Key Insights

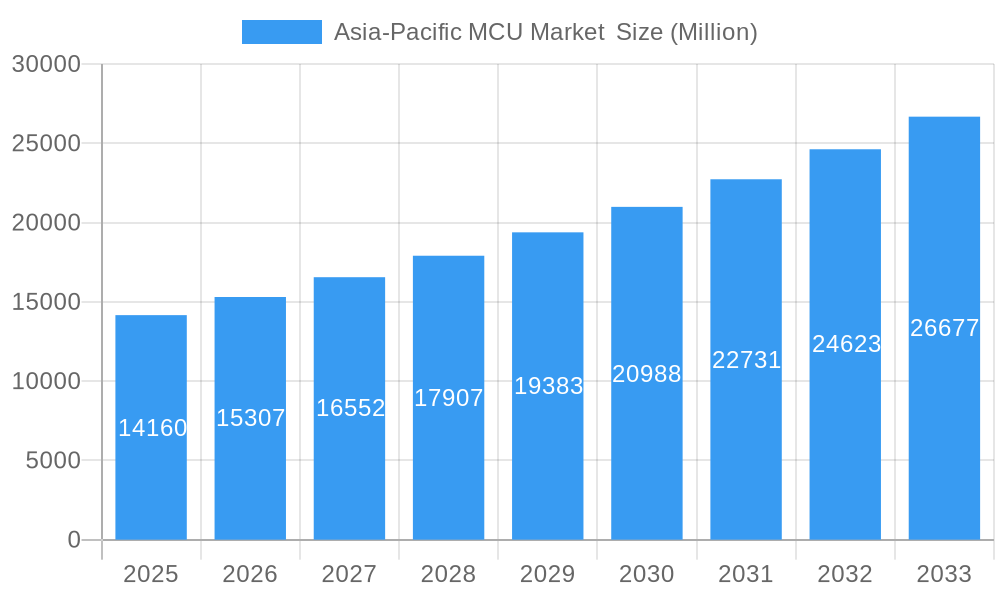

The Asia-Pacific Microcontroller (MCU) market is poised for significant expansion, projected to reach a substantial valuation of $14.16 billion. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.34%, indicating a dynamic and expanding ecosystem for MCU adoption. The market's trajectory is primarily driven by the insatiable demand for advanced features and increased processing power across a multitude of consumer electronics and home appliances, a sector that consistently pushes the boundaries of innovation. Furthermore, the burgeoning automotive industry, with its rapid embrace of electrification and autonomous driving technologies, is a key catalyst, requiring sophisticated MCUs for control systems, infotainment, and safety features. The industrial sector's ongoing automation initiatives and the healthcare industry's increasing reliance on smart medical devices further contribute to this upward trend, creating a diverse and resilient demand landscape.

Asia-Pacific MCU Market Market Size (In Billion)

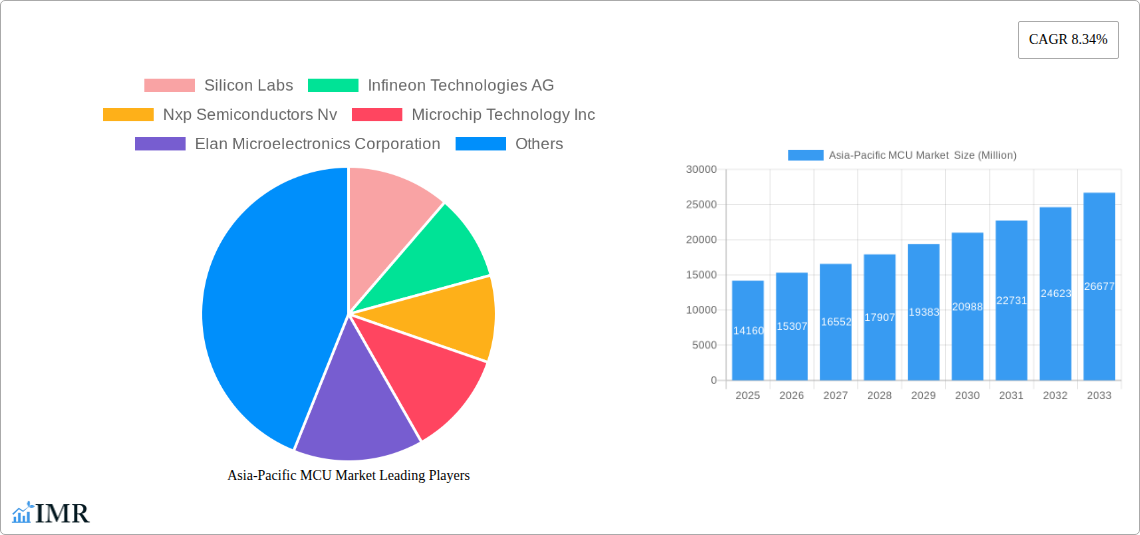

Key trends shaping the Asia-Pacific MCU market include the escalating adoption of 32-bit microcontrollers, favored for their superior performance and complex processing capabilities, which are becoming indispensable for next-generation applications. The market is also witnessing a strong surge in the adoption of MCUs within the data processing and communication sectors, as connectivity becomes more pervasive and data-intensive applications proliferate. While the market exhibits immense promise, potential restraints include supply chain volatilities and the increasing complexity of microcontroller architectures, which may pose challenges for smaller manufacturers. However, the presence of major players like Silicon Labs, Infineon Technologies AG, and Microchip Technology Inc. alongside regional powerhouses like Renesas Electronics Corporation and Toshiba Electronic Devices & Storage Corporation, signifies a competitive yet collaborative environment focused on delivering cutting-edge solutions to meet the diverse needs of the Asia-Pacific region.

Asia-Pacific MCU Market Company Market Share

Asia-Pacific Microcontroller (MCU) Market: In-depth Analysis and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Asia-Pacific Microcontroller (MCU) market, providing critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and the competitive ecosystem. Covering the period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for semiconductor manufacturers, component suppliers, automotive OEMs, consumer electronics giants, industrial automation firms, and investors seeking to understand the evolving MCU landscape across the Asia-Pacific region. We explore the market's trajectory, segmentation by product (4 and 8-bit, 16-bit, 32-bit) and application (Aerospace and Defense, Consumer Electronics and Home Appliances, Automotive, Industrial, Healthcare, Data Processing and Communication, Other End-user Industries), and analyze the strategic moves of key players like Silicon Labs, Infineon Technologies AG, Nxp Semiconductors Nv, Microchip Technology Inc, and others. This report leverages quantitative data and qualitative analysis to forecast market evolution, identify growth accelerators, and highlight emerging opportunities.

Asia-Pacific MCU Market Market Dynamics & Structure

The Asia-Pacific MCU market is characterized by a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is influenced by the presence of major global semiconductor players, with a notable trend towards strategic alliances and acquisitions to enhance technological capabilities and market reach. Technological innovation remains a primary driver, fueled by the increasing demand for advanced features in consumer electronics, the rapid evolution of the automotive sector towards electrification and autonomous driving, and the burgeoning IoT landscape. Regulatory frameworks, while varying across countries, are increasingly supportive of domestic semiconductor manufacturing and innovation, particularly in nations like China and India. Competitive product substitutes are emerging, but the core functionality and cost-effectiveness of MCUs continue to secure their dominant position. End-user demographics are diverse, spanning mass-market consumer devices to highly specialized industrial and automotive applications, each with distinct demand patterns and technical requirements. Mergers & Acquisitions (M&A) activity plays a crucial role in consolidating the market, enabling companies to expand their portfolios, gain access to new technologies, and strengthen their competitive edge. For instance, the consolidation within the automotive semiconductor space directly impacts MCU suppliers catering to this segment. The robust growth in smart home devices and wearables is also a significant demographic shift influencing MCU demand.

Asia-Pacific MCU Market Growth Trends & Insights

The Asia-Pacific MCU market is poised for significant expansion, driven by a confluence of technological advancements and evolving consumer and industrial demands. The market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period (2025-2033), reaching an estimated value of over USD 15,000 million units by 2033. Adoption rates for advanced MCUs, particularly 32-bit variants, are accelerating across all key application segments, including automotive, industrial automation, and consumer electronics. Technological disruptions, such as the increasing integration of AI and machine learning capabilities at the edge, are creating new demand for high-performance MCUs. Furthermore, the proliferation of the Internet of Things (IoT) devices, from smart wearables to industrial sensors and smart home appliances, is a fundamental growth engine, requiring a vast number of cost-effective and power-efficient MCUs. Consumer behavior shifts, particularly the demand for personalized and connected experiences, are pushing manufacturers to embed more intelligence and processing power into everyday devices, directly translating to higher MCU consumption. The increasing sophistication of smart automotive features, including advanced driver-assistance systems (ADAS) and in-car infotainment, is another major contributor to the market's growth. The transition from traditional home appliances to smart, connected versions also fuels demand for MCUs capable of handling complex communication protocols and user interfaces. The penetration of microcontrollers in emerging economies within the Asia-Pacific region is still relatively low compared to developed nations, presenting a substantial opportunity for market expansion. The report will delve into specific metrics such as market penetration rates in different end-user industries and the adoption of specific MCU architectures to provide a granular understanding of these growth trends.

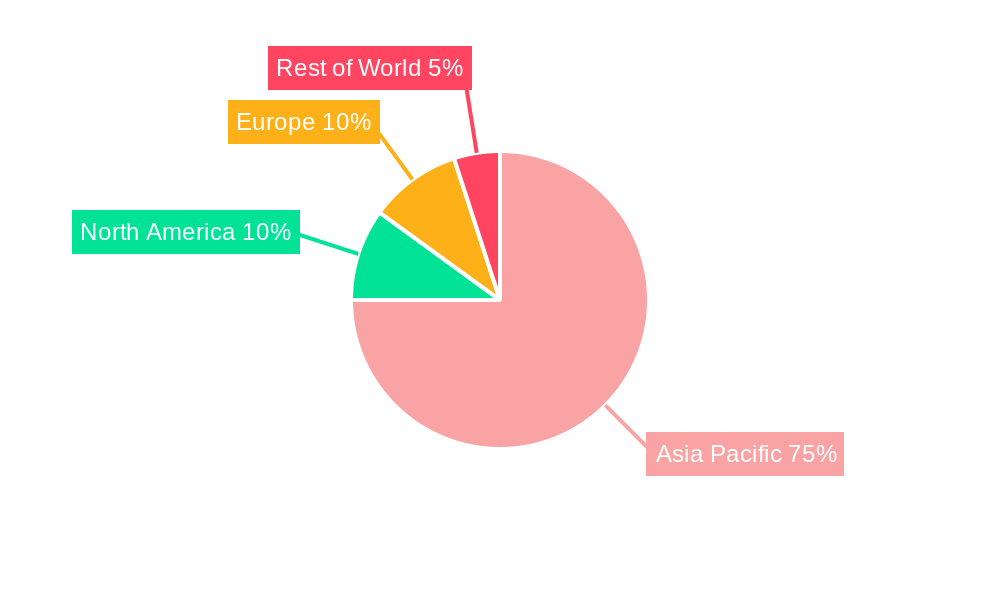

Dominant Regions, Countries, or Segments in Asia-Pacific MCU Market

The Asia-Pacific MCU market's dominance is multifaceted, with several regions, countries, and segments exhibiting exceptional growth and influence. China stands out as a pivotal market, driven by its colossal manufacturing base across consumer electronics, automotive, and industrial sectors, coupled with government initiatives promoting domestic semiconductor production and technological self-sufficiency. South Korea and Japan also maintain strong positions due to their advanced technological infrastructure and leadership in automotive and consumer electronics innovation. The 32-bit MCU segment is the undisputed leader in terms of market share and growth potential within the product landscape. This dominance is fueled by the escalating demand for higher processing power, advanced features, and complex functionalities across various applications, particularly in the automotive sector for ADAS and electric vehicle (EV) systems, and in the industrial sector for sophisticated automation and control systems. Within applications, Automotive and Consumer Electronics and Home Appliances are the largest and fastest-growing segments. The automotive industry's rapid transition towards electrification, autonomous driving, and connected car technologies necessitates an increasing number of sophisticated MCUs for powertrain management, safety systems, infotainment, and sensor processing. Similarly, the ever-evolving consumer electronics market, with its demand for smart devices, wearables, and advanced home appliances, continuously drives the adoption of feature-rich MCUs. The industrial sector also presents significant growth opportunities, driven by Industry 4.0 initiatives, smart manufacturing, and the increasing automation of factory processes. Economic policies in countries like Vietnam and India, focused on attracting manufacturing and fostering technological development, are also contributing to regional growth dynamics. The robust growth in these segments is further bolstered by significant investments in research and development and the establishment of advanced manufacturing facilities across the region, ensuring a steady supply of innovative and competitive MCU solutions.

Asia-Pacific MCU Market Product Landscape

The Asia-Pacific MCU market is defined by a diverse product landscape catering to a wide spectrum of performance and cost requirements. The 4 and 8-bit MCUs, while mature, continue to find applications in cost-sensitive, low-power embedded systems like simple appliances and basic sensors. The 16-bit MCUs offer a balance of performance and power efficiency, suitable for mid-range applications such as entry-level automotive systems and more complex consumer electronics. The 32-bit MCUs represent the pinnacle of performance and functionality, featuring advanced architectures like ARM Cortex-M, RISC-V, and others. These processors are indispensable for demanding applications requiring high computational power, complex algorithms, and extensive connectivity, underpinning advancements in AI-enabled edge devices, sophisticated automotive ECUs, and advanced industrial control systems. Innovations are focused on enhancing processing speeds, reducing power consumption (e.g., ultra-low-power MCUs), integrating advanced peripherals (e.g., security modules, connectivity interfaces like Wi-Fi and Bluetooth), and improving real-time operating system (RTOS) support.

Key Drivers, Barriers & Challenges in Asia-Pacific MCU Market

Key Drivers

The Asia-Pacific MCU market is propelled by several significant forces. Technological advancements are paramount, with the continuous development of more powerful, energy-efficient, and feature-rich MCUs enabling new applications. The rapid digitalization and proliferation of IoT devices across consumer, industrial, and automotive sectors create a massive demand for embedded intelligence. Government support for domestic semiconductor manufacturing and R&D, particularly in countries like China and India, is a crucial economic driver. Furthermore, the growing automotive industry, with its focus on electrification, autonomous driving, and connected car features, is a major consumption driver.

Barriers & Challenges

Despite robust growth, the market faces several challenges. Supply chain disruptions, exacerbated by geopolitical tensions and natural disasters, can impact component availability and pricing. Intense price competition among manufacturers, especially in high-volume segments, can compress profit margins. Talent acquisition and retention of skilled semiconductor engineers remain a challenge in a rapidly evolving technological landscape. Navigating diverse and evolving regulatory frameworks across different Asia-Pacific countries can also pose complexities for global market players. The substantial upfront investment required for advanced manufacturing facilities can also be a barrier to entry for smaller players.

Emerging Opportunities in Asia-Pacific MCU Market

Emerging opportunities within the Asia-Pacific MCU market are ripe for exploration. The growing demand for edge AI solutions presents a significant avenue, as MCUs with integrated AI acceleration capabilities are needed for intelligent devices in smart cities, industrial automation, and consumer electronics. The expansion of electric vehicle (EV) infrastructure and adoption is creating a surge in demand for MCUs for battery management systems, motor controllers, and charging infrastructure. Healthcare technology advancements, including wearable health monitors, remote patient monitoring devices, and diagnostic equipment, offer substantial growth potential for specialized, low-power MCUs. The increasing focus on smart agriculture and sustainable technologies is also creating a niche for MCUs in environmental monitoring, automated farming, and resource management solutions. Furthermore, the ongoing development of 5G infrastructure and applications will necessitate MCUs capable of handling high-speed data processing and low-latency communication in various IoT deployments.

Growth Accelerators in the Asia-Pacific MCU Market Industry

Several catalysts are accelerating long-term growth in the Asia-Pacific MCU market. Breakthroughs in semiconductor manufacturing processes and materials continue to enable the production of smaller, faster, and more power-efficient MCUs. Strategic partnerships and collaborations between semiconductor manufacturers, original equipment manufacturers (OEMs), and technology providers are fostering innovation and market penetration. For instance, collaborations on developing reference designs for specific applications can significantly reduce time-to-market. Market expansion strategies targeting emerging economies within the region, coupled with localized product development and distribution networks, are opening up new customer bases. The increasing adoption of open-source hardware and software platforms, such as RISC-V, is lowering the barrier to entry for new product development and fostering a more competitive and innovative ecosystem.

Key Players Shaping the Asia-Pacific MCU Market Market

- Silicon Labs

- Infineon Technologies AG

- Nxp Semiconductors Nv

- Microchip Technology Inc

- Elan Microelectronics Corporation

- On Semiconductor (semiconductor Components Industries Llc)

- Broadcom Inc

- STMicroelectronics NV

- Toshiba Electronic Devices & Storage Corporation

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Analog Devices Inc

- Intel Corporation

Notable Milestones in Asia-Pacific MCU Market Sector

- May 2024: Mindgrove Technologies, supported by Peak XV Partners and incubated by IIT Madras Pravartak Technologies Foundation and IIT Madras Incubation Cell, launched India’s first commercial high-performance SoC (system on chip) named Secure IoT. This RISC-V-based chip aims to enable domestic original equipment manufacturers to integrate Indian SoCs into their devices, potentially reducing costs and bolstering indigenous semiconductor capabilities.

- March 2024: Toshiba Electronic Devices & Storage Corporation commenced volume shipments of its Smart MCD Series gate driver ICs. The inaugural product, "TB9M003FG," is specifically designed for the sensorless control of three-phase brushless DC motors, a critical component for automotive applications such as water and oil pumps, as well as fans and blowers, indicating a focus on automotive innovation and efficient motor control solutions.

In-Depth Asia-Pacific MCU Market Market Outlook

The Asia-Pacific MCU market is on a trajectory of sustained and robust growth, driven by an confluence of technological innovation and expanding end-user applications. Future market potential is immense, fueled by the increasing integration of intelligence into everyday objects and the relentless pursuit of efficiency and performance in industrial and automotive systems. Strategic opportunities lie in catering to the burgeoning demand for edge computing solutions, where MCUs will play a pivotal role in processing data locally, reducing latency, and enhancing privacy. The ongoing electrification of the automotive sector presents a goldmine for advanced MCU solutions, from battery management to sophisticated infotainment systems. Furthermore, the push towards smart manufacturing and the widespread adoption of IoT across various industries will continue to drive demand for versatile and cost-effective microcontrollers. Investors and stakeholders are advised to focus on companies and technologies that are enabling these key trends, particularly those with strong R&D capabilities and a keen understanding of regional market dynamics and evolving consumer preferences.

Asia-Pacific MCU Market Segmentation

-

1. Product

- 1.1. 4 And 8-bit

- 1.2. 16-bit

- 1.3. 32-bit

-

2. Application

- 2.1. Aerospace And Defense

- 2.2. Consumer Electronics And Home Appliances

- 2.3. Automotive

- 2.4. Industrial

- 2.5. Healthcare

- 2.6. Data Processing And Communication

- 2.7. Other End-user Industries

Asia-Pacific MCU Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific MCU Market Regional Market Share

Geographic Coverage of Asia-Pacific MCU Market

Asia-Pacific MCU Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Internet of Things (IoT); Growth of the Automotive Technology

- 3.3. Market Restrains

- 3.3.1. High Cost and Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Growing Automobile Industry to Drive the Market in Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific MCU Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. 4 And 8-bit

- 5.1.2. 16-bit

- 5.1.3. 32-bit

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aerospace And Defense

- 5.2.2. Consumer Electronics And Home Appliances

- 5.2.3. Automotive

- 5.2.4. Industrial

- 5.2.5. Healthcare

- 5.2.6. Data Processing And Communication

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Silicon Labs

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nxp Semiconductors Nv

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microchip Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Elan Microelectronics Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 On Semiconductor (semiconductor Components Industries Llc)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Broadcom Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 STMicroelectronics NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toshiba Electronic Devices & Storage Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Renesas Electronics Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Texas Instruments Incorporated

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Analog Devices Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Intel Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Silicon Labs

List of Figures

- Figure 1: Asia-Pacific MCU Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific MCU Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific MCU Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific MCU Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific MCU Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific MCU Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Asia-Pacific MCU Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Asia-Pacific MCU Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific MCU Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific MCU Market ?

The projected CAGR is approximately 8.34%.

2. Which companies are prominent players in the Asia-Pacific MCU Market ?

Key companies in the market include Silicon Labs, Infineon Technologies AG, Nxp Semiconductors Nv, Microchip Technology Inc, Elan Microelectronics Corporation, On Semiconductor (semiconductor Components Industries Llc), Broadcom Inc, STMicroelectronics NV, Toshiba Electronic Devices & Storage Corporation, Renesas Electronics Corporation, Texas Instruments Incorporated, Analog Devices Inc, Intel Corporation.

3. What are the main segments of the Asia-Pacific MCU Market ?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Internet of Things (IoT); Growth of the Automotive Technology.

6. What are the notable trends driving market growth?

Growing Automobile Industry to Drive the Market in Region.

7. Are there any restraints impacting market growth?

High Cost and Data Security Concerns.

8. Can you provide examples of recent developments in the market?

May 2024: Mindgrove Technologies, supported by Peak XV Partners and incubated by IIT Madras Pravartak Technologies Foundation and IIT Madras Incubation Cell, launched India’s first commercial high-performance SoC (system on chip) named Secure IoT. The semiconductor startup claimed that their RISC-V-based chip would enable domestic original equipment manufacturers to integrate Indian SoCs into their devices, ultimately reducing costs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific MCU Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific MCU Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific MCU Market ?

To stay informed about further developments, trends, and reports in the Asia-Pacific MCU Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence