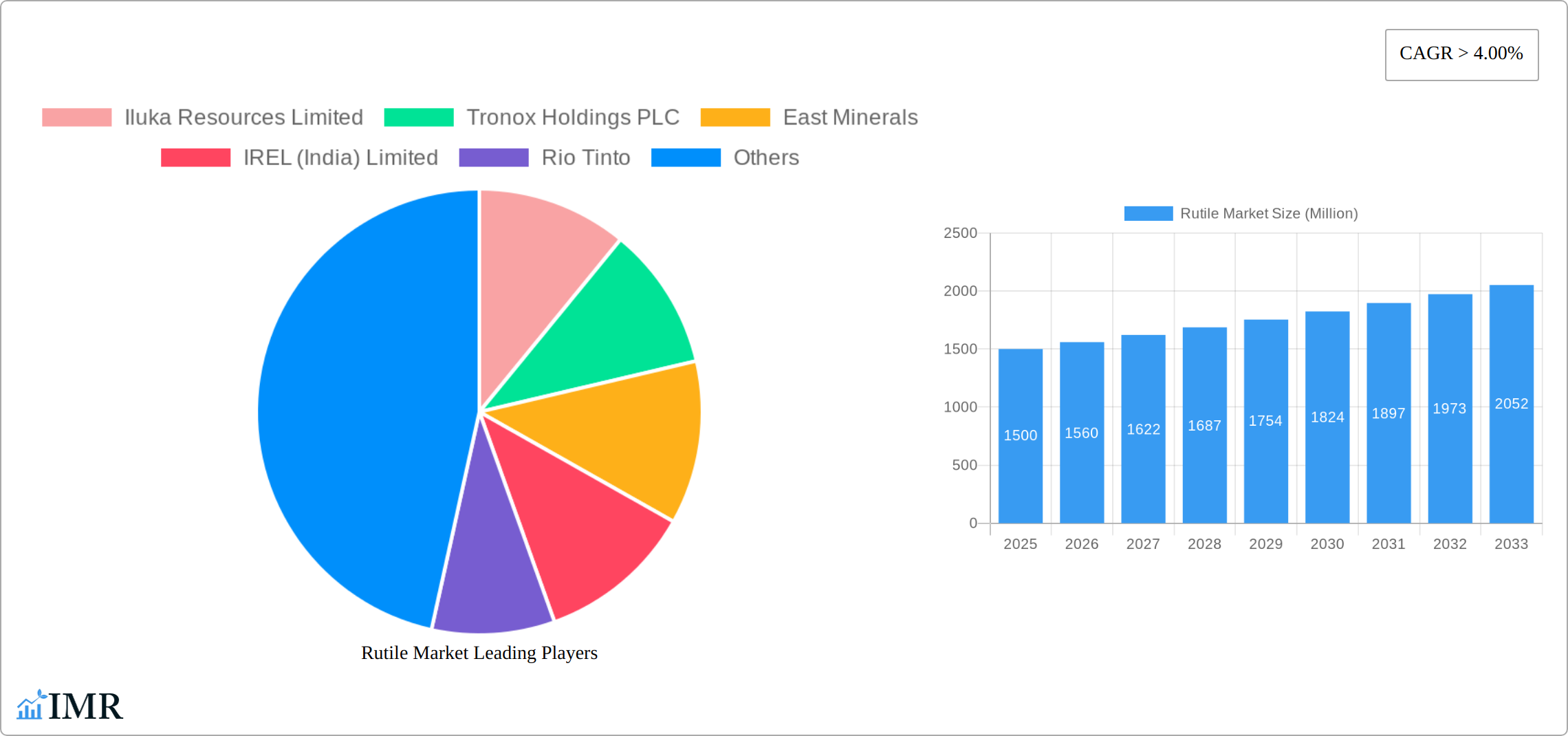

Rutile Market Market Size (In Billion)

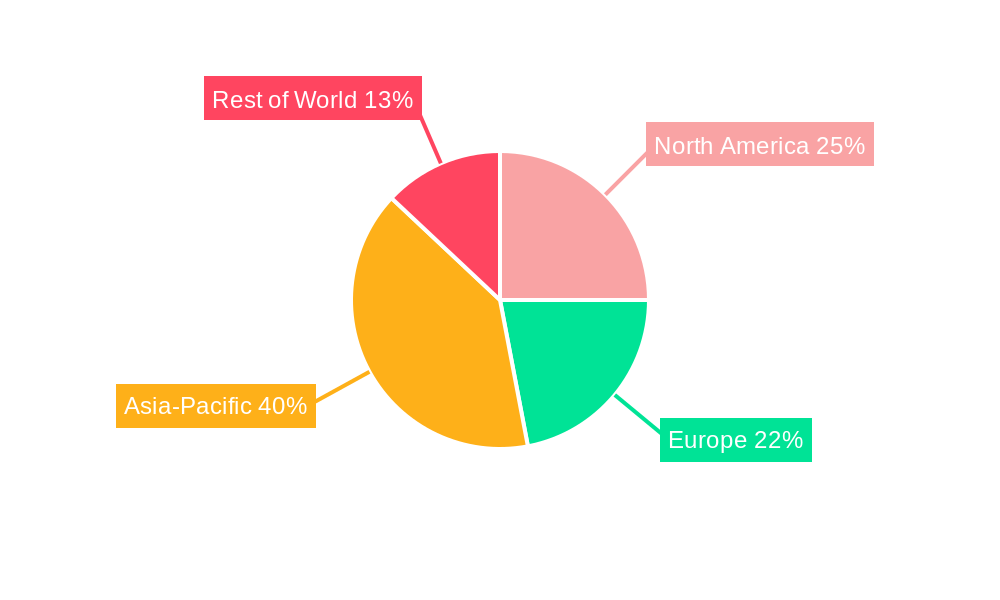

Opportunities for strategic growth exist within specific rutile production and application segments. Regional market performance is influenced by the distribution of rutile resources and processing infrastructure. While specific regional data is pending, a balanced market share across North America, Europe, and Asia-Pacific is anticipated, reflecting the presence of key industry participants and established industrial bases. The forecast period (2025-2033) is expected to see industry consolidation via mergers and acquisitions, as companies aim to strengthen market positions and production capacities. Continued investment in R&D for novel TiO2 applications and a strong emphasis on eco-friendly mining practices will be paramount for sustained market growth and long-term viability.

Rutile Market Company Market Share

Rutile Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Rutile market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). The study meticulously examines market dynamics, growth trends, regional segmentation (including key countries), the product landscape, challenges, opportunities, and the key players shaping this vital sector of the titanium dioxide pigment and welding electrodes market. The report leverages extensive primary and secondary research to deliver actionable insights for industry professionals, investors, and strategic decision-makers. The parent market is the Titanium Dioxide Pigments market and the child market is the Welding Electrodes market.

Rutile Market Dynamics & Structure

This section analyzes the competitive landscape of the Rutile market, exploring market concentration, technological innovation drivers, regulatory landscapes, substitute products, end-user demographics, and M&A activities. The study period (2019-2033) reveals significant shifts and provides a forecast for future market dynamics.

- Market Concentration: The Rutile market exhibits a moderately concentrated structure, with a few major players controlling a significant portion (xx%) of the market share in 2025. Smaller players account for the remaining xx%. This concentration is expected to slightly shift by 2033 with the entry of new players and M&A activities.

- Technological Innovation: Advancements in extraction and processing technologies, including improved efficiency and reduced environmental impact, are major drivers. The barrier to innovation mainly stems from high capital investment costs associated with establishing new mining and processing facilities.

- Regulatory Framework: Stringent environmental regulations globally are shaping the industry, necessitating sustainable practices and compliance across the value chain. Variations in regulations across different regions influence the operational cost and profitability of Rutile producers.

- Competitive Substitutes: Alternative pigments and welding materials pose a competitive threat; however, the unique properties of Rutile continue to maintain its significant market share.

- End-User Demographics: The primary end-users are pigment manufacturers (xx% of total consumption in 2025), followed by welding electrode manufacturers (xx%). Future growth will be driven by increasing demand from these two primary sectors.

- M&A Trends: The period 2019-2024 witnessed xx M&A deals, primarily focused on consolidation and resource acquisition. The forecast period anticipates a similar trend, driven by the need for increased resource control and market expansion.

Rutile Market Growth Trends & Insights

The Rutile market is demonstrating robust expansion, fueled by a confluence of dynamic factors that are shaping its trajectory. Our comprehensive analysis delves into the intricate evolution of this market, meticulously assessing the influences on market size and adoption rates. Leveraging proprietary data modeling, we project a significant upswing in the Rutile market size, anticipated to reach xx million units by 2025, with an impressive Compound Annual Growth Rate (CAGR) of xx% projected for the forecast period spanning 2025-2033.

The primary engine propelling this growth is the escalating demand for high-quality titanium dioxide (TiO2) pigments. These pigments are indispensable across a wide spectrum of industries, including the manufacturing of paints, coatings, and plastics, where they impart crucial properties like opacity, brightness, and UV resistance. Concurrently, the global welding industry continues its upward climb, further bolstering the demand for rutile's role in welding electrodes, which are vital for high-performance welding applications.

Furthermore, ongoing technological advancements in both the extraction and processing of rutile are playing a pivotal role in enhancing operational efficiency and market competitiveness. Innovations are leading to more sustainable and cost-effective methods of production, making rutile a more accessible and attractive commodity. In parallel, shifts in consumer behavior, particularly the growing emphasis on sustainability and eco-friendly products, are indirectly benefiting the rutile market. As industries strive for reduced environmental impact, the demand for materials that contribute to these goals, such as TiO2 in energy-efficient coatings or components for renewable energy technologies, is on the rise. Similarly, the welding sector is increasingly adopting welding technologies and consumables that align with reduced-emission standards, where rutile plays a key part.

Dominant Regions, Countries, or Segments in Rutile Market

This section identifies the leading regions and countries driving market growth, highlighting key economic, geographical and political factors contributing to their dominance. Based on our analysis, Australia is expected to be the dominant region in 2025, holding xx% of the global market share, followed by South Africa (xx%) and India (xx%).

- Key Drivers for Australia: Abundant Rutile reserves, established mining infrastructure, and favorable government policies.

- Key Drivers for South Africa: Significant Rutile production capacity and strategic location for export.

- Key Drivers for India: Growing domestic demand for titanium dioxide pigments and government initiatives supporting the mining sector. The growth potential is expected to remain high, with regions like South America and Southeast Asia showing significant promise owing to factors like increased infrastructure development and industrialization.

Rutile Market Product Landscape

The Rutile market is predominantly characterized by its focus on high-purity Rutile concentrates. These concentrates are the cornerstone for two major industrial applications: the production of superior titanium dioxide pigments and the manufacturing of robust welding electrodes. Recent advancements in purification techniques have been instrumental in elevating the quality of TiO2 pigments, leading to enhanced color intensity, improved opacity, and superior UV protection capabilities. In the welding sector, these innovations translate to welding electrodes with improved arc stability, enhanced slag detachability, and superior weld metal properties, thereby increasing their performance and reliability in demanding environments. The key competitive advantages in this product landscape continue to be unwavering consistency in quality, exceptional purity levels, and demonstrable cost-effectiveness for end-users.

Key Drivers, Barriers & Challenges in Rutile Market

Key Drivers:

- The increasing demand for titanium dioxide pigments in various industries (paints, coatings, plastics).

- The growth of the welding industry, driving demand for Rutile-based welding electrodes.

- Technological advancements in Rutile extraction and processing, improving efficiency and reducing costs.

Key Barriers and Challenges:

- Fluctuations in raw material prices impacting production costs.

- Stringent environmental regulations, requiring increased investment in sustainable practices.

- Competition from substitute materials and pigments. This competition has reduced the market share by an estimated xx% in the past 5 years.

- Supply chain disruptions impacting availability and cost.

Emerging Opportunities in Rutile Market

The Rutile market is ripe with emerging opportunities that promise significant growth and diversification. A key area of expansion lies in the surging demand for high-performance titanium dioxide pigments tailored for specialized applications. This includes their critical role in the manufacturing of advanced solar cells, where TiO2 contributes to efficiency and durability, and in cutting-edge materials such as advanced ceramics and lightweight composites, which are finding increasing use in aerospace, automotive, and construction industries. Furthermore, significant untapped market potential exists within developing economies, where industrialization and infrastructure development are accelerating, thereby creating a growing need for rutile-derived products. Exploring these nascent markets through strategic partnerships and localized supply chains presents a substantial avenue for future revenue generation and market penetration.

Growth Accelerators in the Rutile Market Industry

Long-term growth will be driven by technological breakthroughs in processing, strategic partnerships between mining companies and pigment manufacturers, and expansion into new markets. Sustainable and eco-friendly extraction methods will also be crucial to meeting increasing environmental concerns.

Key Players Shaping the Rutile Market Market

- Iluka Resources Limited

- Tronox Holdings PLC

- East Minerals

- IREL (India) Limited

- Rio Tinto

- V V Mineral

- TOR Minerals

- Kerala Minerals & Metals Ltd

- Yucheng Jinhe Industrial Co Ltd

- *List Not Exhaustive

Notable Milestones in Rutile Market Sector

- November 2022: Rio Tinto and Yindjibarndi Aboriginal Corporation (YAC) signed an updated agreement to strengthen ties and improve social and economic outcomes for the Yindjibarndi people. This agreement is likely to improve social license and operational efficiency at Rio Tinto’s operations.

- October 2022: Rio Tinto announced the modernization of its Sorel-Tracy site in Quebec, aiming to increase mineral supply and reduce emissions. This initiative strengthens Rio Tinto's position in the market and demonstrates a commitment to sustainability.

In-Depth Rutile Market Market Outlook

The Rutile market is exceptionally well-positioned for sustained and accelerated growth in the foreseeable future. This positive outlook is underpinned by the persistent and escalating demand for titanium dioxide pigments, a critical component in numerous consumer and industrial goods, and the unwavering need for high-quality welding electrodes vital for infrastructure development and manufacturing. The market landscape is set to be further sculpted by strategic collaborations between key players, the continuous infusion of technological advancements aimed at optimizing extraction, processing, and application, and the proactive expansion into novel and emerging applications. Significant opportunities lie in the development and adoption of more sustainable extraction and processing methodologies, aligning with global environmental imperatives and catering to the ever-increasing consumer and regulatory demand for eco-friendly products. Moreover, capitalizing on the burgeoning potential of rutile in advanced materials and in niche, high-value applications will be crucial for long-term market leadership and profitability.

Rutile Market Segmentation

-

1. Type

- 1.1. Natural Rutile

- 1.2. Synthetic Rutile

-

2. Variety

- 2.1. Ilmenorutile

- 2.2. Rutilated Quartz

- 2.3. Sagenite

- 2.4. Struverite

- 2.5. Venus Hairstone

- 2.6. Other Varieties

-

3. Application

- 3.1. Titanium Metal

- 3.2. Pigment in Paints

- 3.3. Refractory Ceramic

- 3.4. Optical Equipment

- 3.5. Other Applications

Rutile Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Rutile Market Regional Market Share

Geographic Coverage of Rutile Market

Rutile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific

- 3.4. Market Trends

- 3.4.1. Growing Demand for Rutile from the Production of Titanium Metal

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rutile Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Rutile

- 5.1.2. Synthetic Rutile

- 5.2. Market Analysis, Insights and Forecast - by Variety

- 5.2.1. Ilmenorutile

- 5.2.2. Rutilated Quartz

- 5.2.3. Sagenite

- 5.2.4. Struverite

- 5.2.5. Venus Hairstone

- 5.2.6. Other Varieties

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Titanium Metal

- 5.3.2. Pigment in Paints

- 5.3.3. Refractory Ceramic

- 5.3.4. Optical Equipment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Rutile Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural Rutile

- 6.1.2. Synthetic Rutile

- 6.2. Market Analysis, Insights and Forecast - by Variety

- 6.2.1. Ilmenorutile

- 6.2.2. Rutilated Quartz

- 6.2.3. Sagenite

- 6.2.4. Struverite

- 6.2.5. Venus Hairstone

- 6.2.6. Other Varieties

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Titanium Metal

- 6.3.2. Pigment in Paints

- 6.3.3. Refractory Ceramic

- 6.3.4. Optical Equipment

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Rutile Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural Rutile

- 7.1.2. Synthetic Rutile

- 7.2. Market Analysis, Insights and Forecast - by Variety

- 7.2.1. Ilmenorutile

- 7.2.2. Rutilated Quartz

- 7.2.3. Sagenite

- 7.2.4. Struverite

- 7.2.5. Venus Hairstone

- 7.2.6. Other Varieties

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Titanium Metal

- 7.3.2. Pigment in Paints

- 7.3.3. Refractory Ceramic

- 7.3.4. Optical Equipment

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Rutile Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural Rutile

- 8.1.2. Synthetic Rutile

- 8.2. Market Analysis, Insights and Forecast - by Variety

- 8.2.1. Ilmenorutile

- 8.2.2. Rutilated Quartz

- 8.2.3. Sagenite

- 8.2.4. Struverite

- 8.2.5. Venus Hairstone

- 8.2.6. Other Varieties

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Titanium Metal

- 8.3.2. Pigment in Paints

- 8.3.3. Refractory Ceramic

- 8.3.4. Optical Equipment

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Rutile Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural Rutile

- 9.1.2. Synthetic Rutile

- 9.2. Market Analysis, Insights and Forecast - by Variety

- 9.2.1. Ilmenorutile

- 9.2.2. Rutilated Quartz

- 9.2.3. Sagenite

- 9.2.4. Struverite

- 9.2.5. Venus Hairstone

- 9.2.6. Other Varieties

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Titanium Metal

- 9.3.2. Pigment in Paints

- 9.3.3. Refractory Ceramic

- 9.3.4. Optical Equipment

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Rutile Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural Rutile

- 10.1.2. Synthetic Rutile

- 10.2. Market Analysis, Insights and Forecast - by Variety

- 10.2.1. Ilmenorutile

- 10.2.2. Rutilated Quartz

- 10.2.3. Sagenite

- 10.2.4. Struverite

- 10.2.5. Venus Hairstone

- 10.2.6. Other Varieties

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Titanium Metal

- 10.3.2. Pigment in Paints

- 10.3.3. Refractory Ceramic

- 10.3.4. Optical Equipment

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Iluka Resources Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tronox Holdings PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 East Minerals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IREL (India) Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rio Tinto

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 V V Mineral

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TOR Minerals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kerala Minerals & Metals Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yucheng Jinhe Industrial Co Ltd*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Iluka Resources Limited

List of Figures

- Figure 1: Global Rutile Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 3: Asia Pacific Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 5: Asia Pacific Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 6: Asia Pacific Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 7: Asia Pacific Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Rutile Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 11: North America Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 13: North America Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 14: North America Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 15: North America Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 17: North America Rutile Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 19: Europe Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 21: Europe Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 22: Europe Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 23: Europe Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Rutile Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 27: South America Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 29: South America Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 30: South America Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 31: South America Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Rutile Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 37: Middle East and Africa Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 38: Middle East and Africa Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Rutile Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 3: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Rutile Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 7: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 15: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 16: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: United States Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Canada Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 22: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 23: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: Germany Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: France Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Italy Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 31: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 32: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 33: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Brazil Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 39: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 40: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rutile Market?

The projected CAGR is approximately 3.28%.

2. Which companies are prominent players in the Rutile Market?

Key companies in the market include Iluka Resources Limited, Tronox Holdings PLC, East Minerals, IREL (India) Limited, Rio Tinto, V V Mineral, TOR Minerals, Kerala Minerals & Metals Ltd, Yucheng Jinhe Industrial Co Ltd*List Not Exhaustive.

3. What are the main segments of the Rutile Market?

The market segments include Type, Variety, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1401.75 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific.

6. What are the notable trends driving market growth?

Growing Demand for Rutile from the Production of Titanium Metal.

7. Are there any restraints impacting market growth?

Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific.

8. Can you provide examples of recent developments in the market?

November 2022: Rio Tinto and Yindjibarndi Aboriginal Corporation (YAC) have signed an updated agreement to strengthen ties and deliver improved social and economic outcomes for the Yindjibarndi people for generations to come.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rutile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rutile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rutile Market?

To stay informed about further developments, trends, and reports in the Rutile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence