Key Insights

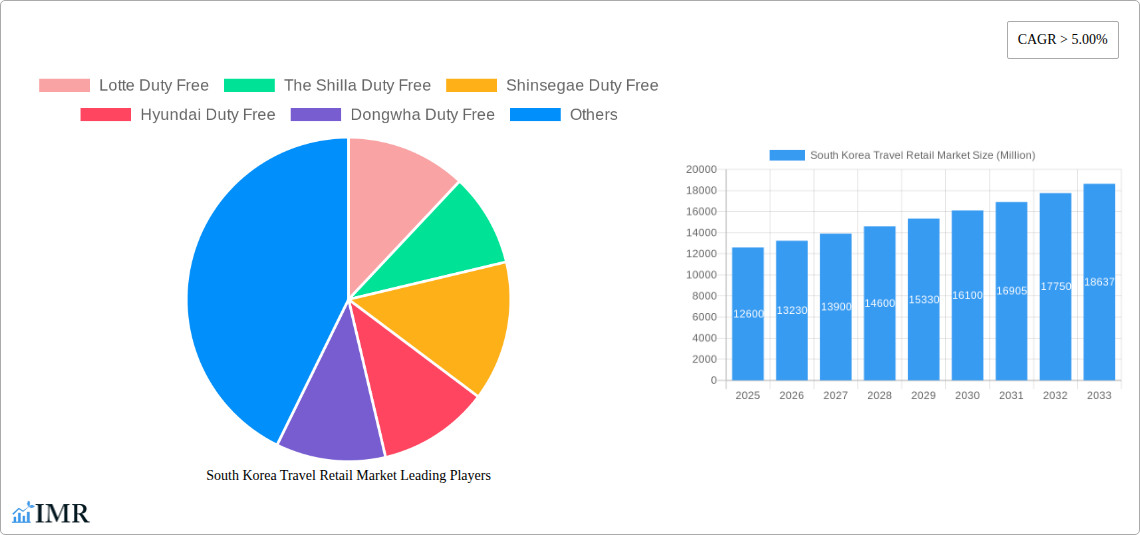

The South Korea Travel Retail Market is poised for robust expansion, projected to reach a significant valuation of $12.60 billion by 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) exceeding 5.00%, indicating a dynamic and expanding sector. The market's strength is significantly driven by the strong performance and consumer preference within the Beauty and Personal Care segment, a consistent performer in travel retail. Wines and Spirits also contribute substantially, reflecting global travel trends and the allure of premium beverages. While Tobacco and Fashion Accessories and Hard Luxury also play a role, their growth trajectories are influenced by evolving consumer preferences and regulatory landscapes. The "Other Types" segment, encompassing a diverse range of impulse and convenience purchases, is expected to show steady growth as well, catering to the varied needs of travelers. These product categories collectively fuel the market's upward momentum, reflecting both the inherent demand for these goods and the strategic offerings of key players within the travel retail ecosystem.

South Korea Travel Retail Market Market Size (In Billion)

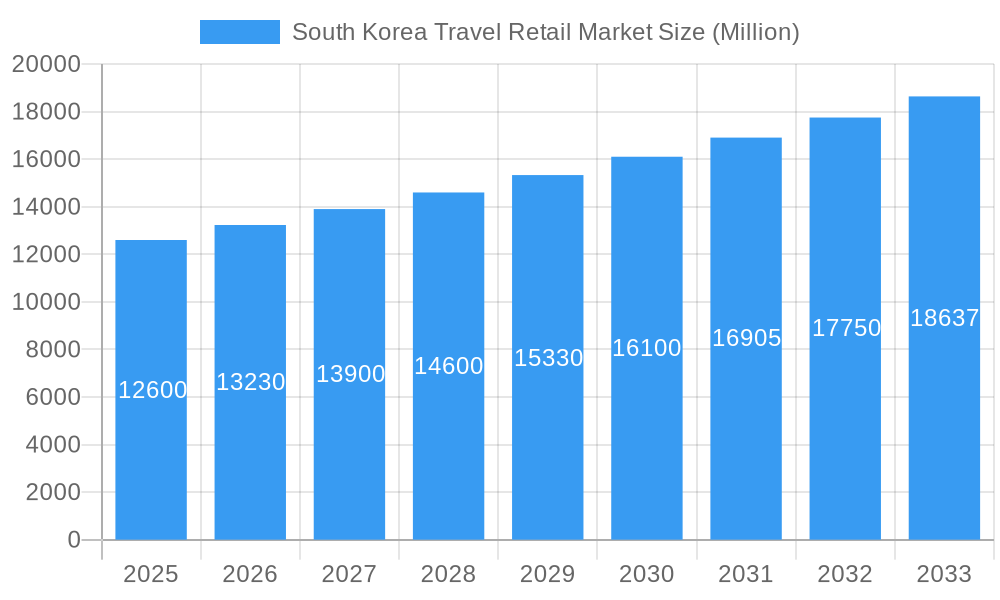

The distribution landscape within South Korea's travel retail market is predominantly shaped by Airports, which serve as primary hubs for passenger traffic and shopping opportunities. Airlines and Ferries, while contributing, represent a smaller but still relevant channel for reaching travelers. The competitive environment is characterized by the presence of established giants like Lotte Duty Free, The Shilla Duty Free, and Shinsegae Duty Free, which actively compete for market share through aggressive marketing, exclusive product launches, and enhanced customer experiences. Hyundai Duty Free, Dongwha Duty Free, and Dufry are also key players, contributing to the market's vibrancy. The study period, spanning from 2019 to 2033 with a base year of 2025, highlights a period of recovery and sustained growth following potential disruptions, with a keen focus on the forecast period of 2025-2033. Understanding these drivers, segments, and competitive forces is crucial for stakeholders aiming to capitalize on the burgeoning opportunities within this lucrative market.

South Korea Travel Retail Market Company Market Share

South Korea Travel Retail Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a critical analysis of the South Korea Travel Retail Market, offering insights into market dynamics, growth trends, competitive landscape, and future opportunities. Designed for industry professionals, investors, and market strategists, this report leverages high-traffic keywords to maximize visibility for crucial terms like "South Korea duty-free market," "travel retail Korea," "duty-free cosmetics Korea," "duty-free liquor South Korea," and "airport retail Korea." We cover parent and child markets extensively, presenting all values in Million units for clear understanding and strategic decision-making.

South Korea Travel Retail Market Market Dynamics & Structure

The South Korea travel retail market exhibits a dynamic structure characterized by significant market concentration among leading players. Technological innovation, particularly in digital integration and personalized customer experiences, acts as a primary driver, while evolving regulatory frameworks influence operational strategies. The competitive landscape is defined by a diverse range of product substitutes, from premium international brands to emerging local offerings, impacting consumer choices. End-user demographics are shifting, with an increasing influence of younger, digitally-savvy travelers seeking unique and convenient shopping experiences. Mergers and acquisitions (M&A) trends are reshaping the market, consolidating power and expanding reach.

- Market Concentration: Dominated by a few key players, with Lotte Duty Free, The Shilla Duty Free, and Shinsegae Duty Free holding substantial market share.

- Technological Innovation Drivers: Rise of e-commerce platforms, augmented reality (AR) for product visualization, and AI-powered personalized recommendations.

- Regulatory Frameworks: Stringent regulations on product sourcing, pricing, and marketing of duty-free goods.

- Competitive Product Substitutes: Intense competition between international luxury brands and Korean beauty and lifestyle products.

- End-User Demographics: Growing segment of millennial and Gen Z travelers, demanding experiential retail and seamless digital integration.

- M&A Trends: Strategic acquisitions and partnerships aimed at expanding geographical presence and product portfolios.

South Korea Travel Retail Market Growth Trends & Insights

The South Korea travel retail market is poised for robust growth, driven by the rebound in international travel and evolving consumer preferences. Market size evolution is directly linked to passenger traffic recovery and increased spending per traveler. Adoption rates of new retail technologies and omnichannel strategies are on the rise, transforming the shopping experience. Technological disruptions, such as the integration of virtual try-on features and contactless payment solutions, are enhancing convenience and engagement. Consumer behavior shifts are evident, with a greater emphasis on sustainability, unique local products, and personalized offers. The market is projected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Market penetration of online duty-free platforms is expected to further accelerate, complementing the traditional brick-and-mortar channels.

Dominant Regions, Countries, or Segments in South Korea Travel Retail Market

Within the South Korea travel retail market, the Beauty and Personal Care segment consistently emerges as the dominant force, driven by the global appeal of K-beauty products and the high demand from international tourists. Airports, particularly Incheon International Airport, represent the primary distribution channel, commanding the largest market share due to high footfall and captive audience. Economic policies supporting tourism and favorable trade agreements contribute to the growth of these segments. Infrastructure development, including airport expansions and improved connectivity, further bolsters the performance of airport retail.

- Dominant Product Type: Beauty and Personal Care (e.g., skincare, makeup, fragrances)

- Key Drivers: Global popularity of K-beauty, diverse product offerings, strong brand presence of South Korean companies.

- Market Share: Estimated to hold XX% of the total travel retail market in 2025.

- Growth Potential: Continued innovation in product formulations and packaging.

- Dominant Distribution Channel: Airports

- Key Drivers: High passenger traffic, strategic location, captive consumer base.

- Market Share: Expected to account for over XX% of travel retail sales in 2025.

- Growth Potential: Expansion of retail space and integration of digital solutions within airport environments.

- Other Influential Segments:

- Wines and Spirits: Driven by gifting and impulse purchases.

- Fashion Accessories and Hard Luxury: Attracting high-spending international travelers.

- Eatables: Growing demand for premium and unique Korean food items.

South Korea Travel Retail Market Product Landscape

The product landscape in the South Korea travel retail market is characterized by a relentless pursuit of innovation and a focus on premiumization. Beauty and personal care products, particularly those leveraging Korean skincare technology and natural ingredients, dominate with unique selling propositions that emphasize efficacy and sensorial experience. Wines and spirits offer a curated selection of international and domestic brands, with an increasing trend towards limited editions and artisanal products. Fashion accessories and hard luxury items showcase a blend of established global brands and emerging Korean designers. Technological advancements are evident in smart packaging, personalized product recommendations, and the integration of augmented reality for product sampling.

Key Drivers, Barriers & Challenges in South Korea Travel Retail Market

Key Drivers: The South Korea travel retail market is propelled by several key drivers. The resurgence of international tourism post-pandemic is a significant catalyst, directly increasing passenger traffic and spending. The enduring global appeal of Korean culture, particularly K-beauty and K-pop, creates strong demand for related products. Technological advancements in e-commerce and digital integration offer new avenues for customer engagement and sales. Government initiatives promoting tourism and trade also play a crucial role.

Barriers & Challenges: Despite its growth potential, the market faces several challenges. Intense competition from both domestic and international players puts pressure on pricing and margins. Evolving consumer preferences and the demand for sustainability require constant adaptation. Supply chain disruptions and logistical complexities can impact product availability and delivery. Regulatory hurdles and fluctuating exchange rates can also pose significant challenges to profitability.

Emerging Opportunities in South Korea Travel Retail Market

Emerging opportunities in the South Korea travel retail market lie in the expansion of personalized and experiential retail. The growing demand for sustainable and ethically sourced products presents a significant untapped market. Leveraging digital platforms for pre-ordering, click-and-collect services, and virtual try-ons can enhance customer convenience and reach. The development of exclusive product lines catering to specific travel segments, such as wellness or eco-tourism, also holds considerable potential. Furthermore, exploring partnerships with local artisans and niche brands can offer unique product differentiation.

Growth Accelerators in the South Korea Travel Retail Market Industry

Several catalysts are accelerating the long-term growth of the South Korea travel retail market. Technological breakthroughs in AI-driven personalization and data analytics enable more targeted marketing and product offerings. Strategic partnerships between duty-free operators, airlines, and tourism boards can create integrated travel retail ecosystems, enhancing customer journeys. Market expansion strategies, including exploring new airport concessions and diversifying product categories beyond traditional offerings, will also be crucial. The increasing focus on building a seamless omnichannel experience, bridging online and offline touchpoints, is a significant growth accelerator.

Key Players Shaping the South Korea Travel Retail Market Market

- Lotte Duty Free

- The Shilla Duty Free

- Shinsegae Duty Free

- Hyundai Duty Free

- Dongwha Duty Free

- Dufry

- Entas Duty Free

- City Plus Korea

- Doota Duty Free

- Hanwha Galleria Time World Duty Free

- JDC Duty Free

- The Grand Duty Free

Notable Milestones in South Korea Travel Retail Market Sector

- July 2022: Dufry AG, the world’s largest duty-free operator, acquired Autogrill SpA, the motorway and airport catering company, from the Benetton Family.

- April 2022: South Korea Lotte Duty Free has partnered with Korean Seven, the operator of the 7-Eleven convenience store chain, to expand local market sales of so-called domestic customs-cleared duty-free goods.

In-Depth South Korea Travel Retail Market Market Outlook

The outlook for the South Korea travel retail market remains highly optimistic, fueled by its inherent strengths and adaptability. Growth accelerators such as enhanced digital integration and the strategic expansion into niche product categories will continue to drive market performance. The market's ability to capitalize on the global fascination with Korean culture, particularly in beauty and lifestyle, presents sustained revenue potential. Strategic collaborations with airlines and ongoing investments in innovative retail technologies will be pivotal in shaping future market dynamics. The focus will increasingly be on creating personalized, convenient, and memorable shopping experiences for the discerning global traveler.

South Korea Travel Retail Market Segmentation

-

1. Product Type

- 1.1. Beauty and Personal Care

- 1.2. Wines and Spirits

- 1.3. Tobacco

- 1.4. Eatables

- 1.5. Fashion Accessories and Hard Luxury

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Channels

South Korea Travel Retail Market Segmentation By Geography

- 1. South Korea

South Korea Travel Retail Market Regional Market Share

Geographic Coverage of South Korea Travel Retail Market

South Korea Travel Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Beauty Products

- 3.2.2 Jewellery

- 3.2.3 Fashion and Accessories are Faster Developing Segments in the Market

- 3.3. Market Restrains

- 3.3.1 Beauty Products

- 3.3.2 Jewellery

- 3.3.3 Fashion and Accessories are Faster Developing Segments in the Market

- 3.4. Market Trends

- 3.4.1. Growing Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beauty and Personal Care

- 5.1.2. Wines and Spirits

- 5.1.3. Tobacco

- 5.1.4. Eatables

- 5.1.5. Fashion Accessories and Hard Luxury

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lotte Duty Free

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Shilla Duty Free

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shinsegae Duty Free

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hyundai Duty Free

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dongwha Duty Free

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dufry

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Entas Duty Free

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 City Plus Korea

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Doota Duty Free

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hanwha Galleria Time World Duty Free

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 JDC Duty Free

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Grand Duty Free**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Lotte Duty Free

List of Figures

- Figure 1: South Korea Travel Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Travel Retail Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: South Korea Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Travel Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Korea Travel Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South Korea Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: South Korea Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: South Korea Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Travel Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South Korea Travel Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Travel Retail Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the South Korea Travel Retail Market?

Key companies in the market include Lotte Duty Free, The Shilla Duty Free, Shinsegae Duty Free, Hyundai Duty Free, Dongwha Duty Free, Dufry, Entas Duty Free, City Plus Korea, Doota Duty Free, Hanwha Galleria Time World Duty Free, JDC Duty Free, The Grand Duty Free**List Not Exhaustive.

3. What are the main segments of the South Korea Travel Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Beauty Products. Jewellery. Fashion and Accessories are Faster Developing Segments in the Market.

6. What are the notable trends driving market growth?

Growing Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Beauty Products. Jewellery. Fashion and Accessories are Faster Developing Segments in the Market.

8. Can you provide examples of recent developments in the market?

July 2022: Dufry AG, the world’s largest duty-free operator, acquired Autogrill SpA, the motorway and airport catering company, from the Benetton Family.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Travel Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Travel Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Travel Retail Market?

To stay informed about further developments, trends, and reports in the South Korea Travel Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence