Key Insights

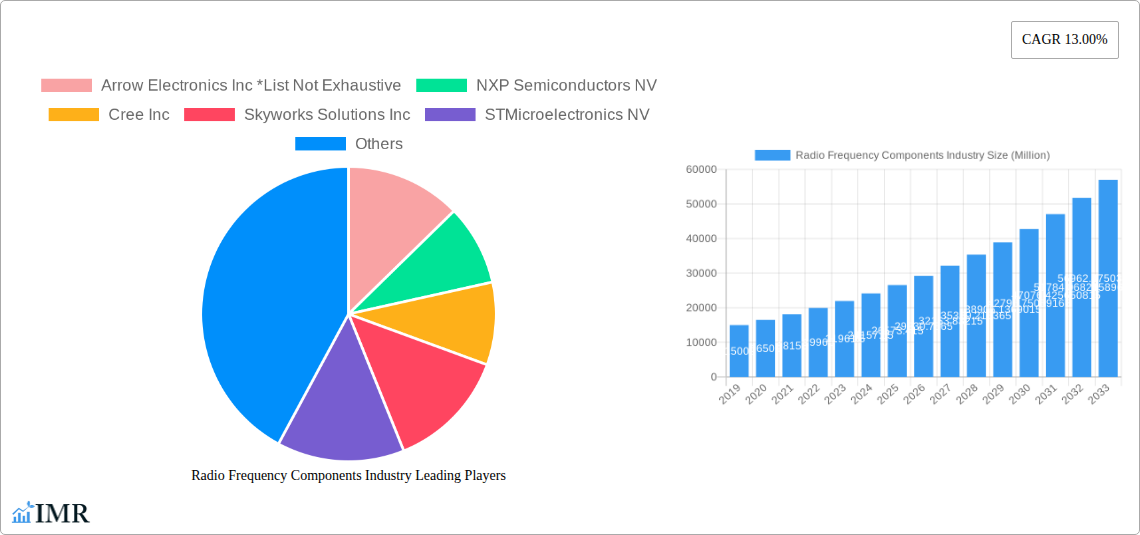

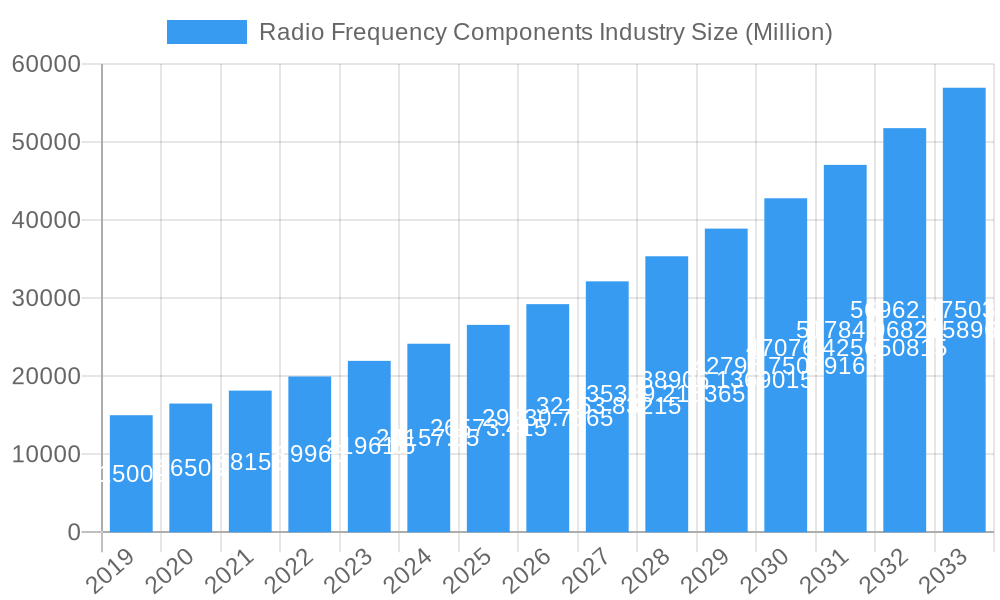

The Radio Frequency (RF) Components market is poised for substantial expansion, projected to reach a significant market size of approximately $30,000 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 13.00% throughout the forecast period (2025-2033). This dynamic growth is propelled by the ever-increasing demand for enhanced wireless connectivity across a multitude of applications, most notably in consumer electronics and the rapidly evolving automotive sector, which is increasingly integrating advanced RF capabilities for infotainment, navigation, and autonomous driving features. The proliferation of 5G technology adoption globally is a primary catalyst, requiring more sophisticated and efficient RF components like power amplifiers, antenna switches, duplexers, and RF filters to support higher frequencies and greater data throughput. Furthermore, the burgeoning Internet of Things (IoT) ecosystem, with its vast network of connected devices, necessitates reliable and high-performance RF solutions, further bolstering market demand. Military applications, characterized by stringent performance requirements and continuous innovation in communication and radar systems, also represent a significant and stable contributor to market growth.

Radio Frequency Components Industry Market Size (In Billion)

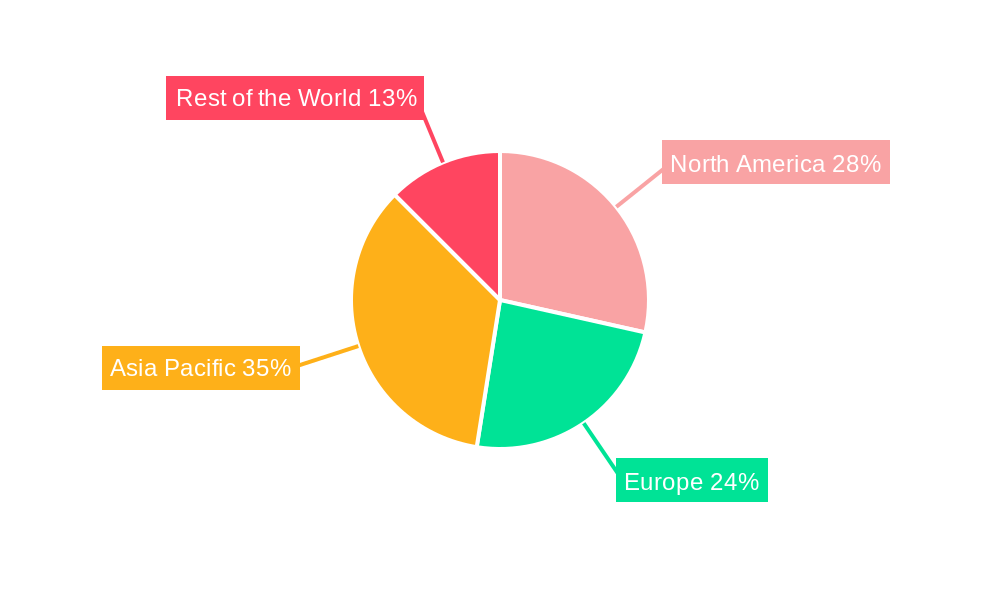

The market's upward trajectory is also influenced by ongoing technological advancements in semiconductor materials and manufacturing processes, enabling the development of smaller, more power-efficient, and cost-effective RF components. Trends such as the integration of RF front-end modules (FEMs) and the increasing adoption of GaN (Gallium Nitride) and SiC (Silicon Carbide) in power amplifiers for improved linearity and efficiency are key indicators of innovation. However, the market faces certain restraints, including the high cost of research and development for next-generation RF technologies and potential supply chain disruptions for specialized materials. Despite these challenges, the dominant presence of key players like Skyworks Solutions Inc., Qorvo Inc., and Murata Manufacturing Co., Ltd., alongside strategic collaborations and acquisitions, will continue to shape the competitive landscape and drive innovation. North America and Asia Pacific are expected to lead the market in terms of revenue, fueled by strong technological adoption and manufacturing capabilities, respectively.

Radio Frequency Components Industry Company Market Share

Radio Frequency Components Industry: Navigating Innovation and Expansion (2019-2033)

Report Description:

Unlock critical insights into the dynamic Radio Frequency (RF) components market with this comprehensive analysis, covering the period from 2019 to 2033, with a base year of 2025. This report delves deep into the evolving landscape of RF components, essential for modern wireless communication, consumer electronics, automotive, and military applications. Understand the intricate market dynamics, identify key growth drivers, and pinpoint emerging opportunities. We meticulously dissect the market by component type, including Power Amplifiers, Antenna Switches, Duplexers, RF Filters, and Modulators and Demodulators, and analyze their penetration across diverse applications such as Consumer Electronics, Automotive, Military, and Wireless Communication. Our detailed study provides granular data on market size, growth rates, and regional dominance, empowering strategic decision-making for stakeholders.

This report is an indispensable resource for manufacturers, suppliers, investors, and R&D professionals seeking to capitalize on the burgeoning demand for advanced RF solutions. Discover how technological advancements, shifting end-user demographics, and evolving regulatory frameworks are shaping the future of the RF components industry. We also explore the parent and child market structures, providing a holistic view of the value chain and interdependencies.

Radio Frequency Components Industry Market Dynamics & Structure

The Radio Frequency (RF) components industry is characterized by a moderately concentrated market structure, with a few key players holding significant market share, particularly in high-performance segments. Technological innovation remains a primary driver, fueled by the relentless demand for faster data speeds, increased connectivity, and miniaturization in devices. This includes advancements in GaN (Gallium Nitride) and GaAs (Gallium Arsenide) semiconductor technologies for power amplifiers, and sophisticated filtering techniques for improved signal integrity. Regulatory frameworks, such as spectrum allocation policies and emerging standards like 6G, also influence market development and component design. Competitive product substitutes, while present in some lower-tier applications, are largely overcome by the performance and efficiency advantages of specialized RF components. End-user demographics are increasingly driven by the proliferation of smartphones, IoT devices, and connected vehicles. Mergers and acquisitions (M&A) are a recurring trend, aimed at consolidating market positions, acquiring new technologies, and expanding product portfolios.

- Market Concentration: Dominated by a mix of large semiconductor manufacturers and specialized RF component providers.

- Technological Innovation Drivers: 5G/6G deployment, IoT expansion, automotive radar and infotainment systems, and miniaturization trends.

- Regulatory Frameworks: Spectrum licensing, electromagnetic compatibility (EMC) standards, and regional telecommunications regulations.

- Competitive Product Substitutes: Limited in high-performance areas, but emerging in cost-sensitive applications.

- End-User Demographics: Growing demand from consumer electronics, automotive, and industrial IoT sectors.

- M&A Trends: Strategic acquisitions to gain access to intellectual property, talent, and expanded market reach.

- M&A Deal Volumes (Estimated 2019-2024): Approximately 15-20 significant deals focused on specialized RF technologies and market access.

Radio Frequency Components Industry Growth Trends & Insights

The Radio Frequency (RF) components market is experiencing robust growth, propelled by the insatiable demand for enhanced wireless connectivity across a multitude of applications. The foundational technologies driving this expansion are underpinned by the ongoing deployment and evolution of wireless communication standards. The widespread adoption of 5G technology, with its promise of higher bandwidth and lower latency, has significantly boosted the demand for advanced RF components, including high-performance power amplifiers, duplexers, and filters. This trend is further amplified by the burgeoning Internet of Things (IoT) ecosystem, where a vast network of connected devices necessitates reliable and efficient RF communication modules.

The automotive sector is emerging as a critical growth engine, with the increasing integration of advanced driver-assistance systems (ADAS), in-car infotainment, and vehicle-to-everything (V2X) communication demanding sophisticated RF solutions for radar, connectivity, and telematics. Consumer electronics, a perennial powerhouse, continues to drive demand through the smartphone upgrade cycle and the diversification of connected devices such as smart wearables and home appliances. Beyond these, the military and defense sector represents a stable and growing market, driven by the need for secure, high-frequency communication systems and advanced sensing technologies.

Technological disruptions, such as the transition to GaN technology for higher power efficiency and the development of new materials for miniaturized filters, are reshaping the product landscape and enabling new design possibilities. Consumer behavior shifts, characterized by an ever-increasing reliance on wireless technologies for communication, entertainment, and productivity, directly translate into sustained market expansion. The CAGR for the RF components market is projected to be robust throughout the forecast period, reflecting these strong underlying trends. Market penetration of 5G-enabled devices and the adoption of advanced RF solutions in emerging applications will continue to fuel this upward trajectory.

Dominant Regions, Countries, or Segments in Radio Frequency Components Industry

The Wireless Communication segment, particularly within the Consumer Electronics and Automotive applications, is currently the dominant force propelling the global Radio Frequency (RF) components industry. This dominance is largely attributed to the widespread and accelerating adoption of advanced wireless technologies, most notably 5G, which has spurred an unprecedented demand for a comprehensive suite of RF components. The Asia Pacific region, led by countries such as China, South Korea, and Japan, stands out as the leading geographical market. This leadership is a confluence of factors including the presence of major smartphone and consumer electronics manufacturers, significant government investment in 5G infrastructure, and a large consumer base readily adopting new technologies.

Within the Component Type segment, Power Amplifiers and RF Filters are experiencing substantial growth. Power amplifiers are crucial for boosting signal strength in mobile devices and base stations, essential for the high-speed data transfer capabilities of 5G and beyond. RF filters are indispensable for isolating desired frequencies and rejecting unwanted ones, critical for maintaining signal integrity in increasingly crowded spectrums. The Consumer Electronics application segment remains the largest market for RF components, driven by the continuous evolution of smartphones, tablets, wearables, and smart home devices, all of which rely heavily on sophisticated RF functionalities. The Automotive application segment is the fastest-growing, fueled by the proliferation of connected cars, ADAS, and in-car Wi-Fi, requiring a diverse range of RF components for radar, communication, and infotainment.

Key drivers for this dominance include:

- Economic Policies: Supportive government initiatives and incentives for 5G deployment and semiconductor manufacturing in key Asia Pacific nations.

- Infrastructure Development: Massive investments in 5G network rollouts across major economies, creating a consistent demand for base station and device components.

- Technological Advancement: Continuous innovation in RF component design, leading to higher performance, increased efficiency, and smaller form factors.

- Consumer Demand: A strong global appetite for connected devices, faster mobile internet, and advanced automotive features.

- Market Share: The Wireless Communication segment commands over 50% of the total RF components market, with Consumer Electronics and Automotive as significant contributors.

- Growth Potential: The Automotive segment shows the highest growth potential due to the increasing electrification and connectivity of vehicles.

Radio Frequency Components Industry Product Landscape

The RF components market is characterized by a diverse and rapidly evolving product landscape driven by the relentless pursuit of higher performance, greater efficiency, and smaller form factors. Key product innovations include advanced Power Amplifiers utilizing GaN and GaAs technologies, offering superior power density and linearity crucial for 5G base stations and high-frequency mobile devices. Antenna Switches are becoming more integrated and versatile, supporting multiple frequency bands and communication standards with minimal signal loss. Duplexers are crucial for enabling simultaneous transmission and reception, with advancements focusing on miniaturization and improved isolation. RF Filters are witnessing significant progress in material science and design, leading to smaller, more efficient components that enhance signal clarity and reduce interference. Modulators and Demodulators are evolving to support higher data rates and complex modulation schemes required by next-generation wireless systems. The unique selling proposition of these components lies in their ability to enable seamless and high-speed wireless communication, critical for the expanding ecosystem of connected devices.

Key Drivers, Barriers & Challenges in Radio Frequency Components Industry

Key Drivers:

- 5G and Beyond Deployment: The ongoing global rollout of 5G networks and the anticipation of 6G technologies are paramount drivers, necessitating advanced RF components for higher frequencies, increased bandwidth, and enhanced connectivity.

- IoT Expansion: The exponential growth of the Internet of Things (IoT) across various sectors, from smart homes to industrial automation, fuels the demand for low-power, efficient RF transceivers and modules.

- Automotive Connectivity: The increasing integration of advanced driver-assistance systems (ADAS), V2X communication, and in-car infotainment systems in vehicles significantly boosts demand for specialized RF solutions.

- Consumer Electronics Evolution: The continuous upgrade cycles of smartphones and the diversification of connected consumer devices like wearables and smart home appliances ensure a steady demand for RF components.

- Technological Advancements: Innovations in materials (e.g., GaN, GaAs) and semiconductor processes enable higher performance, smaller form factors, and improved power efficiency in RF components.

Key Barriers & Challenges:

- Supply Chain Disruptions: The RF components industry is susceptible to global supply chain vulnerabilities, including raw material shortages, geopolitical tensions, and manufacturing capacity constraints, impacting lead times and costs. For instance, shortages in critical semiconductor materials have led to an estimated 10-15% increase in component costs in recent years.

- High Research & Development Costs: Developing cutting-edge RF technologies requires substantial investment in R&D, posing a barrier for smaller players and necessitating strong financial backing.

- Stringent Regulatory Requirements: Evolving spectrum regulations, electromagnetic compatibility (EMC) standards, and product certifications across different regions can be complex and time-consuming to navigate.

- Intense Competition: The market is highly competitive, with both established players and new entrants vying for market share, putting pressure on pricing and profit margins.

- Talent Shortage: A scarcity of skilled engineers and researchers specializing in RF design and semiconductor fabrication can impede innovation and production scalability.

Emerging Opportunities in Radio Frequency Components Industry

Emerging opportunities in the Radio Frequency (RF) components industry are primarily centered around the expansion of new technology frontiers and underserved markets. The burgeoning field of 6G wireless communication, while in its nascent stages, presents a significant long-term opportunity for the development of novel RF components capable of operating at terahertz frequencies. Furthermore, the growing adoption of satellite internet services is creating a demand for specialized RF components for both ground terminals and satellite payloads. The medical device industry, with its increasing reliance on wireless connectivity for remote monitoring and diagnostics, offers another fertile ground for innovative RF solutions. The need for more sophisticated RF sensing applications, beyond traditional communication, for use in areas like gesture recognition and environmental monitoring, also presents untapped potential.

Growth Accelerators in the Radio Frequency Components Industry Industry

Several key catalysts are accelerating growth in the RF components industry. The sustained global deployment of 5G infrastructure remains a primary growth accelerator, driving continuous demand for high-performance RF components for both base stations and user equipment. The rapid expansion of the Internet of Things (IoT) ecosystem, encompassing smart cities, industrial automation, and consumer IoT devices, fuels the need for a diverse range of RF connectivity solutions. The increasing sophistication of automotive electronics, including ADAS, autonomous driving, and in-car connectivity, is creating substantial demand for specialized RF components for radar, LiDAR, and communication systems. Furthermore, strategic partnerships and collaborations between RF component manufacturers and system integrators are fostering innovation and accelerating the development and adoption of new technologies, such as advanced antenna designs and highly integrated RF front-end modules.

Key Players Shaping the Radio Frequency Components Industry Market

- Arrow Electronics Inc

- NXP Semiconductors NV

- Cree Inc

- Skyworks Solutions Inc

- STMicroelectronics NV

- Renesas Electronics Corporation

- Qorvo Inc

- TDK Corporation

- Murata Manufacturing Co Ltd

- Analog Devices Inc

Notable Milestones in Radio Frequency Components Industry Sector

- 2019/2020: Widespread commercial launch of 5G smartphones, driving increased adoption of advanced RF front-end modules and power amplifiers.

- 2020/2021: Significant investments in GaN-based RF power amplifier technology for base stations, promising higher efficiency and performance.

- 2021/2022: Increasing integration of RF functionalities within System-on-Chips (SoCs) for IoT devices, leading to miniaturization and cost reduction.

- 2022/2023: Growing focus on mmWave RF components for enhanced 5G capabilities and emerging applications like autonomous driving.

- 2023/2024: Advancement in RF filter technologies, including SAW, BAW, and advanced dielectric filters, to address spectral congestion and improve signal quality.

- Ongoing: Continuous R&D in RF materials and packaging technologies to enable smaller, more power-efficient, and cost-effective components.

In-Depth Radio Frequency Components Industry Market Outlook

The outlook for the Radio Frequency (RF) components industry remains exceptionally strong, driven by the relentless demand for ubiquitous and high-performance wireless connectivity. The ongoing expansion of 5G networks globally, coupled with the foundational work for 6G, will continue to be a significant growth accelerator, pushing the boundaries of frequency capabilities and data throughput. The burgeoning Internet of Things (IoT) ecosystem, encompassing both industrial and consumer applications, will necessitate a broad spectrum of RF solutions, from low-power modules to high-capacity transceivers. The automotive sector, with its rapid embrace of connectivity and advanced driver-assistance systems, presents a substantial and rapidly growing market for RF components. Strategic alliances, mergers, and acquisitions will continue to shape the competitive landscape, fostering innovation and expanding market reach. Emerging applications in areas like satellite communications and advanced RF sensing offer further avenues for significant long-term growth, solidifying the RF components industry as a critical enabler of future technological advancements.

Radio Frequency Components Industry Segmentation

-

1. Component Type

- 1.1. Power Amplifiers

- 1.2. Antenna Switches

- 1.3. Duplexers

- 1.4. RF Filter

- 1.5. Modulators and Demodulators

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Military

- 2.4. Wireless Communication

- 2.5. Other Applications

Radio Frequency Components Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Radio Frequency Components Industry Regional Market Share

Geographic Coverage of Radio Frequency Components Industry

Radio Frequency Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Advancement in Electronic Warfare (EW) Technology Caters the Demand of RF Components; Adoption of Front-end Modules in Telecom

- 3.3. Market Restrains

- 3.3.1. ; High Power Consumption and High Investment in RF Amplifiers; Low Demand Due to Impact of COVID-19

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Hold Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Power Amplifiers

- 5.1.2. Antenna Switches

- 5.1.3. Duplexers

- 5.1.4. RF Filter

- 5.1.5. Modulators and Demodulators

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Military

- 5.2.4. Wireless Communication

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Power Amplifiers

- 6.1.2. Antenna Switches

- 6.1.3. Duplexers

- 6.1.4. RF Filter

- 6.1.5. Modulators and Demodulators

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive

- 6.2.3. Military

- 6.2.4. Wireless Communication

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Power Amplifiers

- 7.1.2. Antenna Switches

- 7.1.3. Duplexers

- 7.1.4. RF Filter

- 7.1.5. Modulators and Demodulators

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive

- 7.2.3. Military

- 7.2.4. Wireless Communication

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Power Amplifiers

- 8.1.2. Antenna Switches

- 8.1.3. Duplexers

- 8.1.4. RF Filter

- 8.1.5. Modulators and Demodulators

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive

- 8.2.3. Military

- 8.2.4. Wireless Communication

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Rest of the World Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Power Amplifiers

- 9.1.2. Antenna Switches

- 9.1.3. Duplexers

- 9.1.4. RF Filter

- 9.1.5. Modulators and Demodulators

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive

- 9.2.3. Military

- 9.2.4. Wireless Communication

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Arrow Electronics Inc *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semiconductors NV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cree Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Skyworks Solutions Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 STMicroelectronics NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Renesas Electronics Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Qorvo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TDK Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Murata Manufacturing Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Analog Devices Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Arrow Electronics Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Radio Frequency Components Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 3: North America Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 9: Europe Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 10: Europe Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 15: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 21: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 22: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 2: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Radio Frequency Components Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 5: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 10: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 17: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: India Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: China Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 24: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 25: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Latin America Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Middle East and Africa Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radio Frequency Components Industry?

The projected CAGR is approximately 15.89%.

2. Which companies are prominent players in the Radio Frequency Components Industry?

Key companies in the market include Arrow Electronics Inc *List Not Exhaustive, NXP Semiconductors NV, Cree Inc, Skyworks Solutions Inc, STMicroelectronics NV, Renesas Electronics Corporation, Qorvo Inc, TDK Corporation, Murata Manufacturing Co Ltd, Analog Devices Inc.

3. What are the main segments of the Radio Frequency Components Industry?

The market segments include Component Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Advancement in Electronic Warfare (EW) Technology Caters the Demand of RF Components; Adoption of Front-end Modules in Telecom.

6. What are the notable trends driving market growth?

Automotive Sector to Hold Significant Growth.

7. Are there any restraints impacting market growth?

; High Power Consumption and High Investment in RF Amplifiers; Low Demand Due to Impact of COVID-19.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radio Frequency Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radio Frequency Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radio Frequency Components Industry?

To stay informed about further developments, trends, and reports in the Radio Frequency Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence