Key Insights

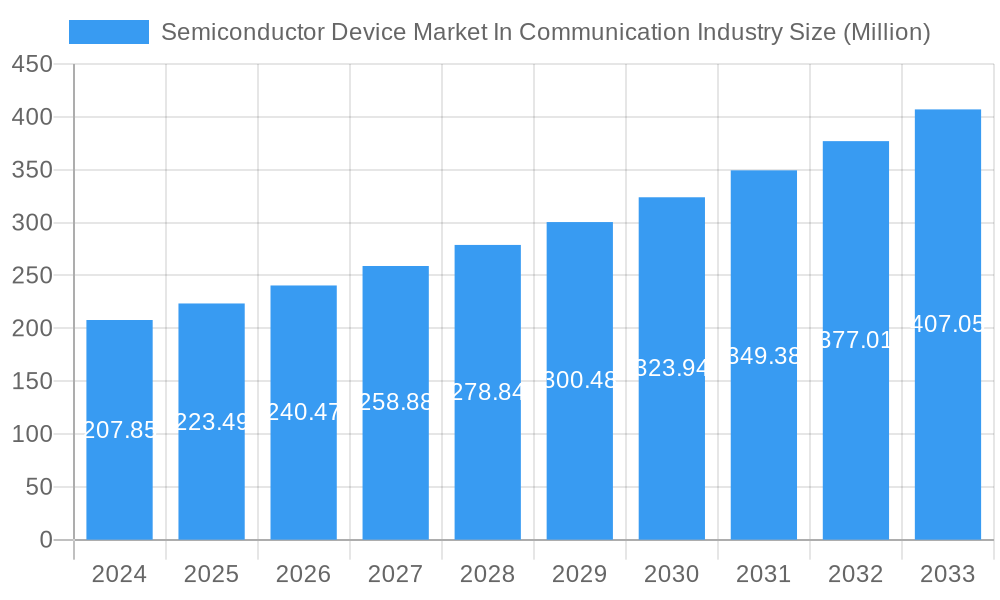

The Semiconductor Device Market within the Communication Industry is poised for robust expansion, projected to reach a substantial market size of $223.49 million. This growth will be propelled by a compelling Compound Annual Growth Rate (CAGR) of 7.50% from 2019 to 2033, indicating a sustained and dynamic trajectory. A primary driver for this surge is the ever-increasing demand for faster, more efficient, and reliable communication technologies. The proliferation of 5G and the anticipated rollout of 6G networks are fundamentally reshaping the communication landscape, necessitating advanced semiconductor solutions for base stations, mobile devices, and network infrastructure. Furthermore, the burgeoning Internet of Things (IoT) ecosystem, with its vast array of connected devices generating immense data volumes, relies heavily on sophisticated semiconductors for processing, connectivity, and sensing. Cloud computing and data center expansion also contribute significantly, requiring high-performance integrated circuits for data storage, processing, and networking.

Semiconductor Device Market In Communication Industry Market Size (In Million)

Key trends shaping this market include the miniaturization of devices, leading to smaller and more powerful semiconductor components, and the growing emphasis on power efficiency to support battery-powered devices and reduce operational costs in large-scale deployments. The evolution towards heterogeneous integration, where different types of semiconductor components are combined within a single package, is another critical trend enabling enhanced performance and functionality. While the market benefits from strong demand, it also faces certain restraints. Supply chain disruptions, geopolitical tensions impacting manufacturing and trade, and the significant capital investment required for R&D and fabrication facilities can pose challenges. However, the relentless pursuit of innovation and the critical role of semiconductors in enabling modern communication infrastructure suggest that these restraints are likely to be navigated through strategic investments and technological advancements. The market is segmented across various device types, including Discrete Semiconductors, Optoelectronics, Sensors, and a wide array of Integrated Circuits such as Analog, Logic, Memory, and Microprocessors (MPU), Microcontrollers (MCU), and Digital Signal Processors, each catering to specific communication needs.

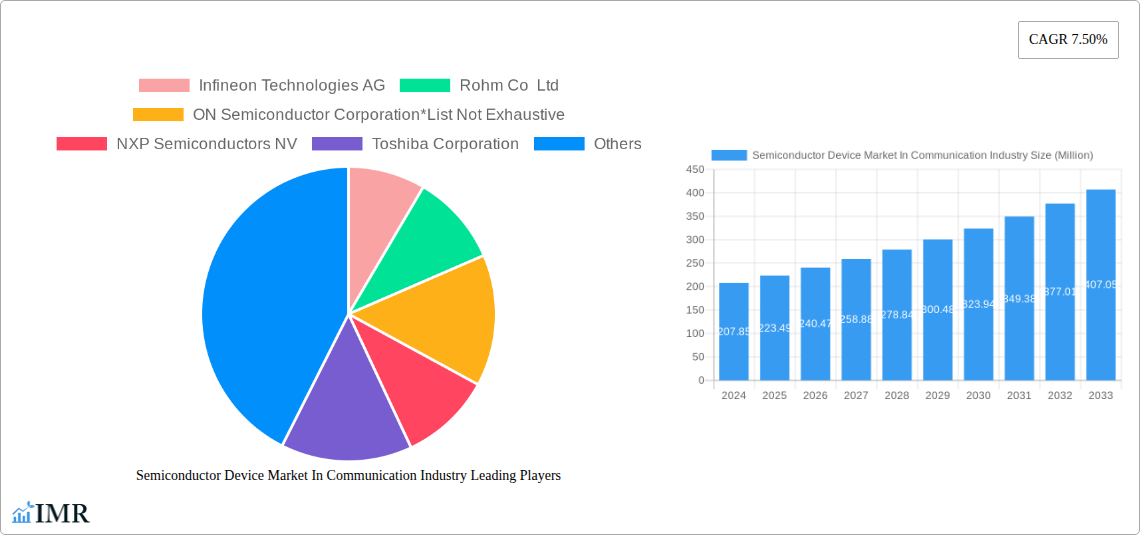

Semiconductor Device Market In Communication Industry Company Market Share

Semiconductor Device Market In Communication Industry: Comprehensive Market Analysis & Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the Semiconductor Device Market in the Communication Industry. Covering historical trends, current dynamics, and future projections from 2019 to 2033, this research is an indispensable resource for stakeholders seeking to understand market evolution, identify growth opportunities, and navigate competitive landscapes. The report meticulously examines parent and child market segments, device types, and industry developments, offering actionable insights for strategic decision-making. All values are presented in Million Units.

Semiconductor Device Market In Communication Industry Market Dynamics & Structure

The semiconductor device market within the communication industry is characterized by a moderately concentrated structure, with key players like Intel Corporation, Taiwan Semiconductor Manufacturing Company (TSMC) Limited, and Samsung Electronics Co. Ltd. dominating global fabrication and design. Technological innovation remains the primary driver, fueled by the relentless demand for faster data transfer, increased bandwidth, and more efficient power consumption in 5G, IoT, and next-generation communication networks. Regulatory frameworks, particularly concerning supply chain security and intellectual property, play a crucial role in shaping market entry and operational strategies. The competitive landscape features a continuous stream of advanced product substitutes, from next-gen AI accelerators to specialized communication ICs, challenging incumbent offerings. End-user demographics are increasingly sophisticated, demanding personalized and seamless connectivity across various devices and platforms. Mergers and acquisitions (M&A) are prevalent, with significant deal volumes aimed at consolidating market share, acquiring cutting-edge technologies, and expanding geographical reach. For instance, the acquisition of Xilinx Inc. by AMD underscores the trend of integrating advanced processing capabilities with communication technologies. Barriers to innovation are primarily related to the immense capital investment required for R&D and advanced manufacturing, alongside the increasing complexity of semiconductor design and fabrication processes.

- Market Concentration: Moderate to High, with a few dominant players in fabrication and design.

- Technological Innovation Drivers: Demand for 5G, IoT, AI integration, higher data speeds, and energy efficiency.

- Regulatory Frameworks: Focus on supply chain resilience, data security, and trade policies.

- Competitive Product Substitutes: Constant evolution of specialized ICs and integrated solutions.

- End-User Demographics: Growing demand for ubiquitous, high-performance, and personalized connectivity.

- M&A Trends: Strategic acquisitions to enhance technological portfolios and market presence.

Semiconductor Device Market In Communication Industry Growth Trends & Insights

The semiconductor device market in the communication industry is poised for substantial growth, driven by an exponential increase in data consumption and the widespread adoption of advanced communication technologies. The market size is projected to expand significantly over the forecast period (2025–2033), reflecting a robust Compound Annual Growth Rate (CAGR). This expansion is largely attributed to the ongoing rollout of 5G networks globally, which necessitates a vast array of high-performance semiconductor components, including advanced integrated circuits like microprocessors and digital signal processors, as well as specialized optoelectronics for optical communication. The burgeoning Internet of Things (IoT) ecosystem further fuels demand for sensors and low-power microcontrollers, enabling smart devices and connected infrastructure across industries such as smart homes, industrial automation, and healthcare.

Technological disruptions, such as the development of AI-powered chipsets and advancements in materials science leading to more efficient and smaller semiconductor designs, are reshaping the market. Consumer behavior shifts towards increased reliance on seamless and high-speed connectivity for entertainment, communication, and productivity are creating sustained demand. The market penetration of advanced communication devices, from smartphones and tablets to enterprise networking equipment and satellite communication systems, continues to deepen. Strategic investments in research and development by major players, including Qualcomm Incorporated and Broadcom Inc., are crucial for sustaining this growth trajectory. Furthermore, the increasing complexity and performance requirements of data centers, which are the backbone of cloud computing and data analytics, are driving demand for high-density memory and advanced logic devices from companies like Micron Technology Inc. and SK Hynix Inc. The evolution of the telecommunications infrastructure, including the upgrade of fiber optic networks and the development of new wireless communication standards, will continue to be a primary catalyst for market expansion. The demand for customized semiconductor solutions for specific communication applications, such as specialized chips for satellite communications or next-generation Wi-Fi standards, will also contribute to market diversification and growth.

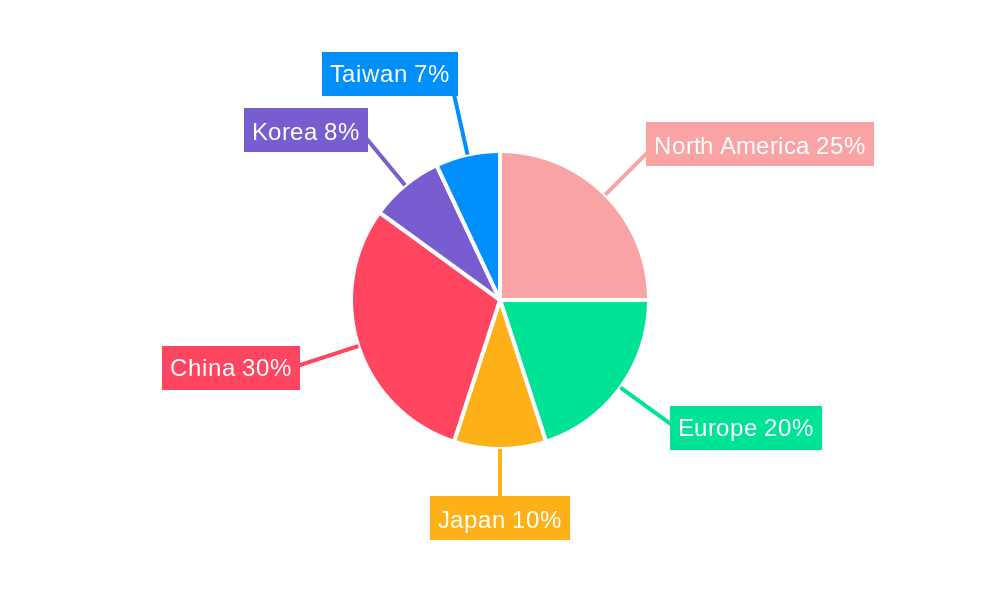

Dominant Regions, Countries, or Segments in Semiconductor Device Market In Communication Industry

The Integrated Circuits (ICs) segment stands as the dominant force driving growth within the Semiconductor Device Market in the Communication Industry. This dominance is underpinned by the foundational role ICs play in virtually every communication technology, from the most sophisticated telecommunications infrastructure to the simplest end-user devices. Within the IC segment, Logic and Micro (comprising Microprocessors (MPU), Microcontrollers (MCU), and Digital Signal Processors (DSP)) are particularly instrumental, enabling the complex processing, control, and signal manipulation essential for modern communication. The rapid proliferation of 5G networks, the expansion of the Internet of Things (IoT) ecosystem, and the increasing integration of Artificial Intelligence (AI) in communication devices are the primary economic policies and infrastructure drivers fueling this segment's growth.

Asia Pacific, particularly countries like Taiwan, South Korea, and China, emerges as the leading region and country driving market growth. Taiwan's unparalleled leadership in advanced semiconductor manufacturing, spearheaded by Taiwan Semiconductor Manufacturing Company (TSMC) Limited, provides the foundational capacity for the global industry. South Korea's strength in memory and leading-edge logic fabrication, with SK Hynix Inc. and Samsung Electronics Co. Ltd. at the forefront, further bolsters the region's dominance. China’s significant investment in domestic semiconductor production and its massive consumer market create substantial demand. Economic policies focused on fostering domestic semiconductor industries and substantial investments in R&D and infrastructure have created a fertile ground for growth. The region's robust manufacturing capabilities, coupled with its position as a major consumer of communication devices and infrastructure, solidify its leading status.

- Dominant Segment: Integrated Circuits (ICs)

- Key Sub-segments: Logic, Micro (MPU, MCU, DSP)

- Drivers: 5G deployment, IoT expansion, AI integration, advanced networking.

- Dominant Region: Asia Pacific

- Key Countries: Taiwan, South Korea, China

- Dominance Factors: Advanced manufacturing capabilities (TSMC), memory leadership (Samsung, SK Hynix), large consumer markets, government support for semiconductor industry.

- Growth Potential: Continued expansion of 5G, increasing adoption of IoT devices, and the development of advanced AI communication applications.

Semiconductor Device Market In Communication Industry Product Landscape

The product landscape is defined by relentless innovation and increasing specialization. Integrated Circuits (ICs) are at the forefront, with advanced processors and microcontrollers powering everything from next-generation smartphones to complex base stations. Optoelectronics are critical for high-speed data transmission in fiber optic networks, while sophisticated sensors enable a new generation of smart, connected devices. Product performance metrics are continually being pushed, with a focus on higher speeds, lower power consumption, and increased integration density. Unique selling propositions lie in the ability of these semiconductor devices to enable new communication functionalities, enhance network efficiency, and deliver superior user experiences, catering to the ever-growing demands of the global communication industry.

Key Drivers, Barriers & Challenges in Semiconductor Device Market In Communication Industry

Key Drivers:

- Technological Advancements: The continuous development of 5G, Wi-Fi 6/6E, and emerging wireless technologies drives demand for high-performance semiconductors. The growth of the Internet of Things (IoT) ecosystem necessitates specialized, low-power, and connected semiconductor solutions. Integration of AI and machine learning into communication devices requires sophisticated processing capabilities.

- Economic Growth & Digital Transformation: Global economic expansion and the ongoing digital transformation across industries fuel the demand for enhanced communication infrastructure and devices.

- Government Initiatives & Investments: Supportive government policies, subsidies, and R&D investments in the semiconductor sector, particularly in regions like Asia Pacific, accelerate innovation and production.

Barriers & Challenges:

- Supply Chain Volatility: Geopolitical tensions, natural disasters, and unforeseen events can disrupt the complex global semiconductor supply chain, leading to shortages and price fluctuations.

- High R&D and Manufacturing Costs: The capital-intensive nature of semiconductor research, development, and advanced fabrication requires substantial investment, creating high entry barriers.

- Talent Shortage: A global shortage of skilled engineers and technicians in semiconductor design, manufacturing, and research poses a significant challenge to industry growth.

- Increasing Complexity: The miniaturization of components and the integration of multiple functionalities lead to increasingly complex designs, requiring advanced expertise and rigorous testing.

- Geopolitical Risks: Trade disputes and national security concerns can impact global market access and international collaboration in the semiconductor industry.

Emerging Opportunities in Semiconductor Device Market In Communication Industry

Emerging opportunities lie in the continued expansion of the 5G ecosystem beyond consumer devices, including industrial 5G private networks and critical infrastructure communication. The burgeoning metaverse and augmented/virtual reality (AR/VR) applications will create a significant demand for high-bandwidth, low-latency communication chips and advanced processors. The ongoing evolution of satellite communication technology for global connectivity presents another vast untapped market. Furthermore, the increasing focus on energy-efficient semiconductors for sustainable communication networks offers a significant avenue for innovation and market penetration. The demand for specialized semiconductors for edge computing, enabling localized data processing and reducing reliance on centralized cloud infrastructure, is also a rapidly growing opportunity.

Growth Accelerators in the Semiconductor Device Market In Communication Industry Industry

The long-term growth of the semiconductor device market in the communication industry is propelled by transformative technological breakthroughs, such as the development of next-generation chip architectures, advancements in materials science for enhanced performance, and the ongoing innovation in AI and machine learning integration. Strategic partnerships between semiconductor manufacturers, telecommunications providers, and device manufacturers are crucial for accelerating product development cycles and ensuring market adoption. Market expansion strategies, including geographical diversification into emerging economies and the development of tailored solutions for specific vertical industries (e.g., automotive, healthcare, industrial automation), will further fuel sustained growth. The increasing demand for secure and reliable communication networks will also drive innovation in areas like quantum computing-enabled encryption and advanced cybersecurity solutions within semiconductor design.

Key Players Shaping the Semiconductor Device Market In Communication Industry Market

- Infineon Technologies AG

- Rohm Co Ltd

- ON Semiconductor Corporation

- NXP Semiconductors NV

- Toshiba Corporation

- Micron Technology Inc

- Kyocera Corporation

- Xilinx Inc

- Texas Instruments Inc

- STMicroelectronics

- Broadcom Inc

- Samsung electronics co ltd

- Qualcomm Incorporated

- Renesas Electronics Corporation

- SK Hynix Inc

- Advanced Semiconductor Engineering Inc

- Nvidia Corporation

- Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- Intel Corporation

- Fujitsu Semiconductor Ltd

Notable Milestones in Semiconductor Device Market In Communication Industry Sector

- June 2022: Micron Technology Inc. launched the world's inaugural 176-layer NAND SATA SSD, tailored specifically for data center workloads. The Micron 5400 SATA SSD stands as a pinnacle of innovation in the realm of data center SATA SSDs. Leveraging the power of the 11th-generation SATA architecture, this SSD offers a wide range of applications, delivers significantly enhanced performance, and prolongs the lifespan of SATA platforms.

- January 2022: Toshiba Electronic Devices and Storage Corporation revealed its latest development, introducing the TC9563XBG Ethernet bridge IC, designed to facilitate 10 Gbps communications in automotive information systems and industrial equipment. This marks a significant milestone for Toshiba, as it represents their first foray into the world of 2-port 10Gbps Ethernet interfaces integrated into a bridge IC. Users can select their preferred interface from a choice of USXGMII, XFI, SGMII, and RGMII. These dual ports are equipped to support Ethernet AVB and TSN, enabling real-time and synchronous data processing.

In-Depth Semiconductor Device Market In Communication Industry Market Outlook

The semiconductor device market in the communication industry is set for a period of dynamic growth and innovation. Key growth accelerators include the ongoing global expansion of 5G infrastructure, the proliferation of smart connected devices driven by IoT, and the increasing demand for higher processing power and data handling capabilities in cloud computing and edge AI applications. Strategic investments in advanced manufacturing technologies and R&D by leading players will continue to push the boundaries of semiconductor performance and efficiency. The market’s future potential is immense, driven by the relentless pursuit of enhanced connectivity, faster data speeds, and more intelligent communication systems across all sectors of the economy. Emerging opportunities in areas like immersive technologies, secure communication networks, and sustainable electronics will further solidify its trajectory as a critical enabler of the digital future.

Semiconductor Device Market In Communication Industry Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessors (MPU)

- 1.4.4.2. Microcontrollers (MCU)

- 1.4.4.3. Digital Signal Processor

Semiconductor Device Market In Communication Industry Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. Korea

- 6. Taiwan

Semiconductor Device Market In Communication Industry Regional Market Share

Geographic Coverage of Semiconductor Device Market In Communication Industry

Semiconductor Device Market In Communication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 5G Technology

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions Resulting in Semiconductor Chip Shortage

- 3.4. Market Trends

- 3.4.1. Growing Adoption of 5G Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Device Market In Communication Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessors (MPU)

- 5.1.4.4.2. Microcontrollers (MCU)

- 5.1.4.4.3. Digital Signal Processor

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. Korea

- 5.2.6. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States Semiconductor Device Market In Communication Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Discrete Semiconductors

- 6.1.2. Optoelectronics

- 6.1.3. Sensors

- 6.1.4. Integrated Circuits

- 6.1.4.1. Analog

- 6.1.4.2. Logic

- 6.1.4.3. Memory

- 6.1.4.4. Micro

- 6.1.4.4.1. Microprocessors (MPU)

- 6.1.4.4.2. Microcontrollers (MCU)

- 6.1.4.4.3. Digital Signal Processor

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Semiconductor Device Market In Communication Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Discrete Semiconductors

- 7.1.2. Optoelectronics

- 7.1.3. Sensors

- 7.1.4. Integrated Circuits

- 7.1.4.1. Analog

- 7.1.4.2. Logic

- 7.1.4.3. Memory

- 7.1.4.4. Micro

- 7.1.4.4.1. Microprocessors (MPU)

- 7.1.4.4.2. Microcontrollers (MCU)

- 7.1.4.4.3. Digital Signal Processor

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Japan Semiconductor Device Market In Communication Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Discrete Semiconductors

- 8.1.2. Optoelectronics

- 8.1.3. Sensors

- 8.1.4. Integrated Circuits

- 8.1.4.1. Analog

- 8.1.4.2. Logic

- 8.1.4.3. Memory

- 8.1.4.4. Micro

- 8.1.4.4.1. Microprocessors (MPU)

- 8.1.4.4.2. Microcontrollers (MCU)

- 8.1.4.4.3. Digital Signal Processor

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. China Semiconductor Device Market In Communication Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Discrete Semiconductors

- 9.1.2. Optoelectronics

- 9.1.3. Sensors

- 9.1.4. Integrated Circuits

- 9.1.4.1. Analog

- 9.1.4.2. Logic

- 9.1.4.3. Memory

- 9.1.4.4. Micro

- 9.1.4.4.1. Microprocessors (MPU)

- 9.1.4.4.2. Microcontrollers (MCU)

- 9.1.4.4.3. Digital Signal Processor

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Korea Semiconductor Device Market In Communication Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Discrete Semiconductors

- 10.1.2. Optoelectronics

- 10.1.3. Sensors

- 10.1.4. Integrated Circuits

- 10.1.4.1. Analog

- 10.1.4.2. Logic

- 10.1.4.3. Memory

- 10.1.4.4. Micro

- 10.1.4.4.1. Microprocessors (MPU)

- 10.1.4.4.2. Microcontrollers (MCU)

- 10.1.4.4.3. Digital Signal Processor

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Taiwan Semiconductor Device Market In Communication Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. Discrete Semiconductors

- 11.1.2. Optoelectronics

- 11.1.3. Sensors

- 11.1.4. Integrated Circuits

- 11.1.4.1. Analog

- 11.1.4.2. Logic

- 11.1.4.3. Memory

- 11.1.4.4. Micro

- 11.1.4.4.1. Microprocessors (MPU)

- 11.1.4.4.2. Microcontrollers (MCU)

- 11.1.4.4.3. Digital Signal Processor

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Infineon Technologies AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Rohm Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ON Semiconductor Corporation*List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 NXP Semiconductors NV

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Toshiba Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Micron Technology Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Kyocera Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Xilinx Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Texas Instruments Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 STMicroelectronics

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Broadcom Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Samsung electronics co ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Qualcomm Incorporated

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Renesas Electronics Corporation

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 SK Hynix Inc

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Advanced Semiconductor Engineering Inc

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Nvidia Corporation

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Intel Corporation

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Fujitsu Semiconductor Ltd

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Semiconductor Device Market In Communication Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United States Semiconductor Device Market In Communication Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 3: United States Semiconductor Device Market In Communication Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 4: United States Semiconductor Device Market In Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: United States Semiconductor Device Market In Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Semiconductor Device Market In Communication Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 7: Europe Semiconductor Device Market In Communication Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 8: Europe Semiconductor Device Market In Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Semiconductor Device Market In Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Japan Semiconductor Device Market In Communication Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 11: Japan Semiconductor Device Market In Communication Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 12: Japan Semiconductor Device Market In Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Japan Semiconductor Device Market In Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: China Semiconductor Device Market In Communication Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 15: China Semiconductor Device Market In Communication Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 16: China Semiconductor Device Market In Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: China Semiconductor Device Market In Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Korea Semiconductor Device Market In Communication Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 19: Korea Semiconductor Device Market In Communication Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 20: Korea Semiconductor Device Market In Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Korea Semiconductor Device Market In Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Taiwan Semiconductor Device Market In Communication Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 23: Taiwan Semiconductor Device Market In Communication Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 24: Taiwan Semiconductor Device Market In Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Taiwan Semiconductor Device Market In Communication Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 4: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 8: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 10: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 12: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: Global Semiconductor Device Market In Communication Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Device Market In Communication Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Semiconductor Device Market In Communication Industry?

Key companies in the market include Infineon Technologies AG, Rohm Co Ltd, ON Semiconductor Corporation*List Not Exhaustive, NXP Semiconductors NV, Toshiba Corporation, Micron Technology Inc, Kyocera Corporation, Xilinx Inc, Texas Instruments Inc, STMicroelectronics, Broadcom Inc, Samsung electronics co ltd, Qualcomm Incorporated, Renesas Electronics Corporation, SK Hynix Inc, Advanced Semiconductor Engineering Inc, Nvidia Corporation, Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Intel Corporation, Fujitsu Semiconductor Ltd.

3. What are the main segments of the Semiconductor Device Market In Communication Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 223.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 5G Technology.

6. What are the notable trends driving market growth?

Growing Adoption of 5G Technology.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions Resulting in Semiconductor Chip Shortage.

8. Can you provide examples of recent developments in the market?

June 2022: Micron Technology Inc. launched the world's inaugural 176-layer NAND SATA SSD, tailored specifically for data center workloads. The Micron 5400 SATA SSD stands as a pinnacle of innovation in the realm of data center SATA SSDs. Leveraging the power of the 11th-generation SATA architecture, this SSD offers a wide range of applications, delivers significantly enhanced performance, and prolongs the lifespan of SATA platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Device Market In Communication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Device Market In Communication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Device Market In Communication Industry?

To stay informed about further developments, trends, and reports in the Semiconductor Device Market In Communication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence