Key Insights

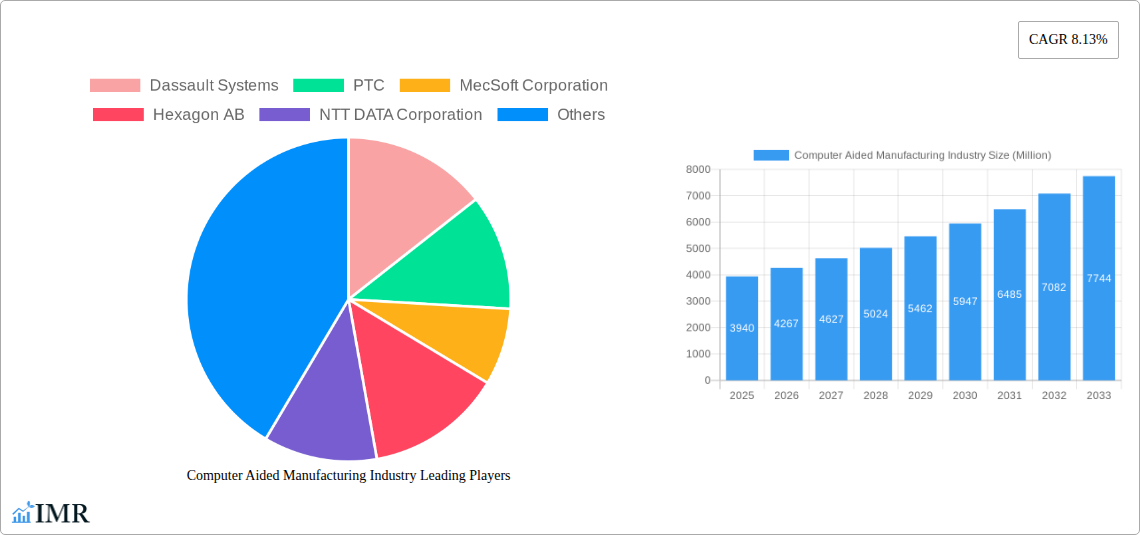

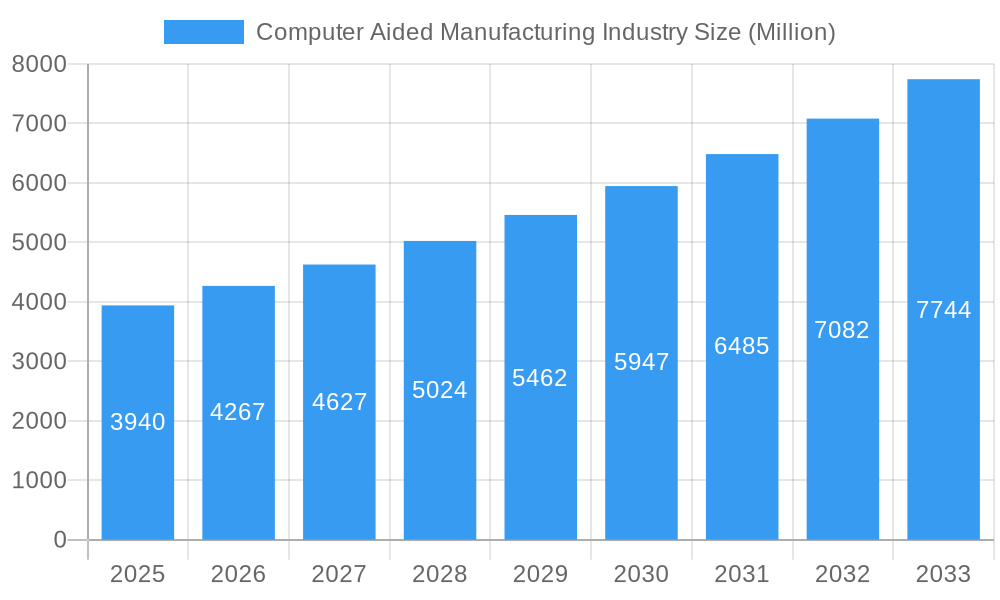

The Computer-Aided Manufacturing (CAM) industry is poised for robust expansion, projected to reach a substantial market size of $3.94 billion. Fueled by a compelling Compound Annual Growth Rate (CAGR) of 8.13%, this sector is set to experience significant value appreciation throughout the forecast period. The primary impetus for this growth stems from the increasing demand for automation in manufacturing processes, driven by the need for enhanced precision, reduced lead times, and improved product quality. Advancements in software capabilities, including sophisticated simulation, optimization, and multi-axis machining, are further solidifying CAM's position as an indispensable tool for modern production environments. The rise of Industry 4.0 initiatives, emphasizing smart factories and interconnected manufacturing ecosystems, is also a critical driver, as CAM software plays a pivotal role in enabling these advanced operational paradigms. Furthermore, the growing adoption of additive manufacturing (3D printing) is creating new avenues for CAM software, as it facilitates the design and production of complex geometries previously unachievable with traditional methods.

Computer Aided Manufacturing Industry Market Size (In Billion)

The CAM market is characterized by a dynamic interplay of key trends and underlying growth drivers, alongside certain restraining factors. Cloud-based deployment models are gaining significant traction, offering enhanced scalability, accessibility, and collaborative capabilities, thereby empowering businesses of all sizes. This shift is particularly evident across diverse end-user industries such as Aerospace & Defense, Automotive, and Medical, where intricate designs and stringent quality standards necessitate sophisticated manufacturing solutions. Emerging applications in energy, utilities, and other specialized sectors are also contributing to market diversification. While the adoption of advanced CAM technologies is largely positive, the initial investment costs and the requirement for skilled personnel to operate and maintain these systems can present a notable restraint. However, the long-term benefits of increased efficiency, reduced waste, and superior product output are increasingly outweighing these initial hurdles. Major players like Dassault Systems, PTC, Siemens AG, and Autodesk Inc. are actively innovating, offering comprehensive suites of CAM solutions and strategic partnerships to capture a larger market share.

Computer Aided Manufacturing Industry Company Market Share

Comprehensive Report: Computer-Aided Manufacturing (CAM) Industry Analysis

This in-depth report provides a complete overview of the global Computer-Aided Manufacturing (CAM) market, covering its dynamic structure, growth trajectories, regional dominance, product innovations, key drivers, emerging opportunities, and leading players. With a detailed analysis spanning the historical period of 2019–2024, the base year of 2025, and a forecast period extending to 2033, this report offers unparalleled insights for industry professionals, stakeholders, and investors. We delve into both parent and child market segments, utilizing high-traffic SEO keywords to ensure maximum visibility and engagement. All quantitative values are presented in millions of units.

Computer Aided Manufacturing Industry Market Dynamics & Structure

The Computer-Aided Manufacturing (CAM) industry is characterized by a moderately consolidated market structure, with a few major players like Dassault Systems, PTC, and Siemens AG holding significant market shares. Technological innovation is the primary driver, fueled by advancements in AI, machine learning, and additive manufacturing, leading to sophisticated CAM software solutions. Regulatory frameworks are evolving to support digital manufacturing initiatives and data security. Competitive product substitutes are emerging from integrated CAD/CAM solutions and specialized niche software. End-user demographics are shifting towards industries demanding higher precision, automation, and customization. Mergers and acquisitions (M&A) are frequent, consolidating market power and expanding technological portfolios. For instance, a notable M&A trend in recent years saw deal volumes increase by an estimated 15% year-on-year, reflecting strategic consolidation.

- Market Concentration: Moderate to High, with key players dominating specific segments.

- Technological Innovation Drivers: AI, IoT, Machine Learning, Additive Manufacturing integration, advancements in simulation and visualization.

- Regulatory Frameworks: Focus on data security, industry standards (e.g., ISO standards), and government incentives for digital transformation.

- Competitive Product Substitutes: Integrated CAD/CAM software suites, specialized machining software, and open-source CAM solutions.

- End-User Demographics: Increasing demand from Automotive, Aerospace & Defense, Medical, and Electronics sectors seeking automation and precision.

- M&A Trends: Driven by the need for expanded product portfolios, market reach, and technological integration.

Computer Aided Manufacturing Industry Growth Trends & Insights

The global Computer-Aided Manufacturing (CAM) market is poised for robust expansion, driven by the escalating adoption of digital manufacturing technologies across diverse industries. The market size is projected to witness a significant Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2025 to 2033. This growth is underpinned by an increasing demand for automated production processes, enhanced precision, and reduced manufacturing lead times. Technological disruptions, such as the integration of generative AI and advanced simulation capabilities, are fundamentally reshaping CAM software functionalities. Consumer behavior is shifting towards customized and on-demand products, further accelerating the need for flexible and efficient manufacturing solutions.

- Market Size Evolution: Projected to grow from an estimated \$6,200 million in 2025 to over \$12,500 million by 2033.

- Adoption Rates: Rapidly increasing, particularly in sectors like automotive and aerospace, with cloud-based solutions showing faster adoption.

- Technological Disruptions: Integration of AI for optimization, machine learning for predictive maintenance, and advanced simulation for virtual prototyping.

- Consumer Behavior Shifts: Growing demand for personalized products and rapid prototyping, driving the need for agile CAM solutions.

- Market Penetration: Expected to reach 75% across major industrial sectors by 2033, with developing economies showing significant growth potential.

- Key Growth Drivers: Automation, Industry 4.0 initiatives, and the need for increased efficiency and cost reduction.

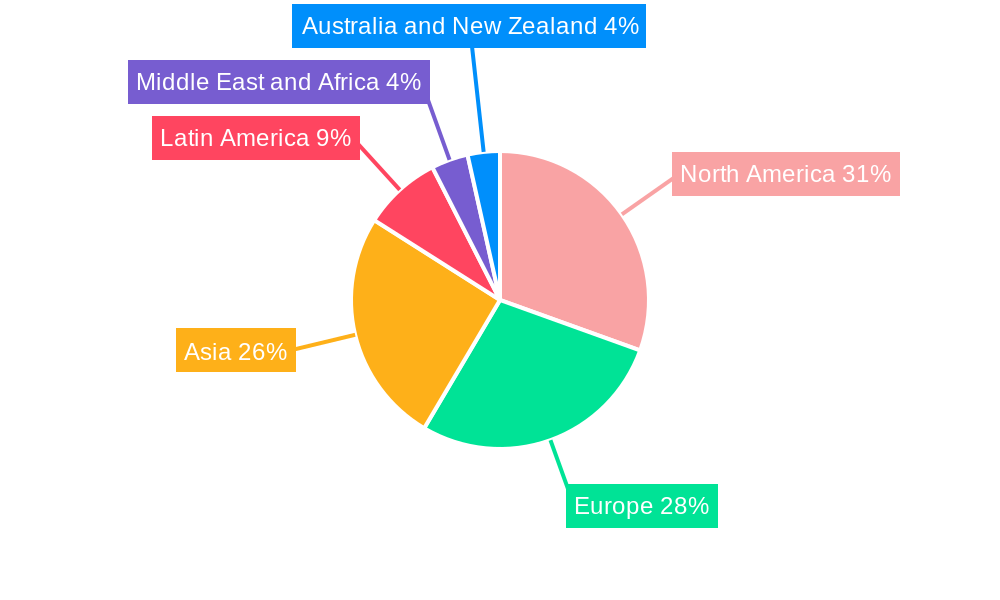

Dominant Regions, Countries, or Segments in Computer Aided Manufacturing Industry

North America, led by the United States, currently dominates the global Computer-Aided Manufacturing (CAM) market. This dominance is fueled by a strong presence of advanced manufacturing sectors, particularly Aerospace & Defense and Automotive, which have a high demand for sophisticated CAM solutions. The region benefits from significant investment in research and development, a robust technological infrastructure, and favorable government initiatives promoting digital transformation and advanced manufacturing.

- Leading Region: North America

- Key Countries: United States, Canada

Deployment Model Dominance:

- Cloud-Based Deployment: Exhibiting the highest growth rate due to its scalability, flexibility, and accessibility. Estimated to capture over 60% of new deployments by 2030.

- Drivers: Lower upfront costs, easier updates and maintenance, enhanced collaboration capabilities.

- On-Premises Deployment: Still holds a significant market share, especially in organizations with stringent data security requirements or existing legacy infrastructure.

- Drivers: Perceived data security and control, integration with existing IT systems.

End-User Industry Dominance:

- Automotive: The largest segment, driven by the increasing complexity of vehicle components, the rise of electric vehicles (EVs), and the demand for mass customization.

- Key Drivers: Advanced driver-assistance systems (ADAS), lightweight materials, autonomous driving technologies.

- Market Share: Estimated to account for 30% of the total CAM market by 2025.

- Aerospace & Defense: A consistently strong segment, requiring high precision, complex geometries, and adherence to stringent quality standards for critical components.

- Key Drivers: Development of new aircraft, defense modernization programs, advanced material utilization.

- Market Share: Estimated to account for 25% of the total CAM market by 2025.

- Medical: Experiencing rapid growth due to the increasing demand for personalized implants, prosthetics, and complex surgical instruments.

- Key Drivers: Advancements in medical device manufacturing, miniaturization, biocompatible materials.

- Growth Potential: High, with a projected CAGR of 10% in this segment.

- Energy & Utilities: Growing demand for optimized component manufacturing for power generation equipment and infrastructure.

- Other End-User Industries: Including consumer electronics, industrial machinery, and heavy equipment manufacturing, contributing to overall market diversification.

Computer Aided Manufacturing Industry Product Landscape

The CAM product landscape is evolving with innovative solutions offering enhanced functionalities like multi-axis machining, advanced simulation, and seamless integration with design and enterprise resource planning (ERP) systems. Product innovations are focused on simplifying complex machining operations, optimizing toolpaths for efficiency, and enabling real-time monitoring and control. Key advancements include AI-driven toolpath generation, adaptive machining capabilities, and robust post-processor customization for a wide range of CNC machines. The performance metrics emphasize increased machining speed, improved surface finish, reduced material waste, and enhanced operational safety.

Key Drivers, Barriers & Challenges in Computer Aided Manufacturing Industry

Key Drivers:

- Industry 4.0 Adoption: The widespread implementation of smart manufacturing principles is a primary catalyst.

- Demand for Automation: Reducing manual labor costs and increasing production efficiency.

- Precision and Accuracy Requirements: Crucial for industries like aerospace, automotive, and medical.

- Advancements in CNC Machinery: Sophisticated hardware necessitates advanced CAM software.

- Growing Popularity of Additive Manufacturing: CAM plays a vital role in preparing designs for 3D printing.

Barriers & Challenges:

- High Initial Investment: The cost of advanced CAM software and associated hardware can be a barrier for SMEs.

- Skilled Workforce Shortage: A lack of trained personnel to operate and manage sophisticated CAM systems.

- Integration Complexity: Integrating CAM with existing legacy systems can be challenging.

- Cybersecurity Concerns: Protecting sensitive manufacturing data is a significant concern, especially with cloud-based solutions.

- Rapid Technological Evolution: The need for continuous learning and adaptation to new software versions and functionalities.

Emerging Opportunities in Computer Aided Manufacturing Industry

Emerging opportunities lie in the development of more accessible and user-friendly CAM solutions for Small and Medium-sized Enterprises (SMEs), the integration of generative design with CAM for automated part optimization, and the expansion of CAM capabilities for novel manufacturing processes like additive manufacturing with multiple materials. The increasing adoption of the Industrial Internet of Things (IIoT) presents an opportunity for CAM systems to become more interconnected, enabling real-time data exchange for predictive maintenance and process optimization. Furthermore, the growing demand for sustainable manufacturing practices opens avenues for CAM software that optimizes material usage and energy consumption.

Growth Accelerators in the Computer Aided Manufacturing Industry Industry

Long-term growth in the CAM industry will be significantly accelerated by continuous technological advancements, particularly in artificial intelligence and machine learning, which will enable more intelligent and autonomous manufacturing processes. Strategic partnerships between software developers and hardware manufacturers will foster tighter integration and improved performance. Market expansion into emerging economies, driven by industrialization and government support for manufacturing, will also be a key growth accelerator. Furthermore, the development of industry-specific CAM solutions catering to the unique needs of sectors like medical device manufacturing and specialized electronics production will unlock substantial new market segments.

Key Players Shaping the Computer Aided Manufacturing Industry Market

- Dassault Systems

- PTC

- MecSoft Corporation

- Hexagon AB

- NTT DATA Corporation

- Siemens AG

- SolidCAM Ltd

- OPEN MIND Technologies AG

- Autodesk Inc

- 3D Systems Inc

- BobCAD-CAM

- SmartCAMcnc

- ZWSOFTCO LTD (Guangzhou)

- HCL Technologies Limited

- CNC Software LLC (Mastercam)

Notable Milestones in Computer Aided Manufacturing Industry Sector

- November 2023: Microlight3D launched Luminis software, a CAM software designed for microFAB-3D, enabling the 3D printing of objects up to 100x smaller than a strand of hair. Luminis features 3D visualization for high-speed data capture and supports prototyping in micro-robotics, microfluidics, micro-optics, and cell culture.

- May 2023: NVIDIA introduced NVIDIA Omniverse, a platform connecting CAD applications, APIs, and generative AI frameworks. This includes NVIDIA Isaac Sim for robot simulation and testing, and NVIDIA Metropolis for automated optical inspection, empowering electronics makers to build virtual factories and digitalize workflows.

In-Depth Computer Aided Manufacturing Industry Market Outlook

The future outlook for the Computer-Aided Manufacturing (CAM) industry is exceptionally promising, driven by the relentless pursuit of operational efficiency, product innovation, and manufacturing flexibility. Emerging trends such as the digital twin concept, where virtual replicas of physical assets are used for simulation and optimization, will further integrate CAM into the broader digital manufacturing ecosystem. Strategic investments in AI-powered CAM solutions and a growing emphasis on cybersecurity will be critical for sustained growth. The report forecasts continued expansion, particularly in cloud-based solutions and specialized industry applications, presenting significant opportunities for companies to lead in this dynamic and evolving market.

Computer Aided Manufacturing Industry Segmentation

-

1. Deployment Model

- 1.1. On-Premises

- 1.2. Cloud-Based

-

2. End-User Industry

- 2.1. Aerospace & Defense

- 2.2. Automotive

- 2.3. Medical

- 2.4. Energy & Utilities

- 2.5. Other End-User Industries

Computer Aided Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. Switzerland

- 2.3. Spain

- 2.4. Austria

- 2.5. Belgium

- 2.6. Netherlands

- 2.7. United Kingdom

- 2.8. France

- 2.9. Italy

- 2.10. Sweden

- 2.11. Poland

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. South Africa

Computer Aided Manufacturing Industry Regional Market Share

Geographic Coverage of Computer Aided Manufacturing Industry

Computer Aided Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Industry 4.; Growing Utilization of CAM Software in the Packaging Machinery Sector

- 3.3. Market Restrains

- 3.3.1. Wide Availability of Open Source CAM Software

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Computer Aided Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 5.1.1. On-Premises

- 5.1.2. Cloud-Based

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Aerospace & Defense

- 5.2.2. Automotive

- 5.2.3. Medical

- 5.2.4. Energy & Utilities

- 5.2.5. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6. North America Computer Aided Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6.1.1. On-Premises

- 6.1.2. Cloud-Based

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Aerospace & Defense

- 6.2.2. Automotive

- 6.2.3. Medical

- 6.2.4. Energy & Utilities

- 6.2.5. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7. Europe Computer Aided Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7.1.1. On-Premises

- 7.1.2. Cloud-Based

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Aerospace & Defense

- 7.2.2. Automotive

- 7.2.3. Medical

- 7.2.4. Energy & Utilities

- 7.2.5. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8. Asia Computer Aided Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8.1.1. On-Premises

- 8.1.2. Cloud-Based

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Aerospace & Defense

- 8.2.2. Automotive

- 8.2.3. Medical

- 8.2.4. Energy & Utilities

- 8.2.5. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9. Australia and New Zealand Computer Aided Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9.1.1. On-Premises

- 9.1.2. Cloud-Based

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Aerospace & Defense

- 9.2.2. Automotive

- 9.2.3. Medical

- 9.2.4. Energy & Utilities

- 9.2.5. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 10. Latin America Computer Aided Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Model

- 10.1.1. On-Premises

- 10.1.2. Cloud-Based

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Aerospace & Defense

- 10.2.2. Automotive

- 10.2.3. Medical

- 10.2.4. Energy & Utilities

- 10.2.5. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment Model

- 11. Middle East and Africa Computer Aided Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Deployment Model

- 11.1.1. On-Premises

- 11.1.2. Cloud-Based

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Aerospace & Defense

- 11.2.2. Automotive

- 11.2.3. Medical

- 11.2.4. Energy & Utilities

- 11.2.5. Other End-User Industries

- 11.1. Market Analysis, Insights and Forecast - by Deployment Model

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dassault Systems

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PTC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 MecSoft Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hexagon AB

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 NTT DATA Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Siemens AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 SolidCAM Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 OPEN MIND Technologies AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Autodesk Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 3D Systems Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 BobCAD-CAM

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 SmartCAMcnc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 ZWSOFTCO LTD (Guangzhou)

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 HCL Technologies Limited

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 CNC Software LLC (Mastercam)

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Dassault Systems

List of Figures

- Figure 1: Global Computer Aided Manufacturing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Computer Aided Manufacturing Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 3: North America Computer Aided Manufacturing Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 4: North America Computer Aided Manufacturing Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America Computer Aided Manufacturing Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Computer Aided Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Computer Aided Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Computer Aided Manufacturing Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 9: Europe Computer Aided Manufacturing Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 10: Europe Computer Aided Manufacturing Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe Computer Aided Manufacturing Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Computer Aided Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Computer Aided Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Computer Aided Manufacturing Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 15: Asia Computer Aided Manufacturing Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 16: Asia Computer Aided Manufacturing Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia Computer Aided Manufacturing Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Computer Aided Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Computer Aided Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Computer Aided Manufacturing Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 21: Australia and New Zealand Computer Aided Manufacturing Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 22: Australia and New Zealand Computer Aided Manufacturing Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Australia and New Zealand Computer Aided Manufacturing Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Australia and New Zealand Computer Aided Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Computer Aided Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Computer Aided Manufacturing Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 27: Latin America Computer Aided Manufacturing Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 28: Latin America Computer Aided Manufacturing Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Latin America Computer Aided Manufacturing Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Latin America Computer Aided Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Computer Aided Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Computer Aided Manufacturing Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 33: Middle East and Africa Computer Aided Manufacturing Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 34: Middle East and Africa Computer Aided Manufacturing Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 35: Middle East and Africa Computer Aided Manufacturing Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 36: Middle East and Africa Computer Aided Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Computer Aided Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 2: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 5: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 10: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 11: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Switzerland Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Austria Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Belgium Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Netherlands Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Sweden Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Poland Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 24: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 25: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 31: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 32: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 34: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 35: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Mexico Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 39: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 40: Global Computer Aided Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: United Arab Emirates Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Saudi Arabia Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Africa Computer Aided Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Computer Aided Manufacturing Industry?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the Computer Aided Manufacturing Industry?

Key companies in the market include Dassault Systems, PTC, MecSoft Corporation, Hexagon AB, NTT DATA Corporation, Siemens AG, SolidCAM Ltd, OPEN MIND Technologies AG, Autodesk Inc, 3D Systems Inc, BobCAD-CAM, SmartCAMcnc , ZWSOFTCO LTD (Guangzhou), HCL Technologies Limited, CNC Software LLC (Mastercam).

3. What are the main segments of the Computer Aided Manufacturing Industry?

The market segments include Deployment Model, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Industry 4.; Growing Utilization of CAM Software in the Packaging Machinery Sector.

6. What are the notable trends driving market growth?

Automotive is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Wide Availability of Open Source CAM Software.

8. Can you provide examples of recent developments in the market?

November 2023 - Microlight3D launched Luminis software, a computer-aided manufacturing (CAM) software built explicitly for the microFAB-3D. Luminis combines the ability to prepare objects for printing and control the printer, aiding to 3D print objects to 100× smaller than a strand of hair. Luminis features 3D visualization for the capturing of 40 fps - 60 fps data under the same load. The software enables printing prototypes of technologies used in micro-robotics, microfluidics, micro-optics, and cell culture and tissue engineering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Computer Aided Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Computer Aided Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Computer Aided Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Computer Aided Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence