Key Insights

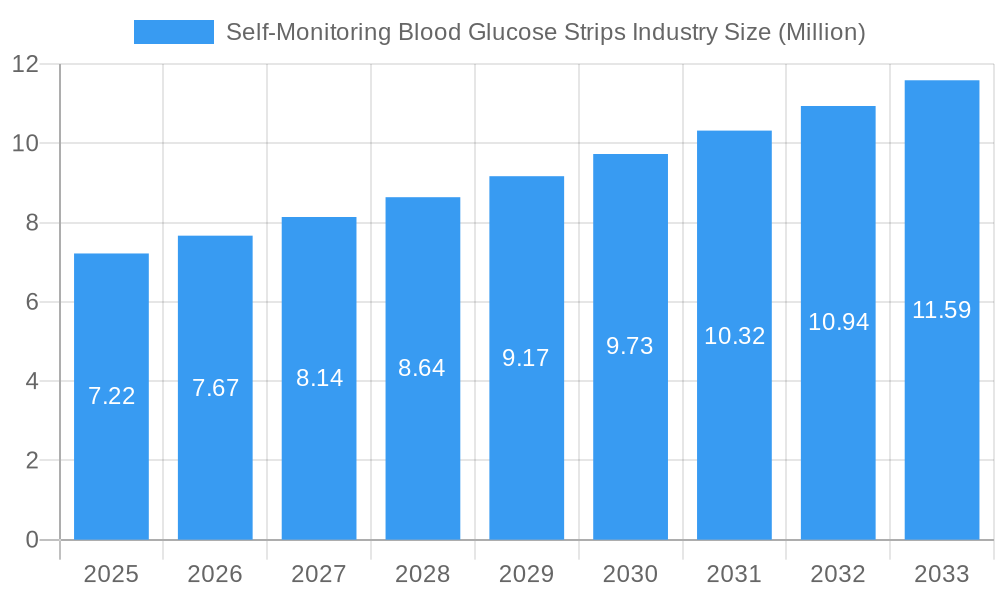

The global Self-Monitoring Blood Glucose Strips market is poised for robust expansion, with an estimated market size of 7.22 Million in 2025. This growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 6.23% over the forecast period of 2025-2033. A significant driver for this sustained increase is the escalating prevalence of diabetes worldwide, coupled with an increased awareness and adoption of self-management practices among diabetic patients. The rising demand for convenient and accessible blood glucose monitoring solutions, especially in home settings, further bolsters the market. Technological advancements in glucometer devices and the introduction of more accurate and user-friendly test strips are also contributing to market penetration. The increasing focus on preventative healthcare and early disease detection, particularly in emerging economies, presents substantial opportunities for market players.

Self-Monitoring Blood Glucose Strips Industry Market Size (In Million)

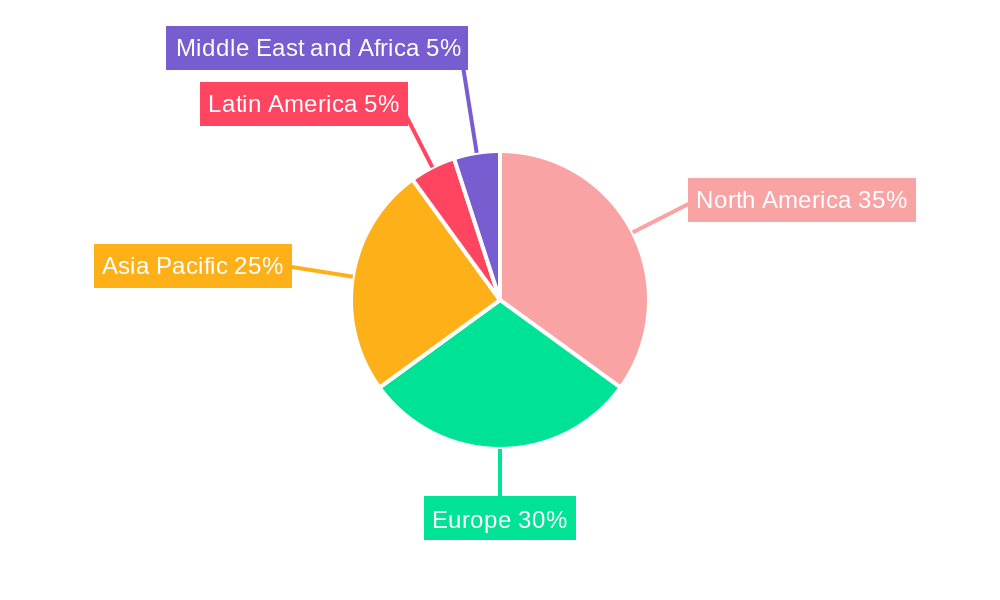

The market for self-monitoring blood glucose strips can be segmented into key components: Glucometer Devices, Test Strips, and Lancets. Among these, Test Strips represent a dominant segment due to their recurring purchase nature, directly linked to the continuous monitoring needs of individuals with diabetes. Key industry players such as Roche Diabetes Care, Abbott Diabetes Care, and LifeScan are actively innovating and expanding their product portfolios to cater to diverse consumer needs and preferences. The market is geographically segmented, with North America and Europe currently holding significant shares due to established healthcare infrastructures and higher rates of diabetes diagnosis. However, the Asia Pacific region is expected to witness the fastest growth, driven by a large and growing diabetic population, improving healthcare access, and increasing disposable incomes. Restraints such as the high cost of some advanced monitoring systems and the growing adoption of continuous glucose monitoring (CGM) devices, which may reduce reliance on traditional strips in the long term, are factors that market participants need to address.

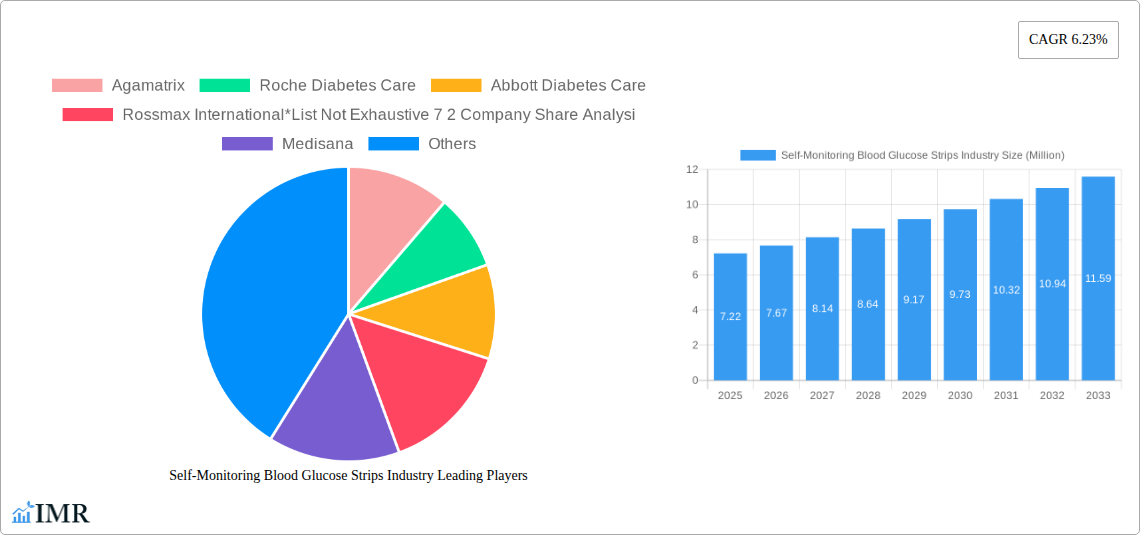

Self-Monitoring Blood Glucose Strips Industry Company Market Share

This comprehensive report provides an in-depth analysis of the global Self-Monitoring Blood Glucose Strips Market. Delve into the intricate dynamics, growth trajectories, and competitive landscape of this vital sector, essential for understanding diabetes management and the healthcare industry.

Self-Monitoring Blood Glucose Strips Industry Market Dynamics & Structure

The Self-Monitoring Blood Glucose (SMBG) strips market exhibits a moderate to high concentration, with key players like Abbott Diabetes Care, Roche Diabetes Care, and LifeScan holding significant market shares. Technological innovation remains a primary driver, focusing on enhanced accuracy, user-friendliness, and connectivity of SMBG devices. Regulatory frameworks, particularly those from bodies like the FDA and EMA, play a crucial role in product approval and market access, influencing product development timelines and market entry strategies. The competitive landscape is characterized by ongoing product innovation, with a constant push for less invasive testing methods and integrated digital health solutions.

- Market Concentration: Dominated by a few large corporations, but with a growing presence of specialized manufacturers.

- Technological Innovation: Driven by advancements in sensor technology, miniaturization, and integration with mobile health applications.

- Regulatory Frameworks: Strict adherence to quality and efficacy standards is paramount for market approval.

- Competitive Product Substitutes: Emerging technologies like Continuous Glucose Monitoring (CGM) present a significant, albeit different, alternative.

- End-User Demographics: An aging global population and rising prevalence of diabetes are key demand drivers.

- M&A Trends: Strategic acquisitions are observed as larger players aim to expand their product portfolios and market reach.

Self-Monitoring Blood Glucose Strips Industry Growth Trends & Insights

The global Self-Monitoring Blood Glucose Strips market is projected for robust growth, fueled by the escalating global prevalence of diabetes and advancements in testing technologies. The market is expected to expand significantly from its current valuation, with an anticipated Compound Annual Growth Rate (CAGR) of approximately 6.8% during the forecast period of 2025–2033. This expansion is underpinned by increasing healthcare expenditure, growing awareness about diabetes management, and the continuous development of more accurate, user-friendly, and affordable SMBG devices.

The adoption rate of SMBG devices, particularly in emerging economies, is steadily increasing. This trend is supported by government initiatives aimed at improving diabetes care infrastructure and wider health insurance coverage. Technological disruptions are a constant theme, with manufacturers actively integrating Bluetooth connectivity, mobile app synchronization, and data analytics capabilities into their product offerings. This allows for better patient engagement, remote monitoring by healthcare providers, and more personalized treatment plans.

Consumer behavior shifts are also playing a pivotal role. Patients are increasingly seeking convenient, less painful, and more data-rich blood glucose monitoring solutions. The demand for strips compatible with advanced glucometers that offer features like larger memory, wider hematocrit ranges, and faster test results is on the rise. Furthermore, the integration of SMBG data with broader digital health ecosystems is empowering individuals to take a more proactive role in managing their diabetes, leading to improved glycemic control and a reduction in diabetes-related complications. The market is witnessing a transition from basic glucose meters to more sophisticated systems that provide comprehensive diabetes management solutions. The market size is expected to reach USD XX Billion by 2033, up from approximately USD YY Billion in 2025.

Dominant Regions, Countries, or Segments in Self-Monitoring Blood Glucose Strips Industry

The Test Strips segment within the Self-Monitoring Blood Glucose (SMBG) industry is the undisputed driver of market growth and dominance. This segment consistently accounts for the largest market share, estimated at over 65% of the total SMBG market value. The primary reason for this dominance lies in the fundamental requirement of test strips for any SMBG device; they are the consumable component essential for every blood glucose measurement. Without test strips, glucometers are rendered inoperable, creating a perpetual demand.

North America, particularly the United States, currently leads in terms of market value and penetration for SMBG test strips. This leadership is attributed to several factors:

- High Prevalence of Diabetes: The US has one of the highest rates of diagnosed and undiagnosed diabetes globally, creating a substantial patient pool requiring regular blood glucose monitoring.

- Advanced Healthcare Infrastructure: Robust healthcare systems, widespread health insurance coverage, and advanced diagnostic and treatment facilities facilitate early diagnosis and consistent management of diabetes.

- Technological Adoption: Consumers in North America are early adopters of new technologies, readily embracing connected glucometers and digital health solutions that often rely on advanced test strips.

- Reimbursement Policies: Favorable reimbursement policies for diabetes management supplies, including test strips, contribute to higher accessibility and demand.

However, the Asia-Pacific region is emerging as the fastest-growing market for SMBG test strips. Key drivers for this rapid expansion include:

- Rising Diabetes Incidence: A significant increase in diabetes cases across countries like China, India, and Southeast Asian nations due to lifestyle changes and an aging population.

- Improving Healthcare Access: Growing investments in healthcare infrastructure and increasing disposable incomes are making diabetes management solutions more accessible.

- Government Initiatives: Public health campaigns and government programs focused on diabetes awareness and prevention are boosting demand for monitoring devices and consumables.

- Favorable Market Dynamics: The presence of a large, price-sensitive population also drives demand for cost-effective SMBG test strips.

The dominance of the test strips segment is further reinforced by ongoing innovation. Manufacturers are continually developing strips with improved accuracy, reduced blood sample requirements, and enhanced shelf life. Furthermore, the integration of test strips with smart glucometers and mobile applications for seamless data tracking and analysis is transforming the landscape, solidifying their position as the core component driving the SMBG market.

Self-Monitoring Blood Glucose Strips Industry Product Landscape

The SMBG test strips product landscape is characterized by a relentless pursuit of accuracy, convenience, and integration. Innovations focus on minimizing the required blood sample volume, reducing pain during sample collection, and ensuring faster, more reliable glucose readings. Modern test strips are designed with advanced enzyme technologies to prevent interference from common substances, thereby enhancing diagnostic precision. Furthermore, their integration with Bluetooth-enabled glucometers and companion mobile applications facilitates seamless data logging, trend analysis, and sharing with healthcare providers, empowering users with comprehensive diabetes management tools.

Key Drivers, Barriers & Challenges in Self-Monitoring Blood Glucose Strips Industry

Key Drivers:

- Rising Global Diabetes Prevalence: The escalating incidence of Type 1 and Type 2 diabetes worldwide is the primary catalyst for SMBG strip demand.

- Technological Advancements: Development of more accurate, user-friendly, and connected SMBG devices and associated strips.

- Increasing Healthcare Expenditure: Growing investments in diabetes management and monitoring solutions by governments and private entities.

- Growing Awareness and Education: Enhanced patient and healthcare provider understanding of the importance of regular blood glucose monitoring.

Barriers & Challenges:

- High Cost of Test Strips: The recurring cost of test strips can be a significant financial burden for many patients, especially in developing economies.

- Competition from Continuous Glucose Monitoring (CGM): The increasing adoption of CGM systems presents a competitive alternative, potentially impacting the demand for traditional test strips.

- Regulatory Hurdles: Stringent approval processes for new test strip technologies and devices can delay market entry.

- Reimbursement Policies: Inconsistent and restrictive reimbursement policies in some regions can limit patient access to advanced SMBG solutions.

- Supply Chain Disruptions: Geopolitical events and manufacturing complexities can lead to shortages and price volatility of essential raw materials for test strips.

Emerging Opportunities in Self-Monitoring Blood Glucose Strips Industry

Emerging opportunities in the SMBG strips industry lie in the development of highly integrated "smart" monitoring systems that combine advanced test strips with sophisticated algorithms and AI-driven insights. There's a significant untapped market in providing affordable, high-quality SMBG solutions to emerging economies, where the diabetes burden is rapidly growing. Innovative applications, such as strips designed for specific patient populations (e.g., neonates, critically ill patients) or integrated with advanced diagnostic capabilities beyond glucose measurement, also present promising avenues for growth. Evolving consumer preferences lean towards data-driven health management, creating demand for strips that seamlessly feed into comprehensive digital health platforms.

Growth Accelerators in the Self-Monitoring Blood Glucose Strips Industry Industry

Long-term growth in the SMBG strips industry will be propelled by sustained technological breakthroughs in biosensor technology, leading to even more accurate and less invasive testing methods. Strategic partnerships between SMBG device manufacturers and digital health platform providers will be crucial for creating integrated ecosystems that offer enhanced patient support and remote monitoring capabilities. Market expansion strategies, particularly focusing on underserved populations and emerging markets with a high diabetes burden, will unlock significant growth potential. Furthermore, the ongoing trend of personalized medicine will drive the demand for SMBG solutions that can provide highly individualized glycemic insights, further accelerating market penetration.

Key Players Shaping the Self-Monitoring Blood Glucose Strips Industry Market

- Agamatrix

- Roche Diabetes Care

- Abbott Diabetes Care

- Rossmax International

- Medisana

- Acon

- Bionime Corporation

- Arkray

- LifeScan

- Ascensia Diabetes Care

Notable Milestones in Self-Monitoring Blood Glucose Strips Industry Sector

- April 2023: NHS England released recommendations for commissioning after the national evaluation of blood glucose meters, testing strips, and lancets, influencing procurement and product standards within the UK.

- June 2022: LifeScan announced that the peer-reviewed journal Diabetes Technology and Therapeutics (DTT) published Real World Evidence of Improved Glycemic Control in People with Diabetes. This highlighted the effectiveness of using Bluetooth-connected blood glucose meters with mobile diabetes management applications, such as the OneTouch Reveal mobile app with the OneTouch Verio Reflect meter, synced via Bluetooth wireless technology, in supporting better glycemic control for individuals with diabetes.

In-Depth Self-Monitoring Blood Glucose Strips Industry Market Outlook

The future outlook for the Self-Monitoring Blood Glucose Strips industry is exceptionally positive, driven by a confluence of strong growth accelerators. The persistent and escalating global prevalence of diabetes, coupled with increasing healthcare investments, ensures a foundational demand for SMBG solutions. Technological breakthroughs, particularly in areas like microfluidics and advanced enzyme chemistry, promise to deliver strips with enhanced accuracy, speed, and minimal invasiveness. Strategic partnerships will be pivotal in integrating SMBG data into comprehensive digital health ecosystems, fostering improved patient engagement and remote care capabilities. As market penetration deepens in emerging economies and personalized diabetes management gains traction, the SMBG strips market is poised for sustained expansion and innovation, solidifying its crucial role in global diabetes care.

Self-Monitoring Blood Glucose Strips Industry Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

Self-Monitoring Blood Glucose Strips Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Philippines

- 3.10. Vietnam

- 3.11. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Oman

- 5.4. Egypt

- 5.5. Iran

- 5.6. Rest of Middle East and Africa

Self-Monitoring Blood Glucose Strips Industry Regional Market Share

Geographic Coverage of Self-Monitoring Blood Glucose Strips Industry

Self-Monitoring Blood Glucose Strips Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. The glucometer devices segment is expected to register the highest CAGR over the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Glucometer Devices

- 6.1.2. Test Strips

- 6.1.3. Lancets

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Glucometer Devices

- 7.1.2. Test Strips

- 7.1.3. Lancets

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Glucometer Devices

- 8.1.2. Test Strips

- 8.1.3. Lancets

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Glucometer Devices

- 9.1.2. Test Strips

- 9.1.3. Lancets

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Glucometer Devices

- 10.1.2. Test Strips

- 10.1.3. Lancets

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Agamatrix

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Roche Diabetes Care

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abbott Diabetes Care

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rossmax International*List Not Exhaustive 7 2 Company Share Analysi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medisana

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Acon

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bionime Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arkray

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LifeScan

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ascensia Diabetes Care

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Agamatrix

List of Figures

- Figure 1: Global Self-Monitoring Blood Glucose Strips Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 7: Europe Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 8: Europe Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 15: Latin America Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Latin America Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 9: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Japan Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Malaysia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Thailand Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Philippines Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 31: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Mexico Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 36: Global Self-Monitoring Blood Glucose Strips Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: South Africa Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oman Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Egypt Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Iran Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Self-Monitoring Blood Glucose Strips Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-Monitoring Blood Glucose Strips Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Self-Monitoring Blood Glucose Strips Industry?

Key companies in the market include Agamatrix, Roche Diabetes Care, Abbott Diabetes Care, Rossmax International*List Not Exhaustive 7 2 Company Share Analysi, Medisana, Acon, Bionime Corporation, Arkray, LifeScan, Ascensia Diabetes Care.

3. What are the main segments of the Self-Monitoring Blood Glucose Strips Industry?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

The glucometer devices segment is expected to register the highest CAGR over the forecast period.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

April 2023: NHS england relased recommendations for commissioning after the national evaluation of blood glucose meters, testing strips, and lancets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-Monitoring Blood Glucose Strips Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-Monitoring Blood Glucose Strips Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-Monitoring Blood Glucose Strips Industry?

To stay informed about further developments, trends, and reports in the Self-Monitoring Blood Glucose Strips Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence